Updates

The Last Titan departs: Fidelity’s last great star manager, Will Danoff, is preparing to leave the stage after nearly four decades at the firm and 35 years at the helm of Fidelity Contrafund, with his retirement slated for the end of 2026.

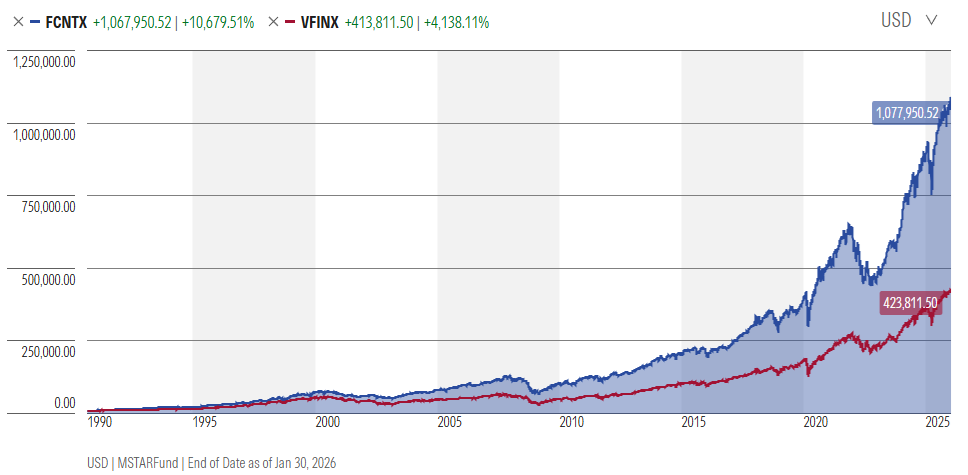

We have long argued that Fidelity in the 21st century had a great many good managers but only two transcendent ones: Joel Tillinghast at Low-Priced Stock and Will Danoff at Contrafund. They both had the ability to make elephants into ballerinas. Mr. Danoff’s fund has spent the century wavering between huge and huger … it currently holds $180 billion in assets and has, since Mr. Danoff became manager in September 1990, beaten the S&P 500 by 292 bps annually

What does that translate to, you ask? Well, it translates to a 10,679% cumulative return for his investors. The S&P 500 looks like a junior varsity team in comparison.

Now in his mid‑sixties, Danoff joined Fidelity in 1986 after Harvard (a history major, another liberal arts success story) and Wharton, apprenticed under Peter Lynch, and in 1990 took over a then‑modest Contrafund that he proceeded to turn into one of the industry’s flagship behemoths. Fidelity, understandably anxious, has opted for a gradual and very public transition: longtime internal managers Jason Weiner and Asher Anolic were added as co‑managers in 2025 and are already running a meaningful slice of the portfolio. The plan is for the duo to assume full control of Contrafund and its related mandates by the close of 2026 while Danoff steps back into an advisory role, offering investors continuity of process even as the personality at the top changes. For shareholders who built decades‑long relationships with “Will” more than with a ticker symbol, it marks the end of an era—and a live experiment in whether a franchise fund can outlast the franchise manager.

Morningstar has placed Contrafund under review, sensibly enough.

FPA Queens Road Small Cap Value gains a second manager. The FPA Queens Road Small Cap Value Fund announced today that Ben Mellman has been named Co-Portfolio Manager alongside Steve Scruggs. Mr. Mellman has served as Senior Analyst on the Fund since 2022, before that he spent a decade at International Value Advisors (IVA), and his new role commenced on January 15, 2026. If the name IVA seems familiar, it should be. IVA was a small but highly regarded global value shop founded by First Eagle alumnus Charles de Vaulx and known for its cautious, cash‑heavy, balance‑sheet‑focused discipline. IVA ultimately closed its funds and wound down the firm in 2021 after years of outflows and style headwinds, but its research culture produced analysts with a pronounced bias toward downside protection rather than benchmark‑hugging. It should be a good team, and both managers are heavily invested in the small cap fund already.

Briefly Noted . . .

Mr. Trump’s Trump Media & Technology Group is acquiring the God Bless America ETF (YALL), likely sometime during the second quarter of 2026. It will be rebranded as the sixth Truth Social ETF. Two quick notes:

- Trump Media & Technology Group stock remains underwater since its inception. Offered at $16, its last trade in January 2026 was 12.78. Morningstar has assigned a “fair value” as high as $87 (in 10/2024) to the stock. Its current assessment is $19.72. They also flag the firm for “moderate” business ethics risks. The firm’s revenues are under $4 million / year.

- The Truth Social ETFs launched in December 2025 and, collectively, hold under $50 million. Their investment strategy, collectively, is “Trump’s right.” All are managed by Matthew Tuttle, who oversees 63 ETFs and, so far as we can determine, invests in none of them. Given that the lineup leans toward “marginal” or stunt‑like ideas is consistent with the prominence of products like the Inverse Cramer ETF and the concentration in single‑stock leveraged trades rather than broad, persistent strategies being typical, Mr. Tuttle is probably well-advised in keeping his money well clear of this crew.

Janus Henderson is buying Richard Bernstein Advisors (RBA) to bulk up in model portfolios and SMAs, bolt on a credible macro “house view,” and deepen U.S. wealth‑channel distribution; the deal is expected to close in Q2 2026 and matters mainly if you own RBA‑run models/SMAs or care about Janus’ strategic tilt toward advice‑driven flows. In the best case, for fund investors, Janus might be acquiring some additional analytic expertise from RBA’s top-down macro teams. Otherwise, meh.

Launches and Reorganizations

The BlackRock GNMA Portfolio was reorganized into the iShares Mortgage-Backed Securities Active ETF (MBBA) on January 23, 2026.

Brandywine Asset Management is set to launch six ETFs in Q2 2026, with the goal of bringing institutional “risk replacement” strategies – full market exposure with downside protection – to a broader market. Here’s the short version from the managers:

We have gained traction in the qualified retirement plan space. Our six U.S. equity funds have outperformed their benchmarks by about 2% annually since inception, with 25% less maximum drawdown and advisors are using our Funds as replacements for their naked risk equity funds, which means they are moving client assets out of traditional unprotected equity positions and into our protected approach.

Now, in Q2 2026, we are launching nine ETFs that make Risk Replacement available to retail and wealth advisory markets for the first time. This is the same strategy that has been working in our institutional funds, now accessible to a much broader market.

On March 16, 2026, the Columbia Bond Fund becomes the Columbia Core Bond ETF, and the Columbia Integrated Large Cap Growth Fund becomes the Columbia Large Cap Growth ETF.

DoubleLine Securitized Credit fund was reorganized into the DoubleLine Securitized Credit ETF on or about January 30.

First Eagle Investments has filed for two additional ETFs, First Eagle US Equity (USFE) and First Eagle Mid Cap Equity (FEMD). First Eagle US Equity ETF will be managed by Matthew McLennan, Mark Wright, Manish Gupta, and Adrian Jones; First Eagle Mid Cap Equity ETF will be managed by William Hench. The ETFs net expenses ratio will be .45% and .55% for the First Eagle US Equity and First Eagle Mid Cap Equity ETFs, respectively.

Harbor Funds has launched its second ETF in a week, Harbor Active Small Cap Growth. The Harbor Active Small Cap Growth ETF will be managed by Bryon Place, an investment management firm with a net expense ratio of .80%.

Harbor AI Inflection Strategy ETF is subadvised by EARNEST Partners, whose portfolio managers combine deep fundamental research with firsthand operational experience with a net expense ratio of .88%. The fund will be managed by firm founder Paul Viera, who also manages (but does not invest in) the $2 billion, three-star Harbor Small Cap Value fund.

T. Rowe Price is launching its T. Rowe Price Innovation Leaders ETF (TXNT). The new active ETF is designed to provide diversified exposure to companies identified as leaders in innovation across sectors, such as technology, healthcare, and financials. It began trading today on the NASDAQ exchange. TXNT will be actively co-managed by two portfolio managers, Sean McWilliams and Som Priestly. The ETF’s net expense ratio will be 0.49%.

Small Wins for Investors

Champlain Small Company fund has reopened to new investors as of January 15th. The fund has been closed to new investors since October 2007.

Closings (and related inconveniences)

None in sight.

Old Wine, New Bottles

Effective March 10, 2026, the American Century Disciplined Core Value Fund will be renamed the Disciplined Value Fund.

Off to the Dustbin of History

ClearBridge Sustainable Infrastructure ETF (INFR) was liquidated on January 29, 2026.

The high price of defiance? Defiance Leveraged Long + Income AMD ETF, Defiance Leveraged Long + Income HIMS ETF, Defiance Leveraged Long + Income HOOD ETF, Defiance Leveraged Long + Income PLTR ETF, Defiance Leveraged Long + Income SMCI ETF, Defiance Leveraged Long + Income Ethereum ETF, and Defiance Trillion Dollar Club Index ETF were all liquidated on January 26, 2026. Admitted the HIMS caught our eye after the endless stream of radio ads for “For HIMS” sexual health products. And indeed, Morningstar reports, “Hims & Hers (HIMS) is one of the leading telehealth firms in the US. Since its 2017 launch, the platform has connected patients with healthcare providers across specialties including erectile dysfunction, hair loss, and weight loss.”

Democracy International Fund will be liquidated on or about February 23, 2026.

Driehaus Event Driven fund will be liquidated on or about March 27, 2026.

Harbor AlphaEdgeTM Next Generation REITs ETF will be liquidated on or about February 26, 2026.

Lord Abbett Emerging Markets Bond and Emerging Markets Corporate Debt funds will be liquidated on or about February 13, 2026.

Tradr 2X Long NEM Daily ETF and Tradr 2X Long QS Daily ETF were both liquidated on January 23, 2026. NEM is Newmont, a gold mining company (up 170% in 2025), and QS is QuantumScape Corporation, which makes solid-state batteries (and was up 70% in 2025).

WCM SMID Quality Value fund was liquidated on or about January 23, 2026.

Westwood Quality AllCap and Westwood Quality MidCap funds will be liquidated on or about February 24, 2026.