My strategy involves looking at what is trending according to my rating system, and buying what fits into my portfolio if I can build a storyline behind it. My rating system of nearly a thousand funds is based mostly on data from Mutual Fund Observer to reflect my assessment of short and intermediate-term trends. I selected the funds using MFO Family ratings, assets under management, risk, and risk-adjusted performance, and availability without loads and transaction fees through Fidelity and Vanguard.

From the S&P 500 PE Ratio – 90 Year Historical Chart by Macrotrends, I estimate that the price-to-earnings ratio today is at the highest 94% since 1929 and is highly valued. My concern is that high deficits, rising national debt, tariffs, falling dollar, sudden cuts to Federal employment and spending, and uncertainty may create shocks to the economy over the coming years. My rating system is tilted toward equity value and bond quality.

Ratings for equity, bonds, mixed assets, and “other” are calculated separately and combined into a single rating system with 100 being the highest and zero being the lowest. All four groupings include three-year performance (return and risk-adjusted return), short-term momentum (YTD returns, moving averages, and fund flow), and risk (drawdown, Ulcer Index, and downside deviation). In addition, equity includes valuation (price-to-earnings, price-to-book), bonds include quality (bond rating, effective duration), and yield (including risk-adjusted yield), and mixed-asset includes both valuation, quality, and yield.

The funds selected for this article have a rating of 90 or higher. The list was pared down to one or two per Lipper Category. This article focuses on individual funds, whereas previous articles focused on best best-performing Lipper Categories as a whole.

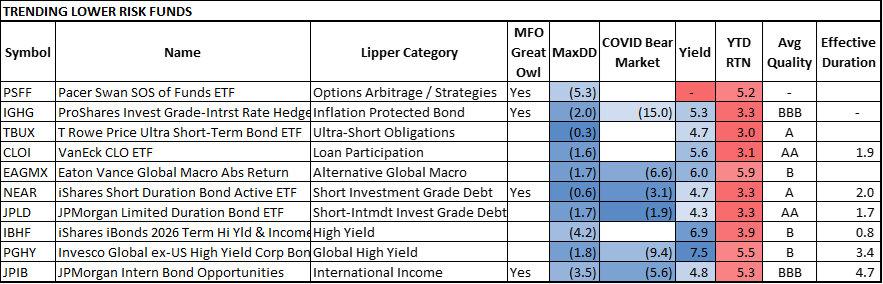

Lower Risk Funds

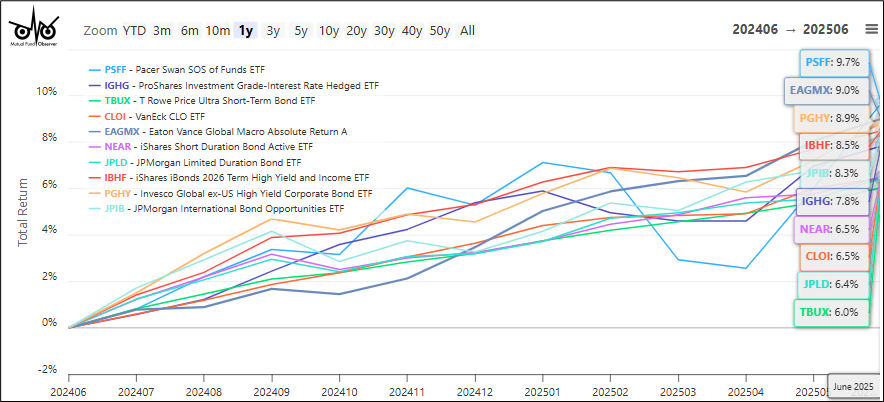

The highest rated lower risk funds are mostly in the short-term bond Lipper categories with higher quality, along with inflation-protected bonds. I own iShares Short Duration Bond ETF (NEAR) for its safety. About 7% of my bond portfolio is invested in inflation-protected bonds, although I do not own IGHG. I plan to invest more in inflation-protected bond ETFs with target maturities to add to rungs in bond ladders.

Table #1: Trending Lower Risk Funds

Source: Author Using MFO Premium fund screener and Lipper global dataset; Morningstar for year-to-date returns as of July 24th.

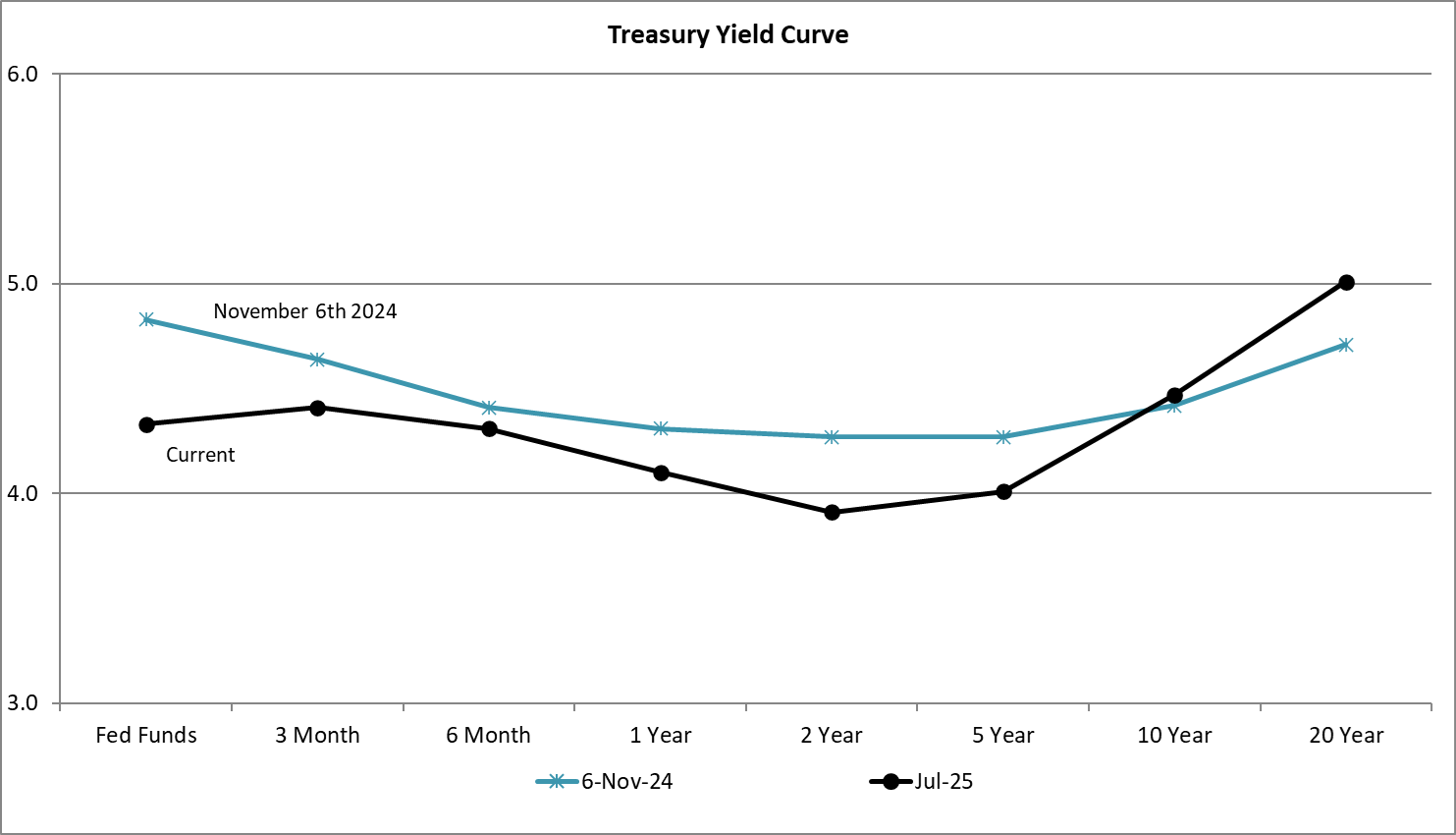

Figure #1 is the yield curve for Treasuries. Long-term rates have risen while short- and intermediate-term rates are falling. I interpret this to mean that investors believe the economy is slowing and rates will fall by the end of the year, but long-term rates are rising on the expectation that higher rates will be required to finance the growing deficit and national debt, along with the potential for higher inflation. I favor bond funds with effective durations in the one-to-five-year range.

Figure #1: Treasury Yield Curve

Eaton Vance Global Macro Absolute Return is certainly worth taking a look at. During its eighteen-year life, it has had a 3.8% return with a maximum drawdown of 7.2%. It has an MFO Risk Rating of “2” for conservative and an MFO Rating of “5” for being in the highest quintile for risk-adjusted return for the category.

Likewise, JPMorgan International Bond Opportunities (JPIB) also has an MFO Risk Rating of “2” for conservative and an MFO Rating of “5”. I have diversified global portfolios managed in part by Fidelity and Vanguard, which own international bond funds. I am in the preliminary stage of determining if I want to buy international bond funds in self-managed portfolios.

Figure #2: Trending Lower Risk Funds

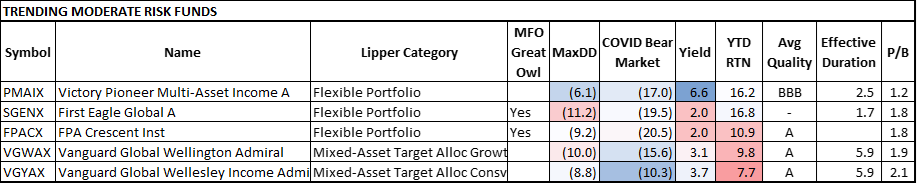

Moderate Risk Funds

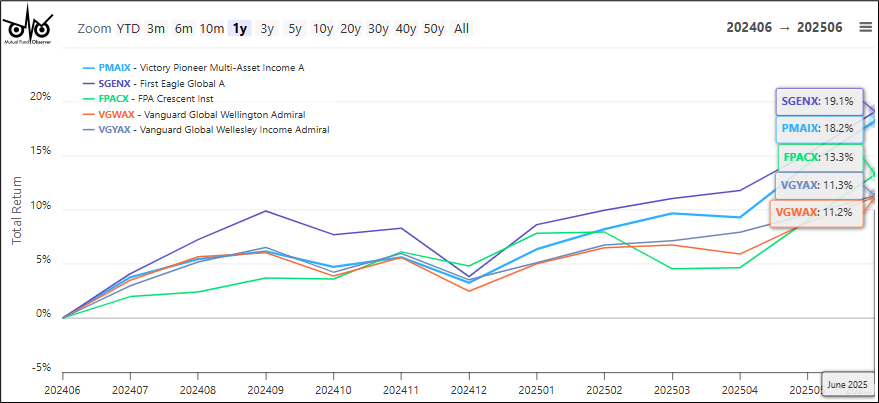

I wrote Investing Internationally for the Timid Investor in the June MFO newsletter about Vanguard Global Wellesley Income Fund (VGWIX), which I own. I have some dry powder in a Bucket #3 long-term account and am considering the more aggressive Vanguard Global Wellington Admiral (VGWAX) to complement Vanguard Global Wellesley Income Fund. All three flexible portfolios in Table #2 have similar performance over the past seven years, with Victory Pioneer Multi-Asset Income (PMAIX) and First Eagle Global (SGENX) outperforming VGWAX year-to-date. SGENX is the most tax-efficient of the three.

Table #2: Trending Moderate Risk Funds

Source: Author Using MFO Premium fund screener and Lipper global dataset; Morningstar for year-to-date returns as of July 24th.

Figure #3: Trending Moderate Risk Funds

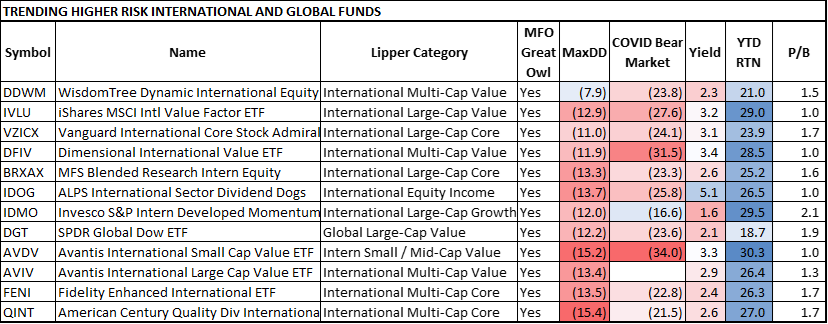

Higher Risk Funds

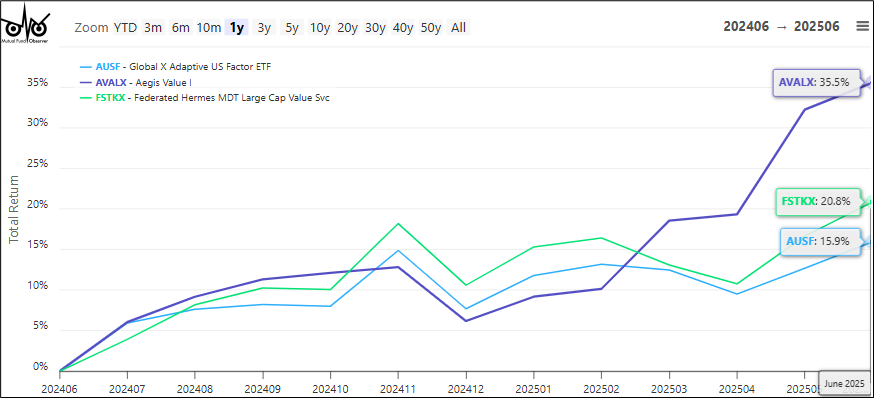

International and global equity funds have done extremely well this year, in part because of their lower valuations compared to the highly valued domestic market. I consider my allocation to stocks to be appropriate, and I am not looking to add any more. The one equity fund that I purchased recently is Aegis Value (AVALX), and I expect to add to that position over the coming years.

Table #3: Trending Domestic Higher Risk Funds

Source: Author Using MFO Premium fund screener and Lipper global dataset; Morningstar for year-to-date returns as of July 24th.

David Snowball wrote about Aegis Value (AVALX) in the MFO July Newsletter, Aegis Value Fund (AVALX), and I purchased some for my younger self. I stopped buying individual securities decades ago, although I always liked small-cap value stocks. It is listed as a Small-Cap Value Lipper Category, but only has 26% invested in the United States and 50% invested in Canada. I bought AVALX as a long-term holding and may add to it over the next year or two.

Figure #4: Trending Domestic Higher Risk Funds

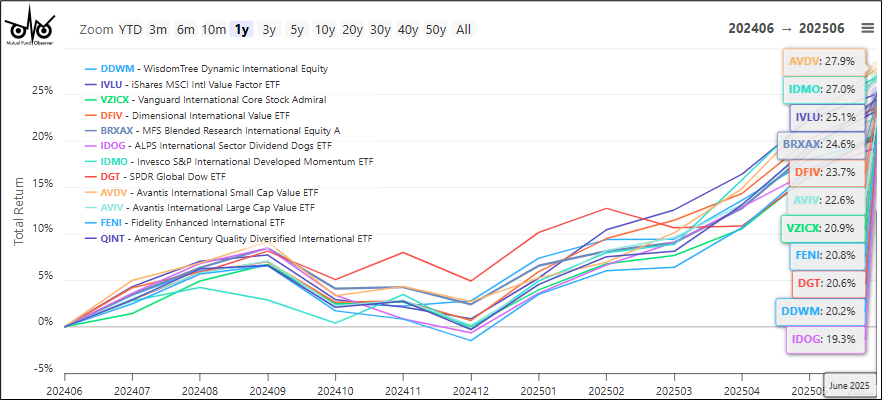

With the guidance of Fidelity and Vanguard, I was well-positioned with global and international equity funds at the beginning of the year. My final list of highest rated global and international equity funds is shown in Table #4.

Table #4: Trending Global and International Higher Risk Funds

Source: Author Using MFO Premium fund screener and Lipper global dataset; Morningstar for year-to-date returns as of July 24th.

Figure #5: Trending Global and International Higher Risk Funds

Closing

I analyze trends monthly, looking for opportunities to sell what is not working in order to buy what is trending. I make small changes when appropriate. I pay attention to the changes that Fidelity is making in my managed accounts. Recently, they have made some small defensive changes, including reductions of both domestic and international stock funds, and added bond and alternative funds. This gives me a sense of comfort.