A tradition dating back to the days of FundAlarm was to annually share our portfolios, and reflections on them, with you. My portfolio, indolent in design and execution, makes for fearfully dull reading. That is its primary charm.

This is not a “here’s what you should own” exercise, much less an “envy me!” one. Instead, it’s a “here’s how I think. Perhaps it will help you do likewise?” exercise.

My portfolio and my life

By design, my portfolio is meant to be mostly ignored for all periods because, on the whole, I have much better ways to spend my time, energy, and attention. For those who haven’t read my previous discussions, here’s the short version:

- Your portfolio doesn’t love you; your family does. Give them your time.

- The market doesn’t need you; the world does. Give it your attention.

- “Beating the market” is completely irrelevant to me as an investor and completely toxic as a goal for anyone else. You win if and only if the sum of your resources exceeds the sum of your needs. If you “beat the market” five years running and the sum of your resources is less than the sum of your needs, you’ve lost. If you get beaten by the market five years running and the sum of your resources is greater than the sum of your needs, you’ve won.

That might be the single most important perspective you can take away this month. Investing is about having reasonable security in support of a reasonably rich life. Not yachts. Not followers. Not bragging rights. Life.

“Winning” requires having a sensible plan enacted with good investment options and funded with some discipline. It’s that simple.

My portfolio is built to allow me to win. It is not built to impress anyone.

My portfolio and stocks

Frankly, I have never made a fetish out of “stocks for the long run.” I view stocks in about the same way that I view chiles in my chili: the first half dozen are delightful, and after that they’re disastrous. (Chip, Will, and I were dining at a Vietnamese restaurant last year, and the owner quietly asked Will, “Do you mean white people spicy or Asian spicy?” Unable to lose face, Will made the choice that prevented him from tasting anything for the following three days.)

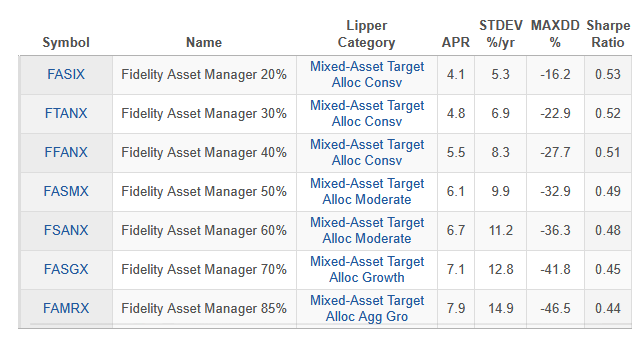

Stocks are like that. In just about any rolling 20-year period, adding stocks to your portfolio (a) raises its total return and (b) lowers its risk-adjusted return. Why? Because stocks are given to bouts of crazy volatility that cause investors to do incredibly self-destructive things. One illustration is the performance of Fidelity’s Asset Manager suite of funds, which differ primarily in how much equity exposure (20 – 85%) is permanently built into the fund.

Asset Allocation Implications – Great Financial Crisis to 2025

Over the past 18 years, your risk-adjusted returns (measured by the Sharpe ratio) fell consistently as your stock exposure rose. That’s anomalous only in this sense: usually, the decline in Sharpe and the gap in maximum drawdown are far larger than this table shows because this period captured an unusually severe bear market for bonds.

Since its inception, Fidelity Asset Manager 50% has returned about 8% with a volatility of about 9%.

Performance since inception of Fidelity’s 50% solution

And so I reached The 50% Solution. “50% what?” you ask? 50% everything. My portfolio targets 50% equity and 50% not, which translates to 50% growth and 50% stability. My equity portfolio targets 50% US and 50% not. My stability portfolio targets 50% bonds and 50% not.

That works for me!

My year-end 2025 allocation

| Domestic equity | Close enough | Traditional bonds | Underweight |

| Target 25% | 2025: 23% | Target: 25% | 2024: 11% |

| Also managed a 45% large cap / 55% small to mid-cap weight. | The low number here and high cash weight purely reflect my liquidation of two income-oriented T Rowe Price funds. | ||

| International equity | Overweight | Cash / market-neutral / liquid | Overweight |

| Target 25% | 2025: 33% | Target: 25% | 2025: 33% |

| This has been a pretty long-lasting overweight. The average US investor has 15% of their equities in international stocks, while I’m targeting 50% and sitting at 60%. | Rather a lot of my managers have found reason to hold a lot of cash of late. FPA, Leuthold, and Palm Valley all sit at or above 20%. | ||

Here’s what that looks like in terms of performance and volatility.

| Indolent portfolio | Annual return | Max Loss | Standard Deviation | Sharpe Ratio | Ulcer Index |

| 2025 | 13.9 | -1.1 | 4.3 | 2.23 | 0.2 |

| Three year | 11.1 | -5.3 | 6.4 | 1.00 | 1.2 |

| Five year | 6.4 | -15.9 | 7.6 | 0.41 | 5.3 |

The five-year performance looks bad because it includes 2022, when the stock market dropped 23%, and the bond market fell 13%. The Indolent Portfolio did better than either in 2022 and about 4% better than a hypothetical portfolio with the same weightings. And that’s been true most years: 1-2% better than a peer-weighted portfolio, 6-9% returns, volatility in check.

My investment choices

I own 10 funds. Yes, I know that’s more than I need. Some of the sprawl represents my interest in tracking newer and innovative funds, some represents a tax trap (I have a lot of unrealized gains), and some is indolence. A fund is doing fine, so why bother to change? The common theme across my fund is that I trust the managers implicitly. Andrew Foster, Steve Romick, Eric Cinnamond, David Sherman … I’ve had the pleasure of talking at length, about investing and life, with all of them. I trust them with my money, and in some ways, also “with my future.” They’ll have good years and other ones, and I’m comfortable with that.

In general, my core funds are equity-oriented, but the managers have the freedom (and the responsibility) to invest elsewhere when equities are not offering rewards that match their risks.

Core growth funds – 2025

| Weight | APR | Max Loss | Standard Deviation | ||

| FPA Crescent | Flexible Portfolio | 22% | 21.0 | -3.1 | 6.1 |

| Palm Valley Capital | Small-Cap Growth | 7 | 4.5 | -1.2 | 3.4 |

| Leuthold Core Investment | Flexible Portfolio | 6 | 14.4 | -4.8 | 8.3 |

| Brown Advisory Sustainable Growth | Multi-Cap Growth | 5 | 3.5 | -12.9 | 16.7 |

Leuthold and FPA are two very different versions of disciplined “go anywhere” funds; each seeks equity-like returns with sub-market risk. Leuthold is a quant fund; FPA’s bias is “absolute value.” Palm Valley Capital is the fourth incarnation of Eric Cinnamond’s strict small-cap discipline: he loves great stocks but would rather sit on hot coals than buy stocks that aren’t priced for exceptional gains. Lots of cash for long periods, which is frustrating for some and just fine for me. Brown Advisory was my choice for the best sustainable equity fund I could find.

Core income / market neutral funds – 2024

| Category | Weight | Return | Max loss | |

| T Rowe Price Multi-Strategy Total Return – fund liquidated | Alternative Multi-Strategy | 0% | ||

| T Rowe Price Spectrum Income – position liquidated | Multi-Sector Income | 0 | ||

| RiverPark Strategic Income | Flexible Portfolio | 7.0 | 6.3 | -0.7 |

| RiverPark Short Term High Yield | Short High Yield | 7.0 | 4.4 | 0.0 |

I bid a sad farewell to my two T. Rowe Price funds. Price chose to liquidate Multi-Strategy Total Return, which was designed to operate like a hedge fund, and had changed Spectrum Income’s strategy to eliminate its ability to hold high dividend stocks. I moved the entire Price portfolio to cash, which returned about 5%. And the two RiverPark funds are low-risk, credit-oriented investments. Short Term made money in 2022 when everything else faltered.

That whole “international overweight” thing – 2025

| Category | Weight | Return | Max loss | |

| Seafarer Overseas Value | International Small / Mid-Cap Value | 7.0% | 37.8 | 0.0 |

| Grandeur Peak Global Micro Cap | Global Small- / Mid-Cap | 14.0 | 13.2 | -4.1 |

| Seafarer Overseas Growth and Income | Emerging Markets | 9.0 | 32.5 | -0.3 |

In general, I’ve never understood why buying shares of large multinational corporations nominally headquartered in London would logically produce results different from buying shares of large multinational corporations nominally headquartered in Boston. As a result, my impulse was to look at smaller markets and smaller companies. In theory, that should work splendidly. In 2025, it made me look a lot smarter than I am.

Tasks for 2026

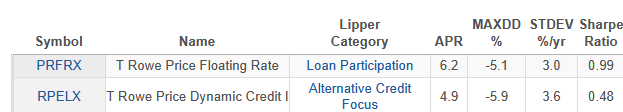

Invest the cash in my T. Rowe Price account. Given my age and the rest of my investments, there’s a limited argument for much equity exposure, so I screened for Price funds with decent Sharpe ratios and limited downside. One stands out; one is a possibility.

Five-year performance for two Price portfolio candidates

Alternatively, I could leave my cash in a high-yield money market (its current home) or transfer it to Schwab, where I have a broader array of choices. Research continues.

Figure out the Grandeur Peak story. Talk about a fall from grace. Grandeur Peak, for years, could do no wrong. Their founder went on a five-year sabbatical to work with his church; most of their funds suffered. As of July 2025, he’s back and has added himself as co-manager on Global Micro-cap.

Think about whether it’s a brave new world. It won’t make a world of difference, but the argument that the US has surrendered its financial primacy in global markets – both equities and income – as a result of fiscal irresponsibility and speculation, might encourage some internal shifts as I work toward responsible, risk-conscious investing.

Alternatives to my choices

It’s not necessary to own more than two or three funds to create an indolent portfolio. The key choice is whether you want to build substantial cash (or cash-like securities) into the mix or stick with stocks and bonds alone.

The Bogleheads endorse a three-fund portfolio, which does not consider “cash” to be an investment. Their process has two steps: (1) pick the asset allocation that’s right for you and (2) buy three low-cost index funds that give you exposure to the assets you’re seeking. Their default set is:

- Vanguard Total Stock Market Index Fund (VTSAX)

- Vanguard Total International Stock Index Fund (VTIAX)

- Vanguard Total Bond Market Fund (VBTLX)

Step One – “figure out your asset allocation” – is the tricky one there. A very simple two-fund portfolio – one flexible fund in the hands of a top-tier manager and one incoming producing fund similarly skippered – split 50/50 could replicate my portfolio and would require negligible maintenance.

The small investors indolent portfolio

| Lipper Category | Weight | APR | Max Loss | |

| Portfolio | – | 100.0% | 9.4 | -2.4 |

| RiverPark Short Term High Yield | Short High Yield | 50 | 4.4 | 0.0 |

| Leuthold Core Investment | Flexible Portfolio | 50 | 14.4 | -4.8 |

Alternately …

| Lipper Category | Weight | APR | Max Loss | |

| Portfolio | – | 100.0% | 12.0 | -1.9 |

| FPA Crescent | Flexible Portfolio | 50.0% | 17.6 | -3.1 |

| RiverPark Strategic Income | Flexible Portfolio | 50.0% | 6.3 | -0.7 |

Why not Fidelity Asset Manager 50%, since I’ve used that as a benchmark? The short answer is that the fund’s income exposure is entirely US Treasuries, and the current state of the US Treasury doesn’t warrant the confidence it once did.

Bottom Line

The best portfolio, like the best water heater or best car, is the one that you never need to think about. My portfolio assumes a balanced allocation with the average fund being in the portfolio for more than a decade. That strategy doesn’t make me rich; it makes me happy. And that’s rather the goal!