Dear friends,

Welcome to the “Midsommar in Scandinavia” issue of the Mutual Fund Observer. Chip and I are enjoying a long-planned holiday in Sweden and Norway. We’re equally delighted that you’re here … and we’re there!

In this month’s Observer…

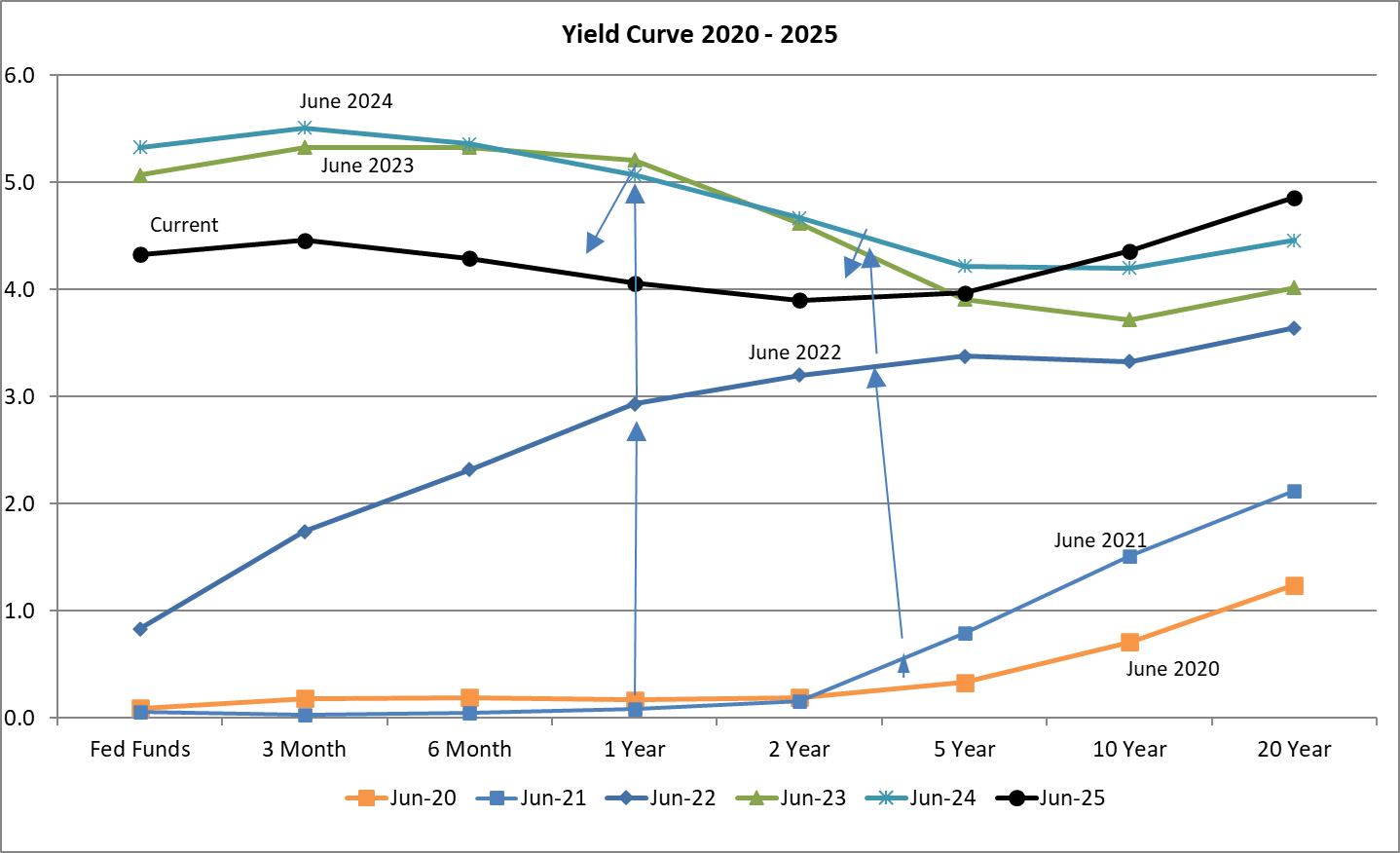

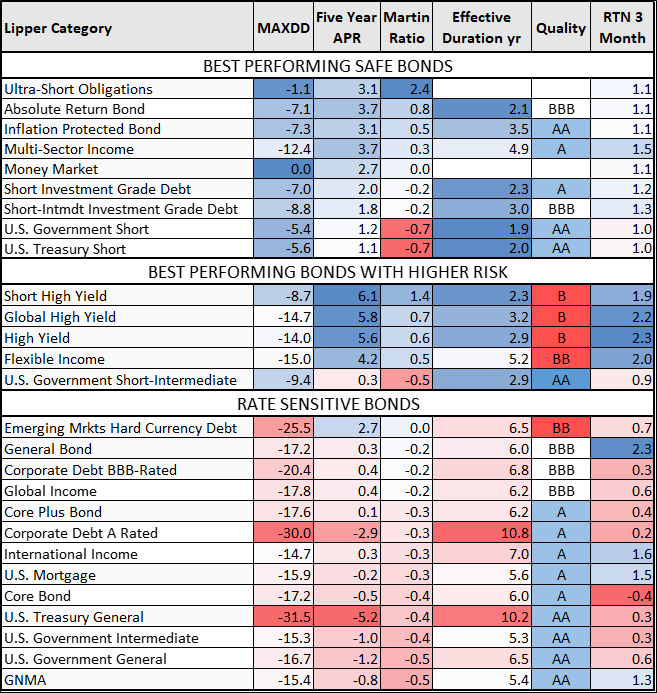

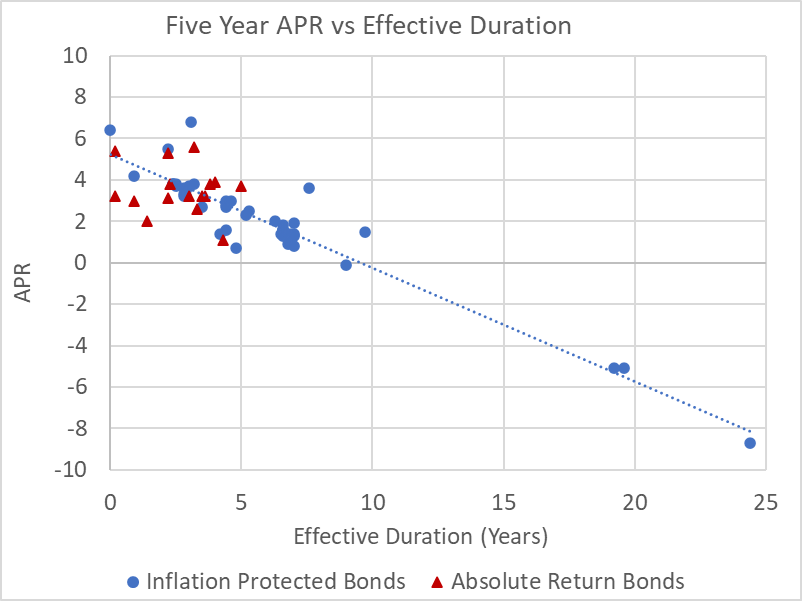

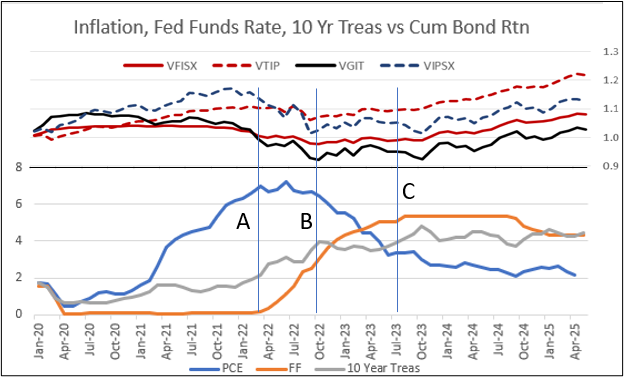

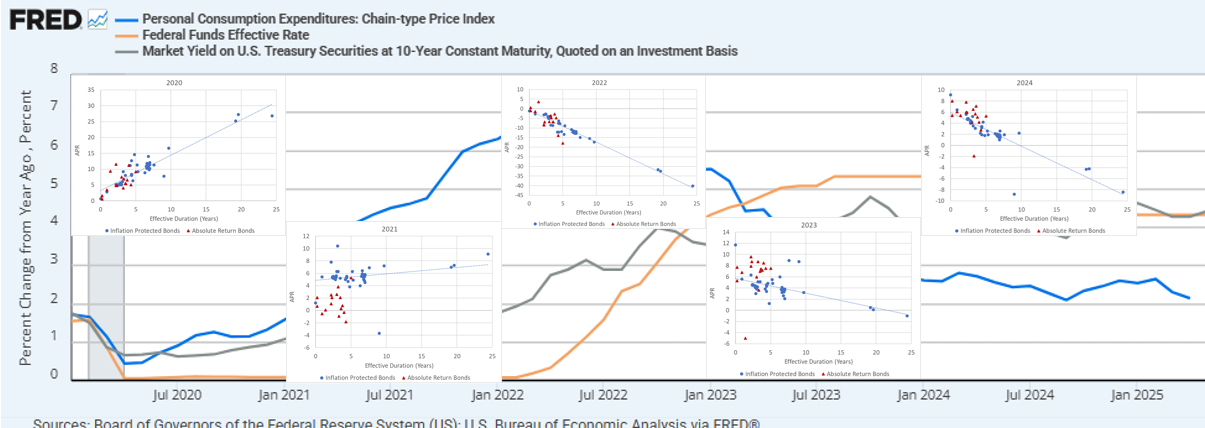

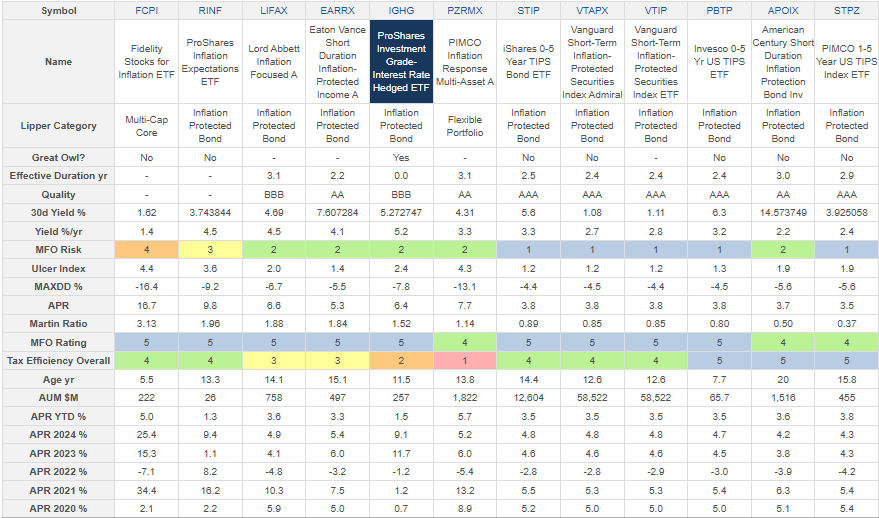

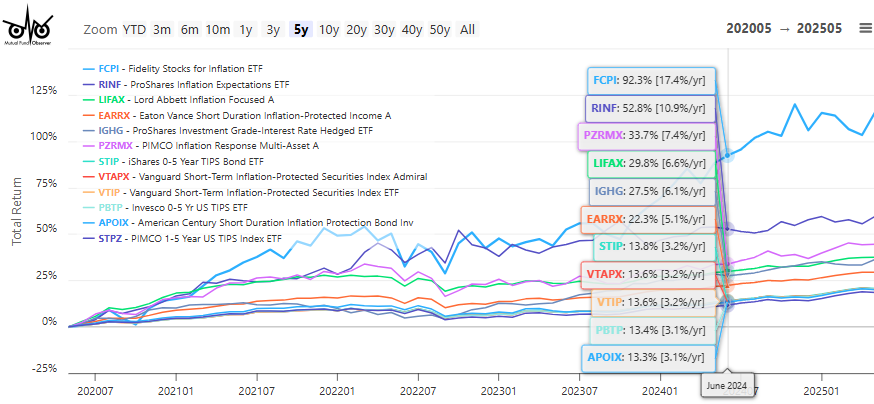

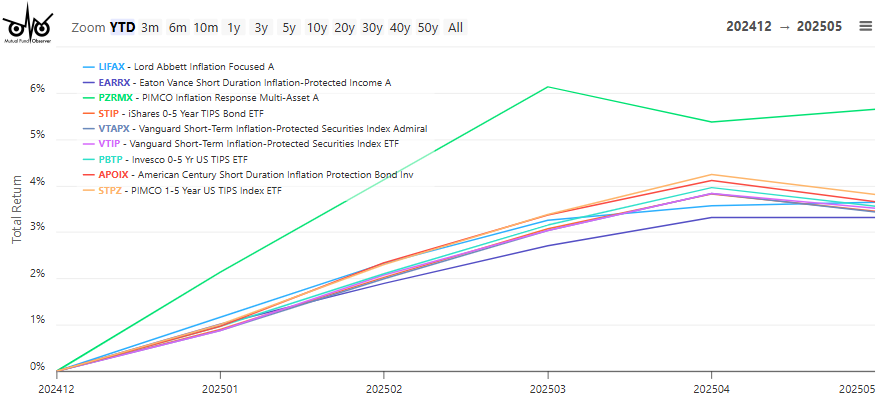

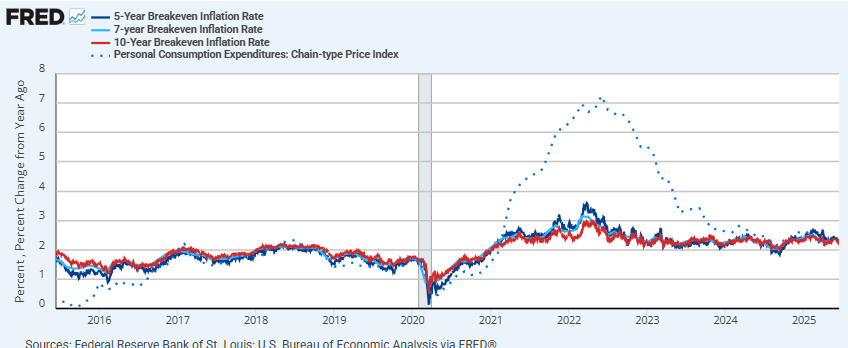

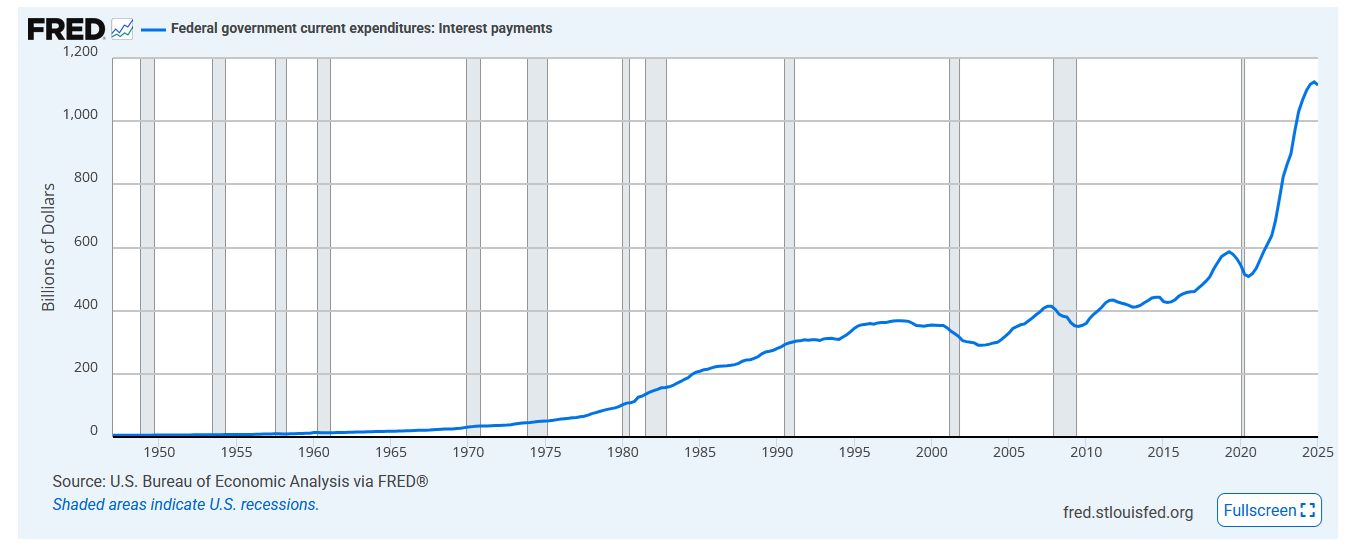

Among other things (how would I know for sure? I’m in Gamla Stan), Lynn Bolin addresses the emerging threat of tariff-induced inflation with “Protecting Against Tariff Induced Inflation,” analyzing how widespread tariffs will likely be passed through to consumers and drive inflation to an estimated 3.4% peak next quarter. Drawing on five years of post-pandemic bond performance data, he demonstrates that shorter-duration and inflation-protected securities have significantly outperformed traditional intermediate-term bonds, leading him to rotate into funds like Vanguard Short-Term Inflation-Protected Securities Index (VTAPX), Fidelity Inflation-Protected Bond Index Fund (FIPDX), and PIMCO Inflation Response Multi-Asset Fund (PZRMX). Bolin has reduced his stock allocation from 65% to 50% and now maintains approximately 7% of his bond allocation in inflation-protected securities, with another 40% in shorter-duration bonds, while also incorporating target-maturity TIPS ETFs like iShares iBonds Oct 2030 Term Tips ETF (IBIG) into his bond ladders.

America’s premier Asian investment boutique, Matthews Asia, has fallen on hard times. Former CEO and portfolio manager Mark Headley has returned from retirement, intent on fixing that. Our hour-long interview is summarized in “Good Bones There.”

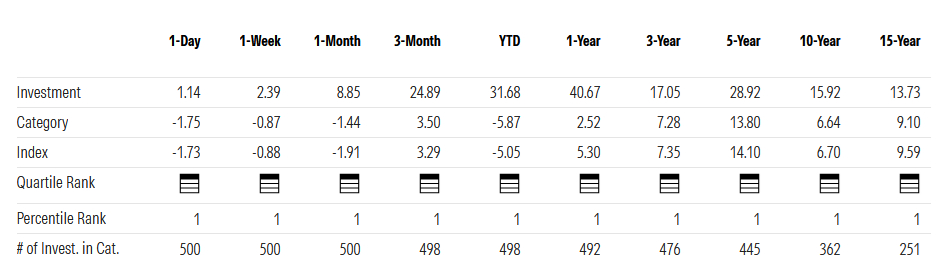

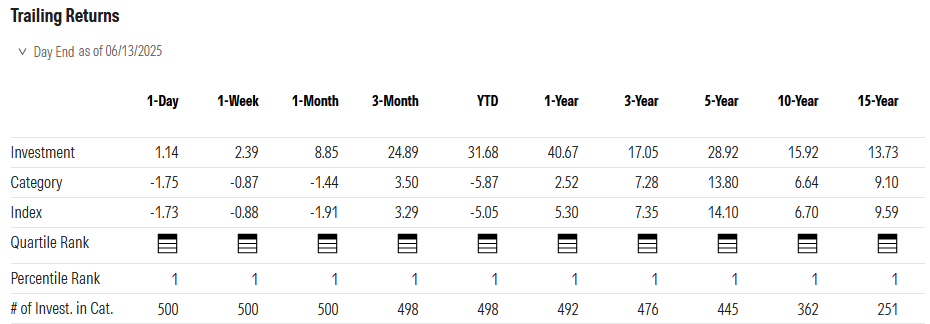

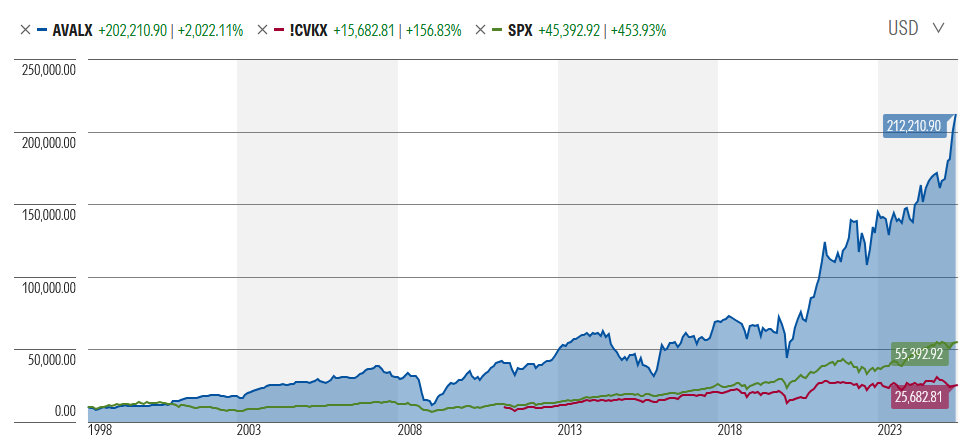

Without any doubt, the most successful small-cap value fund in existence is Scott Barbee’s Aegis Value Fund. We last shared a full profile of the fund in 2013, but it has appeared in eight data-driven articles since then. We decided it was high time to catch up with Mr. Barbee and correct our oversight in a profile of Aegis Value Fund (AVALX).

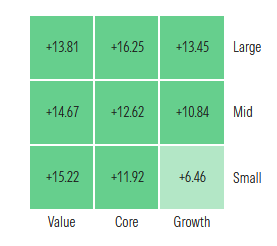

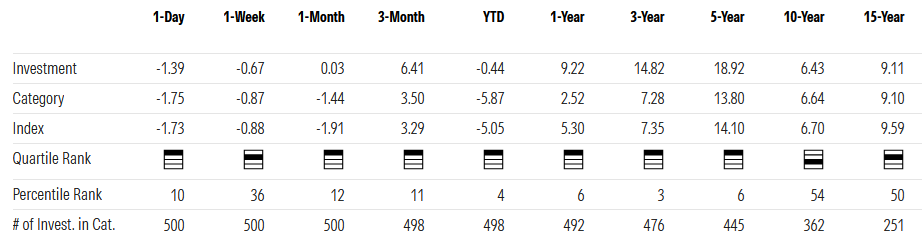

Three years ago, in the midst of a market meltdown (do you even recall the ’22 crash now), we offered advice on how to cope with a … ummm “spanked portfolio.” The whimsical accompanying graphic generated a surprising amount of site traffic. This month, we offer a three-year retrospective on our 2022 advice: keep calm and consider small-value funds with high-quality portfolios. The performance numbers seem promising.

We also share a Launch Alert for Stewart Investors Worldwide Leaders Fund, the US launch of a successful non-US strategy focusing on a concentrated portfolio of high-quality, sustainable businesses. The launch was seeded by a US foundation, so the initial share class is institution with retail in the pipeline!

Bubbling just below the surface

Hedge funds are shifting to Asia. Goldman Sachs reports that hedge fund trading in Asian markets have a five-year high in June. “Hedge funds bought equities in Japan, Hong Kong, Taiwan and India last week, but were short selling onshore Chinese stocks,” Goldman said.

Family offices are shifting to infrastructure and private debt. A BlackRock survey of 175 family offices, the investment manager for ultra-wealthy families, reports that one-third were planning to increase exposure to private debt this year and 30% were planning to commit more resources to infrastructure investments.

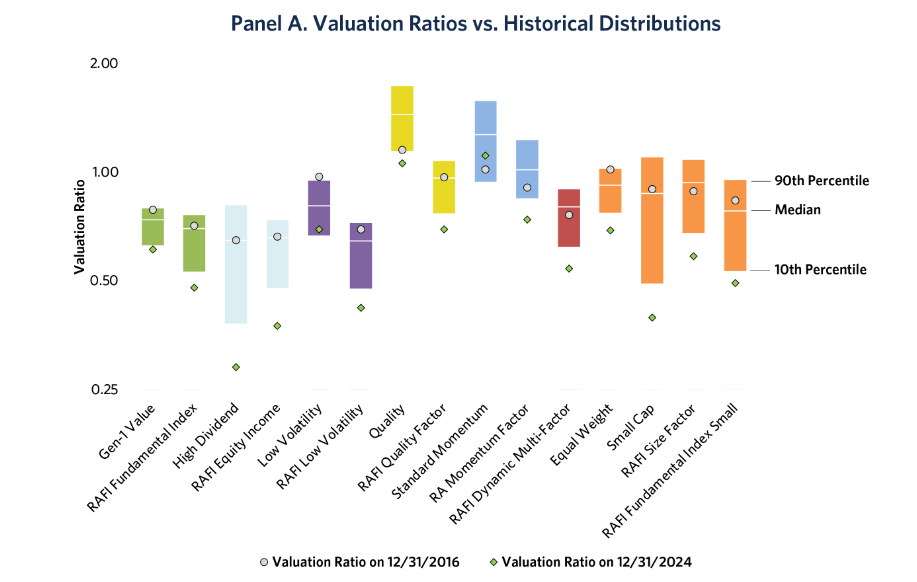

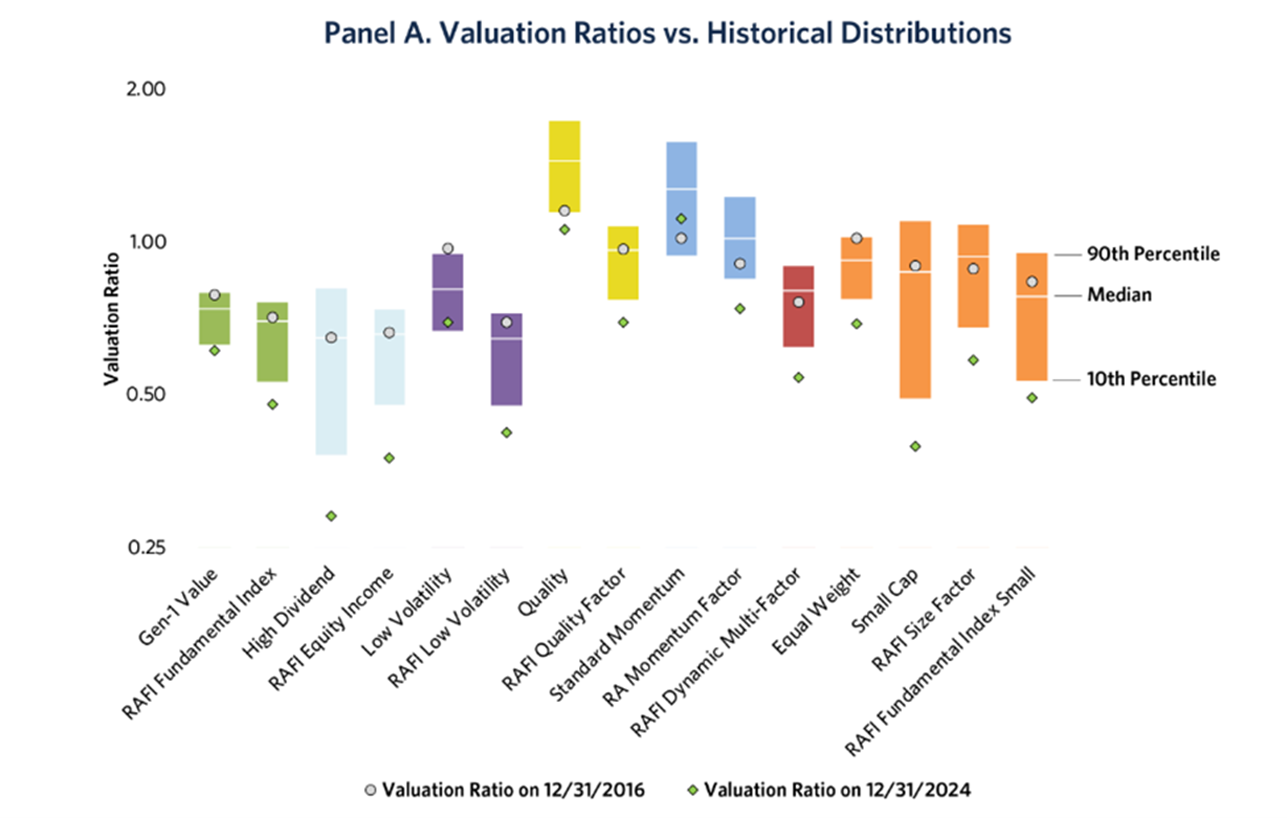

Almost every smart beta (e.g., low volatility or fundamental valuation) strategy has failed to produce, according to new research from Research Affiliates (free registration required). The short version: RA has been tracking the performance of a series of factor-based portfolios since 2018, looking to see whether any provided the promised excess return.

They did not. In every case, just investing in “the market” was a better bet.

The good news: “the market” – defined by its large / growth / momentum subset, is now so egregiously overpriced that almost everything outside of that niche is dramatically underpriced.

The way to read that chart is to start by finding the little green diamonds. Those are the more-or-less current valuations of each strategy relative to its historic valuations. Green diamonds below the colored bar, which illustrates the historic range from 10th percentile to 90th, signals that the strategy is now cheaper than it has been 90% or 95% of the time.

RA concludes that’s good news since valuation matters:

… we believe there may be hope for all smart beta strategies. If markets receive a wake-up call and valuations revert, a multitude of systematic factor-based equity strategies could all have a field day. After eight years of going horribly wrong, smart beta investing may now go horribly right.

AI is a lot dumber than we thought. A series of research reports, most recently from Apple, argue that while AI can execute certain tasks exceptionally well, reasoning is not among them. The researchers found that in simple reasoning tasks, including the Towers of Hanoi challenge, AIs underperform 7-year-olds. Their central argument is that even the most advanced LLMs do not think in any way that resembles us. Their conclusion is that AI “thinking” is not just different, it’s horrible. (Gary Marcus, “A Knockout Blow for LLMs? LLM ‘reasoning’ is so cooked, they turned my name into a verb,” Communications of the ACM, 6/16/2025).

As the complexity of demands rises, moving AI beyond its comfort zone, so does the frequency of hallucinations. One estimate is that 79% of responses from some of the newer AI contain hallucinated content (“A.I. Is Getting More Powerful, but Its Hallucinations Are Getting Worse,” New York Times, 5/6/2025, subscription required).

A coda to that argument: ChatGPT just lost a chess match to an Atari 2600. If you’re, oh, under 50, you can be forgiven for the question “WTF is an Atari?” because the 2600 is a home video game console released in 1977. ChatGPT actually volunteered to play the old game system. Oops. One report of the match contained this summary:

In fact, the Atari wiped the floor with ChatGPT when it came to chess. I don’t mean the near-half-century-old game console won. I mean that ChatGPT made blunders that would embarrass the greenest of beginners.

On the upside, perhaps it thinks it won? “So I said ‘here, hold ma beer an’ gimme a knight an’ I kicked its little Atari keester all the way to …’”.

AI is dirtier than we thought. Not “smutty dirt” (though that’s nice, too) but “energy- and water-gulping dirty.” MIT researchers found two troubling trends: AI data centers use more power and more power derived from fossil fuels than “normal” data centers:

… more than half of the electricity going to data centers will be used for AI. At that point, AI alone could consume as much electricity annually as 22% of all US households. Meanwhile, data centers are expected to continue trending toward using dirtier, more carbon-intensive forms of energy (like gas) to fill immediate needs, leaving clouds of emissions in their wake. (“We did the math on AI’s energy footprint. Here’s the story you haven’t heard,” MIT Technology Review, 6/2025)

Part of the challenge is that AI companies seem desperately concerned with obscuring the magnitude of their energy and water use, which some suspect sounds like a guilty conscience at work.

AI users are stupider than we thought. Folks have casually and constantly observed the tendency of people to be lazy, turning to AI to do their work and thoughtlessly passing it along as their own. The underlying phenomenon is called “cognitive offloading.” It’s driven by two biological imperatives: humans have a limited supply of energy each day and thinking requires a lot of energy. Our survival response is to think as little as necessary to get through the day. The polite term for us is “cognitive misers.” We rely on tricks, shortcuts, and habits – none of which require much energy – to muddle through. But we also offload tasks – we delegate – whenever possible. As a quick test, how many telephone numbers can you recite off the top of your head? (No, 9-1-1 doesn’t count.) When I was young, the answer was probably “dozens.” Today, it’s probably two or three (my own, Chip’s, and my son’s). I count on my phone to keep track of the rest. That’s cognitive offloading.

A second set of MIT researchers, the Brain on Large Language Models team, has been doing fairly rigorous research on how our brains respond to the availability of AI/LLMs as an offloading option. (Spoiler alert: not well.) Most recently, they gave three groups of students the same task. One group had access to ChatGPT, one had access to Google, and the other had to think for themselves. (Yikes.) The study ran over four months and included both brain activity monitors and direct observation. Their findings:

Brain connectivity systematically scaled down with the amount of external support: the Brain‑only group exhibited the strongest, widest‑ranging networks, Search Engine group showed intermediate engagement, and LLM assistance elicited the weakest overall coupling … The reported ownership of LLM group’s essays in the interviews was low. The Search Engine group had strong ownership, but lesser than the Brain-only group. The LLM group also fell behind in their ability to quote from the essays they wrote just minutes prior. (Your Brain on ChatGPT, 6/2025)

The short version: the brains of Chat-dependent students literally powered down and while the students nominally completed the work themselves, they had little belief in their own written conclusions and couldn’t quite remember what they’d just said.

Rather as we can’t quite remember our sibling’s phone number five minutes after we called them.

Job opening: Best billionaire friend

The White House apparently has an opening for a new Best Billionaire Friend (BBF) after a spectacular fallout between Mr. Trump and the previous holder of the position, Mr. Musk. Mr. Musk, who invested heavily in Mr. Trump’s election campaign, left government service, such as it was, denounced Mr. Trump’s signature legislative package as “a disgusting abomination” and endorsed a call for Mr. Trump’s impeachment. He nonetheless affirmed his “love for the guy.”

Two of Mr. Musk’s associates attribute the fallout to Mr. Trump’s failure to give Musk and Tesla favorable treatment under the bill. “Elon was butthurt,” according to one source. Musk threatened to decommission his fleet of Dragon spacecraft. Trump threatened to “terminate Elon’s Government Subsidies and Contracts” and to investigate his business practices. Musk caved.

We’ve written a fair amount about the history and enduring psychology of these alliances (“If you’re so rich, why aren’t you smart?” LinkedIn, 4/2025).

Two things to remember:

- This is not aberrant behavior; it’s a perfectly predictable sequence of events driven by well-documented psychological research (it is exceedingly difficult to amass vast wealth with the presence of high risk tolerance and indifference to negative externalities) and repeated endlessly over the course of the past 125 years. The ultra-rich cozy up to authoritarian rules, hoping to trade support for future wealth. It goes poorly.

- This needs to be an important filter for investors, everyday and professional alike. Recent headlines begin with “Bill Ackman says …” or “Five places billionaires are putting their money” should raise your shields, not your hopes. With vast respect for Mr. Ackman’s acumen at making himself very, very rich, neither his political preferences nor his investment activities ought to guide your thinking. They are manifestations of his world and interests, not yours.

Fortunately, the BBF position is likely to be swiftly filled. UBS reports (6/2025) that there are now 31 people with wealth in excess of $50 billion dollars.

Queue forms to the right!

Thanks …

To all of the folks helping to make our Scandinavian sojourn amazing!

We asked, you answered!

Thanks so much to all the folks who shared good wishes and travel advice for our upcoming Scandinavian adventure: Stuart, Leah, Marjorie, DGH, and Roger. Thank you, thank you!

Stuart: the Vasa Museum is one of our must-see sites! Gotland and Stumholmen are saved for our next trip.

Leah: thanks for the sweater advice – we’re setting aside a budget for Bergen. And Chip might be booking a table at Bryggen Tracteursted as I write.

DGH: Pending good weather, the Norse Folkemuseum and time to wander around Bygdøy are on the itinerary. Also, do we like cinnamon rolls? “Like” is such an understatement. WB Samson, got it!

Roger: We are doing the Norway in a Nutshell with an overnight in Flåm. Since you and Leah both made note of the hiking/walking opportunities, we’ll see what we can fit in. We also have Frogner Park on the list!

And, many thanks, always, to the steady contributors who help us keep the lights on and our spirits up: the good folks at S&F Investment Advisors, Wilson, Greg, William, William, Stephen, Brian, David, Doug, and Altaf. We’ll totally Fika with you ASAP!

We’ll see you in August and share the adventure!