An Unusual Offering from an Unusual Manager

In January 2025, the Militia Long Short Equity ETF (ticker: ORR) launched. We’re profiling it because Sam Lee strongly recommended we look at it, and we trust Sam Lee. Founder of Austin-based SVRN Asset Management, former Morningstar strategist and editor of ETFInvestor newsletter and MFO contributor, Sam is very smart, has assessed a lot of managers, and has never invested in a hedge fund before. He describes manager David Orr as possessing “generational talent” and calls him “one of the best discretionary investors active today.” Ultimately, Sam decided to partner with Mr. Orr on the launch of this ETF, and they collectively decided that they would put all the money generated by their management fee to buy shares of the fund; at base, both have decided to take their compensation in the form of a growing stake in the ETF. That endorsement sparked our interest and warrants yours.

The ETF: Objective and Strategy

The Militia Long Short Equity ETF seeks capital appreciation through a global long-short equity strategy. According to the prospectus, the fund invests in both long and short positions in equity securities or ETFs, maintaining at least 80% of net assets in equities. The fund may invest across all market capitalizations and includes both U.S. and foreign securities.

At launch, the strategy runs approximately 150% long and 100% short, creating a positive market beta (around 0.5). The fund pursues what Orr describes as “higher turnover, fundamental long-short global stock selection,” typically holding 100-200 positions with small individual position sizes. The management fee is 1.3%, though the headline expense ratio of 18.48% reflects accounting quirks: dividends paid on shorted high-yield securities (economically neutral as the underlying drops by the dividend amount), short borrow costs offset by interest earned on short proceeds, and margin interest for leverage.

Orr explicitly acknowledges the ETF has “less edge” than his hedge fund due to liquidity constraints and lower gross leverage. Until assets reach $50-150 million, the ETF shorts mainly ETFs rather than individual stocks due to the mechanics of shorting in an ETF wrapper. The fund holds approximately $127.5 million after nine months.

The Manager: A Different Perspective

David Orr, 39, came to investing through an unusual path. After degrees in accounting and economics, he spent a decade in Thailand as a professional poker player, playing 10 million hands and reaching the top-50 globally in No Limit Texas Hold’em. He’s been similarly passionate about questing games such as Hearthstone and Civilization. He views the stock market as “the best strategy game I’ve ever played.”

This background shapes his approach. From poker, he learned probabilistic thinking, position sizing, and the discipline to exit losing positions without emotional attachment. He looks for “low IQ ideas that seem obvious” and makes investment decisions within hours. His portfolio typically holds 200-300 positions, longs sized around 3%, shorts around 0.5%, with rapid turnover when facts change.

Two principles guide him: First, avoid crowded shorts except those with hard catalysts, recognizing that “degrossing” (i.e., “panicked rush for the exits”) events transform apparent diversification into concentrated risk. Second, prioritize systematic risk management through diversification and disciplined sizing. He runs 175-190% long and 95-125% short, maintaining a low to negative market beta—unusual for a long-biased industry.

And it appears to work.

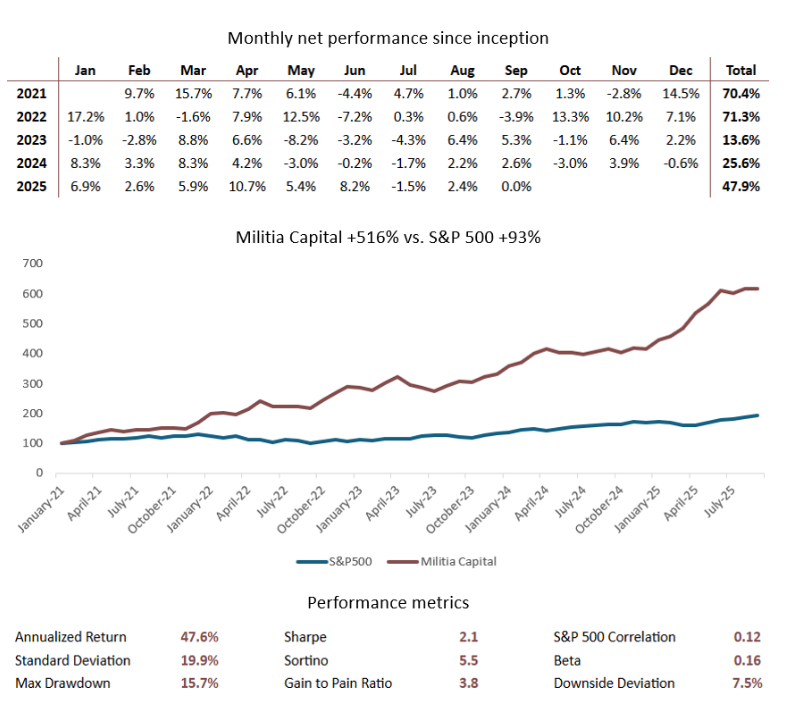

The hedge fund launched in February 2021 with $3 million. Performance through mid-2025 was verified by Interactive Brokers and net of fees (0.5% management, 25% performance over S&P 500).

- 2021 (Feb-Dec): +72%

The Q2 2022 performance is particularly notable: +16% while the S&P fell 15.5%, with +53% from shorts and -24% from longs. The fund has maintained a slightly negative correlation to the market (-0.09 beta) over the full period with a Sharpe ratio of 2.14.

Assets have grown primarily through performance rather than fundraising. The fund raised $55 million but generated $100 million in profit. Orr’s personal partition (other managers run slices of the fund) runs on just $14 million in contributions, with the remainder profit. The fund now manages approximately $154 million, having registered with the SEC in 2025 when it grew beyond thresholds requiring registration.

What Drives the Returns?

Orr’s 2020 investor outline explicitly articulates his edge: exploiting two academic anomalies. First, the “betting against beta” effect: lower volatility stocks generate higher risk-adjusted returns. Second, the size premium: small stocks outperform large stocks. His strategy combines these: buying small, low-volatility stocks (which historically returned 16.73% annually) while shorting large, high-volatility names (7.81% annually).

Orr makes hundreds of bets annually (450 in 2024), identifying “the key fundamental variable” in each company rather than conducting exhaustive research. Sam Lee calls this “meta-rationality”—researching only to the point of maximum expected value rather than psychological comfort, maximizing learning through volume and rapid feedback, updating beliefs without anchoring to previous prices.

The edge manifests most clearly on the short side. Orr’s IRR on shorts has consistently exceeded his longs, genuinely unusual in the industry. He focuses on catalyst-driven shorts (government decisions, cash shortfalls, bankruptcies) and “melting ice cubes,” overleveraged companies where liabilities exceed assets. The 2022 performance validates this: shorts gained 53% during a bear market quarter.

Risk management amplifies the edge. Running 200-300 positions with negative beta avoided the forced deleveraging that destroyed many hedge funds during volatility spikes. His willingness to maintain negative beta through 2023-2024’s AI-driven rally, accepting underperformance while the S&P surged, indicates conviction in the framework over momentum.

ETF vs. Partnership: The Compromises

The ETF necessarily differs from the hedge fund in ways that reduce its expected edge:

Leverage: The ETF runs 150% long/100% short (250% gross) versus the hedge fund’s 200% long/125% short (325%+ gross). Lower leverage means lower absolute returns.

Liquidity requirements: The ETF must hold more liquid securities to handle unpredictable daily flows and maintain reasonable bid-ask spreads. It cannot access the illiquid micro-caps central to the hedge fund strategy.

Short book limitations: Until assets reach $50-150 million, the ETF shorts mainly ETFs rather than individual stocks. Even at scale, it cannot short many of the volatile, illiquid positions the hedge fund targets. Transparency requirements also constrain the short book—revealing risky shorts invites problems.

Beta: The ETF runs positive beta (0.5+) versus the hedge fund’s negative beta (-0.09). This materially changes the risk-return profile.

Portfolio managers: The hedge fund now backs additional portfolio managers (Rodrigo Cabezon and Michael Roussel) managing 40% of assets. Their positions don’t appear in the ETF.

Orr states explicitly: “The ORR ETF has a much lower edge than my hedge fund” and “won’t have its full edge” until reaching a larger scale. The 2025 YTD performance validates this. The ETF gained 8.1% through February versus the hedge fund’s 10.9%, and through June the hedge fund was up 45% versus the ETF’s more modest gains.

Why might you be interested?

Other, of course, than 48% annual returns.

Two factors warrant attention despite the compromises and brief track record:

The ETF’s own performance: Through August 2025, ORR returned 2.9% versus a 1.3% category average, earning an “A” grade. The fund has maintained market-neutral characteristics during volatility, often staying flat when indices declined 2%. Assets have grown to $127.5 million in nine months despite an alarming headline expense ratio, suggesting sophisticated investors see through the accounting quirks to the underlying value.

Sam Lee’s endorsement: Lee’s assessment carries weight because of who he is and what he’s done. As founder of SVRN Asset Management and a former Morningstar strategist, he has spent his career assessing managers professionally. This is the first hedge fund manager he has ever invested in personally: he was a “big day-one investor” in the fund and is now Orr’s co-founder in launching the ETF.

Lee addresses the central skepticism directly. John Hempton, himself a talented investor, views Orr as a poker player-turned-trader whose edge may not scale. Lee disagrees, arguing Orr’s “meta-rationality,” the ability to optimize research intensity, maximize feedback loops, and update beliefs rapidly, represents a durable cognitive advantage rather than a temporary information edge. That Orr and Lee are investing all management fee proceeds back into ORR on margin underscores genuine conviction.

Bottom Line

The Militia Long Short ETF offers something genuinely unusual: retail access to an emerging hedge fund manager before scale erodes advantage. The manager has compiled a verified four-year track record with documented outperformance during market stress. He articulates a clear framework (exploiting betting-against-beta and size premiums) rather than relying on market timing or undisclosed insights.

The caveats are substantial. Four years isn’t definitive. All performance occurred in a single macro regime of elevated interest rates, favoring value stocks and penalizing overleveraged companies. The ETF executes a compromised version of the strategy with lower leverage, more liquid holdings, and a limited short book. The manager explicitly states it has “less edge” than the hedge fund. Whether sufficient alpha survives the ETF structure remains unproven.

Yet the combination of broker-verified performance, articulated edge, systematic risk management, and sophisticated third-party validation from an investor who has never before invested in a hedge fund suggests this deserves consideration. Orr won’t beat raging bull markets, which he states explicitly. But for investors seeking genuinely market-neutral exposure from emerging talent, ORR offers access at the point where the manager still believes his edge exceeds his fees.

The real questions: Does the edge persist at scale? Does the ETF structure preserve sufficient alpha? Will Orr maintain the discipline that got him here? The answers will emerge over the next several years. For investors comfortable with uncertainty and attracted to managers who prioritize substance over marketing, that may be enough to warrant attention.

The ETF’s website is, understandably, pretty thin right now. I was amazed to discover that Mr. Orr allows open access to his hedge fund’s website, which contains both the fund’s performance data but also years’ worth of letters detailing what he was thinking and doing. The single most informative piece might be the very first, in which Mr. Orr explains who he is and why he’s doing what he’s doing. The most recent interview with Mr. Orr is at Raging Capital Ventures. The site that used to be Twitter contains notes from both Mr. Orr and Sam Lee. Which is to say, do your research before you even consider putting down your bets.