Originally published in September 1, 2014 Commentary

Long-time MFO discussion board member AKAFlack emailed me recently wondering how much investors have underperformed during the current bull market due to the practice of rebalancing their portfolios.

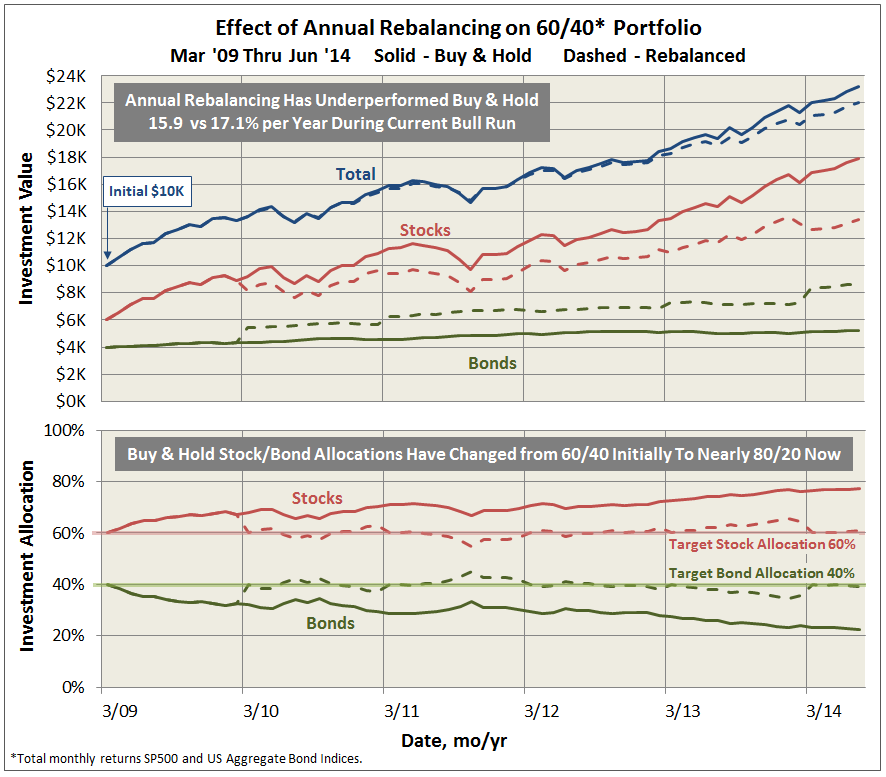

For those that rebalance annually, the answer is…almost 12% in total return from March 2009 through June 2014. Not huge given the healthy gains, but certainly noticeable. The graph below compares performance for a buy & hold and an annually rebalanced portfolio, assuming an initial investment of $10,000 allocated 60% to stocks and 40% to bonds.

So why rebalance?

According to a good study by Vanguard, entitled “Best practices for portfolio rebalancing,” the answer is not to maximize return. “If the sole objective is to maximize return regardless of risk, then the investor should select a 100% equity portfolio.”

The purpose of rebalancing, whether done periodically or by threshold deviation, is to keep a portfolio risk composition consistent with an investor’s tolerance, as defined by their target allocation. Otherwise, investors “can end up with a portfolio that is over-weighted to equities and therefore more vulnerable to equity-market corrections, putting the investors’ portfolios at risk of larger losses compared with their target portfolios.” This situation is evidenced in the allocation shown above for the buy & hold portfolio, which is now at nearly 80/20 stocks/bonds.

In this way, rebalancing is one way to keep loss aversion in check and the attendant consequences of selling and buying at all the wrong times, often chronicled in Morningstar’s notorious “Investor Return” tracking metric.

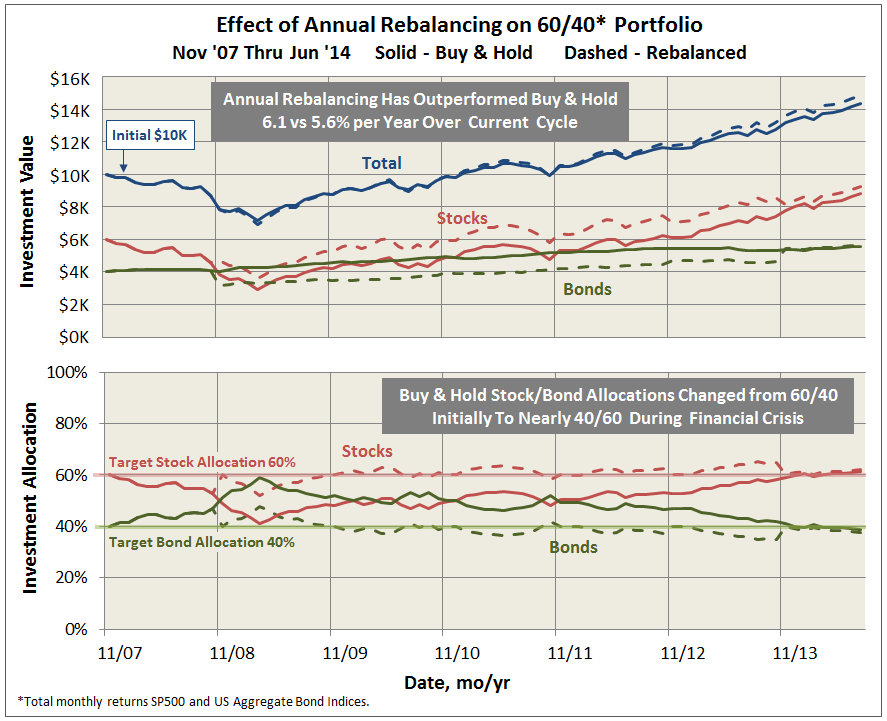

Balancing makes up ground, however, when equities are temporarily undervalued, like was the case in 2008. The same comparison as above but now across the most current full market cycle, beginning in November 2007, shows that annual balancing actually slighted outperformed the buy & hold portfolio.

In his book “The Ivy Portfolio,” Mebane Faber presents additional data to support that “there is a clear advantage to rebalancing sometime rather than letting the portfolio drift. A simple rebalance can add 0.1 to 0.2 to the Sharpe Ratio.”

If your first investment priority is risk management, occasional rebalancing to your target allocation is one way to help you sleep better at night, even if it means underperforming somewhat during bull markets.