Objective

The fund seeks current income and long-term capital appreciation. The managers invest in a combination of blue chip stocks, investment grade intermediate-term bonds, convertible securities and cash. In general, at least 25% of the portfolio will be bonds. In practice, the fund is generally 70% equities. The portfolio turnover rate is modest, typically 25% or below.

Adviser

Founded in 1979 Luther King Capital Management provides investment management services to investment companies, foundations, endowments, pension and profit sharing plans, trusts, estates, and high net worth individuals. Luther King Capital Management has seven shareholders, all of whom are employed by the firm, and 29 investment professionals on staff. As of December, 2010, the firm had about $8 billion in assets. They advise the five LKCM funds and the three LKCM Aquinas funds, which invest in ways consistent with Catholic values.

Manager

Scot Hollmann, J. Luther King and Mark Johnson. Mr. Hollman and Mr. King have managed the fund since its inception, while Mr. Johnson joined the team in 2010.

Management’s Stake in the Fund

Hollman has between $100,00 and $500,000 in the fund, Mr. King has over $1 million, and Mr. Johnson has a pittance (but it’s early).

Opening date

December 30, 1997.

Minimum investment

$10,000 across the board.

Expense ratio

0.81%, after waivers, on an asset base of $19 million (as of April 2011).

Comments

The difference between a successful portfolio and a rolling disaster, is the investor’s ability to do the little things right. Chief among those is keeping volatility low (high volatility funds tend to trigger disastrous reactions in investors), keeping expenses low, keeping trading to a minimum (a high-turnover strategy increases your portfolio cost by 2-3% a year) and rebalancing your assets between stocks, bonds and cash. All of which works, little of which we have the discipline to do.

Enter: the hybrid fund. In a hybrid, you’re paying a manager to be dull and disciplined on your behalf. Here’s simple illustration of how it works out. LKCM Balanced invests in the sorts of stocks represented by the S&P500 and the sorts of bonds represented by an index of intermediate-term, investment grade bonds such as Barclay’s. The Vanguard Balanced Index fund (VBINX) mechanically and efficiently invests in those two areas as well. Here are the average annual returns, as of March 31 2011, for those four options:

| 3 year | 5 year | 10 year | |

| LKCM Balanced | 6.1% | 5.5 | 5.4 |

| S&P 500 index | 2.6 | 3.3 | 4.2 |

| Barclays Intermediate bond index | 5.7 | 5.2 | 5.6 |

| Vanguard Balanced Index fund | 4.9 | 4.7 | 5.2 |

Notice two things: (1) the whole is greater than the sum of its parts. LKCM tends to return more than either of its component parts. (2) the active fund is better than the passive. The Vanguard Balanced Index fund is an outstanding choice for folks looking for a hybrid (ultra-low expenses, returns which are consistently in the top 25% of peer funds over longer time periods). And LKCM consistently posts better returns and, I’ll note below, does so with less volatility.

While these might be the dullest funds in your portfolio, they’re also likely to be the most profitable part of it. Their sheer dullness makes you less likely to bolt. Morningstar research found that the average domestic fund investor made about 200 basis points less, even in a good year, than the average fund did. Why? Because we showed up after a fund had already done well (we bought high), then stayed through the inevitable fall before we bolted (we sold low) and then put our money under a mattress or into “the next hot thing.” The fund category that best helped investors avoid those errors was the domestic stock/bond hybrids. Morningstar concluded:

Balanced funds were the main bright spot. The gap for the past year was just 14 basis points, and it was only 8 for the past three years. Best of all, the gap went the other way for the trailing 10 years as the average balanced-fund investor outperformed the average balanced fund by 30 basis points. (Russel Kinnel, “Mind the Gap 2011,” posted 4/18/2011)

At least in theory, the presence of that large, stolid block would allow you to tolerate a series of small volatile positions (5% in emerging markets small caps, for example) without panic.

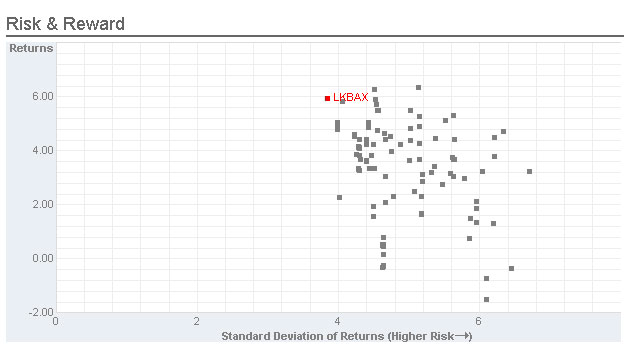

But which hybrid or balanced fund? Here, a picture is really worth a thousand words.

This is a risk versus return scatterplot for domestic balanced funds. As you move to the right, the fund’s volatility grows – so look for funds on the left. As you move up, the fund’s returns rise – so look for funds near the top. Ideally, look for the fund at the top left corner – the lowest volatility, highest return you can find.

That fund is LKCM Balanced.

You can reach exactly the same conclusion by using Morningstar’s fine fund screener. A longer term investor needs stocks as well as bonds, so start by looking at all balanced funds with at least half of their money in stocks.

There are 302 such funds.

To find funds with strong, consistent returns, ask for funds that at least matched the returns of LKCM Balanced over the past 3-, 5- and 10-years.

You’re down to four fine no-load funds (Northern Income Equity, Price Capital Appreciation, Villere Balanced, and LKCM).

Finally, ask for funds no more volatile than LKBAX.

And no one else remains.

What are they doing right?

Quiet discipline, it seems. Portfolio turnover is quite low, in the mid-teens to mid-20s each year. Expenses, at 0.8%, are low, period, and remarkably low for such a small fund. The portfolio is filled with well-run global corporations (U.S. based multinationals) and shorter-duration, investment grade bonds.

Why, then, are there so few shareholders?

Three issues, none related to quality of the fund, come to mind. First, the fund has a high minimum initial investment, $10,000. Second, the fund is not a consistent “chart topper,” which means that it receives little notice in the financial media or by the advisory community. Finally, LKCM does not market its services. Their website is static and rudimentary, they don’t advertise, they’re not located in a financial center (Fort Worth), and even their annual reports offer one scant paragraph about each fund.

What are the reasons to be cautious?

On whole, not many since LKCM seems intent on being cautious on your behalf. The fund offers no direct international exposure; currently, 1% of the portfolio – a single Israeli stock – is it. It also offers no exposure (less than 2% of the portfolio, as of April 2011) to smaller companies. And it does average 70% exposure to the U.S. stock market, which means it will lose money when the market tanks. That might make it, or any fund with substantial stock exposure, inappropriate for very conservative investors.

Bottom Line

This is a singularly fine fund for investors seeking equity exposure without the thrills and chills of a stock fund. The management team has been stable, both in tenure and in discipline. Their objective remains absolutely sensible: “Our investment strategy continues to focus on managing the overall risk level of the portfolio by emphasizing diversification and quality in a blend of asset classes.”

Fund website

© Mutual Fund Observer, 2011. All rights reserved. The information here reflects publicly available information current at the time of publication. For reprint/e-rights contact [email protected].