On December 30, 2016, 361 Capital Management launched 361 US Small Cap Equity (ASFQX). This fund is the newest embodiment of an investment strategy initiated by John Riddle and Mark Jaeger of BRC Investment Management. Messrs. Riddle and Jaeger co-founded BRC in 2005, then merged with 361 Capital in October 2016. BRC was managing about $800 million in assets at the time of the merger, 361 had about $1.3 billion.

What do you need to know?

The strategy is thoughtful and distinctive.

The portfolio is driven the predictable and irrational behavior of other investors. The boom in passive investing was spurred on by efficient market theorists, who labored under the delusion that investors were rational and fully-informed, hence that prices were always “right.” Since every security was, they argued, valued more-or-less correctly, there was no reason to use active managers to pursue “price discovery,” that is, to determine the fair market value of a security.

A bunch of smart people, in and outside of finance, rolled their eyes at this nonsense. The most rudimentary reading of financial history repeatedly, unequivocally, demonstrated that prices were frequently, laughably wrong. Investors would pay the equivalent of 200 years’ worth of earnings for shares of one stock while refusing to pay five years’ worth for another, stock prices jumped around two- to four-times more than a firm’s earnings did, single tulip bulbs fetched the price of an entire house and the value of the land under Japan’s Imperial Palace was once greater than the value of all the land in California. And then it wasn’t.

The task was to identify the drivers and predictable patterns of irrationality. Riddle and Jaeger are among those who believe they did. In particular, they found exploitable patterns of irrationality surrounding favorable earnings announcements or upward earnings revisions.

The managers use two sets of screens: first, a behavioral screen surrounding earnings events and, second, a valuation screen since they found that low-priced stocks are subject to even greater mispricing than most. They then create an evenly weighted, sector neutral, 75-125 stock portfolio.

The managers are richly experienced.

Mr. Riddle was one of the earliest researchers to publish in behavioral finance, with his first article appearing in 1991. In the years between that early research and the founding of BRC, he was President and CIO of Duff & Phelps Investment Management and CEO and CIO of Capital West Asset Management LLC, among other things. Mr. Jaeger was a managing director at Duff & Phelps and a financial executive at Comcast, AT&T Broadband and Arthur Andersen. They describe their investment team as having “over 96 years combined experience utilizing proprietary techniques to identify attractive securities [and] to maximize alpha capture.”

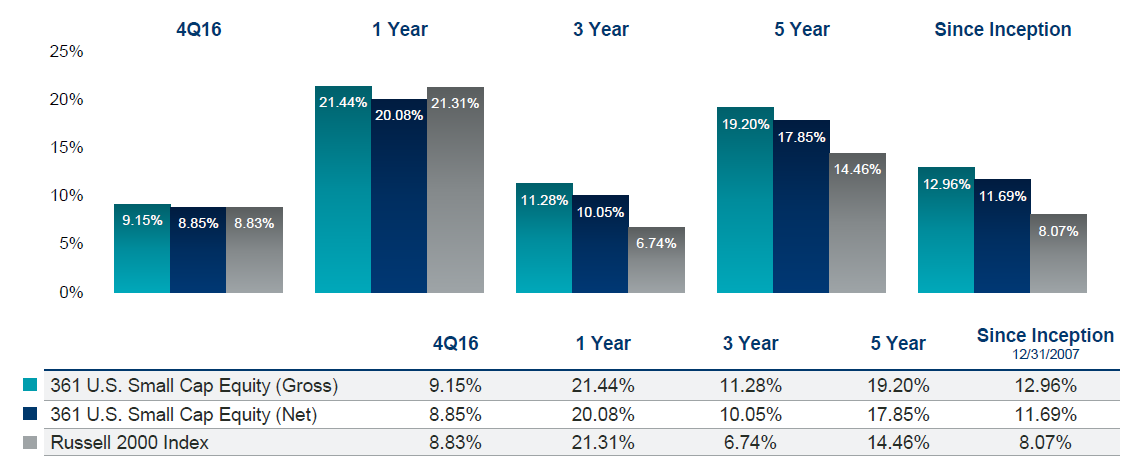

The strategy has performed exceptionally well.

They’ve accomplished those consistently solid returns while capturing over about 85% of the market’s downside. While these results reflect the performance of the strategy in a different vehicle (that is, separate accounts), those accounts were quite large and the results were generated consistently over time. Investors intrigued by the prospect of small-cap exposure that’s capable of generating independent alpha might well want to put 361 Small Cap on their due diligence list.

The “I” class shares of the fund carry 1.26% expense ratio, with a $2,500 minimum initial purchase. “Investor” shares have the same minimum but carry a 12(b)1 fee of 0.25%.

The fund’s website is 361 U.S. Small Cap Equity. It’s a decent site, but there’s substantially more depth of information available around the homepage for BRC’s Small Cap Equity Strategy.