Dear friends,

If it weren’t for everything else I’ve read in the news this week (a “blood feud” between DoubleLine and Morningstar? Blood feud? Really? “Pa! Grab your shotgun. Ah dun seen one a them filthy Mansuetos down by the crik!”), the silliest story of the week would be the transformation of candidate’s mutual fund portfolios into attack fodder. And not even attacks for the right reasons!

Republican U.S. Senate candidate Terri Lynn Land attacked her opponent for owning shares of the French firm Total SA. Three weeks later Democrat Gary Peters struck back after discovering that Land (the wretch!) owned “C” shares of Well Fargo Absolute Return (WARCX)and WARCX in turn owns GMO Benchmark-Free Allocation which owns five other GMO funds, one of which has 3% of its portfolio invested in Total SA stock. “She got her hand caught in the cookie jar,” quoth the Democrat.

Land’s total profit from WARCX was between $200-1000. Total SA represented 4% of a fund that was itself 14% of another fund. Hmmm … maybe 0.5% of her perhaps $200 windfall was Total SA so, yup, the issue came down to $1 worth of cookie.

Of course, it wasn’t about the money. It was about the principle. As politics so often are.

Also in Michigan Democrat Mark Schauer attacked the Republican governor’s tax break which benefited companies “even if they send jobs overseas.” The Republican struck back after discovering that Schauer owned shares of Growth Fund of America (AGTHX) which “has a portfolio of companies that make goods overseas, such as Apple.” Here in the Quad Cities, the Democrat candidate for Congress has been attacked for her investment in Janus Overseas (JAOSX), whose 7% holding in Li and Fung Enterprises raised Republican hackles. Congressional candidate Martha Robertson was attacked for owning stock in the treacherous, border-jumping, tax-inverting Burger King – which turns out to be held in the portfolio of a mutual fund she bought 36 years ago. Minnesota senator Al Franken was found to own Lazard, the parent company of a somehow objectionable company, via shares in a socially responsible mutual fund.

Yup. That sure would have been the craziest story of the month except for …

Notes on The Greatest (ill-timed mutual fund manager transition) Story Ever Told

Bill Gross arriving at Janus

Making sense of Mr. Gross’s departure from PIMCO is the very epitome of an “above my pay grade and outside my circle of competence” story. I don’t know why he left. I don’t know whether PIMCO has a toxic environment or, if so, whether he was the source or the firewall. And I certainly don’t know who, among the many partisans furiously spinning their stories, is even vaguely close to speaking the truth.

Here are, however, seven things that I do believe to be true.

If your adviser has recommended moving out of PIMCO funds, you should fire him. If your endowment consultant has advised moving out of PIMCO funds, fire them. If your newsletter editor has  rushed out a special bulletin urging you to run, cancel your subscription, demand a refund and send the money to us. (We’ll buy chocolate.) If your spouse is planning on selling PIMCO shares, fir … distract him with pie and that adorable story about a firefighter giving oxygen to baby hamsters. (Also switch him to decaf and consider changing the password on your brokerage account.)

rushed out a special bulletin urging you to run, cancel your subscription, demand a refund and send the money to us. (We’ll buy chocolate.) If your spouse is planning on selling PIMCO shares, fir … distract him with pie and that adorable story about a firefighter giving oxygen to baby hamsters. (Also switch him to decaf and consider changing the password on your brokerage account.)

At base, Mr. Gross made some contribution to his core fund’s long-term outperformance, which is in the range of 100-200 basis points/year. In the long term, say over the course of decades, that’s huge. For the immediate future, it’s utterly trivial and irrelevant.

Note to PIMCO (from academe): Thank you! Thank you! Thank you! On behalf of all of us who teach Crisis Communications, Strategic Comm, Media Relations or Public Relations, thanks. Your handling of the story has been manna and will be the source of case studies for years.

For those of you without the time to take a crisis communications course, let me share the five word version of it: Get ahead of the story. Play it, don’t let it play you. Mr. Gross’s departure was absolutely predictable, even if the precise timing wasn’t. The probability of his unhappy departure was exceedingly high, even if the precise trigger was unknown. The firm’s strategists have either known it, or had a responsibility to know it, for the past six months. You could have been planning positive takes. You could have been helping journalists, long in advance, imagine positive frames for the story.

As is, you appeared to be somewhere between scrambling and flailing. About the most positive coverage you could generate was a whiny headline, “Bill Gross relied on us,” and a former employee’s human interest assessment, “El-Erian: PIMCO’s new CIO is one of the most considerate and decent people I know.”

We’d been living off BP’s mishandling of the Gulf oil disaster for years, but it was endless and getting stale. Roger Goodell has certainly offered himself up (latest: he’s got bodyguards and they assault photographers) but it’s great to have a Menu of Misses and Messes to work with.

Note (1) to Janus: You don’t have a Global Unconstrained Bond Fund. Or didn’t at the point that you announced that Mr. Gross was running it:

You might blame the “Global” slip-up on your IT team. It turns out that it’s not just the low-level gnomes. Janus president Richard Weil also invoked the non-existent Global Unconstrained Fund:

Morningstar echoed the confusion:

I called a Janus phone rep, who affirmed that of course they had a Global Unconstrained Fund, followed by a bunch of tapping, a “that’s odd,” an “uh-oh” and a “I’ll have to refer this up the line.” Two hours later Janus filed the name change announcement with the SEC.

Dudes: you were at the top of the news cycle. Everyone was looking. This was just chance to prove to everyone that you were relevant. Why deflect the story with careless goofs? You could have filed a two sentence SEC notice, with no mention of Mr. Gross, the week before. You didn’t. Why, too, does the fund have an eight page summary prospectus with five pages of text, two pages labeled “Intentionally Blank” and another page also blank (even blanker than the two preceding pages with writing on them), but apparently unintentionally so?

Note (2) to Janus: That’s the best picture of Mr. Gross that you could find? Really? Uhhh … that’s not a fund manager. That’s the Grinch.

Note to the ETF zealots, dancing around a bonfire and attempting to howl like wolves: Stop it, you’re embarrassing.

If you actually believed the credo that you so piously pronounce, there’d be about three ETFs in existence, each with a trillion in assets. They’d be overseen by a nonprofit corporation (hi, Jack!) which would charge one basis point. All the rest of you would be off somewhere, hawking nutraceuticals and testosterone supplements for a living. We’ll get to you later.

If you actually believed the credo that you so piously pronounce, there’d be about three ETFs in existence, each with a trillion in assets. They’d be overseen by a nonprofit corporation (hi, Jack!) which would charge one basis point. All the rest of you would be off somewhere, hawking nutraceuticals and testosterone supplements for a living. We’ll get to you later.

Note to pundits tossing around 12 figure guesstimates about PIMCO outflows: Stop it, you’re not helping anyone. I know you want to get headlines and build your personal brand. That’s fine, go date a Kardashian. There are a bunch of them available and apparently their standards are pretty … uhhh, flexible. Making up scary pronouncements with blue sky numbers (“we anticipate as much as $400 billion in outflows…”) does nothing more than encourage people to act poorly.

Note to our readers and other PIMCO investors: this is likely the best news you’ve had in a year. PIMCO has been twisting itself in knots over this issue. It’s been a daily distraction and a source of incredible tension and anxiety for dozens upon dozens of management and investment professionals. The situation had been steadily worsening. And now it’s done.

We don’t much cover PIMCO funds. Like the American Funds, they’re way too big to be healthy or interesting. That said, PIMCO has launched innovative and successful new funds over the past five years. Their collective Morningstar performance ratings (4.4 stars for the average domestic equity fund, 3.8 stars for taxable bond funds, 3.6 for international stocks and 1.9 for muni bonds) are well above average.

There is, I suspect, a real prospect of very healthy outcomes for PIMCO and their investors from all this. I suspect that a lot of people may start to look forward to coming to work again. That it will be a lot easier to attract and retain talent. And that a lot of folks will hear the call to step up and take up the slack. You might want to give them to chance to do just that.

Ever wonder what Mr. Gross did when he wasn’t prognosticating?

When I explained to Chip, overseer of our manager changes data, that Mr. Gross was moving on and that his departure affected a six page, single-spaced list of funds (accounting for all of the share classes and versions), she threatened to go all Air France on us and institute a work stoppage. Shuddering, I promised to share the master list of Gross changes with you in the cover essay. The manager changes page will reflect just some of the higher-profile funds in his portfolio.

Here’s a partial list, courtesy of Morningstar, of the funds he was responsible for:

- PIMCO Total Return, the quarter trillion dollar beast he was famous for

And the other 34:

- MassMutual Select PIMCO Total Return

- PIMCO Emerging Markets Fundamental IndexPLUS Absolute Return Strategy

- JHFunds2 Total Return

- Target Total Return Bond

- AMG Managers Total Return Bond

- PIMCO GIS Total Return Bond

- PIMCO Worldwide Fundamental Advantage Absolute Return Strategy, the fund with the highest buzzwords-to-content ratio of any.

- Transamerica Total Return

- 37 iterations of PIMCO GIS Unconstrained Bond

- Consulting Group Core Fixed-Income

- Harbor Unconstrained Bond

- PIMCO Unconstrained Bond

- PIMCO Total Return IV

- Principal Core Plus Bond

- PL Managed Bond

- PIMCO Fundamental Advantage Absolute Return Strategy

- VY PIMCO Bond

- PIMCO International StocksPLUS® Absolute Return Strategy

- PIMCO Small Cap StocksPLUS® Absolute Return Strategy

- PIMCO Fundamental IndexPLUS Absolute Return

- PIMCO StocksPLUS Absolute RETURN Short Strategy

- PIMCO GIS Low Average Duration

- PIMCO StocksPLUS Absolute Return

- Old Mutual Total Return

- PIMCO GIS StocksPlus

- PIMCO Moderate Duration

- PIMCO StocksPLUS

- PIMCO Low Duration III

- PIMCO Total Return II

- PIMCO Low Duration II

- PIMCO Total Return III

- Harbor Bond

- PIMCO Low Duration

- Prudential Income Builder

As we note with PIMCO GIS Unconstrained (the GIS standing for “global investor series”), there can be literally dozens of manifestations of the same portfolio, denominated in different currencies and hedged and unhedged forms, offers to investors in a dozen different nations.

Morningstar ETF Conference Notes

Morningstar ETF Conference Notes

By Charles Boccadoro

The pre-autumnal weather was perfect. Blue skies. Warm days. Cool nights. Vibrant city scene. New construction. Breath-taking architecture. Diverse eateries, like Lou Malnati’s deep dish pizza. Stylist bars and coffee shops. Colorful flower boxes on The River Walk. Shopping galore. An enlightened public metro system that enables you to arrival at O’Hare and 45 minutes later be at Clark/Lake in the heart of downtown. If you have not visited The Windy City since say when the Sears Tower was renamed the Willis Tower, you owe yourself a walk down The Magnificent Mile.

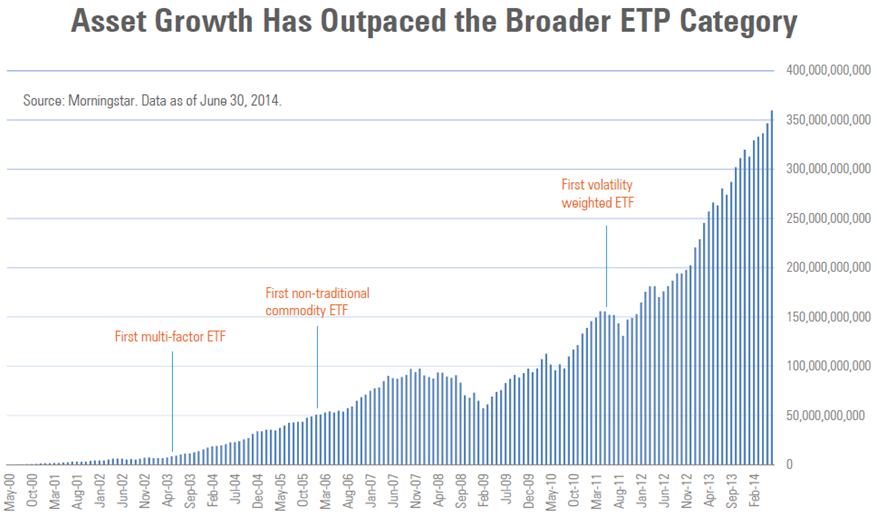

At the opening keynote, Ben Johnson, Morningstar’s director responsible for coverage of exchange traded funds (ETFs) and conference host, noted that ETFs today hold $1.9T in assets versus just $700M only five years ago, during the first such conference. He explained that 72% is new money, not just appreciation.

The conference had a total of 671 attendees, including 470 registered attendees (mostly financial advisors, but this number also includes PR people and individual attendees), 123 sponsor attendees, 43 speakers, and 35 journalists, but not counting a very helpful M* staff and walk-ins. Five years ago? Just shy of 300 attendees.

The Dirty Words of Finance

AQR’s Ronen Israel spoke of Style Premia, which refers to source of compelling returns generated by certain investment vehicle styles, specifically Value, Momentum, Carry (the tendency for higher-yielding assets to provide higher returns than lower-yielding assets), and Defensive (the tendency for lower-risk and higher-quality assets to generate higher risk-adjusted returns). He argues that these excess returns are backed by both theory, be it efficient market or behavioral science, and “decades of data across geographies and asset groups.”

He presented further data that indicate these four styles have historically had low correlation. He believes that by constructing a portfolio using these styles across multiple asset classes investors will yield more consistent returns versus say the tradition 60/40 stocks/bond balanced portfolio. Add in LSD, which stands for leverage, shorting and derivatives, or what Mr. Israel jokingly calls “the dirty word of finance,” and you have the basic recipe for one of AQR’s newest fund offerings: Style Premia Alternative (QSPNX). The fund seeks long-term absolute (positive) returns.

Shorting is used to neutralize market risk, while exposing the Style Premia. Leverage is used to amplify absolute returns at defined portfolio volatility. Derivatives provide most efficient vehicles for exposure to alternative classes, like interest rates, currencies, and commodities.

When asked if using LSD flirted with disaster, Mr. Israel answered it could be managed, alluding to drawdown controls, liquidity, and transparency.

(My own experience with a somewhat similar strategy at AQR, known as Risk Parity, proved to be highly correlated and anything but transparent. When bonds, commodities, and EM equities sank rapidly from May through June 2013, AQR’s strategy sank with them. Its risk parity flagship AQRNX drew down 18.1% in 31 trading days…and the fund house stopped publishing its monthly commentary.)

When asked about the size style, he explained that their research showed size not to be that robust, unless you factored in liquidity and quality, alluding to a future paper called “Size Matters If You Control Your Junk.”

When asked if his presentation was available on-line or in-print, he answered no. His good paper “Understanding Style Premia” was available in the media room and is available at Institutional Investor Journals, registration required.

Launched in October 2013, the young fund has generated nearly $300M in AUM while slightly underperforming Vanguard’s Balanced Index Fund VBINX, but outperforming the rather diverse multi-alternative category.

QSPNX er is 2.36% after waivers and 1.75% after cap (through April 2015). Like all AQR funds, it carries high minimums and caters to the exclusivity of institutional investors and advisors, which strikes me as being shareholder unfriendly. Today, AQR offers 27 funds, 17 launched in the past three years. They offer no ETFs.

In The Shadow of Giants

PIMCO’s Jerome Schneider took over the short-term and funding desk from legendary Paul McCulley in 2010. Two years before, he was at Bear Stearns. Today, think popular active ETF MINT. Think PAIUX.

During his briefing, he touched on 2% being real expected growth rate. Of new liquidly requirements for money market funds, which could bring potential for redemption gates and fees, providing more motivation to look at low duration bonds as an alternative to cash. He spoke of 14 year old cars that needed to be replaced and expected US housing recovery.

He anticipates capital expenditure will continue to improve, people will get wealthier, and for US to provide a better investment outlook than rest of world, which was a somewhat contrarian view at the conference. He mentioned global debt overhang, mostly in the public sector. Of working age population declining. And, of geopolitical instability. He believes bonds still play a role in one’s portfolio, because historically they have drawn down much less than equities.

It was all rather disjointed.

Mostly, he talked about the extraordinary culture of active management at PIMCO. With time tested investment practices. Liquidity sensitivity. Risk management. Credit research capability, including 45 analysts across the globe that he begins calling at 03:45…the start of his work day. He touted PIMCO’s understanding of tools of the trade and trading acumen. “Even Bill Gross still trades.” He displayed a picture of himself that folks often mistook for a young Paul McCulley.

Cannot help but think what an awkward time it must be for the good folks at PIMCO. And be reminded of another giant’s quote: “Only when the tide goes out do you discover who’s been swimming naked.”

Youthful Hosts

Youthful Hosts

Surely, it is my own graying hair, wrinkled bags, muddled thought processes, and inarticulate mannerisms that makes me notice something extraordinary about the people hosting and leading the conference’s many panels, workshops, luncheons, keynotes, receptions, and sidebars. They all look very young! In addition to being clear thinkers, articulate public speakers, helpful and gracious hosts.

It would not be too much of a stretch to say that the combined ages of M*’s Ben Johnson, Ling-Wei Hew, and Samuel Lee together add up to one Eugene Fama. Indeed, when Mr. Johnson sat across from Nobel laureate Professor Fama, during a charming lunch time keynote/interview, he could have easily been an undergraduate from University of Chicago.

Is it because the ETF industry itself is young? Or, is it as a colleague explains: “Morningstar has hard time holding on to good talent because it is a stepping stone to higher paying jobs at places like BlackRock.”

Whatever the reason, if we were all as knowledgeable about investing as Mr. Lee and the rest of the youthful staff, the world of investing would be a much better place.

Damp & Disappointing

That’s how JP Morgan’s Dr. David Kelly, Chief Global Strategist, describes our current recovery. While I did not agree with everything, it was hands-down the best talk of the conference. At one point he said that he wished he could speak for another hour. I wished he could have too.

“Damp and disappointing, like an Irish summer,” he explained.

Short term US prospects are good, but long term not good. “In the short run, it’s all about demand. But in the long run, it’s all about supply, which will be adversely impacted by labor and productivity.” The labor force is not growing. Baby boomers are retiring en masse. He also showed data that productivity was likely not growing, blaming lack of capital expenditure. (Hard to believe since we seem to work 24/7 these days thanks to amazing improvements communications, computing, information access, manufacturing technology, etc. All the while, living longer.)

Dr. Kelly offered up fixes: 1) corporate tax reform, including 10% flat rate, and 2) immigration reform, that allows the world’s best, brightest, and hardest working continued entry to the US. But since congress only acts in crisis, he concedes his forecast prepares for slowing US growth longer term.

Greater opportunity for long term growth is overseas. Manufacturing momentum is gaining around world. Cyclical growth will be higher than US while valuations remain lower and work force is younger. Simply put, they have more room to grow. Unfortunately, US media bias “always gives impression that the rest of the world is in flames…it shows only bad news.”

JP Morgan remains underweight fixed income, since monetary policy remains abnormal, and cautiously over weight US equities. The thing about Irish summers is…everything is green. Low interest rates. Higher corporate margins. Normal valuation. Although he takes issue with the phrase “All the easy money has been made in equities.” He asks “When was it ever easy?”

Alpha Architect

Dr. Wesley Gray is a former US Marine Captain, a former assistant and now adjunct professor at Drexel University, co-author of Quantitative Value: A Practitioner’s Guide to Automating Intelligent Investment and Eliminating Behavioral Errors, and founder of AlphaArchitect, LLC.

He earned his MBA and Finance PhD from University of Chicago, where Professor Fama was on his doctoral committee. He offers a fresh perspective in the investment community. Straight talking and no holds barred. My first impression – a kind of amped-up, in-your-face Mebane Faber. (They are friends.)

In fact, he starts his presentation with an overview of Mr. Faber’s book “The Ivy Portfolio,” which at its simplest form represents an equal allocation strategy across multiple and somewhat uncorrelated investment vehicles, like US stocks, world stocks, bonds, REITS, and commodities.

Dr. Gray argues that simple, equal allocation remains tough to beat. No model works all the time; in fact, the simple equal allocation strategy has under-performed the past four years, but precisely because forces driving markets are unstable, the strategy will reward investors with satisfactory returns over the long run. “Complexity does not add value.”

He seems equally comfortable talking efficient market theory and how to maximize a portfolio’s Sharpe ratio as he does explaining why the phycology of dynamic loss aversion creates opportunities in the market.

When Professor Fama earlier in the day dismissed a question about trend-following, answering “No evidence that this works,” Dr. Gray wished he would have asked about the so-called “Prime anomaly…momentum. Momentum is pervasive.”

When Dr. Gray was asked, “Will your presentation would be made available on-line?” He answered “Absolutely.” Here is link to Beware of Geeks Bearing Formulas.

His firm’s web site is interesting, including a new tools page, free with an easy registration. They launch their first ETF aptly called Alpha Architect’s Quantitative Value (QVAL) on 20 October, which will follow the strategy outlined in the book. Basically, buy cheap high-quality stocks that Wall Street hates using systematic decision making in a transparent fashion. Definitively a candidate MFO fund profile.

Trends Shaping The ETF Market

Ben Johnson hosted an excellent overview ETF trends. The overall briefings included Strategic Beta, Active ETFs (like BOND and MINT), and ETF Managed Portfolios.

Points made by Mr. Johnson:

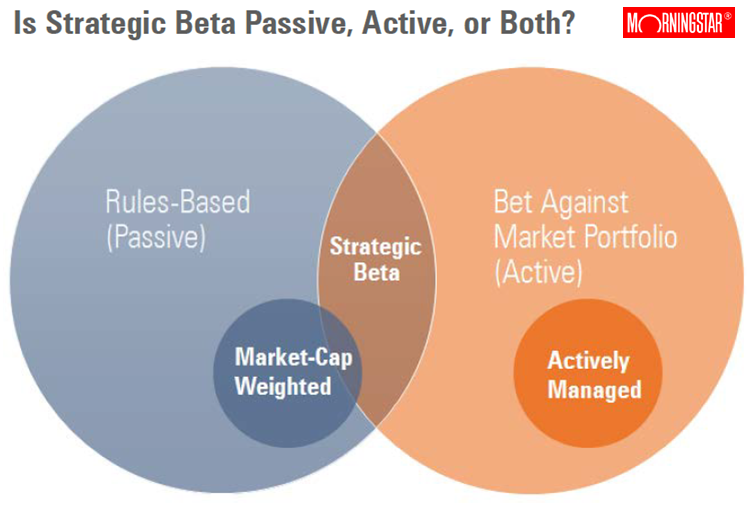

1. Active vs passive is a false premise. Today’s ETFs represent a cross-section of both approaches.

2. “More assets are flowing into passive investment vehicles that are increasingly active in their nature and implementation.”

3. Smart beta is a loaded term. “They will not look smart all the time” and investors need to set expectations accordingly.

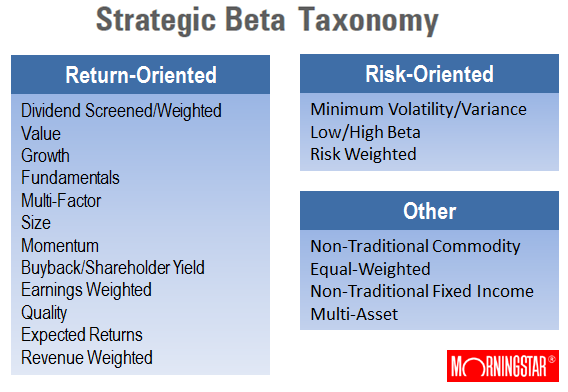

4. M* assigns the term “Strategic Beta” to a growing category of indexes and exchange traded products (ETPs) that track them. “These indexes seek to enhance returns or minimize risk relative to traditional market cap weighted benchmarks.” They often have tilts, like low volatility value, and are consistently rules-based, transparent, and relatively low-cost.

5. Strategic Beta subset of ETPs has been explosive in recent years with 374 listed in US as of 2Q14 or 1/4 of all ETPs, while amassing $360M, or 1/5th of ETP AUM. Perhaps more telling is that 31% of new cash flows for ETPs in 2013 went into Strategic Beta products.

6. Reduction or fees and a general disillusionment with active managers are two of several reasons behind the growth in these ETFs. These quasi active funds charge a fraction of traditional fees. A disillusionment with active managers is evidenced in recent surveys made by Northern Trust and PowerShares.

M* is attempting to bring more neutral attention to these ETFs, which up to now has been driven by product providers. In doing so, M* hopes to help set expectation management, or ground rules if you will, to better compare these investment alternatives. With ground rules set, they seek to highlight winners and call out losers. And, at the end of the day, help investors “navigate this increasingly complex landscape.”

They’ve started to develop the following taxonomy that is complementary to (but not in place of) existing M* categories.

Honestly, I think their coverage of this area is M* at its best.

Welcomed Moderation

Mr. Koesterich gave the conference opening keynote. He is chief investment strategist for BlackRock. The briefing room was packed. Several hundred people. Many standing along wall. The reception afterward was just madness. His briefing was entitled “2014 Mid-Year Update – What to Know / What to Do.”

He threaded a somewhat cautiously reassuring middle ground. Things aren’t great. But, they aren’t terrible either. They are just different. Different, perhaps, because the fed experiment is untested. No one really knows how QE will turn out. But in mean time, it’s keeping things together.

Different, perhaps, because this is first time in 30-some years where investors are facing a rising interest rate environment. Not expected to be rapid. But rather certain. So bonds no longer seem as safe and certainly not as high yield as in recent decades.

To get to the punch-line, his advice is: 1) rethink bonds – seek adaptive strategies, look to EM, switch to terms less interest rate sensitive, like HY, avoiding 2-5 year maturities, look into muni’s on taxable accounts, 2) generate income, but don’t overreach – look for flexible approaches, proxies to HY, like dividend equities, and 3) seek growth, but manage volatility – diversify to unconstrained strategies

More generally, he thinks we are in a cyclical upswing, but slower than normal. Does not expect US to achieve 3.5% annual GDP growth (post WWII normal) for next decade. Reasons: high debt, aging demographics, and wage stagnation (similar to Rob Arnott’s 3D cautions).

He cited stats that non-financial debt has actually increased 20-30%, not decreased, since financial crisis. US population growth last year was zero. Overall wages, adjusted for inflation, same as late ’90s. But for men, same as mid ‘70s. (The latter wage impact has been masked by more credit availability, more women working, and lower savings.) All indicative of slower growth in US for foreseeable future, despite increases in productivity.

Lack of volatility is due to fed, keeping interest rates low, and high liquidity. Expects volatility to increase next year as rates start to rise. He believes that lower interest rates so far is one of year’s biggest surprises. Explains it due to pension funds shifting out of equities and into bonds and that US 10 year is pretty good relative to Japan and Europe.

On inflation, he believes tech and aging demographics tend to keep inflation in check.

BlackRock continues to like large cap over small cap. Latter will be more sensitive to interest rate increases.

Anything cheap? Stocks remain cheaper than bonds, because of extensive fed purchases during QE. Nothing cheap on absolute basis, only on relative basis. “All asset classes above long term averages, except a couple niche areas.”

“Should we all move to cash?” Mr. Koesterich answers no. Just moderate our expectations going forward. Equities are perhaps 10-15% above long term averages. But not expensive compared to prices before previous drops.

One reason is company margins remain high. For couple of same reasons: low credit interest and low wages. Plus higher productivity, which later appeared contrary to JP Morgan’s perspective.

He advises investors be selective in equities. Look for value. Like large over small. More cyclical companies. He likes tech, energy, manufacturing, financials going forward. This past year, folks have driven up valuations of “safe” equities like utilities, staples, REITS. But those investments tend to work well in recessions…not so much in rising interest rate environment. EM relatively inexpensive, but fears they are cheap for reason. Lots of divided arguments here at BlackRock. Japan likely good trade for next couple years due to Japanese pension funds shifting to organic assets.

He closed by stating that only New Zealand is offering a 10 year sovereign return above 4%. Which means, bond holders must take on higher risk. He suggests three places to look: HY, EM, muni’s.

Again, a moderate presentation and perhaps not much new here. While I personally remain more cautiously optimistic about US economy, compared to mounting predictions of another big pull-back, it was a welcomed perspective.

Beta Central

I’m hard-pressed to think of someone who has done more to enlighten investors about the benefits of ETF vehicles and opportunities beyond buy-and-hold US market cap than Mebane Faber. At this conference especially, he represents a central figure helping shape investment opportunities and strategies today.

He was kind enough to spend a few minutes before his panel on dividend investing and ETFs, which he held with Morningstar’s Josh Peters and Samuel Lee.

He shared that Cambria recently completed a funding campaign to expand its internal operations using the increasingly popular “Crowd Funding” approach. They did not use one of the established shops, like EquityNet, simply because of cost. A couple hundred “accredited investors” quickly responded to Cambria’s request to raise $1-2M. The investors now have a private stake in the company. Mebane says they plan to use the funds to increase staff, both research and marketing. Indeed, he’s hiring: “If you are an A+ candidate, incredibly sharp, gritty, and super hungry, come join us!”

The new ETF Global Momentum (GMOM), which we mentioned in the July commentary, is due out soon, he thinks this month. Several others are in pipeline: Global Income and Currency Strategies ETF (FXFX), Emerging Shareholder Yield ETF (EYLD), Sovereign High Yield Bond ETF (SOVB), and Value and Momentum ETF (VAMO), which will make for a total of eight Cambria ETFs. The initial three ETFs (SYLD, FYLD, and GVAL) have attracted $365M in their young lives.

He admitted being surprised that Mark Yusko of Morgan Creek Funds agreed to take over AdvisorShares Global Tactical ETF GTAA, which now has just $20M AUM.

He was also surprised and disappointed to read about the SEC’s probe in F2 Investments, which alleges overstated performance results. F2 specializes in strategies “designed to protect investors from severe losses in down markets while providing quality participation in rising markets” and they sub-advise several Virtus ETFs. When WSJ reported that F2 received a so-called Wells notice, which portends a civil case against the company, Mebane posted “first requirement for anyone allocating to separate account investment advisor – GIPS audit. None? Move on.” I asked, “What’s GIPS?” He explains it stands for Global Investment Performance Standards and was created by the CFA Institute.

Mebane continues to write, has three books in work, including one on top hedge funds. Speaking of insight into hedge funds, subscribers joining his The Idea Farm after 31 December will pay a much elevated $499 annually.

Observer Fund Profiles:

Each month the Observer provides in-depth profiles of between two and four funds. Our “Most Intriguing New Funds” are funds launched within the past couple years that most frequently feature experienced managers leading innovative newer funds. “Stars in the Shadows” are older funds that have attracted far less attention than they deserve.

This month’s funds call into two broad categories: The Fallen Titans Funds and Stealthy Funds from “A” Tier Teams.

Le roi est mort, vive le roi’s new fund

Janus Unconstrained Bond (JUCAX) On October 6, Bill Gross, The Bond King, completes the transition from running 34 funds and $1.8 trillion in assets to managing a single $13 million portfolio. Like a Walmart at dawn on Black Friday, the fund is sure is see a huge crush of anxious, half-unhinged shoppers jammed against the doors.

Miller Income Opportunity (LMCJX) On February 26, Bill Miller, The Guy Who Bested the S&P 15 Years in a Row, partnered with his son to manage a new fund with a slightly misleading name (the portfolio produces little income) and hedge fund like freedom (and fees).

Quiet funds from “A” tier teams

Meridian Small Cap Growth (MSAGX) Small growth stocks have been described as “a failed asset class” because of the inability of most professional investors to control the sector’s downside well enough to benefit from its upside. Fortunately Chad Meade and Brian Schaub didn’t know that it was impossible to profit handsomely by limiting a small growth portfolio’s downside and so, for the past seven years, they’ve been doing exactly that. After moving from Janus to Meridian, they get to do it with a small, nimble fund.

Sarofim Equity (SRFMX) Have you ever looked at a large fund with a sensible strategy, solid management team and fine long-term record and thought to yourself “sure wish they were running a small, new fund doing the exact same thing for noticeably less money”? If so, the management team behind Dreyfus Appreciation has an opportunity for you to consider.

Elevator Talk: Justin Frankel, RiverPark Structural Alpha (RSAFX/RSAIX)

Since the number of funds we can cover in-depth is smaller than the number of funds worthy of in-depth coverage, we’ve decided to offer one or two managers each month the opportunity to make a 200 word pitch to you. That’s about the number of words a slightly-manic elevator companion could share in a minute and a half. In each case, I’ve promised to offer a quick capsule of the fund and a link back to the fund’s site. Other than that, they’ve got 200 words and precisely as much of your time and attention as you’re willing to share. These aren’t endorsements; they’re opportunities to learn more.

Since the number of funds we can cover in-depth is smaller than the number of funds worthy of in-depth coverage, we’ve decided to offer one or two managers each month the opportunity to make a 200 word pitch to you. That’s about the number of words a slightly-manic elevator companion could share in a minute and a half. In each case, I’ve promised to offer a quick capsule of the fund and a link back to the fund’s site. Other than that, they’ve got 200 words and precisely as much of your time and attention as you’re willing to share. These aren’t endorsements; they’re opportunities to learn more.

Justin Frankel (presumably not the JF described as “the world’s most dangerous geek”) co-manages Structural Alpha with his colleague Jeremy Berman. RiverPark launched the fund in June 2013, but the strategy’s public record is considerably longer. It began life in September 2008 as Wavecrest Partners Fund, LP which the guys ran alongside separate accounts for rich folks. Justin and I spent some time discussing the fund over warm drinks in lovely Milwaukee this August.

Structural Alpha embodies an options-based strategy. Every time I write that, my head begins to hurt because I struggle to explain them even to myself. Investors use options as a sort of portfolio insurance. The managers here sell options because those options are structurally overpriced; that is, there’s a predictable excess profit for the sellers built into the market just as you pay more for your insurance policies than you’ll ever get out of them.

The portfolio has four components – long-dated options which tend to move in the direction of the stock market, short-dated options which tend to be market independent, a permanent hedge which buffers the long options’ downside risk and a huge amount of cash which serves as collateral on the options they’ve sold. The guys invest that cash in short-term securities which produce income for the fund. As market conditions change, the managers adjust the size of the options components to keep the fund’s risk exposure within predetermined limits. That is, there are times when their market indicators show that the long-dated portion is carrying the potential for too much downside and so they’ll dial back that component.

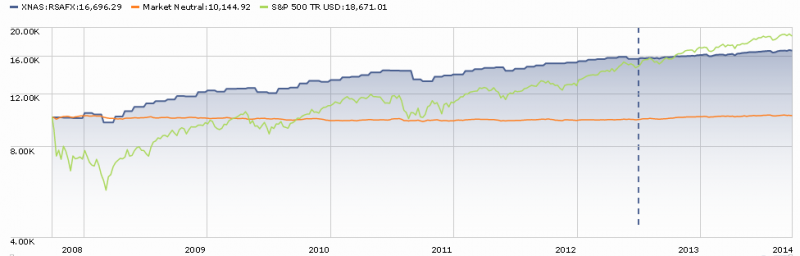

Here’s what that performance looks like, including the strategy’s time as a hedge fund. RiverPark is the blue line, its painfully inept peer group is on the orange line and the S&P 500 is green.

Over the better part of a full market cycle, the Structural Alpha strategy captured the 80% of the stock index’s returns – the strategy gained about 70% while the S&P rose 87% – while largely sidestepping any sustained losses. On average, it captures about 20% of the market’s down market performance and 40% of its up market. The magic of compounding then works in their favor – by minimizing their losses in falling markets, they have little ground to make up when markets rally and so, little by little, they catch up with a pure equity portfolio.

Justin Frankel

It’s clear that they might substantially lag in sustained, low volatility rallies but it’s also clear that they’ll make money for their investors even then.

Here are Justin’s 200 words on how you might buy some insurance:

The RiverPark Structural Alpha Fund is a market-neutral, hedged equity strategy. Our goal is to generate equity-like returns with fixed-income like volatility. We use a consistent and systematic investment process that focuses first on the management of risk, and then on the management of return.

The core of our investment philosophy is that excessive returns are rarely realized, and therefore should be traded for the opportunity to generate more stable returns, protect against some market declines, and reduce overall portfolio volatility. Secondarily, we believe that index options are overpriced, and by systematically selling these options we can generate positive returns without market exposure. This is why we use the term Structural Alpha in the fund’s name.

Jeremy Berman

Importantly, we have no view of the market and do not change our holdings or market exposure based on market conditions. Specifically, we use options to set zones of protection and to allow the fund to perform in up markets while maintaining a constant hedge to help protect the fund in down markets. The non-linear profile of options makes them ideally suited to implement our philosophy. Our portfolio naturally gets more exposed to the market as it declines (which means that we are constantly buying lower), and gets less exposed to the market when it rises (which means we are constantly selling higher).

Over the long run, the fund is slightly long-biased. Therefore, we believe it should perform better in rising markets. In our opinion, small and consistent gains over time, when compounded, will yield above average risk-adjusted returns for our shareholders. We believe our structural approach to investing gives the strategy a high probability for success across a range of different market environments.

RiverPark Structural Alpha has a $1000 minimum initial investment. Expenses are capped at 2.0% on the investor shares and the fund has about gathered about $7 million in assets since its June 2013 launch. Here’s the fund’s homepage, which has a funny video of the guys talking through the strategy. It’s a sort of homemade ten minute video and has much of the unprepossessing charm of Sheldon Cooper’s “Fun with flags” videos on The Big Bang Theory. Spoiler alert: the first two minutes are the managers sharing their biographies and the last seven minutes are soundless images of slides and disclaimers (I feel the compliance group’s hand here). If you’d like to listen to a précis of the strategy, start listening at about the 4:00 minute mark through to about 6:50. They make a complex strategy about as clear as anyone I’ve yet heard.

Launch Alert: T. Rowe Price International Concentrated Equity (PRCNX)

It’s rare that a newly launched fund receives both a “Great Owl” (top quintile risk-adjusted returns in all trailing periods longer than a year) and Morningstar five star rating, but Price’s International Concentrated Equity Fund (PRCNX) managed the trick. On August 22, 2014, T. Rowe released a retail version of its outstanding Institutional International Concentrated Equity Fund (RPICX). That fund launched in July 2010. Federico Santilli, who has managed the RPICX since inception, will manage the new fund. He claims to be style, sector and region-agnostic, willing to go wherever the values are best. He targets “companies that have solid positions in attractive industries, have an ability to generate visible and durable free cash flow, and can create shareholder value over time.”

It’s rare that a newly launched fund receives both a “Great Owl” (top quintile risk-adjusted returns in all trailing periods longer than a year) and Morningstar five star rating, but Price’s International Concentrated Equity Fund (PRCNX) managed the trick. On August 22, 2014, T. Rowe released a retail version of its outstanding Institutional International Concentrated Equity Fund (RPICX). That fund launched in July 2010. Federico Santilli, who has managed the RPICX since inception, will manage the new fund. He claims to be style, sector and region-agnostic, willing to go wherever the values are best. He targets “companies that have solid positions in attractive industries, have an ability to generate visible and durable free cash flow, and can create shareholder value over time.”

The portfolio holds 60 large cap names, weighting them equally but turning them over with alarming speed, about 150% per year. The portfolio offers little direct exposure to the emerging markets but the multinationals that dominate the portfolio (Royal Bank of Scotland, Sony, drug maker Glaxo, Honda) derive much of their earnings from consumers in those newer markets.

The fund has performed well. It has been in or near the top 10% of foreign large blend funds each year. $10,000 invested there at inception would have grown to $15,700 (as of late September, 2014) while its average peer would have generated $13,700 with noticeably higher volatility. It has been the second-strongest performer among all the T. Rowe Price international funds, trailing only International Discovery (PRIDX), whose lead is tiny.

PRCNX is not merely a share class of RPICX. It is a separate fund, managed by the same guy using the same discipline. Nonetheless, the portfolios may show significant differences depending on what names are attractive when money flows into each fund.

The expense ratio is capped at 0.90%, barely higher than the Institutional fund’s 0.75%, under February 2017. The minimum initial investment is $2500, reduced to $1000 for IRAs. The fund’s homepage is here but the institutional fund’s homepage has a far greater array of information and strategy detail. Price would urge me to remind you that the information about the institutional fund is designed to inform qualified investors and analysts and it’s not aimed to persuading you to buy the retail fund.

Funds in Registration

Our colleague David Welsch tracked down 12 new no-load, retail funds in registration this month. In general, these funds will be available for purchase by late November. A number of the prospectuses are incredibly incomplete (not listing, for example, a fund manager) which suggests that they’re just gearing up for the traditional year-end rush to launch new funds. Highlights among the registrants:

- 361 Global Long/Short Equity Fund, which will feature a global long/short portfolio. Its most notable for its cast of managers, including Blaine Rollins from 361 Capitals and Harindra de Silva from Analytic Investors. Mr. Rollins ran Janus Fund at the height of its popularity (sadly, that would be around the year 2000), left investing in 2006 but has since returned to cofound 361, a liquid alts firm that’s dedicated to trying to prevent the sorts of losses the Janus funds suffered. Mr. Silva has roots going back to the PBHG Funds in the 1990s. The fund is no-load with a $2500 minimum, but we don’t yet know the expenses.

- American Century Multi-Asset Income Fund, which will primarily seek income with a conservative balanced portfolio. You might anticipate 40% dividend-paying stocks and 60% bonds. It will be team-managed with a reasonable 0.91% e.r. and $2,000 minimum.

- DoubleLine Long Duration Total Return Bond Fund, which will sport an effective average duration of 10 years or more. That’s a fascinating launch since long duration funds are highly interest rate sensitive and most observers anticipate rising rates (eventually). The Other Bond King and Vitaliy Liberman will manage the fund. The expenses aren’t yet set. The minimum initial investment will be $2,000 for “N” shares.

Manager Changes

Yikes. This month saw 93 manager changes without accounting for the full extent of the turmoil caused by Mr. Gross’s change of employment.

Top Developments in Fund Industry Litigation – September 2014

Fundfox is the only intelligence service to focus exclusively on litigation involving U.S.-registered investment companies, their directors and advisers. Each month editor David Smith shares word of the month’s litigation-related highlights. Folks whose livelihood ride on such matters need to visit FundFox and chat a bit with David about the service.

Fundfox is the only intelligence service to focus exclusively on litigation involving U.S.-registered investment companies, their directors and advisers. Each month editor David Smith shares word of the month’s litigation-related highlights. Folks whose livelihood ride on such matters need to visit FundFox and chat a bit with David about the service.

New Lawsuit

- Harbor was hit with new excessive-fee litigation, alleging that it charges advisory fees to its International and High-Yield Bond Funds that include a mark-up of more than 80% over the fees paid by Harbor to unaffiliated subadvisers who do most of the work. (Tumpowsky v. Harbor Capital Advisors, Inc.)

Orders

- The court consolidated a pair of fee lawsuits regarding the Davis N.Y. Venture Fund. (In re Davis N.Y. Venture Fund Fee Litig.)

- In a pair of ERISA lawsuits regarding a J.P. Morgan pooled stable value investment fund, the court transferred venue to the S.D.N.Y. (Adams v. J.P. Morgan Ret. Plan Servs., LLC; Ashurst v. J.P. Morgan Ret. Plan Servs. LLC.)

- The court denied defendants’ motion to dismiss excessive-fee litigation regarding six Principal LifeTime funds: “[W]hile Plaintiff has included some generalized statements regarding the mutual fund industry in its complaint, Plaintiff is not relying solely on speculation and has included some specific factual allegations regarding Defendants and their practices.” (Am. Chems. & Equip., Inc. 401(k) Ret. Plan v. Principal Mgmt. Corp.)

- The court gave its final approval to a $19.5 million settlement of an ERISA class action regarding TIAA-CREF‘s procedures for closing retirement plan accounts. (Bauer-Ramazani v. TIAA-CREF.)

Brief

- The plaintiff filed her opening brief in an appeal concerning American Century‘s liability for the Ultra Fund’s investments in off-shore Internet gambling businesses. Defendants include independent directors. (Seidl v. Am. Century Cos.)

Amended Complaint

- After surviving a motion to dismiss, a plaintiff filed an amended complaint alleging Securities Act violations in connection with four closed-end Morgan Keegan bond funds (n/k/a Helios funds). (Small v. RMK High Income Fund, Inc.)

For a complete list of developments last month, and for information and court documents in any case, log in at www.fundfox.com and navigate to Fundfox Insider.

Liquid Alternative Observations

Brian Haskin publishes and edits the DailyAlts site, which is devoted to the fastest-growing segment of the fund universe, liquid alternative investments. Here’s his quick take on the DailyAlts mission:

Brian Haskin publishes and edits the DailyAlts site, which is devoted to the fastest-growing segment of the fund universe, liquid alternative investments. Here’s his quick take on the DailyAlts mission:

Our aim is to provide our readers (investment advisors, family offices, institutional investors, investment consultants and other industry professionals) with a centralized source for high quality news, research and other information on one of the most dynamic and fastest growing segments of the investment industry: liquid alternative investments.

I like the site for a couple reasons. The writing is clean, the stories are fresh and the content seems thoughtful. Beyond that, one of the ways that the Observer tries to help folks is by linking them to the resources they need. There are really important areas that are outside our circle of competence and beyond our resources, and we’re deeply grateful for folks like David Smith at FundFox and Brian for their generous willingness to share leads and insights.

Brian offers this as his take on the month just past.

A Key Turning Point

September 2014 may be a month to remember – jot it down in the depths of your memory as it may be a useful data point some time down the road. Why? Because it was the point at which the largest pension fund in the United States, the California Public Employee Retirement System (CalPERS), decided not to push forward with a larger allocation to hedge funds, and instead reversed course and cut their allocation to zero.

Citing costs and complexity, it is easy to see why the prior would be a problem for the taxpayer funded pension system. As James B. Stewart stated in his article for The New York Times, “the fees CalPERS paid [to hedge funds] would have soared to $1.35 billion” if they increased their hedge fund program to a meaningful allocation of their portfolio (~10-15%).

That’s clearly not a number that would make any investment committee member comfortable. The “CalPERS Decision” may be the real turning point for liquid alternatives, which are essentially hedge funds without performance fees wrapped in mutual fund or exchange traded fund wrappers.

By eliminating the performance fee, which generally is equal to 20% of annual returns, investors will reap the short- and long-term benefit of substantially lower costs. This lower cost will be attractive not only to individual investors and their advisors, but also to a much broader universe of investors that includes family offices, endowments, foundations and pension funds. Hedge funds are a key source of diversification for many of these investors already, and as more high quality mutual fund and ETF choices become available, investors will shift assets from higher cost hedge funds to lower cost liquid alternative vehicles.

It should be noted that most, but not all, alternative mutual funds do not incur a performance fee similar to a hedge fund performance fee. However, certain structures within mutual funds do allow for the mutual fund to indirectly purchase limited partnerships (i.e. hedge funds) that charge traditional hedge fund fees, including a performance fee.

New Fund Launches

As of this writing, September saw only six new alternative fund launches, with five of those being mutual funds. Additional launches often occur on the last day of the month, so others may be near, including a long/short equity fund from Goldman Sachs and a multi-alternative fund from Lazard. Two notable new funds that have launched are as follows:

- AQR Style Premia Alternative LV Fund (QSLIX) – this is a low volatility version of an existing AQR fund, but is interesting because it takes a leveraged market neutral approach to investing across multiple asset classes using a factor based investment approach. With a targeted volatility level similar to intermediate term bonds, this fund could be a good substitute for long-only fixed income if rates start to rise.

- Eaton Vance Richard Bernstein Market Opportunities Fund (ERMIX) – this new global macro fund is managed by the former Chief Investment Strategist at Merrill Lynch and the fund’s namesake, Richard Bernstein. The market environment is getting better for global macro funds as the Fed eases up on QE and more natural market trends re-emerge. Keep an eye on this one.

A full list of new funds can be found on the DailyAlts’ New Fund Listing.

New Fund Registrations

We tracked ten new alternative mutual fund filings in September, which means that the end of the year will be flush with new funds. Four of the filings are for long/short equity, which has been a recipient of significant inflows over the past year. Two of the notable filings outside of long/short equity include the following:

o State Street Global Macro Absolute Return Fund – another go-anywhere global macro fund that will invest across global markets and asset classes. As with the new Eaton Vance fund above, the timing could be good and the universe for global macro funds is relatively small.

o Palmer Square Long Short Credit Fund – just in time for rising interest rates, this new fund comes from a boutique asset management firm with a highly experienced fixed income team. The fund has a wide range of credit oriented securities that it can use on both a long and short basis to generate absolute (positive) returns over full market cycles.

Other Items of Interest

- On the ETF front, First Trust launched an actively managed long/short equity ETF. We’ll keep an eye on this low cost vehicle to see how well a long/short strategy can do in an ETF wrapper.

- HedgeCo launched HedgeCoVest, a managed accounts platform available to individual investors for as little as $30,000. Investors can get a hedge fund managed in their own brokerage account with full liquidity and transparency. This could be a real market disruptor.

- TFS marked the 10-year anniversary of their TFS Market Neutral Fund (TFSMX). Quite an accomplishment, especially when (in hindsight) being “market neutral” over the past five years has not been a desirable bet. But as we know, the next five years won’t be like the past five years. Congrats to TFS.

We look forward to bringing readers of the Mutual Fund Observer monthly insights on the evolving market for alternative mutual funds.

Meh. Just meh.

From time to time, I come across what strikes me as an extraordinarily cool website or online retailer. In the past those have included the DailyAlts site and the Duluth Trading Company. When that happens, I’m predisposed to share word about the site with you, for your sake and for theirs.

From time to time, I come across what strikes me as an extraordinarily cool website or online retailer. In the past those have included the DailyAlts site and the Duluth Trading Company. When that happens, I’m predisposed to share word about the site with you, for your sake and for theirs.

I still remember a sign in the hot dog shop’s window from when I was in grad school: “eat here or we’ll both go hungry.” It’s sort of like that.

I have lately been delighted with the little online shop, meh. If we were Vikings, that would be “meh son of woot” or “meh wootson.” Woot was an online shop launched in 2004. The founders worked as wholesalers and looked at the challenge of selling what I think of as “orphan goods.” That is, stuff where the quantity available is substantial but too small to be profitably distributed through a mainline retailer. Woot was distinguished by two characteristics: (1) a one-deal-one-day business model in which shoppers were offered one deeply discounted item each day and at the day’s end, the item vanished. And (2) a snarky dismissiveness of their own offerings.

It was sufficiently cool that Amazon.com bought it in 2010 and messed it up by, oh, 2011. Instead of advertising one great deal, Amazon thought they should offer one deal in each of ten categories, plus Side Deals and Woot!Plus deals and miscellaneous sale items from Amazon’s own site and goodness knows what else.

Woot’s founders decided to try again (presumably after the expiration of non-compete agreements) and, with the help of Kickstarter funding, launched meh. Like the original Woot!, meh offers precisely one deal for no more than 24 hours. The site is tantalizing for two reasons: (1) the stuff is always cheap and sometimes outstanding and (2) checking each day takes me about 30 seconds since there’s, well, just one thing.

What sort of “one thing”? 40 AA Panasonic batteries for $5. Two refurbished 39” Emerson LCD TVs for $300 (not $300 each, $300 for the pair). A Phillips Blu-ray player for $15. Down alternative comforters for $18-20. (I bought two for my son’s bed, under the assumption that 14-year-olds will eventually spot, stain or shred pretty much anything within reach.) A padded laptop, a refurbished Dyson DC41 vacuum, Bluetooth keyboards for your tablet. Stuff.

It’s a small operation. Shipping tends to be slow. They charge $5 per item to ship unless you join their Very Mediocre Person service where you get unlimited free shipping for $5/month. A lot, but not all, of the stuff is refurbished. Neither bells nor whistles are in evidence. On whole they are, I guess, sort of “meh.”

That said, they’re also worth visiting. (And no, we have no relationship of any sort with them. You’re so suspicious.) meh.

Briefly Noted . . .

Effective November 1, 2014, Catalyst/Lyons Hedged Premium Return Fund (CLPAX/ CLPFX) will pursue “long-term capital appreciation and income with less downside volatility than the equity market.” That’s a bold departure from the current promise to seek “long-term capital appreciation and income with low volatility and low correlation to the equity market.”

On October 1st, FTSE and Research Affiliates rolled out a new set of low-volatility indexes. As with many RAFI products, the stocks in the index are weighted using fundamental factors, as opposed to market capitalization. Jason Hsu, one of the RA co-founders, describes it as “a next generation approach that produces a low volatility core universe which is valuation-aware, without uncomfortable country or sector active bets.” Given that there’s $60 billion in funds, ETFs and separate accounts benchmarked against the existing FTSE RAFI indexes, you might reasonably expect the product launches to commence in the near future.

Matthews raised the expense ratio on Matthews China Fund (MCHFX) by one basis point at the end of September, netting them a cool $110,000 on a $1.1 billion fund. MCHFX and Matthews Asia Dividend have both qualified for access to Chinese “A” shares, expenses relating to which apparently triggered the one bp bump.

In another odd development, the Board of Trustees of the Value Line Core Bond Fund (VAGIX) approved a 3:1 reverse stock split on or about October 17, 2014. It’s incredibly rare for a fund to execute a split or a reverse split because the fund’s NAV has absolutely no relevance to its operation. With stocks, share prices that are too low might trigger a delisting alert and shares prices that are too high (think Berkshire Hathaway Cl A shares) might impede trading. Funds have no such excuse. When I spoke with a fund rep, she dutifully read Value Line’s one-sentence rationale to me: “It will realign our fund’s NAV with their peers’ and daily performance would be more appropriately reported.” Neither she nor I nor why the former was important or how the latter occurred, so I rack it up to “it’s Value Line. They do that sort of thing.”

Seafarer adds capacity

As Seafarer Overseas Growth & Income (SFGIX) grows steadily in size, it’s now over $117 million, and approaches its third anniversary, Andrew Foster has taken the opportunity to add to his analyst corps. The estimable Kate Jacquet (Morningstar keeps misspelling her name as “Jacque”) is joined by Paul Espinosa and Sameer Agarwal. Paul was a London-based analyst who has worked for Legg Mason, JP Morgan, Citigroup and Salomon Brothers. He’s got some interesting experience in small cap and market neutral strategies. Sameer grew up in India and worked for an India-based mutual fund before joining Royal Bank of Scotland and later Cartica Management, LLC. Cartica is a sort of liquid alts manager focusing on the emerging markets. I’ll ask Andrew in the month ahead how the guys’ work with what appear to be hedged products might contribute to Seafarer’s famously risk-conscious approach.

Seafarer reduced its expenses again, to 1.25% for Investor shares, though Morningstar continues to report a higher cost.

SMALL WINS FOR INVESTORS

Appleseed (APPLX/APPIX) is lowering their expenses for both investor and institutional classes. Manager Joshua Strauss writes: “As we begin a new fiscal year Oct. 1, we will be trimming four basis points off Appleseed Fund Investor shares, resulting in a 1.20% net expense ratio. At the same time, we will be lowering the net expense ratio on Institutional shares by four basis points, to 0.95%.” It’s a risk-conscious, go-anywhere sort of fund that Morningstar has recognized as one of the few smaller funds that’s impressed them.

Appleseed (APPLX/APPIX) is lowering their expenses for both investor and institutional classes. Manager Joshua Strauss writes: “As we begin a new fiscal year Oct. 1, we will be trimming four basis points off Appleseed Fund Investor shares, resulting in a 1.20% net expense ratio. At the same time, we will be lowering the net expense ratio on Institutional shares by four basis points, to 0.95%.” It’s a risk-conscious, go-anywhere sort of fund that Morningstar has recognized as one of the few smaller funds that’s impressed them.

CLOSINGS (and related inconveniences)

Grandeur Peak Global Reach (GPROX), which was already soft closed to new investors, imposed a hard close on virtually all investors on September 30th.

“Effective immediately, and until further notice” Guggenheim Alpha Opportunity Fund (SAOAX) has closed to all investors. That’s odd. It’s an exceedingly solid long/short fund with negligible assets. There’s been some administrative reshuffling going on but no clear indication of the fund’s future.

OLD WINE, NEW BOTTLES

The Absolute Opportunities Fund has been renamed the Absolute Credit Opportunities Fund (AOFOX). Its prospectus is being revised to reflect a focus on credit-related strategies. At the same time, the fund’s expense ratio is dropping from a usurious 2.75% down to a high 1.60%.

Chilton Realty Income & Growth Fund (REIAX) has become West Loop Realty Fund.

Effective on September 2, 2014, Dreyfus Select Managers Long/Short Equity Fund (DBNAX) became Dreyfus Select Managers Long/Short Fund (DBNAX). Dropping the word “equity” from the name allows the managers to invest more than 20% of the portfolio in non-equity securities but it’s not clear that any great change is in the works. The new prospectus still relegates non-equity securities to one line at the end of paragraph four: “The fund may invest, to a limited extent, in bonds and other fixed-income securities.”

Effective October 1, 2014, Mellon Capital Management Corporation replaced PVG Asset Management Corporation as sub-adviser to the Dunham Loss Averse Equity Income Fund (DAAVX),which was then re-named the Dunham Dynamic Macro Fund.

John Hancock China Emerging Leaders Fund (JCHLX) is rethinking the whole “China” thing and has become just the John Hancock Emerging Leaders Fund. The change allows them to invest across the emerging markets. DFA will still manage the fund.

Effective at the close of business on October 15, 2014, Loomis Sayles Capital Income Fund (LSCAX) becomes Loomis Sayles Dividend Income Fund. The investment strategies change to stipulate the fact that they’ll be investing, mostly, in equities.

Effective September 16, 2014, Market Vectors Wide Moat ETF (MOAT) became Market Vectors Morningstar Wide Moat ETF.

Pioneer is planning to find Solutions for you. Effective mid November, all of the Pioneer Ibbotson Allocation funds will jettison Ibbotson and gain Solutions. So, for example, Pioneer Ibbotson Growth Allocation Fund (GRAAX) will be Pioneer Solutions: Growth Fund. Moderate Allocation (PIALX) will become Solutions: Balanced and Conservative Allocation (PIAVX) will become Solutions: Conservative. Some as-yet undisclosed strategy and manager changes will accompany the name changes.

In that same “let’s add the name of someone well-known to our fund’s name” vein, what was Ramius Trading Strategies Managed Futures Fund (RTSRX) is now State Street/Ramius Managed Futures Strategy Fund. SSgA replaced Horizon Cash Management LLC as manager.

OFF TO THE DUSTBIN OF HISTORY

Dreyfus Emerging Asia Fund (DEAAX) becomes Dreyfus Submerging Asia Fund on or about October 30, 2014. The decision to liquidate caps a sorry seven year run for the tiny, volatile fund which made a ton of money for investors in 2009 (130%) but was unrelievedly bad the rest of the time.

Driehaus Global Growth Fund (DRGGX)is slated to liquidate on October 20, 2014. Cycling through a half dozen managers in a half dozen years certainly didn’t solve the fund’s performance problems and might well have deepened them.

Forward Managed Futures Strategy Fund (FUTRX) no longer has a future, a fact which will be formalized with the fund’s liquidation on October 31, 2014. The fund has lost about 12% since launch in 2012. The whole managed futures universe has performed so abysmally that you have to wonder if regression to the mean is about to rescue some of the surviving funds.

Huntington International Equity Fund (HIEAX) is merging into Huntington Global Select Markets Fund (HGSAX). Effectively both funds are being liquidated. HEIAX disappears entirely and HGSAX transforms from an underperforming equity markets stock fund to a global balanced fund with no particular tilt toward the Ems. The same management team that struggled with these as international equity funds will be entrusted with the new incarnation of Global Select. The best news is a new expense cap of 1.21% on Select. The worst news is that much of the combined portfolio might have to be liquidated to complete the transition.

Morgan Stanley Global Infrastructure Fund (UTLAX)will be absorbed by its institutional sibling, MSIF Select Global Infrastructure (MTIPX). They’re essentially the same fund, except for the fact that the surviving fund is much smaller and charges more. And, too, they’re both really good funds.

Nationwide International Value Fund (NWVAX)will be liquidated on December 19th for all the usual reasons.

Effective November 14, 2014, Northern Large Cap Growth Fund (NOEQX) will merge into Northern Large Cap Core Fund (NOLCX). The Growth Fund shareholders get a major win out of the deal, since they’re joining a far stronger, larger, cheaper fund. The reorganization does not require a shareholder vote.

Perimeter Small Cap Growth Fund (PSCGX/PSIGX) has closed to new investors in anticipation of being liquidated on Halloween. The fund’s redemption fee has been waived, just in case you want to get out early.

On or about November 14, 2014, Pioneer Ibbotson Aggressive Allocation Fund (PIAAX) merges into Pioneer Ibbotson Growth Allocation Fund (GRAAX) At the same time, Growth Allocation changes its name to Pioneer Solutions – Growth Fund.

This is kind of boring, but here’s word that PNC Pennsylvania Tax Exempt Money Market Fund and PNC Ohio Municipal Money Market Fund both liquidate in early October.

QuantShares U.S. Market Neutral Momentum Fund (MOM) and QuantShares U.S. Market Neutral Size Fund (SIZ) are under threat of delisting. “The staff of NYSE Regulation, Inc. recently advised the Trust that the Funds’ shares currently are not in compliance with NYSE Arca, Inc.’s continued listing standards with respect to the number of record or beneficial holders. Therefore, commencing on or about September 16, 2014, NYSE Arca will attach a “below compliance” (.BC) indicator to each Fund’s ticker symbol … Should the Staff determine to delist a Fund, or should the Adviser conclude that a Fund cannot be brought into compliance with NYSE Arca’s continued listing standards, the Adviser will recommend the Fund’s liquidation to the Fund’s Board of Trustees and attempt to provide shareholders with advance notice of the liquidation.”

Pending shareholder approval, Sentinel Capital Growth Fund (BRGRX – it’d read as “Boogers” if it were a license plate) and Sentinel Growth Leaders Fund (BRFOX) will merge into Sentinel Common Stock Fund (SENCX). The shareholder meeting will nominally occur in lovely Montpelier, Vermont, on November 14th. It wouldn’t be unusual for the merger to then occur by year’s end.

TCW Growth Fund (TGGYX) will liquidate around Halloween, 2014.

Turner Large Growth Fund (TCGFX) will soon merge into Turner Midcap Growth Fund (TMGFX), pending shareholder approval. I’ve never really gotten the Turner Funds. They always feel like holdovers from the run and gun ‘90s to me. The fact that Midcap Growth suffered a 56% drawdown during the financial crisis and is routinely a third more volatile than its peers fits with that impression.

Wade Tactical L/S Fund (WADEX) plans to cease and desist around the middle of October.

The Board of Directors for Western Asset Global Multi-Sector Fund (WALAX)has determined that “it is in the best interests of the fund and its shareholders to terminate the fund.” It seemed they long ago also determined it was in shareholders’ best interest not to invest in the fund:

The fund is expected to cease operations on or about November 14, 2014.

On January 30, 2015, Wilmington Short Duration Government Bond Fund (ASTTX) will be merged into the Wilmington Short-Term Corporate Bond Fund (MVSAX). Likewise the Wilmington Maryland Municipal Bond Fund (ARMRX) will be merged into the Wilmington Municipal Bond Fund (WTABX). The latter, muni into muni, makes more sense on face than the former.

The WY Core Fund (SGBFX/SGBYX) disappeared on September 30th, just in case you were wondering why there’s an empty seat at the table.

In Closing . . .

As I sat in my study, 11:30 p.m. CDT on the last day of September, finishing this essay, my internet connection disappeared. Then the lights flickered, flashed then failed. Nuts. The MidAmerican Energy outage map shows that I was one of precisely two customers to lose power. This is the second time since moving to my new home in May that the power disappeared just as we were trying to finishing an update. The first time it happened we were in a world of hurt, both having lost a bunch of writing and having the rest of the new issue trapped inside an inert machine.

This time we were irked and modestly inconvenienced. The difference is that after the first major outage, Chip identified and I bought a really good uninterruptible power supply (UPS) for us. While it’s not an industrial grade unit, it allowed me to save everything, move it for safekeeping to an external solid-state drive and finish the story I was working on before shutting the system down. We resumed work a bit before dawn and finished everything roughly on time.

All of which is to say thank you! to all the folks who’ve supported the Observer. I was deeply grateful that we had the resources at hand to react, quickly and frugally, to resolve the problems caused by the first outage. Thanks to all the folks who use our Amazon link (feel free to share it!), to Joe and Bladen (cool old English name, linked to a village in Oxfordshire) who contributed to our resources this month but most especially to Deb who, in an odd sense, is the Observer’s only subscriber. Deb arranged a monthly auto-transfer from her PayPal account which provides us with a modest, very welcome stipend at the beginning of each month.

The other project that you helped support this month was the first ever face-to-face meeting of the folks who write for you each month. Charles, Chip, Ed and I gathered in Chicago in the immediate aftermath of the Morningstar ETF Conference to discuss (some would say “plot”) the Observer’s future. Among our first priorities coming out of the meeting is to formalize the Observer as a legal enterprise: incorporation, pursue of 501(c)3 tax-exempt organization status, better liability and intellectual property protection and so on. None of that will immediately change the Observer but it all lays the foundation for a more sustainable future. So thanks for your help in covering the expenses there, too.

Take care and enjoy October. It tends to be a rough and tumble month in the markets, but a fine time for visiting orchards with your family and starting the holiday fruitcakes.

As ever,