Dear friends,

We really hope you enjoy the extra start-of-summer profundity that we’ve larded (excuse the expression) into this issue. We took advantage of the extra time afforded by the June 30th leap second and the extra light generated that night by the once-in-two-millennia conjunction of Venus and Jupiter to squeeze in a family-sized portion of insight into this month’s issue.

And it all started with Morningstar.

Mania at the McCormick!

Morningstar’s annual investor conference is always a bit of a zoo. Two thousand people jam together in a building the size of a shopping mall, driven by a long schedule and alternating doses of caffeine (6:00 a.m. to 6:00 p.m.) and alcohol (thereafter). There are some dozens of presentations, ranging from enormously provocative to freakish, mostly by folks who have something to sell but, for the sake of decorum, are trying not to mention that fact.

Okay: the damned thing’s a lot bigger than any shopping mall except the Mall of America. MoA has about 4.2 million square feet total, McCormick is around 3.4 million. We were in the West Building, whose main ballroom alone runs to 100,000 square feet. 500,000 square feet of exhibition space, 250,000 of meeting space, with something like 60 meeting rooms. That building alone cost about $900 million, and McCormick has three others.

What follows are three sets of idiosyncratic observations: mine, Charles and Ed’s. I’ve linked to Morningstar’s video, where available. The key is that their videos auto-launch, which can be mightily annoying. Be ready for it.

Jeremy Grantham: The World Will End, You’ve Just Got to be Patient for a Bit

Grantham, one of the cofounders of GMO, a highly respected institutional investment firm originally named Grantham, Mayo, van Otterloo, is regularly caricatured as a perma-bear. He responds to the charge by asserting “I’m not a pessimist. You’re simply optimists.”

Grantham argues that we’re heading for a massive stock market crash (something on the order of a 60% fall), just not for a while yet. GMO’s study of asset bubbles found that asset prices regularly become detached from reality but they’re not subject to crashing until they exceed their normal levels by about two standard deviations. Roughly speaking, that translates to asset prices that are higher than they are 95% of the time. Right now, we’re about 1.5 standard deviations above average. If current trends continue – and Grantham does expect stocks to follow the path of least resistance, higher – then we’ll reach the two standard deviation mark around the time of the presidential election.

Merely being wildly overvalued doesn’t automatically trigger a crash (in the UK, home prices reached a three standard deviation peak – 99.7% – before imploding) but it’s extremely rare for such a market not to find a reason to crash. And when the crash comes, the market typically falls at about twice the rate that it rose.

As an aside, Grantham also notes that no stock market crash has occurred until after average investors have been dragged into the party’s frenzied last hours, too late to make much money but just in time to have their portfolios gutted (again). While optimism, measured by various investor attitude surveys, is high, it’s not manic. Yet.

So, we’ve got a bit to savor ill-garnered gains and to reassure ourselves that this time we’ll be sharp, discerning and well on our way to safety ere the crash occurs.

Oddly, Grantham expects a crash because capitalism does work, but regulation (mostly) does not. Under capitalism, capital flows to the area of greatest opportunity: if your lemonade stand is able to draw a million in revenue today, you can be pretty much guaranteed that there will be a dozen really cool lemonade stands in your neighborhood within the week. As a result, your profit will decline. More stands will be built, and profits will continue declining, until capitalists conclude that there’s nothing special in the lemonade stand biz and they resume the search for great opportunities. Today’s record corporate profit margins must draw new competitors in to drive those excess profits down, or capitalism is failing.

Grantham argues that capitalism is failing for now. He blames the rise of “stock option culture” and a complicit U.S. fed for the problem. Up to 80% of executive compensation now flows from stock options, which are tied to short-term performance of a company’s stock rather than long-term performance of the company. People respond to the incentives they’re given, so managers tend toward those actions which increase the value of their stock options. Investing in the company is slow, uncertain and risky, and so capital expenditures (“capex”) by publicly-traded firms is falling. Buying back stock (overpriced or not) and issuing dividends is quick, clean and safe, and so that sort of financial engineering expands. Interest rates at or near zero even encourage the issuance of debt to fund buybacks (“Peter, meet Paul”). It would be possible to constrain the exercise of options, but we choose not to. And so firms are not moving capital into new ventures or into improving existing capabilities which, in the short run, continues to underwrite record profit margins.

David Marcus: We’re in the Bottom of the Third

All value investing starts with fundamentally, sometimes appallingly, screwed-up companies that have the potential to do vastly better than they’ve been doing. The question is whether anything will unleash those potential gains. That’s not automatically true; 50 to a hundred publicly-traded companies go bankrupt each year as do something like 30,000 private ones.

On whole, investors would prefer that the firms they invest in not go belly up. In the U.S., they’ve got great leverage to encourage corporate restructurings – spinoffs, mergers, acquisitions, division closures – which might serve to release that locked-up potential. We also have a culture that, for better and worse, endorses the notion of maximizing shareholder (rather than stakeholder or community) value.

Traditionally the U.S. has been one of the few places that countenanced, much less encouraged, frequent corporate dislocations. Europeans encourage a stakeholder model focused on workers’ interests and Asians have a tradition of intricately interwoven corporate interests where corporations share a web of directorships and reciprocal investments in each other.

David Marcus manages Evermore Global Value (EVGBX) and tries to do so in the spirit of his mentor, Michael Price. As one of Price’s Mutual Series managers, he specialized in “special situations” investing, a term that describes the whole array of “rotten company teetering between damnation and salvation” thing. Later, as a private investor in Europe, he saw the beginnings of a change in corporate culture; the first intimations that European managers were willing to make tentative moves toward a shareholder-focused culture. In December 2009, he launched the Evermore funds to exploit that unrecognized change.

The first three years were trying: his flagship fund lost 10% over the period and trailed 95% of its peers. When we spoke several years ago, Mr. Marcus was frustrated but patient: he likened his portfolio to a spring that’s already been compressed a lot but, instead of releasing, was getting compressed even more. In the past three years, the spring rebounded: top third relative returns, 15% annualized ones, with two stretches at the very top of the global equity heap.

Mr. Marcus’s portfolio remains Euro-centric, about 66% against his peers’ 30%, but he foresees a rotation. The 2008 financial meltdown provided an opportunity for European corporate insiders to pursue a reform agenda. International members started appearing on corporate boards, for instance, and managers were given leeway to begin reducing inefficiency. ThyssenKrupp AG, a German conglomerate, had 27 separate IT departments operating with inconsistent policies and often incompatible software. They’ve whittled that down to five and are pursuing the crazy dream of just one IT department. Such moves create a certain momentum: at first, restructuring seems impossible, then a minor restructuring frees up a billion in capital and managers begin to imagine additional work that might reap another billion and a half. As the great Everett Dirksen once reflected, “A billion here, a billion there, and pretty soon you’re talking about real money.” Mr. Marcus believes that Europeans are pursuing such reforms with greater vigor but without wasting capital “on crappy IPOs” that continue to dog the U.S. market.

A bigger change might be afoot in Asia and, in particular, in Japan. Corporate executives are, for the first time, beginning to unwind the complex web of cross-ownership which had traditionally been a one-way move: you invest in another corporation but never, ever sell your stake. Increasingly, managers see those investments as “cash cows,” the source of additional capital that might be put to better use.

Ironically, the same social forces that once held capital captive might now be working to free it. Several new Japanese stock indexes attempt to recognize firms that are good stewards of shareholder capital. The most visible is the Nikkei 400 ROE index, which tracks companies “with high appeal for investors, which meet requirements of global investment standards, such as efficient use of capital and investor-focused management perspectives.” Failure to qualify for inclusion has been deeply embarrassing for some management teams, which subsequently reoriented their capital allocations. Nomura Securities launched a competing index focusing on companies that use dormant cash to repurchase shares, though the effects of that are not yet known.

Mr. Marcus’s sense that the ground might be shifting is shared by several outstanding managers. Andrew Foster of Seafarer (SFGIX) has speculated that conditions favorable to value investing (primarily institutions that might serve as catalysts to unlock value) are evolving in the emerging markets. Messrs. Lee and Richyal at JOHCM International Select Fund (JOHAX) have directly invoked the significance of the Nikkei ROE Index in their Japan investing. Ralf Scherschmidt at Oberweis International Opportunities (OBIOX) has made a career of noticing that investors fail to react promptly to such changes; he tries to react to news promptly then wait patiently for others to begin believing that change is really. All three are five-star funds.

I’ll continue my reviews in August. For now, here are Charles’s quick takes.

Morningstar Investment Conference 2015 Notes

In contrast to the perfect pre-autumnal weather of last year’s ETF conference, Chicago was hot and muggy this past week, where some 2000 attendees gathered for Morningstar’s Investment Conference located at the massive, sprawling, and remote McCormick Place.

Morningstar does a great job of quickly publishing conference highlights and greatly facilitates press … large press room wired with high-speed internet, ample snacks and hot coffee, as well as adjacent media center where financial reporters can record fund managers and speakers then quickly post perspectives, like Chuck Jaffe’s good series of audio interviews.

On the MFO Discussion Board, David attempts to post nightly his impressions and linkster Ted relays newly published conference articles. To say the event is well covered would be a colossal understatement.

Nonetheless, some impressions for inclusion in this month’s commentary …

If you are a financial adviser not catering to women and millennials, your days are numbered.

On women. Per Sallie Krawcheck, former president of BAC’s Global Wealth division and currently chair of the Ellevate network, which is dedicated to economic engagement of women worldwide, women live six to eight years longer than men … 80% of men die married, while 80% of women die unmarried … 70% of widows leave their financial advisers within a year of their husband’s death.

While women will soon account for majority of US millionaires, most financials advisors don’t include spouses in the conversation. The issue extends to the buy side as well. In a pre-conference session entitled, “Do Women Investors Behave Differently Than Men,” panels cited that women control 51% investable wealth and currently account for 47% of high net worth individuals, yet professional women money managers account for only 5% of assets under management. How can that be?

The consequence of this lack of inclusion is “lack of diversification, higher risk, and money left on table.” Women, they state, value wealth preservation many times more than men. One panelist actually argues that women are better suited to handle the stress hormone cortisol since they need not suffer adverse consequences of interaction with testosterone.

While never said explicitly, I could not help but wonder if the message or perhaps question here is: If women played a greater role in financial institutions and at the Fed in years leading up to 2007, would we have avoided the financial or housing crises?

On millennials. Per Joel Brukenstein of Financial Planning Magazine and creator of Technology Tools for Today website, explains that the days of financial advisors charging 1% annual fee for maintaining a client portfolios of four or five mutual funds are no longer sustainable … replaced with a proliferation of robo-advisors, like Schwab Intelligent Portfolios, which charges “no advisory fees, no account service fees, no commissions, period.”

Ditto, if your services are not available on a smart phone. Millennials are beyond internet savvy and mobile … all data/tools must be accessible via the cloud.

Mr. Brukenstein went so far as to suggest that financial advisors not offering services beyond portfolio management should consider exiting the business.

Keynote highlights. Jeremy Grantham, British-born co-founder of Boston-based asset management firm GMO, once again reiterated his belief that US stocks are 30 – 60% overvalued, still paying for overvaluation sins of our fathers … the great bull run of 1990, which started in 1987, finished in 2000, and was right on the heels of the great bull run of the 1980s. No matter that investors have suffered two 50% drawdowns the past 15 years with the S&P 500 and only received anemic returns, “it will take 25 years to get things right again.” So, 10 more years of suffering I’m afraid.

He blames Greenspan, Bernanke, and Yellen for distorting valuations, the capital markets, the zero interest rate policy … leading to artificially inflated equity prices and a stock-option culture that has resulted in making leaders of publically traded companies wealthy at the expense of capital investment, which would benefit the many. “No longer any room for city or community altruism in today’s capitalism … FDR’s social contract no more.”

All that said he does not see the equity bubble popping just yet … “no bubble peaks before abnormal buyers and deals come to market.” He predicts steady raise until perhaps coming presidential election.

Mr. Grantham is not a believer in efficient market theory. He views the cycles of equity expansion and contraction quite inefficiently driven by career risk (never be wrong on your own …), herding, momentum, extrapolation, excursions from replacement value, then finally, arbitrage and mean reversion at expense of client patience. Round and round it goes.

David Kelly, JP Morgan’s Chief Global Strategist whose quarterly “Guide To Markets” now reaches 169 thousand individuals in 25 countries, also does not see a bear market on horizon, which he believes would be triggered by one or more of these four events/conditions: recession, commodity spike, aggressive fed tightening, and/or extreme valuation. He sees none of these.

He sees current situation in Greece as a tragedy … Germany was too tough during recession. Fortunately, 80% of Greek debt is held by ECB, not Euro banks, so he sees no lasting domino effect if it defaults.

On the US economy, he sees it “not booming, but bouncing back.” Seven years into recovery, which represents the fourth longest expansion dating back to 1900. “Like a Yankees/Red Sox game … long because it is slow.”

He disputes Yellen’s position that there is slack in the economy, citing that last year 60 million people were hired … an extraordinary amount. (That is the gross number; subtract 57 million jobs left, for a net of 3 million.) The biggest threat to continued expansion is lack of labor force, given retiring baby boomers, 12.5% of population with felony convictions, scores addicted to drug, and restrictions on foreign nationals, which he calls the biggest tragedy: “We bring them in. They want to be here. We educate them. They are top of class. Then, we send them home. It’s crazy. We need immigration reform to allow skilled workers to stay.”

Like Grantham, he does see QE helping too much of the wrong thing at this point: “Fertilizer for weeds.”

On oil, which he views like potatoes – a classic commodity: “$110 is too much, but $40 is too low.” Since we have “genetically evolved to waste oil,” he believes now is good time to get in cause “prices have stabilized and will gradually go up.”

Like last fall, he continues to see EM cheap and good long term opportunity. Europe valuations ok … a mid-term opportunity.

He closed by reminding us that investors need courage during bear markets and brains during bull markets.

Breakout sessions. Wasatch’s Laura Geritz was stand-out panelist in break-out session “Are Frontier Markets Worth Pursuing?” She articulates her likes (“Active manager’s dream asset class … capital held dear by phenomenal FM management teams … investments by strong subsidiaries, like Nestle … China’s investment in FM … ”) and dislikes (“No practical index … current indices remain too correlated due to lack of diversification … lack of market liquidity …”). She views FM as strictly long-term investment proposition with lots of ups and downs, but ultimately compelling. If you have not listened to her interview with Chuck Jaffe, you should.

Another break-out session, panelists discussed the current increasing popularity of “ESG Investing.” (ESG stands for environmental, social, and governance. ESG funds, currently numbering more than 200, apply these criteria in their investments.) “Ignore increasingly at your own peril … especially given that women and millennials represent the biggest demographic on horizon.” Interestingly, data suggest such funds do just as well if not slightly better than the overall market.

Lengthening Noses

By Edward Studzinski

By Edward Studzinski

“A sign of celebrity is that his name is often worth more than his services.”

Daniel J. Boorstin

So the annual Morningstar Conference has come and gone again, with couple thousand attendees in town hoping to receive the benefit of some bit of investment or business wisdom. The theme of this year’s conference appears to have been that the world of investors now increasingly is populated by and belongs to “Gen X’ers” and “Millennials.” Baby Boomers such as yours truly, are a thing of the past in terms of influence as well as a group from whom assets are to be gathered. Indeed, according to my colleagues, advisors should be focused not on the current decision maker in a client family but rather the spouse (who statistically should outlive) or the children. And their process of decision making will most likely be very different than that of the patriarch. We can see that now, in terms of how they desire to communicate, which is increasingly less by the written word or in face to face meetings.

In year’s past, the conference had the flavor of being an investment conference. Now it has taken on the appearance of a marketing and asset allocation advice event. Many a person told me that they do not come to attend the conference and hear the speakers. Rather, they come because they have conveniently assembled in one place a large number of individuals that they have been interested either in meeting or catching up with. My friend Charles’ observation was that it was a conference of “suits” and “skirts” in the Exhibitors’ Hall. Unfortunately I have the benefit of these observations only second and third hand, as for the first part of the week I was in Massachusetts and did not get back to Chicago until late Wednesday evening. And while I could have made my way to events on Thursday afternoon and Friday morning, I have found it increasingly difficult to take the whole thing seriously as an investment information event (although it is obviously a tremendous cash cow for Morningstar). Given the tremendous success of the conference year in and year out, one increasingly wonders what the correct valuation metric is to be applied to Morningstar equity. Is it the Google of the investment and financial services world? Nonetheless, given the focus of many of the attendees on the highest margin opportunities in the investment business and the way to sustain an investment management franchise, I wonder if, notwithstanding how she said it, whether Senator Elizabeth Warren is correct when she says that “the game is rigged.”

Friday apparently saw two value-oriented investors in a small panel presenting and taking Q&A. One of those manages a fund with $20 Billion in assets, which is a larger amount of money than he historically has managed. Charging a 1% fee on that $20B, his firm is picking up $200 Million in revenue from that one fund alone, notwithstanding that they have other funds. Historically he has been more of a small-midcap manager, with a lot of special situations but not to worry, he’s finding lots of things to invest in, albeit with 40% or so in cash or cash equivalents. The other domestic manager runs two domestic funds as the lead manager, with slightly more than $24 Billion in assets, and for simplicity’s sake, let’s call it a blended rate of 90 basis points in fees. His firm is seeing than somewhat in excess of $216 Million in revenue from the two funds. Now let me point out that unless the assets collapse, these fees are recurring, so in five years, there has been a billion dollars in revenue generated at each firm, more than enough to purchase several yachts. The problem I have with this is it is not a serious discussion of the world we are in at present. Valuation metrics for stocks and bonds are at levels approaching if not beyond the two standard deviation warning bells. I suppose some of this is to be expected, as if is a rare manager who is going to tell you to keep your money. However, I would be hard pressed at this time if running a fund, to have it open. I am actually reminded of the situation where a friend sent me to her family’s restaurant in suburban Chicago, and her mother rattled off the specials of the evening, one of which was Bohemian style duck. I asked her to go ask the chef how the duck looked that night, and after a minute she came back and said, “Chef says the duck looks real good tonight.” At that point, one of the regulars at the bar started laughing and said, “What do you think? The chef’s going to say, oh, the duck looks like crap tonight?”

Now, if I could make a suggestion in Senator Warren’s ear, it would be that hearings should be held about what kind of compensation in the investment management field is excessive. When the dispersion between the lowest paid employee and the highest results in the highest compensated being paid two hundred times more than the lowest, it seems extreme. I suppose we will hear that not all of the compensation is compensation, but rather some reflects ownership and management responsibilities. The rub is that many times the so-called ownership interests are artificial or phantom.

It just strikes that this is an area ripe for reform, for something in the nature of an excess profits tax to be proposed. After all, nothing is really being created here that redounds to the benefit of the U.S. economy, or is creating jobs (and yes Virginia, carried interest for hedge funds as a tax advantage should also be eliminated).

We now face a world where the can increasingly looks like it cannot be kicked down the road financially for either Greece or Puerto Rico. And that doesn’t even consider the states like Illinois and Rhode Island that have serious underfunded pension issues, as well as crumbling infrastructures. So, I say again, there is a great deal of risk in the global financial system at present. One should focus, as an investor, in not putting any more at risk than one could afford to write off without compromising one’s standard of living. Low interest rates have done more harm than good, for both the U.S. economy and the global economy. And liquidity is increasingly a problem, especially in the fixed income markets but also in stocks. Be warned! Don’t be one of the investors who has caught the disease known as FOMO or “Fear of Missing Out.”

It’s finally easy being green

The most widely accepted solution to Americans’ “retirement crisis” – our lifelong refusal to forego the joy of stuff now in order to live comfortably later – is pursuing a second (or third or fifth) career after we’ve nominally retired. Some of us serve as school crossing guards, greeters, or directors of mutual fund boards, others as consultants, carpenters and writers. Honorable choices, all.

The most widely accepted solution to Americans’ “retirement crisis” – our lifelong refusal to forego the joy of stuff now in order to live comfortably later – is pursuing a second (or third or fifth) career after we’ve nominally retired. Some of us serve as school crossing guards, greeters, or directors of mutual fund boards, others as consultants, carpenters and writers. Honorable choices, all.

But what if you could make more money another way, by selling cigarettes directly to adolescents in poor countries? There’s a booming market, the U.S. Chamber of Commerce is working globally to be sure that folks keep smoking, and your customers do get addicted. A couple hours a day with a stand near a large elementary school or junior high and you’re golden.

Most of us would say “no.” Many of us would say “HELL NO.” The thought of imperiling the lives and health of others to prop up our own lifestyle just feels horribly wrong.

The question at hand, then, is “if you aren’t willing to participate directly in such actions, why are you willing to participate indirectly in them through your investments?” Your decision to invest in, for example, a tobacco company lowers their cost of capital, increases their financial strength and furthers their business. There’s no real dodging the fact: you become a part-owner of the corporation, underwrite its operations and expect to be well compensated for it.

And you are doing it. In the case of Phillip Morris International (PM), for example, 30% of the firm’s stock is owned by ten investment companies:

Capital World & Capital Research are the advisors to the American Funds. Barrow sub-advises funds for, among others, Vanguard and Touchstone.

That exercise can be repeated with a bunch of variations: what role would you like to play in The Sixth Great Extinction, the impending collapse of the Antarctic ice sheet, or the incineration of young people in footwear factories? In the past, many of us defaulted to one of two simple positions: I don’t have a choice or I can’t afford to be picky.

The days when socially-responsible investing was the domain of earnest clergy and tree-hugging professors are gone. How gone? Here’s a quick quiz to help provide context: how many dollars are invested through socially-screened investment vehicles?

- A few hundred million

- A few billion

- A few tens of billions

- A few hundred billion

- A few trillion

- Just enough to form a really satisfying plug with which to muffle The Trump.

The answer is “E” (though I’d give credit, on principle, for “F”). ESG-screened investments now account for about one-sixth of all of the money invested in the U.S. —over $6.5 trillion— up by 76% since 2012. In the U.S. alone there are over 200 open-end funds and ETFs which apply some variety of environmental, social and governance screens on their investors’ behalf.

There are four reasons investors might have for pursuing, or avoiding, ESG-screened investments. They are, in brief:

- It changes my returns. The traditional fear is that by imposing screening costs and limiting one’s investable universe, SRI funds were a financial drag on your portfolio. There have been over 1200 academic and professional studies published on the financial effects, and a dozen or so studies of the studies (called meta-analyses). The uniform conclusion of both academic and professional reviews is that SRI screens do not reduce portfolio returns. There’s some thin evidence of improved performance, but I wouldn’t invest based on that.

- It changes my risk profile. The traditional hope is that responsible firms would be less subject to “headline risk” and less frequently involved in litigation, which might make them less risky investments. At least when examining SRI indexes, that’s not the case. TIAA-CREF examined a quarter century’s worth of volatility data for five widely used indexes (Calvert Social Index, Dow Jones Sustainability U.S. Index, FTSE4Good US Index, MSCI KLD 400 Social Index, and MSCI USA IMI ESG Index) and concluded that there were no systematic differences between ESG-screened indexes and “normal” ones.

- It allows me to foster good in the world. The logic is simple: if people refuse to invest in a company, its cost of doing business rises, its products become less economically competitive and fewer people buy them. Conversely, if you give managers access to lots of capital, their cost of capital falls and they’re able to do more of whatever you want them to do. In some instances, called “impact investing,” you actually direct your manager to put money to work for the common ground through microfinance, underwriting housing construction in economically-challenged cities and so on.

- It’s an expression of an important social value. In its simplest form, it’s captured by the phrase “I’m not giving my money to those bastards. Period.” Some critics of SRI have made convoluted arguments in favor of giving your money to the bastards on economic grounds and then giving other money to social causes or charities. The argument for investing in line with your beliefs seems to have resonated most strongly with Millennials (those born in the last two decades of the 20th century) and with women. Huge majorities in both groups want to align their portfolio with their desires for a better world.

Our bottom line is this: you can invest honorably without weakening your future returns. There is no longer any credible doubt about it. The real problems you face are (1) sorting through the welter of funds which might impose both positive and negative screens on a conflicting collection of 20 different issues and (2) managing your investment costs.

We’ve screened our own data to help you get started. We divided funds into two groups: ESG Stalwarts, funds with long records and stable teams, and Most Intriguing New ESG Funds, those with shorter records, smaller asset bases and distinctly promising prospects. We derived those lists by looking for no-load options open to retail investors, then looking for folks with competitive returns, reasonable expenses and high Sharpe ratios over the full market cycle that began in October 2007.

In addition, we recommend that you consult the exceedingly cool, current table of SRI funds maintained by the Forum for Sustainable and Responsible Investment. The table, which is sadly not sortable, provides current performance data and screening criteria for nearly 200 SRI funds. In addition, it has a series of clear, concise summaries of each fund on the table.

In addition, we recommend that you consult the exceedingly cool, current table of SRI funds maintained by the Forum for Sustainable and Responsible Investment. The table, which is sadly not sortable, provides current performance data and screening criteria for nearly 200 SRI funds. In addition, it has a series of clear, concise summaries of each fund on the table.

ESG Stalwarts

| Domini International Social Equity DOMIX | International core |

| 1.6% E.R. | Minimum investment $2,500 |

| What it targets. DOMIX invests primarily in mid to large cap companies in Europe, Asia, and the rest of the world. Their primary ESG focus is on two objectives: universal human dignity and environmental sustainability. They evaluate all prospective holdings to assess the company’s response to key sustainability challenges. | |

| Why it’s a stalwart. DOMIX is a five star fund by Morningstar’s rating and, by ours, both a Great Owl and an Honor Roll fund that’s in the top 1-, 3-, and 5-year return group within its category. | |

| Parnassus Endeavor PARWX | Large growth |

| 0.95% E.R. | Minimum investment $2,000 |

| What it targets. PARWX invests in large cap companies with “outstanding workplaces” with the rationale that those companies regularly perform better. They also refuse to invest in companies involved in the fossil fuel industry. | |

| Why it’s a stalwart. The Endeavor Fund is an Honor Roll fund that returned 5.7% more than its average peer over the last full market cycle. It’s also a five-star fund, though it has never warranted Morningstar’s attention. It used to be named Parnassus Workplace. | |

| Eventide Gilead ETGLX | Mid-cap growth |

| 1.5% E.R. | Minimum investment $1,000 |

| What it targets. ETGLX invests in companies having the “ability to operate with integrity and create value for customers, employees, and other stakeholders.” They seek companies that reflect five social and environmental value statements included in their prospectus. | |

| Why it’s a stalwart. The Eventide Gilead Fund is a Great Owl and Honor Roll fund that’s delivered an APR 9% higher than its peers since its inception in 2008. It’s also a five-star fund and was the subject of an “emerging managers” panel at Morningstar’s 2015 investment conference. | |

| Green Century Balanced GCBLX | Aggressive hybrid |

| 1.48% E.R. | Minimum investment $2,500 |

| What it targets. GCBLX seeks to invest in stocks and bonds of environmentally responsible companies. They screen out companies with poor environmental records and companies in industries such as fossil fuels, tobacco, nuclear power and nuclear energy. | |

| Why it’s a stalwart. Green Century Balanced fund has delivered annual returns 1.8% higher than its average peer over the past full market cycle. The current management team joined a decade ago and the fund’s performance has been consistently excellent, both on risk and return, since. It’s been in the top return group for the 1-, 3-, and 10-year periods. | |

| CRA Qualified Investment Retail CRATX | Intermediate-term government bond |

| 0.83% E.R. | Minimum investment $2,500 |

| What it targets. It invests in high credit quality, market-rate fixed-income securities that finance community and economic development including affordable homes, environmentally sustainable initiatives, job creation and training programs, and neighborhood revitalization projects. | |

| Why it’s a stalwart. There’s really nothing quite like it. This started as an institutional fund whose clientele cared about funding urban revitalization through things like sustainable neighborhoods and affordable housing. They’ve helped underwrite 300,000 affordable rental housing units, $28 million in community healthcare facilities, and $700 million in state home ownership initiatives. For all that, their returns are virtually identical to their peer group’s. | |

| Calvert Ultra-Short Income CULAX | Ultra-short term bond |

| 0.79% E.R. | Minimum investment $2,000 |

| What it targets. CULAX invests in short-term bonds and income-producing securities using ESG factors as part of its risk and opportunity assessment. The fund avoids investments in tobacco sector companies. | |

| Why it’s a stalwart. The Calvert Ultra-Short Income fund has delivered annual returns 1% better than its peers over the last full market cycle. That seems modest until you consider the modest returns that such investments typically offer; they’re a “strategic cash alternative” and an extra 1% on cash is huge. | |

Most intriguing new ESG funds

| Eventide Healthcare & Life Sciences ETNHX | Health – small growth |

| 1.63% E.R. | Minimum investment $1,000 |

| What it targets. All three Eventide funds, including one still in registration, look for firms that treat their employees, customers, the environment, their communities, suppliers and the broader society in ways that are ethical and sustainable. | |

| Why it’s intriguing. It shares both a manager and an investment discipline with its older sibling, the Gilead fund. Gilead’s record is, on both an absolute- and risk-adjusted returns basis, superb. Over its short existence, ETNHX has delivered returns 11.8% higher than its average peer though it has had several sharp drawdowns when the biotech sector corrected. | |

| Matthews Asia ESG MASGX | Asia ex-Japan |

| 1.45% E.R. (Prospectus, 4/30/2015) | Minimum investment $2,500 |

| What it targets. The managers are looking for firms whose practices are improving the quality of life, making human or business activity less destructive to the environment, and/or promote positive social and economic developments. | |

| Why it’s intriguing. Much of the global future hinges on events in Asia, and no one has broader or deeper expertise the Matthews. Matthew Asia is differentiated by their ability to identify opportunities in the 90% of the Asian universe that is not rated by data service providers such as MSCI ESG. They start with screens for fundamentally sound businesses, and then look for those with reasonable ESG records and attractive valuations. | |

| Saturna Sustainable Equity SEEFX | Global large cap |

| 0.99% E.R. (Prospectus, 3/27/2015) | Minimum investment $10,000 |

| What it targets. SEEFX invests in companies with sustainable characteristics: larger, more established, consistently profitable, and financially strong, and with low risks in the areas of the environment, social responsibility and corporate governance. They use an internally developed ESG rating system. | |

| Why it’s intriguing. Saturna has a long and distinguished track record, through their Amana funds, of sharia-compliant investing. That translates to a lot of experience screening on social and governance factors and a lot of experience on weighing the balance of financial and ESG factors. With a proprietary database that goes back a quarter century, Saturna has a lot of tested data to draw on. | |

| TIAA-CREF Social Choice Bond TSBRX | Intermediate term bond |

| 0.65% E.R. | Minimum investment $2,500 |

| What it targets. “Invests in corporate issuers that are leaders in their respective sectors according to a broad set of Environment, Social, and Governance factors. Typically, environmental assessment categories include climate change, natural resource use, waste management and environmental opportunities. Social evaluation categories include human capital, product safety and social opportunities. Governance assessment categories include corporate governance, business ethics and government & public policy.” | |

| Why it’s intriguing. TIAA-CREF has long experience in socially responsible investing, driven by the demands of its core constituencies in higher ed and non-profits. In addition, the fund has low expenses and solid returns. TSBRX has offered annual returns 1.3% in excess of its peers since its inception in 2013. | |

| Pax MSCI International ESG Index PXINX | International core |

| 0.80% E.R. | Minimum investment $1,000 |

| What it targets. MSCI looks at five issues – environment, community and society, employees and supply chain, customers – including the quality and safety record of a company’s products, and governance and ethics – in the context of each firm’s industry. As a result, the environmental expectations of a trucking company would differ from those of, say, a grocer. | |

| Why it’s intriguing. Passive options are still fairly rare and Pax World is a recognized leader in sustainable investing. It’s a four-star fund and it has steadily outperformed both its Morningstar peer group and the broader MSCI index by a couple percent annually since inception. | |

| Calvert Emerging Markets Equity CVMAX | EM large cap core |

| 1.78% E.R. | Minimum investment $2,000 |

|

What it targets: the fund uses a variety of positive screens to look for firms with good records on global sustainability and human rights while avoiding tobacco and weapons manufacturers. |

|

| Why it’s intriguing: So far, this is about your only EM option. Happily, it’s beaten its peers by nearly 5% since its inception just over 18 months ago. “Calvert … manages the largest family of mutual funds in the US that feature integrated environmental, social, and governance research.” | |

In the wings, socially responsible funds still in registration with the Securities and Exchange Commission which will be available by early autumn include:

Thornburg Better World Fund will seek long-term capital growth. The plan is to invest in international “companies that demonstrate one or more positive environmental, social and governance characteristics.” Details in this month’s Funds in Registration feature.

TIAA-CREF Social Choice International Equity Fund will seek a favorable long-term total return, reflected in the performance of ESG-screened international stocks. MSCI will provide the ESG screens and the fund will target developed international markets. This fund, and the next, will be managed by Philip James (Jim) Campagna and Lei Liao. The managers’ previous experience seems mostly to be in index funds.

TIAA-CREF Social Choice Low Carbon Equity Fund will seek a favorable long-term total return, reflected in the performance of ESG-screened US stocks. MSCI will provide the ESG screens, which will be supplemented by screens looking for firms with “demonstrate leadership in managing and mitigating their current carbon emissions and (2) have limited exposure to oil, gas, and coal reserves.”

Trillium All Cap Fund will seek long term capital appreciation by investing in an all-cap portfolio of “stocks with high quality characteristics and strong environmental, social, and governance records.” Up to 20% of the portfolio might be overseas. The fund will be managed by Elizabeth Levy and Stephanie Leighton of Trillium Asset Management. Levy managed Winslow Green Large Cap from 2009-11, Leighton managed ESG money at SunLife of Canada and Pioneer.

Trillium Small/Mid Cap Fund will seek long term capital appreciation by investing in a portfolio of small- to mid-cap “stocks with high quality characteristics and strong environmental, social, and governance records.” Small- to mid- is defined as stocks comparable in size to those in the S&P 1000, a composite of the S&P’s small and mid-cap indexes. Up to 20% of the portfolio might be overseas. The fund will be managed by Laura McGonagle and Matthew Patsky of Trillium Asset Management. Trillium oversees about $2.2 billion in assets. McGonagle was previously a research analyst at Adams, Harkness and Hill and is distantly related to Professor Minerva McGonagall. Patsky was Director of Equity Research for Adams, Harkness & Hill and a manager of the Winslow Green Solutions Fund.

We, now more than ever in human history, have a chance to make a difference. Indeed, we can’t avoid making a difference, for good or ill. In our daily lives, that might translate to helping our religious community, coaching youth sports, serving meals at a center for the marginally secure or turning our backs on that ever-so-manly Cadillac urban assault vehicle, the Escalade.

We, now more than ever in human history, have a chance to make a difference. Indeed, we can’t avoid making a difference, for good or ill. In our daily lives, that might translate to helping our religious community, coaching youth sports, serving meals at a center for the marginally secure or turning our backs on that ever-so-manly Cadillac urban assault vehicle, the Escalade.

That’s all inconvenient, a bit limiting and utterly right, and so we do it. ESG advocates argue that we’ve reached the point where we can do the same things with our portfolios: we can make a difference, encourage good behavior and affirm important personal values, all with little or no cost to ourselves. It seems like a deal worth considering.

The league’s top rebounders

Even the best funds decline in value during either a correction or a bear market. Indeed, many of the best decline more dramatically than their peers because the high conviction, high independence portfolios that are signs of their distinction also can leave them exposed when things turn bad. The disastrous performance of the Dodge & Cox funds during the 2007-09 crash is a case in point.

Even the best funds decline in value during either a correction or a bear market. Indeed, many of the best decline more dramatically than their peers because the high conviction, high independence portfolios that are signs of their distinction also can leave them exposed when things turn bad. The disastrous performance of the Dodge & Cox funds during the 2007-09 crash is a case in point.

The real question isn’t “will it fall?” We know the answer. The real question is “will the fall be so bad that I’ll get stupid and insist on selling at a painful loss (again), probably just before a rebound?” Two rarely discussed statistics address that question. The first is recovery time, which simply measures the number of months that it’s taken each fund to recover from its single worst drawdown. The second is the Ulcer Index, one of Charles’s favorite metrics if only because of the name, which was designed by Peter Martin to factor–in both the depth and duration of a fund’s drawdown.

For those casting about for tummy-calming options, we screened for funds that had been around for a full market cycle, then looked at funds which have the shortest recovery times and, separately, the lowest Ulcer Indexes over the current market cycle. That cycle started in October 2007 when the broad market peaked and includes both the subsequent brutal crash and ferocious rebound. Our general sense is that looking at performance across such a cycle is better than focusing on some arbitrary number of years (e.g., 5, 10 or 15 year results).

The first table highlights the funds with the fastest rebounders in each of six popular categories.

|

Category |

Top two funds (recovery time in months) Best Great Owl (recovery time in months) |

|

Conservative allocation |

Berwyn Income BERIX (10) Permanent Portfolio PRPFX (15) RidgeWorth Conserv Alloc SCCTX (20) |

|

Moderate allocation |

RiverNorth Core Opportunity RNCOX (18) Greenspring GRSPX (22) Westwood Income Opp WHGIX (24) |

|

Aggressive allocation |

LKCM Balanced LKBAX (28) PIMCO StocksPlus Long Duration PSLDX (34) PIMCO StocksPlus Long Duration PSLDX (34) |

|

Large cap core |

Yacktman Focused YAFFX (20) Yacktman YAKKX (21) BBH Core Select BBTEX (35) |

|

Mid cap core |

Centaur Total Return TILDX (22) Westwood SMidCap WHGMX (23) Weitz Partners III WPOPX (28) |

|

Small cap core |

Royce Select RYSFX (18) Dreyfus Opportunistic SC DSCVX (22) Fidelity Small Cap Discovery FSCRX (25) |

|

International large core |

Forester Discovery INTLX (4) First Eagle Overseas SOGEX (34) Artisan International Value ARTKX (37) |

The rebound or recovery time doesn’t directly account for the depth of the drawdown. It’s possible, after all, for an utterly nerve-wracking fund to power dive then immediately rocket skyward again, leaving your stomach and sleep behind. The Ulcer Index figures that in: two funds might each dive, swoop and recover in two months but the one dove least earned a better (that is, lower) Ulcer Index score.

Again, these calculations are looking at performance over the course of the current market cycle only.

|

Category |

Top two funds (Ulcer Index) Best Great Owl (Ulcer Index) |

|

Conservative allocation |

Manning & Napier Pro-Blend Conservative EXDAX (2.4) Nationwide Investor Destinations Conserv NDCAX (2.5) RidgeWorth Conservative Allocation (2.8) |

|

Moderate allocation |

Vantagepoint Diversifying Strategies VPDAX (2.4) Westwood Income Opportunity WHGIX (3.2) Westwood Income Opportunity WHGIX (3.2) |

|

Aggressive allocation |

Boston Trust Asset Management BTBFX (8.0) LKCM Balanced LKBAX (8.0) PIMCO StocksPlus Long Duration PSLDX (15.6) |

|

Large cap core |

Yacktman Focused YAFFX (8.7) First Eagle U.S. Value FEVAX (9.0) BBH Core Select BBTEX (9.9) |

|

Mid cap core |

Centaur Total Return TILDX (9.4) FMI Common Stock FMIMX (9.9) Weitz Partners III WPOPX (12.9) |

|

Small cap core |

Natixis Vaughan Nelson SCV NEFJX (11) Royce Select RYSFX (11.1) Fidelity Small Cap Discovery FSCRX (11.1) |

|

International large core |

Forester Discovery INTLX (4) First Eagle Overseas SGOVX (10) Sextant International SSIFX (13.7) Artisan International Value ARTKX (14.9) |

How much difference does paying attention to risk make? Fully half of all international large cap funds are still underwater; 83 months after the onset of the crash, they have still not made their investors whole. That roster includes all of the funds indexed to the MSCI EAFE, the main index of large cap stocks in the developed world, as well as actively-managed managed funds from BlackRock, Goldman Sachs, Janus, JPMorgan and others.

In domestic large caps, both the median fund on the list and all major market index funds took 57 months to recover.

Bottom Line: the best time to prepare for the rain is while the sun is still shining. While you might not feel that a portfolio heavy on cash or short-term bonds meets your needs, it makes sense for you to investigate – within whatever asset classes you choose to pursue – funds likely to inflict only manageable amounts of pain. Metrics like recovery time and Ulcer Index should help guide those explorations.

FPA Perennial: Time to Go.

FPA Perennial (FPPFX) closed to new investors on June 15, 2015. The fund that re-opens to new investors at the beginning of October will bear no resemblance to it. If you are a current Perennial shareholder, you should leave now.

FPA Perennial (FPPFX) closed to new investors on June 15, 2015. The fund that re-opens to new investors at the beginning of October will bear no resemblance to it. If you are a current Perennial shareholder, you should leave now.

Perennial and its siblings, FPA Paramount (FPRAX) and the closed-end Source Capital (SOR), were virtual clones, managed by Steve Geist and Eric Ende. While the rest of FPA were hard-core absolute value guys, G&E ran splendid small- to mid-cap growth funds, fully invested in very high-quality companies, negligible turnover, drifting between small and mid, growth and blend. Returns were consistent and solid. Greg Herr was added to the team several years ago.

In 2013, FPA made the same transition at Paramount that’s envisaged here: the managers left, a new strategy was imposed and the portfolio was liquidated. Domestic growth became global value. Only the name remained the same.

With Perennial, not even the name will remain.

- All of the managers are going. Mr. Geist retired in 2014 and Ende, at age 70, is moving toward the door. Mr. Herr is leaving to focus on Paramount. They are being replaced by Greg Nathan. Mr. Nathan is described as “the longest serving analyst for the Contrarian Value Strategy, including FPA Crescent Fund (FPACX).”

- The strategy is going. Geist and Ende were small- to mid-cap growth. The new fund will be all-cap value. It will be the US equity manifestation of the stock-picking strategy used in Crescent, Paramount and International Value. It is a perfectly sensible strategy, but it bears no resemblance to the one for which the fund is known.

- The portfolio is going. FPA warns that the change “will result in significant long-term capital gains.” Take that warning seriously. Morningstar calculates your potential capital gains exposure at 63%, that is, 63% of the fund’s NAV is a result of so far untaxed capital gains. If the portfolio is liquidated, you could see up to $36/share in taxable distributions.

How likely is a hit of that magnitude? We can compare Paramount’s portfolio before and after the 2013 transition. Of the 31 stocks in Paramount’s portfolio:

27 positions were entirely eliminated

2 positions (WABCO and Zebra Technologies) were dramatically reduced

1 position (Aggreko plc) was dramatically expanded

1 position (Maxim Integrated Products) remained roughly equalDuring that transition, the fund paid out about 40% of its NAV in taxable gains including two large distributions over the course of two weeks at year’s end.

Certainly the tax hit will vary based on your cost basis, but if your cost basis is high – $35/share or more – you might be better getting out before the big tax hit comes.

- The name is going. The new fund will be named FPA S. Value Fund.

I rather like FPA’s absolute value orientation and FPA U.S. Value may well prove itself to be an excellent fund in the long-term. In the short term, however, it’s likely to be a tax nightmare led in an entirely new direction by an inexperienced manager. If you bought FPPFX because you likely want what Geist & Ende did, you might want to look at Motley Fool Great America (TMFGX). It’s got a similar focus on quality growth, low turnover and small- to mid-cap domestic stocks. It’s small enough to be nimble and we’ve identified it as a Great Owl Fund for its consistently excellent risk-adjusted returns.

The mills of justice turn slowly, but grind exceedingly fine.

The SEC this month announced sanctions against two funds for misdeeds that took place five to seven years ago while a third fund worked to get ahead of SEC concerns about its advisor.

On June 17, 2015, the SEC issued penalties to Commonwealth Capital Management and three former three independent members of its mutual fund board. The basic argument is that, between 2008 and 2010, the adviser fed crap to the board and they blindly gobbled it up. (Why does neither half of their equation surprise me?) The SEC’s exact argument is that the board provided misleading information about the fund to the directors and the independent directors failed to exercise reasonable diligence in examining the evidence before approving a new investment contract. The fund in question was small and bad; it quickly added “extinct” to its list of attributes.

On June 22, 2015, the Board of Trustees of the Vertical Capital Income Fund (VCAPX) terminated the investment advisory agreement with Vertical Capital Asset Management, LLC. The fund’s auditor has also resigned. The Board’s vaguely phrased concern is that VCAM “lacks sufficient resources to meet its obligations to the Fund, and failed to adequately monitor the actions of its affiliate Vertical Recovery Management in its duties as the servicing agent of the mortgage notes held by the Fund.”

On June 23, 2015, the SEC reached a settlement with Pekin Singer Strauss Asset Management (PSS), advisor to the Appleseed Fund (APPLX) and portfolio managers William Pekin and Joshua Strauss. The SEC found “that the securities laws were violated in 2009 and 2010 when PSS did not conduct timely internal annual compliance reviews or implement and enforce certain policies and procedures.” PSS also failed to move clients from the higher-cost investor shares to the lower-cost institutional ones. No one admits or denies anything, though PSS were the ones who detected and corrected the share class issue on their own.

Morningstar, once a fan of the fund, has placed them “under review” as they sort out the implications. That’s got to sting since Appleseed so visibly positions itself as a socially-responsible fund.

Top developments in fund industry litigation

Fundfox, launched in 2012, is the mutual fund industry’s only litigation intelligence service, delivering exclusive litigation information and real-time case documents neatly organized, searchable, and filtered as never before. For the complete list of developments last month, and for information and court documents in any case, log in at www.fundfox.com and navigate to Fundfox Insider.

Fundfox, launched in 2012, is the mutual fund industry’s only litigation intelligence service, delivering exclusive litigation information and real-time case documents neatly organized, searchable, and filtered as never before. For the complete list of developments last month, and for information and court documents in any case, log in at www.fundfox.com and navigate to Fundfox Insider.

Order

- The court gave its final approval to a $9.475 million settlement in the ERISA class action that challenged MassMutual‘s receipt of revenue-sharing payments from third-party mutual funds. (Golden Star, Inc. v. Mass Mut. Life Ins. Co.)

Briefs

- Calamos filed a motion to dismiss excessive-fee litigation regarding its Growth Fund. Brief: “Plaintiffs advance overwrought policy critiques of the entire mutual fund industry, legally inapt comparisons between services rendered to a retail mutual fund (such as the [Growth] Fund) and those provided to an institutional account or as sub-adviser, and conclusory assertions that the Fund grew over time but did not reduce its fees that are just the sort of allegations that courts in this Circuit have consistently dismissed for more than 30 years.” (Chill v. Calamos Advisors LLC.)

- Parties filed dueling motions for summary judgment in fee litigation regarding eight Hartford mutual funds. Plaintiffs’ section 36(b) claims, first filed in 2011, previously survived Hartford’s motion to dismiss. The summary judgment briefs are unavailable on PACER. (Kasilag v. Hartford Inv. Fin. Servs. LLC; Kasilag v. Hartford Funds Mgmt. Co.)

- New York Life filed a motion to dismiss excessive-fee litigation regarding four of its MainStay funds. Brief: Plaintiffs’ complaint “asserts in conclusory fashion that Defendant New York Life Investment Management LLC (‘NYLIM’) received excessive fees for management of four mutual funds, merely because NYLIM hired subadvisors to assist with its duties and paid them a portion of the total management fee. But NYLIM’s employment of this manager/subadvisor structure—widely utilized throughout the mutual fund industry and endorsed by NYLIM’s regulator—cannot itself constitute a breach of NYLIM’s fiduciary duty under Section 36(b) of the Investment Company Act . . . .” (Redus-Tarchis v. N.Y. Life Inv. Mgmt., LLC.)

The Alt Perspective: Commentary and news from DailyAlts.

Survey Says…

Survey Says…

The spring is the season for surveys and big opinion pieces. Perhaps it is the looming summer vacations of readers that prompt companies to survey the market for opinions and views on particular topics before everyone heads out of the office for a long break. Regardless, the survey results are in, the results have been tallied and in the world of liquid alternatives, it appears that the future looks good.

Two industry surveys that were completed recently are cited in the articles below. The first provides the results of a survey of financial advisors about their allocations to alternative investments, and notes that more than half of the financial advisors surveyed think that their clients should allocate between 6% and 15% to alternative investments – a significant increase from today’s levels.

The second report below provides big picture industry thinking from Citi’s Business Advisory Services unit, and projects the market for liquid alternatives to double over the next five years, increasing to more than $1.7 trillion in assets.

- Majority of Advisors Plan to Continue Recommending Alternatives

- Citi Sees Boom in Unconstrained Long, Smart Beta and Liquid Alts

While industry surveys and big picture industry reports can often over-project the optimism and growth of a particular product group, the directional trends are important to watch. And in this case, the trends continue to be further growth of the liquid alternatives market, both here in the U.S. and abroad.

Monthly Liquid Alternative Flows

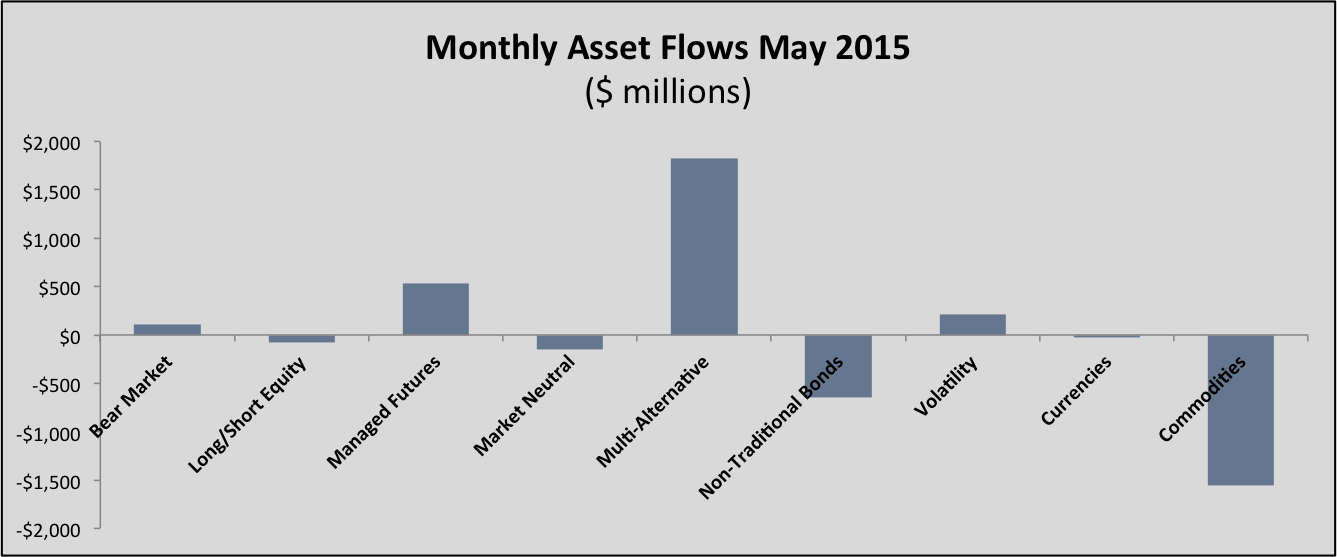

Consistent with the reports above, investors continued to allocate to alternative mutual funds and ETFs in May of this year. Investors allocated a net total of $2 billion to the space in May, a healthy increase from April’s level of $723 million, and a return to levels we saw earlier in the year.

While only two categories had positive inflows last month, this month has four categories with positive inflows. Once again, multi-alternative funds that combine multiple styles of investing, and often multiple asset managers, all into a single fund had the most significant inflows. These funds pulled in $1.8 billion in net new assets. Managed futures are once again in second place with just over $520 million in new inflows.

While the outflows from long/short equity funds have moved closer to $0, they have yet to turn positive this year. With equity market conditions as they are, this has the potential to shift to net inflows over the coming months. Commodity funds continued to struggle in May, but investors kicked it up a notch and increased the net outflows to more than $1.5 billion, more than a double from April’s level.

Diversification and one stop shopping continue to be an important theme for investors. Multi-alternative fund and managed futures funds provide both. Expect asset flows to liquid alternatives to continue on their current course of strong single-digit to low double-digit growth. Should the current Greek debt crisis or other global events cause the markets to falter, investors will look to allocate more to liquid alternatives.

New Fund Launches

We have seen 66 new funds launched this year, up from 53 at the end of April. This includes alternative beta funds as well as non-traditional bond funds, both of which provide investors with differentiated sources of return. In May, we logged 13 new funds, with nearly half being alternative beta funds. The remaining funds cut across multi-alternative, non-traditional bonds and hedged equity.

Two of the funds that were launched in May were unconstrained bond funds, one of the more popular categories for asset inflows in 2014. This asset category is meant to shield investors from the potential rise in interest rates and the related negative impact of bond prices. Both Virtus and WisdomTree placed a bet on the space in May with their new funds that give the portfolio managers wide latitude to invest across nearly all areas of the global fixed income market on a long and short basis.

While significant assets have flowed into this category of funds over the past several years, the rise in interest rates has yet to occur. This may change come September, and at that point we will find out if the unconstrained nature of these funds is helpful.

For more details on new fund launches, you can visit our New Funds 2015 page.

Observer Fund Profiles:

Each month the Observer provides in-depth profiles of between two and four funds. Our “Most Intriguing New Funds” are funds launched within the past couple years that most frequently feature experienced managers leading innovative newer funds. “Stars in the Shadows” are older funds that have attracted far less attention than they deserve.

Eventide Healthcare & Life Sciences (ETNHX): Morningstar’s 2015 conference included a laudatory panel celebrating “up and coming” funds, including the five star, $2 billion Eventide Gilead. At yet as I talked with the Eventide professionals the talk kept returning to the fund that has them more excited, Healthcare. The fund looks fascinating and profitable. Unfortunately, we need answers to two final questions before publishing the profile. We’re hopeful of having those answers in the first couple days of July; we’ll notify the 6000 members of our mailing list as soon as the profile goes live

Launch Alert

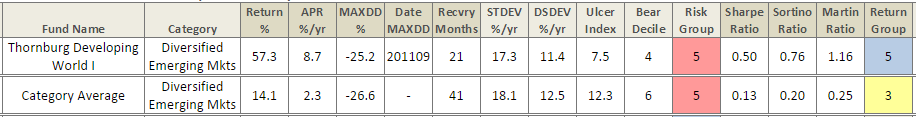

Thornburg Developing World (THDAX) is one of the two reasons for being excited about Artisan Developing World (ARTYX). Artisan’s record for finding and nurturing outstanding management teams is the other.

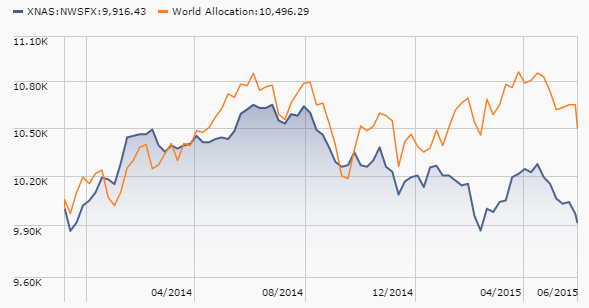

Lewis Kaufman managed Thornburg Developing World from inception through early 2015. During that time, he amassed a remarkable record for risk-sensitive performance. A $10,000 investment at inception would have grown to $15,700 on the day of Mr. Kaufman’s departure, while his peers would have earned $11,300. Morningstar’s only Gold-rated emerging markets fund (American Funds New World Fund NEWFX) would have clocked in at $13,300, a gain about midway between mediocre and Mr. Kaufmann.

By all of the risk and risk/return measures we follow, he achieved those gains with lower volatility than did his peers.

Mr. Kaufman pursues a compact, primarily large-cap portfolio. He’s willing to invest in firms tied to, but not domiciled in, the emerging markets. And he has a special interest in self-funding companies; that is, firms that generate free cash flow sufficient to cover their operating and capital needs. That allows the firms insulate themselves from both the risk of international capital flight and dysfunctional capital markets that are almost a defining feature of the emerging markets. Andrew Foster of Seafarer Overseas Growth & Income (SFGIX) shares that preference for self-funding firms and it has been consistently rewarding.

There are, of course, two caveats. First, Thornburg launched after the conclusion of the 2007-09 market crisis. That means that it only dealt with one sharply down quarter (3Q2011) and it trailed the pack then. Second, Thornburg’s deep analyst core doubtless contributed to Mr. Kaufmann’s success. It’s unclear how reliance on a smaller team will affect him.

In general, Artisan’s new funds have performed exceptionally well (the current E.M. product, which wasn’t launched in the retail market, is the exception). Artisan professes only ever to hire “category killers,” then gives them both great support and great autonomy. That process has worked exceptionally well. I suggested on our discussion board “that immediately upon launch, our short-list of emerging markets funds quite worth your money’ will grow by one.” I’m pretty comfortable with that prediction.

Artisan Developing World (ARTYX) has a 1.5% initial expense ratio and a $1,000 investment minimum.

Funds in Registration

There are eight new funds in registration this month. Funds in registration with the SEC are not available for sale to the public and the advisors are not permitted to talk about them, but a careful reading of the filed prospectuses gives you a good idea of what interesting (and occasionally appalling) options are in the pipeline. Funds currently in registration will generally be available for purchase in September or early October.

Two funds sort of pop out:

RiverNorth Marketplace Lending Fund will invest in loans initiated by peer-to-peer lenders such as LendingClub and Prosper.com. It’s structured as a non-listed closed-end fund which will likely offer only periodic liquidity; that is, you might be able to get out just once a month or so. The portfolio’s characteristics should make it similar to high-yield bonds, offering the chance for some thrills and interest rate insulation plus high single-digit returns. It’s a small market; about $7 billion in loans were made last year, which makes it most appropriate to a specialist boutique firm like RiverNorth.

Thornburg Better World will be an international fund with strong ESG screens. Thornburg’s international funds are uniformly in the solid-to-outstanding range, though the departure of Lewis Kaufmann and some of his analysts for Artisan certainly make a dent. That said, Thornburg’s analyst core is large and well-respected and socially-responsible investing has established itself as an entirely mainstream strategy.

Manager Changes

This month there were only 38 funds reporting partial or complete changes in their management teams. This number is slightly inflated by the departure of Wayne Crumpler from eleven American Beacon funds. The most notable changes include Virginie Maisonneuve’s departure from another PIMCO fund, and Thomas Huber stepping down from T. Rowe Price Growth & Income. The good news is that he’s remaining at T. Rowe Price Dividend Growth where he’s had a longer record and more success.

Updates

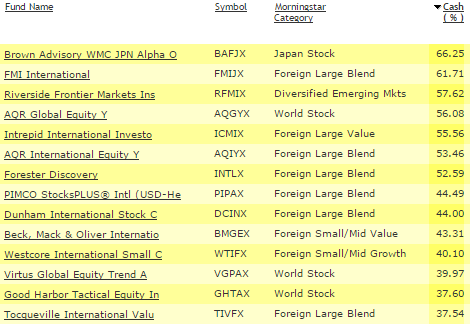

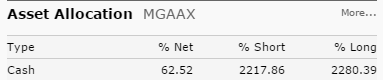

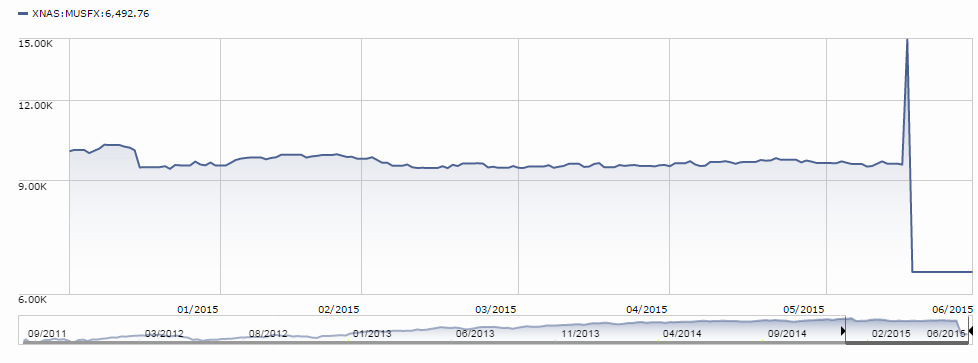

In May we ran The Dry Powder Gang, a story highlighting successful funds that are currently holding exceptionally high levels of cash. After publication, we heard from two advisors who warned that their funds’ cash levels were dramatically lower than we’d reported: FMI International (FMIJX) and Tocqueville International Value (TIVFX).

The error came from, and remains in, the outputs from Morningstar’s online fund screener. Here is Morningstar’s report of the most cash-heavy international funds, based on a June 30 2015 screening:

Cool, except for the fact the Brown is 9% cash, not 66%; FMI is 20%, not 62%; AQR is 7%, not 56% … down to Tocqueville which is 6%, not 38%.

Where do those lower numbers come from? Morningstar, of course, on the funds’ “quote” and “portfolio” pages.

We promptly corrected our misreport and contacted Morningstar. Alexa Auerbach, a kind and crafty wizard there, explained the difficulty: the cash levels reported in the screener are “long rescaled” numbers. If a fund has both long and short positions, which is common in international funds which are hedging their currency exposures, Morningstar recalculates the cash position as a percentage of the fund’s long portfolio. “So,” I asked, “if a fund was 99% short and 1% long, including a 0.3% cash position, the screener would report a 30% cash stake?” Yep.

When I mentioned that anomaly to John Rekenthaler, Morningstar’s resident thunderer and former head of research, he was visibly aroused. “Long-rescaled? I thought I’d killed that beast five years ago!” And, grabbing a cudgel, he headed off again in the direction of IT.

I’ll let you know how the quest goes. In the interim, we will, and you should be a bit vigilant in checking curious outputs from the software.

Trust but Verify

On December 9, 2014, BlackRock president Larry Fink told a Bloomberg TV interviewer, “I am absolutely convinced we will have a day, a week, two weeks where we will have a dysfunctional market. It’s going to create some sort of panic, create uncertainty again.” That’s pretty much the argument that Ed and I have made, in earlier months, about ongoing liquidity constraints and an eventual crisis. It’s a reasonably widespread topic of conversation about serious investment professionals, as well as the likes of us.

Fink’s solution was electronic bond trading and his fear was not the prospect of the market crisis but, rather, of regulators reacting inappropriately. In the interim, BlackRock applied for permission to do inter-fund lending: if one of their mutual funds needed cash to meet redemptions, they could take a short-term loan from a cash-rich BlackRock fund in lieu of borrowing from the banks or hastily selling part of the portfolio. It is a pretty common provision.

Which you’d never know from one gold bug’s conclusion that Fink sounded “BlackRock’s Warning: Get Your Money Out Of All Mutual Funds.” It’s the nature of the web that that same story, generally positioned as “What They Don’t Want You to Know,” appeared on a dozen other websites, some with remarkably innocuous names. Those stories stressed that the problem would last “days or even weeks,” which is not what Fink said.

Briefly Noted . . .

On June 4, 2015, John L. Keeley, Jr., the president and founder of Keeley Asset Management and a portfolio manager to several of the Keeley funds passed away at a still-young 75. He’s survived by his wife of 50+ years and a large family. His rich life, good works and premature departure remind us all of the need to embrace our lives while we can, rather than dully plodding through them.

Conestoga SMid Cap Fund (CCSMX) just gained, with shareholder approval, a 12(b)1 fee. (Shareholders are a potentially valuable source of lanolin.) Likewise, the Hennessy Funds are asking shareholders to raise their costs via a 12(b)1 fee on the Investor Class of the Hennessy Funds.

In the “let’s not be too overt about this” vein, Janus quietly added a co-manager to Janus Unconstrained Global Bond (JUCAX). According to the WSJ, Janus bought the majority stake in an Australian bond firm, Kapstream Capital Pty Ltd., then appointed Kapstream’s founder to co-manage Unconstrained Bond. Kumar Palghat, the co-manager in question, is a former PIMCO executive who managed a $22 billion bond portfolio for PIMCO’s Australian division. He resigned in 2006, reportedly to join a hedge fund.

In the “let’s not be too overt about this” vein, Janus quietly added a co-manager to Janus Unconstrained Global Bond (JUCAX). According to the WSJ, Janus bought the majority stake in an Australian bond firm, Kapstream Capital Pty Ltd., then appointed Kapstream’s founder to co-manage Unconstrained Bond. Kumar Palghat, the co-manager in question, is a former PIMCO executive who managed a $22 billion bond portfolio for PIMCO’s Australian division. He resigned in 2006, reportedly to join a hedge fund.

It’s intriguing that Gross, who once managed $1.8 trillion, is struggling with one-tenth of one percent of that amount. Janus Unconstrained is volatile and underwater since launch. Its performance trails that of PIMCO Unconstrained (PFIUX), the BarCap Aggregate, its non-traditional bond peer group, and most other reasonable measures.

PIMCO has announced reverse share-splits of 2:1 or 3:1 for a series of its funds: PIMCO Commodity Real Return Strategy Fund (PCRAX), PIMCO RAE Fundamental Advantage PLUS Fund (PTFAX), PIMCO Real Estate Real Return Strategy Fund (PETAX) and PIMCO StocksPLUS Short Fund (PSSAX). Most of the funds have NAVs in the neighborhood of $2.50-4.00. At that level, daily NAV changes of under 0.25% don’t get reflected (they round down to zero) until a couple consecutive unreported changes pile up and trigger an unusually large one day move.

O Canada! Your home and native land!! Vanguard just noticed that Canada exists and that it is (who knew?) a developed market. As a result, the Vanguard Developed Markets Index Fund will now track the FTSE Developed All Cap ex US Index rather than the FTSE Developed ex North America Index. The board has also approved the addition of the Canadian market to the Fund’s investment objective. Welcome, o’ land of pines and maples, stalwart sons and gentle maidens!

O Canada! Your home and native land!! Vanguard just noticed that Canada exists and that it is (who knew?) a developed market. As a result, the Vanguard Developed Markets Index Fund will now track the FTSE Developed All Cap ex US Index rather than the FTSE Developed ex North America Index. The board has also approved the addition of the Canadian market to the Fund’s investment objective. Welcome, o’ land of pines and maples, stalwart sons and gentle maidens!

Vanguard’s Emerging Markets, Pacific and European stock index funds will also get new indexes, some time late in 2015. Vanguard’s being intentionally vague on the timing of the transition to try to prevent front-running by hedge funds and others. In each case, the new index will include a greater number of small- to mid-cap names. The Emerging Markets index will, in addition, include Chinese “A” shares. One wonders if recent events are causing them to reconsider?

Villere Balanced Fund (VILLX) and Villere Equity Fund (VLEQX) may, effective immediately, lend securities – generally, that means “to short sellers” – “in order to generate return.”

SMALL WINS FOR INVESTORS

AMG Yacktman (YACKX) and AMG Yacktman Focused (YAFFX) both reopened to new investors on June 22, 2015. The reopening engendered a lively debate on our discussion board. One camp pointed out that these are top 1% performers over the past 10- and 15-year periods. The other mentioned that they’re bottom 10% performers over the past 3- and 5-year periods. The question of asset bloat (about $20 billion between them) came up as did the noticeable outflows ($4 billion between them) in the last several years. There was a sense that the elder Mr. Yacktman was brilliant and a phenomenally decent man but, really, moving well into the “elder” ranks. Son Steve, who has been handling the funds’ day-to-day operations for 15 years is … hmmm, well, a piece of work.

The Barrow Funds, Barrow Value Opportunity Fund (BALAX/BALIX) and Barrow Long/Short Opportunity Fund (BFLSX/BFSLX) are converting from two share classes to one. The investor share class closed to new purchases on June 2 and merged into the institutional share class on June 30. At that same time, the minimum investment requirement for the institutional shares dropped from $250,000 to $2,500. The net effect is that Barrow gets administrative simplicity and their investors, current and potential, get a price break.

Effective immediately, the name of the Hatteras Hedged Strategies Fund has changed to Hatteras Alternative Multi-Manager Fund (HHSIX). Here’s the “small wins” part: they’ve sliced their minimum initial investment from $150 million to $1 million! Woo hoo! And here’s the tricky part: the fund has only $97 million in assets which implies that the exalted minimum was honored mostly in the breach.

The Royce Funds reduced their advisory fees for their European Smaller-Companies Fund, Global Value, International Smaller-Companies, International Micro-Cap and International Premier funds on July 1, 2015. The reductions are about 15 basis points, which translates to a drop in the funds’ expense ratios of about 10%.