Objective and strategy

The managers aspire to outperform the S&P 500 over meaningful time periods, while managing risk by blending non-correlated assets such as a discretionary global macro strategy with a portfolio of US equities. The portfolio has two components: a US equity component, which is executed by buying low-cost ETFs, and a macro-driven Futures Trading Strategy. Through rebalancing between these approaches, they hope to harness divergent performance drivers to create what they term “Dynamic Alpha.” The equity strategy divides its investments between growth, high-dividend, and broad market stocks. The Future Trading Strategy, executed by a trading adviser, provides exposure to over 40 liquid markets with negligible return correlations to each other and the S&P 500.

Adviser

Dynamic Wealth Group, LLC, of Las Vegas, Nevada. The parent corporation serves as a sort of advisor-to-advisors, offering outsourced chief investment officer services to financial planners. The discipline was then embodied in the Dynamic Alpha Macro fund. As of April 2025, the firm had $150 million under management and more than two billion under advisement.

Managers

Bradley Barrie and David Johnson. Mr. Barrie has earned the CFP and ChFC certifications, is the firm’s CIO, and co-founder of the Dynamic Wealth Group. David Johnson, Managing Director and Chief Operations Officer, started his career at NASA as a systems engineer on the Space Shuttle program. Messrs. Barrie and Johnson have managed the fund since its inception. It is their sole charge. Asim Ghaffar is an advisor for the futures-trading strategy and is the founder and CIO of AG Capital, a global macro hedge fund based in Boston, Massachusetts. That fund was established in 2014 and aims to deliver attractive absolute returns with zero correlation to major asset classes and other macro managers.

Strategy capacity and closure

Their current projection is that their strategy would be constrained at about a billion in AUM, at which point they would likely soft-close the fund. That said, their markets are all ultra-liquid, so they’ll need to judge as the decision point approaches.

Management’s stake in the fund

Lead manager Brad Barrie has invested over $1 million in the fund. David Johnson has invested $100,000 – $500,000.

Opening date

July 31, 2023, though Morningstar lists the managers’ start as 07/02/23.

Minimum investment

$5000

Expense ratio

The reported net expense ratio is 1.98% on assets for $150 million (as of 4/30/2025). That said, the most recent Semi-Annual Shareholder Report reports “1.73% is the Cost paid as a percentage of a $10,000 investment” (12/30/2024), which portends a likely reduction in the reported expense ratio when the prospectus is updated in November.

Comments

The Dynamic Alpha Macro Fund was launched in August 2023. The fund employs a distinctive dual strategy approach, allocating assets approximately equally (50%/50%) between equity securities and futures trading strategies. This combination aims to deliver returns that are minimally correlated to broader market movements by blending non-correlated assets.

The equity securities component invests in exchange-traded funds (ETFs) that provide low-cost broad market exposure, while the futures trading strategy involves long and short positions across various assets, including currencies, debt, equities, energy, metals, and agricultural commodities. More specifically, the equity allocation is divided among growth stocks (approximately 40%), above-average dividend-paying stocks (approximately 40%), and broad market stocks (approximately 20%).

Performance Analysis

The fund has done well in its relatively short history. The fund was ranked as the #1 performing fund for 2024 in the Morningstar Macro Trading category out of 60 funds, with a gain of 18.4% against its peers’ 6.5%. In the Lipper rankings, it finished #3 of 45 in 2024. This achievement is particularly notable given the challenging market environment.

Fit in a Chaos-Resistant Portfolio

The fund’s dual strategy approach is specifically designed to provide smoother returns during market turbulence – a key consideration for a chaos-resistant portfolio. By combining equity securities with futures trading strategies that can provide non-correlated returns, DYMIX aims to deliver a smoother investing experience compared to equity-only strategies.

For context, 2024 was a banner year for U.S. stocks, with the S&P 500 up more than 23%. However, beneath the surface, only 19% of stocks within the S&P 500 actually outperformed the index itself. This disparity highlights the importance of strategies that can navigate selective market environments.

For investors seeking protection against market volatility in the current environment, particularly given the political transitions and economic uncertainties, DYMIX offers several compelling attributes:

-

Diversification Beyond Traditional Assets: The fund’s dual approach provides exposure to both equities and alternative strategies through futures trading, potentially offering more robust diversification than traditional stock/bond portfolios. Mr. Barrie argues that “True diversification requires multiple drivers and multiple diversifiers, not just one of each.” By MFO’s calculation, the fund’s since-inception (19 months) correlation with the S&P 500 has been 0.27.

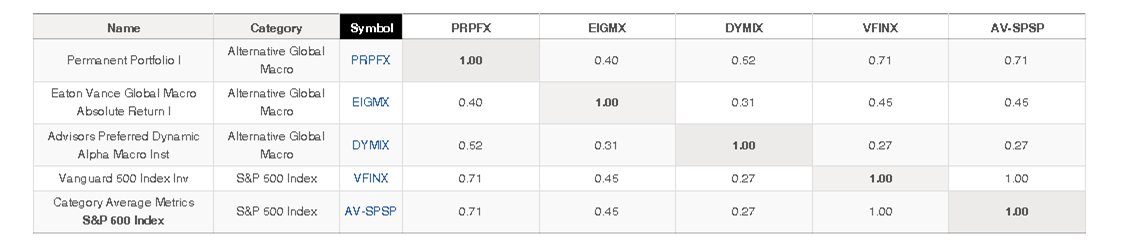

19-month correlations between the highest Sharpe ratio Global Macro funds and the S&P 500

-

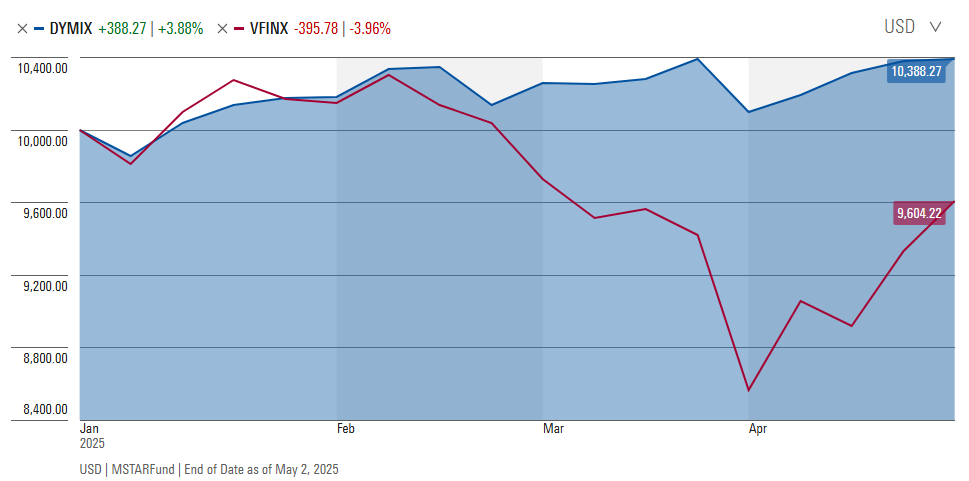

Active Management During Volatility: The fund aims to serve as “an alpha creator and potential volatility buffer to traditional asset allocation strategies.” In turbulent markets, this active approach may provide value. That does not involve single-direction bets or trend following. Barrie argues, “Don’t have a crystal ball. Too many investors and advisors rely on hope or predictions; our approach is to be prepared for a range of outcomes since pretty much anything can happen.” That’s illustrated, we think, by the fund’s performance over the first four months of 2025.

-

Demonstrated Performance: The fund’s strong performance in 2024-25 suggests the strategy can deliver results, though its track record remains relatively short. Its 18.4% APR since inception exceeds the S&P 500 and vastly exceeds its peers. The private fund, whose strategy is reflected in the futures trading strategy, has a strong record stretching over more than a decade.

Considering the hedge

Traditionally, hedge funds were not designed to be an investor’s core holding. They were designed to complement the core, to provide a degree of protection in bad times and a possible boost to performance in good ones. The question is, how large should the hedge be relative to the core? The advice commonly given by financial planners, driven by reasonable research, is to devote perhaps 5 to 10% of a well-diversified portfolio to a hedge.

In Dynamic Alpha Macro, there’s essentially a 50/50 split between core and hedge. You might reasonably ask, is that weight justifiable? Recent academic research endorses the possibility. A hedge has two possible roles in a portfolio: it reduces beta (that is, dampens volatility and likely total return) or it adds alpha (that is, boosts total long-term returns). The research that recommends limiting the hedge to a small sliver is driven by the view that your hedges just reduce beta. Holding cash or short-term bonds in an equity fund, for example, would dampen volatility but would trade off assets that might produce high long-term returns (equities: 10% or so) for ones that would produce lower returns (cash / short-term bonds: 4% or so). That all changes if your hedge also adds alpha; researchers recently concluded that a hedge that adds 2% in alpha might receive a weight as high as 100% of the portfolio (Gregory Brown, et al, “Optimal Hedge Fund Allocation,” SSRN, 31 Mar 2025).

To be clear: that’s not Dynamic Wealth’s intent. But it does corroborate the decision to incorporate a very large, alpha-generating macro-driven component into the portfolio.

The “macro” part is critical to your assessment of the fund. Many fine funds use a futures strategy to execute a momentum or trend-following discipline; that is, they have an algorithm for what’s worked recently and what hasn’t. They buy the former and dodge or short the latter. A macro strategy is distinct. They’re looking to exploit macro-level events (climbing demand for copper, coordinated central bank rate cuts, currency revaluation, or whatever) that operate independently of the whims of the stock market. Executed well, that generates market-independent alpha.

However, several considerations should temper expectations:

- Limited Track Record: With less than two years of history, the fund’s long-term performance through various market cycles remains unproven.

- Higher Expenses: The above-average expense ratio will create a performance drag that must be overcome by consistently superior management. We’ve talked with the advisor about it, and they’ve emphasized their commitment to reduce expenses as assets grow, which they have done.

- Management Expertise: The management team’s relatively short tenure with the fund means investors are placing significant faith in their ability to navigate complex markets.

Bottom Line

The Dynamic Alpha Macro Fund stands out as a promising tool for building a chaos-resistant portfolio. Its dual-strategy approach, strong recent performance, and top industry ranking make it worthy of consideration for investors looking to add diversification and reduce reliance on traditional markets. Caution is warranted due to its short history, but its structure and results to date indicate it could play a valuable role as part of a broader, thoughtfully diversified investment strategy. As the markets become less certain, the need for chaos managers grows.

Fund website

https://dynamicalphafunds.com/