What a month it has been. The jobs numbers for May and June were revised lower, and the July numbers were below expectations as a wakeup call to a slowing economy. Two weeks later, wholesale prices rose 3.3% compared to a year earlier, and the producer price index rose 0.9% compared to the month before as tariffs began to raise the cost of inputs. National debt hit $37 trillion in August. Underlying growth for the economy year-to-date is a weak 1.4%, but it is distorted by imports. Federal Reserve Chairman Jerome Powell gave his speech following the Jackson Hole Symposium, in which he expressed rising risks to employment, persistent inflation pressures, and an openness to interest rate cuts. The markets reacted enthusiastically to this “bad news is good news”. Federal Reserve Governor Lisa Cook is suing the Trump administration over the attempt to fire her, raising questions about the Fed’s independence. What a month it has been, and it is not over yet.

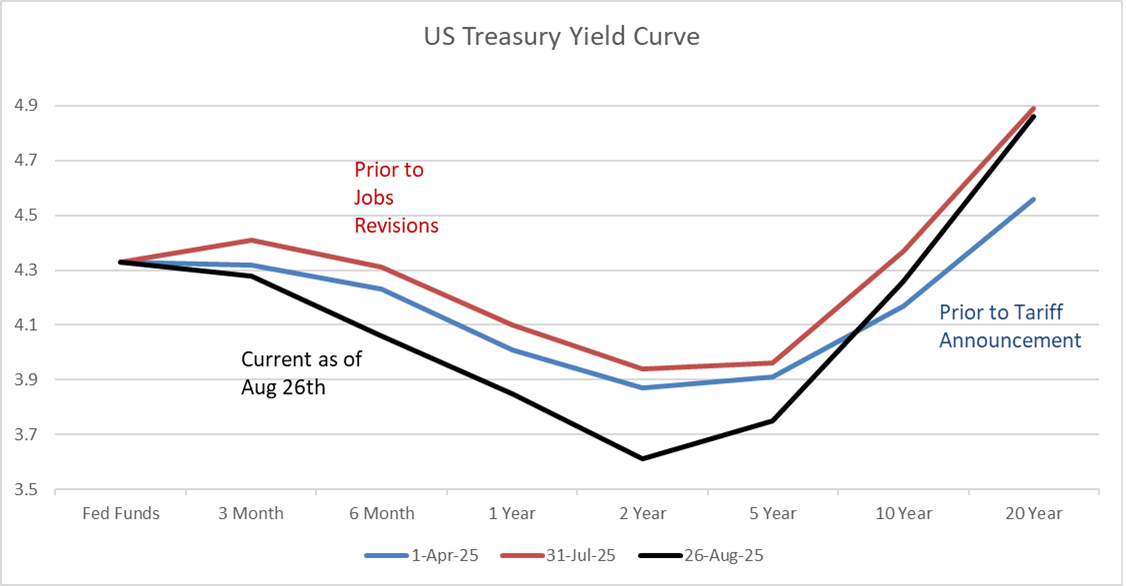

Figure #1 shows the yield curves for U.S. Treasuries just before President Trump announced tariffs, before the employment revisions, and the current yield curve. Investors are seeking higher, longer-term yields because of the higher risk of inflation and rising debt. They anticipate rate cuts to begin in September. After the employment numbers were revised lower, I have shifted more from short-term bond funds to intermediate bond funds in time for rates to drop.

Figure #1: U.S. Treasury Yield Curves

Source: Author Using St. Louis Federal Reserve FRED database.

I finished reading “Our Dollar, Your Problem” by Kenneth Rogoff. I try to take away at least one concept that I can apply from each economics and investing book that I read. Dr. Rogoff describes the declining dominance of the dollar and the relationship between the dollar, interest rates, exchange rates, inflation, debt, and deficits. As I have written, my long-term view is of slower economic growth due in part to demographics, higher long-term interest rates because of high deficits and rising national debt, and below-average future domestic stock returns because of high valuations. I adjust this long-term view to include “a sustained period of global financial volatility marked by higher average real interest rates and inflation and more frequent bouts of debt and financial crises.”

This article describes the changes that I have been making to my portfolio, as it appears that we are reaching an inflection point in interest rates with a slowing economy and rising inflation. First, I have lowered my stock to bond allocation from 65% to 50% including lowering my risk profile of what Fidelity manages, which allows more flexibility in what I manage. Second, I have adopted a barbell approach, shifting money from short-term bond funds to intermediate bond funds. Third, I have shifted investments from funds with lower quality bonds to higher quality. Last but not least, I have added bond and flexible portfolio funds to protect against inflation.

iShares iBonds with Target Maturities

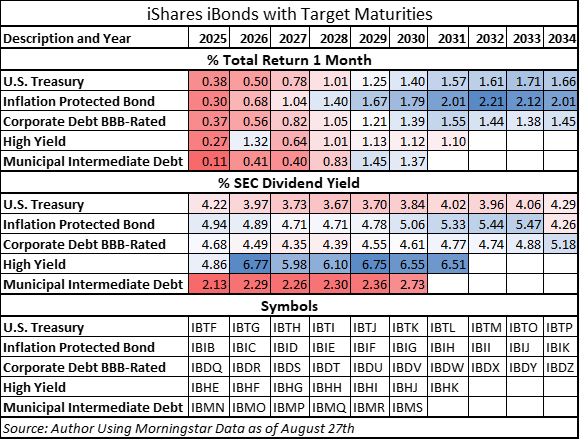

This year, I switched from adding individual bonds to iShares iBonds with target maturities to my bond ladder. I like them for diversification, simplicity, and liquidity. They hold bonds that mature near the target date, and the fund is liquidated on its maturity date, and pays interest monthly.

Table #1 shows the one-month return, the yield, and symbols for these funds through 2034, to reflect performance. While job numbers were revised lower, inflation shows signs of rising, and after Fed Chair Powell’s speech, short-term Corporate bond ETFs had about 0.37% one-month returns, while those maturing in 2033 and 2034 had 1.4% one-month returns. Inflation-protected bonds with longer durations have done even better.

Table #1: iShare iBonds One Month Returns and Yields

Author’s Recent Bond Fund Purchases

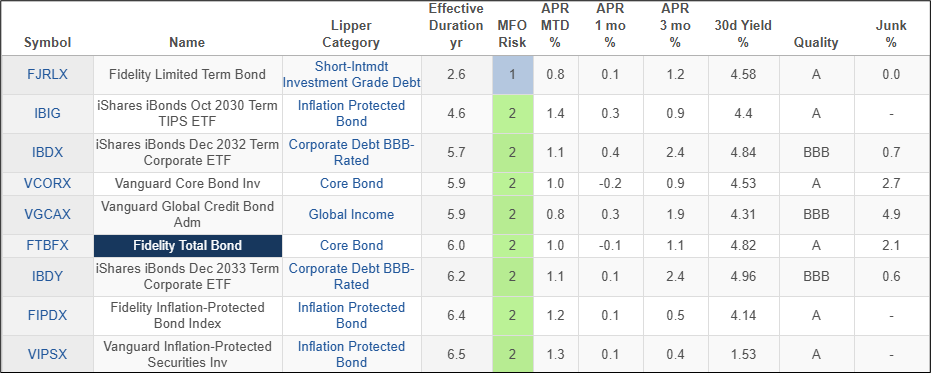

The economy is slowing, and bankruptcies are rising. Over the past several months, I sold all of my high-yield bond funds and many of my loan participation funds in order to focus more on quality. I shifted from shorter-duration bond funds to those with longer durations in a barbell approach. I diversified into more investment-grade corporate bond funds through core and total bond funds. Table #2 contains my latest changes over the past few months.

Table #2: Author’s Recent Bond Purchases – Metrics as of August 23rd

Closing

Quantitative Easing suppressed long-term yields until inflation increased following the COVID pandemic. I agree with Dr. Rogoff’s comment in Chapter 26, “The Siren Call of ‘Lower Forever’ Interest Rates”, “My long-standing guess is that the average real interest rate on ten-year inflation-indexed U.S. Treasury bonds will be much higher in the 2020s and 2020s than the near-zero average level in 2012-2021.”

Federal Reserve Chairman has signaled a receptiveness to lowering rates in September because of a softening labor market. I use the barbell approach with short-term bonds and inflation-protected bonds to protect against rising inflation. I have locked in higher yields with intermediate bond funds to take advantage of a steepening yield curve and diversified into investment-grade bonds. I expect that longer-term rates will have to stay longer to finance the rising national debt and threats of higher inflation. Financing long-term debt with short-term debt is a major risk.

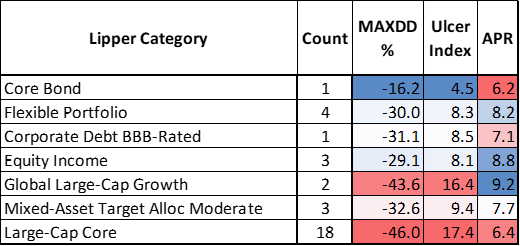

Out of curiosity, I calculated the average return of Lipper Categories during the 1970s when inflation averaged 6.6%. Most stocks and bonds did not beat inflation. Global equity funds and corporate bonds performed a bit better. I don’t expect inflation to be as severe in the coming decade; however, I believe that it is prudent to have a diversified portfolio.

Table #3: Lipper Category Performance During the 1970s.