Setting aside uncertainty this year over tariffs, affordability, a slowing economy, high stock market valuations, and government shutdowns, this article is focused on the long-term risk of the next financial crisis. I am not worried about a gloom and doom scenario. I do want to have a portion of my overall portfolio prepared for another financial crisis or currency devaluation, whether it is associated with the next bear market or one after that.

This Time Is Different – Eight Centuries of Financial Folly (2009) by Carmen M. Reinhart and Kenneth S. Rogoff covers debt cycles and financial crises:

“If there is one common theme to the vast range of crises we consider in this book, it is that excessive debt accumulation, whether it be by the government, banks, corporations, or consumers, often poses greater systemic risks than it seems during a boom.”

Federal debt as a percentage of gross domestic product rose from 62% of GDP in 2007 to 119% currently. In Our Dollar, Your Problem (2025), Kenneth Rogoff writes that he expects “a sustained period of global financial volatility marked by higher average real interest rates and inflation and more frequent bouts of debt and financial crises.”

I just finished reading Principles for Dealing with the Changing World Order – Why Nations Succeed and Fail (2021) by Ray Dalio, focusing on the “Big Cycle of Money, Credit, Debt, and Economic Activity”. Mr. Dalio summarizes the powers and prospects of the United States to be that the United States appears to be a strong power in gradual decline, and its “weaknesses are its unfavorable economic/financial position and its large domestic conflicts.”

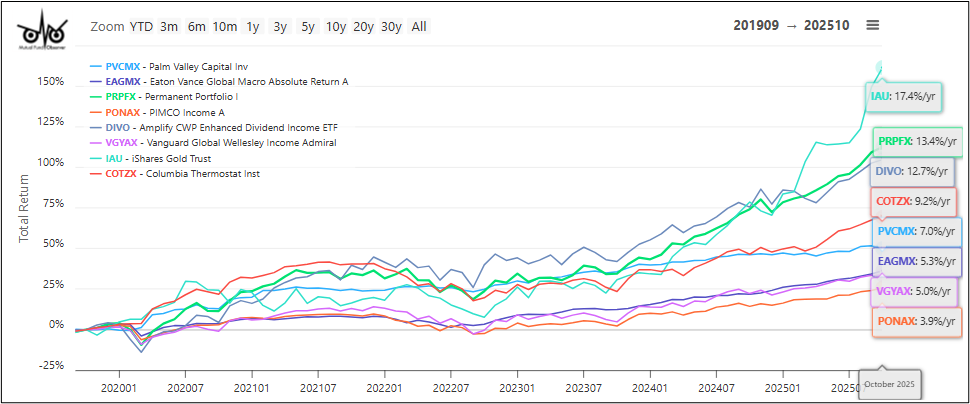

In this article, I create a range of portfolios for drawdowns during the financial crisis and returns for the past eighteen years. I then combine the best of the established funds with newer funds that have high risk-adjusted performance since the beginning of the COVID pandemic. I consider that the bear market (2020), high inflation (2021), recovery of stocks (2023), and tariff uncertainty (2025) of the past six years to be more indicative of performance for the next six years while The Great Normalization (2022) bear market with interest rates rising from a low level to closer to historical levels and the stock market becoming highly valued (2024) to be less relevant. My Excel optimization is intended to capture these relevant aspects while excluding the less relevant years (2022, 2024). In the final section, I conclude by showing how my conservative target portfolio performed over the past six years.

Investment Environment

S&P Global Ratings lowered its rating of U.S. Government debt in 2011. Fitch Ratings lowered its rating from AAA to AA+ in 2023, and Moody’s Investors Service lowered its rating on U.S. government debt from Aaa to Aa1 this year. The Third Quarter 2025 Survey of Professional Forecasters by the Federal Reserve Bank of Philadelphia estimates that real GDP for the U.S. in 2025 will be about 1.7% and 1.6% in 2026. The price-to-earnings ratio of the S&P 500 is nearly as high as it was prior to the bursting of the Dotcom Bubble.

Fiscal and monetary stimulus, along with supply shocks following the pandemic, resulted in high inflation not seen for fifty years. The stage was set for the rise in gold prices with the announcement in April 2020 of the Federal Reserve injecting $2.3T into the economy, rise of inflation starting in March 2021 which peaked in June 2022, Russia invading Ukraine in February 2022, the ten-year to two-year yield curve inverting in July 2022 warning of a recession, central banks accelerating the purchase of gold in 2022, banking crisis of March 2023 triggered by the collapse of Silicon Valley Bank followed by troubles at Credit Suisse, and the start of the Israeli-Hamas war in October 2023.

Inflation peaked in mid-2022 while gold began its recent ascent at the end of 2022 after inflation was well on its way to being tamed. Bondholders would be repaid in dollars that would have lower purchasing power. The Federal Reserve began lowering the funds rate in September 2024, making it less expensive to own gold, and flows into iShares Gold Trust (IAU) started to rise in November 2024.

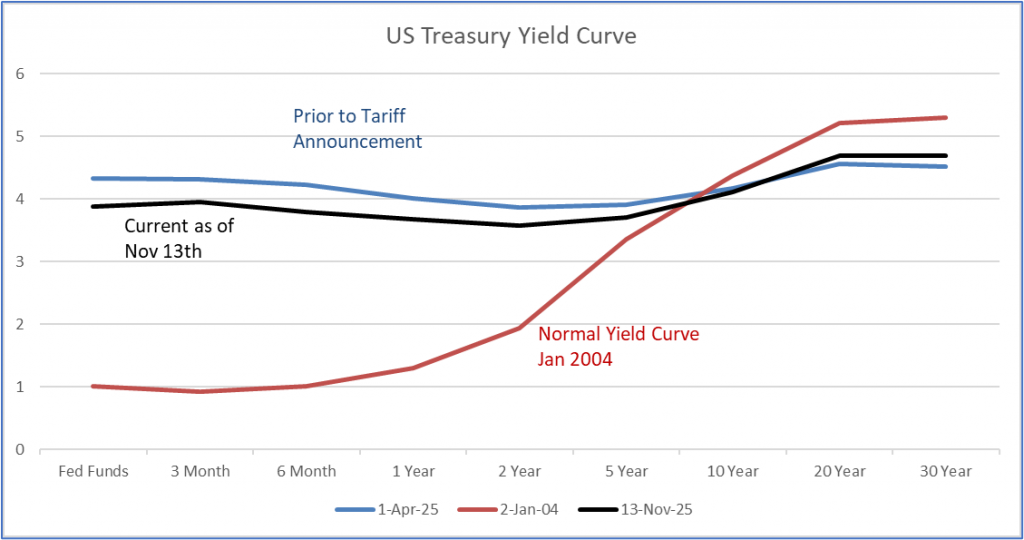

Figure #1 shows that the Treasury yield curve is still slightly inverted, but starting to fall on the short end as the Federal Reserve lowers rates to address the softening of the labor market. Long-term yields have risen because investors want to be compensated for the risk of rising national debt and the risk of inflation.

Figure #1: Treasury Yield Curve

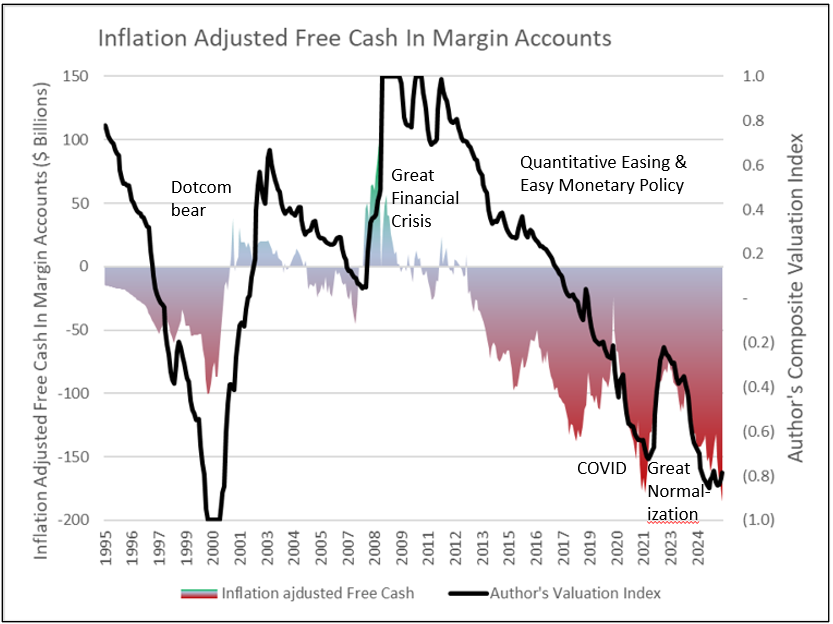

Financial Industry Regulatory Authority (FINRA) members report the total of all debit balances in securities margin accounts, and the total of all free credit balances in all cash accounts and all securities margin accounts. In Figure #2, I show the free cash in margin accounts adjusted for inflation back to 1994. I also show my estimate of domestic stock valuations, which is a composite of six common valuation methods. A negative one for valuation is highly overvalued. The markets are both highly leveraged and richly valued.

Figure #2: Inflation Adjusted Free Cash in Margin Accounts vs Stock Valuation

Source: Author Using St Louis Federal Reserve (FRED), Financial Industry Regulatory Authority (FINRA)

Commodity Prices to Hit Six-Year Low in 2026 as Oil Glut Expands (October 2025) by the World Bank Group states, “It [gold price] is projected to increase by a further 5% next year, leaving gold prices at nearly double their 2015-2019 average.” They qualify, “Conversely, geopolitical tensions and conflicts could push oil prices higher and boost demand for safe-haven commodities such as gold and silver.”

Portfolio Performance – Great Financial Crisis to Date

During the Great Financial Crisis bear market to now, 9% (by assets under management) of the mixed-asset funds with less than 65% allocated to stocks and alternative funds had drawdowns of less than fifteen percent and returns over the past twenty years of seven percent or more. Of the 677 similar funds with a six-year history, 58% had drawdowns of less than fifteen percent during the COVID bear market and returns over the past six years of seven percent or more.

I constructed five model portfolios with drawdowns during the Great Financial Crisis, ranging from 4% to 20% and with long-term returns of 5% to 10%. I then built a global portfolio to reflect my view that domestic stocks are overvalued, and foreign stocks are likely to outperform because of lower valuations.

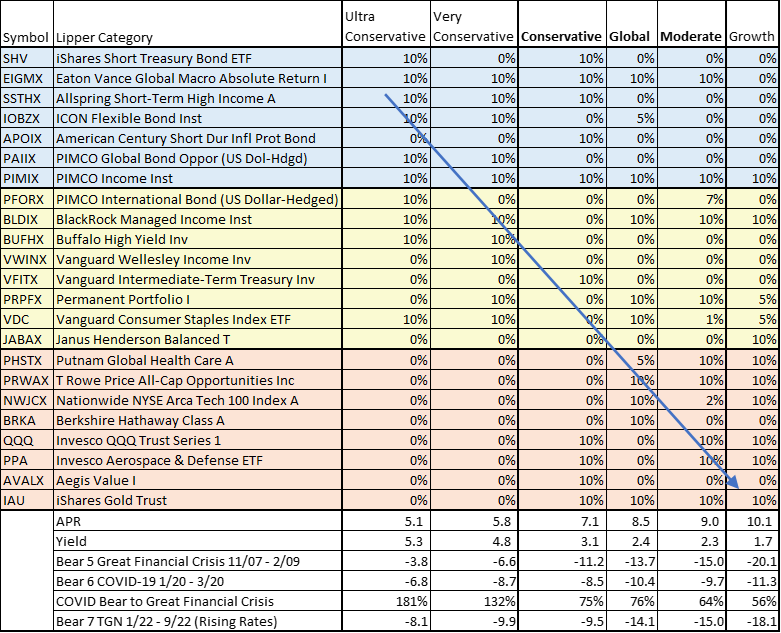

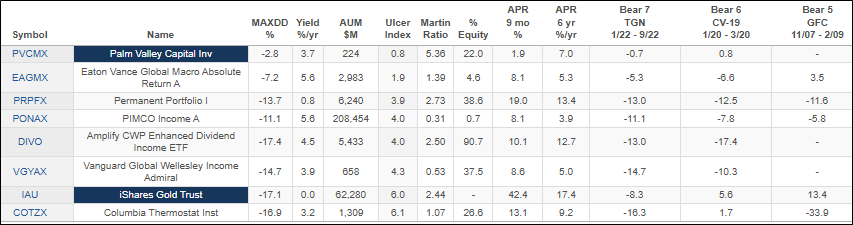

Table #1 contains the twenty-three funds selected by the optimizer to be included in the six model portfolios, sorted from lowest risk (Ulcer Index) to the highest for the eighteen-year period. The funds shaded light blue are the least risky as measured by the Ulcer Index, which measures the depth and duration of drawdowns. The funds shaded red are the riskiest, with the yellow being moderate risk.

Table #1: Funds Selected in Optimizer Scenarios

Table #2 contains the allocations in the model portfolios. The allocations transition from the least risky for the Ultra-Conservative portfolio on the left to the riskiest in the Growth portfolio on the right, somewhat along the path of the arrow. The Ultra and Very conservative portfolios are invested in the low and moderate-risk funds. The Conservative, Global, and Moderate portfolios tend to take more of a barbell approach with lower-risk and higher-risk funds. The Growth portfolio has only one fund in the lower risk sections. Most portfolios include either Permanent Portfolio (PRPFX) or iShares Gold Trust (IAU) or both.

Table #2: Allocations Across Six Model Portfolios – 18 Years

Finalizing My Target Portfolio for Lessons Learned

Shorter-term risk includes policy uncertainty, high equity valuations, and rising geopolitical risks. Risk during a severe bear market is not being able to meet spending needs and financial obligations. Longer-term risks are high national debt and currency devaluation. The role of this conservative sub-portfolio is to combine some funds that are doing well in any environment with other funds providing some growth potential, and of course, to keep it simple.

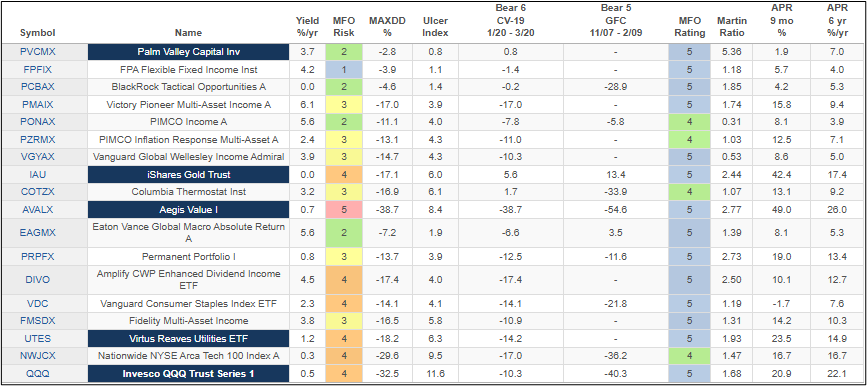

Table #3 contains the nine funds that I have been buying this past year at the top of the table, followed by four defensive funds (EAGMX, PRPFX, DIVO, VDC) that I may consider next year, depending upon market conditions. The bottom five funds (FMSDX, UTES, NWJCX, QQQ) are the types of funds that I may want to add during the next correction for longer-term growth at reasonable prices.

Table #3: Author’s Watchlist – Metrics for Six Years

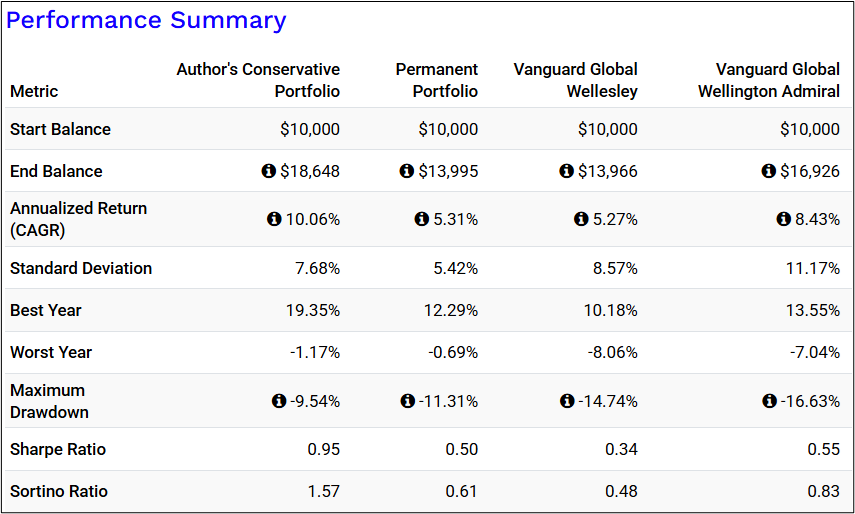

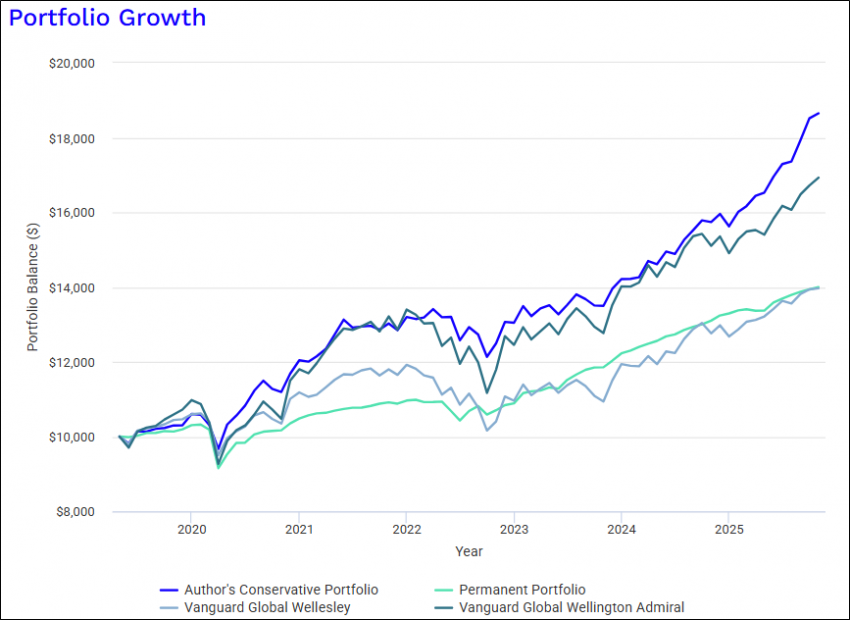

Table #4 is a comparison of the funds in my conservative portfolio, equally weighted plus Amplify CWP Enhanced Dividend Income ETF (DIVO) to Permanent Portfolio (PRPFX), Vanguard Global Wellesley Income (VGYAX), and Vanguard Global Wellington (VGWAX). My portfolio performance had higher returns and lower drawdown than the Global Wellington. The link to Portfolio Visualizer is provided here.

Table #4: Portfolio Performance – May 2019 – October 2025

My “Conservative Portfolio” is 32% allocated to stocks. Bonds are mostly higher than investment grade “BBB”. The yield is 3.0%. The expense ratio is a relatively high 1.04%, but I’m paying for downside protection. I believe that the conservative portfolio in the table above would likely have a drawdown of 15% or less during a financial crisis as severe as the Great Financial Crisis. Separately, I invest at Vanguard for a low-cost, buy-and-hold strategy.

Figure #3 is a visual display of portfolio performance. The performance of Vanguard Global Wellesley Income (VGYAX) was hurt in 2022 because of its allocation to bonds with rising interest rates. It has a high allocation to financial sectors, which should benefit from falling rates, and a low allocation to technology, which is highly valued.

Figure #3: Portfolio Performance – May 2019 – October 2025

My portfolio has advantages over Global Wellington in that I can strategically rebalance the portfolio and tilt it for market conditions. I can sell a fund that is doing well in a down market if I need to. Global Wellington has the advantage of simplicity and being professionally managed without the need to rebalance. Permanent Portfolio has a smooth profile, and a drawdown slightly higher than the Author’s target portfolio during the COVID bear market.

Fund Spotlight

Over the past several months, I focused on the funds in Table #5 and purchased Palm Valley Capital (PVCMX), PIMCO Income (PONAX), Columbia Thermostat (COTZX, CTFAX), and a small amount of iShares Gold Trust (IAU). Palm Valley Capital and Columbia Thermostat have tactical strategies and are currently twenty-two percent and twenty-seven percent invested in stocks. Both have averaged seven to nine percent annual returns for the past six years. David Snowball described PVCMX in “Portfolio update #1: added Palm Valley Capital” for the September 2020 MFO newsletter. Since the financial crisis, managers at Columbia Thermostat have changed their strategy to gradually change the allocation to stocks instead of being all stocks or bonds.

Table #5: Author’s Shortlist of Funds for Recent Purchases

Figure #4 shows the total returns of the funds. Notice the smooth profile of PVCMX (light blue line). I like Eaton Vance Global Macro Absolute Return (EAGMX) and Amplify CWP Enhanced Dividend Income ETF (DIVO), and might have bought them had I done the research for this article earlier. I also like Permanent Portfolio (PRPFX) but opted to have iShares Gold Trust (IAU) as a long-term holding in my conservative sub-portfolio.

Figure #4: Author’s Shortlist of Funds for Recent Purchases

Closing

Gold can help protect against the inflationary impacts of debt monetization (“printing money”) and rising geopolitical risk. My conclusion is that gold is both overbought in the short-term and at the start of a long rise in prices because of the debt cycle and the gradual weakening of the dollar as the world’s global currency. I added a small amount of iShares Gold Trust (IAU) to my conservative sub-portfolio last month and plan to buy more over time. Since yields are high, falling rates will benefit bond performance during a recession.

I will conclude with one last quote from Ray Dalio:

“The goal of printing money is to reduce debt burdens, so the most important thing for currencies to devalue against is debt (i.e., increase the amount of money relative to the amount of debt, to make it easier for debtors to repay).”