Gold is considered one of the best hedges against inflation and uncertainty. Gold fell from about $385 in 1995 to a low of around $250 by 2001, to a high of $1,750 in 2011 before falling to $1060 in 2015. It is now over $3,750. For the past ten years, iShares Gold Trust (IAU) has had a total return of 195% compared to 289% for Vanguard 500 Index ETF (VOO). In this article, I compare funds with lower volatility than stocks and gold to protect from inflation. Preparing for inflation should be part of an overall strategy and not just timing the market when inflation rises.

Most of my career was in the precious metals industry on the technical side. It was a stable industry to be in during the financial crisis, but stressful when gold tumbled. Recently, the price of gold has increased significantly due in large part to central banks buying gold, the weaker dollar, geopolitical risk, economic uncertainty, falling interest rates, and inflation. The price of gold and stocks of gold miners have risen so fast, I don’t consider either category appropriate for my conservative, low-turnover portfolio in retirement.

Higher Inflation

Tariffs are making the headlines for increasing inflation. Core inflation has risen from 2.3% in April to 2.9% in August. New tariffs were just added for heavy trucks, drugs, and kitchen cabinets. Economists in the Federal Reserve Bank of Philadelphia’s Third Quarter 2025 Survey of Professional Forecasters estimate that headline CPI inflation will begin to fall from third-quarter levels, but the rules keep changing. The Federal Reserve is now lowering short-term rates to stimulate employment at the risk of aggravating inflation. Keep in mind that inflation is the change in price levels, so the increase from tariffs will be a temporary bump in inflation to a “permanently” higher price level.

In addition to tariffs, the value of the dollar has fallen by eleven percent this year. As inflation increases, the purchasing power of the dollar decreases. The falling value of the dollar raises the price of imports while making U.S. exports less expensive. The falling dollar hurts investments in U.S. held by foreigners who finance part of the national debt. The cost of buying a dollar of earnings of the S&P 500 is now $30 per dollar of earnings. It is known as the price-to-earnings ratio and has doubled since 2010.

The Price of Money

I recently read The Price of Money by Rob Dix, who suggests that we may be in for a period of higher inflation and lower interest rates. I also finished reading “Our Dollar, Your Problem” by Kenneth Rogoff, in which he expects “a sustained period of global financial volatility marked by higher average real interest rates and inflation and more frequent bouts of debt and financial crises.” The reasons have a lot to do with the burden of rising national debt and how it is financed, along with the decline of the dominance of the dollar as the world’s reserve currency. I am more concerned about long-term inflation as described by Rob Dix and Kenneth Rogoff; tariffs may play a role.

Mr. Dix explained that Quantitative Easing was not highly effective for raising inflation to the Federal Reserve target of 2% initially because the money went into the financial system and largely resulted in inflating asset prices such as stocks. QE was more effective following the COVID recession because it increased the money available to the Treasury to create stimulus for the consumer. Along with disruptions to the supply chain from COVID and the Russian invasion of Ukraine, inflation rose to levels not seen since the 1970s.

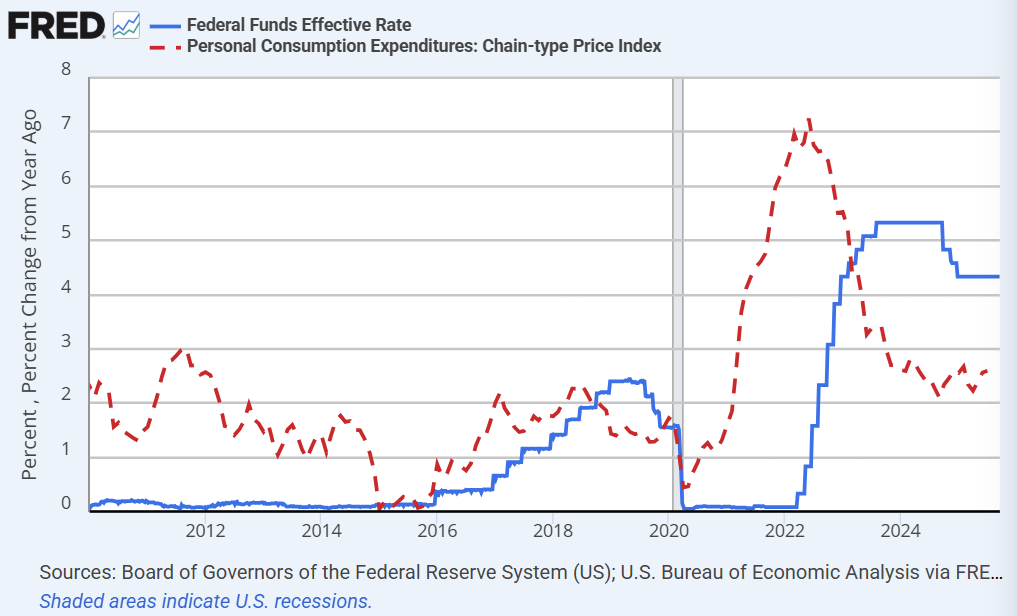

Figure #1 captures the annual inflation rate of the personal consumption expenditures price index and the Federal Funds rate, which is the rate at which commercial banks lend to other banks overnight. The COVID bear market occurred in 2020, inflation rose dramatically in 2021, and the Federal Funds rate was raised to slow inflation in 2022. My analysis of fund performance in this article focuses to a large extent on 2021.

Figure #1: Federal Funds Rate and PCE Year-Over-Year Inflation

Quantitative Tightening

Wolf Richter discusses mortgage rates being between 6% to 7% following a large increase in home prices after the COVID recession in Longer-Term Treasury Yields & Mortgage Rates Jump after Rate Cut, Yield Curve Steepens, Bond Market Gets Edgy on Wolf Street:

“But that’s a bubble-pricing problem now that should have never occurred, not a rate problem. The rates are fine. They’re historically at the low end of the normal range. The 5% and below mortgage rates were a creature of massive QE during the Financial Crisis and after, when the Fed loaded up on trillions of dollars of Treasury securities and MBS to push down long-term rates. But the Fed has been doing the opposite since the second half of 2022 and has shed $2.4 trillion of those securities as QT continues.”

The Federal Reserve has been gradually unwinding its balance sheet when the economy and markets are strong. I expect the long end of the yield curve to stay higher for longer because of the high national debt, specter of inflation, unwinding of Quantitative Easing, and rising geopolitical risks. Federal Reserve independence is gradually being eroded. The Federal Reserve is lowering short-term rates, and a coordinated effort by the Treasury and Federal Reserve may lower intermediate-term rates. I anticipate that short- and intermediate-term rates will be lower over the next year, but remain higher than they were from 2009 to 2021.

Planning For More Frequent Bouts of Inflation

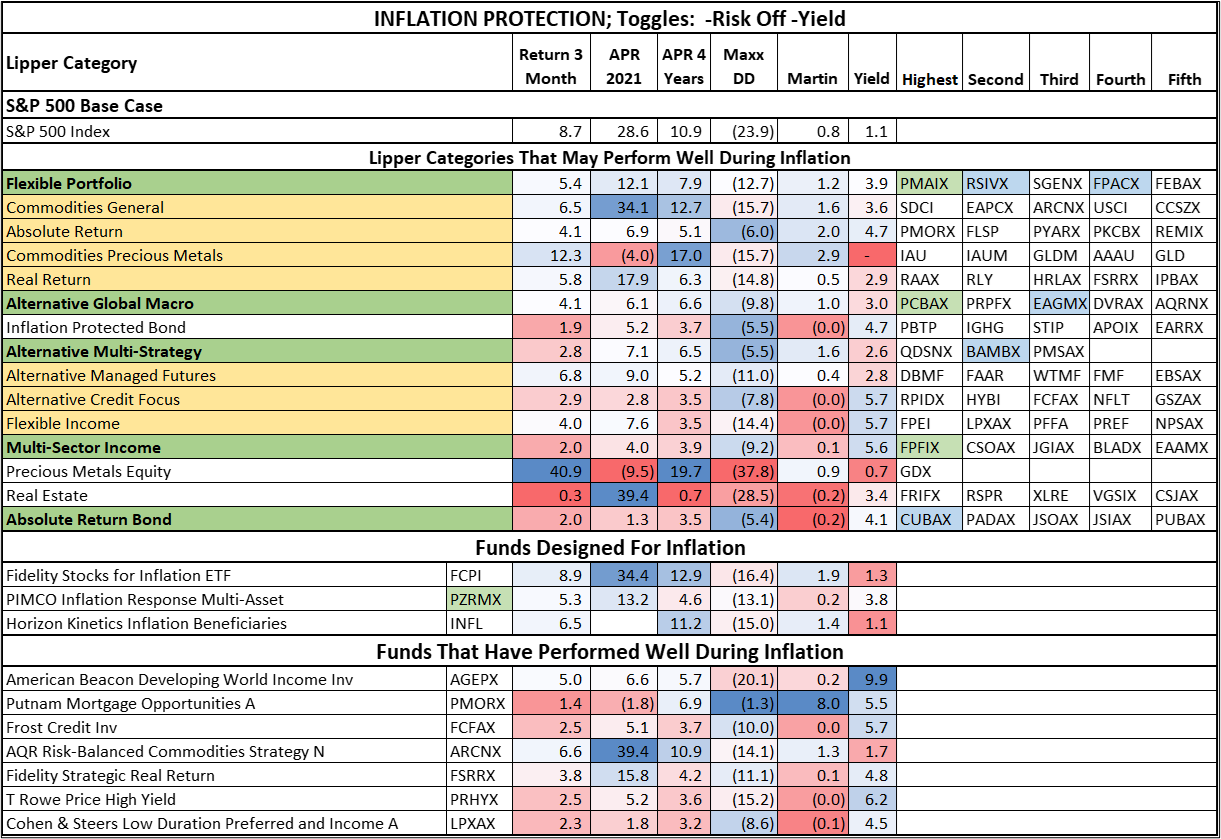

Table #1 shows Lipper Categories that have traditionally hedged against inflation, along with those I identified by looking at the recent period of high inflation. They are sorted by a Ranking System composed of my proprietary ranking system, three-month return, return in 2021 when inflation was rising, four-year Martin Ratio for risk-adjusted return, and yield. I have added toggles to my investment system to add or tilt weights for “Tax Efficiency” for after-tax accounts, “Risk Off” for my outlook, and “Yield” if income is an objective. Table #1 is rated for a conservative, tax-advantaged account where I am seeking income. Metrics in the table are shaded red for “worst” and blue for “best”.

Table #1: Categories That Did Well During High Inflation – Four-Year Metrics

Source: Author using MFO Premium fund screener and Lipper global dataset, and Morningstar returns as of Sep 26th.

The Commodities Precious Metals category did not provide much protection against inflation in 2021, but has performed well since then because of rising rates, falling dollar, and uncertainty. Notice the high maximum drawdowns of Precious Metals Equity, Real Estate, and the S&P500 relative to other categories.

Inflation-protected bonds are considered safe protection against inflation. The green shaded categories are the ones that I identified in this month’s companion article, “Putting My Conservative Retirement Portfolio on Cruise Control”. The gold shaded categories are what I consider to be possible lower-risk hedges against inflation; however, commodities can be very volatile, as we will see later.

The green shaded funds are the ones that I currently own, and the blue shaded funds are in my Conservative Target Portfolio for future investments. I like the Flexible Portfolio, Alternative Global Macro, and Alternative Multi-Strategy categories, where managers have the discretion to adjust according to market conditions.

Creating a Short List of Funds

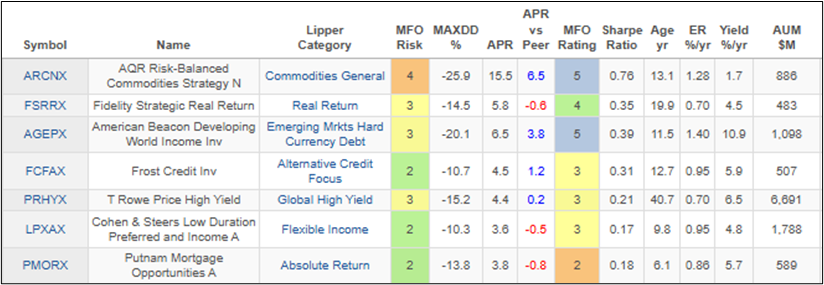

I used Mutual Fund Observer metrics and Portfolio Visualizer to select the following funds in Table #2 to be added to my watch list for inflation. As a general observation, they either have higher MFO Risk or lower MFO Rating for risk-adjusted returns compared to the funds in “Putting My Conservative Retirement Portfolio on Cruise Control”.

Table #2: MFO Metrics for Selected Funds – Six Years

Substituting Funds into the Conservative Target Portfolio

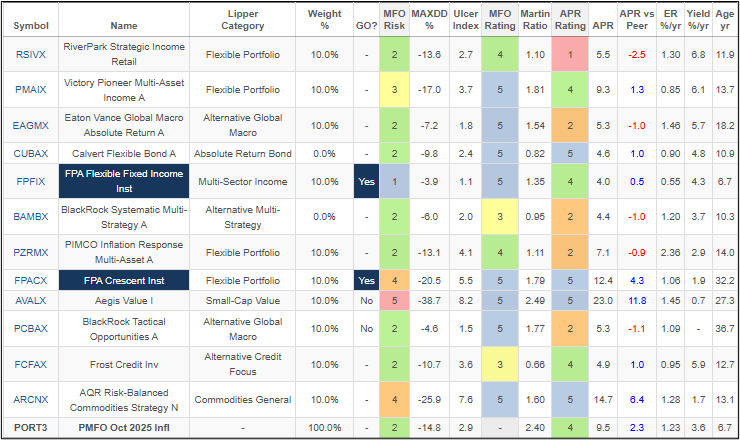

In Table #3, I substituted Frost Credit (FCFAX) and AQR Risk-Balanced Commodities Strategy (ARCNX) for Calvert Flexible Bond (CUBAX) and BlackRock Systematic Multi-Strategy (BAMBX) in my conservative portfolio from the companion article. This adjusted portfolio has an APR of 9.5% compared to 8.4% for the Conservative Portfolio; however, it also has a higher drawdown of -14.8% compared to -12.4% and the Ulcer Index increases from 2.2 to 2.9. The portfolio continues to have an MFO Risk of “Conservative” (MFO Risk =2).

Table #3: MFO Portfolio Modified for More Inflation Protection – Six Years

Figure #2 compares Frost Credit (FCFAX) and AQR Risk-Balanced Commodities Strategy (ARCNX) to BlackRock Systematic Multi-Strategy (BAMBX), Calvert Flexible Bond (CUBAX), and PIMCO Inflation Response Multi-Asset (PZRMX). The funds being tested have higher returns and higher volatility than the funds in my target portfolio.

Figure #2: Comparison of Total Return for Selected Funds

Closing

After doing the research for this article, I added around fifty funds to my investment system, which I have not had time to evaluate thoroughly. This is a task for next month to see if I want to modify my Conservative Target Portfolio. When looking to invest in a fund, I generally start with the five funds with the highest rating per Lipper Category from my spreadsheet.

In a stagflationary environment like the 1970s, I would want to own a fund that invests in commodities such as the AQR Risk-Balanced Commodities Strategy (ARCNX). I don’t expect inflation to reach that extreme in the near term. I prefer the lower volatility of PIMCO Inflation Response Multi-Asset (PZRMX). More aggressive investors and those with major concerns over tariffs may prefer ARCNX.

Frost Credit (FCFAX) and Calvert Flexible Bond (CUBAX) are both good funds, with FCFAX having higher returns and yield with slightly more risk. I have rungs on my bond ladder maturing next year, and I will continually reevaluate the funds in my Conservative Target Portfolio.