At the time of publication, this fund was named Matthews Asia Strategic Income.

We’ve published several profiles of MAINX. for background, our February 2013 profile is here.

*Matthews Asia liquidated their two fixed-income funds in March, 2023. In consequence, the information for Marathon Value should be read for archival purposes only.*

Objective and Strategy

MAINX seeks total return over the long term with an emphasis on income. The fund invests in income-producing securities including, but not limited to, debt and debt-related instruments issued by government, quasi-governmental and corporate bonds, dividend-paying stocks and convertible securities (a sort of stock/bond hybrid). The fund may hedge its currency exposure, but does not intend to do so routinely. In general, at least half of the portfolio will be in investment-grade bonds. Equities, both common stocks and convertibles, will not exceed 20% of the portfolio.

Adviser

Matthews International Capital Management. Matthews was founded in 1991 and advises the 15 Matthews Asia funds. As of July 31, 2014, Matthews had $27.3 billion in assets under management. On whole, the Matthews Asia funds offer below average expenses. They also publish an interesting and well-written newsletter on Asian investing, Asia Insight.

Manager(s)

Teresa Kong is the lead manager. Before joining Matthews in 2010, she was Head of Emerging Market Investments at Barclays Global Investors (now BlackRock) and responsible for managing the firm’s investment strategies in Emerging Asia, Eastern Europe, Africa and Latin America. In addition to founding the Fixed Income Emerging Markets Group at BlackRock, she was also Senior Portfolio Manager and Credit Strategist on the Fixed Income credit team. She’s also served as an analyst for Oppenheimer Funds and JP Morgan Securities, where she worked in the Structured Products Group and Latin America Capital Markets Group. Kong has two co-managers, Gerald Hwang and Satya Patel. Mr. Hwang for three years managed foreign exchange and fixed income assets for some of Vanguard’s exchange-traded funds and mutual funds before joining Matthews in 2011. Mr. Patel worked more in the hedge fund and private investments universe.

Strategy capacity and closure

“We are,” Ms. Kong notes, “a long way from needing to worry about that.” She notes that Matthews has a long record of moving to close their funds when asset flows and market conditions begin to concern the manager. Both the $8 billion Pacific Tiger (MAPTX) and $5.4 billion Asia Dividend (MAPIX) funds are currently closed.

Management’s Stake in the Fund

As of the April 2014 Statement of Additional Information, Ms. Kong had between $100,000 and 500,000 invested in the fund, as well as substantial investments in seven other Matthews funds. There’s no investment listed for her co-managers. In addition, two of the fund’s five trustees have invested in it: Geoffrey Bobroff has between $10,000 – 50,000 and Mr. Matthews has over $100,000.

Opening date

November 30, 2011.

Minimum investment

$2500 for regular accounts, $500 for IRAs for the retail shares. The fund’s available, NTF, through most major supermarkets.

Expense ratio

1.10%, after waivers, on $66 million in assets (as of August, 2014). There’s also a 2% redemption fee for shares held fewer than 90 days. The Institutional share class (MINCX) charges 0.90% and has a $3 million minimum.

Comments

If I spoke French, I’d probably shrug eloquently, gesture broadly with an impish Beaujolais and declare “plus ça change, plus c’est la même chose.” (Credit Jean-Baptiste Alphonse Karr, 1849.)

After four conversations with Teresa Kong, spread out over three years, it’s clear that three fundamental things remain unchanged:

- Asia remains a powerful and underutilized source of income for many investors. The fundamentals of their fixed-income market are stronger than those in Europe or the U.S. and most investors are systematically underexposed to the Asian market. That underexposure is driven by a quirk of the indexes and of all of the advisors who benchmark against them. Fixed income indexes are generally debt-weighted, that is, they give the greatest weight to the most heavily indebted issuers. Since few of those issuers are domiciled in Asia, most investors have very light exposure to a very dynamic region.

- Matthews remains the firm best positioned to help manage your exposure there. The firm has the broadest array of funds, longest history and deepest analyst core dedicated to Asia of any firm in the industry.

- MAINX remains a splendid tool for gaining that exposure. MAINX has the ability to invest across a wide array of income-producing securities, including corporate (61% of the portfolio, as of August 2014) and government (22%) bonds, convertibles (9%), equities (5%) and other assets. It has the freedom to hedge its currency exposure and to change duration in response to interest rate shifts. The fund’s risk and return profile maximum drawdown continues to track the firm’s expectations which is good given the number of developments which they couldn’t have plausibly predicted before launch. Ms. Kong reports that “the maximum drawdown over one- and three- months was -4.41% and -5.84%, which occurred in June and May-July 2013, respectively. This occurred during the taper tantrum and is fully in-line with our back-tests. From inception to July 2014, the strategy has produced an annualized return of 6.63% and a Sharpe ratio of 1.12 since inception, fully consistent with our long-term return and volatility expectations.”

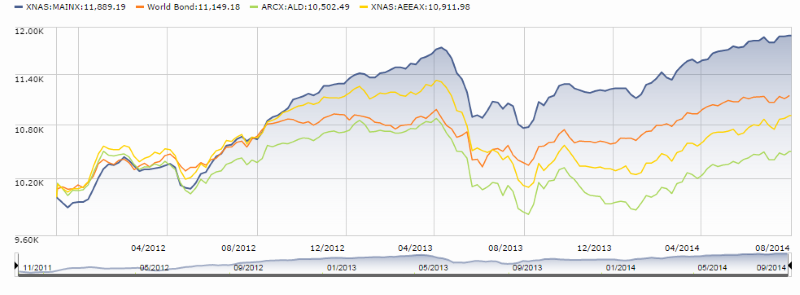

The fund lacks a really meaningful Morningstar peer group and has few competitors. That said, it has substantially outperformed its World Bond peer group (the orange line), Aberdeen Asian Bond (AEEAX, yellow) and Wisdom Tree Asia Local Debt ETF (ALD, green).

In our August 2014 conversation, Ms. Kong made three other points which are relevant for folks considering their options.

- the US is being irreversibly marginalized in global financial markets which is what you should be paying attention to. She’s neither bemoaning nor celebrating this observation, she’s just making it. At base, a number of conditions led to the US dollar becoming the world’s hegemonic currency which was reinforced by the Saudi’s decision in the early 1970s to price oil only in US dollars and to US investment flows driving global liquidity. Those conditions are changing but the changes don’t seem to warrant the attention of editors and headline writers because they are so slow and constant. Among the changes is the rise of the renminbi, now the world’s #2 currency ahead of the euro, as a transaction currency, the creation of alternative structures to the IMF which are not dollar-linked or US driven and a frustration with the US regulatory system (highlighted by the $9B fine against BNP Paribas) that’s leading international investors to create bilateral agreements that allow them to entirely skirt us. The end result is that the dollar is likely to be a major currency and perhaps even the dominant currency, but investors will increasingly have the option of working outside of the US-dominated system.

- the rising number of “non-rated” bonds is not a reflection on credit quality: the simple fact is that Asian corporations don’t need American money to have their bond offerings fully covered and they certainly don’t need to expense and hassle of US registration, regulation and paying for (compromised) US bond rating firms to rate them. In lieu of US bond ratings, there are Asia bond-rating firms (whose work is not reflecting in Morningstar credit reports) and Matthews does extensive internal research. The depth of the equity-side analyst corps is such that they’re able “to tear apart corporate financials” in a way that few US investors can match.

- India is fundamentally more attractive than China, at least for a fixed-income investor. Most investors enthused about India focus on its new prime minister’s reform agenda. Ms. Kong argues that, by far, the more significant player is the head of India’s central bank, who has been in office for about a year. The governor is intent on reducing inflation and is much more willing to deploy the central bank’s assets to help stabilize markets. Right now corporate bonds in India yield about 10% – not “high yield” bond but bonds from blue chip firms – which reflects a huge risk premium. If inflation expectations change downward and inflation falls rather than rises, there’s a substantial interest rate gain to be harvested there. The Chinese currency, meanwhile, is apt to undergo a period of heightened volatility as it moves toward a free float; that is, an exchange rate set by markets rather than by Communist Party dictate. She believes that that volatility is not yet priced in to renminbi-denominated transactions. Her faith is such that the fund has its second greatest currency exposure to the rupee, behind only the dollar.

Bottom Line

MAINX offers rare and sensible access to an important, under-followed asset class. The long track record of Matthews Asia funds suggests that this is going to be a solid, risk-conscious and rewarding vehicle for gaining access to that class. The fund remains small though that will change. It will post a three-year record in November 2014 and earn a Morningstar rating by year’s end; the chart above hints at the possibility of a four- or five-star rating. Ms. Kong also believes that it’s going to take time for advisors get “more comfortable with Asia Fixed Income as an asset class. It took a decade or so for emerging markets to become more widely adopted and we expect that Asia fixed income will become more ubiquitous as investors gain comfort with Asia as a distinct asset class.” You might want to consider arriving ahead of the crowd.

Disclosure: while the Observer has no financial or other ties to Matthews Asia or its funds, I do own shares of MAINX in my personal account and have recently added to them.

Fund website

Matthews Asia Strategic Income homepage and Factsheet. There’s a link to a very clear discussion of the fund’s genesis and strategy in a linked document, entitled Matthews Q&A. It’s worth your time.

© Mutual Fund Observer, 2014. All rights reserved. The information here reflects publicly available information current at the time of publication. For reprint/e-rights contact us.