Each month, I update my ranking system for the thousand or so funds that I track using the MFO Premium fund screener and Lipper global dataset. I then compare the funds that I own to the trending funds to see if I want to make any changes. I follow a diversified traditional portfolio approach with over half managed by Fidelity and Vanguard. In this article, I look at the Lipper Categories and highest ranked funds for bonds, mixed assets, and equities.

Bond Funds

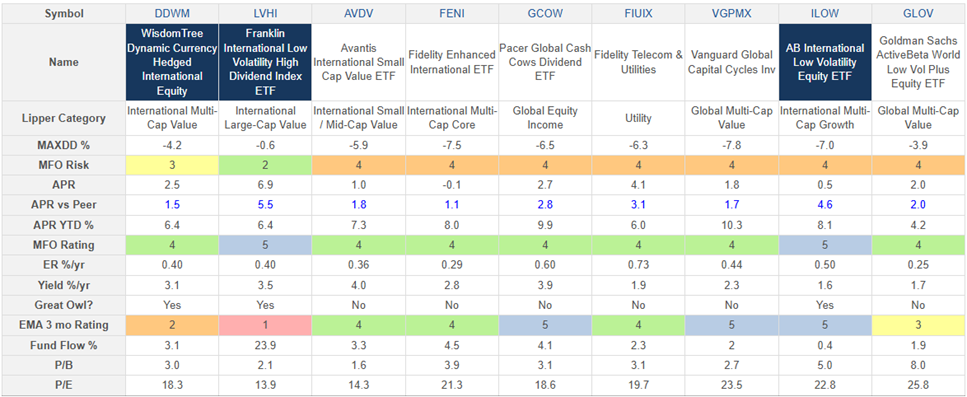

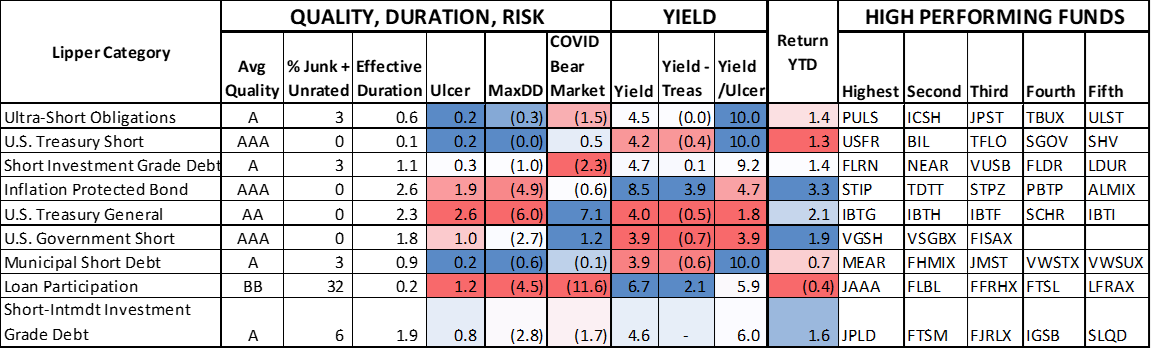

Bond funds are ranked based upon 1) three-year risk-adjusted returns (Martin Ratio), 2) short-term returns and momentum, 2) risk (drawdowns and Ulcer Index), 3) bond quality, and 4) yields, among other metrics. The funds in Table #1 are ordered from the highest ranked Lipper Category to the lowest, along with the five highest ranked funds. Over half of the investments in bonds that I manage are in bond ladders. I am satisfied with the performance of my funds; however, high-yield funds that are intended for income have had slightly negative returns year-to-date. Over the course of the next few months, I will evaluate trading Fidelity Capital & Income (FAGIX) for a short-term or inflation-protected bond fund.

Table #1: Top Ranked Lipper Bond Categories and Highest Ranked Funds – Three Year Metrics

Source: Author Using MFO Premium fund screener and Lipper global dataset with YTD Returns from Morningstar as of April 22nd

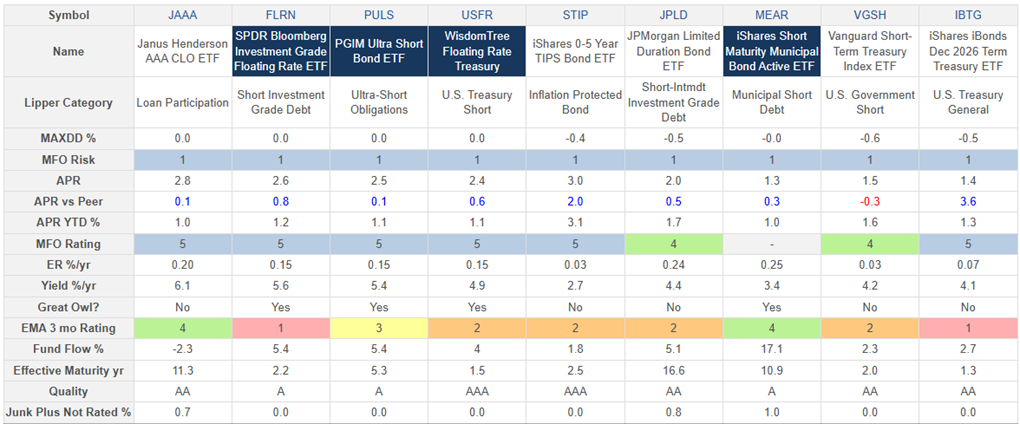

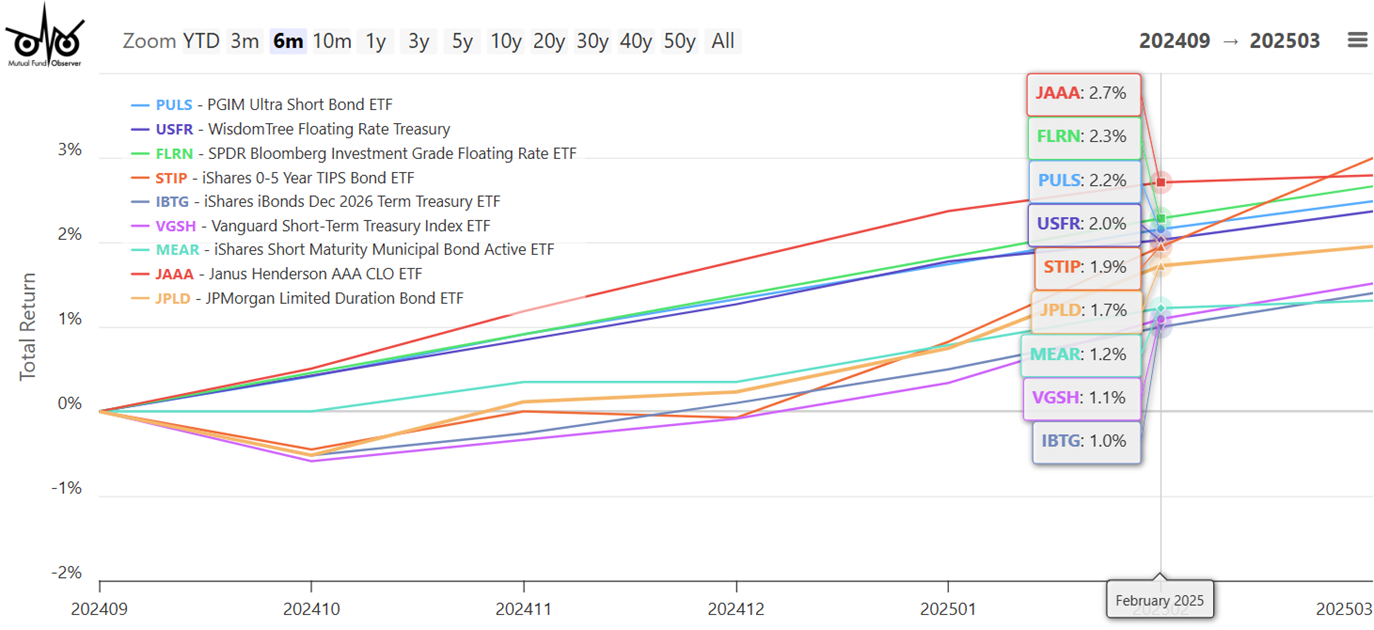

In Table #2, I display a snapshot of the highest-ranked fund in each of the above nine Lipper Categories. Note that IBTG in the U.S. Treasury General Category is the iShares iBond Dec 2026 Term Treasury ETF, which is a fund designed for bond ladders. I wrote about these funds in “ETF Bond Ladders” last month. Figure #1 shows the total return of these funds since Inauguration Day.

Table #2: Highest-Ranked Bond Funds – Metrics For Six Months

Figure #1: Total Return of Highest-Ranked Bond Funds Since Inauguration Day

Mixed Asset Funds

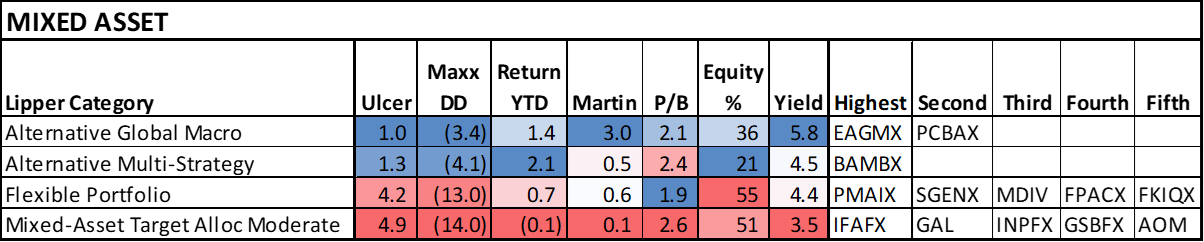

Mixed-asset funds are ranked based upon 1) three-year risk-adjusted returns (Martin Ratio), 2) short-term returns and momentum, 3) risk (drawdowns and Ulcer Index), 4) valuation, and 5) yields. Mixed-asset funds are great for a buy-and-hold strategy and letting a professional manager make the investment decisions. The drawback in retirement may be that you have less control over withdrawals because you can’t withdraw from certain categories when they are performing well.

Table #3 shows the Lipper Mixed-Asset Categories that I rank the highest, along with the five funds with the highest rank. Alternative global macro and alternative multi-strategy tend to have higher expense ratios. I may consider buying one as a “Risk Off” diversifier. In a “Risk On” environment, I may consider adding a flexible portfolio fund in accounts that I manage.

Table #3: Top-Ranked Lipper Mixed-Asset Categories and Highest Ranked Funds – Three-Year Metrics

Source: Author Using MFO Premium fund screener and Lipper global dataset with YTD Returns from Morningstar as of April 22nd

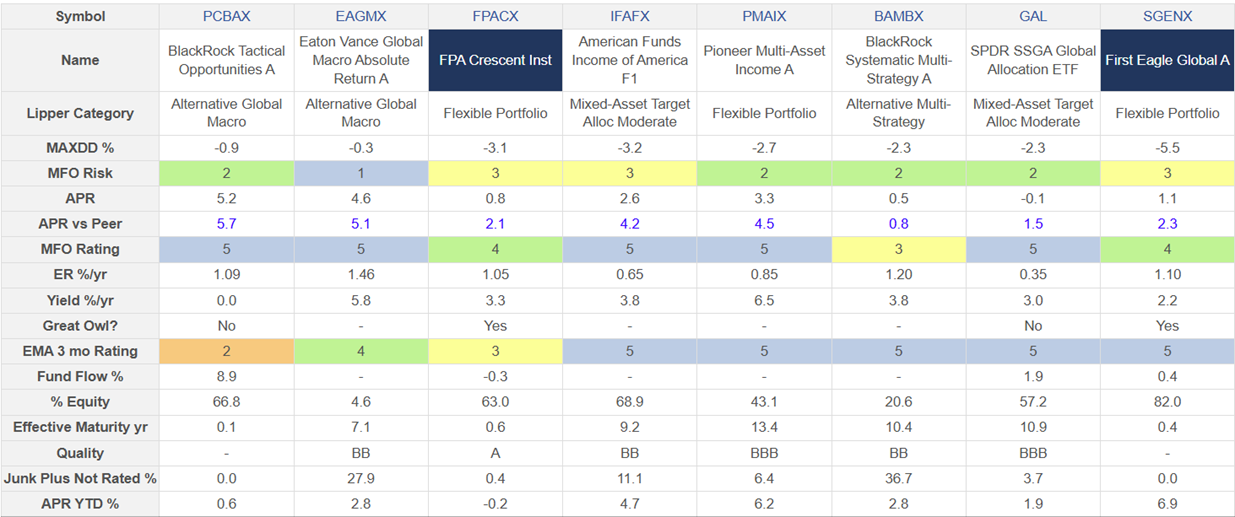

Table #4 shows a snapshot of the highest ranked fund in each Lipper Category, along with a few other well-known funds.

Table #4: Selected High-Performing Mixed-Asset Funds – Metrics For Six Months

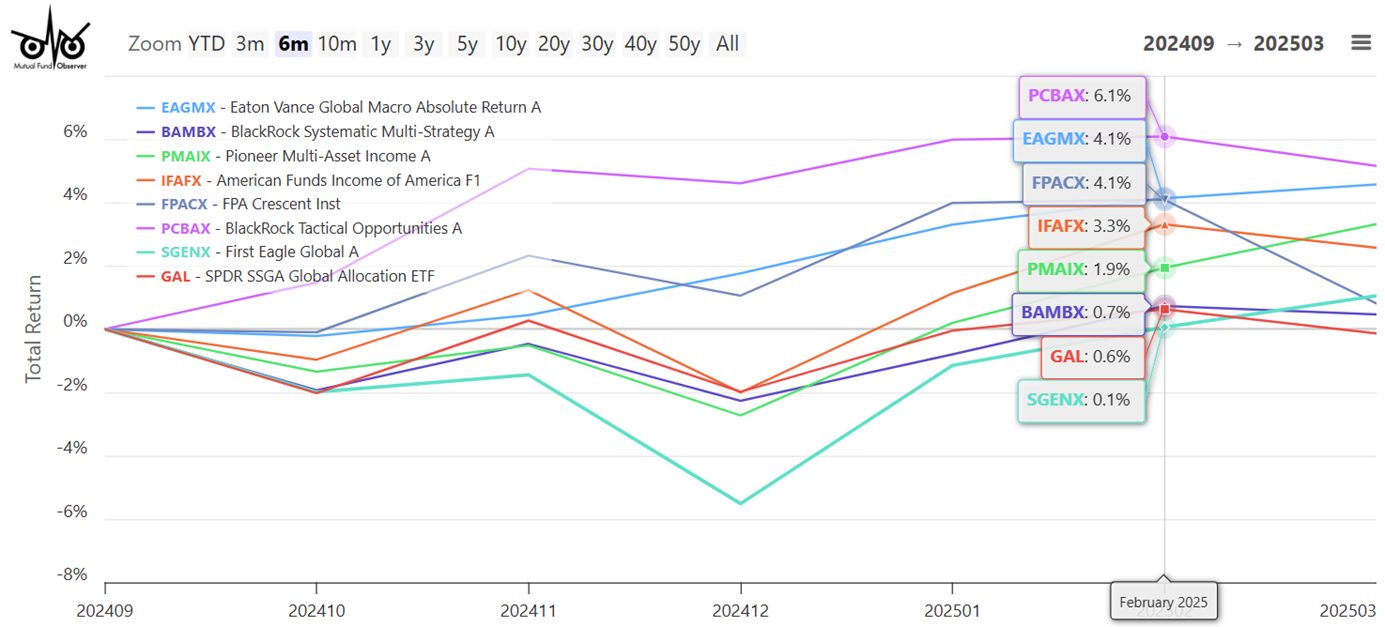

I like the return profile of the Eaton Vance Global Macro Absolute Return (EAGMX) fund as shown in Figure #2.

Figure #2: Total Return of Selected High Performing Mixed-Asset Funds Since Inauguration Day

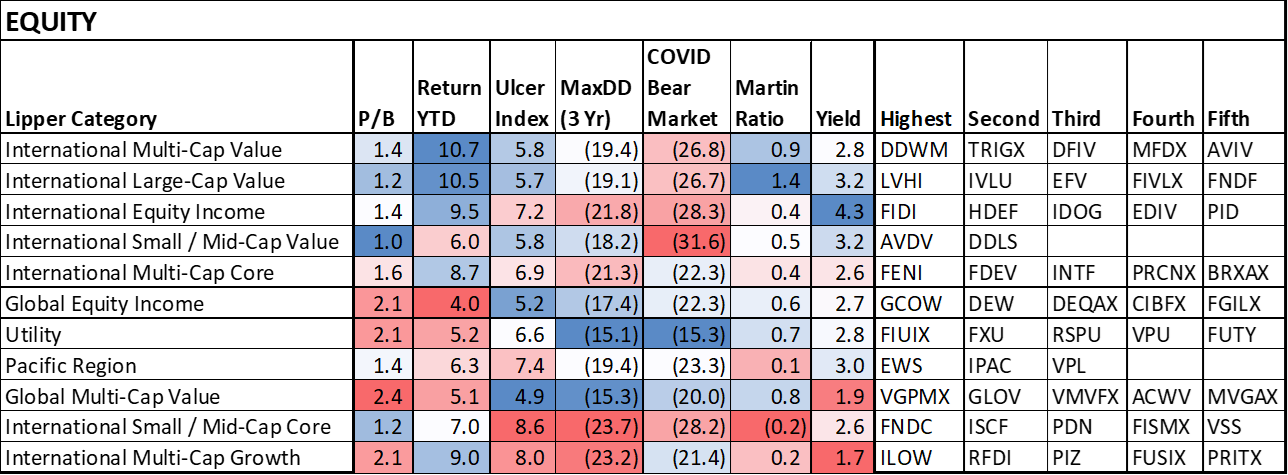

Equity Funds

I rank equity funds based upon 1) three-year risk-adjusted returns (Martin Ratio), 2) short-term returns and momentum, 3) risk (drawdowns and Ulcer Index), and 4) valuations. Almost all of the highest ranked Lipper Equity Categories are international or global. The returns are strong for the year in light of the uncertainty.

Table #5: Top Ranked Lipper Equity Categories and Highest Ranked Funds – Three Year Metrics

Source: Author Using MFO Premium fund screener and Lipper global dataset with YTD Returns from Morningstar as of April 22nd

Table #6: Selected High-Performing Equity Funds – Metrics for Six Months

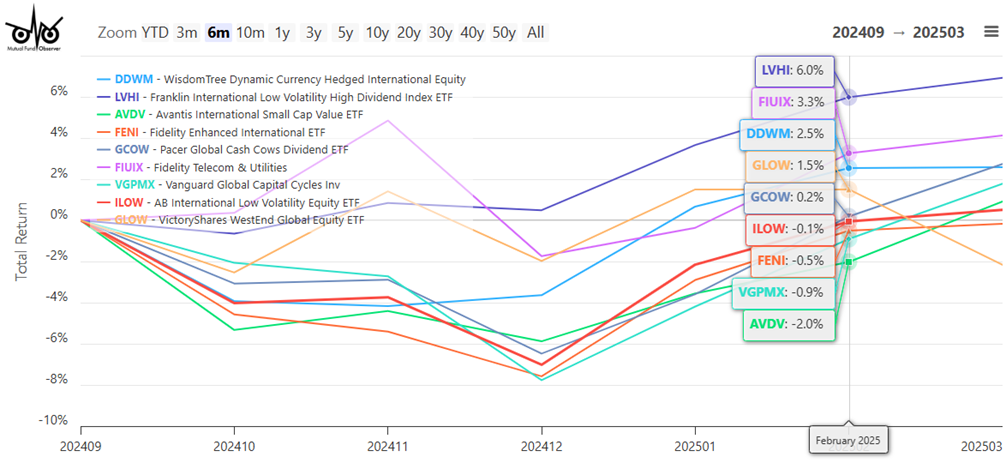

Figure #3: Total Return of Selected High-Performing Equity Funds Since Inauguration Day

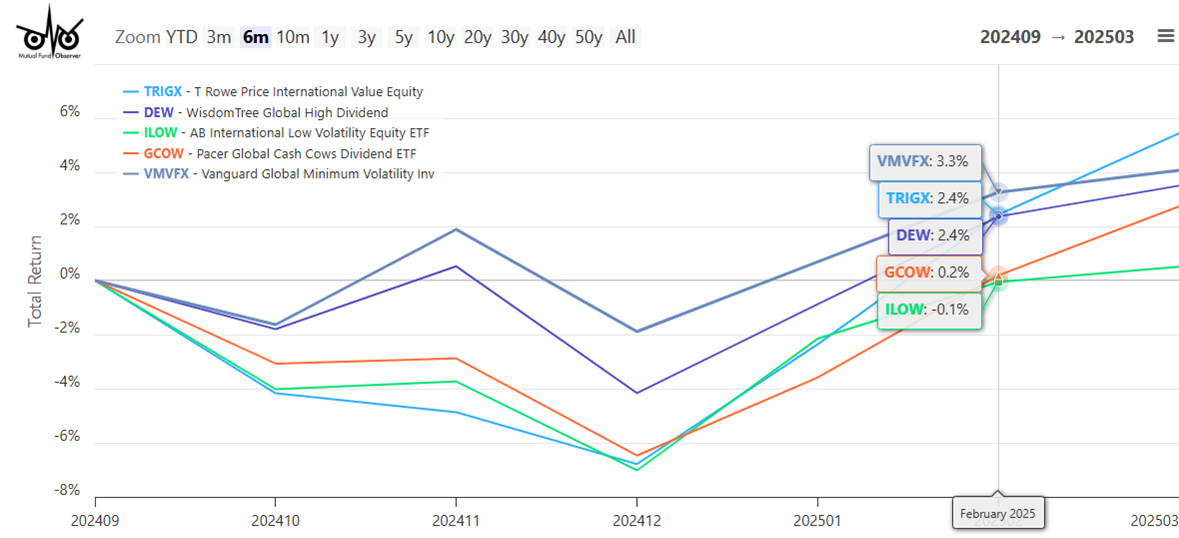

As the dust from the trade war settles, I will probably be in the market for a tax-efficient international or global equity fund. My short list is shown in Figure #4.

Figure #4: High-Performing Tax-Efficient International Equity Funds

Closing

I believe that the impact of tariffs will begin to show up more clearly in June because imports affected by tariffs will reach the shelves in May. A recession won’t become evident unless the uncertainty spreads to business investments and international trade worsens, along with shocks to supply chains. The longer the uncertainty lasts, the higher the probability of a recession will be.

Tariffs are a regressive tax on lower-income households who spend most of their income on basic needs. Cuts to Federal programs that support the poor will increase the financial stress on these families. I favor fiscal responsibility and slowing the increase of the national debt in a well-thought-out bipartisan manner.

My ranking system is currently oriented to highlight funds that will do well in market downturns. I remain risk off and focus more on having a reliable cash flow from fixed income for the next five to ten years.