Objective and strategy

Grandeur Peak calls fast-growing, high-quality stocks with market capitalizations above $1.5 billion “stalwarts”. They are too big for Grandeur Peak’s small- and micro-cap funds, but too good to let go, so Grandeur Peak rolled out two funds to hold them.

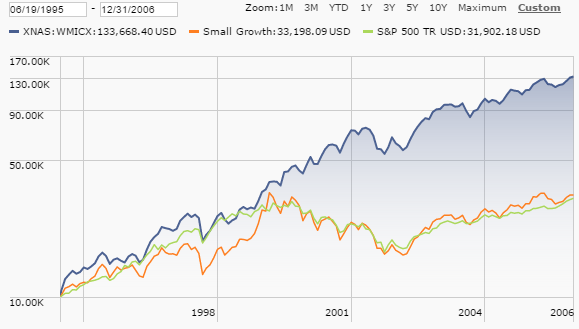

It is a little appreciated fact that most of the gains in the stock market are driven by a handful of runaway winners; most stocks earn sub-par returns. Grandeur Peak’s strategy is to try to find them when they’re small—the tinier, the better—and ride them up. Founder Robert T. Gardiner made an ungodly sum of money applying this strategy for the lucky shareholders of Wasatch Micro Cap (WMICX) from 1995 to 2006.

Here’s how a 2000 New York Times article described Gardiner’s strategy:

“To choose the 80 or so stocks in the fund, he first looks at companies with annual earnings and revenue growth of at least 15 percent. … Next, he screens the stocks for stable or increasing operating return on assets, or earnings before interest and taxes, divided by company assets other than cash and intangibles. …To help make his final choices, he visits more than 100 companies a year.”

Grandeur Peak builds on this very successful formula. The firm’s analysts screen the global market for quality stocks, which usually have high margins, low earnings/revenue volatility, high (and increasing) returns on capital, minimal debt and restrained share issuance. Once promising stocks have been found, the analysts look to see if they have good business models, competent and honest leadership, and room for more growth.

Analysts travel the world to investigate particularly interesting companies. (Grandeur Peak has a public “touch tracker” showing how many companies their analysts have visited.) The sheer amount of legwork they put into visiting obscure stocks in remote locales creates an informational edge; many of the firms they’ve visited are rarely if ever contacted by analysts. This due diligence is important because screening for attractive statistical traits in emerging-markets micro-cap stocks will also surface some (perhaps many) companies engaging in accounting fraud.

Stocks that pass this gantlet get an extensive earnings model built. The decision to buy is determined by a “quality/value/momentum” matrix, where the stocks with the highest quality, cheapest valuations, and strongest business momentum get the biggest weights (with a cap of around 3%). High quality stocks that are too expensive are put on a watch list. Positions are frequently monitored and revised, leading to turnover that has ranged from 20% to 50% across all their funds.

The process has worked well. Most of Grandeur Peak’s funds have beaten their peers and benchmarks, some by crushing margins.

Adviser

Grandeur Peak Global Advisors, LLC, located in Salt Lake City, Utah, was founded in 2011 by Robert Gardiner, Blake Walker and Eric Huefner. All three worked together at Wasatch Advisors and many key hires also came from Wasatch. The firm managed $2.9 billion as of 2016 end and employs about 32 people, most of whom are in research or investment roles. Thankfully, the firm doesn’t have a chief marketing officer.

The firm’s principals have shown admirable restraint. Grandeur Peak could easily quadruple assets by monetizing its track record but has held true to their promise to keep assets in their small- and micro-capped strategies capped at $2 billion to $3 billion. All the firm’s micro- and small-cap funds are hard closed.

Recently Grandeur Peak announced a partnership with Rondure Global Advisors, taking a minority stake in the firm. Rondure and Grandeur Peak share office space, research analysts, and operations. Rondure is launching international funds that may overlap with Grandeur Peak’s funds. I am not concerned about potential conflicts of interest yet because Rondure likely won’t reach a size where it matters for at least a couple of years. Rondure is also pursuing a “core” strategy, which should reduce its overlap with Grandeur Peak’s growth-oriented approach.

Managers

Randy Pearce and Blake Walker are the portfolio managers. Robert Gardiner is “guardian” portfolio manager, where his role is to act as a consultant to Pearce and Walker.

Pearce is lead portfolio manager of the Stalwarts funds. He was the firm’s first hire in 2011 and his ascent has been swift. He became co-director of research in 2015 and chief investment officer this year. Pearce is guardian portfolio manager of Grandeur Peak Global Reach (GPRIX) and had stints helping run Grandeur Peak International Opportunities (GPGIX) and Grandeur Peak Emerging Markets Opportunities (GPEIX).

He has a CFA and an MBA from UC Berkeley’s Haas School of Business. Prior to business school, he worked at Wasatch as a research analyst from 2005 to 2009. Gardiner has singled out Pearce for praise in his letters. Pearce picked the firm’s first 20-bagger, Australian asset manager Magellan Financial Group.

Walker is chief executive officer and co-founder. In addition to the Stalwarts funds, Walker manages Grandeur Peak Emerging Markets Opportunities (GPEIX), Grandeur Peak Global Opportunities (GPGIX), and Grandeur Peak International Opportunities (GPIIX). He had stints managing Grandeur Peak Global Reach (GPRIX) and Grandeur Peak Global Micro Cap (GPMCX).

At Wasatch, he co-managed Wasatch Global Opportunities (WIGOX) with Gardiner and Wasatch International Opportunities (WIIOX). He had a brief stint managing Wasatch Emerging Markets Small Cap (WIEMX).

Gardiner is chairman and co-founder. In addition to the Stalwarts funds, he’s guardian portfolio manager of Grandeur Peak Global Micro Cap (GPMCX). With Walker he co-manages Grandeur Peak Global Opportunities (GPGIX) and Grandeur Peak International Opportunities (GPIIX).

He was a long-time employee (and later partner) of Wasatch Advisors, where he managed Wasatch Micro Cap (WMICX), Wasatch Micro Cap Value (WAMVX), and Wasatch Global Opportunities (WIGOX).

The criss-crossing of portfolio management responsibilities reflects Grandeur Peak’s team-oriented process. While Gardiner and Walker are still relatively young, the widespread delegation of responsibilities helps cultivate future talent and mitigates worries about succession. That said, I can’t rule out the possibility that Grandeur Peak’s fantastic results are driven by the principals’ non-replicable abilities. Daniel Chace, who co-managed Wasatch Micro Cap with Gardiner for three years, produced mediocre returns for over a decade after Gardiner left the fund, despite having years to observe and learn from Gardiner.

Strategy capacity and closure

Grandeur Peak estimates its Stalwarts strategy can roughly handle $5 billion to $7 billion. The Stalwarts mutual funds have about $386 million as of March-end but there are also separate accounts and other vehicles that run the strategy.

Manager incentives

Portfolio managers are given relatively small base salaries and paid bonuses only when their funds beat the median fund manager in the relevant Morningstar category or the primary benchmark over 1- or 3-year periods. Anything below median peer performance or benchmark performance results in no bonus; the full bonus is only paid for top-quartile peer performance or more than 400 basis points versus the primary benchmark.

This compensation structure is sensible. It penalizes below-benchmark performance and pays out linearly as performance surpasses peers or the benchmark.

Gardiner and Walker have equity ownership of the firm; Pearce likely has synthetic equity ownership. For Gardiner and Walker, their incentives are tied much more strongly to the overall financial success of the firm than to the performance of the Stalwarts funds.

As of April-end 2016, Walker had $100,001-$500,000 in each of Global Stalwarts International Stalwarts; Pearce had $100,001-$500,000 in Global Stalwarts and $50,001-$100,000 in International Stalwarts; and Gardiner had $500,001-$1,000,000 in Global Stalwarts and $100,001-$500,000 in International Stalwarts. The managers’ personal allocations suggest that they like Global Stalwarts version over International Stalwarts, but I suspect it’s driven by diversification considerations as Grandeur Peak has no U.S.-only funds.

Overall, the portfolio managers’ incentives are well-aligned with shareholders’. The firm’s principals have consistently behaved in a way that indicates they care about producing superior risk-adjusted returns more than maximizing fee income.

Expense ratio

The Global Stalwarts Fund charges 1.17% for its Investor class shares and 0.93% for its Institutional class shares on assets of $191.3 million.

The International Stalwarts Fund charges 1.14% for its Investor class shares and 0.89% for its Institutional class shares on assets of $1.7 Billion.

(July 2023)

Website

Grandeur Peak Global Stalwarts Fund

Grandeur Peak International Stalwarts Fund

Sam Lee and Severian Asset Management

Sam Lee and Severian Asset Management

Sam is the founder of Severian Asset Management, Chicago. He is also former Morningstar analyst and editor of their ETF Investor newsletter. Sam has been celebrated as one of the country’s best financial writers (Morgan Housel: “Really smart takes on ETFs, with an occasional killer piece about general investment wisdom”) and as Morningstar’s best analyst and one of their best writers (John Coumarianos: “ Lee has written two excellent pieces [in the span of a month], and his showing himself to be Morningstar’s finest analyst”). He has been quoted by The Wall Street Journal, Financial Times, Financial Advisor, MarketWatch, Barron’s, and other financial publications.

Severian works with high net-worth partners, but very selectively. “We are organized to minimize conflicts of interest; our only business is providing investment advice and our only source of income is our client fees. We deal with a select clientele we like and admire. Because of our unusual mode of operation, we work hard to figure out whether a potential client, like you, is a mutual fit. The adviser-client relationship we want demands a high level of mutual admiration and trust. We would never want to go into business with someone just for his money, just as we would never marry someone for money—the heartache isn’t worth it.” Sam works from an understanding of his partners’ needs to craft a series of recommendations that might range from the need for better cybersecurity or lower-rate credit cards to portfolio reconstruction.