It looks like you're new here. If you want to get involved, click one of these buttons!

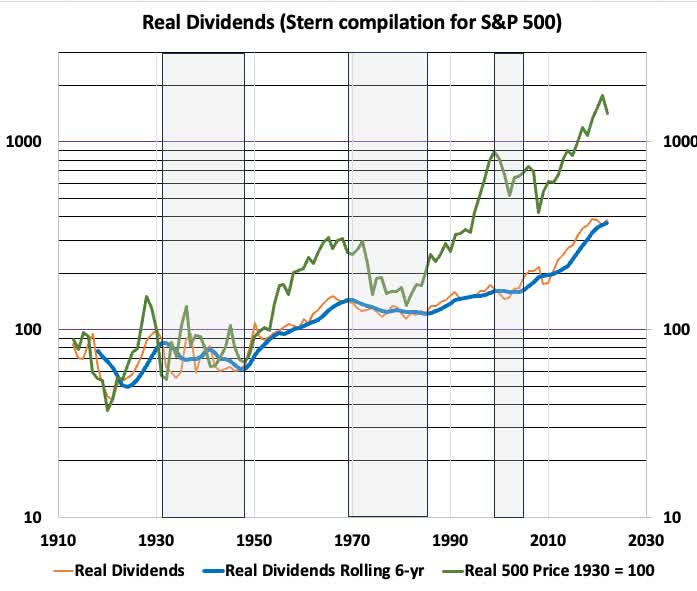

The areas shaded gray show periods when the real value of the dividends from the S&P 500 decreased. Notice that they did not decrease much and decreased far less than the real index value. During those periods, a retirement strategy based on those dividends would have been far more successful than one based on total returns.

© 2015 Mutual Fund Observer. All rights reserved.

© 2015 Mutual Fund Observer. All rights reserved. Powered by Vanilla

Comments

"Any thoughts on this?" For one thing, the stocks I choose all must offer me at least a 3% dividend. I stole that rule from someone on a board I've been banned from. I can use some measurements and statistics to understand more than a novice, but I get lost in the weeds when I try to run with the Big Dogs who can look at complicated charts and very granular statistics and stuff.

So: "KISS" it. "Keep it simple, stupid."

I just discovered a tiny bank out of Richmond, Indiana. I like smid-banks. I won't give a penny to the Behemoth Banksters who all fleece the public. Some might be worse than others, but I just steer clear. If you have a mind to do it, take a look at RMBI. The dividend stands at over 5% right now. And its moneymaking thesis is utterly simple and straightforward. Nothing fancy or convoluted.

Like the writer, I hold REITS. Just a SINGLE REIT, so far, though. I suppose I will forever be growing my stuff, rather than relying on income-production via dividends. One must be ready to flex, but for the time being, my choices are made, and a single adjustment will happen sooner or later. Still keeping an eye on when to make that tactical move.

Midstream oil/gas? Yes, the GIANT one he does NOT own: ET. It's an LP. I suppose taxes will not be an issue if I just never sell it. Wifey will get the step-up basis.

But when that isn't enough, and one has to withdraw more than portfolio income on a consistent basis, that can lead to problems from the SOR issues, or if the entire portfolio is drastically changed just to support high income.

Stats such as SD, Sharpe Ratio, etc aren't helpful, and there is no good relation between the long-term TR and appropriate withdrawal rates. Simply taking LT average TR and subtracting, say, 4% to account for inflation or SOR can lead to premature portfolio exhaustion (believe it or not, that is what a famous radio/podcast host did recently).

Only stats such as PWR, SWR, SWRM, etc are helpful for assessing the withdrawal capacities of portfolios. Randomized Monte Carlo studies are an alternative. But those are based on backward looking historical data, and one has to have some faith that if something(s) worked for the worst past stretches, they may also be OK for the future.

72 3.65%

80 4.95%

85 6.25%

90 8.20%

95 11.23%

100 15.63%

Now, the IRS humor zone

110 28.57%

120 50.00%

@bee had generated a post several years back with an attachment from Kitces with a spreadsheet to determine the most efficient withdrawal strategy, and I've adopted it to this day.

I remember that too, @PRESSmUP. Is this the link-report you are referring to?

I was commenting on the infeasibility relying only on distributions for meeting RMDs.

But with larger IRA accounts, the RMDs are large, and may be sufficient to meet retirement expenses. Then, there is no worry about SWRs. Or, the RMDs may only need small supplements from the portfolio. So, that becomes a valid retirement withdrawal strategy. However, for many, the RMDs aren't enough for expenses.

https://www.i-orp.com/Plans/index.html

We switched to Roth 401(k) when it became available. The market has been kind to us, so we are facing RMD with our traditional tax-deferred accounts like everyone else. Will do Roth conversion from now till 72 while staying below the threshold for higher Medicare premiums.

In years where SP500 or Wiltshire or ur index of choice is within 5% of all time high, withdraw living expenses from equities. When index below 5% take money out of cash. Refill cash bucket over 2 to 3 years. This way u never sell equities at bottom

https://i-orp.com/Plans/index.html

r

@bee Yes. And a link to Portfolio Visualizer's Monte Carlo portfolio simulator may be useful too.

https://www.portfoliovisualizer.com/monte-carlo-simulation

Some people have a second bucket in between consisting of bonds and balanced funds to dampen the market volatility and the possibility of prolong drawdown. Dividend growth funds can be part of this strategy. You can decide the % that you feel comfortable to fill the cash bucket every year. Personally, I use both balanced funds and dividend growth funds.

The third bucket is consisting of stocks/stock funds for capital growth.

YMMV.

Could have posted this in the bucket thread too.

Example: you can use a simple index = SP500 = FXAIX at Fidelity to sell shares every month for a specific amount ($2-4K) on a certain day and let it run for years, problem solved and you know exactly how much you get every month.

The only thing that matters is total returns which include the distributions.