The US Treasury first implemented Inflation-Protected Bonds (TIPS) in 1997, and they now make up about 7% of the Treasury market. Since then, inflation has rarely gone above 3% until 2021. Tariffs (customs duties) began surging in 2018, and President Trump is now implementing widespread tariffs. With retailers having low profit margins, these tariffs will mostly be passed on a tax on consumers. This article represents my research on how to invest the bond portion of a portfolio to reduce volatility and prepare for higher inflation.

Inflation Forecasts

Inflation by various measures has fallen below 2.3%. Tariff increases were announced on April 2nd, and it takes time for products with the additional tariffs to reach the shelves. The Fed – Monetary Policy: Beige Book describes prices increasing at a moderate pace. The report says, “All District reports indicated that higher tariff rates were putting upward pressure on costs and prices.”

The Philadelphia Federal Reserve Second Quarter 2025 Survey of Professional Forecasters shows that economists estimate that inflation will peak at 3.4% next quarter and decline to 2.5% in 2026 and 2.1% in 2027. The Organisation for Economic Co-operation and Development released its OECD Economic Outlook, Volume 2025 Issue 1, with estimates that inflation in the US will average 3.2% in 2025 and 2.8% in 2026. In “2025 Economy Watch”, The Conference Board estimated that inflation would average 2.9% in 2025 and 3.0% in 2026. The International Monetary Fund database estimates that consumer prices in the US will be 3.0% in 2025, 2.5% in 2026, and 2.1% in 2027.

In spite of these noble efforts to estimate inflation, there is too much uncertainty in policy and too many unknowns regarding geopolitical risk and supply chain disruptions to have a reliable forecast. Following the escalation of the Israeli-Iran conflict in June, oil prices rose 22% from a low of $60 to $73 on June 15th. Geopolitical risks and supply chain disruptions have the potential to exacerbate tariff-induced inflation. I expect moderate rises in inflation in a slowing economy with the Federal Reserve lowering rates toward the end of the year.

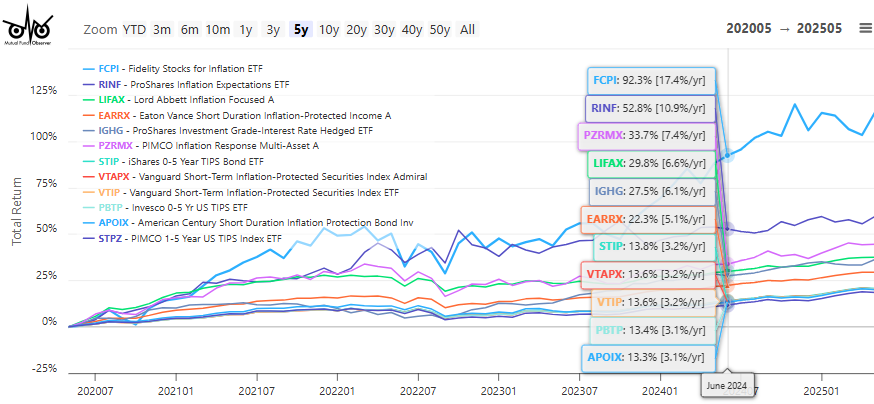

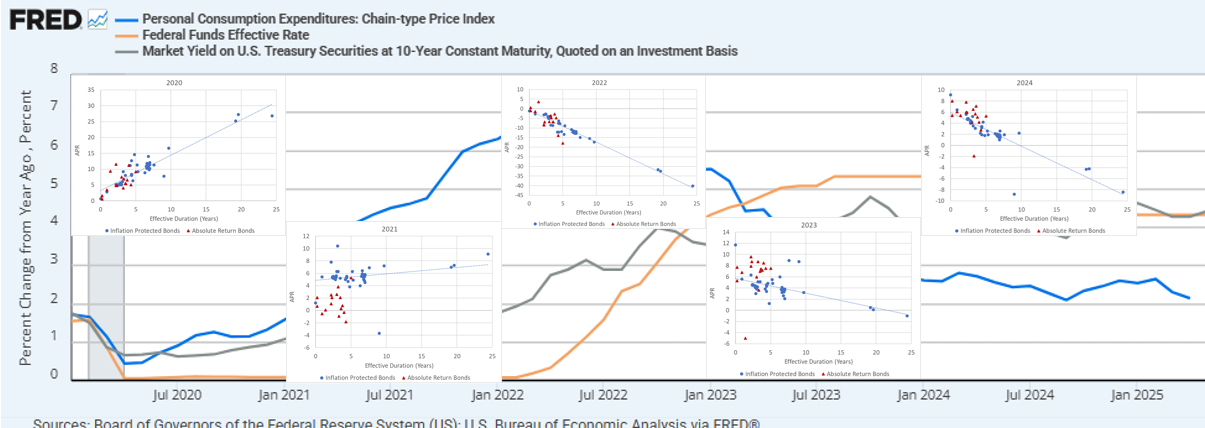

Post-Pandemic Five-Year Return

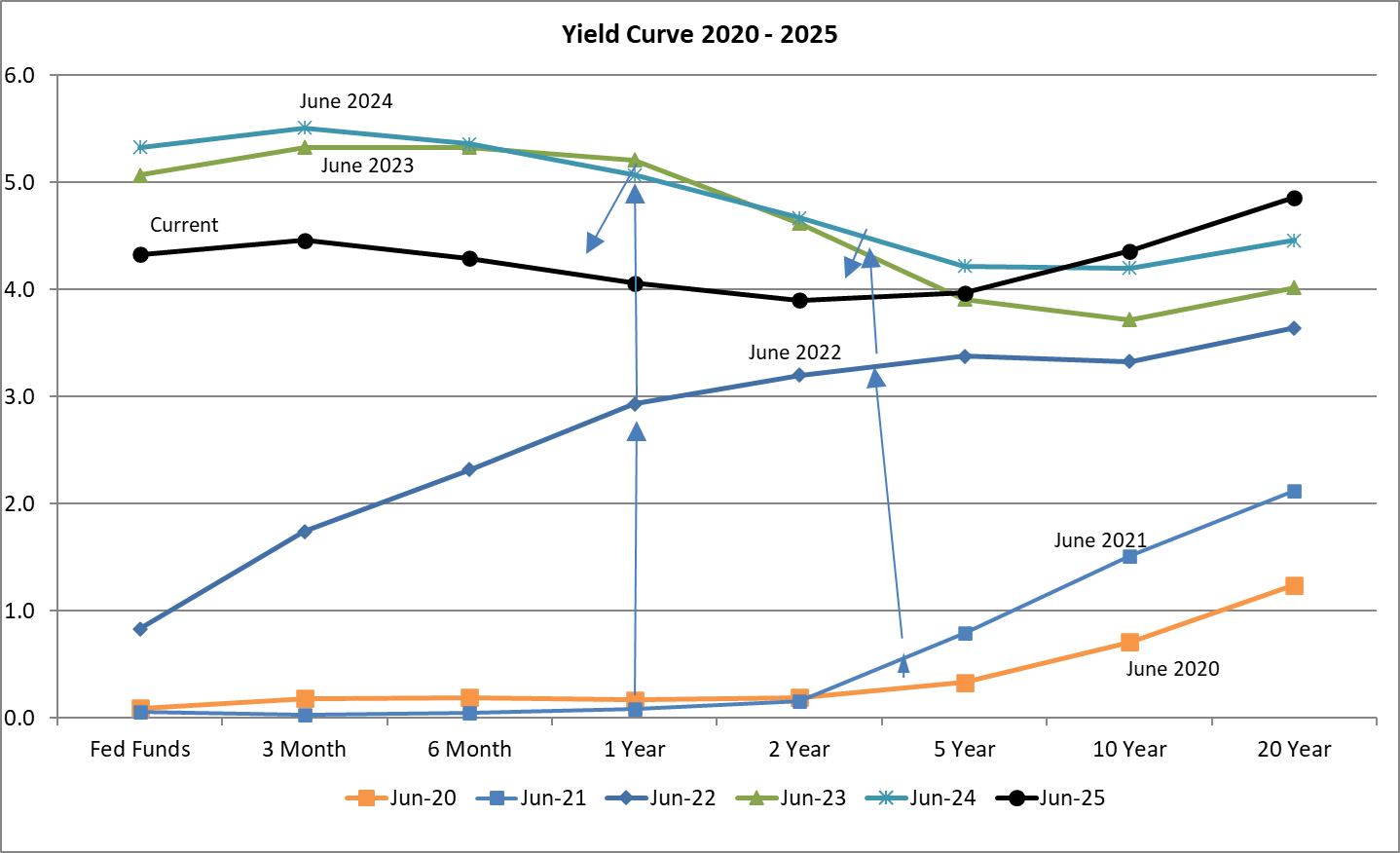

During the past five years, the US has experienced the COVID pandemic, massive stimulus, ensuing inflation, and rapid monetary tightening. As shown in Figure #1, the yield curve has responded with the entire curve normalizing by June 2022. In 2023 and 2024, the short end of the curve rose and portions of the curve inverted as the Federal Reserve raised rates to fight inflation. Today, the short end of the curve is falling as the economy slows and investors anticipate lower rates, and the long end remains high, possibly impacted by the prospects of higher deficits.

Figure #1: Yield Curve June 2020 to June 2025

Now, as tariffs take effect amidst rising geopolitical risk, we can anticipate a resurgence of inflation to some extent. Let’s take a 30,000-foot-high level look at bond performance over the past five years. It should be no surprise that bonds with shorter durations have done the best because those with longer durations have been battered by rising long-term rates.

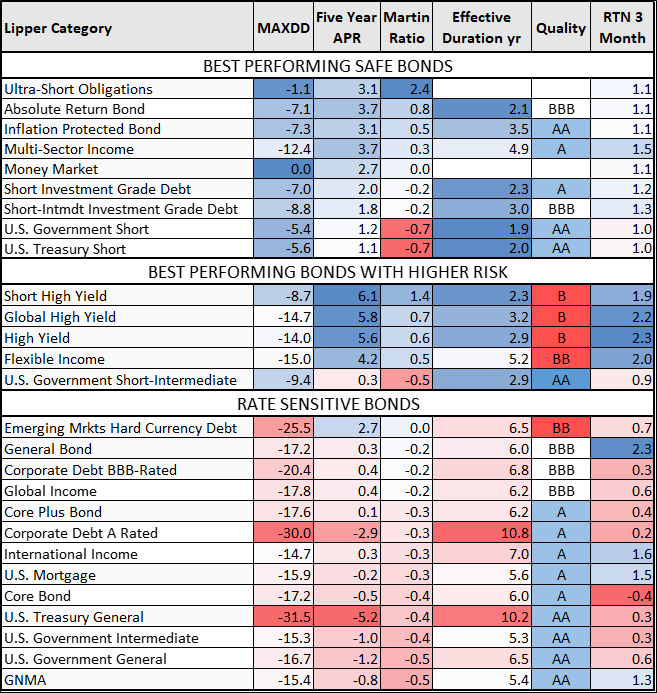

Table #1 contains most of the Lipper Bond Categories divided into “safer”, “moderate risk”, and “rate sensitive” Lipper Categories. Over the past five years, high yield funds with shorter durations and Flexible Income funds were the best performing, followed by Ultra-Short Bond, Absolute Return Bond, and Inflation Protected Bond, and Multi-Sector Funds. These are the same bond categories that have performed the best over the past three months. The Lipper Category of Inflation Protected Bonds is not segregated by duration which is the focus of the next section.

Table #1: Lipper Bond Category Performance – Five Years

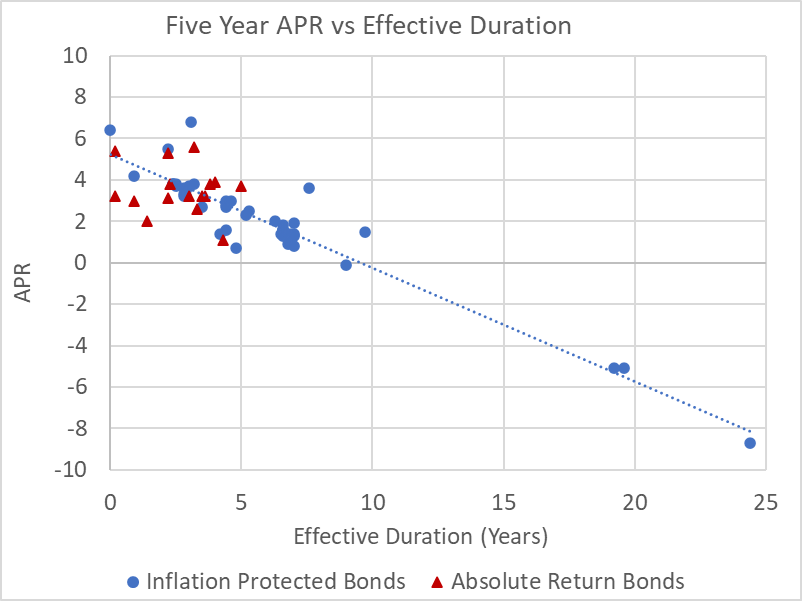

Figure #2 shows the relationship between annualized percent return for the past five years and duration for inflation-protected bonds and absolute return bond funds.

Figure #2: Bond Performance Versus Effective Duration

I retired in 2022 and began using Financial Advisors at Fidelity and Vanguard about that time. They tend to rely on core and general bond funds, which over the long term have a low correlation to stocks. I manage the more conservative sub-portfolios of Traditional IRAs. To prepare for tariff-induced inflation, over the past nine months, I have increased allocations to ultra-short and short-term bond funds, absolute return bond funds, inflation-protected bond funds, and multi-sector funds.

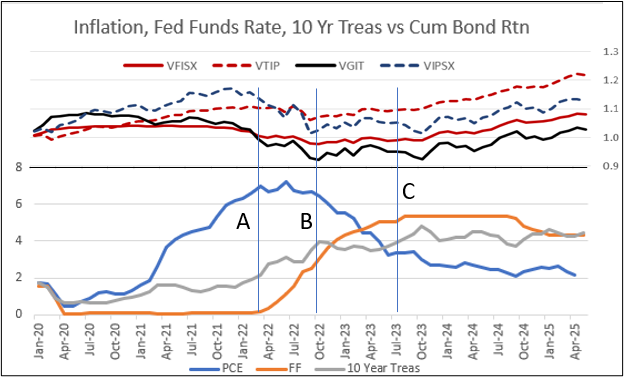

The Great 2020 to 2025 Inflation Laboratory

The post-COVID pandemic time period provides an excellent opportunity to understand how inflation-protected bonds perform. The bottom half of the chart shows inflation as measured by the personal consumption expenditure index (year over year), the Federal funds rate, which is the Federal Reserve’s primary tool for slowing the economy to reduce inflation, and the 10-Year Treasury. The top half of the chart shows the cumulative returns of short-term government bonds (solid red line) and short-term Treasury inflation-protected bonds (dashed red line) compared to intermediate government bonds (solid black line) and intermediate-term Treasury inflation-protected bonds (dashed black line) performed.

Figure #3: Cumulative Bond Return vs Inflation and Yields

Source: Author Using St. Louis Federal Reserve FRED database and MFO Premium fund screener and Lipper global dataset.

Point A in the figure above is when the Federal Reserve began raising short-term rates (orange line). Point B is when inflation (blue line) began to fall and the rise in the 10-year Treasury rate (gray line) began to flatten. Point C is when the Federal Reserve stopped raising short-term rates.

The storyline is that intermediate inflation-protected bonds performed best prior to Point A, when inflation was rising, while intermediate government bonds began to perform poorly as intermediate rates began to climb. Up to point B, intermediate inflation-protected bonds began to perform poorly as inflation plateaued and intermediate rates continued to rise. Prior to Point C, both short- and intermediate-term inflation-protected bonds outperformed their nominal counterparts as inflation fell but remained above 2%, and rates stabilized. After Point C, short-term bonds, especially inflation-protected, outperformed as short-term rates fell and intermediate rates remain elevated. Short-term inflation-protected bonds continue to perform well in 2025.

Table #2: Bond Fund Performance By Year

Figure #4 shows all inflation-protected bonds (blue circle) and real return bonds (red triangle) by year overlain onto a chart of inflation (PCE YOY), Fed Funds rate, and 10-year Treasury rate. I favor the bonds with shorter durations at this time.

Figure #4: Bond Performance vs Effective Duration By Year

Source: Author Using St. Louis Federal Reserve FRED database and MFO Premium fund screener, and Lipper global dataset.

Imaginable Risks

What we saw in the previous section are inflation and interest rate risks. A recession was avoided. There are other risks that can impact performance. Slowing growth can lead to a recession or, worse yet, a recession with higher inflation is known as stagflation which presents problems for the Federal Reserve. Isolationism and trade wars can lead to supply chain disruptions, retaliatory tariffs, and even higher inflation. Economists that I follow agree that the budget proposal will lead to higher deficits and further increases in the national debt, which can lead to higher rates and slower growth. Equity valuations are high, which are tailwinds for domestic stocks.

For these reasons, I have taken precautions to reduce my stock-to-bond allocation from 65% to 50%, maintain bond ladders for around seven years, increase allocations to short-term bonds, and invest in funds to protect against inflation. I maintain a diversified global allocation to stocks and bonds.

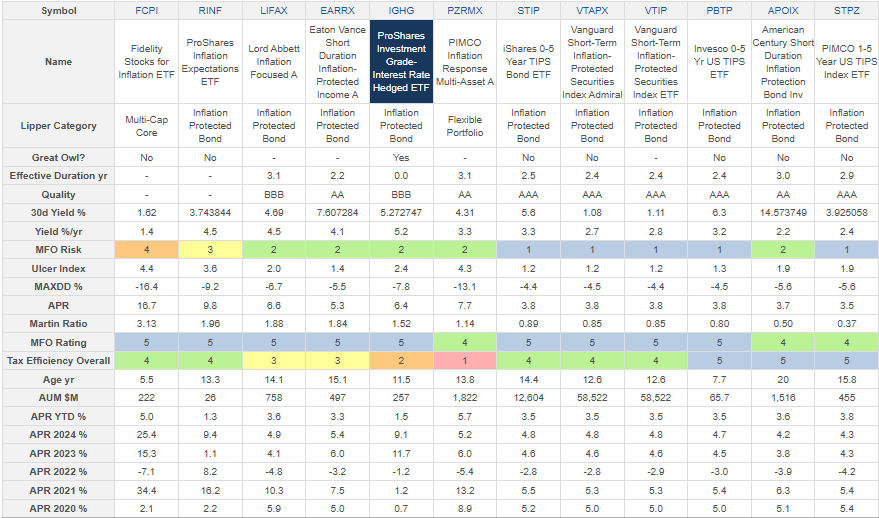

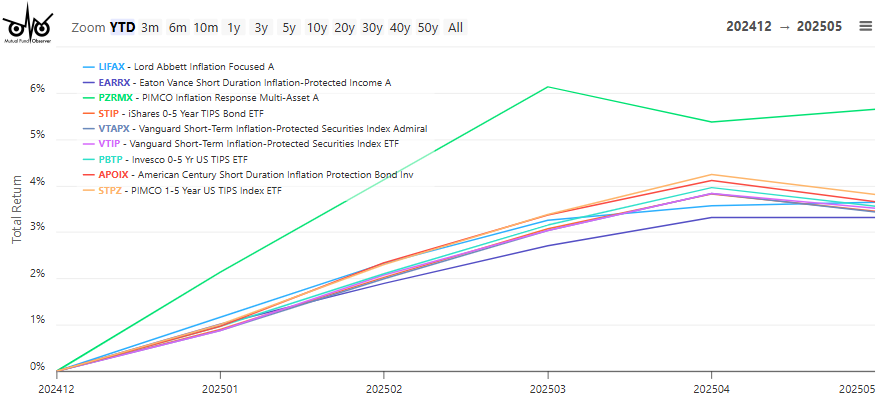

Table #3 contains some of the high-performing funds that protect against inflation. They are sorted from the highest risk-adjusted return (Martin Ratio) on the left to the lowest on the right.

Table #3: Selected High-Performing Inflation-Protected Funds – Five Years

Figure #5: Selected High-Performing Inflation-Protected Funds – Five Years

Figure #6: Selected High Performing Inflation Protected Funds – YTD

My Strategy

Over the past several months, I have rotated from my worst-performing bond funds into inflation-protected bond funds and purchased the PIMCO Inflation Response Multi-Asset Fund (PZRMX) mentioned by David Snowball last month. I have bought mostly Vanguard Short-Term Inflation-Protected Securities Index (VTAPX, VTIP). I also bought Fidelity Inflation-Protected Bond Index Fund (FIPDX), which has a somewhat longer duration, and will monitor it for a possible sale if performance falls.

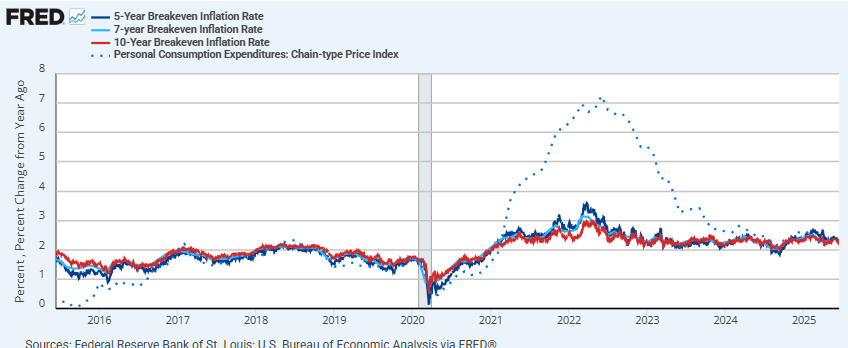

I became interested in adding Treasury Inflation-Protected Bonds to my bond ladders after reading, Retirement Planning Guidebook by Wade Pfau, among other books. He explains that TIPS outperform treasuries when inflation exceeds the implied break-even inflation rate. I created Figure #7 to show various breakeven inflation rates and inflation (PCE). I expect inflation to rise to close to 3.5% over the next year or two, while the breakeven rate is currently 2.3%.

Figure #7: Inflation Breakeven Rates and PCE Price Index (YOY)

As I wrote, in the Mutual Fund Observer March newsletter, ETF Bond Ladders, I am interested in using ETFs designed for bond ladders. Kim Clark describes Blackrock’s inflation-protected bond ETF with target maturities in These New TIPS ETFs Make It Easier To Build A Bond Ladder at Kiplinger. I bought iShares iBonds Oct 2030 Term Tips ETF (IBIG) to add to the 2030 rung on my bond ladder. The effective duration is 4.7 years, which gets shorter over time.

Closing

I now have approximately 7% of my bonds invested in inflation-protected bonds, including PIMCO Inflation Response Multi-Asset Fund (PZRMX). Another 40% is invested in bond funds with shorter durations. Next month, I will reevaluate inflation and geopolitical risk and make small adjustments if appropriate. I also have the 2025 rung in my bond ladder maturing in a few months, and need to determine where to reinvest the funds.