Reducing my risk profile for accounts that Fidelity manages allows more flexibility in what I manage. In other words, the intermediate investment bucket aggressive sub portfolio that Fidelity manages became more conservative, while I added a little risk to the conservative sub portfolio that I manage.

I would like to design a low-risk sub-portfolio that has a low correlation to stocks and bonds, returns about 5%, and has some inflation protection. The objective is to always have at least one fund that is up while still having decent returns. I began with the MFO Premium fund screener and Lipper global dataset, limited by correlations to the S&P 500 and bonds, low losses for the minimum rolling three-year period, and an MFO Risk rating of average or lower. I trimmed the list using 2022 performance, in which both stocks and bonds did poorly, and the COVID bear market. I found BlackRock Tactical Opportunities (PCBAX) and BlackRock Systematic Multi-Strategy (BAMBX) worth further investigation.

In this article, I evaluate how a sub-portfolio including PCBAX and BAMBX might be able to meet my objectives. I have already purchased Victory Pioneer Multi-Asset Income (PMAIX) and Aegis Value Fund (AVALX) which David Snowball wrote about in When Reality Bites: Preparing for Market Turbulence Ahead and Aegis Value Fund (AVALX). I already own PIMCO Inflation Response Multi-Asset (PZRMX) and include it in this analysis.

Short List of Funds for This Investment Environment

I finished reading Our Dollar, Your Problem, by Kenneth Rogoff, which left me with more questions than answers, so I bought and am currently reading The Price of Money, by Rob Dix. I also dusted off The Demise of the Dollar, by Addison Wiggin, and Global Macro Trading, by Greg Gliner, which, fortunately, I highlighted when I first read and can skim again in a few hours. Since President Nixon took the U.S. off the gold standard in 1971, the US has gone through periods of stability, but also the 1970s decade of stagflation, the Great Financial Crisis (2008), Quantitative Easing (2009 to 2014, 2020 to 2021), and the COVID pandemic (2020). Gross Federal debt as a percentage of gross domestic product has risen from 34% to 120%, and the federal deficit has risen to 6% of GDP. Central banks have been experimenting with their own versions of stablecoin, which may further erode the dominance of the dollar. Domestic stock valuations are high, suggesting below-average long-term returns. I expect higher financial volatility and more frequent periods of inflation in the coming decade(s).

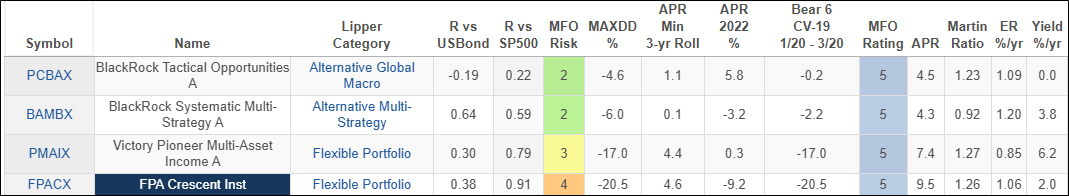

I selected the funds in Table #1 to evaluate further. They are sorted from the lowest correlation to the S&P 500 to the highest over the past seven years. Notice that PCBAX has the lowest correlation to both stocks and bonds. BAMBX pays a dividend of 3.8% while PCBAX does not currently have a dividend. PMAIX and FPACX have the potential to increase returns, but at higher risk. PCBAX had a maximum drawdown of 37% during the financial crisis compared to 29% for FPACX. This highlights the benefits of building a diversified portfolio.

Table #1: – Fund Candidates – Metrics 7 Years

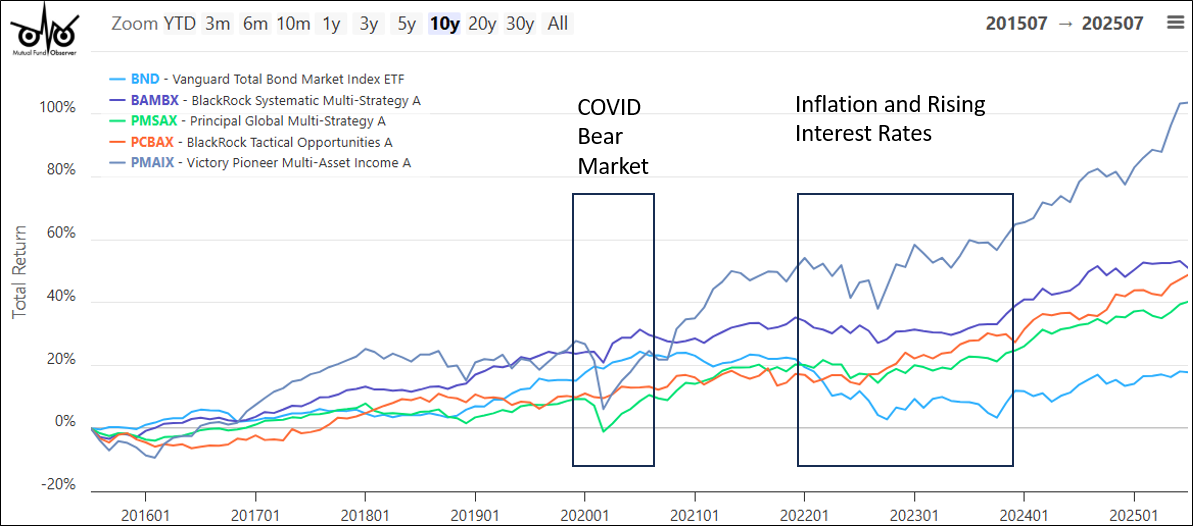

The past decade covers the COVID bear market, Quantitative Easing and Tightening, rising inflation and interest rates, and rising valuations of the S&P 500. In particular, I am interested in how funds performed during the COVID bear market and 2022, when stocks and bonds did poorly. BlackRock Tactical Opportunities (PCBAX), BlackRock Systematic Multi-Strategy (BAMBX), and Victory Pioneer Multi-Asset Income (PMAIX) performed well during these two periods.

Figure 1 – Fund Candidates

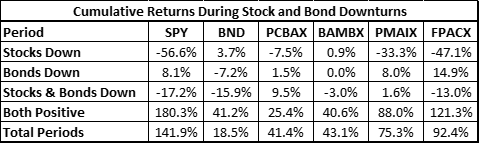

I extracted monthly returns for the past ten years for these funds using the MFO Premium fund screener. I selected periods with at least three months where stocks had negative returns, bonds had negative returns, and both stocks and bonds had negative returns. The results are contained in Table #2.

Table 2 – Cumulative Returns During Stock and Bond Downturns – 10 Years

BlackRock Tactical Opportunities (PCBAX) has a lower correlation to stocks and bonds than BlackRock Systematic Multi-Strategy (BAMBX). Returns are similar, but PCBAX does not pay a dividend. BAMBX appears to outperform PCBAX when both stocks and bonds are positive, while PCBAX appears to outperform when neither stocks nor bonds are doing well.

PMAIX is less correlated to the S&P500 than FPACX and is a little less risky, but has lower returns than FPACX. FPA Crescent Fund is available with Fidelity in two share classes: FPACX with a $49.95 transaction fee and 1.06% expense ratio, and FPFRX without a transaction fee and 1.15% expense ratio. I don’t own the FPA Crescent Fund, but I want to purchase it at some point.

PORTFOLIO VISUALIZER

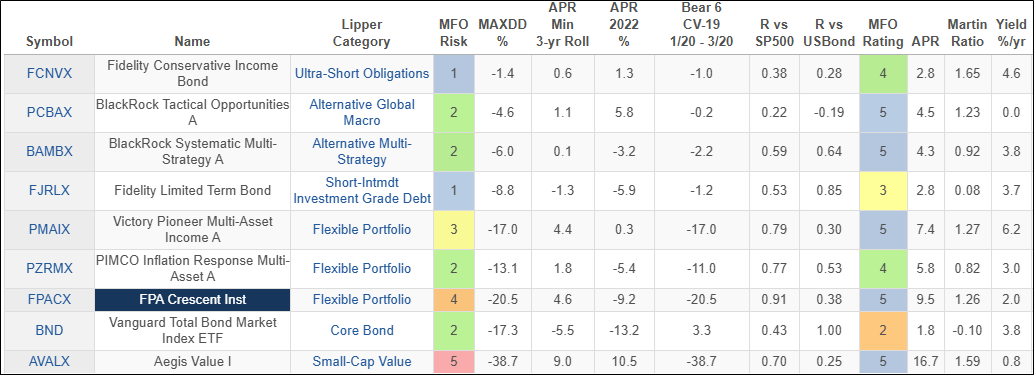

I wanted a little help evaluating a low-risk portfolio that is uncorrelated to stocks and bonds and returns 5%. I selected the funds in Table #3 as inputs in Portfolio Visualizer. The link is provided here. I selected the time period from January 2018 to December 2023 to capture the COVID bear market 2022, in which stocks and bonds did poorly, but excluded 2024, where stock market valuation increased significantly.

Table 3 – Funds Selected for Portfolio Visualizer Optimization

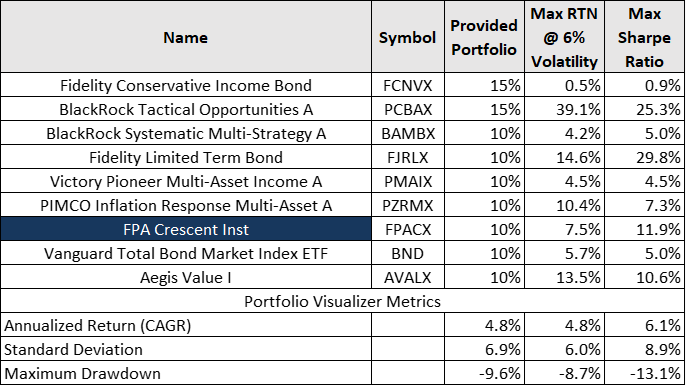

Table #4 shows the results of the optimization for maximum return at 6% volatility, maximum Sharpe ratio, and a simple allocation of my own. All three had returns of 4.8% to 6.1% with drawdowns of 8.7% to 13.1%.

Table 4 – Portfolio Visualizer Results

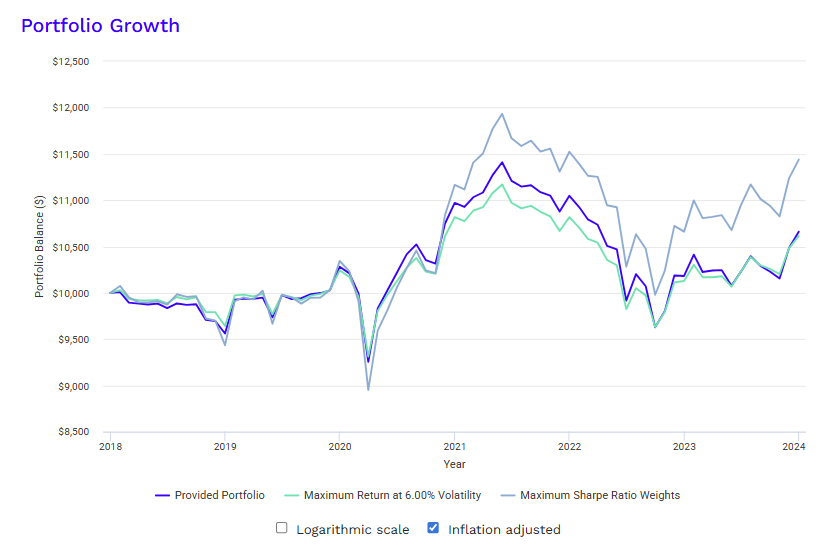

Figure #2 shows the results graphically adjusted for inflation. The drawdowns can be reduced by adding both BlackRock Tactical Opportunities (PCBAX) and BlackRock Systematic Multi-Strategy (BAMBX) without the return suffering significantly.

Figure 2 – Portfolio Visualizer Results Adjusted for Inflation

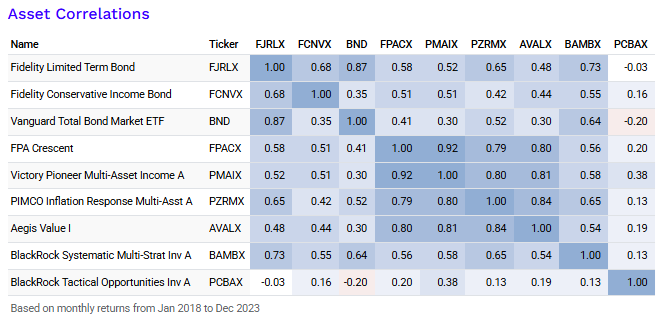

Table #5 contains the correlation matrix of the funds. Victory Pioneer Multi-Asset Income (PMAIX), Aegis Value Fund (AVALX), PIMCO Inflation Response Multi-Asset (PZRMX), and FPA Crescent Fund (FPACX) have correlations close to each other, which reduces their ability to diversify a portfolio.

Table 5 – Asset Correlations

A CLOSER LOOK

BlackRock Systematic Multi-Strategy (BAMBX)

About this Fund:

- Allocates to three uncorrelated strategies, seeking consistent returns across all markets

- Higher fixed income yields increase potential returns and income

- Taps into defensive return streams that have outperformed in down markets, helping to diversify equity risk

Investment Approach: The BlackRock Systematic Multi-Strategy Fund is a diversified alternative strategy that seeks to provide total return comprised of current income and capital appreciation in both periods of strong market returns and periods of market stress.

Investors Who Might Be Interested in BAMBX: BlackRock’s systematic alternative strategies seek differentiated risk and return profiles with a low correlation to broad asset classes to help diversify portfolios.

Blackrock Tactical Opportunities (PCBAX):

About this Fund:

- A liquid alternative fund with low correlation to stocks and bonds

- Tactically allocates across 25+ countries in stocks, bonds, and FX

- Combines complementary discretionary and systematic macro investment processes

Investment Approach: The BlackRock Tactical Opportunities Fund is a macro strategy that tactically allocates across global markets and asset classes and has achieved lowly correlated, stable growth.

Investors Who Might Be Interested in PCBAX: An alternative multi-asset strategy might be a good fit for investors seeking differentiated risk and return profiles with low correlation to broad asset classes to help diversify 60/40 portfolios.

MY STRATEGY

My conservative intermediate sub portfolio that I manage consists of bond ladders, short- and intermediate-duration bond funds. I have been shifting to a barbell approach, moving short-term bond funds into those with intermediate durations in order to lock in higher yields. My withdrawal strategy is to withdraw 4% from this sub portfolio when stocks are not performing well and more aggressive sub-portfolios when stocks are doing well.

At this point, as bond ladders mature, I favor BlackRock Systematic Multi-Strategy (BAMBX) over BlackRock Tactical Opportunities (PCBAX) as a long-term investment because it is more conservative and pays a dividend. PCBAX has been outperforming BAMBX year-to-date. I don’t expect to make changes until closer to the end of the year and will continue to monitor both.