It was a great and horrifying story about two young boys and the arrival of the Cooger and Dark Carnival in Green Town, Illinois. If you entered the carnival grounds late at night, you might be drawn to its iconic ride, Cooger & Dark’s Pandemonium Shadow Show. It’s a story about the ways in which evil can be a powerful temptation to even the best of people. Some of the lines are maddeningly good.

A stranger is shot in the street, you hardly move to help. But if, half an hour before, you spent just ten minutes with the fellow and knew a little about him and his family, you might just jump in front of his killer and try to stop it. Really knowing is good. Not knowing, or refusing to know is bad, or amoral, at least. You can’t act if you don’t know.

Others half-haunt me.

Oh, what strange wonderful clocks women are. They nest in Time. They make the flesh that holds fast and binds eternity. They live inside the gift, know power, accept, and need not mention it. Why speak of time when you are Time, and shape the universal moments, as they pass, into warmth and action? How men envy and often hate these warm clocks, these wives, who know they will live forever.

Bradbury declared it his most “delicious” story.

The title is also an homage to the witches of Macbeth (Act 4, Scene 1, following “boil and trouble”):

2nd Witch:

By the pricking of my thumbs,

Something wicked this way comes. [Knocking]

Open locks,

Whoever knocks!

[Enter Macbeth]

I admit to having been thinking of dark circuses and evil clowns rather a lot lately. They make it hard to pick up the newspaper most mornings. Chief Justice Warren got it, too: “I always turn to the sports section first. The sports section records man’s accomplishments; the front page has nothing but man’s failures” (Sports Illustrated, July 22, 1968).

For readers of the Mutual Fund Observer, two coming circuses will be particularly pressing.

The explosion of single-stock and leveraged single-stock ETFs.

Single-stock exchange-traded funds (ETFs) and leveraged single-stock ETFs are relatively new and complex investment products that have garnered significant attention from both investors and researchers. I was struck by the utter flood of new fund registrations in the first weeks of May, which might signal a July or August. Launch.

In the middle of 2024, there were about 100 such funds globally. The first in the US seems to have been AXS Tesla and AXS NVIDIA, both launched in 2022. Trading volume and AUM data are scant. Morningstar did report a doubling in the pool’s AUM in the first quarter of 2024.

What do they do? In general, they do not own the single stock in question. They own derivatives tied to the performance of the stock, but they are generally tied to one day’s performance: if Tesla drops 25% tomorrow, an inverse-leveraged TSLA ETF will drop by 25%, or 50%, or 75% in a day. The extent of the drop depends on the extent of the leverage provided. The same is true in the other direction.

- Returns are sequence-dependent. TSLA might fall 25% then rise 25% in consecutive days. A TSLA ETF might show a two-day loss of 6.25% because the fall eroded the share’s value on day one, reducing the impact of day two’s rise. A 2x Bull TSLA would show a loss of 25% in the same two days. A 3X Bull TSLA would be down 56%. The phenomenon is called “compounding decay due to path dependency.”

- The cost of the derivatives and management fees create a huge drag. Per Morningstar, the average leveraged single-stock ETF charges 1.07%, about three times as much as the average ETF overall. Those expenses mean you never get the pure performance of the stock.

In general, these are toys for speculators. They are not investment products. Sadly, investors fall for marketing and overestimate their own abilities. They think they’ll track that 3X DraftKings ETF and move like a ballerina. Or, frankly, more likely, like Dumbo.

In general, academic and professional research reach the same conclusion. If you’re a professional with vast tracking resources and a holding period of one day or less, these are fine tools. If you aren’t a professional and don’t intend to monitor hour-by-hour for the rest of your adult life, run away.

Morningstar’s take:

Single-stock ETFs can meet the needs of a few. High-conviction traders with a single-day or shorter holding period may find them useful vehicles to express their views. After all, it’s hard for everyday investors to use leverage or construct their own covered calls.

But the fact is that these products are rarely sensible for everyday investors. They are flawed, costly, and liable to take more from investors than they give. (Ryan Jackson, “For Most Investors, Single-Stock ETFs Are Best Left Alone,” Morningstar.com, 4/9/2024)

Which, of course, means that we’re being flooded with them. Here’s a sampling of the 485A prospectus filings that MFO came across during just two weeks in May 2025:

| GraniteShares 2x Long ABNB Daily ETF | Airbnb, Inc. |

| GraniteShares 2x Long APP Daily ETF | AppLovin Corporation |

| GraniteShares 2x Long BULL Daily ETF | Webull Corporation |

| GraniteShares 2x Long CEG Daily ETF | Constellation Energy Corporation |

| GraniteShares 2x Long COST Daily ETF | Costco Wholesale Corporation |

| GraniteShares 2x Long CRWV Daily ETF | CoreWeave, Inc. |

| GraniteShares 2x Long CVNA Daily ETF | Carvana Co. |

| GraniteShares 2x Long ETOR Daily ETF | eToro Group Ltd. |

| GraniteShares 2x Long FSLR Daily ETF | First Solar, Inc. |

| GraniteShares 2x Long GLXY Daily ETF | Galaxy Digital Inc. |

| GraniteShares 2x Long HIMS Daily ETF | Hims & Hers Health, Inc. |

| GraniteShares 2x Long ISRG Daily ETF | Intuitive Surgical, Inc. |

| GraniteShares 2x Long KO Daily ETF | The Coca-Cola Company |

| GraniteShares 2x Long MCD Daily ETF | McDonald’s Corporation |

| GraniteShares 2x Long MELI Daily ETF | MercadoLibre, Inc. |

| GraniteShares 2x Long NBIS Daily ETF | Nebius Group N.V. |

| GraniteShares 2x Long NKE Daily ETF | NIKE, Inc. |

| GraniteShares 2x Long OKLO Daily ETF | Oklo Inc. |

| GraniteShares 2x Long PM Daily ETF | Philip Morris International Inc. |

| GraniteShares 2x Long RGTI Daily ETF | Rigetti Computing, Inc. |

| GraniteShares 2x Long SBUX Daily ETF | Starbucks Corporation |

| GraniteShares 2x Long SNAP Daily ETF | Snap Inc. |

| GraniteShares 2x Long SPOT Daily ETF | Spotify Technology S.A. |

| GraniteShares 2x Long UNH Daily ETF | UnitedHealth Group Incorporated |

| GraniteShares 2x Long WMT Daily ETF | Walmart Inc. |

| Leverage Shares 2X Long ABNB Daily ETF | Airbnb, Inc. |

| Leverage Shares 2X Long AFRM Daily ETF | Affirm Holdings, Inc. |

| Leverage Shares 2X Long BBAI Daily ETF | BigBear.ai Holdings, Inc. |

| Leverage Shares 2X Long BYDDY Daily ETF | BYD Company ADR |

| Leverage Shares 2X Long COST Daily ETF | Costco Wholesale Corporation |

| Leverage Shares 2X Long FUTU Daily ETF | Futu Holdings Limited |

| Leverage Shares 2X Long GOLD Daily ETF | Gold |

| Leverage Shares 2X Long HIMS Daily ETF | Hims & Hers Health, Inc. |

| Leverage Shares 2X Long JD Daily ETF | JD.com, Inc. |

| Leverage Shares 2X Long NEM Daily ETF | Newmont Corporation |

| Leverage Shares 2X Long OKLO Daily ETF | Oklo Inc. |

| Leverage Shares 2X Long PDD Daily ETF | PDD Holdings Inc. |

| Leverage Shares 2X Long RGTI Daily ETF | Rigetti Computing, Inc. |

| Leverage Shares 2X Long RKLB Daily ETF | Rocket Lab Corporation |

| Leverage Shares 2X Long SOUN Daily ETF | SoundHound AI, Inc. |

| Leverage Shares 2X Long UNH Daily ETF | UnitedHealth Group Incorporated |

| Leverage Shares 2X Long VST Daily ETF | Vistra Corp. |

| Roundhill 2X Long VIX Futures Points ETF | Volatility Index |

| Roundhill 2X Short VIX Futures Points ETF | Volatility Index |

| Roundhill Long VIX Futures Points ETF | Volatility Index |

| Roundhill Short VIX Futures Points ETF | Volatility Index |

| Tradr 2X Long ASTS Daily ETF | AST SpaceMobile, Inc. |

| Tradr 2X Long CEG Daily ETF | Constellation Energy Corporation |

| Tradr 2X Long CEP Daily ETF | Cantor Equity Partners, Inc. |

| Tradr 2X Long CRWV Daily ETF | CoreWeave, Inc. |

| Tradr 2X Long DDOG Daily ETF | Datadog, Inc. |

| Tradr 2X Long GEV Daily ETF | GE Vernova Inc. |

| Tradr 2X Long ISRG Daily ETF | Intuitive Surgical, Inc. |

| Tradr 2X Long LRCX Daily ETF | Lam Research Corporation |

| Tradr 2X Long NET Daily ETF | Cloudflare, Inc. |

| Tradr 2X Long SMR Daily ETF | NuScale Power Corporation |

| T-REX 2X Long ACHR Daily Target ETF | Archer Aviation Inc. |

| T-REX 2X Long AFRM Daily Target ETF | Affirm Holdings, Inc. |

| T-REX 2X Long AUR Daily Target ETF | Aurora Innovation, Inc. |

| T-REX 2X Long AVAV Daily Target ETF | AeroVironment, Inc. |

| T-REX 2X Long AXON Daily Target ETF | Axon Enterprise, Inc. |

| T-REX 2X Long BBAI Daily Target ETF | BigBear.ai Holdings, Inc. |

| T-REX 2X Long BKNG Daily Target ETF | Booking Holdings Inc. |

| T-REX 2X Long BULL Daily Target ETF | Webull Corporation |

| T-REX 2X Long CEG Daily Target ETF | Constellation Energy Corporation |

| T-REX 2X Long CRWV Daily Target ETF | CoreWeave, Inc. |

| T-REX 2X Long CVNA Daily Target ETF | Carvana Co. |

| T-REX 2X Long DDOG Daily Target ETF | Datadog, Inc. |

| T-REX 2X Long DKNG Daily Target ETF | DraftKings Inc. |

| T-REX 2X Long DNA Daily Target ETF | Ginkgo Bioworks Holdings, Inc. |

| T-REX 2X Long DUOL Daily Target ETF | Duolingo, Inc. |

| T-REX 2X Long GEV Daily Target ETF | GE Vernova Inc. |

| T-REX 2X Long GLXY Daily Target ETF | Galaxy Digital Inc. |

| T-REX 2X Long GOLD Daily Target ETF | Gold |

| T-REX 2X Long HHH Daily Target ETF | Howard Hughes Holdings Inc. |

| T-REX 2X Long KTOS Daily Target ETF | Kratos Defense & Security Solutions, Inc. |

| T-REX 2X Long OKLO Daily Target ETF | Oklo Inc. |

| T-REX 2X Long QUBT Daily Target ETF | Quantum Computing Inc. |

| T-REX 2X Long RXRX Daily Target ETF | Recursion Pharmaceuticals, Inc. |

| T-REX 2X Long SMLR Daily Target ETF | Semler Scientific, Inc. |

| T-REX 2X Long SMR Daily Target ETF | NuScale Power Corporation |

| T-REX 2X Long SOUN Daily Target ETF | SoundHound AI, Inc. |

| T-REX 2X Long TEM Daily Target ETF | Tempus AI, Inc. |

| T-REX 2X Long TTD Daily Target ETF | The Trade Desk, Inc. |

| T-REX 2X Long UPST Daily Target ETF | Upstart Holdings, Inc. |

| T-REX 2X Long UPXI Daily Target ETF | Upexi, Inc. |

| T-REX 2X Long WGS Daily Target ETF | GeneDx Holdings Corp. |

| T-REX 2X Long XXI Daily Target ETF | Twenty One |

| Tradr 2X Long SMR Daily ETF | NuScale Power Corporation |

More specialized new games include:

- Bitwise Bitcoin Option Income Strategy ETF

- Bitwise BITQ Option Income Strategy ETF

- Bitwise Ethereum Option Income Strategy ETF

- Defiance Enhanced Long Vol ETF

- Defiance Enhanced Short Vol ETF

- Defiance Vol Carry Hedged ETF

- Tuttle Capital 1x Inverse Volatility ETF

- Tuttle Capital 2x Inverse Volatility ETF

The arrival of cryptocurrency in retirement plan portfolios

On May 28, 2025, Mr. Trump’s Department of Labor rescinded a 2022 policy urging “extreme caution” about including cryptocurrency in retirement plans. The official announcement read:

The U.S. Department of Labor’s Employee Benefits Security Administration has rescinded a 2022 compliance release that previously discouraged fiduciaries from including cryptocurrency options in 401(k) retirement plans.

The 2022 guidance directed plan fiduciaries to exercise “extreme care” before adding cryptocurrency to investment menus. This language deviated from the requirements of the Employee Retirement Income Security Act and marked a departure from the department’s historically neutral, principled-based approach to fiduciary investment decisions.

“The Biden administration’s department of labor made a choice to put their thumb on the scale,” said U.S. Secretary of Labor Lori Chavez-DeRemer. “We’re rolling back this overreach and making it clear that investment decisions should be made by fiduciaries, not D.C. bureaucrats.”

One might pause at the breathtaking hypocrisy disguised as policy guidance. If we’re talking about crypto, beloved by Elon & co., the rule is “investment decisions should be made by fiduciaries, not D.C. bureaucrats.” If we’re talking about the option of socially-responsible investments in the same accounts, the rule reverses, and the government must surely make financial decisions rather than trusting fiduciaries.

It’s a policy that marries the mendacious with the disastrous, a rare accomplishment.

The proposed inclusion of cryptocurrencies in employer retirement plan options raises significant concerns about investor protection, particularly given the extreme volatility and risk characteristics these digital assets exhibit.

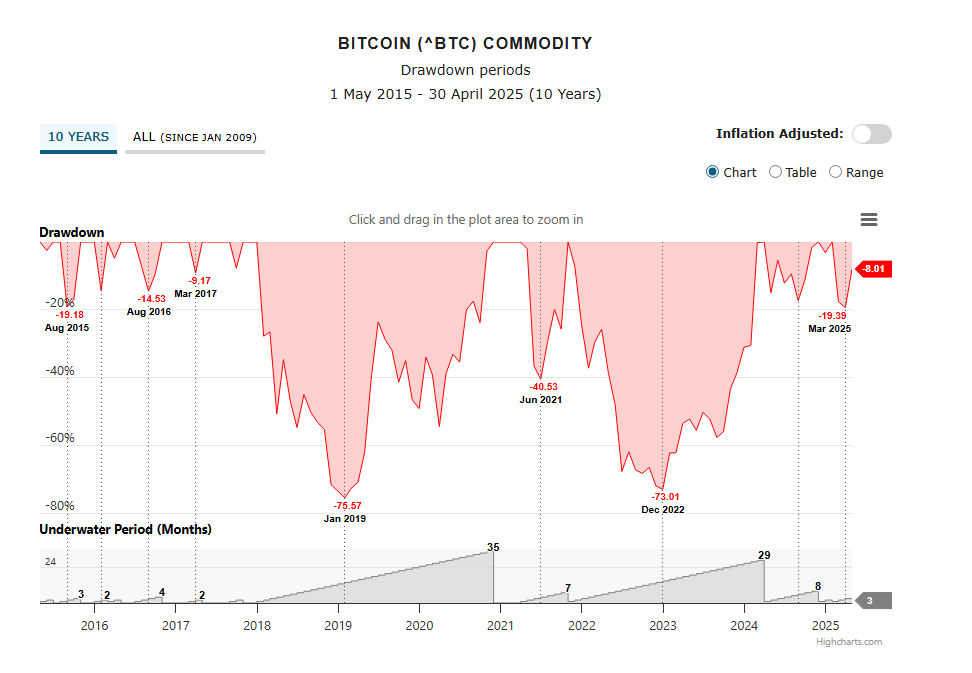

The cryptocurrency market has experienced substantial growth in trading activity, with the top exchanges processing trillions in volume annually. According to current market data, there are literally millions of cryptocurrencies in circulation (really, you could make your own this afternoon since there are no regulations and no barriers to entry). The total cryptocurrency market capitalization fell 18.6% in Q1 2025 to close at $2.8 trillion, after briefly touching $3.8 trillion in January. This dramatic swing within a single quarter exemplifies the type of volatility that could devastate retirement portfolios, particularly for investors nearing or in retirement who have limited time to recover from significant losses. Consider, for example, the drawdown periods for the oldest and most liquid coin, Bitcoin.

Source: LazyPortfolioETF, using Highcharts graphing.

Remember, this is just the downside. There are lunatic price spikes the rest of the time. The point here is to help you get a big picture of how deep the knife plunges (the red drawdowns) and how long the wound lasts (the gray “ramps” shows months to recovery).

Below are the five-year risk-return metrics for the two largest cryptocurrencies, which we assume are the two most likely to infiltrate a retirement plan.

| Annual Return | Maximum Drawdown | Standard Deviation | Best Year Return | Worst Year Return | Ulcer Index | |

| Bitcoin (BTC) | 51% | -73% | 65.6% | +303% (2020) | -64% (2022) | 36.2 |

| Ethereum (ETH) | 61% | -79% | 91.2% | +420 (2020) | -68% (2022) | ~40 |

Sources: Lazy Portfolio ETF (for Bitcoin), Portfolio Labs ETH-USD, and S&P Ethereum Index

The data reveals several alarming characteristics that underscore the inappropriateness of these investments for retirement accounts. Bitcoin, despite being the most established cryptocurrency, has experienced maximum drawdowns exceeding 70%, meaning investors could lose more than 70% of their investment. The recovery period for Bitcoin’s maximum drawdown required 19 months, during which retirement investors would face sustained and severe portfolio losses.

Ethereum presents even more extreme risk characteristics, with a maximum five-year drawdown of nearly 79% (and a near-complete meltdown in 2018) The current Ethereum drawdown stands at 45.29%, that is, at the end of May 2025, an Ether is worth 45% less than it was at its November 2021 peak. For retirement investors, such sustained periods of substantial losses could prove financially catastrophic, particularly for those requiring portfolio withdrawals during retirement.

The smaller cryptocurrencies are worse.

Retirement investors require stable, predictable growth that preserves capital while generating reasonable returns over long time horizons. The documented maximum drawdowns approaching 95-96% for major cryptocurrencies represent existential threats to the retirement security of elderly investors. The extreme volatility documented in this analysis represents not an investment opportunity but rather a fundamental threat to retirement system stability and individual financial security.

Bottom Line

These decisions, government and corporate, continue to move the markets in the direction of a casino. Investors’ conviction that “patience is for losers” just makes them losers. Buy quality stocks from experienced managers. Diversify away from assets that depend on Washington acting like adults. Find managers who manage volatility thoughtfully. We list them!

What’s an investor to do? Learn from the experience of others. When you suspect something wicked is around, do not go alone into the basement with a flickering light. When you suspect something wicked this way comes, do not wander off on your own – away from the security of friends – “to see what made that noise.”

“Acting without knowing takes you right off the cliff.” ― Ray Bradbury, Something Wicked This Way Comes (1962)

An MFO Bonus Feature: What Investors Can Learn from Teen Slasher Flicks!

| How to Die in a Teen Slasher Flick | How to Lose All Your Money |

| Split Up – “Let’s cover more ground!” (Spoiler: you just covered your grave.) | Go All-In – “Let’s 3X leverage this!” (Spoiler: you just leveraged your bankruptcy.) |

| Ignore the Weird Local – “He’s just being dramatic.” (He’s also always right.) | Ignore the Boring Expert – “They don’t understand innovation!” (They do. You just don’t like what they say.) |

| Investigate That Noise – “Is someone there?” (Yes. With a machete.) | Chase the Hype – “Everyone’s talking about this token!” (Just before it vanishes.) |

| Drop the Weapon – “Oh, thank god, it’s just you!” (It’s not.) | Sell the Winner, Hold the Loser – “It’ll come back eventually.” (It won’t. Ever.) |

| Say You’ll Be Right Back – (You won’t. Ever.) | Say You’ve Got a Gut Feeling – (Your gut also told you Taco Bell was a good idea.) |

| Trust the Cop – He’s either dead, possessed, or useless. Possibly all three. | Trust the Finfluencer – She’s not your friend. She’s your exit liquidity. |

| Go Into the Basement – No exit, no lights, no hope. | YOLO Into Retirement Crypto – No floor, no plan, no future. |