THIS IS AN UPDATE OF THE FUND PROFILES published in 2009 and 2013.

Objective and strategy

The fund seeks long-term capital appreciation by investing in a diversified portfolio of very, very small North American companies.

Aegis believes excess returns can be generated by:

- purchasing a well-researched portfolio of fundamentally sound small-cap stocks trading at low valuations during periods of stress or neglect, when liquidity is low and investor sentiment is poor,

- holding these investments patiently through periods of short-term price volatility while fundamental conditions normalize, and

- selling after fundamental trends reverse, as recovery becomes visible and investor sentiment improves, driving valuations higher.

They look for stocks that are “significantly undervalued,” given fundamental accounting measures including book value, revenues, or cash flow. They define themselves as “deep value investors.” While the fund invests predominantly in microcap stocks, it does have the authority to invest in an all-cap portfolio if that ever seems prudent.

Adviser

Aegis Financial Corporation of McLean, Virginia, is the Fund’s investment advisor. Aegis has been in operation since 1994 and has advised the fund since its inception in 1998.

Manager

Scott L. Barbee, CFA, is portfolio manager of the fund and a Managing Director of AFC. He was a founding director and officer of the fund and has been its manager since inception. He also manages 66 separate equity account portfolios of other AFC clients managed in an investment strategy similar to the Fund, with a total value of approximately $30 million. Mr. Barbee received an MBA degree from the Wharton School at the University of Pennsylvania. He is supported by four other professionals.

Strategy capacity and closure

Aegis Value closed to new investors in late 2004, when assets in the fund reached $820 million. The manager estimates that, under current conditions, the strategy could accommodate roughly $1.5 billion. That aligns with the size of its average holding.

Management’s stake in the fund

As of June 2025, Aegis employees owned more than $48 million of Fund shares. The vast majority of that investment is held by Mr. Barbee and his family. Two of the fund’s three independent directors, though very modestly compensated, have large stakes in the fund.

Opening date

May 15, 1998

Minimum investment

Nominally $10,000 for regular accounts and $5,000 for retirement accounts, but brokerages such as Schwab require a $1 minimum initial investment.

Expense ratio

1.45% on assets of $560 million, as of June 2025. The fund has attracted about $100 million in inflows in the first half of 2025. With a management fee of 1.2%, room for additional expense reductions is modest.

Comments

Small-cap value investing has long been out of favor as investors feverishly judge themselves on how many FAANGs or MAGs they’ve managed to acquire. Aegis Value presents the case for double-checking those easy impulses. My colleague, Devesh Shah, engaged in a long conversation with Mr. Barbee in 2023, which resulted in the essay, “In Conversation with Scott Barbee, Portfolio Manager at Aegis Value Fund” (8/2023). Devesh and Scott talked at length about his investable universe and his (since validated) perception of “a rare and fascinating opportunity” which now dominates his portfolio. Given the depth of those discussions, this profile will limit itself to three arguments: (1) Aegis is phenomenally successful, (2) Aegis is distinctive, and (3) the Aegis discipline makes sense.

1. Aegis is phenomenally successful

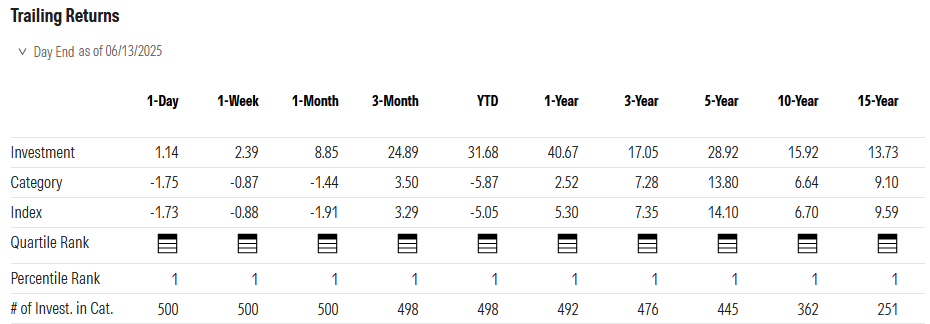

As we composed this profile in mid-June 2025, Morningstar reported the following absolute and relative returns for Aegis Value. We should look at both the row labeled “Investment” and the one labeled “Percentile Rank.” The first row indicates annualized returns over a variety of trailing periods; for instance, the fund has averaged a return of 13.73% annually for the past 15 years. The lower row shows how that ranked within its peer group. The “1” means that Aegis Value was in the top 1% of its peers over the past 15 years.

The top 1% over the past 15 years is remarkable. The top 1% over the past week, month, quarter, year, three years, five years, ten years, and 15 years is pretty much unprecedented. It’s also not a fluke: Lipper gave Aegis a five-star rating for consistency over the lifetime of the fund, the same rating assigned by MFO Premium’s calculation of the fund’s Ferguson Consistency Index: Lifetime.

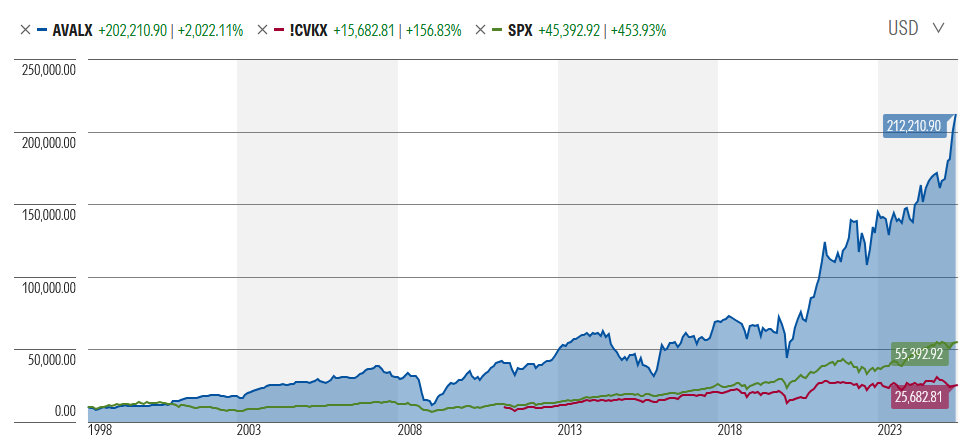

The fund has done well even in comparison to its antithesis: the large-cap growth-oriented S&P 500. A $10,000 investment in Aegis at inception has grown to $202,000 today; the same investment in the S&P 500 has risen by one-fourth as much.

2. Aegis is distinctive.

It is now, as it has frequently been, a portfolio incomparable to peers or benchmarks. Active Share measures the independence of a portfolio from its benchmark; the higher the active share, the greater the difference and the greater the prospect that the returns represent a manager’s skill rather than his asset class’s successor. Aegis has an Active Share of 99.3%, the highest of any fund we track. In 2022, we constructed a basket of small-cap value funds with the highest quality portfolios (updated this month in “More dirty sex and your spanked portfolio: A three-year review,” 7/2025). Of the 11 funds – active and passive – in that basket, Aegis had the lowest correlation to its peer group, to its benchmark, and to the S&P 500.

Concrete markers of that difference come from a glance at the portfolio:

- 92% of the portfolio is in just two sectors: materials and energy. The peer weight is 11%.

- 15% of the portfolio is in the US, compared to 97% for peers

- 59% of the portfolio is invested in Canada accounting as opposed to 1% for peers.

- 42% is invested in microcap stocks, compared to 9% for its peers

- By Morningstar’s metrics, the fund’s average market cap is $655 million, the average holding in its peers is 800% larger

- The fund currently holds 9% cash, compared to 1.7% for peers (and 4% two years ago, when Devesh spoke with Mr. Barbee).

That gives some weight to a comment that Mr. Barbee made to Devesh in 2023: “We are an odd duck in that we do detailed work on stocks as if we were a hedge fund without charging the performance fees.”

3. The Aegis discipline makes sense.

Many managers claim to ignore macroeconomic factors. “We’re not into political economics. We just buy the best stocks available” is their mantra. Mr. Barbee seems to have rather more sympathy for understanding Big Picture issues than trying to position Aegis Value for success within them. There seem to be two big picture issues on his mind. First, the major US stock indices are highly concentrated and wildly overvalued:

Today, speculative fervor continues to dominate the markets. The ratio of assets in levered long ETFs to assets in short ETFs hit 11.1 times, the most on record according to Bloomberg. Fund Manager Survey cash allocations are at the lowest since 2001 according to Bank of America. Retail sentiment is also unusually robust with Households all-in on equities. Ned Davis Research recently reported that stocks as a percentage of total household financial assets hit 36.1 percent, the highest household allocation to equities since 1952. NYSE margin debt is also on the rise, climbing nearly 50 percent in the last two years to levels near $900 billion today. US equities today are top-heavy, fully-valued, and vulnerable to decline. The market capitalization of the top-10 stocks in the S&P 500 Index at year-end constituted nearly 40 percent of the overall index, with the largest market-cap stock at a record valuation 750 times as large as the 75th percentile stock in the Index, a concentration level not seen since the 1930s, according to Goldman Sachs. (Shareholder Letter, 1/27/2025)

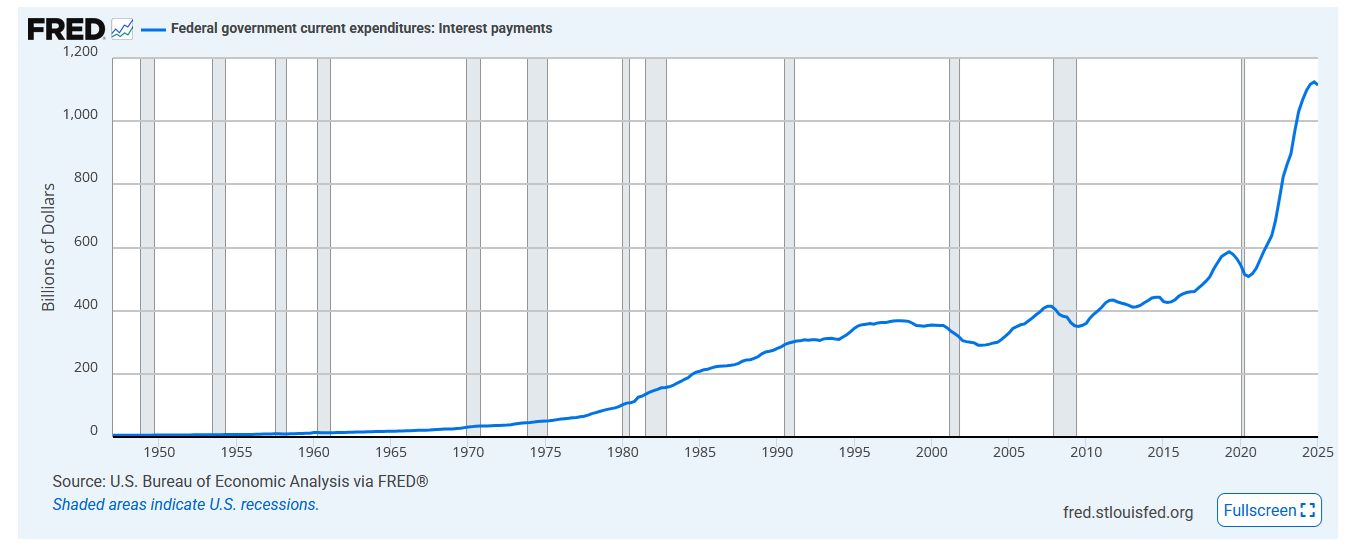

Second, the federal government’s inability to align its income with its expenses risks leading to a debasement of the dollar. The federal government’s status as the world’s safest investment and strongest haven is being called into question by a debt that’s so large that interest payments on it exceed $1 trillion a year.

Source: St. Louis Fed, 5/29/2025

Debt payments are the third-largest, and the fastest-growing, category of federal outlay. The combination of huge deficits and diffidence from international investors creates the prospect for real and sustained inflation. As DoubleLine founder and hedge fund manager Jeff Gundlach warned in June: “a reckoning is coming.”

Mr. Barbee believes that he has positioned the portfolio intelligently in light of both of those factors.

We believe our angular portfolio, with a strong focus on materials and energy, is well positioned given today’s environment We are currently maintaining a portfolio that is unusually angular, with high concentration among a number of deeply undervalued small-cap energy and materials stocks from the value universe, including a substantial number of Canadian stocks and a few other foreign equities. Many of these Fund positions have been performing well despite the significant headwinds of a rapidly strengthening dollar. However, with the dollar hitting new highs, sentiment towards securities trading outside the United States has deteriorated markedly. Resultingly, significantly lower valuations remain available on foreign securities. With the strong dollar now looking quite extended, and with US technology equities today in the spotlight, we believe it is a great time to be opportunistically positioned in international, commodity-producing stocks, particularly given that commodities are typically priced in dollars. Should the dollar roll-over, whether driven by a new Washington political consensus or otherwise, the recent dollar headwinds faced by international stocks and commodity producers could rapidly shift to tailwinds. As the S&P 500 has soared in the last few years, US small caps have also been underperforming, with many managers appearing to be throwing in the towel. Fund manager positioning toward small-cap stocks was recently reported by Bank of America to be at the lowest level in records going back to 2015. (Shareholder Letter, 1/27/2025)

The portfolio is positioned to benefit from declines in the US dollar, and many of its holdings are considered traditional inflation hedges.

Bottom Line

Aegis Value is a deep-value fund that has traditionally found some of the most compelling values in the small- to microcap space. Mr. Barbee is one of the field’s longest tenured managers, and Aegis sports one of its longest records. Both testify to the fact that steadfast investors here have had their patience more than adequately rewarded. You should consider it.

Fund website

Aegis Value fund. We’d mostly commend the wealth of shareholder letters to you.