Welcome to the New Year’s issue of the Mutual Fund Observer. We’re glad you’re here.

Heraclitus, the famously elusive Greek philosopher, reminded his students that you cannot step into the same river twice. Both we and the river will have changed. According to legend, one of those students – snarky little barstid – replied: “I don’t think you can step into the same river once.” Even as we step, the river flows and changes.

As do we.

Heraclitus was speaking of a physical river. Centuries later, we have extended his insights to allow us to consider the River of Time itself: the continuous flow in which change happens, meaning accumulates, and our lives—and markets—actually unfold.

January has that fluid quality. We think of ourselves standing on the bank of the River, looking backward and forward at once—convinced that the past can be measured and the future mapped, even as the present slips by almost unnoticed. The river does not pause for our resolutions.

In reality, we don’t just get to watch time rush past; we are not on the bank, we are in the river. We may think we resolutely face the future, eyes upstream, scrying risk and opportunity. We may turn our back to the torrent, knowing that we can only know what has already passed and contemplating the dark sea into which it must eventually empty. We might be still and resolute, like a stone, or moving along with the flow. The young might experience a mere ankle-deep flow while some of us experience … the deeper currents pulling toward that wine-dark sea.

Perspective matters.

And metaphors matter because they teach us what to look for. From the riverbank, all motion feels alarming. From within the river, we begin to notice that not all movement means change, not all froth is consequential, and not all change arrives with noise. Some of what most shapes our lives—technological shifts, medical progress, environmental repair—moves steadily, almost invisibly, beneath the surface.

In this month’s Observer …

This January issue of the Observer lingers over a stretch of the river that many hurried past. Amid the noise and anxiety of 2025, extraordinary things went quietly right: a vast expansion of green energy in China, meaningful progress against several endemic diseases, and other developments that rarely commanded headlines but may shape lives for decades to come.

Uncertain times require clear thinking, and clear thinking requires … well, a functioning brain. In “New Year’s Resolution #1: Avoid lobotomies” we look at the threat that AI seductively poses to brains … yours, your alma mater’s, and your investment advisor’s. A short sidebar piece, “What Five AI Told Me About Investing in 2026, and what their answers tell you,” highlights the problematic patterns in AI’s response to an (admittedly unfair) question about what’s going to win in the year ahead.

Our colleague Lynn Bolin contributes two complementary pieces exploring income-focused investing for the uncertain years ahead. In “My 2026 Investment Plan,” Lynn walks through the construction of his conservative Core TIRA portfolio – a traditional IRA designed to generate a steady income of at least 4% while limiting drawdowns to -15% during severe bear markets. He demonstrates how different funds yield differently depending on whether they’re responding to interest rate cycles or stock market cycles, and evaluates adding Standpoint Multi-Asset (REMIX) to improve diversification. Particularly valuable: Lynn’s analysis of how his portfolio performed through both the COVID bear market and the Great Normalization’s rising rates, and his discussion of why he’s moved from a 65% stock allocation to 50% as forecasts from the OECD, Federal Reserve, and Conference Board all point to slowing growth ahead. Vanguard’s own time-varying model now recommends a 40/60 stocks-to-bonds allocation – a near-revolutionary flip from the traditional 60/40.

In “A Closer Look at Income Strategy,” Lynn drills deeper into the mechanics of generating steady income in an environment where short and intermediate Treasury yields are falling while long-term rates rise. Working from 30,000 feet (which Lipper categories produce income in low-yield environments) down to ground level (specific fund recommendations), he identifies funds that maintained consistent yields through multiple market cycles. His analysis reveals that some funds distribute more when stock market opportunities appear limited, while others fluctuate with interest rates – and a select few provide genuinely steady income regardless of market conditions. The payoff: an example portfolio that achieved 7.7% annual returns with a maximum drawdown of just -9.8% over the past six years while yielding 5.2%.

The Shadow, as ever, surveys the month’s most consequential changes in the fund and ETF world in “Briefly Noted.”

We also pause, briefly and with gratitude, to acknowledge those who have sustained the Observer—financially, intellectually, and through simple acts of encouragement. And then, before the current carries us onward, we raise a glass to what has been, to what is, and to what may yet emerge from upstream.

The Good News You Scrolled Past

Pessimism is easy.

Way too easy, frankly.

If I were to construct the Pessimism Industrial Complex, it would have three pillars:

-

The federal government is controlled by toddlers, a bunch famous for tantrums when their irrational, I-am-the-universe demands are not met. And so we get the Trump Kennedy Center, chaired by Donald J. Trump and the Donald J. Trump US Institute for Peace. The Trump-class battleships that will populate The Golden Fleet. The Trump dollar coin. The Trump accounts for infants. The decision to make access to the national parks free on Trump’s birthday, which, I think, is somewhere in the month of Trumpruary.

There are no adults left in the room. Interviews with three departing US senators made two points: (1) every member of the US Senate is appalled and (2) they’re all waiting “for the right time” to, you know, develop a spine, remember their oath of office, or something (“Why Won’t Senators Stand Up to Trump? We Asked 3 Who Called It Quits,” New York Times, 12/13/2025). Until then, the federal response to a global climate crisis is “don’t wanna and you can’t make me!”

When you’re dealing with a creature named “The Doomsday Glacier,” it’s easy to foresee Bad Things Aplenty.

-

The media loves reporting bad news. We don’t know where the newsroom adage “if it bleeds, it leads” originated – the confident online assertions about Hearst in the 1890s is unattributed and a random New York Magazine article in 1989 is laughably wrong – but it does express a well-documented truth. Bad news sells, terrible news sells more. A 20-year study of German media found a “significant, positive correlations between explicitly negative cover pages and the magazines’ sales” (Arango-Kure and Marcel Garz, “Bad News Sells,” Journal of Media Economics, 2014). Globally, every additional negative word added to a story’s title increases readership (Robertson, et al, “Negativity drives online news consumption,” Nature: Human Behavior, 2023; btw, their study of 105,000 online news stories also found that positive words in titles drove down readership) and the more negative a story is, the more frequently and widely it’s shared on social media (Watson, et al, “Negative online news articles are shared more to social media,” Scientific Reports, 2024).

-

You love to doom-scroll. Doom‑scrolling, for the three of you who didn’t know, is the practiced art of dragging your thumb down an endless feed of bad news long after you have stopped learning anything new. It is not just “reading the news online”; it is staying locked in the loop of crisis headlines, live‑updated horrors, and algorithm-driven outrage until your mood and sense of the world are thoroughly saturated. Some psychologists speculate that it’s a hard-wired behavior; within evolutionary time-frames, our survival depends on obsessively locating and assessing all potential threats in our neighborhood (“is that a nice kitty or a creature whose nickname for me is ‘niblet’?”), and doom-scrolling is just the latest iteration of the impulse.

Surveys and behavioral studies suggest that a substantial minority of adults, and a flat‑out majority of younger users, now report doom‑scrolling regularly (“Gen Z has a doomscrolling problem,” Newsweek, 5/11/2025). In those same studies, heavier doom‑scrolling is consistently associated with higher levels of stress, depression, anxiety, sleep problems, and even secondary trauma symptoms, a joy of witnessing wave after wave of misery through a four‑inch screen (Satici, et al, “Doomscrolling Scale: its Association with Personality Traits, Psychological Distress, Social Media Use, and Wellbeing,” Applied Research in the Quality of Life, 2022).

And, boy howdy, is there a fair number of regrettable developments in the world. Andrew Winston’s curiously optimistic essay in Forbes (“2025: the year sustainability didn’t die,” 12/21/2025) began with a fairly bracing list of negatives:

… the harsh reality is the world’s greatest challenges [are] getting worse. Inequality grew, especially at the very top, where individuals amassed unfathomable wealth (hundreds of billions of dollars) and some corporate valuations hit unreal heights ($4 trillion to $5 trillion).

Meanwhile, climate impacts escalated; political winds don’t change actual winds. For example, part of Los Angeles burned to the ground (at an estimated cost of up to $250 billion) during unprecedented wildfires, historic heat baked India, Pakistan, and the EU, and devastating floods in Texas killed dozens of children. Scientists told us that climate change is “beyond scientific dispute,” at “tipping points,” and “extremely dangerous” (and that the world will blow past the 1.5C warming target). Insurer Allianz issued an eye-popping report that climate change could “destroy capitalism.”

In addition, the world got less democratic and pulled to the right and generally away from the sustainability agenda, making collective action even harder. This puts more pressure on businesses. And even facing headwinds, sustainability didn’t die. That’s the top story of the year. Let’s look at that and some other big themes.

Well … yeah. But if pessimism feels effortless at the end of 2025, that is not just because the news is bad; it is because you are mainlining it, in real time, on an interface designed never to run out.

Much of our success as a species is driven by two factors: a good plan and resilience in executing it. The media’s business model tends to emphasize doom because, well, doom sells. But 2025 offered remarkable evidence that when we commit to sustained action—plugging ozone holes, protecting beaches, installing solar panels, developing breakthrough medicines, restoring ecosystems—we can achieve transformations that once seemed impossible.

In our draft letter, what follows are eleven pages of incredibly consequential, positive developments. Chip’s anguished plea, “have mercy on their eyes!” led us to share the news in two forms: a dozen bullet points here and a dozen pages of detail in a sidebar story entitled, “The Big Box of Delights.”

So here’s what happened while doom was scrolling:

- Renewables overtook coal as the world’s largest source of electricity, and solar alone grew by 306 terawatt hours.

- China emerged as “the green giant,” adding twice as much solar as the rest of the world combined, including a single solar farm twice the size of Washington DC, and sold $180 billion in “green tech” to the rest of the world.

- India crossed an emissions inflection point, with their power sector carbon emissions actually falling as renewables surged.

- Clean energy investment surged, driven in part by AI’s power needs and tens of billions of private investments in batteries, nuclear, and solar.

- Green energy stocks outperformed traditional markets with the S&P Global Clean Energy Index up 46% by Christmas, beating the S&P 500, Nasdaq 100, and MSCI World Index.

- Corporate sustainability investments accelerated … quietly. As it turns out, sustainability makes sense, and an Accenture survey of global CEOs found 99% planned to maintain or expand sustainability while avoiding the press conferences that send the clown cars crashing in their direction.

- Economies have decoupled growth from emissions at scale; that is, there is no longer a correlation between economic growth and carbon growth because of, well, all that stuff above.

- Ireland ended coal power generation, which makes me smile. There’s a growing cadre of European nations on the same path.

- Lenacapavir, a revolutionary HIV prevention drug, reached Africa in record time. As in 2,000,000 doses of a drug that has 100% efficacy in preventing infections among women and 96% efficacy among others.

- Disease elimination victories multiply (except apparently in the US, where we wiped out measles in 2020, then decided that a Healthy America needed mass disease outbreaks). Three more countries eliminated malaria. A half dozen eliminated trachoma, which causes blindness. Special note to readers in Dallas: Cabo Verde, Mauritius, and Seychelles eliminated both measles and rubella. Check with the state health department about how they managed the feat with measles in Texas spiked.

- Cervical cancer vaccination reaches 86 million girls.

- Brain-machine interfaces – a combination of sound decoders and AI – restored speech to an ALS (“Lou Gehrig’s disease”) patient, offering hope for thousands. Hmmm … what else?

- Shades of “Finding Nemo,” green sea turtles have returned from the brink of extinction, and 20 other species were “downlisted” from threatened status by the International Union for the Conservation of Nature.

- High Seas Treaty, which the US signed but the titans in the US Senate refuse to vote on, enters force and provides a framework for preserving global biodiversity.

- Marriage equality advanced in Asia and Europe, baby steps admittedly, Poland abolished its last “LGBT-free” zones, and Kazakhstan criminalized bride kidnapping. No, literally. “Alyp qashu.” Brides were abducted and abused ‘cause … traditional values?

- Agrivoltaics, the practice of combining agriculture with solar arrays, is booming. It turns out that crops and cattle both thrive when they get protection from the summer sun.

- And, too, there was the drunk raccoon that united a nation.

In November, a liquor store employee in Virginia discovered broken bottles and an apparently intoxicated raccoon sleeping on the store’s bathroom floor. An animal control officer noted that he fell through a ceiling tile, “went on a rampage, drinking everything,” with a special fondness for … umm, whisky. The animal showed no signs of injury, according to local animal protection services, though they guessed the raccoon might be grappling with “a hangover” and regret over “poor life choices.”

The story delighted readers across the political spectrum—a rare moment of shared laughter in a divided time. But it became more than a viral moment when merchandise commemorating the raccoon’s night of debauchery raised a quarter of a million dollars for the local animal shelter that housed him. The Hanover County animal protection service teamed up with apparel maker Bonfire to create shirts, sweatshirts, cups, and stickers featuring the now-infamous image of a raccoon spreadeagled next to a spilled booze bottle, along with the words “Trashed Panda.” Through 12/22, they’ve sold 19,764 against a goal of 20,000.

The drunk raccoon reminds us that hope sometimes arrives in unexpected forms: in a hungover raccoon that brings people together, in merchandise that funds animal care, in our capacity to find joy and meaning in the absurd.

On Christmas Day, Pope Leo made his traditional papal “Urbi et Orbi” address, Latin for “To the City and to the World,” which summarizes the bad news (see above, plus your danged doomscroll) and prescribes a response: put aside indifference, stop scrolling and start acting, stand with the oppressed rather than the oppressive. “There will be peace when our monologues are interrupted and, enriched by listening, we fall to our knees before the humanity of the other.”

Stop wasting our time demonizing one another? Dreamer.

Progress is rarely dramatic. It’s built day by day through the determined efforts of scientists, healthcare workers, conservationists, educators, and ordinary citizens working to solve problems both great and small. While 2025’s headlines often focused on conflict and crisis, millions of people worldwide continued humanity’s long tradition of quietly building a better world.

They dreamt of better, and acted.

The answer to “what’s there to be optimistic about?” is the same as it was in 2025, and will be in 2027: enormous things happened because millions of good people rejected the counsel of despair, and that you probably didn’t hear about because doom sells better than progress. The choice isn’t between naive optimism and realistic despair. It’s between staying informed about what’s actually happening—the turtle populations recovering, the emissions curves bending, the diseases being eliminated, the hungover raccoons raising money for animal shelters—and letting a curated feed of catastrophe convince you that nothing good is possible.

Step away from the mediated world and step into the immediate one. Put your phones away. Hug someone today. Smile at a stranger. Do a good deed. Read a book. We recommend Always Remember (2025), a singularly beautiful little 30-minute read that reminds you of important things you already know but need to hear. Subscribe to Nautilus, a site (and magazine) that reminds you that science is cool … and important. Consider joining The Conversation, a site that has actual researchers write clear articles about important topics (“Deepfakes leveled up in 2025. Here’s what’s coming next.”)

Be like Jimmy the President. Be like Leo the Pope. Be like the Drunken Raccoon.

Make a difference where you are.

(Want cool pictures, more detail, and a couple more stories? Open “The Big Box o’ Delights.” Or, if you’re in the long-scroll version, just keep scrolling!)

What would you do if you had no idea of what’s coming?

The question’s not hypothetical, at least for investors. In truth, you have no idea of what’s coming. If you knew, you’d be richer than Croesus.

Two things are true when we stand in the river of time: we can see neither the river’s bottom nor what’s coming at us from just around the bend. The bottom might fall out. The torrent might be nearly upon us. We cannot know, but we’ve still got to act.

In general, the guides that professionals use are called “capital market assumptions” – data-driven estimates of the range of likely outcomes given current inputs. “Given a CAPE of 40 and capex spending of X, the likeliest range of US equity returns over the next 3-5 years falls between…” The recommendations that flow from those assumptions are called “strategic asset allocations,” statements that say broadly “a prudent investor with an intermediate time horizon should plan on holding X% in equities, with the possibility of some adjustments as markets evolve.”

The problem is that there are a million factors weighing on markets, but not all million – birth rates in Nigeria? thawing permafrost in Siberia? financial nihilism in Gen Z? – can be incorporated into the models. Different trillion-dollar advisors reach very different trillion-dollar conclusions about what course to chart.

Two of the largest firms – BlackRock and Vanguard – seem to have reached starkly different conclusions about prudent investor behavior. Given Vanguard’s intrinsic conservativeness, their new recommendation seems particularly tectonic.

Vanguard’s call: For investors with a medium-term outlook (3-5 years), flip the traditional 60% stocks/40% bonds allocation to 40/60. Same expected returns as 60/40, but with substantially less risk. Why? The S&P 500’s CAPE ratio sits at 40.40 – rivaling the dot-com bubble peak. Vanguard projects US equities will return just 3.5% to 5.5% annually over the next decade, while growth stocks (including the Magnificent Seven) may deliver only 2.3% to 4.3%. Meanwhile, bonds now offer 3.8% to 4.8% with far less volatility. Roger Aliaga-Díaz, Vanguard’s global head of portfolio construction: “We see that overvaluation of equity markets more as a risk to the investor than as opportunity.”

This isn’t panic or market timing. In a December podcast, Vanguard’s chief economists explained that “stay the course” never meant “never adjust your allocation.” It meant stay invested, avoid emotional decisions, but use evidence-based risk management. Their Time-Varying Asset Allocation model – driven by the Vanguard Capital Markets Model that processes decades of data on risk factors and returns – now suggests this is a moment for conservative asset allocation. They estimate a 25-30% probability that AI disappoints and fails to deliver on current expectations.

Goldman Sachs concurs on muted US prospects, forecasting just 6.5% annual S&P 500 returns through 2035 – driven by earnings, not the multiple expansion that powered the last decade. They see better opportunities elsewhere: Emerging Markets (+10.9%), Asia ex-Japan (+10.3%), Japan (+8.2%). The “multiple expansion era” is over, they argue. Profit margins already jumped from 5% in 1990 to 13% today and can’t expand further.

BlackRock takes the opposite view: Stay pro-risk, overweight US stocks on the AI theme. Yes, valuations are stretched, and concentration is concerning, but AI capital spending is transforming the economy at an unprecedented scale. The challenge isn’t whether to reduce equity exposure – it’s identifying which companies beyond the current winners will capture AI revenues as they spread across sectors. Their 2026 outlook emphasizes “the diversification mirage” – that traditional diversifiers like long-term Treasuries now offer diminished cushion, so seek idiosyncratic returns in private markets and active strategies instead.

T. Rowe Price splits the difference: Neutral on equities overall but underweight US large-cap (-2.0%) while overweight small-cap, international, and emerging markets. They’re concerned about “the narrowness of AI trends” and prefer to position for market broadening. Like Vanguard, they’re underweight long-term bonds, worried about fiscal deficits keeping upward pressure on rates.

What’s an investor to make of this? The honest answer is that nobody knows what’s upstream. Vanguard’s systematic approach says: when you can’t see around the bend, measure what you can – valuations, yields, historical risk/return relationships – and position defensively. BlackRock’s view: the AI build-out is real, the momentum is powerful, stay engaged but stay nimble. Both might be right over different time horizons.

The shift isn’t just theoretical. Our colleague Lynn Bolin has reduced his overall stock allocation from 65% to 50% over the past year, positioning his conservative Core TIRA portfolio to weather what he expects will be a more turbulent second half of the decade. My own long-term allocation, which we discuss each February along with my portfolio, is 50/50.

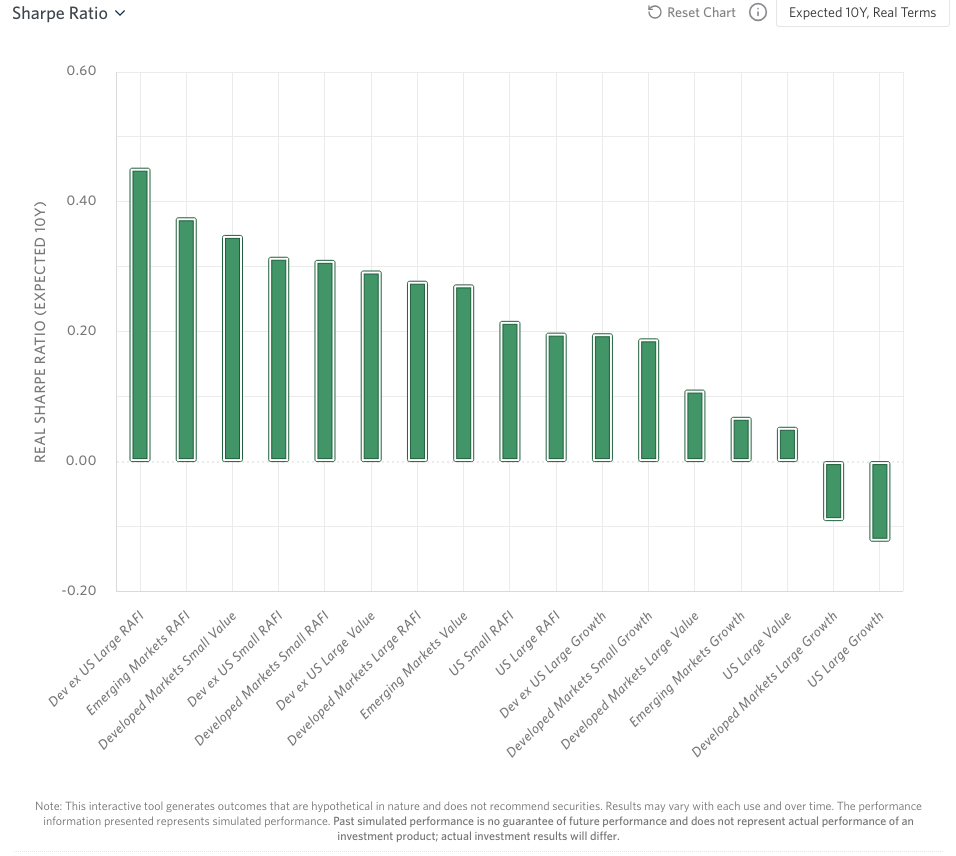

Research Affiliates, whose long-term asset allocation system has been broadly validated, offers striking support for the defensive shift. Their models project that a global 60/40 portfolio will deliver just 2.5% real returns over the next decade with a Sharpe ratio of 0.16. Their conservative model portfolio – shifting to 40% equity/60% bonds with commodities and inflation-linked assets – projects 3.5% real returns with a Sharpe ratio of 0.44. The more defensive portfolio projects higher returns with better risk-adjusted performance.

Their analysis also reinforces Goldman’s geographic thesis: looking across asset classes globally, US large-cap growth shows near-zero risk-adjusted returns (Sharpe ratio of -0.01), while developed ex-US large-cap value, emerging markets, and smaller international stocks all show meaningfully better prospects. The message is consistent: lighten on US growth, reduce overall equity exposure, look globally.

The takeaway isn’t that one firm has discovered the answer. It’s that even trillion-dollar asset managers using sophisticated models reach honestly different conclusions from the same data. Vanguard says reduce equity risk because valuations are stretched and bonds are finally paying again. BlackRock says stay engaged because AI momentum is real and traditional diversifiers don’t work like they used to. Goldman says look elsewhere entirely – emerging markets and Asia offer better prospects than US equities. Research Affiliates’ models strongly favor the defensive positioning.

Which suggests that broad diversification driven by your needs – not by greed or fear or the confident pronouncements of any single adviser – remains the most prudent course when standing in a river whose depths and currents we cannot fully know. The evidence from multiple independent sources supports a more conservative stance than the traditional 60/40 for those with intermediate time horizons. Whether that means 50/50, 40/60, or some other mix depends on your own circumstances, goals, and capacity to weather volatility.

But the days of assuming that 60/40 will automatically deliver double-digit returns through multiple expansion and tech dominance? Those have already flowed past us.

Thanks, as ever …

To the good folks we’ve met along the way, and with whom we chat too rarely. To Andrew and Michelle Foster of Seafarer Capital Partners for their vision of a better kind of fund company, and their enduring success. To Mark and Tina Oelschlager, the folks behind the small and excellent Towpath Focus Fund, for thoughtful talks and cheerful humanity … and enduring success. To Amit Wadhwaney of Moerus Worldwide, one of those remarkable people who make you feel like you become wiser, perhaps better, just talking to him. To Dave Sherman, founder of Cohanzick / CrossingBridge, whose formidable intellect and Tigger-like energy has translated into a bunch of funds that consistently honor the credo, “return of investment is more important than return on investment.” To the inestimably talented Charles, maestro of MFO Premium, whose tools deserve about ten times the attention – and financial support – that they receive. To Chuck Jaffe, aka “Hurricane Chuck,” who’s still at it after all these years, and to Dan Wiener, who our colleague Ed Studzinski denominated as Dan Dan the Vanguard Man, who has had the sense to take a step back and enjoy life. To our colleague Lynn Bolin, who has done likewise and yet writes better than ever, and to The Shadow, who might yet find cause to slow down. To Victoria Odinotska of Kanter Public Relations, a bright spirit and humane voice who toils bravely while under the burden of the ongoing assault on her beloved homeland. To the good folks at Long/Short Advisors and Cook & Bynum for keeping in touch, thoughtfully and consistently, over the years.

Finally, to our faithful subscribers and readers, thanks!

You have all made a difference.

L’Chaim!