It looks like you're new here. If you want to get involved, click one of these buttons!

A more accurate list on taxation would point out that we all pay many "everyday" taxes well beyond income tax.haven't paid a dime in taxes since 2012, and may not pay them for 5-10 more years.

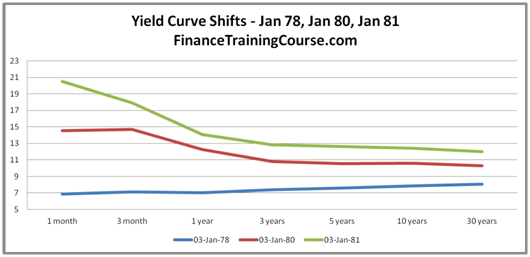

While I'm a big fan of VWINX, I don't feel that comparing it with funds that are very different in composition is quite cricket. VWINX has had a 40 year tailwind (falling yields), while real return funds have had a headwind over the same time frame - years of moderate to low inflation.

https://www.macrotrends.net/2497/historical-inflation-rate-by-year

Should inflation pick up (OP: " I don't see how we can avoid inflation"), this could all flip. Unfortunately, what appears to be the granddaddy of inflation friendly funds, PRPFX, goes back only to 1982, after inflation started receding. So one can't look easily to historical data.

Here's a recent M* column suggesting 22 funds that could be considered diversified real asset funds designed to handle bouts of inflation:

Now's the Time to Consider These Inflation Protection Strategies

https://connect.rightprospectus.com/MutualofAmerica/TADF/62824C842/FS?site=NAV#The Investment Company offers shares in the Funds to the Insurance Companies, without sales charge, for allocation to their Separate Accounts. See your variable annuity or variable life insurance prospectus ... Shares of the Funds are also offered through retirement plans. See your Summary Plan Description or consult with your plan sponsor for information on how to purchase shares of the Funds through your retirement plan

Well, for many it goes a bit beyond guessing.Event based markets are difficult to bet on, especially when the event is 2 weeks away. Small and micro caps are in red today. So, it is not full on risk, notwithstanding a decent up day in large cap averages.

Yep. Anybody’s guess how it will all play out. Not only the debt question, but Evergrande and a lot of other newsworthy issues. I’d expect a “relief bounce” in many markets lasting a day of two if / when the debt issue is settled. However, I still think the path of least resistance near term is down - if we’re talking about the major indexes. That’s not to say some individual stocks and sectors won’t do well.

© 2015 Mutual Fund Observer. All rights reserved.

© 2015 Mutual Fund Observer. All rights reserved. Powered by Vanilla