It looks like you're new here. If you want to get involved, click one of these buttons!

Bengen says based on the current environment he thinks a new retiree should be safe if they start with a withdrawal rate of…no more than 5%.

“That’s what I use myself,” Bengen told me when we spoke by phone.

....retirees right now have one saving grace: Very low inflation.

It's not about knowing more, it's about backing up a "new" concept with real numbers. The best teacher is the market.FD - So you know more about investing than the professionals quoted in Barron’s?

https://www.nationalgeographic.com/news/energy/2012/12/121206-high-voltage-dc-breakthrough/An updated, high-voltage version of DC, called HVDC, is being touted as the transmission method of the future because of its ability to transmit current over very long distances with fewer losses than AC. And that trend may be accelerated by a new device called a hybrid HVDC breaker, which may make it possible to use DC on large power grids without the fear of catastrophic breakdown that stymied the technology in the past. ...

[HVDC is] better suited to places where electricity must be transmitted extraordinarily long distances from power plants to urban areas. It also is more efficient for underwater electricity transmission. ...

Far-flung arrays of wind farms and solar installations could be tied together in giant networks. Because of its stability and low losses, HVDC could balance out the natural fluctuations in renewable energy in a way that AC never could.

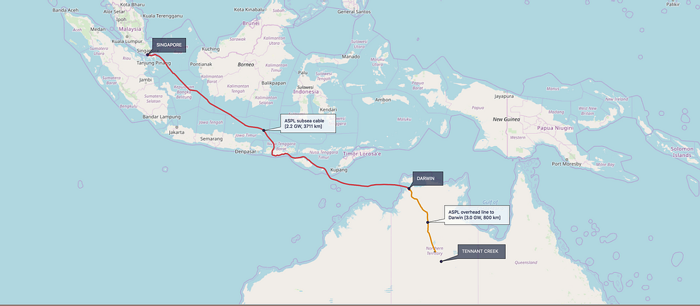

.....the Power Link doesn't just involve building the world's largest solar farm, which will be easily visible from space. The project also anticipates construction of what will be the world's longest submarine power cable, which will export electricity all the way from outback Australia to Singapore via a 4,500-kilometre (2,800 miles) high-voltage direct current (HVDC) network.

https://fa-mag.com/news/choosing-the-highest-safe-withdrawal-rate-at-retirementBengen says based on the current environment he thinks a new retiree should be safe if they start with a withdrawal rate of…no more than 5%.

That’s been my experience as well. I recall a recent Barron’s “Mid-Year Roundup” (or whatever they call it) in which a couple money managers alluded to moving to the barbell approach. Seems to me they feel the “middle-ground” investment approach is in trouble now because typical income-earning investments aren’t working. That’s due to not just low rates on investment grade bonds. EM & HY bonds hadn’t done much either this year up to that point. And look at the disaster PRFDX - once considered a conservative fund - has experienced lately.“When you hear the phrase "barbell strategy" among investment professionals it has a wide spectrum of meaning ...”

jesse-livermore-upside-down-markets-understanding-fiscal-and-monetary-policy-invest-like-the-bestWe seek to answer the simple question: against a horrible economic backdrop, how can the stock market be near all-time highs? Jesse explains in detail the impact that fiscal policy has had on the market and may have in the future.

Again, the thread is not about me but after you couldn't come up with anything to debunk the original post you resort to make it personal. I never said that what I do is the only game in town, it works extremely well for our portfolio. I actually posted many times that the average Joe should buy several funds (indexes+managed) and hardly trade.It's all good, FD. PIMIX is still good for long term holders. I'm meeting my goals. That is what is important to me. Keep convincing yourself that getting 5% per year with low SD is the only game in town. I guess there's a reason people live in Georgia :o}

Huh? Do you also graph them $10k growth for 10-9-8-7-6-5-4-3-2-1y-ytd? That's the first thing I do.Why would you choose this over say BIV? or the more volatile FTBFX?

Plug the symbols into Portfolio Visualizer and you'll see why. Not only does TCW have the best returns dating back to 2007 (with no down years) but lowest SD and highest Sharp. It's not even really close.

(Even Orman concedes that in this low interest rate environment she puts some money into stocks, though most is still in munis.)Do you enjoy spending money? Oh, yes. My greatest pleasure is still flying private. I spend between $300,000 to $500,000, depending on my year, on flying private.

What do you do with the rest of your money? Save it and build it in municipal bonds. I buy zero-coupon municipal bonds, and all the bonds I buy are triple-A-rated and insured so that even if the city goes under, I get my money.

https://www.theatlantic.com/politics/archive/2014/08/why-arent-reformicons-pushing-a-guaranteed-basic-income/375600/The idea isn’t new. As [David] Frum notes, Friederich Hayek endorsed it. In 1962, the libertarian economist Milton Friedman advocated a minimum guaranteed income via a “negative income tax.” In 1967, Martin Luther King Jr. said, “The solution to poverty is to abolish it directly by a now widely discussed measure: the guaranteed income.” Richard Nixon unsuccessfully tried to pass a version of Friedman’s plan a few years later, and his Democratic opponent in the 1972 presidential election, George McGovern, also suggested a guaranteed annual income.

NYT Article:As companies furloughed millions of workers and stock prices plunged through late March, Treasury Secretary Steven Mnuchin offered a glimmer of hope: The government was about to step in with a $4 trillion bazooka.

The scope of that promise hinged on the Federal Reserve.

© 2015 Mutual Fund Observer. All rights reserved.

© 2015 Mutual Fund Observer. All rights reserved. Powered by Vanilla