It looks like you're new here. If you want to get involved, click one of these buttons!

I think this concern is a little backwards. For one thing, I don’t love the terminology. As Morgan Ricks, a leading scholar of shadow banking, puts it: “‘Shadow banks’ originally meant nonbank financial institutions offering deposit substitutes and I still think it would be better to stick with that terminology, rather than using the term to refer to any nonbank lender.” Lots of companies make loans, and it is better to use “shadow banks” to refer to companies whose liabilities make them look like banks, who borrow short-term to invest long-term and thus have the same fragility and run risk as real banks.[6] I have spent a lot of time over the last year or so describing various crypto firms (exchanges and lending platforms) as “crypto shadow banks,” because they are in the business of issuing deposit-like claims and investing that money in crypto hedge funds or whatever. (Well, they were in that business. Then they all had bank runs.)That means businesses large and small may soon need to look elsewhere for loans. And a growing cohort of nonbanks, which don’t take deposits — including giant investment firms like Apollo Global Management, Ares Management and Blackstone — are chomping at the bit to step into the vacuum.

For the last decade, these institutions and others like them have aggressively scooped up and extended loans, helping to grow the private credit industry sixfold since 2013, to $850 billion, according to the financial data provider Preqin.

Now, as other lenders slow down, the large investment firms see an opportunity.

“It actually is good for players like us to step into the breach where, you know, everybody else has vacated the space,” Rishi Kapoor, a co-chief executive of Investcorp, said on the stage of the Milken Institute’s global conference this week.

But the shift in loans from banks to nonbanks comes with risk. Private credit has exploded partly because its providers are not subject to the same financial regulations put on banks after the financial crisis. What does it mean for America’s loans to be moving to less-regulated entities at the same time the country is facing a potential recession?

Institutions that make loans but aren’t banks are known (much to their chagrin) as “shadow banks.” They include pension funds, money market funds and asset managers.

Because shadow banks don’t take in deposits, they’re not subject to the same regulations as banks, which allows them to take greater risks. And so far, their riskier bets have been profitable: Returns on private credit since 2000 exceeded loans in the public market by 300 basis points, according to Hamilton Lane, an investment management firm.

Still, the most important reason to avoid entering into negotiations over the debt limit itself goes beyond politics. It is why, in 2011, Mr. Obama pledged never again after trying to negotiate with the Republicans. Allowing the Republicans to use the threat of default as extortion could cripple the remainder of Mr. Biden’s presidency.

This time it’s spending cuts and work requirements for Medicaid recipients. What happens when the debt limit comes up again next year? Will the Republicans demand a federal abortion ban? A pardon for the Jan. 6 perpetrators?

You don’t have to believe this theory, but something like it seems to be pretty popular. In particular, environmental, social and governance investors often express some version of this; they talk about the need to transition to green energy and question the long-term viability of fossil fuels.

• The world runs on oil right now, demand for oil is high, the price of oil is high, and getting oil out of the ground is lucrative.

• In X years — pick a number — the world will not run on oil, because the environmental effects of burning oil are bad, and eventually, through some combination of better green-energy technology, consumer demand and government regulation, the world will stop burning oil.

• Therefore the oil-drilling business will produce a series of cash flows that is large now and will, over the next X years, decline to zero.

Answer 1 seems wrong, on this theory: If you make long-term oil investments, and oil is doomed in the long term, then your investments are wasteful. You are taking profits that belong to shareholders and wasting them on inertia.

1) Do what you’ve always done. Drill lots of oil, acquire new leases, explore the deep ocean, make long-term investments in drilling technology, keep being an oil company, hope it all works out.

2) Pivot to renewables.[1] Drill oil for now, but make your long-term investments in green energy; build wind farms or drill geothermal wells or whatever, so that in X years, when the world stops using oil, you will be able to sell whatever it does use.

3) Drill the oil you’ve got, but plan for decline. Stop making lots of new long-term investments in oil fields. Maximize current cash flow, and spend it on stock buybacks. Eventually, in X years, your cash flows will be zero, and you will close up shop gracefully. But in the meantime there is money coming in, and rather than waste it on drilling new oil fields, you give it back to shareholders.

I should add that, like, pure-play wind-farm companies might have another advantage over oil companies in building wind farms: Their cost of capital might be lower. ESG investors tend to reward companies with good ESG scores (like green-energy companies) and penalize companies with bad ESG scores (like oil companies). This can have the (intended) result of lowering the cost of capital of green companies (lots of ESG investors want to buy their stock) and raising the cost of capital of polluting companies (nobody wants their stock). We talked a few weeks ago about a paper on “Counterproductive Sustainable Investing: The Impact Elasticity of Brown and Green Firms,” by Samuel Hartzmark and Kelly Shue, arguing that this has the effect of making polluting companies more short-term-focused: If your cost of capital is high, near-term projects are worth relatively more and long-term projects are worth relatively less, so you will focus on the short term. Hartzmark and Shue argue that in particular this means that polluting oil companies who get little love from ESG investors will decide to drill more oil to maximize short-term cash flows, but it does also suggest that polluting oil companies might decide to do less oil exploration and other long-term oil-focused investment, and spend more of their cash flows on stock buybacks. Your model could be something like “ESG lowers the cost of capital of green firms and raises the cost of capital of polluting firms, to encourage green firms to invest more for the long term and encourage polluting firms not to plan to stick around.” And then a lot of stock buybacks from oil firms would be a reasonable ESG outcome.Oil-and-gas companies have built up a mountain of cash with few precedents in recent history. Wall Street has a few ideas on how to spend it—and new drilling isn’t near the top of the list. ...

Even as an uncertain economic outlook has weighed on crude in 2023, making the energy sector the S&P 500’s worst performer, cash has continued flowing. Companies that previously chased growth and funneled money into speculative drilling investments, weighing down their stocks, have instead tried to appease Wall Street by boosting dividends and repurchasing shares.

The cash has helped make up for stock prices that often seesaw alongside volatile commodity markets. Steady returns also buoy an industry with an uncertain long-term outlook as governments, markets and the global economy gradually shift toward cleaner energy. …

President Biden has called on producers to ramp up output in a bid to lower prices at the pump. “These balance sheets make clear that there is nothing stopping oil companies from boosting production except their own decision to pad wealthy shareholder pockets and then sit on whatever is left,” White House Assistant Press Secretary Abdullah Hasan said. ...

“U.S. oil-and-gas producers are less focused on capital spending than they have been in years,” said Mark Young, a senior analyst at Evaluate Energy.

The cash buildup owes itself to other factors as well. Many companies have paid off debt racked up during growth mode, when they dug much of the top-tier territory for wells. While some companies have pledged huge sums to carbon-capture technology or hydrogen production, clean-energy investment has been slowed by lower expected returns and the wait for yet-to-be-finalized regulations in Mr. Biden’s climate package.

+1 Thank you @Bobpa. It makes perfect sense put that way.I have it in my Schwab account and there are times when I want to move distributions from other funds into VWINX, but the $75.00 fee discourages that if the amount is not significant. That is the reason to look for another fund that is no-load.

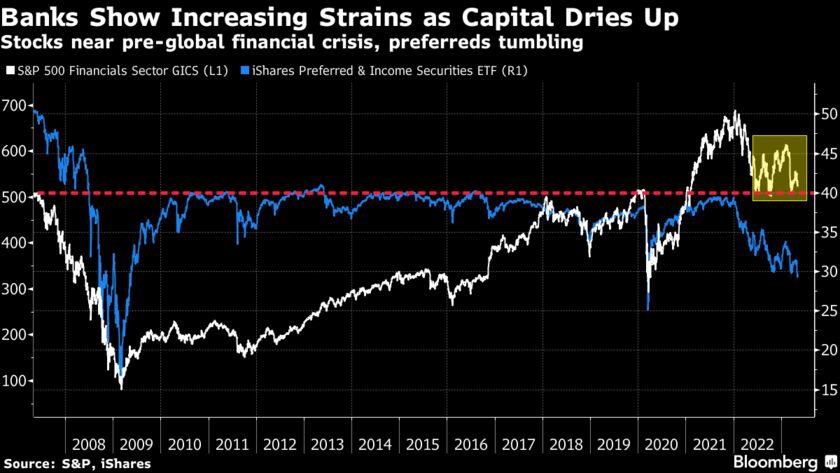

This is the #1 reason why I refuse to hold bank preferreds. In good times, they're fine - but when the banks get into trouble (often at their own doing) they can nix or suspend the preferred dividend and treat our money (likely now trading for a capital loss on OUR books) like an interest-free loan that's likely going to remain (until it recovers value to us) on THEIR books.Long-term PFF chart from Twitter LINK. It is underperforming financials by a lot because of the concerns that noncumulative bank preferred may be worthless in the FDIC or other bank rescues.

It’s hard to come up with a better low-cost alternative than the highly regarded VWINX. Lots of good suggestions, In the end, it’s your decision. But changing horses mid-stream not always wise.”Since everyone’s situation is unique with respect to withdrawal needs., RMD, and investment horizon, the question is more on financial planning rather than a “drop-in” replacement with a different asset allocation fund.”

Good info.Last post @Bobpa posted on MFO was back in June 2022.

https://mutualfundobserver.com/discuss/discussion/comment/151173/#Comment_151173

In this post, he talked about his portfolio and holdings where VWINX is one of the larger allocation fund. Bobpa is in his retirement and he is looking for a replacement for some reason that he did not specify on this post. Since everyone’s situation is unique with respect to withdrawal needs., RMD, and investment horizon, the question is more on financial planning rather than a “drop-in” replacement with a different asset allocation fund.

On Tuesday March 7, Sen. Elizabeth Warren, D-Mass., chair of the Subcommitee on Economic Policy, held a hearing on the debt limit, in which experts assessed its economic and financial consequences. In prepared testimony at the hearing, Mark Zandi, chief economist of the financial services company Moody's Analytics, said a default would be "a catastrophic blow to the already fragile economy."

Zandi warned of consequences akin to the Great Recession, including a roiled stock market that would cause market crashes, high interest rates and tanking equity prices. He said even if the default is quickly remedied, it would be too late to avoid a recession. Waiting too long to act could cause severe economic turmoil with global impacts.

The testimony included Moody's simulations of what an economic downturn could be, should the government default, casting a bleak view of the prospect that includes:

• Real GDP declines over 4% and diminished long-term growth prospects.

• 7 million jobs lost.

• Over 8% unemployment.

• Stock price decreases by almost a fifth, with households seeing a $10 trillion decline in wealth as a result.

• Spiking rates on treasury yields, mortgages and other consumer and corporate borrowing.

Further, Zandi expressed skepticism that lawmakers would be able to resolve their impasse quickly, as evidenced in part by the difficulty House Republicans had in electing McCarthy as speaker of the House. It took 15 rounds of voting for McCarthy to succeed.

"Odds that lawmakers are unable to get it together and avoid a breach of the debt limit appear to be meaningfully greater than zero," Zandi said in the testimony.

What would happen if the U.S. defaulted on debt?

If the default lasts for weeks or more, rather than days, it could trigger a fire-and-brimstone, Armageddon-level financial crisis for the U.S. and global economies.

A report from the White House Council of Economic Advisors in October 2021 warned of the possible effects of the U.S. defaulting, which include a worldwide recession, worldwide frozen credit markets, plunging stock markets and mass worldwide layoffs. The real gross domestic product, or GDP, could also fall to levels not seen since the Great Recession.

The U.S. has only defaulted once, in 1979, and it was an unintentional snafu — the result of a technical check-processing glitch that delayed payments to certain U.S. Treasury bond holders. The whole affair affected only a few investors and was remedied within weeks.

But the 1979 default was not intentional. And from the point of view of the global markets, there's a world of difference between a short-lived administrative snag and a full-blown default as a result of Congress failing to raise the debt limit.

A default could happen in two stages. First, the government might delay payments to Social Security recipients and federal employees. Next, the government would be unable to service its debt or pay interest to its bondholders. U.S. debt is sold to investors as bonds and securities to private investors, corporations or other governments. Just the threat of default would cause market upheaval: A big drop in demand for U.S. debt as its credit rating is downgraded and sold, followed by a spike in interest rates. The U.S. government would need to promise higher interest payments to justify the increased risk of buying and holding its debt.

Here’s what else you can expect to see if the U.S. defaults on its debt.

A sell-off of U.S. debt

A default could provoke a sell-off in debt issued by the U.S. government, considered among the safest and most stable securities in the world. Such a sell-off of U.S. Treasurys would have far-reaching repercussions.

Money market funds could sell out

Money market funds are low-risk, liquid mutual funds that invest in short-term, high-credit quality debt, such as U.S. Treasury bills. Conservative investors use these funds as they typically shield against volatility and are less susceptible to changes in interest rates.

In the past, investors have sold out of money market funds when the U.S. ran up against debt ceiling limits and signaled potential government default. Yields on shorter-term T-bills go up because they are impacted more compared with longer-term bonds, which give investors more time for markets to calm down.

Federal benefits would be suspended

In the event of a default, federal benefits would be delayed or suspended entirely.

Those include:

Social Security; Medicare and Medicaid; Supplemental Nutrition Assistance Program, or SNAP, benefits; housing assistance; and assistance for veterans.

Stock markets would roil

A default would likely trigger a downgrade of the United States’ credit rating — the S&P downgraded the nation’s credit rating only once before, in 2011 when it was approaching default. The default combined with the downgraded credit rating would in turn cause the markets to tank, the White House’s Council of Economic Advisors said in 2021.

If current debt ceiling talks continue for too long, the markets are likely to become more volatile than they already are.

Interest rates would increase

As debt ceiling negotiations linger, Americans could see rates increase on consumer lending products, including credit cards and variable rate student loans.

Credit lenders may have less capital to lend or may tighten their standards, which would make it more difficult to get credit.

Depending on the timing of a default and how long the effects are felt, rates could increase on new fixed auto loans, federal or private student loans and personal loans.

Tax refunds could be delayed

If the debt ceiling isn’t raised, it could take more time for tax filers to receive their refunds — usually within 21 days of filing. If the government defaults, those who file late run a risk of not receiving their refund.

Housing rates would increase

A debt ceiling crisis won’t impact those with fixed-rate mortgages or fixed-rate home equity lines of credit, or HELOCs. But adjustable-rate mortgage, or ARM, holders may see rates rise even further than they already have — more than four percentage points on rate indexes since spring 2022. Those in the fixed period of their ARM can expect to see rates rise when reaching their first adjustment.

Me either, but something tells me that, if it were to be challenged in court, we-the-people might end up wishing it could have been challenged before 2016. Constitutionality seems to sway in the wind sometimes. If it were deemed constitutional for some reason, things might get even worse than they are. I imagine the challenge has not occurred because of appearances (big spender) or the deadly outside chance of an unexpected result.

I still do not understand why the debt ceiling is not unconstitutional.

© 2015 Mutual Fund Observer. All rights reserved.

© 2015 Mutual Fund Observer. All rights reserved. Powered by Vanilla