I like Will Rogers’ quote, “Don’t gamble; take all your savings and buy some good stock and hold it till it goes up, then sell it. If it don’t go up, don’t buy it.” A good friend of mine once said that a balanced portfolio will usually have funds that are losing money. Then there are the unusual years like 2022 when few categories other than money market funds, short-term bonds, and commodities had positive returns. This article looks at how Vanguard Global Wellesley Income Fund (VGWIX) may fit into the portfolio of a timid investor, or how WisdomTree Dynamic Currency Hedged International Equity Fund (DDWM) might fit into the portfolio of a somewhat less timid investor.

With all of this market turmoil and uncertainty, we can reduce anxiety by getting out and doing the things we enjoy. Smell the roses. This baby Gold Finch was enjoying the sunshine in our yard and the bird seed that we set out. Turn off the news and go for a walk.

With all of this market turmoil and uncertainty, we can reduce anxiety by getting out and doing the things we enjoy. Smell the roses. This baby Gold Finch was enjoying the sunshine in our yard and the bird seed that we set out. Turn off the news and go for a walk.

On the investing side, we can develop long-term plans and stick to them. A well-balanced portfolio within our risk tolerance can help reduce anxiety.

I am searching for sustainable simplicity.

As I review investments of family and friends, I am asked why do I (we) own this fund if it’s losing? In the past, someone told me that they sold all equities before the Great Financial Crisis, but they never got back in, and I showed how much more they would have had if they had just stayed in. Investors should increase their financial literacy and understand their risk tolerance.

The psychology of investing is that the fear of losing is often greater than the satisfaction of gaining. Inflation is a stealthy thief. People see their ultra-conservative investments gaining, but don’t see the loss of purchasing power. I take this into account when assisting family and friends with investments. They sometimes want to make more money, but sell the dips and miss the upswings. I recommend using financial advisors to develop a long-term plan and stick with it.

International equities are outperforming domestic stocks lately, partly because valuations are very high in the US. Some analysts cite tariffs as disproportionately impacting the US. When I explain this to timid investors, they ask if they should buy international stocks. My answer is no, because they don’t like to see the value of their accounts or funds go down.

For the less timid investor who can handle that some holdings will go down while others are up, I like the WisdomTree Dynamic Currency Hedged International Equity Fund (DDWM). It is classified by MFO as a Great Owl Fund for consistently being in the top quintile of International Multi-Cap Value funds for risk-adjusted returns. I selected it from all international equity funds for its high risk-adjusted performance.

For the ultra-conservative, timid investor who does not like to see big losses among their funds, I suggest mixed asset funds with global exposure. I have assisted some of them in the past to own the Vanguard Wellesley Income Fund (VWINX/VWIAX), and it is often one of their favorites. VWINX has 13% exposure to international investments.

My advice for some timid investors to get more exposure to international equities is to consider switching to the Vanguard Global Wellesley Income Fund (VGWIX), which has a 52% exposure to international investments. The Global Wellesley fund has outperformed its counterpart for the past five years with slightly less risk. Both have about 37% allocated to stocks. I also like VGWIX, in part, because its valuation is much lower than VWINX. Both of these funds are classified as Mixed-Asset Target Allocation Conservative.

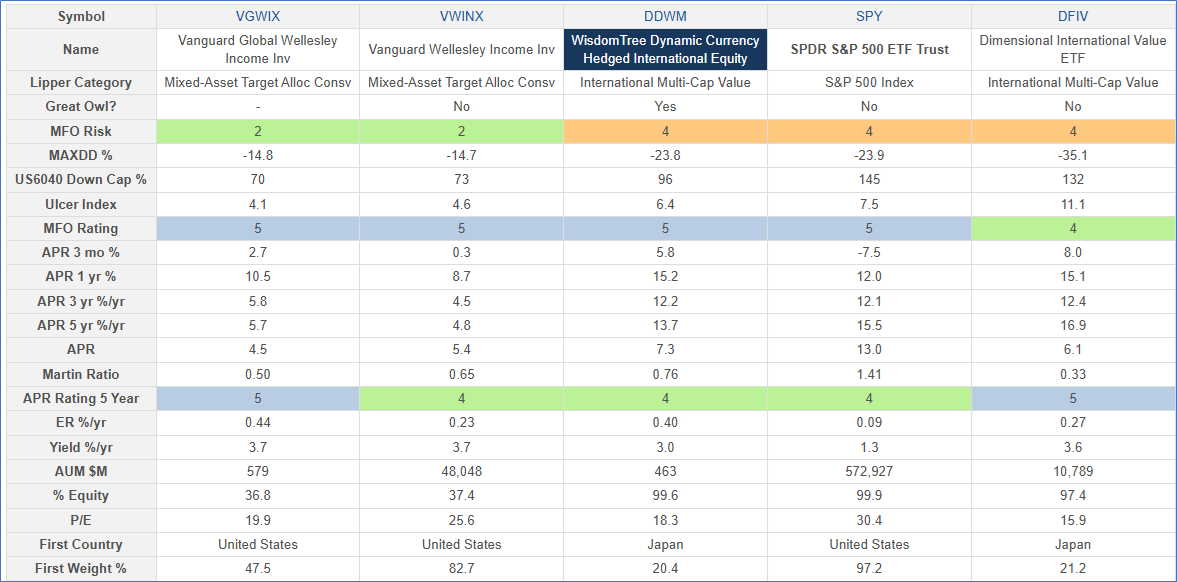

Table #1: High Performing International Equity and Global Mixed Asset Funds – 7 Years

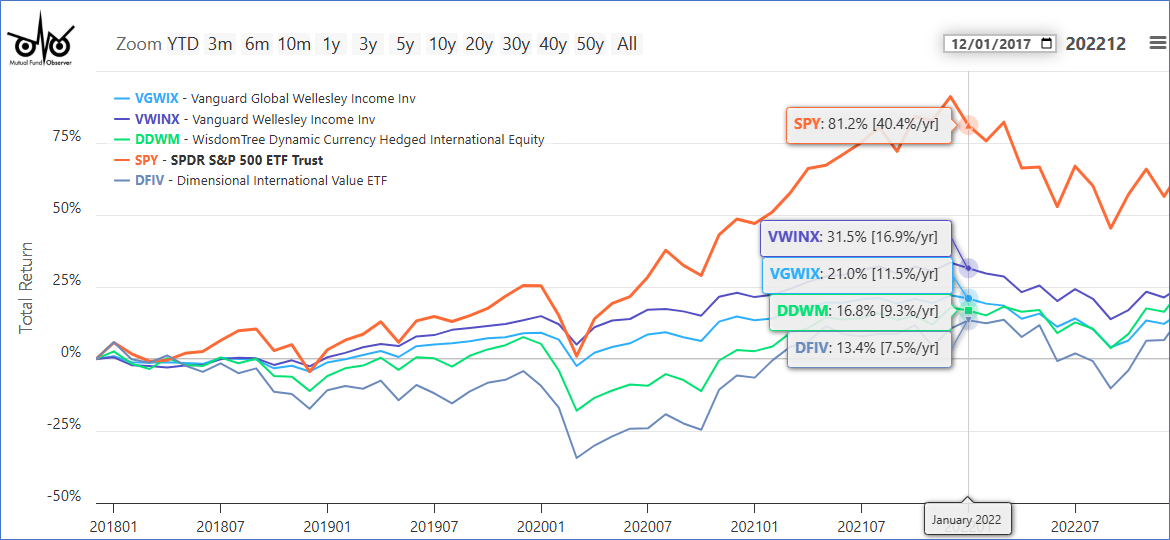

Figure #1 shows that the performance of the Vanguard Global Wellesley Income Fund (VGWIX) has been very close to that of Vanguard Wellesley Income Fund (VWINX) for the past seven years. The return of WisdomTree Dynamic Currency Hedged International Equity Fund (DDWM) has been slightly higher than Dimensional International Value ETF (DFIV), but with less downside risk.

Figure #1: High Performing International Equity and Global Mixed Asset Funds – 7 Years

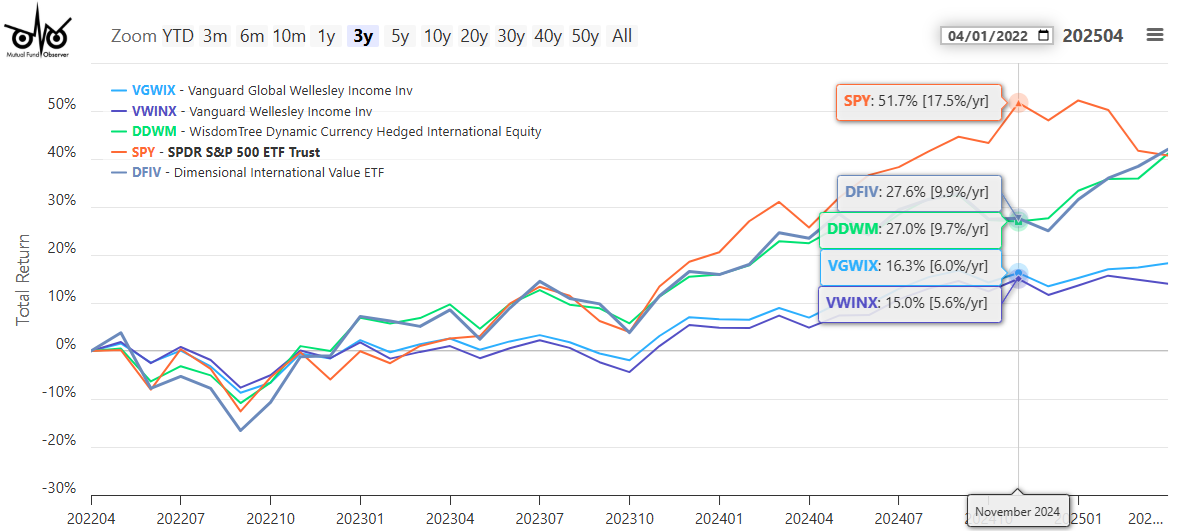

Figure #2 shows that the performance of the Vanguard Global Wellesley Income and Vanguard Wellesley Income has been almost identical for the past three years. Likewise, the performance of WisdomTree Dynamic Currency Hedged International Equity ETF and Dimensional International Value ETF is also similar.

Figure #2: High Performing International Equity and Global Mixed Asset Funds – 3 Years

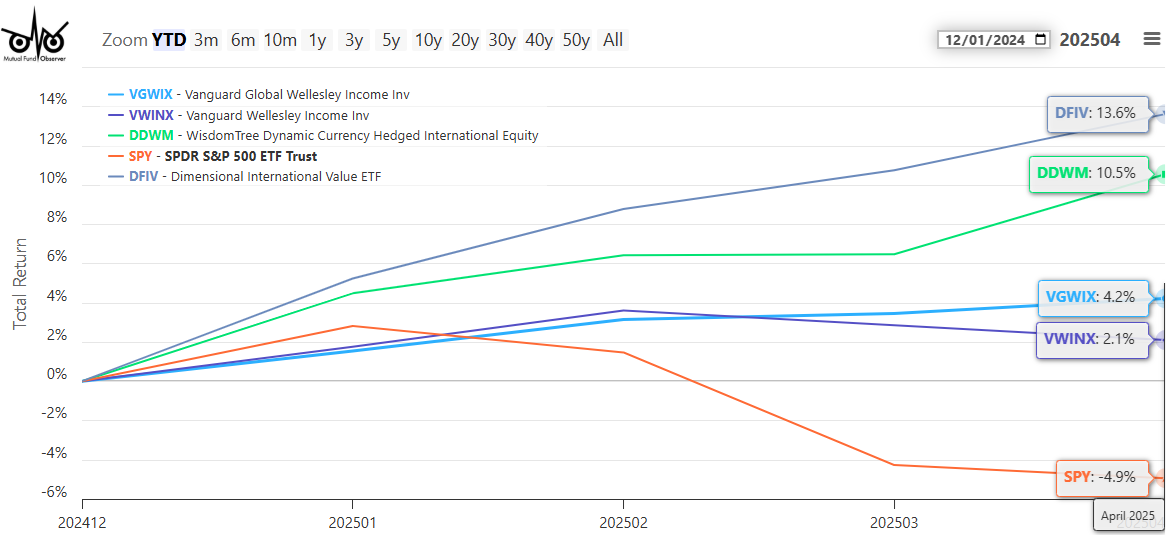

Year to date as of April, Dimensional International Value ETF (DFIV) is outperforming WisdomTree Dynamic Currency Hedged International Equity Fund (DDWM). The Vanguard Global Wellesley Income is outperforming Vanguard Wellesley Income.

Figure #3: High Performing International Equity and Global Mixed Asset Funds – YTD

Closing

I extracted all mixed asset funds with 40% or less allocated to stocks, above average risk-adjusted performance, and average or better annual percent returns. I narrowed the list to those with at least 20% invested internationally. Vanguard Global Wellesley Income Fund (VGWIX) is about the only fund to make the list of sixteen funds besides Mixed-Asset Target Funds with a target date of 2025 or earlier, and Mixed-Asset Target Today funds. So, the timid investor who wants to get international exposure should look at Vanguard Global Wellesley Income Fund (VGWIX).