Updates

The conversion of Akre Focus Fund into an ETF was authorized by its investors in September and is proceeding apace. Thanks to all who took the time to vote their shares!

Briefly Noted . . .

Launches and Reorganizations

On October 17, abrdn International Small Cap fund and the $36m abrdn Intermediate Municipal Income fund will become the abrdn International Small Cap Active ETF and the abrdn Ultra Short Municipal Income Active ETF, respectively.

The BlackRock GA Dynamic Equity fund has been converted into the iShares Dynamic Equity Active ETF, and the BlackRock GA Disciplined Volatility Equity fund has been converted into the iShares Disciplined Volatility Equity Active ETF.

JPMorgan Unconstrained Debt Fund has been reorganized into the JPMorgan Flexible Debt ETF effective September 26th.

And some funds in registration

Deepwater Beachfront Small Cap ETF is in registration. Joe Robillard will be the portfolio manager; expenses have not been disclosed. The ETF will primarily invest in small-cap companies.

Hood River Emerging Markets Fund is in registration. Lance R. Cannon, CFA, Rohan B. Kumar, and Ruoshi Qi will be the portfolio managers. Expenses have not been stated.

Sterling Capital has registered five new ETFs. Sterling Capital Ultra Short Duration; Short Duration Bond, National Municipal Bond, Multi-Strategy Income, and Equity Premium Income ETFs. Many managers, no expense ratios.

The Truth Social American Energy Security ETF, Truth Social American Icons ETF, Truth Social American Next Frontiers ETF, Truth Social American Red State REITs ETF, and Truth Social American Security & Defense ETF are in registration. Matthew Tuttle will be the portfolio manager for each of the funds. Expenses have not been stated.

Vanguard Core-Plus Bond Index ETF is in registration. Joshua C. Barrickman, CFA, will be the portfolio manager. Expenses have not been stated.

Westwood Enhanced Income Opportunity, Enhanced Multi-Asset Income, and Enhanced Alternative Income ETFs are in registration. Numerous managers; expenses have not been stated as of this filing.

Small Wins for Investors

Dodge and Cox is forward splitting several of its mutual funds: Balanced, International, and Stock in the amounts eight for one, four for one, and sixteen for one, respectively, at the close of business on October 24. Their reason for the stock split was the following:

New mutual funds generally launch with an initial NAV of $10.00 per share. Given their earlier inception dates and asset classes, the NAVs of the Balanced Fund, International Stock Fund, and Stock Fund have grown considerably. We believe the share splits will better align these Funds’ NAVs with the other Dodge & Cox Funds’ NAVs.

As of September 27, 2025, the NAV for Balanced is $110.13/share, Stock is $276.70, and International is $64.85.

Leuthold Grizzly Short Fund underwent a one-for-four reverse stock split at the close of business on September 22nd, which boosted its per-share NAV from about $5 to about $20.

Effective on January 21, 2026, Virtus is eliminating the Class C Shares on virtually all of its funds. Given that “C” shares are and always were a marketing malignancy (“hey, look! There’s no sales load though we do …umm, charge you 1.76% annually forever”), we always celebrate their disappearance.

Closings (and related inconveniences)

None that we’ve found.

Old Wine, New Bottles

DoubleLine Floating Rate Fund will be reorganized into the American Beacon DoubleLine Floating Rate Income Fund once it is approved by shareholders. The reorganization will occur sometime during the first quarter of 2026. Quick history: The American Beacon FEAC Floating Rate Income Fund was previously the Sound Point Floating Rate Income Fund until it was acquired by American Beacon. First Eagle Alternative Credit, LLC’s (FEAC) investment advisory agreement ended on June 20, 2025, at which time DoubleLine Capital commenced managing the fund, and the name of the fund was changed to American Beacon DoubleLine Floating Rate Income Fund.

DoubleLine Income Fund and DoubleLine Infrastructure Income Fund will change their names to DoubleLine Securitized Credit Fund and DoubleLine Select Income Fund, with predictable rewrites to their prospectuses, on October 28th.

Off to the Dustbin of History

The hottest trend in prospectus writing? “The fund may terminate and liquidate at any time without shareholder approval,” a phrase now used by the AIM, Amplify, Collaborative Investments, ETF Opportunities, Innovators, Northern Lights, REX, SCM, Truth Social, and Ultimus ETF trusts, among others. Sub-text: “We’re just tossing s**t against the wall to see what sticks, we got no commitment to any of this stuff and want to be able to flush it as quickly and easily as possible! Welcome aboard!”

2x Daily Software Platform ETF will be liquidated on October 10, 2025. The fund launched on July 1, 2025, and no one, including the managers, cared.

September 25, 2025, was a big day for the AXS Real Estate Income ETF! It managed to cease operations, liquidate its assets, and prepare to distribute proceeds to shareholders of record.

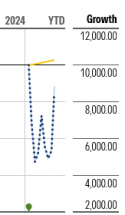

Battleshares TSLA vs F ETF (ticker: ELON) will be liquidated on October 10, 2025, because “the Fund could not conduct its business and operations in an economically efficient manner over the long term due to the Fund’s inability to attract sufficient investment assets to maintain a competitive operating structure.” Here’s the strategy: short Ford, long Tesla, trust Elon. If the Morningstar charting is correct, it seems to have lost 50% in its first two weeks. Apparently, the fund, which launched in mid-February 2025, somehow lost faith and only drew $1.1 million in assets. Per Morningstar, neither of the managers risked their own money on the fund.

Battleshares TSLA vs F ETF (ticker: ELON) will be liquidated on October 10, 2025, because “the Fund could not conduct its business and operations in an economically efficient manner over the long term due to the Fund’s inability to attract sufficient investment assets to maintain a competitive operating structure.” Here’s the strategy: short Ford, long Tesla, trust Elon. If the Morningstar charting is correct, it seems to have lost 50% in its first two weeks. Apparently, the fund, which launched in mid-February 2025, somehow lost faith and only drew $1.1 million in assets. Per Morningstar, neither of the managers risked their own money on the fund.

BlackRock Sustainable High Yield Bond Fund is closing to new purchases on November 12, 2025, and will be liquidated on December 12, 2025.

Franklin Sustainable International Equity ETF will liquidate and dissolve on or about January 16, 2026. One-star fund that was wildly successful from 2017-2021 and hasn’t been able to find its butt with both … well, it has trailed 95-100% of its peers over the past 1, 3, and 5 year periods.

Harding, Loevner Chinese Equity and Emerging Markets ex China have begun the process of liquidating their assets, which the managers expect to complete by November 19, 2025. Same team, negligible assets.

Johnson International Fund, which was launched in 2008, will be liquidated on November 21, 2025. A curious development, really. The fund has had the same manager since inception. He’s been very successful as the lead manager on the Johnson Opportunity Fund, but international has managed to pretty consistently trail 80-100% of its peers and has attracted negligible assets.

Kempner Multi-Cap Deep Value fund will be liquidated on or about October 15, 2025.

Penn Mutual AM Strategic Income Fund and Penn Mutual AM 1847 Income Fund will cease operations and liquidate on or about November 14, 2025.

Themes Airlines ETF and Themes European Luxury ETF closed and liquidated on September 12, 2025.

T Rowe Price Global Consumer Fund will be liquidated on November 14, 2025.

T Rowe Price Multi-Strategy Total Return Fund will experience liquidation and dissolution on or about January 23, 2026. No reason given, though performance sort of sucks. It’s a Price fund whose five-year records (1.89%) barely exceed its expense ratio (1.19%). The mandate was to outperform cash with low volatility and low correlation to the stock and bond markets. The “edge” was that the managers had immediate and ongoing access to other T Rowe Price managers, which gave them exceptional insights into movements across asset classes. The system may have broken down when Price had an internal restructure, which impeded the managers’ daily strategy pipeline.