Many and many a year ago, in the kingdom of ABC, Woody Allen was one of my very first guests. And we consented to take questions from an eager audience of mostly young people. Like ourselves.

The questioner looked like a high school girl and shouted to Woody from the balcony, “Do you think sex is dirty?”

Allen: “It is if you do it right.” (Dick Cavett, “As the comics say, These kids today! I tell ya.” New York Times, 9/13/2013)

I’d rather hoped that the observation originated with someone rather more wholesome, Groucho Marx or Mae West, for example, but we’re stuck with what the historical record gives us.

Three years ago, in the midst of a substantial market correction (equity portfolios were down 20%, 60/40 portfolios down 16% – in just six months), we wrote “Dirty sex, your spanked portfolio and planning for the next market” (07/2022). For reasons unclear to Midwesterners like me, we had a short-lived spike in our Google search ratings that month. Odd, since the point of the article was modest:

- First, we wanted to remind readers that corrections happen and are not a cause for portfolio upheaval

- Second, we wanted to commend high-quality small caps as a potential source of gain in the next market.

The question is, how good was the advice? We’ll look at it in turn.

Corrections do not warrant panic.

How might you respond, we asked, to the current bout of painful bruising?

- If you have a well-designed strategic investment plan, do nothing.

- If your portfolio is an unplanned collage of things best described as “it seemed like a good idea at the time,” build a plan before executing the plan.

- If your portfolio is taxable, start identifying the cost basis of your shares.

From that date to this, “calm” was a profitable strategy. Here are the three-year returns from 10 Vanguard index funds representing major asset classes:

| Vanguard 500 | US large core | 18.5% |

| Total Stock Market | US large core | 17.8% |

| Extended Market Index | Mid- to small cap | 13.6% |

| Small Cap Index | US small core | 10.6% |

| Vanguard International Core Stock | Int’l large core | 14.8% |

| Vanguard EM Stock Index | Diversified EM | 8.6% |

| Balanced Index | Moderate 60/40 allocation | 11.8% |

| Total International Bond Index | Global bond – USD Hedged | 3.9% |

| Total Bond Market Index | Intermediate core bond | 2.7% |

| Short-Term Bond Index | Short-term bonds (duh) | 3.7% |

Source: Morningstar.com, 6/14/2025

The short version: an indolent investor with typical equity exposure, 60% seems the default, easily booked double-digit returns despite two crises (2022 and spring 2025) and, as a bonus, had time to read a good book or three (or to organize a pro-democracy protest, but that’s a separate tale).

Small and quality are worthy focuses

We wrote: “Reasonable commentators – from T Rowe Price and Leuthold to GMO and Warren Buffett – have argued that your greatest returns now might come from focusing on undervalued, high-quality companies that are growing dividends and are grounded in real assets. At a time when there are historic discounts for small vs large, value vs growth, and quality vs momentum, we asked the folks at Morningstar to look at which small-cap value funds had the highest quality portfolios.”

Small, quality, and value seemed to align with the recommendations of serious adults. Surprisingly, it also aligns with total returns over the past five years.

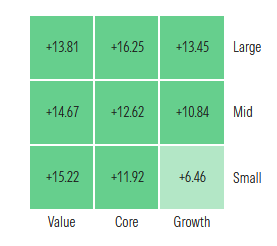

5-year performance by style box, as of 6/13/2025

Small-value won? Bet you didn’t see that coming! The past five years saw three major market dislocations (Covid, 2022’s inflation panic, and the spring 2025 tariff panic) and pretty uniformly double-digit returns. (The estimable Bill Bernstein, a self-described asset class junkie, once described small-growth as “a failed asset class” because they’re volatile, structurally overpriced and do not pay a risk premium for it.)

Morningstar ranked 160 portfolios from highest quality to lowest. Morningstar measures “quality” by assessing “the profitability and financial leverage of a company, based on an equally weighted mix of trailing 12-month return on equity and debt/capital ratios.” The table below includes the 11 funds considered small-cap value by Morningstar with the highest quality portfolios. (Why 11 and not 10? There was a tie.) This table is sorted by their 2022 portfolio quality, with Royce Special having the highest quality portfolio of the 160 Morningstar assessed, Auer second, and so on.

Here’s how they have performed since then, relative to their category averages.

Quality small caps, three-year performance, sort by portfolio quality

| Category | APR |

APR |

APR Rating | Ulcer Rating | DSDEV Rating | Bear Market Rating | MFO Rating | Sharpe Rating | ||

| Royce Small-Cap Special Equity | RYSEX | SCV | 2.5 | -1.6 | 2 | 1 | 1 | 2 | 2 | 2 |

| Auer Growth | AUERX | SCC | 9.4 | 4.3 | 5 | 1 | 4 | 7 | 5 | 5 |

| Pacer US Small Cap Cash ETF | CALF | SCC | 1.3 | -3.9 | 1 | 5 | 5 | 8 | 1 | 1 |

| Acquirers Small and Micro Deep Value ETF | DEEP | SCV | 1.0 | -3.1 | 1 | 4 | 3 | 7 | 2 | 2 |

| Aegis Value | AVALX | SCV | 13.2 | 9.2 | 5 | 1 | 3 | 8 | 5 | 5 |

| Hartford Multifactor Small Cap ETF | ROSC | SCC | 5.6 | 0.4 | 3 | 2 | 2 | 5 | 3 | 3 |

| Royce SCV | RYVFX | SCC | 6.1 | 0.9 | 4 | 3 | 3 | 6 | 3 | 4 |

| James Small Cap | JASCX | SCC | 11.6 | 6.4 | 5 | 1 | 1 | 5 | 5 | 5 |

| James Micro Cap | JMCRX | SCC | 6.6 | 1.4 | 4 | 3 | 4 | 6 | 4 | 4 |

| Ancora MicroCap | ANCIX | SCV | 3.0 | -1.1 | 2 | 1 | 1 | 5 | 3 | 3 |

| WCM SMID Quality Value | WCMFX | SCC | 7.7 | 2.5 | 5 | 2 | 1 | 4 | 5 | 5 |

| Small core average | 5.2 | 3 | 3 | 3 | 6 | 3 | 3 | |||

| Small value average | 4.0 | 3 | 3 | 3 | 6 | 3 | 3 |

Here’s how to read that table. The first three columns identify the fund: name, ticker, and Lipper category. The next two focus on total returns: annualized percentage and the amount by which they led or trailed their peers. The remaining columns offer simplified risk-return ratings. For each measure of risk versus return (Ulcer Index, downside deviation, bear market performance, MFO’s overall assessment, Sharpe ratio), MFO divides peer groups into five bands – best, above average, average, below average, worst – and color codes them. For your purposes, check for blue (best) and green (above average). Yellow is respectably average. Avoid red.

Conclusions:

- Active worked. 75% of the active funds on the list outpaced their peer group and benchmark.

-

Passive didn’t, so much. Two of the three passive funds lagged their peers by, on average, 350 basis points, which is a big honkin’ deal when your total return is around 1%. The two funds that most dramatically trailed their peers were passive, smart beta EFTs. Pacer US Small Cap Cash Cows invests in small caps with exceedingly high free-cash flows. That led to vast overweights in tech and energy, and vast underweights in consumer goods and financial services. It’s a high turnover strategy (108%) with 200+ names in the portfolio. Acquirers Small and Micro Deep Value ETF tracks an index of 100 deeply undervalued small and micro-cap stocks. Their strategy is distinctive and not … umm, index-like:

The initial universe of stocks is then valued holistically—assets, earnings, and cash flows are examined—in accordance with the Index methodology to understand the economic reality of each stock. Each stock is then ranked on the basis of such valuation. Potential components are further evaluated using statistical measures of fraud, earnings manipulation, and financial distress. Each potential component is then examined for a margin of safety in three ways: (a) a wide discount to a conservative valuation, (b) a strong, liquid balance sheet, and (c) a robust business capable of generating free cash flows. Finally, a forensic-accounting due diligence review is performed …

As advertised, it invests in stocks much smaller and much more undervalued that almost any of its SCV peers. Like CALF, its annual portfolio turnover exceeds 100%. In the long term, the strategy tends to underperform its peers by 100-300 bps.

-

Aegis Value and James Small Cap worked best. Aegis, a purely outstanding and distinctive fund, beat its peers by 920 basis points, while James Small led by 640.

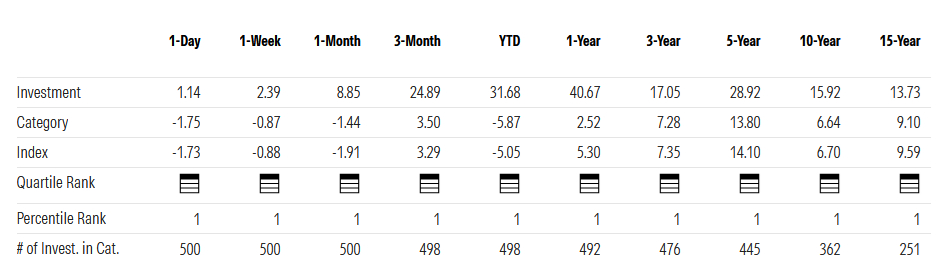

Aegis Value Fund (AVALX) pursues long-term capital appreciation by investing in a concentrated portfolio of deeply undervalued, small-cap stocks—often in the lowest quintile of the market by price-to-book value. Managed by Scott Barbee since its 1998 inception, the fund targets overlooked out-of-favor companies, exploiting market inefficiencies and volatility where analyst coverage is sparse and liquidity is low. With a disciplined, research-intensive approach, AVALX has achieved amazing results. How amazing? Here’s Morningstar’s summary of its total returns – the top row – and what percentage it occupies among all small-value funds.

Translation for the data-hesitant: the fund performed in the top 1% of all small cap funds for the past day, week, month, quarter, year and then 3-, 5, 10- and 15-year periods. We’ve profiled Aegis Value Fund in this month’s issue.

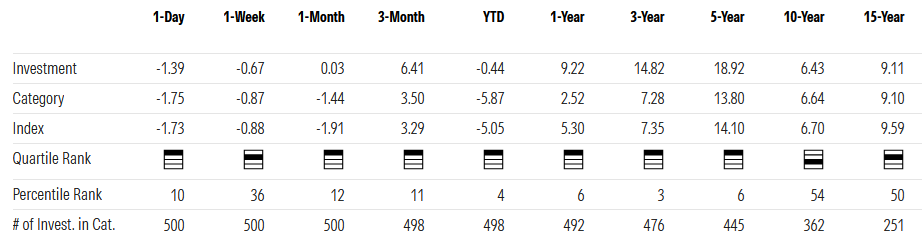

The James Small Cap Fund (JASCX) seeks long-term capital appreciation by investing primarily in undervalued domestic and international small cap stocks. The target are companies with strong profitability and positive momentum, emphasizing quality “core” names with a slight value tilt. The fund typically holds a diversified portfolio (86 stocks as of March 2025), with about 28% of assets in its top 10 holdings, and maintains an amazing low turnover rate of 18%. Most small caps are far higher and Vanguard’s three small cap index funds have turnovers (13 – 21%) in this same range.

The fund’s long-term performance, depending on the exact time frame, ranges from perfectly respectable to rock star.

The fund’s three current managers have been 10 – 25 years of experience managing the fund. The team was once much larger (as much as nine managers in 2015-2018) but this tighter team seems to be working.

Bottom line

It’s the never-ending tale: planning works, patience works, calm works. Grabbing for bangles and baubles? Not so much.

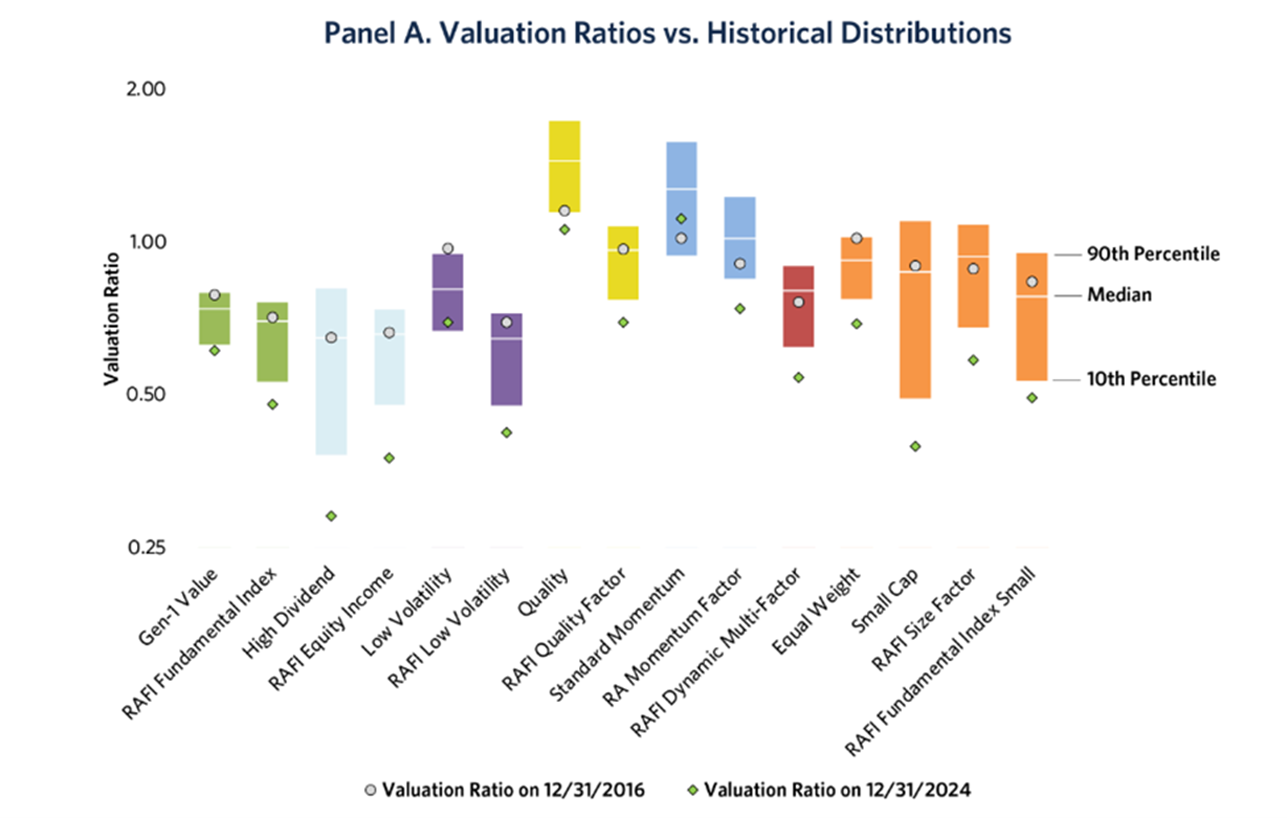

The key question is: what’s the prospective that small and q1uality will continue to work in the years just ahead? Because of the incessant focus on one niche, the Favored Few within the large growth arena – the FANGs, then the MAG-7 and now All Things AI – and the continued growth of corporate earnings across the board, small and quality are both cheaper now than they were eight years ago. If you think that purchase price matters in future returns, that means they’re more attractive now than they were eight years ago.

The chart below also appears in the July 2025 Publisher’s Letter.

The way to read that chart is to start by finding the little green diamonds. Those are the more-or-less current valuations of each strategy relative to its historic valuations. Green diamonds below the colored bar which illustrates the historic range from 10th percentile to 90th, signals that the strategy is now cheaper than it has been 90 or 95% of the time.

Finally, we’ve addressed the value of “calm” in an age of chaos in a series of articles by four different authors on The Chaos-Resistant Portfolio. (All are easy to find. Use the “Search MFO” box and enter just the word “chaos.”) The short version of those articles is that the price of calm in the years ahead is a thoughtful reevaluation of your portfolio allocation today.