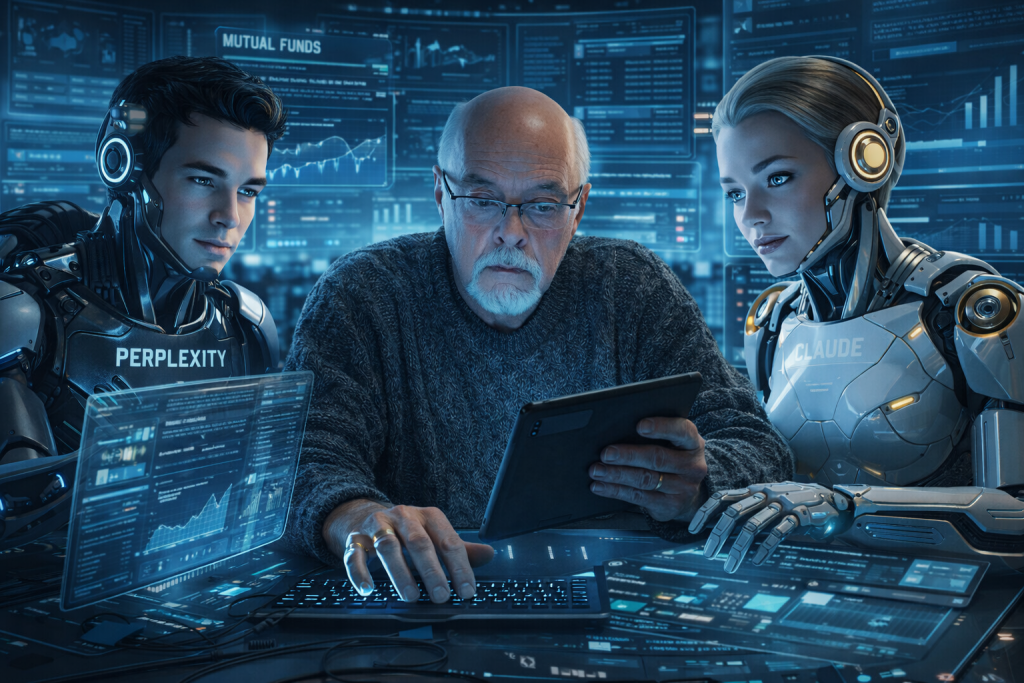

Since our January 2026 issue has two distinct, cautionary essays on the incursion of artificial intelligence chatbots into our lives, schools, and portfolios, it’s important for you to understand the role of AI at MFO.

Every single article is conceived and written by one of three human beings: Snowball, Lynn Bolin, or The Shadow. All of them are reviewed, cleaned, edited (and occasionally snickered at) by one of two human beings: Raychelle and Chip. Whether the argument or the writing is sublime or execrable, it’s human.

Snowball uses AI in class prep, teaches about it in classes and workshops, and has proposed a substantial Mellon Foundation grant on the cultural diffusion and effects of AI. For his purposes, the most appropriate assistants are Claude.ai (who has the highest ethical standards and most polished writing, give or take a predictable fetish for em dashes and an oddly formal phrasings) and Perplexity.ai (which has an unparalleled training overlay that focuses on academic and professional research). For teaching and research purposes, I’ve explored more than a dozen models in all.

Snowball uses and pays for two AI tools in refining his articles here. Here’s the division of responsibility:

- Snowball (aka “I”) is responsible for ideation, argument structure, voice, and conclusions. I read a lot, talk with folks in the industry a lot, and sometimes wonder things like “how’s Aegis Value doing (splendidly, fyi) and why haven’t people noticed?” At that point, I start poking around by checking the Aegis website, looking at Morningstar’s take, and running analyses at MFO Premium. If I think I have something to say (which is “sometimes but not always”), I draft, am appalled by, and redraft an article.

- Perplexity.ai often surveys academic and professional research to confirm (sharpen or challenge) my sometimes-suspect recollection. “My vague recollection is that domestic microcap stocks have a peculiarly high correlation with junk bonds. Please could you check the academic and professional literature, stressing research conducted since 2000, to determine whether that’s true; if so, to what degree or under what conditions; and, what explanations scholars have offered for the apparent correlation of two unrelated assets.”

- Claude.ai, specifically Claude Sonnet, which is far less compute-intense than Claude Opus, serves as an interlocutor: the person who weighs in on “does this make sense? what am I missing? how could we be clearer?” – and offer the occasional nag – “go to sleep, Snowball, you’re having trouble completing your sentences and this file can wait.” I will also share Perplexity’s claims with Claude, with the request to double-check the validity of the claims or summaries Perplexity proposes.

If you happen to spot any spectacularly implausible images – oh, Warren Buffett wielding a battle axe while riding his dragon Charlie in Elon Musk’s general direction – that likely means that Chip got bored, then got playful, and used tools far beyond my limited ken to generate whimsy on your behalf.

If you’ve got questions or reservations, feel free to drop me a note, and I’ll think things through with you.