It looks like you're new here. If you want to get involved, click one of these buttons!

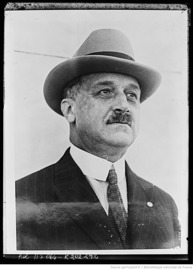

My father, who was also Italian, had nothing but contempt for the BofA, which had turned a friendly and helpful local bank into what you folks are still observing today. Boy, was he ever right.A. P. Giannini was an American banker who founded the Bank of Italy, which eventually became Bank of America. Giannini is credited as the inventor of many modern banking practices. Most notably, Giannini was one of the first bankers to offer banking services to middle-class Americans, mainly Italian immigrants, rather than only the upper class. He also pioneered the holding company structure and established one of the first modern trans-national institutions.

I would never buy an OEF (traditional mutual fund) that I didn’t consider a long-term hold (“buy and forget” to use @BaluBalu’s words)."Is this a buy and forget fund, as I am looking for one? If this is not a buy and forget fund, what purpose does this fund serve in a portfolio?

© 2015 Mutual Fund Observer. All rights reserved.

© 2015 Mutual Fund Observer. All rights reserved. Powered by Vanilla