By David Snowball

Dear friends,

Welcome. Do you think it a coincidence that the holiday season occurs at the least promising time of the year? The days are getting shorter and, for our none-too-distant ancestors, winter represented a period of virtual house arrest. Night was a time of brigands and beasts. Even in the largest cities, respectable folks traveled abroad after dark only with armed guard. In villages and on farms, travel on a clouded night risked disappearance and death. The homes of all but the richest citizens were, contrary to your mental fantasy of roaring hearths and plentiful candles, often a single room that could boast a single flickering rushlight. The hungry months of late winter were ahead.

And so they did what any sensible group would do. They partied. One day’s worth of oil became eight nights’ worth of light; Jewish friends gathered, ate and gifted. Bacchus reigned from our Thanksgiving to the Winter Solstice, and the Romans drank straight through it. The Kalash people of Pakistan sang, danced, lit bonfires and feasted on goat tripe “and other delicacies” (oh, yum!). Chinese and Korean families gathered and celebrated with balls of glutinous rice (more yum!). Welsh friends dressed up like wrens (yuh), and marched from home to home, singing and snacking. Romans in the third century CE celebrated Dies Natalis Solis Invicti (festival of the birth of the Unconquered Sun) on December 25th, a date later borrowed by Christians for their own mid-winter celebration. Some enterprising soul, having consumed most of the brandy, inexplicably mashed together figs, stale bread and the rest of the brandy. Figgy pudding was born and revelers refused to go until they got some (along with a glass of good cheer).

And so they did what any sensible group would do. They partied. One day’s worth of oil became eight nights’ worth of light; Jewish friends gathered, ate and gifted. Bacchus reigned from our Thanksgiving to the Winter Solstice, and the Romans drank straight through it. The Kalash people of Pakistan sang, danced, lit bonfires and feasted on goat tripe “and other delicacies” (oh, yum!). Chinese and Korean families gathered and celebrated with balls of glutinous rice (more yum!). Welsh friends dressed up like wrens (yuh), and marched from home to home, singing and snacking. Romans in the third century CE celebrated Dies Natalis Solis Invicti (festival of the birth of the Unconquered Sun) on December 25th, a date later borrowed by Christians for their own mid-winter celebration. Some enterprising soul, having consumed most of the brandy, inexplicably mashed together figs, stale bread and the rest of the brandy. Figgy pudding was born and revelers refused to go until they got some (along with a glass of good cheer).

Few of these celebrations recognized a single day, they brought instead Seasons Greetings. Fewer still celebrated individual success or personal enrichment, they instead brought to the surface the simple truth that we often bury through the rest of the year: we are infinitely poorer alone in our palaces than we are together in our villages.

Season’s greetings, dear friends.

But curb yer enthusiasm

Small investors and great institutions alike are partaking in one of the market’s perennial ceremonies: placing your investments atop an ever-taller pile of dried kindling and split logs. All of the folks who hated stocks when they were cheap are desperate to buy them now that they’re expensive.

We have one word for you: Don’t.

Or, at the very least, don’t buy them until you’re clear why they weren’t attractive to you five years ago but are calling so loudly to you now. We’re not financial planners, much like market visionaries, but some very careful folks forecast disappointment for starry-eyed stock investors in the years ahead.

Sam Lee, editor of Morningstar ETFInvestor, warned investors to “Expect Below-Average Stock Returns Ahead” based on his reading of the market’s cyclically-adjusted price/earnings ratio. He wrote, on November 21, that:

The Shiller P/E recently hit 25. When you invert that you get is another measure that I like: the cyclically adjusted earnings yield. The inverse of the Shiller P/E, 1 divided by 25 is about 0.04, or 4%. And this is the smooth earnings yield of the market. This is actually, I think, a reasonable forecast for what the market can be expected to return during the next 10, 20 years. And a 4% real expected return is well below the historical average of 6.5%.

The Shiller P/E is saying that the market is overvalued relative to history, that you can expect about 2 percentage points less per year over a long period of time. .. if you believe that the market is mean reverting to its historical Shiller P/E, and that the past is a reasonable guide to the future, then you can expect lower returns than the naive 4% forecast return that I provided.

The institutional investors at Grantham, Mayo, van Otterloo (GMO) believe in the same tendency of markets to revert to their mean valuations and profits to revert to their mean levels (that is, firms can’t achieve record profit levels forever – some combination of worker demands to share the wealth and predatory competitors drawn by the prospect of huge profits, will drive them back down). After three years of research on their market projection models, GMO added some factors that slightly increased their estimate of the market’s fair value and still came away from the projection that US stocks are poised to trail inflation for the rest of this decade. Ben Inker writes:

In a number of ways it is a “clean sheet of paper” look at forecasting equities, and we have broadened our valuation approach from looking at valuations through the lens of sales to incorporating several other methods. It results in about a 0.7%/year increase in our forecast for the S&P 500 relative to the old model. On the old model, fair value for the S&P 500 was about 1020 and the expected return for the next seven years was -2.0% after inflation.

On the new model, fair value for the S&P 500 is about 1100 and the expected return is -1.3% per year for the next seven years after inflation. For those interested in the broader U.S. stock market, our forecast for the Wilshire 5000 is a bit worse, at -2.0%, due to the fact that small cap valuations are even more elevated than those for large caps.

In 2013, the average equity investor made inflation plus about 28%. Through the remainder of the decade, optimists might give you inflation plus 2, 3 or 4%. Bearish realists are thinking inflation minus 1 or 2%.

The Leuthold Group, looking at the market’s current valuation, is at most masochistically optimistic: they project that a “normal” bear market, starting now, would probably not trim much more than 25% off your portfolio.

What to do? Diversify, keep expenses aligned with the value added by your managers, seek some income from equities and take time now – before you forget and before some market event makes you want to look away forever – to review your portfolio for balance and performance. As an essential first step, remember the motto:

Off with their heads!

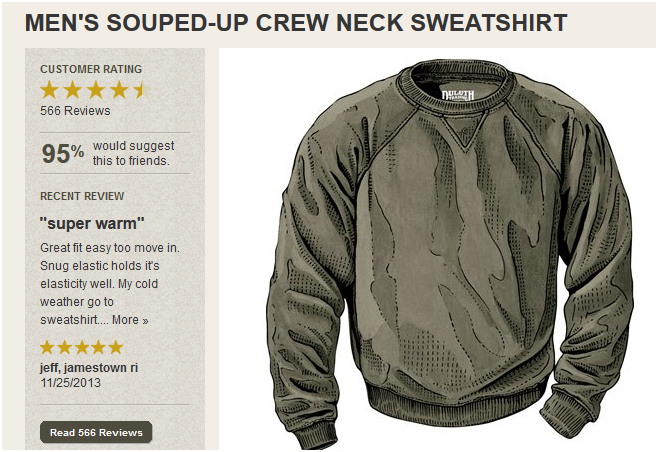

As the Thanksgiving holiday passes and you begin year-end financial planning, we say it’s time to toss out the turkeys. There are some funds that we’re not impressed with but which have the sole virtue that they’re not rolling disasters. You know: the overpriced, bloated index-huggers that seemed like the “safe” choice long ago. And now, like mold or lichen, they’ve sort of grown on you.

Fine. Keep ‘em if you must. But at least get rid of the rolling disasters you’ve inherited. There are a bunch of funds whose occasional flashes of adequacy and earnest talk of new paradigms, great rotations, sea changes, and contrarian independence simply can’t mask the fact that they suck. A lot. For a long time.

It’s time to work through your portfolio, fund by fund, and answer the simple question: “if I didn’t already own this fund, is there any chance on earth I’d buy it?” If the answer is “no,” sell.

Mutual Fund Observer is an outgrowth of FundAlarm, whose iconic Three Alarm Funds list continually identified the worst of the worst in the fund industry. For the last several years we’ve published our own Roll Call of the Wretched, an elite list of funds whose ineptitude stretches over a decade or more. In response to requests that arrive every month, we’re happy to announce the re-introduction of the Three Alarm Funds list which will remain an ongoing service of the Observer. So here we go!

|

It’s easy to create lists of “best” and “worst” funds. It’s easier still to screw them up. The two ways that happens is the inclusion of silly criteria and the use of invalid peer groups. As funds become more distinctive and less like the rest of the herd, the risk of such invalid comparisons grows.

Every failing fund manager (or his anxious marketing maven) has an explanation for why they’re not nearly as bad as the evidence suggests. Sometimes they’re right, mostly they’re just sad and confused.

Use lists like the Roll Call of the Wretched or the Three Alarm Funds as a first step, not a final answer. If you see a fund of yours on either list, find out why. Call the adviser, read the prospectus, try the manager’s letter, post a question on our board. There might be a perfectly good reason for their performance, there might be a perfectly awful one. In either case, you need to know.

|

The Observer’s Annual “Roll Call of the Wretched”

If you’re resident in one of the two dozen states served by Amazon’s wine delivery service, you might want to buck up your courage with a nice 2007 Domaine Gerard Charvin Chateauneuf du Pape Rhône Valley Red before you settle in to enjoy the Observer’s annual review of the industry’s Most Regrettable funds. Just as last year, we looked at funds that have finished in the bottom one-fourth of their peer groups for the year so far. And for the preceding 12 months, three years, five years and ten years. These aren’t merely “below average.” They’re so far below average they can hardly see “mediocre” from where they are.

When we ran the screen in 2011, there were 151 consistently awful funds, the median size for which is $70 million. In 2012 there were . . . 151 consistently awful funds, the median size for which is $77 million. And now? 152 consistently awful funds (I love consistency), the median size of which is $91 million.

Since managers love to brag about the consistency of their performance, here are the most consistently awful funds that have over a billion in assets. Funds repeating from last year are flagged in red.

|

|

|

|

|

|

AllianceBernstein Wealth Appreciation Strategy (AWAAX)

|

Large blend

|

1,524

|

Like many of the Wretched, 2008 was pivotal: decent before, then year after year of bad afterward

|

|

CRA Qualified Investment (CRAIX)

|

Intermediate bond

|

1,572

|

Virtue has its price: The Community Reinvestment Act requires banks make capital available to the low- and moderate-income communities in which they operate. That’s entirely admirable but the fund’s investors pay a price: it trails 90% of its intermediate-bond peers.

|

|

DWS Equity Dividend A (KDHAX)

|

Large value

|

1,234

|

2012 brought a new team but the same results: its trailed 90% of its peers. The current crew is the 9th, 10th and 11th managers to try to make it work.

|

|

Eaton Vance Short Duration Strategy (EVSGX)

|

Multi-sector bond

|

2,248

|

A pricey, closed fund-of-funds whose below-average risk does compensate for much below average returns.

|

|

Hussman Strategic Growth (HSGFX)

|

Long/short equity

|

1,579

|

Dr. Hussman is brilliant. Dr. Hussman has booked negative annual returns for the past 1, 3, 5 and 10 years. Both statements are true, you just need to decide which is relevant.

|

|

MainStay High Yield Corporate (MKHCX)

|

High-yield bond

|

8,811

|

Morningstar likes it because, despite trailing 80% of its peers pretty much permanently, it does so with little risk.

|

|

Pax World Balanced (PAXWX)

|

Aggressive allocation

|

1,982

|

Morningstar analysts cheered for the fund (“worth a look, good option, don’t give up, check this fund out”) right up to the point when they started pretending it didn’t exist. Their last (upbeat) analysis was July 2011.

|

|

Pioneer A (PIODX)

|

Large blend

|

5,245

|

The fund was launched in 1928. The lead manager joined in 1986. The fund has sucked since 2007.

|

|

Pioneer Mid-Cap Value A (PCGRX)

|

Mid-cap value

|

1,107

|

Five bad years in a row (and a lead manager whose held the job of six years). Coincidence?

|

|

Putnam Global Health Care A (PHSTX)

|

Health

|

1,257

|

About 30% international, compared to 10-20% for its peers. That’s a pretty poor excuse for its performance, since it’s not required to maintain an exposure that high.

|

|

Royce Low Priced Stock (RYLPX)

|

Small growth

|

1,688

|

A once-fine fund that’s managed three consecutive years in the bottom 5% of its peer group. Morningstar is unconcerned.

|

|

Russell LifePoints Equity Growth (RELEX)

|

World stock

|

1,041

|

Has trailed its global peers in 10 of the past 11 years which shows why the ticker isn’t RELAX

|

|

State Farm LifePath 2040 (SAUAX)

|

Target-date

|

1,144

|

A fund of BlackRock funds, it manages to trail its peers two years in three

|

|

Thrivent Large Cap Stock (AALGX)

|

Large blend.

|

1,784

|

The AAL in the ticker stands for Aid Association for Lutherans. Let me offer even more aid to my Lutheran brethren: buy an index fund.

|

|

Wells Fargo Advantage S/T High Yield (STHBX)

|

High yield

|

1,537

|

A really bad benchmark category for a short-term fund. Judged as a short-term bond fund, it pretty consistently clubs the competition.

|

Some funds did manage to escape this year’s Largest Wretched Funds list, though the strategies vary: some went extinct, some took on new names, one simply shrank below our threshold and a few rose all the way to mediocrity. Let’s look:

|

BBH Broad Market (BBBMX)

|

An intermediate bond fund that got a new name, BBH Limited Duration (think of it as entering the witness protection program) and a newfound aversion to intermediate-term bonds, which accounts for its minuscule (under 1%) but peer-beating returns.

|

|

Bernstein International (SIMTX)

|

A new management team guided it to mediocrity in 2013. Even Morningstar recommends that you avoid it.

|

|

Bernstein Tax-Managed International (SNIVX)

|

The same new team as at SIMTX and results just barely north of mediocre.

|

|

DFA Two-Year Global Fixed Income (DFGFX)

|

Fundamentally misclassified to begin with, Morningstar now admits it’s “better as an ultrashort bond fund than a global diversifier.” Which makes you wonder why Morningstar adamantly keeps it as a global bond fund rather than as …

|

|

Eaton Vance Strategic Income (ETSIX)

|

As of November 1, 2013, a new name, a new team and a record about as bad as always.

|

|

Federated Municipal Ultrashort (FMUUX)

|

Another bad year but not quite as awful as usual!

|

|

Invesco Constellation

|

Gone! Merged into Invesco American Franchise (VAFAX). Constellation was, in the early 90s, an esteemed aggressive growth fund and it was the first fund I ever owned. But then it got very, very bad.

|

|

Invesco Global Core Equity (AWSAX)

|

“This fund isn’t headed in the right direction,” quoth Morningstar. Uh, guys? It hasn’t been headed in the right direction for a decade. Why bring it up now? In any case, it escaped our list by posting mediocre but not wretched results in 2013.

|

|

Oppenheimer Flexible Strategies (QVOPX)

|

As bad as ever, maybe worse, but it’s (finally) slipped below the billion dollar threshold.

|

|

Thornburg Value A (TVAFX)

|

Thornburg is having one of its periodic brilliant performances: up 38% over the past 12 months, better than 94% of its peers. Over the past decade it’s had three years in the top 10% of its category and has still managed to trail 75% of its peers over the long haul.

|

While most Roll Call funds are small enough that they’re unlikely to trouble you, there are 50 more funds with assets between $100 million and a billion. Check to see if any of these wee beasties are lurking around your portfolio:

|

Aberdeen Select International

AllianceBern Tx-Mgd Wlth Appr

AllianzGI NFJ Mid-Cap Value C

Alpine Dynamic Dividend

BlackRock Intl Bond

BlackRock Natural Resources

Brandywine

Brandywine Advisors Midcap Growth

Brown Advisory Intermediate

ClearBridge Tactical Dividend

CM Advisors

Columbia Multi-Advisor Intl Eq

Davis Government Bond B

Davis Real Estate A

Diamond Hill Strategic Income

Dreyfus Core Equity A

Dreyfus Tax-Managed Growth A

Fidelity Freedom 2000

Franklin Double Tax-Free Income

Gabelli ABC AAA

Gabelli Entpr Mergers & Acquis

GAMCO Global Telecommunication

Guggenheim StylePlus – Lg Core

GuideMark World ex-US Service

GuideStone Funds Cnsrv Allocat

ICON Bond C

Invesco Intl Core Equity

Ivy Small Cap Value A

|

JHancock Sovereign Investors A

Laudus Small-Cap MarketMasters

Legg Mason Batterymarch Emerging

Madison Core Bond A

Madison Large Cap Growth A

MainStay Government B

MainStay International Equity

Managers Cadence Capital Appre

Nationwide Inv Dest Cnsrv A

Neuberger Berman LgCp Discp Gr

Oppenheimer Flexible Strategie

PACE International Fixed Income

Pioneer Classic Balanced A

PNC Bond A

Putnam Global Utilities A

REMS Real Estate Income 50/50

SEI Conservative Strategy A (S

Sentinel Capital Growth A

Sterling Capital Large Cap Val

SunAmerica GNMA B

SunAmerica Intl Div Strat A

SunAmerica US Govt Securities

Thrivent Small Cap Stock A

Touchstone International Value

Waddell & Reed Government Secs

Wells Fargo Advantage Sm/Md Cap

|

Morningstar maintains a favorable analyst opinion on three Wretched funds, is Neutral on three (Brandywine BRWIX, Fidelity Freedom 2000 FFFMX and Pioneer PIODX) and Negative on just four (Hussman Strategic Growth HSGFX, Oppenheimer Flexible Strategies QVOPX and two State Farm LifePath funds). The medalist trio are:

|

Royce Low-Priced Stock RYLPX

|

Silver: “it’s still a good long-term bet.” Uhh, no. By Morningstar’s own assessment, it has consistently above average risk, below average returns, nearly $2 billion in assets and high expenses. There are 24 larger small growth funds, all higher five year returns and all but one have lower expenses.

|

|

AllianzGI NFJ Mid-Cap Value PQNAX

|

Bronze: “a sensible strategy that should win out over time.” But it hasn’t. NFJ took over management of the fund in 2009 and it continues to trail about 80% of its mid-cap value peers. Morningstar argues that the market has been frothy so of course sensible, dividend-oriented funds trail though the amount of “froth” in the mid-cap value space is undocumented.

|

|

MainStay High Yield Corporate MKHCX

|

Bronze: “a sensible option in a risky category.” We’re okay with that: it captures about 70% of its peers downside and 92% of their upside. Over the long term it trails about 80% of them, banking about 6-7% per year. Because it’s highly consistent and has had the same manager since 2000, investors can at least made an informed judgment about whether that’s a profile they like.

|

And now (drum roll, please), it’s the return of a much-loved classic …

Three Alarm Funds Redux

Roy Weitz first published the legacy Three Alarm fund list in 1996. He wanted to help investors decide when to sell mutual funds. Being on the list was not an automatic sell, but a warning signal to look further and see why.

Roy Weitz first published the legacy Three Alarm fund list in 1996. He wanted to help investors decide when to sell mutual funds. Being on the list was not an automatic sell, but a warning signal to look further and see why.

“I liken the list to the tired old analogy of the smoke detector. If it goes off, your house could be on fire. But it could also be cobwebs in the smoke detector, in which case you just change the batteries and go back to sleep,” he explained in a 2002 interview.

Funds made the list if they trailed their benchmarks for the past 1, 3, and 5 year periods. At the time, he grouped funds into only five equity (large-cap, mid-cap, small-cap, balanced, and international) and six specialty “benchmark categories.” Instead of pure indices, he used actual funds, like Vanguard 500 Index Fund VFINX, as benchmarks. Occasionally, the list would catch some heat because “mis-categorization” resulted in an “unfair” rating. Some things never change.

At the end of the day, however, Mr. Weitz wanted “to highlight the most serious underperformers.” In that spirit, MFO will resurrect the Three Alarm fund list, which will be updated quarterly along with the Great Owl ratings. Like the original methodology, inclusion on the list will be based entirely on absolute, not risk-adjusted, returns over the past 1, 3, and 5 year periods.

Since 1996, many more fund categories exist. Today Morningstar assigns over 90 categories across more than 7500 unique funds, excluding money market, bear, trading, volatility, and specialized commodity. MFO will rate the new Three Alarm funds using the Morningstar categories. We acknowledge that “mis-categorization” may occasionally skew the ratings, but probably much less than if we tried to distill all rated funds into just 11 or so categories.

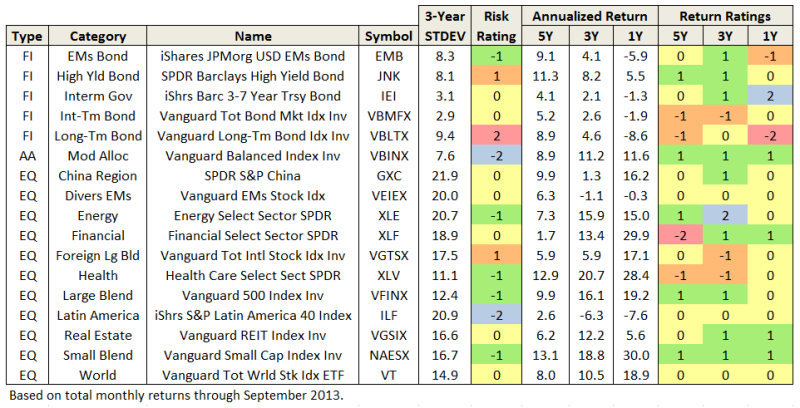

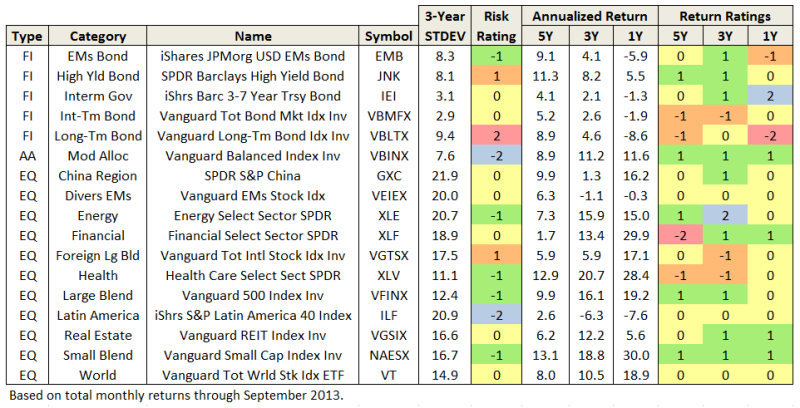

For more than two-thirds of the categories, one can easily identify a reasonable “benchmark” or reference fund, thanks in part to the proliferation of ETFs. Below is a sample of these funds, sorted first by broad investment Type (FI – Fixed Income, AA – Asset Allocation, EQ – Equity), then Category:

Values in the table include the 3-year annualized standard deviation percentage (STDEV), as well as annualized return percentages (APR) for the past 1, 3, and 5 year periods.

A Return Rating is assigned based how well a fund performs against other funds in the same category during the same time periods. Following the original Three Alarm nomenclature, best performing funds rate a “2” (highlighted in blue) and the worst rate a “-2” (red).

As expected, most of the reference funds rate mid range “0” or slightly better. None produce top or bottom tier returns across all evaluation periods. The same is true for all 60 plus category reference funds. Selecting reference funds in the other 30 categories remains difficult because of their diversity.

To “keep it simple” MFO will include funds on the Three Alarm list if they have the worst returns in their categories across all three evaluation periods. More precisely, Three Alarm Funds have absolute returns in the bottom quintile of their categories during the past 1, 3, and 5 years. Most likely, these funds have also under-performed their “benchmarks” over the same three periods.

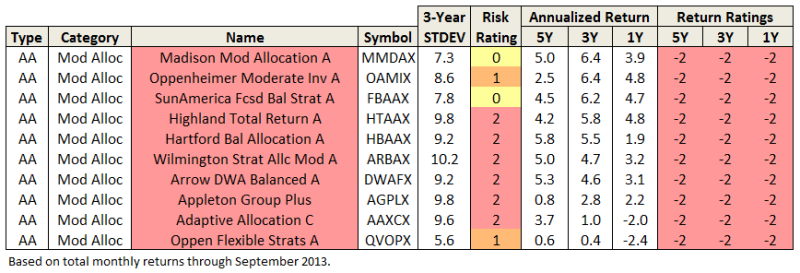

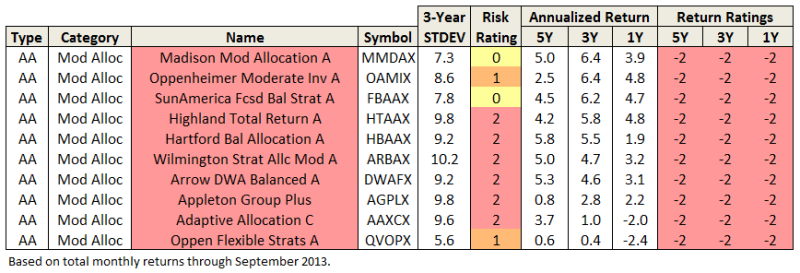

There are currently 316 funds on the list, or fewer than 6% of all funds rated. Here are the Three Alarm Funds in the balanced category, sorted by 3 year annualized return:

Like in the original Three Alarm list, a fund’s Risk Rating is assigned based a “potential bad year” relative to other funds in the same category. A Risk Rating of “2” (highlighted in red) goes to the highest risk funds, while “-2” (blue) goes to the lowest risk funds. (Caution: This rating measures a fund’s risk relative to other funds in same category, so a fund in a high volatility category like energy can have high absolute risk relative to market, even if it has a low risk rating in its category.)

“Risk” in this case is based on the 3 year standard deviation and return values. Specifically, two standard deviations are subtracted from the return value. The result is then compared with other funds in the category to assign a rating. The rating is a little more sensitive to downside than the original measure as investors have experienced two 50% drawdowns since the Three Alarm system was first published.

While never quite as popular as the Three Alarm list, Mr. Weitz also published an Honor Roll list. In the redux system, Honor Roll funds have returns in the top quintile of their categories in the past 1, 3, and 5 years. There are currently 339 such funds.

The Three Alarm, Honor Roll, and Reference funds can all be found in a down-loadable *.pdf version.

06Nov2013/Charles

Funds that are hard to love

Not all regrettable funds are defined by incompetent management. Far from it. Some have records good enough that we really, really wish that they weren’t so hard to love (or easy to despise). High on our list:

Oceanstone Fund (OSFDX)

Why would we like to love it? Five-star rating from Morningstar. Small asset base. Flexible mandate. Same manager since launch. Top 1% returns over the past five years.

What makes it hard to love? The fund is entirely opaque and the manager entirely autocratic. Take, for example, this sentence from the Statement of Additional Information:

Ownership of Securities: As of June 30, 2013, the dollar range of shares in the Fund beneficially owned by James J. Wang and Yajun Zheng is $500,001-$1,000,000.

Mr. Wang manages the fund. Ms. Zheng does not. Nor is she a director or board member; she is listed nowhere else in the prospectus or the SAI as having a role in the fund. Except this: she’s married to Mr. Wang. Which is grand. But why is she appearing in the section of the manager’s share ownership?

Mr. Wang was the only manager to refuse to show up to receive a Lipper mutual fund award. He’s also refused all media attempts to arrange an interview and even the chairman of his board of trustees sounds modestly intimidated by him. His explanation of his investment strategy is nonsense. He keeps repeating the magic formula: IV = IV divided by E, times E. No more than a high school grasp of algebra tells you that this formula tells you nothing. I shared it with two professors of mathematics, who both gave it the technical term “vacuous.” It works for any two numbers (4 = 4 divided by 2, times 2) but it doesn’t allow you to derive one value from the other.

The fund’s portfolio turns over at triple the average rate, consists of just five stocks and a 70% cash stake.

Value Line Asset Allocation Fund (VLAAX)

Why would we like to love it? Five-star rating from Morningstar. Consistency below-average to low risk. Small asset base. Same manager for 20 years. Top tier returns over the past decade.

What makes it hard to love? Putting aside the fact that the advisory firm’s name is “value” spelled backward (“Eulav”? Really guys?), it’s this sentence:

Ownership of Securities. None of the portfolio managers of the Value Line Asset Allocation Fund own shares of the Fund. The portfolio manager of the Value Line Small Cap Opportunities Fund similarly does not own shares of that Fund.

It’s also the fact that I’ve tried, on three occasions, to reach out to the fund’s advisor to ask why no manager ever puts a penny alongside his shareholders but they’ve never responded to any of the queries.

But wait! There’s

Four things strike us as quite good:

- You probably aren’t invested in any of the really rotten funds!

- Even if you are, you know they’re rotten and you can easily get out.

- There are better funds – ones more appropriate to your needs and personality – available.

- We can help you find them!

Accipiter, Charles and Chip have been working hard to make it easier for you to find funds you’ll be comfortable with. We’d like to share two and have a third almost ready, but we need to be sure that our server can handle the load (we might a tiny bit have precipitated a server crash in November and so we’re being cautious until we can arrange a server upgrade).

The Risk Profile Search is designed to help you understand the different measures of a fund’s risk profile. Most fund profiles reduce a fund’s risks to a single label (“above average”) or a single stat (standard deviation = 17.63). Unfortunately, no one measure of risk captures the full picture and most measures of risk are not self-explanatory (how would you do on a pop quiz over the Martin Ratio?). Our Risk Profile Reporter allows you to enter a single ticker symbol for any fund and it will generate a short, clear report, in simple, conversational English, that walks you through the various means of risk and returns and will provide you with the profiles for a whole range of possible benchmarks. Alternatively, entering multiple ticker symbols will return a tabular results page, making side-by-side comparisons more convenient.

The Great Owl Search Engine allows you to screen our Great Owl Funds – those which have top tier performance in every trailing period of three years or more – by category or profile. We know that past performance should never be the primary driver of your decision-making, but working from a pool of consistently superior performers and learning more about their risk-return profile strikes us as a sensible place to start.

Our Fund Dashboard. a snapshot of all of the funds we’ve profiled, is updated quarterly and is available both as a .pdf and searchable, sortable search.

Accipiter’s Miraculous Multi-Search will, God and server willing, launch by mid-December and we’ll highlight its functions for you in our New Year’s edition.

Touchstone Funds: Setting a high standard on analysis

On November 13, Morningstar published an essay entitled “A Measure of Active Management.” Authored by Touchstone Investments, it’s entirely worth your consideration as one of the most readable walk-throughs available of the literature on active management and portfolio outperformance.

On November 13, Morningstar published an essay entitled “A Measure of Active Management.” Authored by Touchstone Investments, it’s entirely worth your consideration as one of the most readable walk-throughs available of the literature on active management and portfolio outperformance.

We all know that most actively managed funds underperform their benchmarks, often by more than the amount of their expense ratios. That is, even accounting for an index fund’s low-expense advantage, the average manager seems to actively detract value. Literally, many investors would be better off if their managers were turned to stone (“calling Madam Medusa, fund manager in Aisle Four”), the portfolio frozen and the manager never replaced.

Some managers, however, do consistently earn their keep. While they might or might not produce raw returns greater than those in an index fund, they can fine-tune strategies, moderate risks and keep investors calm and focused.

Touchstone’s essay at Morningstar makes two powerful contributions. First, the Touchstone folks make the criteria for success – small funds, active and focused portfolios, aligned interests – really accessible. Second, they document the horrifying reality of the fund industry: that a greater and greater fraction of all investments are going into funds that profess active management but are barely distinguishable from their benchmarks.

Here’s a piece of their essay:

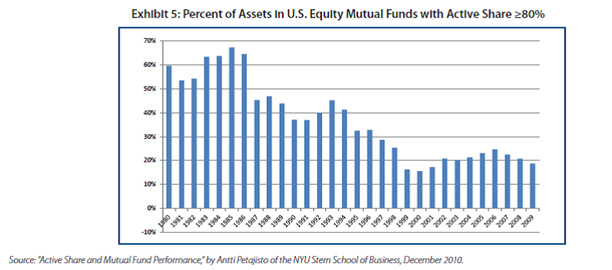

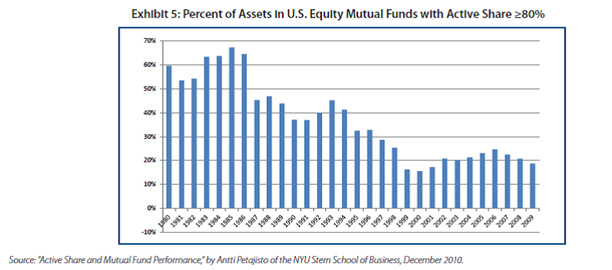

A surprising take away from the Active Share studies was the clear trend away from higher Active Share (Exhibit 5). The percentage of assets in U.S. equity funds with Active Share less than 60% went from 1.5% in 1980 to 50.2% in 2009. Clearly indexing has had an impact on these results.

Yet mutual funds with assets under management with an Active Share between 20% and 60% (the closet indexers) saw their assets grow from 1.1% in 1980 to 31% in 2009, meaning that closet index funds have seen the greatest proportion of asset growth. Assets in funds managed with a high Active Share, (over 80%), have dropped precipitously from 60% in 1980 to just 19% in 2009.

While the 2009 data is likely exaggerated — as Active Share tends to come down in periods of high market volatility —the longer term trend is away from high Active Share.

Cremers and Petajisto speculate that asset growth of many funds may be one of the reasons for the trend toward lower Active Share. They note that the data reveals an inverse relationship between assets in a fund and Active Share. As assets grow, managers may have a tougher time maintaining high Active Share. As the saying goes “nothing fails like success,” and quite often asset growth can lead to a more narrow opportunity set due to liquidity constraints that prevent managers from allocating new assets to their best ideas, they then add more liquid benchmark holdings. Cremers states in his study: “What I say is, if you have skill, why not apply that skill to your whole portfolio? And if your fund is too large to do that, why not close your portfolio?”

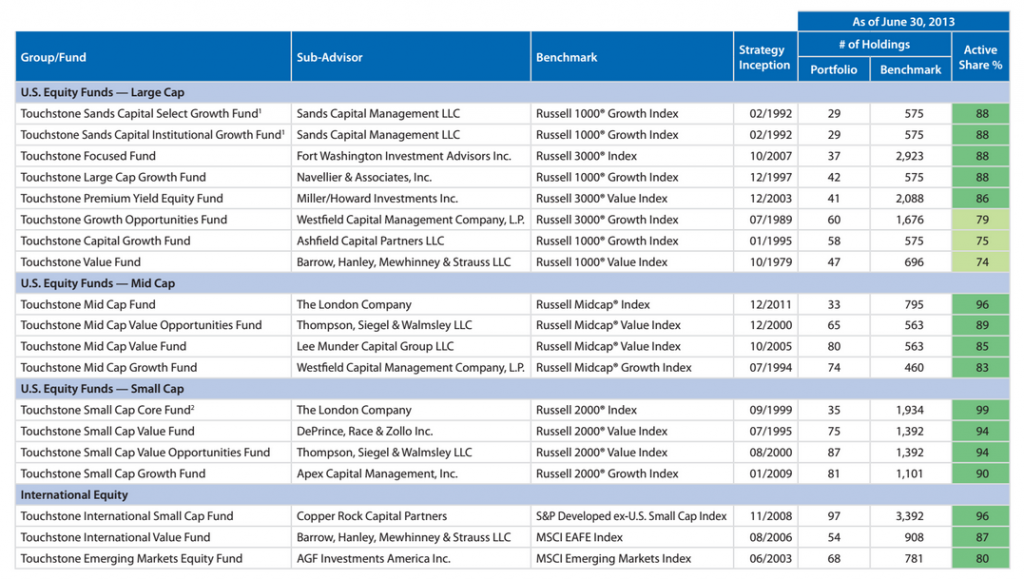

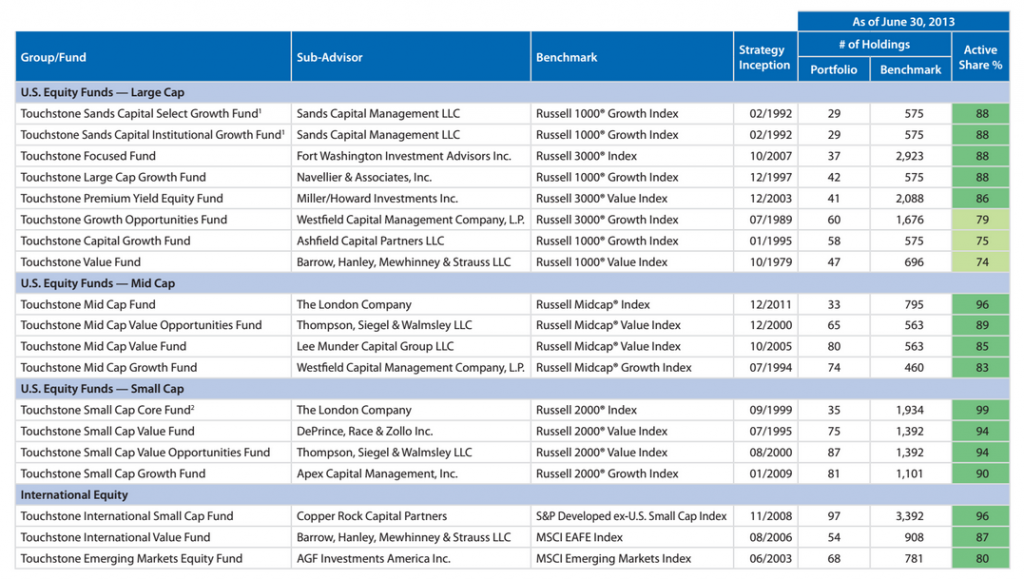

In an essentially unprecedented disclosure, Touchstone then published the concentration and Active Share statistics for their entire lineup of funds:

While it’s clear that Touchstone has some great funds and some modest ones, they really deserve attention and praise for sharing important, rarely-disclosed information with all of their investors and with the public at large. We’d be much better served if other fund companies had the same degree of confidence and transparency.

Touchstone is also consolidating four funds into two, effective March 2014. Steve Owen, one of their Managing Directors and head of International Business Development, explains:

With regard to small value, we are consolidating two funds, both subadvised by the same subadvisor, DePrince, Race & Zollo. Touchstone Small Cap Value Fund (TVOAX) was a legacy fund and that will be the receiving fund. Touchstone Small Company Value Fund (FTVAX), the one that is going away, is a fund that was adopted last year when we bought the Fifth Third Fund Family and we replaced the subadvisor at that time with DePrince Race & Zollo. Same investment mandate, same subadvisor, so it was time to consolidate the two funds.

The Mid Value Opportunities Fund (TMOAX)was adopted last year from the Old Mutual Fund Family and will be merged into Touchstone Mid Cap Value Fund (TCVAX). Consolidating the lineup, eliminating the adopted fund in favor of our incumbent from four years ago.

In preparation for the merger, Lee Munder Capital Group has been given manager responsibilities for both mid-cap funds. Neither of the surviving funds is a stand-out performer but bear watching.

Observer Fund Profiles:

Each month the Observer provides in-depth profiles of between two and four funds. Our “Most Intriguing New Funds” are funds launched within the past couple years that most frequently feature experienced managers leading innovative newer funds. “Stars in the Shadows” are older funds that have attracted far less attention than they deserve.

Aegis Value (AVALX): There are a few funds that promise to pursue the most inefficient, potentially most profitable corner of the domestic equity mark, ultra-small deep value stocks. Of the handful that pursue it, only one other microcap value fund even comes close to Aegis’s long-term record.

T. Rowe Price Global Allocation (RPGAX): T. Rowe is getting bold, cautiously. Their newest and most innovative fund offers a changing mix of global assets, including structural exposure to a single hedge fund, is also broadly diversified, low-cost and run by the team responsible for their Spectrum and Personal Strategy Funds. So far, so good!

Elevator Talk

Elevator Talks are a short feature which offer the opportunity for the managers of interesting funds which we are not yet ready to profile, to speak directly to you. The basic strategy is for the Observer to lay out three paragraphs of introduction and then to give the manager 200 unedited words – about what he’d have time for in an elevator ride with a prospective investors – to lay out his case for the fund.

Elevator Talks are a short feature which offer the opportunity for the managers of interesting funds which we are not yet ready to profile, to speak directly to you. The basic strategy is for the Observer to lay out three paragraphs of introduction and then to give the manager 200 unedited words – about what he’d have time for in an elevator ride with a prospective investors – to lay out his case for the fund.

Our planned Elevator Talk for December didn’t come to fruition, but we’ll keep working with the managers to see if we can get things lined up for January.

Our earlier Elevator Talks were:

- February 2013: Tom Kerr, Rocky Peak Small Cap Value (RPCSX), whose manager has a 14 year track record in small cap investing and a passion for discovering “value” in the intersection of many measures: discounted cash flows, LBO models, M&A valuations and traditional relative valuation metrics.

- March 2013: Dale Harvey, Poplar Forest Partners (PFPFX and IPFPX), a concentrated, contrarian value stock fund that offers “a once-in-a-generation opportunity to invest with a successful American Funds manager who went out on his own.”

- April 2013: Bayard Closser, Vertical Capital Income Fund (VCAPX), “a closed-end interval fund, VCAPX invests in whole mortgage loans and first deeds of trust. We purchase the loans from lenders at a deep discount and service them ourselves.”

- May 2013: Jim Hillary, LS Opportunity Fund (LSOFX), a co-founder of Marsico Capital Management whose worry that “the quality of research on Wall Street continues to decline and investors are becoming increasingly concerned about short-term performance” led to his faith in “in-depth research and long-term orientation in our high conviction ideas.”

- July 2013: Casey Frazier, Versus Capital Multi-Manager Real Estate Income Fund (VCMRX), a second closed-end interval fund whose portfolio “includes real estate private equity and debt, public equity and debt, and broad exposure across asset types and geographies. We target a mix of 70% private real estate with 30% public real estate to enhance liquidity, and our objective is to produce total returns in the 7 – 9% range net of fees.”

- August 2013: Brian Frank, Frank Value Fund (FRNKX), a truly all-cap value fund with a simple, successful discipline: if one part of the market is overpriced, shop elsewhere.

- August 2013: Ian Mortimer and Matthew Page of Guinness Atkinson Inflation Managed Dividend (GAINX), a global equity fund that pursues firms with “sustainable and potentially rising dividends,” which also translates to firms with robust business models and consistently high return on capital.

- September 2013: Steven Vannelli of GaveKal Knowledge Leaders (GAVAX), which looks to invest in “the best among global companies that are tapping a deep reservoir of intangible capital to generate earnings growth,” where “R&D, design, brand and channel” are markers of robust intangible capital. From launch through the end of June, 2013, the fund modestly outperformed the MSCI World Index and did so with two-thirds less volatility

- October 2013: Bashar Qasem of Wise Capital (WISEX), which provides investors with an opportunity for global diversification in a fund category (short term bonds) mostly distinguished by bland uniformity.

- November 2013: Jeffrey Ringdahl of American Beacon Flexible Bond (AFXAX) gives teams from Brandywine Global, GAM and PIMCO incredible leeway wth which to pursue “positive total return regardless of market conditions.” Since inception the fund has noticeably outrun its “nontraditional bond” peers with reasonable volatility.

Conference Call Highlights: John Park and Greg Jackson, Oakseed Opportunity

If I had to suggest what characteristics gave an investor the greater prospects for success, I suggest looking for demonstrably successful managers who viscerally disliked the prospect of careless risk and whose interests were visibly, substantially and consistently aligned with yours.

If I had to suggest what characteristics gave an investor the greater prospects for success, I suggest looking for demonstrably successful managers who viscerally disliked the prospect of careless risk and whose interests were visibly, substantially and consistently aligned with yours.

The evidence increasingly suggests that Oakseed Opportunity matches those criteria. On November 18th, Messrs Jackson and Park joined me and three dozen Observer readers for an hour-long conversation about the fund and their approach to it.

I was struck, particularly, that their singular focus in talking about the fund is “complete alignment of interests.” A few claims particularly stood out:

- their every investable penny in is in the fund.

- they intend their personal gains to be driven by the fund’s performance and not by the acquisition of assets and fees

- they’ll never manage separate accounts or a second fund

- they created an “Institutional” class as a way of giving shareholders a choice between buying the fund NTF with a marketing fee or paying a transaction fee but not having the ongoing expense; originally they had a $1 million institutional minimum because they thought institutional shares had to be that pricey. Having discovered that there’s no logical requirement for that, they dropped the institutional minimum by 99%.

- they’ll close on the day they come across an idea they love but can’t invest in

- they’ll close if the fund becomes big enough that they have to hire somebody to help with it (no analysts, no marketers, no administrators – just the two of them)

Highlights on the investing front were two-fold:

first, they don’t intend to be “active investors” in the sense of buying into companies with defective managements and then trying to force management to act responsibly. Their time in the private equity/venture capital world taught them that that’s neither their particular strength nor their passion.

second, they have the ability to short stocks but they’ll only do so for offensive – rather than defensive – purposes. They imagine shorting as an alpha-generating tool, rather than a beta-managing one. But it sounds a lot like they’ll not short, given the magnitude of the losses that a mistaken short might trigger, unless there’s evidence of near-criminal negligence (or near-Congressional idiocy) on the part of a firm’s management. They do maintain a small short position on the Russell 2000 because the Russell is trading at an unprecedented high relative to the S&P and attempts to justify its valuations require what is, to their minds, laughable contortions (e.g., that the growth rate of Russell stocks will rise 33% in 2014 relative to where they are now.

Their reflections of 2013 performance were both wry and relevant. The fund is up 21% YTD, which trails the S&P500 by about 6.5%. Greg started by imagining what John’s reaction might have been if Greg said, a year ago, “hey, JP, our fund will finish its first year up more than 20%.” His guess was “gleeful” because neither of them could imagine the S&P500 up 27%. While trailing their benchmark is substantially annoying, they made these points about performance:

- beating an index during a sharp market rally is not their goal, outperforming across a complete cycle is.

- the fund’s cash stake – about 16% – and the small short position on the Russell 2000 doubtless hurt returns.

- nonetheless, they’re very satisfied with the portfolio and its positioning – they believe they offer “substantial downside protection,” that they’ve crafted a “sleep well at night” portfolio, and that they’ve especially cognizant of the fact that they’ve put their friends’, families’ and former investors’ money at risk – and they want to be sure that they’re being well-rewarded for the risks they’re taking.

John described their approach as “inherently conservative” and Greg invoked advice given to him by a former employer and brilliant manager, Don Yacktman: “always practice defense, Greg.”

When, at the close, I asked them what one thing they thought a potential investor in the fund most needed to understand in order to know whether they were a good “fit” for the fund, Greg Jackson volunteered the observation “we’re the most competitive people alive, we want great returns but we want them in the most risk-responsible way we can generate them.” John Park allowed “we’re not easy to categorize, we don’t adhere to stylebox purity and so we’re not going to fit into the plans of investors who invest by type.”

They announced that they should be NTF at Fidelity within a week. Their contracts with distributors such as Schwab give those platforms latitude to set the minimums, and so some platforms reflect the $10,000 institutional minimum, some picked $100,000 and others maintain the original $1M. It’s beyond the guys’ control.

Finally, they anticipate a small distribution this year, perhaps $0.04-0.05/share. That reflects two factors. They manage their positions to minimize tax burdens whenever that’s possible and the steadily growing number of investors in the fund diminishes the taxable gain attributed to any of them.

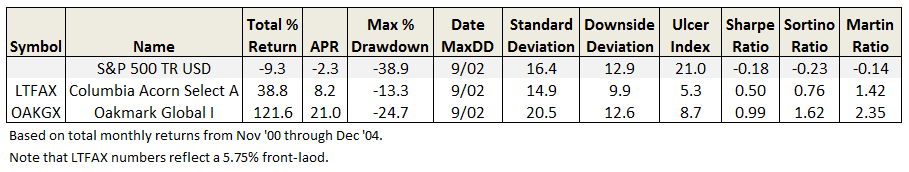

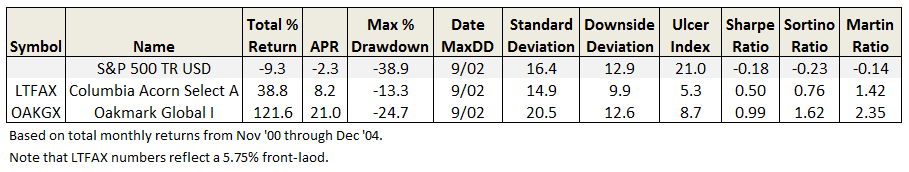

If you’re interested in the fund, you might benefit from reviewing the vigorous debate on the discussion board that followed the call. Our colleague Charles, who joined in on the call, looked at the managers’ previous funds. He writes: “OK, quick look back at LTFAX and OAKGX from circa 2000 through 2004. Ted, even you should be impressed…mitigated drawdown, superior absolute returns, and high risk adjusted returns.”

For folks interested but unable to join us, here’s the complete audio of the hour-long conversation.

The SEEDX Conference Call

As with all of these funds, we’ve created a new featured funds page for Oakseed Opportunity Fund, pulling together all of the best resources we have for the fund.

December Conference Call: David Sherman, RiverPark Strategic Income

David Sherman

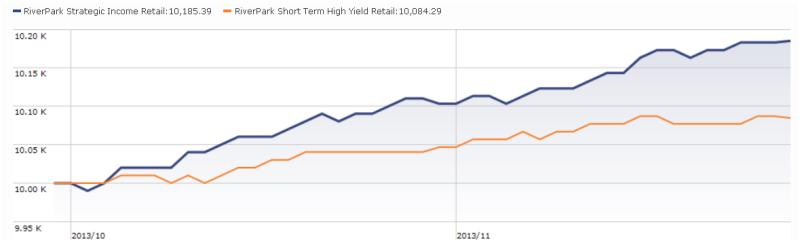

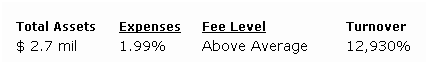

We’d be delighted if you’d join us on Monday, December 9th, for a conversation with David Sherman of Cohanzick Asset Management and Morty Schaja, president of the RiverPark funds. On September 30, 2013, Cohanzick and Riverpark collaborated on the launch of their second fund together, RiverPark Strategic Income (RSIVX). Two months later, the fund has drawn nearly $90 million into a limited capacity strategy that sort of straddles the short- to intermediate-term border.

David describes this as a conservatively managed fund that focuses on reasonable returns with maximum downside protection. With both this fund and RiverPark Short-Term High-Yield (RPHYX, closed to new investors), David was comfortable having his mom invest in the fund and is also comfortable that if he gets, say, abducted by aliens, the fund could simply and profitably hold all of its bonds to redemption without putting her security as risk. Indeed, one hallmark of his strategy is its willingness to buy and hold to redemption rather than trading on the secondary market.

President Schaja writes, “In terms of a teaser….

- Sherman and his team are hoping for returns in the 6-8% range while managing a portfolio of “Money Good” securities with an average duration of less than 5 years. Thereby, getting paid handsomely for the risk of rising rates.

- By being small and nimble Sherman and his team believe they can purchase “Money Good” securities with above average market yields with limited risk if held to maturity.

- The fund will be able to take advantage of some of the same securities in the 1-3 year maturity range that are in the short term high yield fund.

- There are “dented Credits” where credit stress is likely, however because of the seniority of the security the Fund will purchase, capital loss is deemed unlikely.

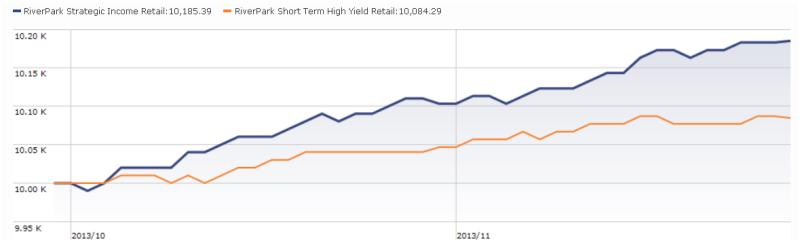

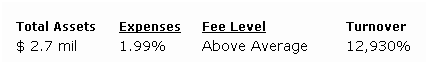

David has the fund positioned as the next step out from RPHYX on the risk-return spectrum and he thinks the new fund will about double the returns on its sibling. So far, so good:

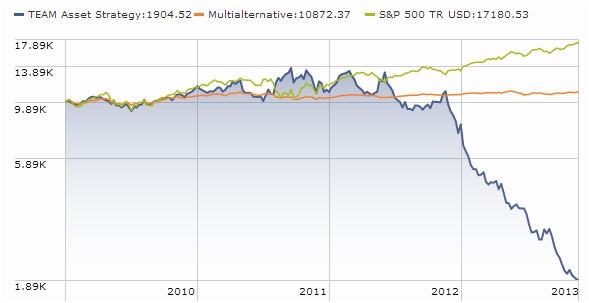

Since I’m not a fan of wild rivers in a fixed-income portfolio, I really appreciate the total return line for the two RiverPark funds. Here’s Strategic Income against its multisector bond peer group:

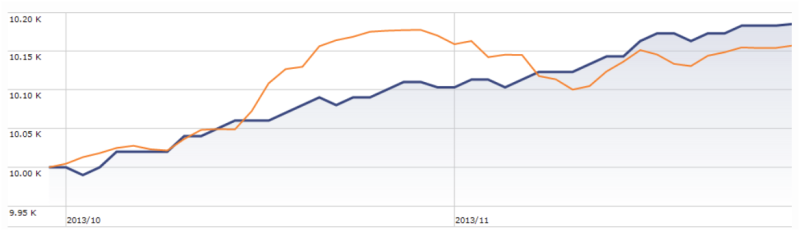

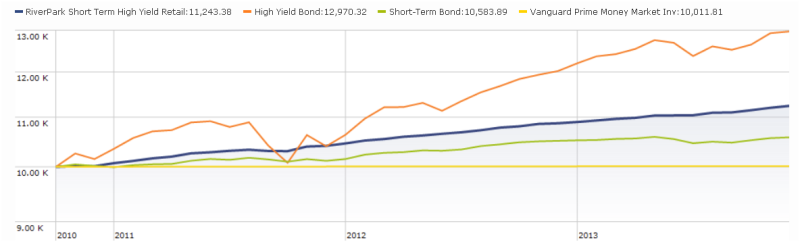

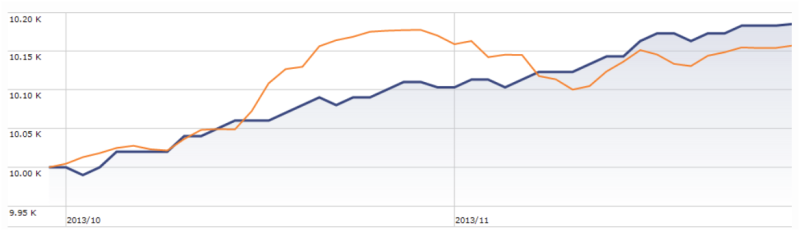

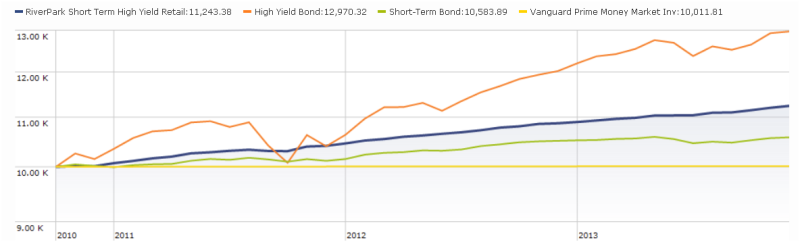

Well, yes, I know that’s just two months. By way of context, here’s the three year comparison of RPHYX with its wildly-inappropriate Morningstar peer group (high yield bonds, orange), its plausible peer group (short-term bonds, green) and its functional peer, Vanguard’s Prime Money Market (VMMXX, hmmm…goldenrod?):

Our conference call will be Monday, December 9, from 7:00 – 8:00 Eastern. It’s free. It’s a phone call.

How can you join in?

If you’d like to join in, just click on register and you’ll be taken to the Chorus Call site. In exchange for your name and email, you’ll receive a toll-free number, a PIN and instructions on joining the call. If you register, I’ll send you a reminder email on the morning of the call.

If you’d like to join in, just click on register and you’ll be taken to the Chorus Call site. In exchange for your name and email, you’ll receive a toll-free number, a PIN and instructions on joining the call. If you register, I’ll send you a reminder email on the morning of the call.

Remember: registering for one call does not automatically register you for another. You need to click each separately. Likewise, registering for the conference call mailing list doesn’t register you for a call; it just lets you know when an opportunity comes up.

WOULD AN ADDITIONAL HEADS UP HELP?

Over two hundred readers have signed up for a conference call mailing list. About a week ahead of each call, I write to everyone on the list to remind them of what might make the call special and how to register. If you’d like to be added to the conference call list, just drop me a line.

Launch Alert: Kopernik Global All-Cap Fund (KGGAX and KGGIX)

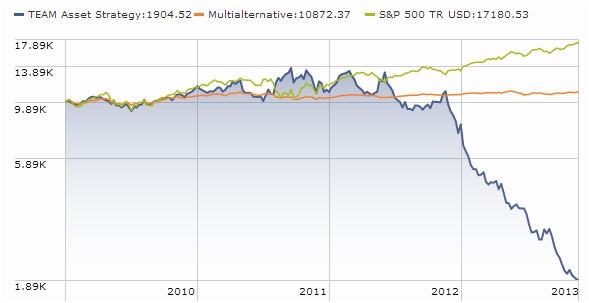

It’s rare that the departure of a manager triggers that collapse of an empire, but that’s pretty much what happened when David Iben left his Nuveen Tradewinds Global All-Cap Fund (NWGAX) in June 2012. From inception through his departure, a $10,000 investment in NWGAX would have grown by $3750. An investment made in his average peer would have grown by $90.

Iben was hired away from Tradewinds by Jeff Vinik, the former Fidelity Magellan manager who’d left that fund in 1996 to establish his hedge fund firm, Vinik Asset Management. Iben moved with four analysts to Vinik and became head of a 20-person value investing team.

In the six months following his announced intention to depart, Tradewinds lost nearly 75% of its total assets under management. Not 75% of his funds’ assets. 75% of the entire firm’s assets, about $28 billion between investor exits and market declines.

In May 2013, Vinik announced the closure of his firm “citing poor performance over a 10-month period” (Tampa Bay Business Journal, May 3 2013). You’ll have to give me a second to let my eyes return to normal; the thought of closing a firm because of a ten month bad stretch made them roll. Mr. Iben promptly launched his own firm, backed by a $20 million investment (a/k/a pocket change) by Mr. Vinik.

On November 1, 2013, Kopernik Global Investors launched launched Kopernik Global All-Cap Fund (Class A: KGGAX; Class I: KGGIX) which they hope will become their flagship. By month’s end, the fund had nearly $120 million in assets.

If we base an estimate of Kopernik Global on the biases evident in Nuveen Tradewinds Global, you might expect:

A frequently out-of-step portfolio, which reflects Mr. Iben’s value orientation, disdain for most investors’ moves and affinity for market volatility. They describe the outcome this way:

This investment philosophy implies ongoing contrarian asset positioning, which in turn implies that the performance of Kopernik holdings are less reliant on the prevailing sentiment of market investors. As one would expect with such asset positioning, the performance of Kopernik strategies tend to have little correlation to common benchmarks.

A substantial overweight in energy and basic materials, which Mr. Iben overweighted almost 2:1 relative to his peers. He had a particular affinity for gold-miners.

The potential for a substantial overweight in emerging markets, which Mr. Iben overweighted almost 2:1 relative to his peers.

A slight overweight in international stocks, which were 60% of the Tradewinds’ portfolio but a bit more than 50% of its peers.

The themes of independence, lack of correlation with other investments, and the exploitation of market anomalies recur throughout Kopernik’s website. If you’re even vaguely interested in exploring this fund, you’d better take those disclosures very seriously. Mr. Iben had brilliant performance in his first four years at Tradewinds, and then badly trailed his peers in five of his last six quarters. While we do not know how his strategy performed at Vinik, we do know that 10 months after his arrival, the firm closed for poor performance.

Extended periods of poor performance are one of the hallmarks of independent, contrarian, visionary investors. It’s also one of the hallmarks of self-prepossessed monomaniacs. Sometimes the latter look like the former. Often enough, the former are the latter.

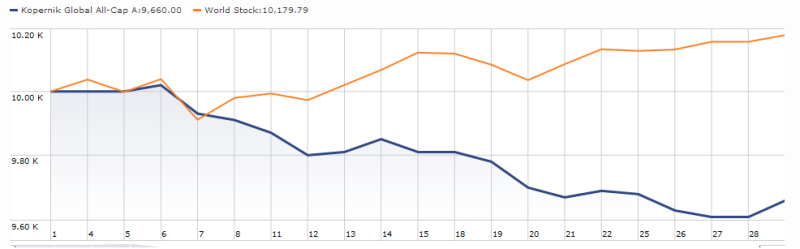

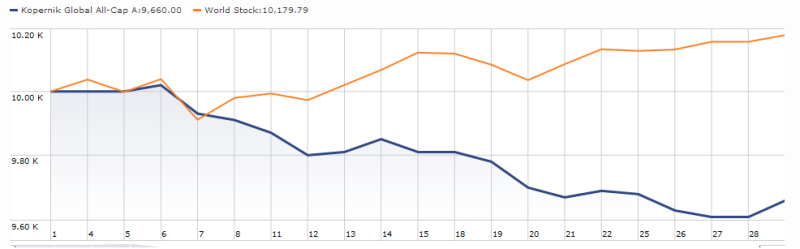

The first month of Kopernik’s performance (in blue) looks like this:

Mr. Iben is clearly not following the pack. You’d want to be comfortable with where he is leading the caravan before joining.

“A” shares carry a 5.75% load, capped 1.35% expenses and $3000 minimum. Institutional shares are no-load with expenses of 1.10% and a $1 million minimum. The fund is not (yet) available for sale at Schwab or the other major platforms and a Schwab rep says he does not see any evidence of active negotiation with Kopernik but recommends that interested parties check in occasionally at the Kopernik Global All-Cap page at Schwab. The “availability” tab will let you know if it has become available.

Funds in Registration

New mutual funds must be registered with the Securities and Exchange Commission before they can be offered for sale to the public. The SEC has a 75-day window during which to call for revisions of a prospectus; fund companies sometimes use that same time to tweak a fund’s fee structure or operating details. Any fund that wanted to launch before the end of the year needed to be in registration by mid- to late October.

And there were a lot of funds targeting a year-end launch. Every day David Welsch, firefighter/EMT/fund researcher, scours new SEC filings to see what opportunities might be about to present themselves. This month he tracked down 15 no-load retail funds in registration, which represents our core interest. That number is down from what we’d normally see because these funds won’t launch until February 2014; whenever possible, firms prefer to launch by December 30th and so force a lot of funds into the pipeline in October.

Interesting entries this month include:

American Beacon Global Evolution Frontier Markets Income Fund will be the first frontier market bond fund, focusing on sovereign debt. It will be managed by a team from Global Evolution USA, LLC, a subsidiary of Global Evolution Fondsmæglerselskab A/S. But you already knew that, right?

PIMCO Balanced Income Fund primarily pursues income and will invest globally, both very much unlike the average balanced fund. They’ll invest globally in dividend-paying common and preferred stocks and all flavors of fixed- and floating-rate instruments. The prospectus is still in the early stages of development, so there’s no named manager or expense ratio. This might be good news for Sextant Global High Income (SGHIX), which tries to pursue the same distinctive strategy but has had trouble explaining itself to investors.

SPDR Floating Rate Treasury ETF and WisdomTree Floating Rate Treasury Fund will track index of the as-yet unissued floating rate Treasury notes, the first small auction of which will occur January 29, 2014.

Manager Changes

On a related note, we also tracked down 58 fund manager changes.

Updates: the reorganization of Aegis Value, take two

Last month we noted, with unwarranted snarkiness, the reorganization of Aegis Value Fund (AVALX). We have now had a chance to further review the preliminary prospectus and a 73-page proxy filing. The reorganization had two aspects, one of which would be immediately visible to investors and the other of which may be significant behind the scenes.

Last month we noted, with unwarranted snarkiness, the reorganization of Aegis Value Fund (AVALX). We have now had a chance to further review the preliminary prospectus and a 73-page proxy filing. The reorganization had two aspects, one of which would be immediately visible to investors and the other of which may be significant behind the scenes.

The visible change: before reorganization AVALX operates as a no-load retail fund with one share class and a $10,000 investment minimum. According to the filings, after reorganization, Aegis is expected to have two share classes. In the reorganization, a new, front-loaded, retail A-share class would be introduced with a maximum 3.75% sales load but also a series of breakpoint reductions. There would also be a two-year, 1% redemption fee on some A-share purchases with value in excess of $1 million. There would also be a no-load institutional share class with a published $1,000,000 minimum. However, current AVALX shareholders would become holders of grandfathered institutional shares not subject to the $1 million investment minimum.

Does this mean that new retail investors get stuck paying a sales load? No, not necessarily. While the institutional class of Aegis High Yield has the same nominal million dollar minimum as Aegis Value will, it’s currently available through many fund supermarkets with the same $10,000 minimum investment as the retail shares of Aegis Value now have. We suspect that Aegis Value shareholders may benefit from the same sort of arrangement.

Does this mean that retail investors get stuck paying a 1% redemption fee on shares sold early? Again, not necessarily. As best I understand it, the redemption fee applies only to broker-sold A-shares sold in denominations greater than $1 million where the advisor pays a commission to the broker if the shares are then redeemed within two years of purchase. So folks buying no-load institutional shares or buying “A” shares and actually paying the sales load are expected to be exempt.

The visible changes appear designed to make the fund more attractive in the market and especially to the advisor market, though it remains an open question whether “A” shares are the package most attractive to such folks. Despite competitive returns over the past five years, the fund’s AUM remains far below its peak so we believe there’s room and management ability for substantially more assets.

The invisible change: two existing legal structures interfere with the advisor’s smooth and efficient organization. They have two funds (Aegis High Yield AHYAX/AHYFX is the other) with different legal structures (one Delaware Trust, one Maryland Corporation) and different fiscal year ends. That means two sets of bookkeeping and two sets of reports; the reorganization is expected to consolidate the two and streamline the process. We estimate the clean-up might save the advisor a little bit in administrative expenses. In the reorganization, AVALX is also eliminating some legacy investment restrictions. For example, AVALX is currently restricted from holding more than 10% of the publicly-available shares of any company. The reorganization would lift these restrictions. While the Fund has in the past only rarely held positions approaching the 10 percent ownership threshold, lifting these kinds of restrictions may provide management with more investment flexibility in the future.

Briefly Noted . . .

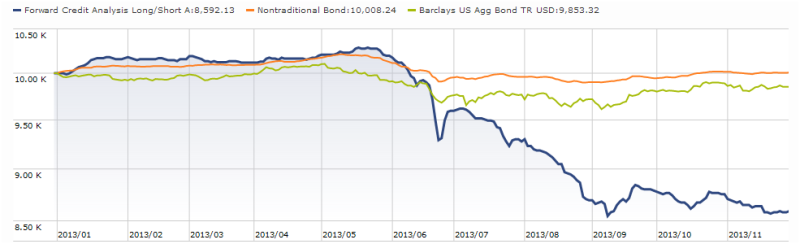

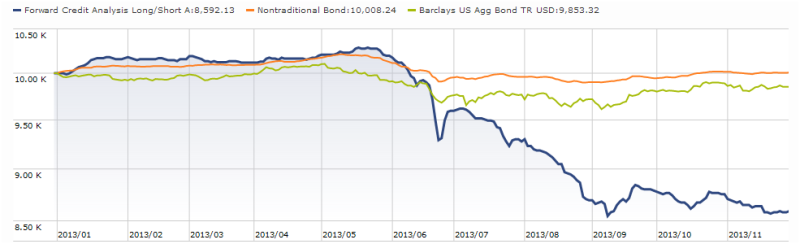

In a surprising announcement, Forward Funds removed a four-person team from Cedar Ridge Partners as the sub-advisers responsible for Forward Credit Analysis Long/Short Fund (FLSLX). The fund was built around Cedar Ridge’s expertise in muni bond investing and the team had managed the fund from inception. Considered as a “non-traditional bond” fund by Morningstar, FLSLX absolutely clubbed their peers in 2009, 2011, and 2012 while trailing a bit in 2010. Then this in 2013:

In a surprising announcement, Forward Funds removed a four-person team from Cedar Ridge Partners as the sub-advisers responsible for Forward Credit Analysis Long/Short Fund (FLSLX). The fund was built around Cedar Ridge’s expertise in muni bond investing and the team had managed the fund from inception. Considered as a “non-traditional bond” fund by Morningstar, FLSLX absolutely clubbed their peers in 2009, 2011, and 2012 while trailing a bit in 2010. Then this in 2013:

Over the past six months, FLSLX dropped about 14% in value while its peers drifted down less than 2%.

We spoke with CEO Alan Reid in mid-November about the change. While he praised the Cedar Ridge team for their work, he noted that their strategy seemed to work best when credit spreads were compressed and poorly when they widened. Bernanke’s May 22 Congressional testimony concerning “tapering” roiled the credit markets, but appears to have gobsmacked the Cedar Ridge team: that’s the cliff you see them falling off. Forward asked them to “de-risk” the portfolio and shortly afterward asked them to do it again. As he monitored the fund’s evolution, Mr. Reid faced the question “would I put my money in this fund for the next three to five years?” When he realized the answer was “no,” he moved to change management.

The new management team, Joseph Deane and David Hammer, comes from PIMCO. Both are muni bond managers, though neither has run a fund or – so far as I can tell – a long/short portfolio. Nonetheless they’re back by an enormous analyst corps. That means they’re likely to have access to stronger research which would lead to better security selection. Mr. Reid points to three other distinctions:

There is likely to be less exposure to low-quality issues, but more exposure to other parts of the fixed-income market. The revised prospectus points to “municipal bonds, corporate bonds, notes and other debentures, U.S. Treasury and Agency securities, sovereign debt, emerging markets debt, variable rate demand notes, floating rate or zero coupon securities and nonconvertible preferred securities.”

There is likely to be a more conservative hedging strategy, focused on the use of credit default swaps and futures rather than shorting Treasury bonds.

The fund’s expenses have been materially reduced. Cedar Ridge’s management fee had already been cut from 1.5% to 1.2% and the new PIMCO team is under contract for 1.0%.

It would be wise to approach with care, since the team is promising but untested and the strategy is new. That said, Forward has been acting quickly and decisively in their shareholders’ interests and they have arranged an awfully attractive partnership with PIMCO.

Wow. In mid-November T. Rowe Price’s board decided to merge the T. Rowe Price Global Infrastructure Fund (TRGFX) into T. Rowe Price Real Assets Fund (PRAFX). Equity CIO John Linehan talked with us in late November about the move. The short version is this: Global Infrastructure found very little market appeal because the vogue for infrastructure investing is in private equity rather than stocks. That is, investors would rather own the lease on a toll road than own stock in a company which owns, among other things, the lease on a toll road. Since the fund’s investment rationale – providing a hedge against inflation – can be addressed well in the Real Assets funds, it made business sense to merge Infrastructure away.

Wow. In mid-November T. Rowe Price’s board decided to merge the T. Rowe Price Global Infrastructure Fund (TRGFX) into T. Rowe Price Real Assets Fund (PRAFX). Equity CIO John Linehan talked with us in late November about the move. The short version is this: Global Infrastructure found very little market appeal because the vogue for infrastructure investing is in private equity rather than stocks. That is, investors would rather own the lease on a toll road than own stock in a company which owns, among other things, the lease on a toll road. Since the fund’s investment rationale – providing a hedge against inflation – can be addressed well in the Real Assets funds, it made business sense to merge Infrastructure away.

Taken as a global stock fund, Infrastructure was small and mediocre. (We warned that “[t]he case for a dedicated infrastructure fund, and this fund in particular, is still unproven.”) Taken as a global stock fund, Real Assets is large and rotten. The key is that “real assets” funds are largely an inflation-hedge, investing in firms that control “stuff in the ground.” With inflation dauntingly low, all funds with this focus (AllianceBernstein, Cohen & Steers, Cornerstone, Harford, Principal and others offer them) has looked somewhere between “punky” and “putrid.” In the interim, Price has replaced Infrastructure’s manager (Kes Visuvalingam has replaced Susanta Mazumdar) and suspended its redemption fee, for the convenience of those who would like out early.

Our Real Assets profile highlights the fact that this portfolio might be used as a small hedge in a diversified portfolio; perhaps 3-5%, which reflects its weight in Price’s asset allocation portfolios. Mr. Lee warns that the fund, with its huge sector bets on energy and real estate, will underperform in a low-inflation environment and would have no structural advantage even in a moderate rate one. Investors should probably celebrate PRAFX’s underperformance as a sign that the chief scourge of their savings and investments – inflation – is so thoroughly suppressed.

FundX Tactical Total Return Fund (TOTLX) Effective January 31, 2014, the investment objective of the FundX Tactical Total Return Fund is revised to read: “The Fund seeks long term capital appreciation with less volatility than the broad equity market; capital preservation is a secondary consideration.”

SMALL WINS FOR INVESTORS

CAN SLIM® Select Growth Fund (CANGX) On Monday, November 11, 2013, the Board of Trustees of Professionally Managed Portfolios approved the following change to the Fund’s Summary Prospectus, Prospectus and Statement of Additional Information: The Fund’s Expense Cap has been reduced from 1.70% to 1.39%.

The expense ratio on nine of Guggenheim’s S&P500 Equal Weight sector ETFS (Consumer Discretionary, Consumer Staples, Energy, Financials, Health Care, Industrials, Materials, Technology and Utilities) have dropped from 0.50% to 0.40%.

Effective November 15th, REMS Real Estate Income 50/50 (RREFX) eliminated its sales load and reduced its 12(b)1 fee from 0.35% to 0.25%. The new investment minimum is $2,500, up from its previous $1,000. The 50/50 refers to the fund’s target allocation: 50% in the common stock of REITs, 50% in their preferred securities.

Effective mid-November, the Meridian Funds activated Advisor and Institutional share classes.

CLOSINGS (and related inconveniences)

Effective November 18, 2013, the Buffalo Emerging Opportunities Fund (BUFOX), a series of Buffalo Funds, will be closed to all new accounts, including new employer sponsored retirement plans (“ESRPs”). The Fund will remain open to additional investments by all existing accounts

Invesco European Small Company Fund (ESMAX) will close to all investors effective the open of business on December 4, 2013. The fund has $560 million in AUM, a low turnover style and a splendid record. The long-time lead manager, Jason Holzer, manages 13 other funds, most for Invesco and most in the European and international small cap realms. That means he’s responsible for over $16 billion in assets. He has over a million invested both here and in his International Small Company Fund (IEGAX).

Effective December 31, 2013, T. Rowe Price New Horizons Fund (PRHNX) will be closed to new investors. This used to be one of Price’s best small cap growth funds until the weight of $14 billion in assets moved it up the scale. Morningstar still categorizes it as “small growth” and it still has a fair chunk of its assets in small cap names, but a majority of its holdings are now mid- to large-cap stocks.

Also on December 31, 2013, the T. Rowe Price Small-Cap Stock Fund (OTCFX) will be closed to new investors. Small Cap is smaller than New Horizons – $9 billion versus $14 billion – and maintains a far higher exposure to small cap stocks (about 70% of the portfolio). Nonetheless it faces serious headwinds from the inevitable pressure of a rising asset base – up by $2 billion in 12 months. There’s an interesting hint buried in the fund’s ticker symbol: it was once the Over the Counter Securities Fund.

Too late: Vulcan Value Partners Small Cap Fund (VVPSX), which we profiled as “a solid, sensible, profitable vehicle” shortly after launch, vindicated our judgment when it closed to new investors at the end of November. The closure came with about one week’s notice, which strikes me as a responsible decision if you’re actually looking to close off new flows rather than trigger a last minute rush for the door. The fund’s current AUM, $750 million, still gives it plenty of room to maneuver in the small cap realm.

Effective December 31, 2013, Wells Fargo Advantage Emerging Markets Equity Fund (EMGAX) will be closed to most new investors. Curious timing: four years in a row (2009-2012) of top decile returns, and it stayed open. Utterly mediocre returns in 2013 (50th percentile, slightly underwater) and it closes.

OLD WINE, NEW BOTTLES

BlackRock Emerging Market Local Debt Portfolio (BAEDX) is changing its name and oh so much more. On New Year’s 2014, shareholders will find themselves invested in BlackRock Emerging Markets Flexible Dynamic Bond Portfolio which certainly sounds a lot more … uhh, flexible. And dynamic! I sometimes wonder if fund marketers have an app on their iPhones, rather like UrbanSpoon, where you hit “shake” and slot machine-like wheels start spinning. When they stop you get some combination of Flexible, Strategic, Multi-, Asset, Manager, Strategy, Dynamic, Flexible and Tactical.

Oh, right. Back to the fund. The Flexible Dynamic fund will flexibly and dynamically invest in what it invests in now except they are no longer bound to keep 65% or more in local-currency bonds.

Effective March 1, 2014, BMO Government Income Fund (MRGIX) beomes BMO Mortgage Income Fund. There will be no change in strategy reflecting the fact that the government gets its income from . . . uh, mortgages?

Effective December 11, 2013 Columbia Large Cap Core Fund (NSGAX) will change to Columbia Select Large Cap Equity Fund. The prospectus for the new version of the fund warns that it might concentrate on a single sector (they name technology) and will likely hold 45-65 stocks, which is about where they already are. At that same time, Columbia Active Portfolios® – Diversified Equity Income Fund (INDZX) becomes Active Portfolios® Multi-Manager Value Fund and Columbia Recovery and Infrastructure (RRIAX) becomes Columbia Global Infrastructure Fund. Morningstar rates it as a one-star fund despite high relative returns since inception, which suggests that the fund’s volatility is higher still.

Dreyfus will ask shareholders to approve a set of as-yet undescribed strategy changes which, if approved, will cause them to change the Dreyfus/Standish Intermediate Tax Exempt Bond Fund to Dreyfus Tax Sensitive Total Return Bond Fund

On February 21, 20414, Dreyfus/The Boston Company Emerging Markets Core Equity Fund will change its name to Dreyfus Diversified Emerging Markets Fund.

Effective December 23, 2013, Forward Select Income Opportunity Fund (FSONX) becomes Forward Select Opportunity Fund. The fact that neither the fund’s webpage nor its fact sheet report any income (i.e., there’s not even a spot for 30-day SEC yield or anything like it) might be telling us why “income” is leaving the name.

Ivy Pacific Opportunities Fund (IPOAX) seems to have become Ivy Emerging Markets Equity Fund. The new fund’s prospectus shifts it from a mid-to-large cap fund to an all-cap portfolio, adds the proviso that up to 20% of the portfolio might be invested in precious metals. There’s an unclear provision about investing in a Cayman Islands subsidiary to gain commodities exposure but it’s not clear whether that’s in addition to the gold. And, finally, Ivy Asset Strategy New Opportunities Fund (INOAX) will merge into the new fund in early 2014. That might come as a surprise to INOAX shareholders, since their current fund is not primarily an emerging markets vehicle.

OFF TO THE DUSTBIN OF HISTORY

Corporate America CU Short Duration Fund (CASDX) liquidated at the end of November. That’s apparently more evidence of Corporate America’s shortened time horizon. The fund was open a bit more than a year and pulled in a bit more than $60 million in assets before the advisor thought … what? “Oh, we’re not very good at this”? “Oh, we’re not apt to get very good at this”? “Oh, look! There’s a butterfly”?

Delaware International Bond Fund (DPIFX) will be liquidated and dissolved on New Year’s Eve. I knew several grad students who suffered a similar fate that evening.

The Equinox funds plan a wholesale liquidation: Equinox Abraham Strategy Fund (EABIX), Absolute Return Plus Strategy (EMEIX), Eclipse Strategy (EECIX), John Locke Strategy (EJILX), QCM Strategy (EQQCX) and Tiverton Strategy (EQTVX) all meet their maker on December 9th. The smallest of these funds has about $8500 in AUM. Right: not enough to buy a used 2010 Toyota Corolla. The largest has about $600,000 and, in total, they don’t reach $750,000. All are classified as “managed futures” funds and no, I have no earthly idea why Equinox has seven such funds: the six dead funds walking and the surviving Equinox Crabel Strategy (EQCRX) which has about $15,000 in AUM.

Given that these funds have $25,000 minimums and half of them have under $25,000 in assets, the clear implications is that several of these funds have one shareholder. In no instance, however, is that one shareholder a manager of the fund since none of the five managers was silly enough to invest.

FundX ETF Upgrader Fund (REMIX) is merging into the FundX Upgrader Fund (FUNDX) and the FundX ETF Aggressive Upgrader Fund (UNBOX) goes into the FundX Aggressive Upgrader Fund (HOTFX), effective January 24, 2014. My colleague Charles’s thoughtful and extensive analysis of their flagship FundX Upgrader Fund offers them as “a cautionary tale” for folks whose strategy is to churn their portfolios, always seeking hot funds.

An ING fund disappears: ING has designated ING Bond Portfolio (IABPX) as a “disappearing portfolio.” They craftily plan to ask shareholders in late February to authorize the disappearance. The largely-inoffensive ING Intermediate Bond Portfolio (IIABX) has been designated as “the Surviving Portfolio.”

But nothing will survive of ING American Funds International Growth and Income Portfolio (IAIPX) or ING American Funds Global Growth and Income Portfolio (IAGPX), both of which will be liquidated on February 7, 2014.

ING PIMCO High Yield Portfolio (IPHYX) disappears on February 14 and is replaced by ING High Yield Portfolio. See ING decided to replace the world’s most renowned fixed income shop, which was running a four-star $900 million portfolio for them, with themselves with Rick Cumberledge and team, nice people who haven’t previously managed a mutual fund. The investors get to celebrate a two (count ‘em: 2!) basis point fee reduction as a result.

The Board of Trustees of the JPMorgan India Fund (JIDAX) has approved the liquidation and dissolution of the Fund on or about January 10, 2014. The fund has a six-year record that’s a bit above average but that comes out as a 17% loss since inception. The $9.5 million there would have been, and would still be, better used in Matthews India (MINDX).

We’d already announced the closure and impending liquidation of BlackRock India Fund (BAINX). The closure occurred October 28 and the liquidation occurs on December 10, 2013. BAINX – the bane of your portfolio? due to be bain-ished from it? – is down 14% since launch, its peers are down 21% from the same date.

The Board of Trustees of the JPMorgan U.S. Real Estate Fund (SUSIX) has approved the liquidation and dissolution of the Fund on or about December 20, 2013. Color me clueless: it’s an unimpressive fund, but it’s not wretched and it does have $380 million dollars.

Litman Gregory Masters Focused Opportunities Fund (MSFOX) is merging into Litman Gregory Masters Equity Fund (MSENX) because, they explain, MSFOX

… has had net shareholder redemptions over the past five years, causing the asset level of the Focused Opportunities Fund to decline almost 50% over that time period. The decline in assets has resulted in a corresponding increase in the Focused Opportunities Fund’s expense ratio, and … it is unlikely that the Focused Opportunities Fund will increase in size significantly in the foreseeable future.