Objective and strategy

The fund seeks to provide long-term capital appreciation with low volatility relative to the global equity market. The managers use quantitative models to “construct a global equity portfolio that seeks to achieve the lowest amount of expected volatility subject to a set of reasonable constraints designed to foster portfolio diversification and liquidity.” It’s broadly diversified, with 340 stocks across all capitalizations and industry groups, with about 50% outside the U.S. The fund generally hedges most of its currency exposure to further reduce overall portfolio volatility.

Adviser

The Vanguard Group, Inc. Vanguard was founded by Jack Bogle in 1975 as a sort of crazed evangelical investing hobby. It now controls between $2.2 trillion and $2.7 trillion in assets and advises 170 mutual funds. Struck by Vanguard’s quarter trillion dollars of inflows in 2014, Morningstar’s John Rekenthaler recently mused about “what will happen when Vanguard owns everything.”

Manager

James D. Troyer, James P. Stetler, and Michael R. Roach co-manage the fund. Mr. Troyer and Mr. Stetler are Principals at Vanguard and all three have been with the fund since launch. Messrs. Troyer, Stetler, and Roach also co-manage all or a portion of 14 funds with total assets of $121 billion.

Strategy capacity and closure

Unknown.

Active share

“Active share” measures the degree to which a fund’s portfolio differs from the holdings of its benchmark portfolio. High active share indicates management which is providing a portfolio that is substantially different from, and independent of, the index. An active share of zero indicates perfect overlap with the index, 100 indicates perfect independence. Vanguard does not, however, make active share calculations public.

Management’s stake in the fund

As of October 31, 2014, Mr. Troyer had invested between $500,001–$1,000,000 in the fund while Mr. Roach had a minimal investment and Mr. Stetler had none at all. None of Vanguard’s trustees, each of whom oversees 178 funds, has invested in this fund. Oddly, the fund’s largest investor is Vanguard Managed Payout Fund (VPGDX) which owns 52% of it. Overall, Vanguard employees have invested more than $4.7 billion in their funds.

Opening date

December 12, 2013.

Minimum investment

$3,000

Expense ratio

0.21% on Investor class shares, on assets of about $2 Billion, as of July 2023.

Comments

The case for owning a consciously low-volatility stock fund comes down to two observations:

- Most options for reducing portfolio volatility are complicated, expensive and ineffective.

Investors loathe equity managers who hold cash (“I’m not paying you 1.0% a year to buy CDs,” they howl), which is why there are so few managers willing to take the risk: of 2260 US equity funds, well under 100 have 15% or more in cash as of April 2015. Bonds are priced for long-term disappointment, which reduces the appeal of traditional 60/40 portfolios. Folks are much more prone to invest in “liquid alts” despite the fact that most combine untested teams, untested strategies, high expenses (the “multi-alternative” group averages 1.7-1.8%) and low returns (over most trailing periods, the multi-alt group returns between 3-4%).

While we’ve tried to identify the few most-promising options in these areas, there’s an argument that for many investors simply investing in the right types of stocks makes a lot of sense, which brings us to …

- Low volatility stock portfolios substantially raise returns and reduce risk.

The evidence here is remarkable. You’re taught in financial class that high risk assets have higher returns than low risk assets, simply because no one in their right mind would invest in a high risk game without the prospect of commensurately high returns. While that’s true between asset classes (stocks tend to return more than bonds which tend to return more than cash), it’s not true within the stock class. There’s a mass of research that shows that low volatility stocks are a free lunch, worldwide.

There are different ways to constructing such a portfolio. The folks at Research Associates tested four different techniques against a standard market cap weighted index and found the same results everywhere, pretty much regardless of how you chose to choose your portfolio. In the US market, low vol stocks returned 156 basis points higher (134-182, depending) than did the market. In a global sample, the returns were 56 basis points higher (8-143, depending) but the risk was 30% lower. And in the emerging markets, the returns gain was huge – 203 basis points (97-407, depending) – and the volatility reduction was stunning, about a 50% lower volatility was achievable. “In all cases,” they concluded, “the risk reduction is economically and statistically significant.”

Researchers at Standard & Poor’s found that the effect holds across all sizes of stocks, as well. Oddly, the record for large and small cap low volatility stocks is far more consistently positive than for mid-caps. Got no explanation for that.

If the reduction in volatility keeps investors from fleeing the stock market at exactly the wrong moment, then the actual gains to investor portfolios might well be greater than the raw returns suggest.

Why is there a low volatility anomaly? That is, why are less risky stocks more profitable? The best guess is that it’s because they’re boring. No one is excited by them, no one writes excitedly about Church & Dwight (the maker of Arm & Hammer baking soda, Orajel and … well, Trojan condoms) or The Clorox Company. As a result, the stocks aren’t subject to getting bid frantically up and crashing down.

The case for using Vanguard Global Minimum is similarly straightforward:

- It’s Vanguard.

That brings three advantages: it’s going to be run at-cost (30 bps, less than one-quarter of what their peers charge). It’s going to be disciplined. They argue that the “minimum” volatility moniker signals a more sophisticated approach than the simple, more-common “low volatility” strategy. Low-vol, they argue, is simply a collection of the lowest volatility stocks in a screening process; minimum volatility approaches the problem of managing the entire portfolio by accounting for factors such as correlations between the stocks, sector weights and over-exposure to less obvious risk factors such as currency or interest rate fluctuations. And it’s not going to be subject to “Great Man” risk since it’s team-managed by Vanguard’s Quantitative Equity Group.

- It’s global and broadly diversified.

The managers work with a universe of 50 developed and emerging markets. Their expectation is that about half of the money, on average, will be in the US and half elsewhere. The portfolio is spread widely across various market caps (20% small- to micro-cap and 20% mega-cap) and valuations (30% value, 32% growth) and industries (though noticeably light on basic materials, tech and financials).

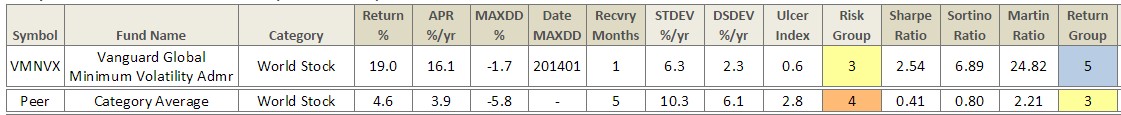

So far, at least in the fund’s first 15 months, it’s working. Our colleague Charles generated a quick calculation of the fund’s performance since inception (December, 2013) against its global peers. Here’s the summary:

Bottom Line

Minimum volatility portfolios allow you to harness the power of other investor’s stupidly: you get to profit from their refusal to bid up boring stocks as they choose, instead, to become involved in the feeding frenzy surrounding sexy biotechs. For investors interested in maintaining their exposure to stocks for the long run, using a global minimum volatility portfolio makes a lot of sense. Using a cheap, discipline one such as Vanguard Global Minimum Volatility makes the most sense for folks who want to pursue that course.

Fund website

Vanguard Global Minimum Volatility. The Vanguard site covers the basics, but doesn’t occur any particularly striking insights into the dynamics of low- or minimum-volatility investing. Happily there are a number of reasonably good reviews, mostly readable, of what you might expect from such a portfolio.

Feifei Li, Ph.D. and Philip Lawton, Ph.D., both of Research Associates, wrote True Grit: The Durable Low Volatility Effect (September 2014). The essay spends as much time on the question of whether the effect is sustainable as on the nature of the effect itself. They draw, in part, on a study of fund manager behavior: fund managers love to tell a dramatic story to clients and associates, which leads them to invest in stocks that … well, have drama. As a result, they subconsciously prefer risky stocks to safe ones. Li and Lawton conclude:

… it is reasonable to expect low volatility investing to persist in producing excess returns. The intensity of investors’ preferences may vary, but chasing outlier returns from stocks that are in vogue seems to be a steady habit … many people find it very hard to change their mindset, and they just don’t seem to learn from experience.

For those who really revel in the statistics, a larger Research Associates team, including the firm’s co-founder Jason Hsu, published a more detailed study of the findings in 2014. Because the web is weird, you can access a pdf of the published study by Googling the title but I can’t embed the link for you. However the pre-publication draft, dated December 2013, is available from the Social Sciences Research Network. Tzee-man Chow, Jason Hsu, Li-lan Kuo, and Feifei Li, A Study of Low-Volatility Portfolio Construction Methods, Journal of Portfolio Management (Summer 2014)

Aye Soe, director of index research and design, Standard & Poor’s, The Low-Volatility Effect: A Comprehensive Look (2012) is not particularly readable, but it delivers what it promises: a comprehensive presentation of the statistical research.

© Mutual Fund Observer, 2015. All rights reserved. The information here reflects publicly available information current at the time of publication. For reprint/e-rights contact us.