At the time of publication, this fund was named Miller Income Opportunity Fund.

Objective and strategy

The fund hopes to provide a high level of income while maintaining the potential for growth. They hope to “generate a high level of income from a wide array of sources” by prowling up and down firms’ capital structures and across asset classes. The range of available investments is nigh unto limitless: common stocks, business development corporations, REITs, MLPs, preferred stock, convertibles, public partnerships, royalty trusts, bonds, currency-linked derivatives, CEFs, ETFs and both offensive and defensive derivatives. The managers may choose to short markets or individual securities, “a speculative strategy that involves special risks.” The fund is non-diversified, though it holds a reasonably large number of positions.

Adviser

Legg Mason. Founded in 1899, the firm is headquartered in Baltimore but has offices around the world (New York, London, Tokyo, Dubai, and Hong Kong). It is a publicly traded company with $711 billion in assets under management, as of August, 2014. Legg Mason advises 86 mutual funds. Its brands and subsidiaries include Clearbridge (the core brand, launched after the value of the “Legg Mason” name became impaired), Permal (hedge funds), Royce Funds (small cap funds), Brandywine Global (institutional clients), QS Investors (a quant firm managing the QS Batterymarch funds) and Western Asset (primarily their fixed-income arm).

Manager

Bill Miller III and Bill Miller IV. The elder Mr. Miller (William Herbert Miller III) managed the Legg Mason Value Trust from 1982 – 2012 and still co-manages Legg Mason Opportunity (LMOPX). Mr. Miller received many accolades for his work in the 1990s, including Morningstar’s manager of the year (1998) and of the decade. Of the younger Mr. Miller we know only that “he has been employed by one or more subsidiaries of Legg Mason since 2009.”

Strategy capacity and closure

Not available.

Active share

Not available. Mr. Miller’s other Opportunity Fund (LMOPX) has a low r-squared and high tracking error, which implies a high active share but does not guarantee it.

Management’s stake in the fund

None yet recorded. Mr. Miller owns more than $1 million in LMOPX shares.

Opening date

February 26, 2014.

Minimum investment

$1,000 for “A” shares, reduced to $250 for IRAs and $50 for accounts established with an automatic investment plan.

Expense ratio

1.21% on assets of $141.2 million (as of July 2023). “A” shares also carry a 5.75% sales load. Expenses for the other share classes range from 0.90 – 1.95%.

Comments

If you believe that Mr. Miller’s range of investment competence knows no limits, this is the fund for you.

Mr. Miller’s fame derives from a 15 year streak of outperforming the S&P 500. That streak ran from 1991-2005. It was followed by trailing the S&P500 in five of the next six years. During this latter period, a $10,000 investment in the Legg Mason Value Trust (LMVTX, now ClearBridge Value Trust) declined to $6,700 while an investment in the S&P500 grew to $12,000. At the height of its popularity, LMVTX held $12 billion in assets. By the time of Mr. Miller’s departure in April 2012, it has shrunk by 85%. Morningstar counseled patience (“we think this is a good time to buy this fund” 2007; “keep the faith” 2008; “we still like the fund” late 2008; “we appreciate the bounce” 2009; “over the past 15 years, however, the fund still sits in the group’s best quartile” 2010) before succumbing to confusion and doubt (“The case for Legg Mason Capital Management Value Trust is hard, but not impossible, to make” 2012).

The significance of Mr. Miller’s earlier accomplishment has long been the subject of dispute. Mr. Miller described the streak as “an accident of the calendar … maybe 95% luck,” since many of his annual victories reflected short-lived bursts of outperformance at year’s end. Defenders such as Legg Mason’s Michael Mauboussin calculated the probability that his streak was actually luck at one in 2.3 million. Skeptics, arguing that Mauboussin used careless if convenient assumptions, claim that the chance his streak was due to luck ranged from 3 – 75%.

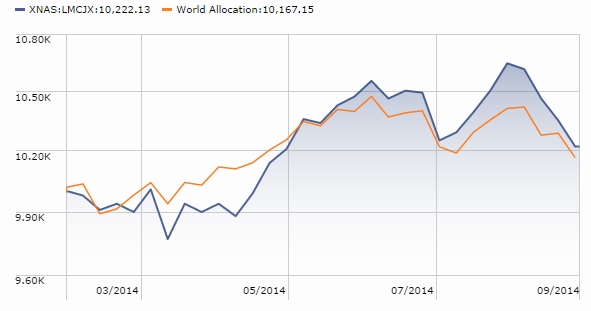

Mr. Miller’s approach is contrarian and concentrated: he’s sure that many securities are substantially mispriced much of the time and that the path to riches is to invest robustly in the maligned, misunderstood securities. Those bets produced dramatic results: his Opportunity Trust (LMOPX) captured nearly 200% of the market’s downside over the past five- and ten-year periods, as well as 150% of its upside. The fund’s beta averages between 1.6 – 1.7 over the same periods. Its alpha is substantially negative (-5 to -8), which suggests that shareholders are not being fairly compensated for the fund’s volatility. Here’s the fund’s history (in blue) against the S&P MidCap 400 (yellow). Investors seem to have had trouble sticking with the fund, whose 5- and 10-year investor returns (a Morningstar measure that attempts to capture the experience of the average investor in the fund) trail 95% of its peers. Assets have declined by about 80% since their 2007 peak.

Against this historic backdrop, Mr. Miller has been staging a comeback. “Unchastened” and pursuing “blindingly obvious trends” (“Mutual-fund king Bill Miller makes a comeback,” Wall Street Journal, 6/29/14), LMOPX has returned 35% annually over the past three years (through September 2014) which places him in the top 2% of his peer group. In February he and his son were entrusted with this new fund.

Four characteristics of the fund stand out.

-

Its portfolio is quite distinctive. The fund can invest, long or short, in almost any publicly traded security. The asset class breakdown, as of August 2014, was:

Common Stock

39%

REITs

20

Publicly-traded partnerships

20

Business development companies and registered investment companies

9

Bonds

7

Preferred shares

3

Cash

2

Mr. Miller’s stake in his top holdings is often two or three times greater than the next most concentrated fund holding.

-

Its performance is typical. There are two senses of “typical” here. First, it has produced about the same returns as its competitors. Second, it has done so with substantially greater volatility, which is typical of Mr. Miller’s funds.

-

It is remarkably expensive. That’s also typical for a Legg Mason fund. At 1.91%, this is the single most expensive fund in its peer group: world allocation funds, either “A” or no-load, with at least $100 million in assets. The fund charges about 50 basis points more than its next most expensive competitor. According to the prospectus, an A-share account that started at $10,000 and grew by 5% per year would incur $1212 in annual fees over the next three years.

-

Its income production is minimal. While the fund aspires to “a high level of income,” Morningstar reports that its 30-day SEC yield is 0.00% (as of September 2014). The fund’s website reports a midyear income payout of $0.104 per share, roughly 1%. “Yield” is not reported as one of the “portfolio characteristics” on the webpage.

Bottom Line

It is hard to make a case for Miller Income Opportunity. It’s impossible to project the fund’s returns even if we were to assume the wildly improbable “average” stock market performance of 10% per year. We can, with some confidence, say that the returns will be idiosyncratic and exceedingly volatile. We can say, with equal confidence, that the fund will be enduringly expensive. Individual interested in exposure to a macro hedge fund, but lacking the required high net worth, might find this hedge fund like offering and its mercurial manager appealing. Most investors will find greater profit in small, flexible funds (from Oakseed Opportunity SEEDX to T. Rowe Price Global Allocation RPGAX) with experienced teams, lower expenses and greater sensitivity to loss control.