By Edward Studzinski

The Mountains are High, and the Emperor is Far, Far Away

Chinese Aphorism

Year-end 2014 presents investors with a number of interesting conundrums. For a U.S. dollar investor, the domestic market, as represented by the S&P 500, provided a total return of 13.6%, at least for those invested in it by the proxy of Vanguard’s S&P 500 Index Fund Admiral Shares. Just before Christmas, John Authers of the Financial Times, in a piece entitled “Investment: Loser’s Game” argued that this year, with more than 90% of active managers on track to underperform their benchmarks, a tipping point may have finally been reached. The exodus of money from actively managed funds has accelerated. Vanguard is on track to take in close to $200B (yes, billion) into its passive funds this year.

And yet, I have to ask if it really matters. As I watch the postings on the Mutual Fund Observer’s discussion board, I suspect that achieving better than average investment performance is not what motivates many of our readers. Rather, there is a Walter Mittyesque desire to live vicariously through their portfolios. And every bon mot that Bill (take your pick, there are a multitude of them) or Steve or Michael or Bob drops in a print or televised interview is latched on to as a reaffirmation the genius and insight to invest early on with one of The Anointed. The disease exists in a related form at the Berkshire Hathaway Annual Circus in Omaha. Sooner or later, in an elevator or restaurant, you will hear a discussion of when that person started investing with Warren and how much money they have made. The reality is usually less that we would like to know or admit, as my friend Charles has pointed out in his recent piece about the long-term performance of his investments.

Rather than continuing to curse the darkness, let me light a few candles.

- When are index funds appropriate for an investment program? For most of middle America, I am hard pressed to think of when they are not. They are particularly important for those individuals who are not immortal. You may have constructed a wonderful portfolio of actively-managed funds. Unfortunately, if you pass away suddenly, your spouse or family may find that they have neither the time nor the interest to devote to those investments that you did. And that assumes a static environment (no personnel changes) in the funds you are invested in, and that the advisors you have selected, if any, will follow your lead. But surprise – if you are dead, often not at the time of your choice, you cannot control things from the hereafter. Sit in trust investment committee meetings as I did for many years, and what you will most likely hear is – “I don’t care what old George wanted – that fund is not on our approved list and to protect ourselves, we should sell it, regardless of its performance or the tax consequences.”

- How many mutual funds should one own? The interplay here is diversification and taxes. I suspect this year will prove a watershed event as investors find that their actively-managed fund has generated a huge tax bill for them while not beating its respective benchmark, or perhaps even losing money. The goal should probably be to own fewer than ten in a family unit, including individual and retirement investments. The right question to ask is why you invested in a particular fund to begin with. If you can’t remember, or the reason no longer applies, move on. In particular, retirement and 401(k) assets should be consolidated down to a smaller number of funds as you get older. Ideally they should be low cost, low expense funds. This can be done relatively easily by use of trustee to trustee transfers. And forget target date funds – they are a marketing gimmick, predicated on life expectancies not changing.

- Don’t actively managed funds make sense in some circumstances? Yes, but you really have to do a lot of due diligence, probably more than most investment firms will let you do. Just reading the Morningstar write-ups will not cut it. I think there will be a time when actively-managed value funds will be the place to be, but we need a massive flush-out of the industry to occur first, followed by fear overcoming greed in the investing public. At that point we will probably get more regulation (oh for the days of Franklin Roosevelt putting Joe Kennedy in charge of the SEC, figuring that sometimes it makes sense to have the fox guarding the hen house).

- Passive funds are attractive because of low expenses, and the fact that you don’t need to worry about managers departing or becoming ill. What should one look for in actively-managed funds? The simple answer is redundancy. Dodge and Cox is an ideal example, with all of their funds managed by reasonably-sized committees of very experienced investment personnel. And while smaller shops can argue that they have back-up and succession planning, often that is marketing hype and illusion rather than reality. I still remember a fund manager more than ten years ago telling me of a situation where a co-manager had been named to a fund in his organization. The CIO told him that it was to make the Trustees happy, giving the appearance of succession planning. But the CIO went on to say that if something ever happened to lead manager X, co-manager Y would be off the fund by sundown since Y had no portfolio management experience. Since learning such things is difficult from the outside, stick to the organizations where process and redundancy are obvious. Tweedy, Browne strikes me as another organization that fits the bill. Those are not meant as recommendations but rather are intended to give you some idea of what to look for in kicking tires and asking questions.

A few final thoughts – a lot of hedge funds folded in 2014, mainly for reasons of performance. I expect that trend to spread to mutual funds in 2015, especially those that are at best marginally profitable. Some of this is a function of having the usual acquiring firms (or stooges, as one investment banker friend calls them) – the Europeans – absent from the merger and acquisition trail. Given the present relationship of the dollar and the Euro, I don’t expect that trend to change soon. But I also expect funds to close just because the difficulty of outperforming in a world where events, to paraphrase Senator Warren, are increasingly rigged, is almost impossible. In a world of instant gratification, that successful active management is as much an art as a science should be self-evident. There is something in the process of human interaction which I used to refer to as complementary organizational dysfunction that produces extraordinary results, not easily replicable. And it involves more than just investment selection on the basis of reversion to the mean.

One example of genius would be Thomas Jefferson, dining alone, or Warren Buffet, sitting in his office, reading annual reports. A different example would be the 1927 Yankees or the Fidelity organization of the 1980’s. In retrospect what made them great is easy to see. My advice to people looking for great active management today – look for organizations without self-promotion, where individuals do not seek out to be the new “It Girl” and where the organizations focus on attracting curious people with inquiring but disciplined minds, so that there ends up being a creative, dynamic tension. Avoid organizations that emphasize collegiality and consensus. In closing, let me remind you of that wonderful scene where Orson Welles, playing Harry Lime in The Third Man says,

… in Italy for 30 years under the Borgias they had warfare, terror, murder, and bloodshed, but they produced Michelangelo, Leonardo da Vinci, and the Renaissance. In Switzerland they had brotherly love – they had 500 years of democracy and peace, and what did they produce? The cuckoo clock.

One of the joys of having entered the investment business in the 1980’s is that you came in at a time when the profession was still populated by some really nice and thoughtful people, well-read and curious about the world around them. They were and are generally willing to share their thoughts and ideas without hesitation. They were the kind of people that you hoped you could keep as friends for life. One such person is my friend, Bruce, who had a thirty-year career on the “buy side” as both an analyst and a director of research at several well-known money management firms. He retired in 2008 and divides his time between homes in western Connecticut and Costa Rica.

One of the joys of having entered the investment business in the 1980’s is that you came in at a time when the profession was still populated by some really nice and thoughtful people, well-read and curious about the world around them. They were and are generally willing to share their thoughts and ideas without hesitation. They were the kind of people that you hoped you could keep as friends for life. One such person is my friend, Bruce, who had a thirty-year career on the “buy side” as both an analyst and a director of research at several well-known money management firms. He retired in 2008 and divides his time between homes in western Connecticut and Costa Rica.

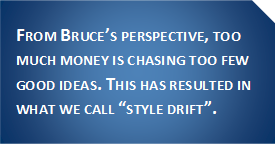

From Bruce’s perspective, too much money is chasing too few good ideas. This has resulted in what we call “style drift”. Firms that had made their mark as small cap or mid cap investors didn’t want to kill the goose laying the golden eggs by shutting off new money, so they evolved to become large cap investors. But ultimately that is self-defeating, for as the assets come in, you either have to shut down the flows or change your style by adding more and larger positions, which ultimately leads to under-performance.

From Bruce’s perspective, too much money is chasing too few good ideas. This has resulted in what we call “style drift”. Firms that had made their mark as small cap or mid cap investors didn’t want to kill the goose laying the golden eggs by shutting off new money, so they evolved to become large cap investors. But ultimately that is self-defeating, for as the assets come in, you either have to shut down the flows or change your style by adding more and larger positions, which ultimately leads to under-performance. I go out of the darkness

I go out of the darkness When I mention to institutional investors that I think the change in Japan is real, the most common response I get is a concern about “Abenomics.” This is usually expressed as “They are printing an awful lot of money.” Give me a break. Ben Bernanke and his little band of merry Fed governors have effectively been printing money with their various QE efforts. Who thinks that money will be repaid or the devaluation of the U.S. dollar will be reversed? The same can be said of the EU central bankers. If anything, the U.S. has been pursuing a policy of beggar thy creditor, since much of our debt is owed to others. At least in Japan, they owe the money to themselves. They have also gone through years of deflation without the social order and fabric of society breaking down. One wonders how the U.S. would fare in a similar long-term deflationary environment.

When I mention to institutional investors that I think the change in Japan is real, the most common response I get is a concern about “Abenomics.” This is usually expressed as “They are printing an awful lot of money.” Give me a break. Ben Bernanke and his little band of merry Fed governors have effectively been printing money with their various QE efforts. Who thinks that money will be repaid or the devaluation of the U.S. dollar will be reversed? The same can be said of the EU central bankers. If anything, the U.S. has been pursuing a policy of beggar thy creditor, since much of our debt is owed to others. At least in Japan, they owe the money to themselves. They have also gone through years of deflation without the social order and fabric of society breaking down. One wonders how the U.S. would fare in a similar long-term deflationary environment.