I’m struck by the near unanimity of Informed Commentary on the direction of the US stock market. People seem to agree that “the magic number” is 15%.

The disagreement comes in the query: but 15% in which direction? There, there’s about a 50/50 split among the people paid to pretend to know the future. Both growth and recession, market melt-up and market meltdown scenarios are broadly represented. “The melt-up in risk assets continues,” saith HSBC, the global bank based in London. Remember that markets spiked about Alan Greenspan’s original warning about “irrational exuberance.”

We’ll offer a snippet to help you understand each side.

Cause for pessimism

…drunk on propaganda, oblivious to the risks ahead, they may soon find out that they are in for a nasty shock.

Pop quiz! “They” in the above quotations refers to:

- Investors betting on an eternal bull

- Trump and his advisers

- Putin and his advisers

- Americans, confidently relocating to the southern and southwestern US

- All of the above.

The narrow answer to the question: C.

The passage is the conclusion of Russian journalist Mikhail Zygar’s essay “Russia’s rulers are in for a nasty shock” (NYT, 8/5/2025). The argument is that Putin has decided that America is not worth negotiating with since we keep changing governments (and hence the rules of the game), and so Mr. Trump’s (or, more broadly, the American government’s) disapproval no longer registers: “Russia’s president couldn’t care less.” The oligarchs supporting Mr. Putin believe that sanctions will never be more than window dressing, a nuisance that cannot become serious because Mr. Trump will not risk the attendant oil price spike. Russian propagandists increasingly ridicule the current administration. “This derisive attitude,” Mr. Zygar writes, “betrays how disconnected – and even delusional – Russia’s ruling elite has become.”

At least the survivors are delusional. In the past six weeks, a senior vice president of the world’s largest pipeline company, TransNeft, “jumped” out of his 10th floor apartment window, the transportation minister shot himself “inside his car” – despite video showing police removing his body from a nearly thicket of bushes – and his 42-year-old deputy died because “his heart stopped.”

The moral of the story: powerful people believe that reality bends to their whims; it does not.

Reality contains a great deal for investors to worry about. Briefly:

-

Warren Buffett, one of our most renowned investors and a guy who counsels never to bet against America, is de facto betting against America. He has been a steady net seller of US equities and now sits on $350 billion in cash. He is joined in his caution by Bill Gross (“Investors, wake up!” X, 7.16.2025), the Apollo Group (valuations on the 10 largest US stocks are more outrageous than in 1999)

-

The Shiller CAPE Index sits at 37.8, the second-highest level recorded. Motley Fool argues that once the CAPE crosses 37, “the index usually declines over the next one, two, and three years.”

-

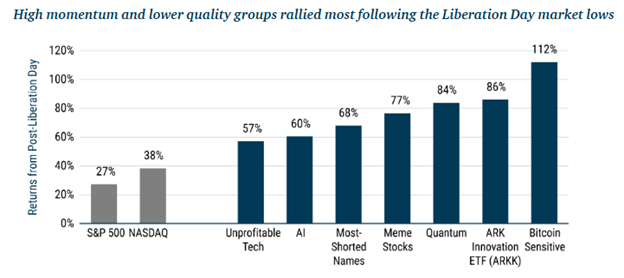

The best-performing stocks are from the lowest quality companies. At base, speculation is winning. Bespoke Investment Group, in a note to clients, noted that shares of companies that are making no profit have been rising faster than those that are deeply profitable. GMO shared Goldman Sachs data that made the point more broadly.

-

The Trump tax package, hidden behind bluster about imposing “discipline” on government, could add up to $9.1 trillion to the national debt over ten years when including interest costs (Peterson Foundation, 2025).

-

The Trump international goods tax, as currently configured, is projected to reduce US annual GDP by36%. This equates to $108.2 billion or $861 per household per year (Niven Winchester, “New Trump tariffs: early modelling shows most economies lose – the US more than many,” The Conversation, 8/3/2025). The “as currently configured” hedge reflects the fact that expert trackers and legal reviews (e.g., Congressional Research Service, Atlantic Council, Yale Budget Lab) suggest several dozen distinct, formal tariff changes and hundreds of targeted modifications by product, country, or category have occurred since January 2025, often by fiat and with no notice.

-

The Trump international goods tax, concurrently, will cost consumers about $300 billion in 2025. Trump’s tariffs have brought in over $150 billion in 2025 and could reach $300 billion if the current pace persists. Economic analyses show that 75–100% of tariff costs are paid by American businesses and consumers; foreign exporters absorb only a negligible fraction, if any. A corporation’s first impulse has been to try to absorb the cost; General Motors, Ford, Stellantis (Chrysler), Apple, and Procter & Gamble have each taken $1 billion or more in earnings hit this year. The ultimate cost is generally passed to U.S. consumers in the form of higher prices. Procter & Gamble, for example, is set to increase the price of its consumer products – think Tide – by 25% to offset the tariff.

-

The most recent jobs report sucked. Shannon Carroll of Quartz wrote a really sharp analysis of it:

The July jobs report wasn’t just underwhelming. It may have flipped the story on its head. Payrolls grew by a meagre 73,000 jobs, far below the roughly 110,000 anticipated. Adding insult to injury, May and June were revised down by a staggering 258,000 jobs — the biggest two-month revision in five years— leaving the labor market’s momentum looking weaker than ever. That means payroll growth averaged just 35,000 jobs per month over the last three months, once revisions are accounted for, the weakest stretch since early in the COVID-19 pandemic. That suggests that any job growth in the two earlier post-tariff reports may have been nothing more than a mirage. (Shannon Carroll, The job market’s warning lights are flashing red, Quartz, 8/3/2025)

There are “no redeeming qualities” to the report, according to “Jeffries analysts” quoted in the story.

The report had two immediate consequences:

- The stock market evaporated $1.1 trillion. The Dow dropped 1.23%, the S&P 500 by 1.6% and the Nasdaq by 2.24% in a single trading session. The drivers were both the wretched economic report and the latest tariff tirade, “sweeping new tariffs by US President Donald Trump on 68 countries and the European Union, ranging from 10 to 41 per cent” (“Why did the US stock market fall? 3 reasons behind $1.1tn wipe out in single day,” Financial Express, 8/2/2025).

- President Trump, frothing, fired the Bureau of Labor Statistics official who dared to report the data. In a more-or-less typical move, the president invented unexplained and unproven accusations of “incompetence” and “inaccuracies.” Past BLS directors joined economists in denouncing the move (“Statisticians blast Trump over BLS firing: ‘Dangerous precedent’,” The Hill, 8/2/2025) while Mr. Trump’s appointees rushed to his defense (“White House officials defend Trump’s firing of BLS chief,” MSN.com, 8/3/2025). The credibility of BLS data has been described as “Trump’s $2 trillion gamble,” because there’s a $2 trillion securities market tied to US inflation data. Bloomberg concludes that the effects of a loss of faith in the data would be “catastrophic” (Bloomberg evening briefing, Americas edition, 8/5/2025).

Cause for optimism

This is trickier. I guess there are two bits of guarded optimism.

-

The US is not the world. Only 4% of the world’s population (though a very influential 4%) live in the US, and just under half of them live in “red” states that are feeding the climate-denial / anti-renewable energy fire. Much of the rest of the world is (a) bewildered by us – Chip and I fielded a lot of half-amused questions while in Scandinavia but (b) is moving sensibly forward without us. Maybe we’ll become the New Portugal?

As of May 2025, all houses in the UK will be legally required to install solar panels by 2027. The goal is to decarbonize the electricity grid by 2030. A new report shows that Paris has cut its emissions in half with simple changes to the city. Over the past few years, Paris has been reconstructing their infrastructure to move towards sustainable transportation. Cities worldwide are cutting emissions, greening streets, and adapting to climate threats faster than national governments. Solar and wind are now the fastest-growing energy sources in history, with global solar capacity doubling in just two years and new projects supplying most of the world’s electricity demand. Solar and wind are now the fastest-growing energy sources in history, with global solar capacity doubling in just two years and new projects supplying most of the world’s electricity demand. Global investment in clean energy is on track to reach a record $2.2 trillion in 2025, according to the International Energy Agency (IEA), which is twice the amount expected for fossil fuels.

And in most European and Asian countries, national policies seem to reflect a rational assessment of the needs of the people rather than an obsessive concern for a small group of the ultra-rich. That translates, in most instances, to reasonable regulation, reasonable debt covenant requirements, and reasonable profits.

-

Most securities, in most markets, are reasonably priced. Most non-US markets and a wide spectrum of global assets are considered reasonably priced or even undervalued relative to long-term averages. Major asset managers highlight that, outside the US, most developed and emerging market equities are trading near or below historical valuation norms, making them attractive by comparison to the US. Private markets also show a favorable environment for dealmaking thanks to realistic valuations and robust capital supply. Real estate and credit markets outside the US similarly reflect valuations near fair value, with some pockets of undervaluation. In the US, some sectors (notably value, small-cap, energy, and healthcare) trade below fair value or at discounts. There is money to be made, just not where you’ve been making it lately.

-

Claude could save us, aka an AI-Driven Productivity Revolution. While many argue that the “AI revolution” is 90% hype, recent research cited by the St. Louis and Dallas Federal Reserve banks suggests AI could boost productivity growth by 0.3 to 3.0 percentage points annually over the next decade, with a median estimate of 1.5 percentage points. Workers using generative AI reported saving 5.4% of their work hours, suggesting a 1.1% increase in productivity for the entire workforce. This could represent a productivity breakthrough comparable to the IT revolution of the 1990s.

Managing through the uncertainty

In general, both statistical analyses and expert opinion push you in the same direction. In general, the recommendations are:

- Assume that the market may rise dramatically soon

- Allow for the prospect that it will then fall dramatically

- Don’t get greedy; establish a sensible, risk-aware asset allocation and tune out the noise

- Move away from overpriced assets ‘cause they’re often historically overpriced

- Move away from a US-centric portfolio

- Move away from assets that are highly sensitive to changes in federal policy.

In practical terms, consider more weight in bonds and short-term high yield. Consider more weight in gold and real assets. Consider investing in smaller stocks, rather than larger. And don’t write off the emerging markets. That doesn’t mean selling long-held positions; it means getting psychologically prepared for volatility and making shifts in your portfolio to keep your worst-case outcomes manageable.

Vanguard’s balance: In an interview with Shawn Tully, a senior editor at Fortune, Vanguard’s president and CIO, Greg Davis, made these arguments:

- The bullish case for US equities, driven by Mr. Trump’s wise policies and an AI revolution, is implausible.

- US stocks are likely to underperform bonds on a risk-adjusted basis over the next decade. That’s because they’re wildly expensive (about 49% overvalued, based on their Shiller Cyclically Adjusted Price-to-Earnings multiple), and earnings for the market as a whole are stagnant. From the end of 2021 to the beginning of 2025, S&P 500 earnings per share rose just 9.6%. Not 9.6% annually. 9.6% total over three years, substantially less than the rise in inflation.

- Vanguard projects US equities are priced to return between 3.8 – 5.8% annually. The midpoint would be something like 5% a year at a time when you can get 4.3% on cash. International stocks, which start with dramatically lower valuations and fewer political headwinds, are priced to return 7% annually.

Recommendation: a balanced portfolio should be 60% bonds, 20% US equities and 20% international equities. (Shawn Tully, “The investment chief at $10 trillion giant Vanguard says it’s time to pivot away from U.S. stocks,” Fortune, 7/24/2025)

Which, by the way, is pretty much The Indolent Portfolio (50% growth, 50% stability; 50% here, 50% international with a preference for small, cheap, and quality) that we’ve been encouraging you to consider all along. Year-to-date, through 7/30/2025, the portfolio is up 8.4%.

Options for a US-lite addition

We used the MFO Premium screener to identify funds that demonstrated XX important characteristics over the past five years:

- They had equity-like returns: we looked for 8.0% annually or more.

- They had a low correlation to the S&P 500: that’s our attempt to build in insulation against US market gyrations and, to an extent, against US tax and tariff policies.

- They generated some income, which might come from dividends or the interest on bonds.

- They demonstrated exceptional downside protection: measured by a combination of their Ulcer Index rating (which combines metrics on how far a fund falls and how long it stays down), S&P500 downside capture (which measures how much a fund captures of the S&P’s fall), plus downside and down market deviation (how much “bad” volatility they capture).

Quick snapshots of some of the funds that pass the test.

AQR Diversifying Strategies (QDSNX):

What it does: Allocates to six AQR alternative mutual funds (Managed Futures Strategy, Equity Market Neutral) and seeks to add additional value over time through tactical positioning

Why you might be interested: It has a 0.01 correlation with the S&P 500. That translates to, “nothing that happens in the S&P 500 predicts what this fund will do.” S&P soars, fund shrugs. S&P crashes, fund shrugs. Five-year annual return 12.0%, MFO Great Owl and Morningstar five-star rating. Remarkably low expenses, at 0.44%.

Why you might hesitate: Well, it does kind of layer complexity on top of complexity since the underlying funds are all financial engineering vehicles. And it does have $4.1 billion in AUM already.

First Eagle Global Income Builder (FEBAX)

What it does: They want to generate current income while also providing long-term growth. The equity team is value-oriented and looks for companies they believe to be well-positioned, well-managed, and well-capitalized, and invests in them only when they are trading at a “margin of safety.” They move opportunistically between assets, typically holding 0-55% of their assets in global equities, 30%-40% in corporate and sovereign bonds, 5%-10% in cash, and 5%-10% in gold bullion. It yields about 2.5%

Why you might be interested: It has a five-year correlation of 0.56, which means that the movements in the S&P predict about half of the movements in this fund. About 20% of the portfolio is currently in US equities. It has returned 8.8% annually. Its maximum lifetime drawdown was short and shallow.

Why you might hesitate: The long-term record of the fund is good, but the entire fixed-income team decamped in February 2024. The new team offers us just a 16-month track record.

Hartford Real Asset (HRLAX):

What it does: The managers seek exposure to inflation-related equities, inflation-linked bonds, and commodities. Currently, that’s 25% US equities, 25% international equities, 40% bonds, and the rest in commodities. Its equity holdings are heavily weighted toward real estate, basic materials, and energy (“real asset” sectors) and, on the whole, smaller and more value-oriented than its peers’.

Why you might be interested: it has a five-year correlation of 0.49 and has returned 9.6% annually. It has a 4.2% dividend yield. It is consciously constructed to take on inflation, which is often a disaster for other sorts of funds. It captures 96% of its Morningstar benchmark’s upside and 75% of its downside. The fund is sub-advised by Wellington Management, which is generally recognized for investment excellence. The expense ratio is 1.25%.

Why you might hesitate: the fund holds $61 million in AUM (which is either good or bad depending on your business model).

Intrepid Income (ICMUX)

What it does: The managers want to create a diversified portfolio of high-yield corporate debt securities, bank debt, convertible debt, and U.S. government securities. Typically, they have a relatively short duration (typically 2-6 years, currently 3.5 years, which makes them pretty interest rate insensitive). They target businesses that are understandable, typically mature, established leaders in their industries, generate consistent cash flows, have strong balance sheets, and are run by strong management teams. They’re pretty obsessive about understanding their issuers because they need to believe that the bonds’ prices are temporarily depressed and that default risk is minimal. They also target smaller bond issuances, under $500 million, because many bond funds are too large to invest in such issues, which increases the prospect of mispricing.

Why you might be interested: a 0.48 correlation to the S&P 500 plus a negative downside capture of -26 against its Morningstar benchmark index, which means that the fund tends to rise when its core-bond benchmark falls. It has returned 8.3% annually over the past five years, has an 8.0% yield, and has done an exceptional job of risk management. Its maximum drawdown over the past five years is 4.9%, 300 basis points less than its peers’. Morningstar rates it as a five-star / Bronze fund.

Why you might hesitate: The fund recently topped $1 billion in assets. When we profiled the fund in 2022, the managers identified $1 billion as about the limit of the strategy’s capacity.

Thornburg Investment Income Builder (TIBAX)

What it does: The managers build a global, diversified multi-asset portfolio of income-producing stocks and bonds that seeks to deliver an attractive and growing income stream. About 25% US stocks, 50% international stocks, and 25% … umm, other stuff.

Why you might be interested: they carry a five-year correlation of 0.61 and have returned 15.7% annually over the past five years. They’ve managed a 5% yield and Morningstar rates them a five-star fund.

Why you might hesitate: $16.3 billion in assets and 75% in equities, which cuts the downside protection. It’s got really strong downside protection for an equity fund, but that still translates to a maximum drawdown of 18.7% over the past five years. That’s good by equity fund standards, but that doesn’t mean it’s automatically good for you. Half of the management team responsible for the fund at the start of 2023 is gone; that’s not a slight on the remaining members or the new guy, but it is a signal that you’d want to think about the changes.

Victory Pioneer Multi-Asset Income (PMFYX)

What it does: The fund seeks high current monthly income relative to the broad market through a diversified portfolio of income-producing stocks and bonds. It has broad geographic diversification – 23% US equities, 21% international equities, 36% in bonds – and asset class diversification, including catastrophe bonds, master limited partnerships, and real estate. The equity holdings tend to be smaller and more value-oriented than their peers. The portfolio is also actively hedged to reduce volatility, while protecting income.

Why you might be interested: The fund has a 0.5 correlation with the S&P 500 and has returned 11.0% annually over the past five years. It has a 6.9% yield, almost double its peers’. MFO recognizes it as a Great Owl fund, and Morningstar assigns it five stars.

Why you might hesitate: This is an $8.3 billion fund, and lead manager Marco Pirondini recently added the responsibilities of Chief Investment Officer for the firm to his portfolio. Those responsibilities, plus some turnover in the management team, give Morningstar pause.

Bottom line

Be careful. Don’t be afraid. Don’t drift into the rocks. Make reasonable, thoughtful changes that align with your needs and risk tolerance, then get back to the things that make life worth living. Good books. Good friends. Gardens. Helping others. Forgiving yourself.

Cheers!