I am well on my way to implementing my version of the all-weather portfolio, where some funds will perform well in any environment. This conservative retirement portfolio is a subset of my overall portfolio and fits into tax-advantaged accounts within the intermediate bucket, along with several traditional bond funds and bond ladders. The goal for this “basket” of funds is to have income that meets most withdrawal needs with some upside potential. I incorporated three funds into this portfolio from David Snowball’s article, Thinking More Broadly: Bonds Beyond Vanilla, from the MFO September newsletter. I also included some funds that I already own.

I desire some protection against inflation and financial instability. I believe that U.S. stock market returns in the U.S. will be below average over the coming decade because starting valuations are so high. Funds were selected based partially on having global allocations. Likewise, some bond funds will perform well because interest rates are high and bond values rise when interest rates fall. Several of the funds use hedging strategies that invest beyond traditional stocks, bonds, and cash, and should only be purchased by experienced investors in a well-diversified portfolio.

This target sub-portfolio with ten funds would have returned eight percent over the past six years with a maximum drawdown of twelve percent. The Mutual Fund Observer Portfolio tool rates it conservative (MFO Risk = 2) and above average returns (APR Rating = 4). I own five of the ten funds and plan to buy two more before the end of the year.

I am now putting this strategy on cruise control. I will continue to monitor and adjust the portfolio if I find funds better suited for these uncertain times.

The Price of Money

I finished reading The Price of Money by Rob Dix who takes the reader through the conversion of the dollar into a fiat currency when it was taken off the gold standard, why governments target inflation, the tendencies for governments to spend more money than they bring in through taxes, the extraordinary rise in national debt during peace time and financing that debt, the impacts of Quantitative Easing, the increase in financial inequality, the return of inflation, and the rising risk of financial repression. He suggests that we may be in for a period of higher inflation and lower interest rates. The book was published in 2023, before tariffs were increased this year. The Federal Reserve is now facing the dilemma of weak employment and rising inflation.

The Price of Money is a great companion to “Our Dollar, Your Problem” by Kenneth Rogoff, which I also completed last month. Dr. Rogoff expects “a sustained period of global financial volatility marked by higher average real interest rates and inflation and more frequent bouts of debt and financial crises.”

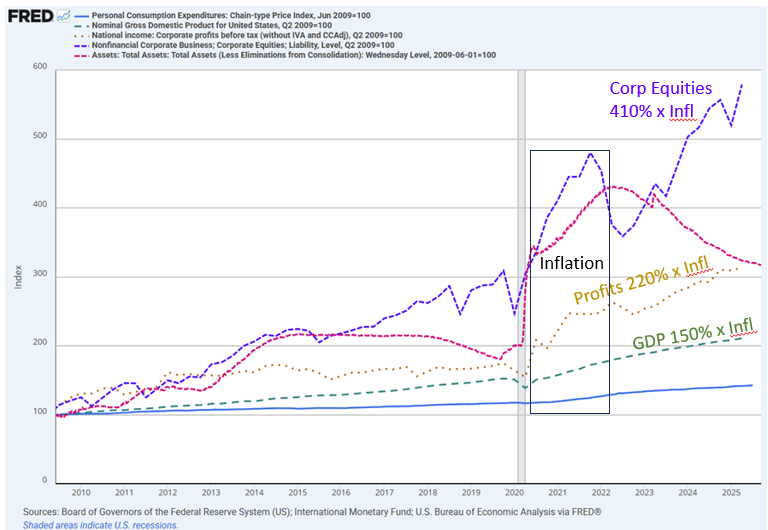

I created Figure #1 to show the high correlation of stock market capitalization (dashed purple line) to Federal Reserve Assets (QE, dashed red line) compared to personal consumption expenditure price index (inflation, solid blue line) and nominal gross domestic product (dashed green line). Investors who owned or bought stocks during the past fifteen years have greatly benefited from the increase in price-to-earnings ratio, while savers have suffered from low yields. Profits (dashed gold line) and stock prices rose dramatically following the COVID recession in large part because of stimulus, including QE. People saving for retirement now are buying at a time when stock prices are near an all-time high, which implies lower average future returns.

Figure #1: Influence of Quantitative Easing on Market Capitalization

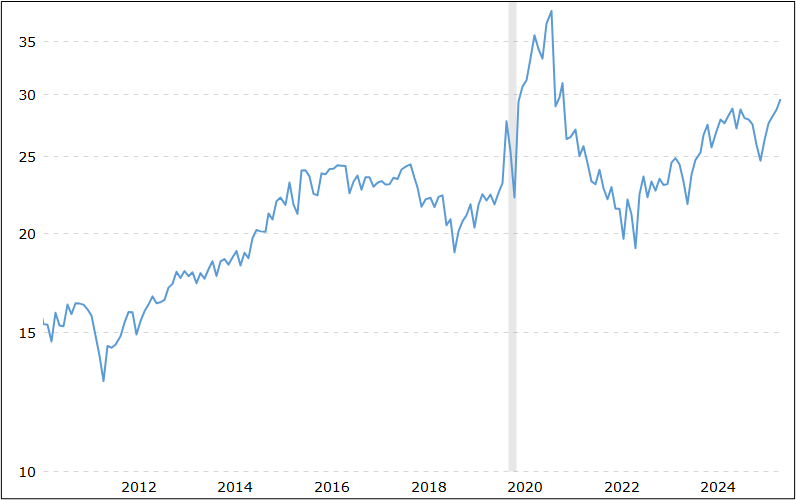

A traditional view of stock valuations for the S&P 500 can be found at S&P 500 PE Ratio – 90 Year Historical Chart by MacroTrends, as shown in Figure #2, which shows that stocks are highly valued. The Vanguard Capital Markets Model describes their forecasts over the next ten to thirty years, which estimates that Global ex-U.S. equities and many fixed income categories may do as well or better than US equities.

Figure #2: Price-To-Earnings of the S&P 500

Conservative Portfolio with Equal Weights

I track around a thousand mutual and exchange-traded funds with share classes available at Fidelity with no loads or transaction fees each month using the MFO Premium fund screener and Lipper global dataset. To select funds for this portfolio, I filtered out funds that had poor downturn ratings, high correlations to the S&P500, and did poorly during the COVID recession, 2021, when inflation was rising, 2022, when rates were rising, and past recessions. I also selected funds that have returned at least 4% percent annually over the past five to ten years and have yields of over 4%. I used Portfolio Visualizer to assist in narrowing the list down to ten funds.

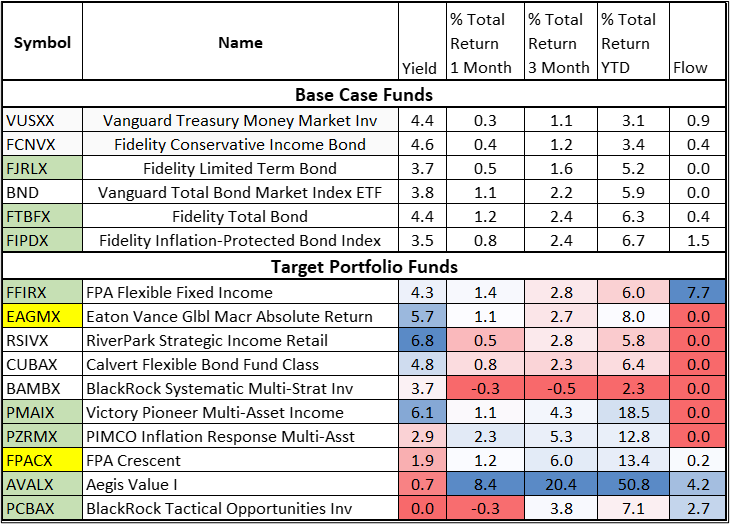

Table #1 contains the ten funds weighted equally in my conservative target portfolio, sorted from the highest “Yield to Ulcer Index” ratio to the lowest for risk-adjusted yield. While yield is one of my primary objectives, it is not the only one. Over the past six and a half years, the portfolio would have returned 8.4% annually with a maximum drawdown of 12.4%. The portfolio has an MFO Risk of “2” for below average, an APR rating of 4” for above average, and all but one fund has above average risk-adjusted returns as measured by the MFO Rating.

Table #1: Target Portfolio with Equal Weight Performance – 6.7 Years

FPA Flexible Fixed Income (FPFIX, FFIRX) and Victory Pioneer Multi-Asset Income (PMAIX) were covered in David Snowball’s article, and I own shares in both. RiverPark Strategic Income Retail (RCTIX, RSIVX) was also covered in the article. I own PIMCO Inflation Response Multi-Asset (PZRMX) for inflation protection, and BlackRock Tactical Opportunities (PCBAX) for its performance during down markets. I own Aegis Value I (AVALX), which David Snowball covered in Aegis Value Fund (AVALX) for its global diversification of deep value, small-cap stocks. The stock market usually dips during government shutdowns, and I look for opportunities to buy FPA Crescent (FPACX, FPFRX) and Eaton Vance Glbl Macr Absolute Return (EAGMX) before the end of the year.

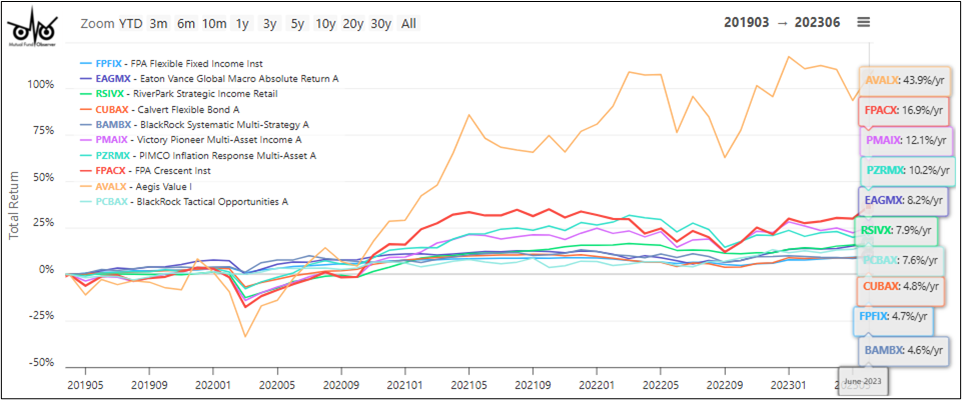

Figure #3 shows the funds during the COVID recession (2020), rising inflation (2020-2021), rising interest rates (2022- 2023), falling inflation (2022-2024), and falling interest rates (2024-2025). I selected funds that tended to do relatively well in each of these environments. I excluded 2024 and 2025 because valuations rose to very high levels.

Figure #3: Total Return of Funds in the Target Conservative Portfolio

Portfolio Visualizer

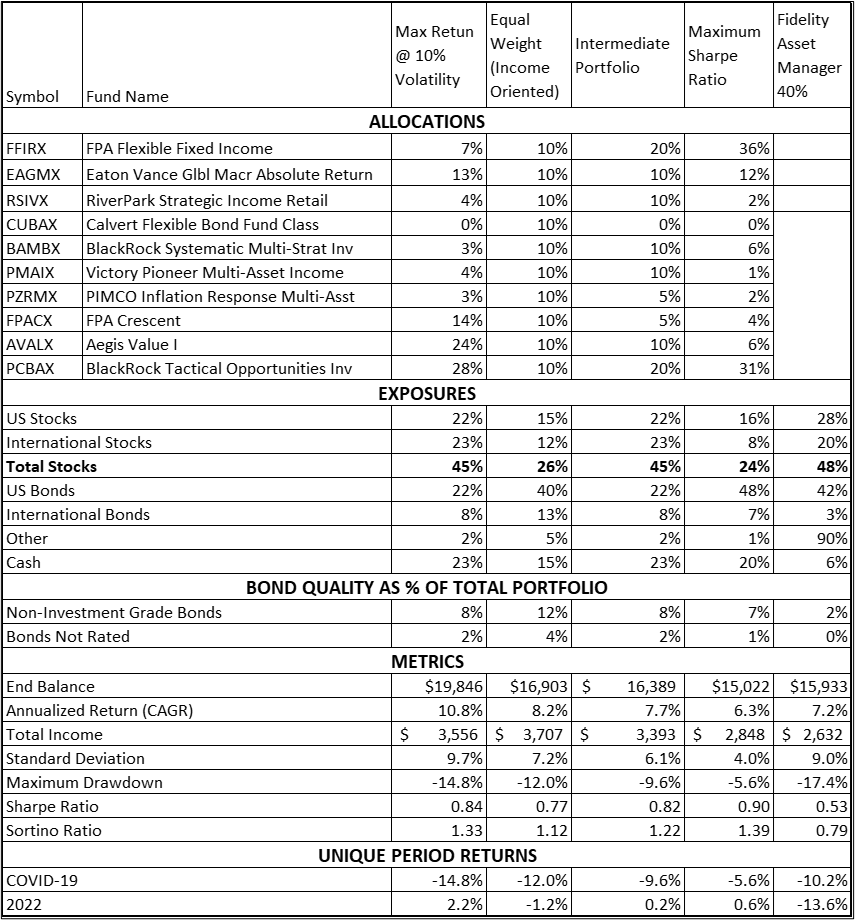

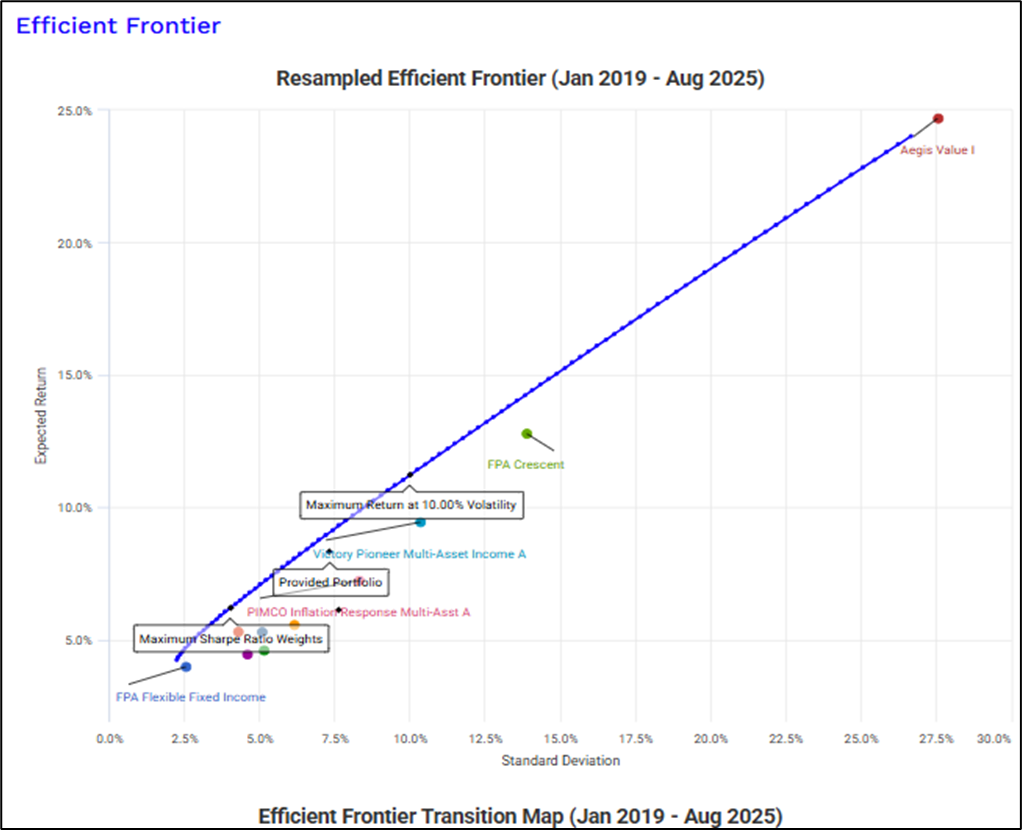

I used Portfolio Visualizer to identify funds that would contribute to high risk-adjusted returns. For this to happen, the funds have to have low correlations to one another so that some are up when others are down. The objectives that I set in Portfolio Visualizer included “minimize drawdown given a targeted return”, “maximize return for a target volatility”, and “maximize the Sharpe ratio”. The link is provided here. From these results, I back-tested simplified allocations again using Portfolio Visualizer. The link is provided here. The results are summarized in Table #2.

Future results are guaranteed to be different than the past, so I am loosely following an equal-weighted allocation for simplicity. While I like the lower drawdown of the Maximize Sharpe Ratio, I am comfortable with that of the Equal Weight portfolio. I created the “Intermediate Portfolio” to review the results if I wanted to tilt the “Equal Weight” portfolio more towards the “Maximize Sharpe Ratio” portfolio with a preference for higher yield and return.

Table #2: Summary of Portfolio Strategies

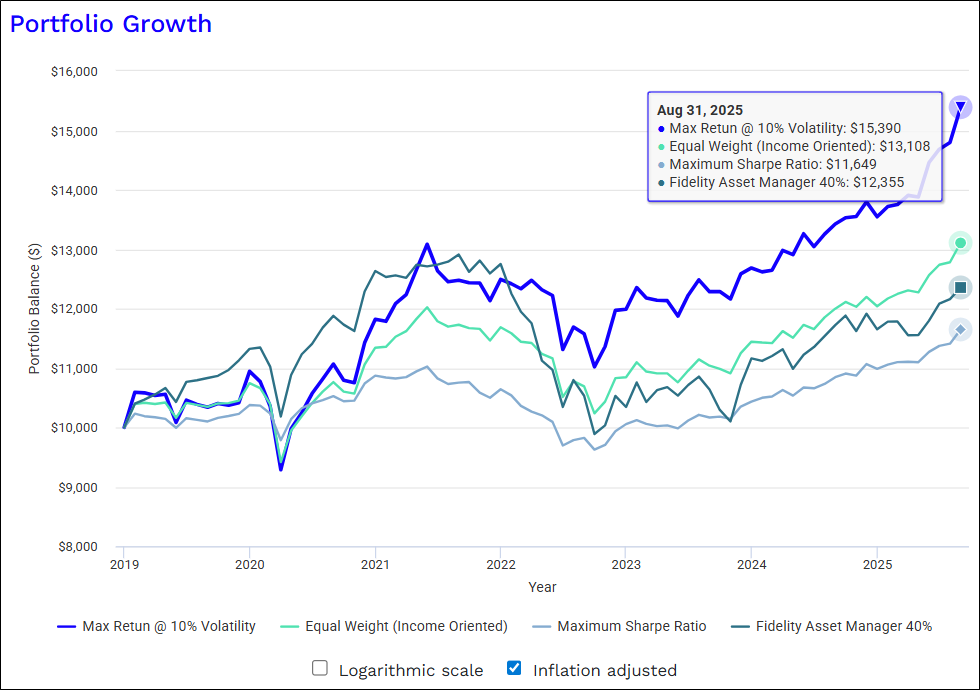

Figure #4 compares the growth of $10,000 from 2019 adjusted for inflation with the globally diversified Fidelity Asset Manager 40% (FFANX), which is a good globally diversified mixed asset fund. While I am comfortable with the drawdowns of the “Maximize Return @ 10% Volatility) over the past six years, I might not be under more severe market conditions. I like the backtested portfolios over FFANX because of their lower volatility.

Figure #4: Growth of $10,000 for Portfolio Strategies

Figure #5 is the Efficient Frontier (blue line) of the funds. It estimates the maximum return that can be achieved for a given standard deviation (volatility) by combining funds. While I own and like Aegis Value (AVALX) for investing in globally diversified small-cap companies, I recognize that it is the riskiest fund by far, and I am comfortable with a reasonable buy-and-hold allocation to it.

Figure #5: Efficient Frontier of Funds in the Conservative Target Portfolio

Short-Term Performance

Table #3 shows the short-term performance of the funds along with some of my baseline funds. I own the funds shaded green, and plan to buy the ones shaded yellow before the end of the year. As interest accumulates and bond rungs mature, I will evaluate the three remaining funds in the target portfolio and expect to add them to the portfolio. I evaluated BAMBX and PCBAX last month in BlackRock Systematic Multi-Strategy (BAMBX) vs BlackRock Tactical Opportunities (PCBAX) | Mutual Fund Observer, and purchased PCBAX. I am holding off on BAMBX because of poor short-term performance.

Table #3: Short-Term Performance of Funds in Target Conservative Portfolio

Source: Author using MFO Premium fund screener and Lipper global dataset, and Morningstar returns as of Sep 26th.

Closing

Tariffs, high domestic stock valuations, geopolitical risks, rising national debt, and uncertainty are creating an environment where I think actively managed funds will outperform. In particular, I favor Alternative Global Macro, Alternative Multi-Strategy, Flexible Portfolio, and globally diversified mixed-asset categories.

I am now re-reading Global Macro Trading by Greg Gliner. Mr. Gliner says, “The first rule in any kind of investing is to understand how much you stand to lose, rather than how much you stand to gain.” This is important to keep in mind with stock markets at all-time highs. With a government shutdown looming as I write this article, I have a little dry powder looking for the opportunity to add to funds in this article to my conservative portfolio if the opportunity arises.