It looks like you're new here. If you want to get involved, click one of these buttons!

Well, an early guess of mine (same thread) was that folks have shifted into cash, CDs and the like. If so, the swoon could partially reflect assets moving out of the types of things CCOR owns, or actually fleeing the fund. Without looking, I’d have to guess the latter is true, as today’s fund investors aren’t likely to sit on a stinker like this too long. What I wonder is - if being”It's too bad CCOR is stinking up the place this year as I've been interested in this fund for a while. Admittedly, some of my interest faded when short-term Treasuries started yielding over 4% and now 5%. High quality bonds are far more attractive today than they were at the start of 2022 … “

Interesting history, worth reading for some of it, but it also perpetuates some false mythology about the democratization of the stock market and “everybody getting rich” off it. The vast majority of Americans who own stocks or stock mutual funds, own them in very small quantities so that the top 1% still owns most of the market just like they always have. Moreover, one of the reasons for the ostensible democratization is that workers were losing their pension plans and being put by their employers into 401ks with stock mutual funds. So now they’re stock owners. The end result was a massive increase in wealth inequality. So, to say everyone was getting rich in the 1990s simply isn’t true.

[snip]

I've got average too.Average stock likely to perform much better over the next 3-5 years than the average index because the average index is so beholden to a few vastly overextended stars.

https://www.nytimes.com/1992/12/05/news/strategies-buying-stock-ways-to-save-on-brokers-commissions.htmlwhenever fewer than 100 shares are being traded it may be important to ask how minimums -- the rock bottom charge for a trade, however small -- will affect the fee. In such trades, the discount houses may not always be less costly.

A discount broker like Fidelity Investments would charge its current $54 minimum to sell 25 shares of a $30 stock. At Quick & Reilly the minimum would be $37.50 and at Schwab it would be $42.75. At Shearson Lehman Brothers, a full-service house, the sale would result in a $50 minimum commission. This compares with Shearson's 1987 schedule of charges, when no minimums applied. Back then the trade would have cost $20 plus a $12 odd-lot premium.

We went from 1% stock market ownership in 1929 to 19% in 1983 to nearly 60% by 2000.

Almost 60% of households who owned stocks had purchased their first share after 1990. One-third of all buyers entered the market in 1995 or later.

It didn’t hurt that the S&P 500 was up 20% or more for 5 straight years from 1995-1999 while the Nasdaq Composite was up a blistering 41% per year in that same stretch.

Everyone was getting rich and the rise of the internet broke down even more barriers to entry as companies like E-Trade brought a whole new segment of investors into the market.

LSLTX beat VFINX because the SP500 lost money in 2000-2010. Starts at 01/2009 or 01/2010 and VFINX easily beat it.Interestingly, Leuthold Select Industries, LSLTX, has beaten VFINX, the Vanguard S&P 500 fund, since its inception but lagged VIMAX, the Vanguard mid-cap index fund. Depending on how you want to define the Leuthold fund, you could call that success. It is currently categorized, though, as mid-cap.

I suspect that poster might be a collector's item now. Bogle welcomed the challenge and found it amusing.In July 1971, the first index fund was created by McQuown and Fouse with a $6 million contribution from the Samsonite Luggage pension fund, which had been referred to Fouse by Bill Sharpe, who was already teaching at Stanford. It was Sharpe’s academic work in the 1960s that formed the theoretical underpinning of indexing and would later earn him the Nobel Prize. The small initial fund performed well, and institutional managers and their trustees took note.....

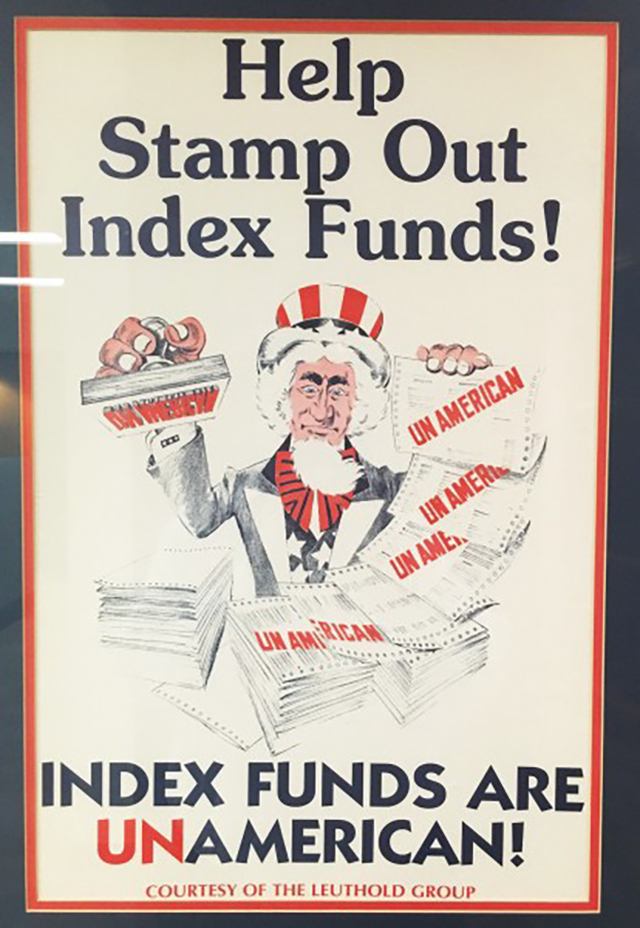

...But even in San Francisco, as in the country’s other financial centers, Fouse and McQuown’s findings were not a welcome development for brokers, portfolio managers, or anyone else who thrived on the industry’s high salaries and fees. As a result, the counterattack against indexing began to unfold. Fund managers denied that they had been gouging investors or that there was any conflict of interest in their profession. Workout gear appeared with the slogan “Beat the S&P 500,” and a Minneapolis-based firm, the Leuthold Group, distributed a large poster nationwide depicting the classic Uncle Sam character saying, “Index Funds Are UnAmerican,” implying that anyone who was not trying to beat the averages was nothing more than an unpatriotic wimp. (That poster still hangs on the office walls of many financial planners and fund managers.)

© 2015 Mutual Fund Observer. All rights reserved.

© 2015 Mutual Fund Observer. All rights reserved. Powered by Vanilla