By Leigh Walzer

It is May 1. The time of flowers, maypoles and labor solidarity.

For football fans it is also time for that annual tradition, the NFL draft. Representatives of every professional football team assemble in Chicago and conspire to divide up the rights to the 250 best college players. The draft is preceded by an extensive period of due diligence.

Some teams are known to stockpile the best available talent. Other teams focus on the positions where they have the greatest need; if there are more skilled players available at other positions they try to trade up or down to get the most value out of their picks. Others focus on the players who offer the best fit, emphasizing size, speed, precision, character, or other traits.

The highly competitive world of professional sports offers a laboratory for investors selecting managers. Usually at Trapezoid we focus on finding the most skillful asset managers, particularly those with active styles who are likely to give investors their money’s worth. In the equity world, identifying skill is three quarters of the recipe for investment success.

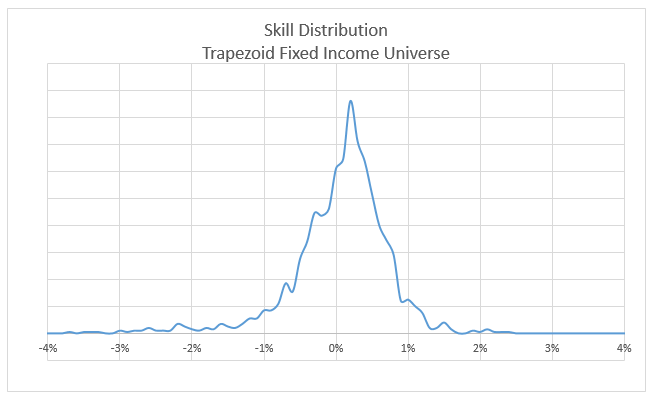

But when we apply our principles to fixed income investing, the story is a little different. The difference in skill between the top 10% and bottom 10% is only half as great as for the equity world. In other words, time spent looking for the next Jeff Gundlach is only half as productive as time spent looking for the next Bill Miller.

Exhibit I

That assumes you can identify the good fixed income managers. Allocators report the tools at their disposal to analyze fixed income managers are not as good as in equities.

Some people argue that in sports, as in investing, the efficient market hypothesis rules. The blog Five-thirty-eight argues that No Team Can Beat the Draft. General managers who were seen as geniuses at one point in their career either reverted to the mean or strayed from their discipline.

Readers might at this point be tempted to simply buy a bond ETF or passive mutual fund like VTBXX. Our preliminary view is that investors can do better. Many fixed income products are hard to reproduce in indices; and the expense difference for active management is not as great. We measure skill (see below) and estimate funds in the top ten percentile add approximately 80 basis points over the long haul; this is more than sufficient to justify the added expense.

However, investors need to think about the topic a little differently. In fixed income, skillful funds exist but they are associated with a fund which may concentrate in a specific sector, duration, and other attributes. It is often not practical to hedge those attributes – you have to take the bundle. Below, we identify n emerging market debt fund which shows strong skill relative to its peers; but the sector has historically been high-risk and low return which might dampen your enthusiasm. It is not unlike the highly regarded quarterback prospect with off-the-field character issues.

When selecting managers, skill has to be balanced against not only the skill and the attractiveness of the sector but also the fit within a larger portfolio. We are not football experts. But we are sympathetic to the view that the long term success of franchises like the New England Patriots is based on a similar principle: finding players who are more valuable to them than the rest of the league because the players fit well with a particular system.

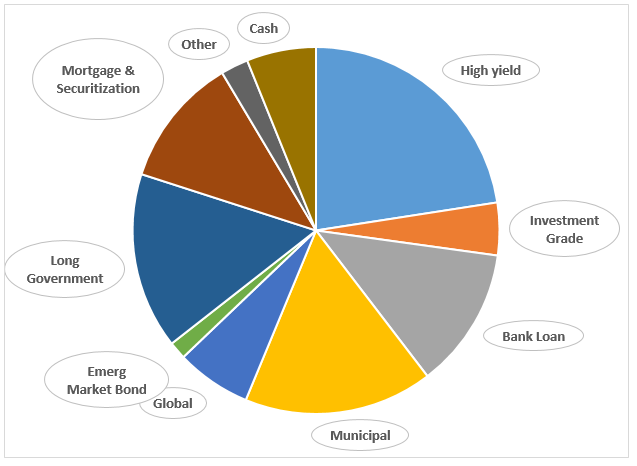

To illustrate this point, we constructed an idealized fixed income portfolio. We identified 22 skilled bond managers and let our optimizer choose the best fund allocation. Instead of settling upon the manager with the best track record or highest skill, the model allocated to 8 different funds. Some of those were themselves multi-sector funds. So we ended up fairly diversified across fixed income sectors.

Exhibit I

Sector Diversification in one Optimized Portfolio

Characteristics of a Good Bond Portfolio

We repeated this exercise a number of times, varying the choice of funds, the way we thought of skill, and other inputs. We are mindful that not every investor has access to institutional classes and tax-rates vary. While the specific fund allocations varied considerably with each iteration, we observed many similarities throughout.:

BUSINESS CREDIT: Corporate bonds received the largest allocation; the majority of that went to high yield and bank loans rather than investment grade bonds

DON’T OVERLOAD ON MUNIs. Even for taxable investors, municipal funds comprised only a minority of the portfolio.

STAY SHORT: Shorter duration funds were favored. The example above had a duration of 5.1 years, but some iterations were much shorter

DIVERSIFY, UP TO A POINT: Five to eight funds may be enough.

Bond funds are more susceptible than equity funds to “black swan” events. Funds churn out reliable yield and NAV holds steady through most of the credit cycle until a wave of defaults or credit loss pops up in an unexpected place. It is tough for any quantitative due diligence system to ferret out this risk, but long track records help. In the equity space five years of history may be sufficient to gauge the manager’s skill. But in fixed income we may be reluctant to trust a strategy which hasn’t weathered a credit crunch. It may help to filter out managers and funds which weren’t around in 2008. Even then, we might be preparing our portfolio to fight the last war.

Identifying Skilled Managers

The recipe for a good fixed income portfolio is to find good funds covering a number of bond sectors and mix them just right. We showed earlier that fixed income manager skill is distributed along a classic bell curve. What do we mean by skill and how do we identify the top 10%?

The principles we apply in fixed income are the same as for equities but the methodology is the same. While the fixed income model is not yet available on our website, readers of Mutual Fund Observer may sample the equity model by registering at www.fundattribution.com. We value strong performance relative to risk. While absolute return is important, we see value in funds which achieve good results while sitting on large cash balances – or with low correlation to their sectors. And we look for managers who have outperformed their peer group -or relevant indices – preferably over a long period of time. We also consider the trend in skill.

For fixed income we currently rely on a fitted regression model do determine skill. A few caveats are in order. This approach isn’t quite as sophisticated as what we do with equity funds. We don’t use the holdings data to directly measure what the manager is up to, we simply infer it. We don’t break skill down into a series of components. We rely on gross performance of subsectors rather than passive indices. We haven’t back-tested this approach to see whether it makes relevant predictions for future periods. And we don’t try to assess the likelihood that future skill will exceed expenses. Essentially, the funds which show up well in this screen outperformed a composite peer group chosen by an algorithm over a considerable period of time. While we call them skillful, we haven’t ruled out that some were simply lucky. Or, worse, they could be generating good performance through a strategy which back to bite them in the long term. For all the reasons noted earlier, quantitative due diligence of portfolio managers has limitations. Ultimately, it pays to know what is inside the credit “black box”

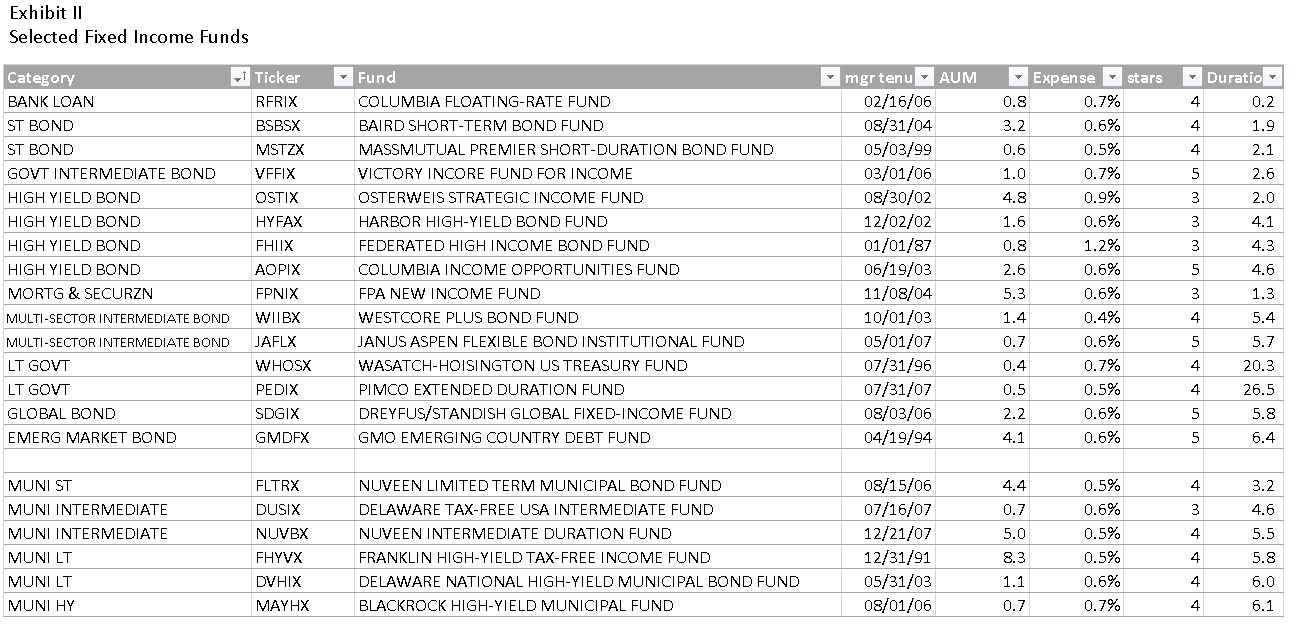

Exhibit II lists some of the top-ranking funds in some of the major fixed income categories. We culled these from a list of 2500 fixed income funds, generally seeking top-decile performance, AUM of at least $200mm, and sufficient history with the fund and manager.

We haven’t reviewed these funds in detail. Readers with feedback on the list are welcome to contact me at [email protected]

From time to time, the media likes to anoint a single manager as the “bond king.” But we suggest that different shops seem to excel in different sectors. Four High Yield funds are included in the list led by Osterweis Strategic Income Fund (OSTIX). In the Bank Loan Category several funds show better but Columbia Floating-Rate Fund (RFRIX) is the only fund with the requisite tenure. The multi-sector funds listed here invest in corporate, mortgage, and government obligations. We are not familiar with Wasatch-Hoisington US Treasury Fund (WHOSX), but it seems to have outperformed its category by extending its duration.

FPA New Income Fund (FPNIX) is categorized with the Mortgage Funds, but 40% of its portfolio is in asset-backed securities including subprime auto. Some mortgage-weighted funds with excellent five year records who show up as skillful but weren’t tested in the financial crisis or had a management change were excluded. Notable among those is TCW Total Return Bond Fund (TGLMX).

Skilled managers in the municipal area include Nuveen (at the short to intermediate end), Delaware, Franklin, and Blackrock (for High Yield Munis).

Equity

Style diversification seems less important in the equity area. We tried constructing a portfolio using 42 “best of breed” equity funds from the Trapezoid Honor Roll. Our optimizer proposed investing 80% of the portfolio in the fund with the highest Sharpe Ratio. While this seems extreme, it does suggest equity allocators can in general look for the “best available athlete” and worry less about portfolio fit.

Bottom Line

Even though fixed income returns fall in a narrower range than their equity counterparts, funds whose skill justify their expense structure are more abundant. Portfolio fit and sector timeliness sometimes trumps skill; diversification among fixed income sectors seems to be very important; and the right portfolio can vary from client to client. If in doubt, stay short. Quantitative models are important but strive to understand what you are investing in.

What’s the Trapezoid story? Leigh Walzer has over 25 years of experience in the investment management industry as a portfolio manager and investment analyst. He’s worked with and for some frighteningly good folks. He holds an A.B. in Statistics from Princeton University and an M.B.A. from Harvard University. Leigh is the CEO and founder of Trapezoid, LLC, as well as the creator of the Orthogonal Attribution Engine. The Orthogonal Attribution Engine isolates the skill delivered by fund managers in excess of what is available through investable passive alternatives and other indices. The system aspires to, and already shows encouraging signs of, a fair degree of predictive validity.

What’s the Trapezoid story? Leigh Walzer has over 25 years of experience in the investment management industry as a portfolio manager and investment analyst. He’s worked with and for some frighteningly good folks. He holds an A.B. in Statistics from Princeton University and an M.B.A. from Harvard University. Leigh is the CEO and founder of Trapezoid, LLC, as well as the creator of the Orthogonal Attribution Engine. The Orthogonal Attribution Engine isolates the skill delivered by fund managers in excess of what is available through investable passive alternatives and other indices. The system aspires to, and already shows encouraging signs of, a fair degree of predictive validity.

The stuff Leigh shares here reflects the richness of the analytics available on his site and through Trapezoid’s services. If you’re an independent RIA or an individual investor who need serious data to make serious decisions, Leigh offers something no one else comes close to. More complete information can be found at www.fundattribution.com. MFO readers can sign up for a free demo.