Dear friends,

Welcome to the Summer Break edition of the Mutual Fund Observer. I’m writing from idyllic Ephraim, Wisconsin, a beautiful little village in Door County on the shores of Green Bay. Here’s a quick visual representation of how things are going:

Thanks to Kathy Glasnap, a very talented artist who has done some beautiful watercolors of Door County, for permission to use part of one of her paintings (“All in a Row”). Whether or not you’ve (yet) visited the area, you should visit her gallery online at http://www.glasnapgallery.com/

Chip, Anya, Junior and I bestirred ourselves just long enough to get up, hit <send>, refill our glasses with sangria and settle back into a stack of beach reading and a long round of “Mutual Fund Truth or Dare.” (Don’t ask.)

In celebration of the proper activities of summer (see above), we offer an abbreviated Observer.

MFO in Other Media: David on Chuck Jaffe’s MoneyLife Radio Show

I’ll be the first to admit it: I have a face made for radio and a voice made for print. Nonetheless, I was pleased to make an appearance on Chuck Jaffe’s MoneyLife radio show (which is also available as a podcast). I spoke about three of the funds that we profiled this month, and then participated in a sort of “stump the chump” round in which I was asked to offer quick-hit opinions in response to listener questions.

I’ll be the first to admit it: I have a face made for radio and a voice made for print. Nonetheless, I was pleased to make an appearance on Chuck Jaffe’s MoneyLife radio show (which is also available as a podcast). I spoke about three of the funds that we profiled this month, and then participated in a sort of “stump the chump” round in which I was asked to offer quick-hit opinions in response to listener questions.

Dodge & Cox Global Stock (DODWX) for Rick in York, Pa. It’s easy to dismiss DODWX if you’ve give a superficial glance at its performance. The fund cratered immediately after launch in 2008 when the managers bought financial stocks that were selling at a once-in-a-generation price only to see them fall to a once-in-a-half-century price. But those purchases set up a ferocious run in 2009. It was hurt in 2011 by an oversized emerging markets stake which paid off handsomely in the first quarter of 2012. It’s got a great management team and an entirely sensible investment discipline. It’ll be out-of-step often enough but will, in the long run, be a really good investment.

Fidelity Emerging Markets (FEMKX) for Brad in Cazenovia, NY. My bottom line was “it’s not as bad as it used to be, but there’s still no compelling reason to own it.” If you’re investing with Fido, their new Fidelity Total Emerging Markets (FTEMX) is a more much intriguing option.

Leuthold Core Investment (LCORX) for Scott in Redmond, Ore. This was the original go-anywhere fund, born of Leuthold’s sophisticated market analysis service. Quant driven, quite capable of owning pallets of lead or palladium. Brilliant for years but, like many computer-driven funds, largely hamstrung lately by the market’s irrational jerks and twitches. If you anticipate a return to a more-or-less “normal” market where returns aren’t driven by fears of the Greeks, it’s likely to resume being an awfully attractive, conservative holding.

Matthews Asia Dividend Fund (MAPIX) for Robert in Steubenville, Ohio. With Matthews Asian Growth & Income (MACSX), this fund has the best risk-return profile of any Asian-focused fund. The manager invests in strong companies with lots of free cash flow and a public commitment to their dividend. What it lacks in MACSX’s bond and convertibles holdings, it makes up for in good country selection and stock picking. If you want to invest in Asia, Matthews is the place to start.

T. Rowe Price Capital Appreciation (PRWCX) for Dennis in Strongsville, Ohio. PRWCX usually holds about 65% of the portfolio in large, domestic dividend-paying stocks and a third in other income-producing securities. Traditionally the fund held a lot of convertible securities though David Giroux, manager since 2006, has held a bit more stock and fewer converts. The fund has lost money once in a quarter century and a former manager chuckled over the recollection that Price’s internal allocation models kept coming to the same conclusion: “invest 100% in PRWCX.”

MFO in Other Media: David on “The Best Fund for the Next Six Months … and Beyond”

Early in July, John Waggoner wrote to ask for recommendations for “the remainder of 2012.” Answers from three “mutual fund experts” (I shudder) appear in John’s July 5th column. Dan Wiener tabbed PrimeCap Odyssey Aggressive Growth (POAGX) and Jim Lowell picked Fidelity Total Emerging Markets (FTEMX). I highlighted the two most recent additions to my non-retirement portfolio:

RiverPark Short Term High Yield (RPHYX), which I described as “one of the most misunderstood funds I cover. It functions as a cash management fund for me — 3% to 4% returns with (so far) negligible volatility. Its greatest problem is its name, which suggests that it invests in short-term, high-yield bonds (which, in general, it doesn’t) or that it has the risk profile of a high-yield fund (ditto).”

David Sherman, the manager, stresses that RPHYX “is not an ATM machine.” That said, the fund returned 2.6% in the first seven months of 2012 with negligible volatility (the NAV mostly just drops with the month-end payouts). That’s led to a Sharpe ratio above 3, which is simply great. Mr. Sherman says that he thinks of it as a superior alternative to, say, laddered bonds or CDs. While in a “normal” bond market this will underperform a diversified fund with longer durations, in a volatile market it might well outperform the vast majority.

Seafarer Overseas Growth & Income (SFGIX), driven by the fact that Mr. Foster “performed brilliantly at Matthews Asian Growth & Income (MACSX), which was the least volatile (hence most profitable) Asian fund for years. With Seafarer, he’s able to sort of hedge a MACSX-like portfolio with limited exposure to non-Asian emerging markets. The strategy makes sense, and Mr. Foster has proven able to consistently execute it.”

SFGIX has substantially outperformed the average emerging-Asia, Latin America and diversified emerging markets fund in the months since its launch, though it trails MACSX. The folks on our discussion board mostly maintain a “deserves to be on the watch-list” stance, based mostly on MACSX’s continued excellence. I’m persuaded by Mr. Foster’s argument on behalf of a portfolio that’s still Asia-centered but not Asia exclusively.

Seafarer Overseas Piques Morningstar’s Interest

One of Morningstar’s most senior analysts, Gregg Wolper, examined the struggles of two funds that should be attracting more investor interest than they are, in “Two Young Funds Struggle to Get Noticed” (July 31, 2012).

One is TCW International Small Cap (TGICX) which launched in March 2011. It’s an international small-growth fund managed by Rohit Sah. Sah had “an impressive if volatile record” in seven years at Oppenheimer International Small Company (OSMAX). The problem is that Sah has a high-volatility strategy even by the standards of a high-volatility niche, which isn’t really in-tune with current investor sentiment. Its early record is mostly negative which isn’t entirely surprising. No load, $2000 investment minimum, 1.44% expense ratio.

The other is Seafarer Overseas Growth and Income (SFGIX). Wolper recognizes Mr. Foster’s “impressive record” at Matthews and his risk-conscious approach to emerging markets investing. “His fund tries to cushion the risks of emerging-markets investing by owning less-volatile, dividend-paying stocks and through other means, and in fact over the past three months it has suffered a much more moderate loss than the average diversified emerging-markets fund.” Actually, from inception through July 31 2012, Seafarer was up by 0.4% while the average emerging markets fund had lost 7.4%.

Mr. Wolper concludes that when investors’ appetite for risk returns, these will both be funds to watch:

At some point, though, certain investors will be looking for a bold fund to fill a small slot in their portfolio. Funds with modest asset bases have more flexibility than their more-popular rivals to own smaller, less-liquid stocks in less-traveled markets should they so choose. For that reason, it’s worth keeping these offerings in mind. Their managers are accomplished, and though there are caveats with each, including their cost, they feature strategies that are not easy to find at rival choices.

It’s What Makes Yahoo, Yahoo

Archaic, on the Observer’s discussion board, complained, “When I use Yahoo Finance to look at a particular fund … [its] Annual Total Return History, the history is complete through 2010 but ends there. No 2011. Anyone know why?”

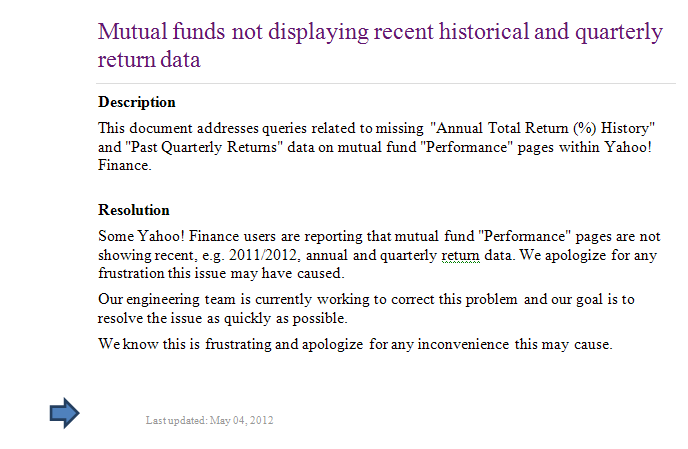

The short answer is: because it’s Yahool. This is a problem that Yahoo has known about for months, but has been either unable or unmotivated to correct. Here’s their “Help” page on the problem:

I added a large arrow only because I don’t know how to add either a flashing one or an animated GIF of a guy slapping himself on the forehead. Yahoo has known about this problem for at least three months without correcting it.

Note to Marissa Mayer, Yahoo’s new CEO: Yahoo describes itself as “a company that helps consumers find what they are looking for and discover wonders they didn’t expect.” In this case, we’re looking for 2011 data and the thing we wonder about is what it says about Yahoo’s corporate culture and competence. Perhaps you might check with the folks at Morningstar for an example of how quickly and effectively a first-rate organization identifies, addresses and corrects problems like this.

Too Soon Gone: Eric Bokota and FPA International Value (FPIVX)

I had the pleasure of a long conversation with Eric Bokota at the Morningstar Investment Conference in June. I was saddened to hear that events in his private life have obliged him to resign from FPA. The FPA folks seemed both deeply saddened and hopeful that one day he’ll return. I wish him Godspeed.

Four Funds That Are Really Worth Your Time (even in summer!)

Each month the Observer provides in-depth profiles of between two and four funds. Our “Most Intriguing New Funds” are funds launched within the past couple years that most frequently feature experienced managers leading innovative newer funds. “Stars in the Shadows” are older funds that have attracted far less attention than they deserve. This month’s lineup features three newer funds and an update ING Corporate Leaders, a former “Star in the Shadows” whose ghostly charms have attracted a sudden rush of assets.

FPA International Value (FPIVX): led by Oakmark alumnus Pierre Py, FPA’s first new fund in almost 30 years has the orientation, focus, discipline and values to match FPA’s distinguished brand.

ING Corporate Leaders Trust (LEXCX): the ghost ship of the fund world sails into its 78th year, skipperless and peerless.

RiverPark Long/Short Opportunity Fund (RLSFX): RiverPark’s successful hedge, now led by a guy who’s been getting it consistently right for almost two decades, is now available for the rest of us.

The Cook and Bynum Fund (COBYX): you think your fund is focused? Feh! You don’t know focused until you’ve met Messrs. Cook and Bynum.

The Best Small Fund Websites: Seafarer and Cook & Bynum

The folks at the Observer visit scores of fund company websites each month and it’s hard to avoid the recognition that most of them are pretty mediocre. The worst of them post as little content as possible, updated as rarely as possible, signaling the manager’s complete disdain for the needs and concerns of his (and very rarely, her) investors.

The folks at the Observer visit scores of fund company websites each month and it’s hard to avoid the recognition that most of them are pretty mediocre. The worst of them post as little content as possible, updated as rarely as possible, signaling the manager’s complete disdain for the needs and concerns of his (and very rarely, her) investors.

Small fund companies can’t afford such carelessness; their prime distinction from the industry’s bloated household names is their claim to a different and better relationship with their investors. If investors are going to win the struggle against the overwhelming urge to buy high and leave in a panic, they need a rich website and need to use it. If they can build a relationship of trust and understanding with their managers, they’ve got a much better chance of holding through rough stretches and profiting from rich ones.

This month, Junior and I enlisted the aid of two immensely talented web designers to help us analyze three dozen small fund websites in order to find and explain the best of them. One expert is Anya Zolotusky, designer of the Observer’s site and likely star of a series of “Most Interesting Woman in the World” sangria commercials. The other is Nina Eisenman, president of Eisenman Associates and founder of FundSites, a firm which helps small to mid-sized fund companies design distinctive and effective websites.

This month, Junior and I enlisted the aid of two immensely talented web designers to help us analyze three dozen small fund websites in order to find and explain the best of them. One expert is Anya Zolotusky, designer of the Observer’s site and likely star of a series of “Most Interesting Woman in the World” sangria commercials. The other is Nina Eisenman, president of Eisenman Associates and founder of FundSites, a firm which helps small to mid-sized fund companies design distinctive and effective websites.

If you’re interested in why Seafarer and Cook & Bynum are the web’s best small company sites, and which twelve earned “honorable mention” or “best of the rest” recognition, the entrance is here!

Launch Alert: RiverNorth and Manning & Napier, P. B. and Chocolate

Two really good fund managers are combining forces. RiverNorth/Manning & Napier Dividend Income (RNMNX) launched on July 18th. The fund is a hybrid of two highly-successful strategies: RiverNorth’s tactical allocation strategy based, in part, on closed-end fund arbitrage, and Manning & Napier’s largely-passive dividend focus strategy. Both are embedded in freestanding funds, though the RiverNorth fund is closed to new investors. There’s a lively discussion of the fund and, in particular, whether it offers any distinct value, on our discussion board. The minimum investment is $5000 and we’re likely to profile the fund in October.

Briefly Noted . . .

As a matter of ongoing disclosure about such things, I want to report several changes in my personal portfolio that touch on funds we’ve profiled or will soon profile. In my non-retirement portfolio, I sold off part of my holdings of Matthews Asian Growth and Income (MACSX) and invested the proceeds in Seafarer Overseas Growth & Income (SFGIX). As with all my non-retirement funds, I’ve established an automatic investment plan in Seafarer. In my retirement accounts, I sold my entire position in Fidelity Diversified International (FDIVX) and Canada (FICDX) and invested the proceeds in a combination of Global Balanced (FGBLX) and Total Emerging Markets (FTEMX). FDIVX has gotten too big and too index-like to justify inclusion and Canada’s new-ish manager is staggering around, and I’m hopeful that the e.m. exposure in the other two funds will be a significant driver while the fixed-income components offer some cushion. Finally, also in my retirement accounts, I sold T. Rowe Price New Era (PRENX) and portions of two other funds to buy Real Assets Fund (PRAFX). What can I say? Jeremy Grantham is very persuasive.

SMALL WINS FOR INVESTORS

A bunch of funds have tried to boost their competitiveness by cutting expenses or at least waiving a portion of them.

Cohen & Steers Dividend Value (DVFAX) will limit fund expenses to 1.00% for A shares through June 2014.

J.P. Morgan announced 9 basis point cuts for JP Morgan US Dynamic Plus (JPSAX) and JP Morgan US Large Cap Core Plus (JLCAX).

Legg Mason capped expenses on Legg Mason BW Diversified Large Cap Value (LBWAX) at between 0.85% – 1.85%, depending on share class.

Madison Investment Advisors cuts fees on Madison Mosaic Investors (MINVX) by 4 bps, Madison Mosaic Mid Cap (GTSGX) by 10, and Madison Mosaic Dividend Income (BHBFX, formerly Balanced) by 30.

Managers is dropping fees for Managers Global Income Opportunity (MGGBX), Managers Real Estate Securities (MRESX), and Managers AMG Chicago Equity Partners Balanced (MBEAX) by 11 – 16 bps.

Alger Small Cap Growth (ALSAX) and its institutional brother reopened to new investors on Aug. 1, 2012. It was once a really solid fund but it’s been sagging in recent years so your ability to get into it really does qualify as a “small win.”

CLOSINGS

Columbia Small Cap Value (CSMIX) has closed to new investors. For those interested, The Wall Street Journal publishes a complete closed fund list each month. It’s available online with the almost-poetic name, Table of Mutual Funds Closed to New Investors.

OLD WINE, NEW BOTTLES

Just as a reminder, the distinguished no-load Marketfield (MFLDX) will become the load-bearing MainStay Marketfield Fund on Oct. 5, 2012. The Observer profile of Marketfield appeared in July.

At the end of September, Lord Abbett Capital Structure (LAMAX), a billion dollar hybrid fund, will be relaunched as Lord Abbett Calibrated Dividend Growth, with a focus on dividend-paying stocks and new managers: Walter Prahl and Rick Ruvkun. No word about why.

Invesco announced it will cease using the Van Kampen name on its funds in September. By way of example, Invesco Van Kampen American Franchise “A” (VAFAX) will simply be Invesco American Franchise “A”.

Oppenheimer Funds is buying and renaming the five SteelPath funds, all of which invest in master limited partnerships and all of which have sales loads. There was a back door into the fund, which allowed investors to buy them without a load, but that’s likely to close.

OFF TO THE DUSTBIN OF HISTORY

BlackRock is merging its S&P 500 Index (MDSRX) and Index Equity (PNIEX) funds into BlackRock S&P 500 Stock (WFSPX). And no, I have no idea of what sense it made to run all three funds in the first place.

DWS Clean Technology (WRMAX) will be liquidated in October 2012.

Several MassMutual funds (Strategic Balanced, Value Equity, Core Opportunities, and Large Cap Growth) were killed-off in June 2012.

Oppenheimer is killing off their entry into the retirement-date fund universe by merging their regrettable Transition Target-Date into their regrettable static allocation hybrid funds. Oppenheimer Transition 2030 (OTHAX), 2040 (OTIAX), and 2050 (OTKAX) will merge into Active Allocation (OAAAX). The shorter time-frame Transition 2015 (OTFAX), 2020 (OTWAX), and 2025 (OTDAX) will merge into Moderate Investor (OAMIX). Transition 2010 (OTTAX) will, uhhh … transition into Conservative Investor (OACIX). The same management team oversaw or oversees the whole bunch.

Goldman Sachs took the easier way out and announced the simple liquidation of its entire Retirement Strategy lineup. The funds have already closed to new investors but Goldman hasn’t yet set a date for the liquidation. It’s devilishly difficult to compete with Fidelity, Price and Vanguard in this space – they’ve got good, low-cost products backed up by sophisticated allocation modeling. As a result they control about three-quarters of the retirement/target-date fund universe. If you start with that hurdle and add mediocre funds to the mix, as Oppenheimer and Goldman did, you’re somewhere between “corpse” and “zombie.”

Touchstone Emerging Markets Equity II (TFEMX), a perfectly respectable performer with few assets, is merging into Touchstone Emerging Markets Equity (TEMAX). Same management team, similar strategies.

In a “scraping their name off the door” move, ASTON has removed M.D. Sass Investors Services as a subadvisor to ASTON/MD Sass Enhanced Equity (AMBEX). Anchor Capital Advisors, which was the other subadvisor all along, now gets its name on the door at ASTON/Anchor Capital Enhanced Equity.

Destra seems already to have killed off Destra Next Dimension (DLGSX), a tiny global stock fund managed by Roger Ibbotson.

YieldQuest Total Return Bond (YQTRX), one of the first funds I profiled as an analyst for FundAlarm, has finally ceased operations. (P.S., it was regrettable even six years ago.)

In Closing . . .

Some small celebrations and reminders. This month the Observer passed its millionth pageview on the main site with well over two million additional pageviews on our endlessly engaging discussion board (hi, guys!). We’re hopeful of seeing our 100,000th new reader this fall.

Speaking of the discussion board, please remember that registration for participating in the board is entirely separate from registering to receive our monthly email reminder. Signing up for board membership, a necessary safeguard against increasingly agile spambots, does not automatically get you on the email list and vice versa.

And speaking of fall, it’s back-to-school shopping time! If you’re planning to do some or all of your b-t-s shopping online, please remember to Use the Observer’s link to Amazon.com. It’s quick, painless and generates the revenue (equal to about 6% of the value of your purchases) that helps keep the Observer going. Once you click on the link, you may want to bookmark it so that your future Amazon purchases are automatically and invisibly credited to the Observer. Heck, you can even share the link with your brother-in-law.

And speaking of fall, it’s back-to-school shopping time! If you’re planning to do some or all of your b-t-s shopping online, please remember to Use the Observer’s link to Amazon.com. It’s quick, painless and generates the revenue (equal to about 6% of the value of your purchases) that helps keep the Observer going. Once you click on the link, you may want to bookmark it so that your future Amazon purchases are automatically and invisibly credited to the Observer. Heck, you can even share the link with your brother-in-law.

A shopping lead for the compulsive-obsessive among you: How to Sharpen Pencils: A Practical & Theoretical Treatise on the Artisanal Craft of Pencil Sharpening for Writers, Artists, Contractors, Flange Turners, Anglesmiths, & Civil Servants (2012). The book isn’t yet on the Times’ bestseller lists, though I don’t know why.

A shopping lead for folks who thought they’d never read poems about hedge funds: Katy Lederer’s The Heaven-Sent Leaf (2008). Lederer’s an acclaimed poet who spent time working at, and poetrifying about, a New York hedge fund.

In September, we’ll begin looking at the question “do you really need to buy a dedicated ‘real assets’ fund?” T. Rowe Price has incorporated one into all of their retirement funds and Jeremy Grantham is increasingly emphatic on the matter. There’s an increasing area of fund and ETF options, including Price’s own fund which was, for years, only available to the managers of Price funds-of-funds.

We’ll look for you.