The fund: |

RiverPark Large Growth Fund (RPXFX) |

|

Managers: |

Mitch Rubin, a Managing Partner at RiverPark and their CIO. | |

The call: |

On December 17th we spoke for an hour with Mitch Rubin, manager of RiverPark Large Growth (RPXFX/RPXIX), Conrad van Tienhoven, his long-time associate, and Morty Schaja, CEO of RiverPark Funds. Here’s a brief recap of the highlights:

In the long term, the system works. The fund has returned 20% annually over the past three years. It’s four years old and had top decile performance in the large cap growth category after the first three years. Then we spent rather a lot of time on the ugly part. In relative terms, 2014 was wretched for the fund. The fund returned about 5.5% for the year, which meant it trailed 93% of its peers. It started the year with a spiffy five-star rating and ended with three. So, the question was, what happened? Mitch’s answer was presented with, hmmm … great energy and conviction. There was a long stretch in there where I suspect he didn’t take a breath and I got the sense that he might have heard this question before. Still, his answer struck me as solid and well-grounded. In the short term, the time arbitrage discipline can leave them in the dust. In 2014, the fund was overweight in a number of underperforming arenas: energy E&P companies, gaming companies and interest rate victims.

The fundamental story of rising demand for natural gas, abetted by better US access to the world energy market, is unchanged. In the interim, the portfolio companies are using their strong balance sheets to acquire assets on the cheap.

Three questions came up:

For folks interested but unable to join us, here’s the complete audio of the hour-long conversation. |

|

The profile: |

The Mutual Fund Observer profile of RPXFX, January 2015. |

|

Web: |

RiverPark Large Growth Fund homepage. Fund Focus: Resources from other trusted sources |

|

Yearly Archives: 2015

Manager changes, December 2014

Because bond fund managers, traditionally, had made relatively modest impacts of their funds’ absolute returns, Manager Changes typically highlights changes in equity and hybrid funds.

|

Ticker |

Fund |

Out with the old |

In with the new |

Dt |

|

AGMZX |

361 Global Macro Opportunity Fund |

Brian Cunningham is no longer a portfolio manager of the fund |

Clifford Stanton joins Blaine Rollins, Jeremy Frank, Nick Libertini and Aditya Bhave |

12/14 |

|

AMFZX |

361 Managed Futures Strategy Fund |

Brian Cunningham and Randall Bauer are no longer portfolio managers for the fund. |

Clifford Stanton joins Blaine Rollins, Tom Florence, Jeremy Frank, Nick Libertini and Aditya Bhave |

12/14 |

|

ALSZX |

361 Market Neutral Fund |

Brian Cunningham and Randall Bauer are no longer portfolio managers for the fund. |

Clifford Stanton joins Blaine Rollins, Tom Florence, Jeremy Frank, Nick Libertini and Aditya Bhave |

12/14 |

|

AIEAX |

American Beacon International Equity Fund |

Neil Devlin has been removed as a portfolio manager |

The rest of the extensive team remains. |

12/14 |

|

AGGRX |

American Century Global Growth Fund |

No one, but . . . |

Ted Harlan has been promoted to portfolio manager, joining Keith Creveling and Brent Puff |

12/14 |

|

AARMX |

American Independence Risk-Managed Allocation Fund |

No one, but . . . |

Charles McNally joins the existing team of John Forlines and Eric Rubin. |

12/14 |

|

IFCSX |

American Independence Stock Fund |

No one, but . . . |

AJO Partners is being added as a sub-advisor to the fund |

12/14 |

|

MGGBX |

AMG Managers Global Income Opportunity Fund |

No one, but . . . |

Scott Service joined the team of Kenneth Buntrock, David Rolley, and Lynda Schweitzer |

12/14 |

|

BROAX |

BlackRock Global Opportunities Portfolio |

Nigel Hart |

Thomas Callan and Ian Jamieson remain |

12/14 |

|

BREAX |

BlackRock International Opportunities Portfolio |

Nigel Hart |

Thomas Callan and Ian Jamieson remain |

12/14 |

|

BMEAX |

BlackRock U.S. Opportunities Portfolio |

Nigel Hart |

Thomas Callan and Ian Jamieson remain |

12/14 |

|

CEIAX |

Calvert Equity Income Fund |

James McGlynn is no longer listed as a portfolio manager |

Rachel Volynsky and Natalie Trunow join Yvonne Bishop in managing the fund. We’ll note, in passing, that an all-female portfolio management team is a regrettable rarity. |

12/14 |

|

CWVGX |

Calvert International Equity Fund |

Thornburg Investment Management has been removed as a subadvisor, along with Rolf Kelly. Additionally, Christine Montgomery will be retiring in January. |

Fabrice Bay has joined David Sheasby and Natalie Trunow. |

12/14 |

|

CLVAX |

Calvert Large Cap Value Fund |

James McGlynn is no longer listed as a portfolio manager |

Rachel Volynsky and Natalie Trunow join Yvonne Bishop in managing the fund. |

12/14 |

|

IGLGX |

Columbia Global Equity Fund |

As of January 15, 2015, Neil Robson will no longer be listed as a portfolio manager |

David Dudding will join Pauline Grange at that time. |

12/14 |

|

NEIAX |

Columbia Large Cap Index Fund |

Alfred Alley is no longer on the fund |

Christopher Lo has joined Vadim Shteyn in managing the fund |

12/14 |

|

NTIAX |

Columbia Mid Cap Index Fund |

Alfred Alley is no longer on the fund |

Christopher Lo has joined Vadim Shteyn in managing the fund |

12/14 |

|

NMSAX |

Columbia Small Cap Index Fund |

Alfred Alley is no longer on the fund |

Christopher Lo has joined Vadim Shteyn in managing the fund |

12/14 |

|

DRCVX |

Comstock Capital Value Fund |

Martin Weiner is no longer listed as a portfolio manager |

Charles Minter is joined by Dennis DeCore. |

12/14 |

|

AVGAX |

Dynamic Total Return Fund |

No one, but . . . |

Sinead Colton joins Torrey Zaches, James Stavena, Joseph Miletech, and Vassilis Dagioglu in managing the 3 month old fund |

12/14 |

|

ETGIX |

Eaton Vance Greater India Fund |

Christopher Darling is no longer listed as a portfolio manager |

Rishikesh Patel takes over |

12/14 |

|

FRFDX |

First Investors Floating Rate Fund |

David Bowen is no longer listed as a portfolio manager |

Clinton Comeaux has joined Dennis Dowden and Bryan Petermann |

12/14 |

|

FACEX |

Frost Growth Equity Fund |

No one, but . . . |

AB Mendez joins the team of Brad Thompson, Tom Stringfellow, and John Lutz |

12/14 |

|

GIEIX |

GE International Equity Fund |

Jonathan Passmore retired as portfolio manager on November 30, 2014. |

Ralph Layman and Michael Solecki carry on. |

12/14 |

|

GRGAX |

Giralda Risk-Managed Growth Fund |

Marina Goodman and Jeremy Welther left the fund on October 28, 2014 |

Gladys Chow joined Jerry Miccolis, effective December 1, 2014. |

12/14 |

|

GLBFX |

GL Beyond Income Fund |

As of November 14th, Frank Luisi was no longer listed as a co-portfolio manager. Remaining manager, Daniel Thibeault, was arrested by the FBI in early December on securities fraud charges. He’s subsequently been blocked from accessing the fund’s assets. |

As of December 12, the fund is closed to new share sales while the board figures this out. |

12/14 |

|

GTCIX |

Glenmede International |

Management is being taken in-house, so Philadelphia International Advisors is out, along with Wei Huang and Stephen Dolce. |

Alexander Antanasiu, Paul Sullivan, and Vladimir de Vassal will manage the fund. |

12/14 |

|

SAOAX |

Guggenheim Alpha Opportunity Fund |

Effective immediately, Michael Dellapa will no longer serve as a portfolio manager for the fund. |

The remaining portfolio managers for the Fund, Michael Byrum and Ryan Harder, have assumed Mr. Dellapa’s portfolio management responsibilities |

12/14 |

|

GMIFX |

GuideMark Opportunistic Fixed Income Fund |

Canyon Chan is no longer a portfolio manager of the fund. |

The team of Matthew Eagan, Michael Hasenstab, Kevin Kearns, Todd Vandam, Philip Barach, Jeffrey Gundlach, and Christine Zhu will carry on. |

12/14 |

|

GPARX |

GuidePath Absolute Return Asset Allocation Fund |

Michael Abelson no longer serves as a portfolio manager for the fund. |

Zoë Brunson and Selwyn Crews are joined by Jeremiah Chafkin |

12/14 |

|

GPAMX |

GuidePath Altegris Diversified Alternatives Allocation Fund |

Matthew Osborne no longer serves as a portfolio manager for the fund. |

Robert Murphy and Lara Magnusen are now managing the fund |

12/14 |

|

GPIFX |

GuidePath Fixed Income Allocation Fund |

Michael Abelson no longer serves as a portfolio manager for the fund. |

Zoë Brunson and Selwyn Crews are joined by Jeremiah Chafkin |

12/14 |

|

GPMIX |

GuidePath Multi-Asset Income Asset Allocation Fund |

Michael Abelson no longer serves as a portfolio manager for the fund. |

Zoë Brunson and Selwyn Crews are joined by Jeremiah Chafkin |

12/14 |

|

GPSTX |

GuidePath Strategic Asset Allocation Fund |

Michael Abelson no longer serves as a portfolio manager for the fund. |

Zoë Brunson and Selwyn Crews are joined by Jeremiah Chafkin |

12/14 |

|

GPTCX |

GuidePath Tactical Constrained Asset Allocation Fund |

Michael Abelson no longer serves as a portfolio manager for the fund. |

Zoë Brunson and Selwyn Crews are joined by Jeremiah Chafkin |

12/14 |

|

GPTUX |

GuidePath Tactical Unconstrained Asset Allocation Fund |

Michael Abelson no longer serves as a portfolio manager for the fund. |

Zoë Brunson and Selwyn Crews are joined by Jeremiah Chafkin |

12/14 |

|

ICSCX |

ICM Small Company Portfolio |

On December 31, 2014, Simeon Wooten and Robert Jacapraro will cease serving as portfolio managers of the fund. |

William Heaphy and Gary Merwitz will carry on. |

12/14 |

|

JAIMX |

James Alpha Multi-Strategy Alternative Income Portfolio |

Marshall Bassett, George Clairmont, Barry Gladstein, Nicolas Jenks, R. Brentwood Strasler, and Lori Wachs are no longer listed as portfolio manager. |

Remaining on the fund are William Bales, Andrew Duffy, Leonard Edelstein, Kevin Greene (not the former Steeler), Jakob Holm, James Hug, Michael Montague, Darren Schuringa, and James Vitalie. |

12/14 |

|

JAWGX |

Janus Aspen Global Research Fund |

James Goff is off the fund |

Carmel Wellso will take the lead over a group of sector team leaders consisting of Jean Barnard, John Jordan, Kristopher Kelley, Ethan Lovell, Kenneth Spruell, and Garth Yettick |

12/14 |

|

JNRFX |

Janus Research |

James Goff is retiring after more than a quarter century as Janus, and he’s one of the last managers left from their Gunslinging Golden Days. |

Carmel Wellso will take the lead over a group of sector team leaders consisting of Jean Barnard, John Jordan, Kristopher Kelley, Ethan Lovell, Kenneth Spruell, and Garth Yettick |

12/14 |

|

GAOAX |

JPMorgan Global Allocation Fund |

No one, but . . . |

James Elliot, Jeffrey Geller, Jonathan Cummings, and Grace Koo are joined by Eric Bernbaum |

12/14 |

|

JNBAX |

JPMorgan Income Builder Fund |

Patrik Jakobson is no longer listed as a portfolio manager |

Jeffrey Geller, Michael Schoenhaut, and Anne Lester are joined by Eric Bernbaum |

12/14 |

|

MAPOX |

Mairs & Power Balanced Fund |

Bill Frels has retired after more than 20 years on the fund. |

Kevin Earley joins Ronald Kaliebe in managing the fund |

12/14 |

|

MPGFX |

Mairs & Power Growth Fund |

Bill Frels, who succeeded the redoubtable George Mairs, retires after 15 years here. |

Andrew Adams joins Mark Henneman in managing the fund |

12/14 |

|

MSCFX |

Mairs & Power Small Cap Fund |

No one, but … |

Allen Steinkopf joins Andrew Adams in managing the fund as part of a firm-wide move to have a second manager on each fund. |

12/14 |

|

MALGX |

Mirae Emerging Markets Fund |

Young Hwan Kim is no longer a portfolio manager to the fund |

Jose Morales and Rahul Chadha continue on |

12/14 |

|

MECGX |

Mirae Emerging Markets Great Consumer Fund |

Young Hwan Kim is no longer a portfolio manager to the fund |

Jose Morales and Joohee An continue on |

12/14 |

|

MSIEX |

Morgan Stanley Emerging Markets Domestic Debt Portfolio |

No one, but . . . |

Jens Nystedt and Warren Mar join Eric Baurmeister |

12/14 |

|

MEAPX |

Morgan Stanley Emerging Markets External Debt Portfolio |

No one, but . . . |

Jens Nystedt and Warren Mar join Eric Baurmeister |

12/14 |

|

NMMGX |

Northern Multi Manager Global Real Estate |

CBRE Clarion Securities is out as a subadvisor to the fund. |

Brookfield Investment Management will be a new subadvisor on the fund. |

12/14 |

|

OMSOX |

Oppenheimer Main Street Select Fund |

Manind Govil is no longer listed as a portfolio manager |

The new team is Benjamin Ram, Magnus Krantz, and Joy Budzinski |

12/14 |

|

OAIEX |

Optimum International Fund |

Nigel Hart is no longer listed on the management team |

Thomas Callan, Ian Jamieson, and Paul Viera remain |

12/14 |

|

PTXAX |

PIMCO Tax Managed Real Return Fund |

Rahul Seksaria is no longer listed as a portfolio manager |

Jeremie Banet joins Joseph Deane in managing the fund |

12/14 |

|

PIAVX |

Pioneer Solutions Conservative Fund |

Ibbotson Associates is no longer a subadvisor to the fund, and managers Paul Arnold, Brian Huckstep, and Scott Wentsel are out. |

Salvatore Buono, John O’Toole, and Paul Weber are taking over the portfolio management duties as Pioneer Investment Management assumes day-to-day management of the fund. |

12/14 |

|

GRAAX |

Pioneer Solutions Growth Fund |

Ibbotson Associates is no longer a subadvisor to the fund, and managers Paul Arnold, Brian Huckstep, and Scott Wentsel are out. |

Salvatore Buono, John O’Toole, and Paul Weber are taking over the portfolio management duties as Pioneer Investment Management assumes day-to-day management of the fund. |

12/14 |

|

POAGX |

Primecap Odyssey Aggressive Growth Fund |

No one, but . . . |

James Marchetti joins Joel Fried, Theo Kolokotrones, Alfred Mordecai, and M. Mohsin Ansari on the management team. |

12/14 |

|

POGRX |

Primecap Odyssey Growth Fund |

No one, but . . . |

James Marchetti joins Joel Fried, Theo Kolokotrones, Alfred Mordecai, and M. Mohsin Ansari on the management team. |

12/14 |

|

POSKX |

Primecap Odyssey Stock Fund |

No one, but . . . |

James Marchetti joins Joel Fried, Theo Kolokotrones, Alfred Mordecai, and M. Mohsin Ansari on the management team. |

12/14 |

|

RSGRX |

RS Growth Fund |

No one, but . . . |

Christopher Clark joins D. Scott Tracy, Melissa Chadwick-Dunn, and Stephen Bishop in managing the fund. |

12/14 |

|

RSMOX |

RS Mid Cap Growth Fund |

No one, but . . . |

Christopher Clark joins D. Scott Tracy, Melissa Chadwick-Dunn, and Stephen Bishop in managing the fund. |

12/14 |

|

RSDGX |

RS Select Growth Fund |

No one, but . . . |

Christopher Clark joins D. Scott Tracy, Melissa Chadwick-Dunn, and Stephen Bishop in managing the fund. |

12/14 |

|

GPSCX |

RS Small Cap Equity Fund |

No one, but . . . |

Christopher Clark joins D. Scott Tracy, Melissa Chadwick-Dunn, and Stephen Bishop in managing the fund. |

12/14 |

|

RSEGX |

RS Small Cap Growth Fund |

No one, but . . . |

Christopher Clark joins D. Scott Tracy, Melissa Chadwick-Dunn, and Stephen Bishop in managing the fund. |

12/14 |

|

SLLAX |

SEI Small Cap Fund |

J. P. Morgan and William Blair are out as subadvisors to the fund, along with David Mitchell, Mark Leslie, Chad Kilmer, and Eytan Shapiro. |

EAM Investors and Snow Capital Management join the existing (and extensive) ranks, with Montie Weisenberger, Joshua Schachter, and Anne Wickland added to the portfolio management team. |

12/14 |

|

FNAPX |

Strategic Advisers Small-Mid Cap Multi-Manager Fund |

Massachusetts Financial Services Company is no longer a subadvisor to the fund. Hence, Michael Grossman and Thomas Wetherald are out as portfolio managers |

Christopher Clark, of RS Investment Management, joins the already extensive team. |

12/14 |

|

GDAMX |

The Giralda Manager Fund |

Marina Goodman and Jeremy Welther left the fund on October 28, 2014 |

Gladys Chow joined Jerry Miccolis, effective December 1, 2014. |

12/14 |

|

TLIIX |

TIAA-CREF Enhanced Large-Cap Growth Index Fund |

Kelvin Zhang is no longer a portfolio manager of the fund |

Adam Cao and James Johnson, Jr. are now the management team. |

12/14 |

|

PDIAX |

Virtus Growth & Income Fund |

Shareholders voted to replace the fund’s current subadviser, QS Investors, LLC, with Rampart Investment Management Company, LLC. Therefore, Russell Shtern and Robert Wang are out. |

Brendan Finneran and Robert Hofemen, Jr. are now managing the fund. |

12/14 |

|

IIGIX |

Voya Multi-Manager International Equity Fund |

Paul Faulkner is out. |

Sophie Earnshaw, Moritz Sitte, and Tom Walsh join the large team in managing the fund. |

12/14 |

|

EKGAX |

Wells Fargo Advantage Global Opportunities Fund |

No one, but . . . |

Robert Rifkin joins James Tringas, Oleg Makhorine, and Bryant VanCronkhite as a portfolio manager |

12/14 |

|

EGWAX |

Wells Fargo Advantage Traditional Small Cap Growth Fund |

Paul Carder is no longer listed as a portfolio manager. |

Linda Freeman, Jeffrey Drummond, and Jeffrey Harrison remain. |

12/14 |

|

AWSFX |

West Shore Real Return Income Fund |

James Rickards, a famous pundit and oracle whose presence brought attention to the fund, is no longer even nominally serving as a portfolio manager. He’s now Chief Global Strategist for West Shore Group, LLC, the fund’s investment adviser. |

Steve Cordasco and Michael Shamosh will continue as portfolio managers of the fund |

12/14 |

|

WMMRX |

Wilmington Multi-Manager Real Asset Fund |

Rahul Seksaria is no longer listed as a portfolio manager |

George Chen, Steven Burton, T. Ritson Ferguson, Joseph Smith, Mihir Worah, Thomas Pierce, Todd Murphy, Thomas Seto, and David Stein continue on. |

12/14 |

January 2015, Funds in Registration

RiverPark Focused Value Fund

RiverPark Focused Value Fund will seek long-term capital appreciation. The plan is to focus on large cap domestic stocks, with particular focus on “special situations” such as spin-offs or reorganizations and on firms whose share prices might have cratered. They’ll buy if it’s a high quality firm and if the stock trades at a substantial discount to intrinsic value. They’ll sell when the stock approaches their target price for it. The manager will have a limited ability to invest in illiquid securities, to short and to leverage the portfolio. David Berkowitz will be the portfolio manager. Mr. Berkowitz co-founded and co-managed Gotham Partners, a value-oriented hedge fund (1992-2002), and was the Chief Investment Officer for a New York family office (2003-2005). In 2006, he founded Festina Lente, a long-only, concentrated investment partnership that he managed through 2008. From 2009-2013, he held various positions at Ziff Brother Investments, where he was Partner as well as the Chief Risk and Strategy Officer. The expense ratios are 1.25% (Investor) and 1.00% (Institutional) after waivers. The minimum initial investment is $1,000 for Investor shares and $100,000 for Institutional ones.

RiverPark Large Growth (RPXFX/RPXIX), January 2015

Objective and strategy

The fund pursues long-term capital appreciation by investing in large cap growth stocks, which it defines generously as those with capitalizations over $5 billion. The manager describes his style as having a “value orientation toward growth.” Their discipline combines a macro-level sensitivity to the effects of powerful and enduring secular changes and on industries which are being disrupted, with intense fundamental research and considerable patience. The fund holds a fair fraction of its portfolio, about 20% at the end of 2014, in mid-cap stocks and has a small lower market cap, lower turnover and more compact portfolio than its peers. Most portfolio positions are weighted at about 2-3% of assets.

Adviser

RiverPark Advisors, LLC. RiverPark was formed in 2009 by former executives of Baron Asset Management. The firm is privately owned, with 84% of the company being owned by its employees. They advise, directly or through the selection of sub-advisers, the seven RiverPark funds. Overall assets under management at the RiverPark funds were over $3.5 billion as of September, 2014.

Manager

Mitch Rubin, a Managing Partner at RiverPark and their CIO. Mr. Rubin came to investing after graduating from Harvard Law and working in the mergers and acquisitions department of a law firm and then the research department of an investment bank. The global perspective taken by the M&A people led to a fascination with investing and, eventually, the opportunity to manage several strategies at Baron Capital. He’s assisted by RiverPark’s CEO, Morty Schaja, and Conrad van Tienhoven, a long-time associate of his. Mitch and his wife are cofounders of The IDEAL School of Manhattan, a small school where gifted kids and those with special needs study and play side-by-side.

Strategy capacity and closure

While Morty Schaja describes capacity and closure plans as “somewhat a comical issue” for a tiny fund, he estimates capacity “to be around $20 billion, subject to refinement if and when we get in the vicinity.” We’ll keep a good thought.

Active share

79.6, as of November 2014. “Active share” measures the degree to which a fund’s portfolio differs from the holdings of its benchmark portfolio. High active share indicates management which is providing a portfolio that is substantially different from, and independent of, the index. An active share of zero indicates perfect overlap with the index, 100 indicates perfect independence. As a rule of thumb, large cap funds with an active share over 70 have legitimately “active” managers while the median for Morningstar’s large cap Gold funds is 76. The active share for RiverPark Large Growth is 79.6, which reflects a high level of independence from its benchmark, the S&P 500 index.

Management’s stake in the fund

Mr. Rubin and Mr. Schaja each have over $1 million invested in the fund. Between them, they own 70% of the fund’s institutional shares. One of the fund’s three trustees has invested between $10,000 and $50,000 in the fund while the other two have not invested in it. As of December 31, 2013, the Trustees and officers of the Trust, as a group, owned 16.27% of the outstanding shares of the fund.

We’d also like to compliment RiverPark for exemplary disclosure: the SEC allows funds to use “over $100,000” as the highest report for trustee ownership. RiverPark instead reports three higher bands: $100,000-500,000, $500,000-1 million, over $1 million. That’s really much more informative than the norm.

Opening date

September 30, 2010.

Minimum investment

The minimum initial investment in the retail class is $1,000 and in the institutional class is $50,000.

Expense ratio

Retail class at 1.23% and institutional class at 0.95% on total assets of $38.3 million, as of July 2023.

Comments

If we had written this profile in January 2014 instead of January 2015, our text could have been short and uncontroversial. It would read something like:

Mitch Rubin is one of the country’s most experienced growth managers. He’s famously able to follow companies for decades, placing them first in one of the small cap funds he’s run, later in a large cap fund before selling them when they plateau and shorting them as they enter their latter years. With considerable discipline and no emotional investment in any of his holdings, he has achieved outstanding results here and in his earlier charges. From inception through the end of 2013, Large Growth has dramatically outperformed both its large cap growth peer group and the S&P500, and had easily matched or beaten the performance of the top tier of growth funds. That includes Sequoia (SEQUX), RiverPark Wedgewood (RWGFX), Vanguard PRIMECAP (VPMCX) and the other Primecap funds.

Accurate, true and sort of dull.

Fortunately, 2014 gave us a chance to better understand the fund and Mr. Rubin’s discipline. How so? Put bluntly, the fund’s short-term performance sort of reeked and it managed to reduce a five-star rating down to a three-star one. While it finished 2014 with a modest profit, the fund trailed more than 90% of its large-growth peers. That one year slide then pulled its three-year record from “top 10%” to “just above average.”

The question is: does 2014 represent “early” (as in, the fund moved toward great companies whose discount to fair value kept growing during the year) or “wrong” (that is, making an uninformed, undisciplined or impulsive shift that blew up)? If it’s the former, then 2014’s lag offers reasons to buy the fund while its portfolio is underpriced. If it’s the latter, then it’s time for investors to move on.

Here’s the case that Mitch, Conrad and Morty make for the former.

- They’re attempting to invest in companies which will grow by at least 20% a year in the future, in hopes of investing in stocks which will return 20% a year for the period we hold them. Since no company can achieve that rate of growth, the key is finding growth that is substantially underpriced.

- There’s a sort of time arbitrage at work, a claim that’s largely substantiated by a lot of behavioral finance research. Investors generally do not give companies credit for high rates of growth until that growth has been going on for years, at which point they pile in. RiverPark’s goal is to anticipate where next year’s growth is going to be, rather than buying where last year’s growth – or even this year’s growth – was.

- The proper questions then are (1) is the company’s performance outpacing its stock performance? And, if so, (2) can that performance be sustained? If you answer “yes” to both, then it’s probably time to buy. The mantra was “buy, hold, and, if necessary, double down.”

- If they’re right, in 2014 they bought a bunch of severely underpriced growth. The firms in the portfolio are growing earnings by about 20% a year and they’re paying a 16x p/e for those stocks. Investors in the large cap universe in general are also paying a 16x p/e, but they’re doing it for stocks that are growing by no more than 7% annually.

Those lower quality firms have risen rapidly, bolstered by low interest rates which have made it cheap for them to buy their way to visibility through financial engineering; debt refinance, for example, might give a one-time boost to shaky earnings while cheap borrowing encourages them to “buy growth” by acquiring smaller firms. Such financial engineering, though, doesn’t provide a basis for long-term growth. For the Large Growth portfolio, they target firms with “fortress-like balance sheets.”

So, they buy great growth companies for cheap. How does that explain the sudden sag in 2014? They point to three factors:

- Persistently low interest rates: in the short term, they prop up the fortunes of shaking companies, whose stock prices continue to rise as late-arriving investors pile in. In the interim, those rates punish cash-rich financial services firms like Schwab (SCH) and Blackstone Group (BX)

- Energy repricing: about 13% of the portfolio is focused on energy firms, about twice the category average. Three of their four energy stocks have lost money this year, but are cash-rich with a strong presence in the Marcellus shale region. Globally natural gas sells for 3-4 times more than it does in the US; our prices are suppressed by a lack of transport capacity. As that becomes available, our prices are likely to move toward the global average – and the global average is likely to rise as growth resumes.

- Anti-corruption contagion: the fund has a lot of exposure to gaming stocks and gaming companies have a lot of exposure to Asian gambling and retail hubs such as Macau. Those are apt to be incredibly profitable long-term investments. The Chinese government has committed to $500 billion in new infrastructure investments to help middle class Chinese reach Macau, and Chinese culture puts great stock in one’s willingness to challenge luck. As a result, Chinese gamblers place far higher wagers than do Western ones, casinos catering to Chinese gamblers have far higher margins (around 50%) than do others and the high-end retailers placed around those casinos rake in about $7,000 per square foot, well more than twice what high-end stores here make. In the short term, though, Prime Minister Xi’s anti-corruption campaign has terrified Chinese high-rollers who are buying and gambling a lot less in hopes of avoiding the attention of crusaders at home. While the long-term profits are driven by the mass market, in the short-term their fate is tied to the cowed high-wealth cohort.

Sooner rather than later, the managers argue, energy prices will rise and firms like Cabot Oil & Gas (COG) will see their stocks soar. Sooner rather than later, the gates of Macau will be opened to hundreds of millions of Chinese vacationers, anxious to challenge luck and buy some bling and stocks like Wynn Resorts (WYNN) will rise dramatically.

This is not a high turnover, momentum strategy designed to capture every market move. Almost all of the apparent portfolio turnover is simply rebalancing within the existing names in order to capture a better risk/return profile. It’s a fairly patient strategy that has, for decades, been willing to tolerate short-term underperformance as the price of long-term outperformance.

Bottom Line

The argument for RiverPark is “that spring is getting compressed tighter and tighter.” That is, a manager with a good track record for identifying great underpriced growth companies and then waiting patiently currently believes he has a bunch of very high quality, very undervalued names in the portfolio. They point to the fact that, for 26 of the 39 firms in the portfolio, the firm’s underlying fundamentals exceeded the market while the stock price in 2014 trailed it. It is clear that the manager is patient enough to endure a flat year or two as the price for long-term success; the fund has, after all, returned an average of 20% a year. The question is, are you?

Fund website

RiverPark Large Growth. Folks interested in hearing directly from Messrs. Rubin and Schaja might listen to our December 2014 conference call with them, which is housed on the Featured Fund page for RiverPark Large Growth.

© Mutual Fund Observer, 2015. All rights reserved. The information here reflects publicly available information current at the time of publication. For reprint/e-rights contact us.Reflections – 2014

By Edward Studzinski

The Mountains are High, and the Emperor is Far, Far Away

Chinese Aphorism

Year-end 2014 presents investors with a number of interesting conundrums. For a U.S. dollar investor, the domestic market, as represented by the S&P 500, provided a total return of 13.6%, at least for those invested in it by the proxy of Vanguard’s S&P 500 Index Fund Admiral Shares. Just before Christmas, John Authers of the Financial Times, in a piece entitled “Investment: Loser’s Game” argued that this year, with more than 90% of active managers on track to underperform their benchmarks, a tipping point may have finally been reached. The exodus of money from actively managed funds has accelerated. Vanguard is on track to take in close to $200B (yes, billion) into its passive funds this year.

And yet, I have to ask if it really matters. As I watch the postings on the Mutual Fund Observer’s discussion board, I suspect that achieving better than average investment performance is not what motivates many of our readers. Rather, there is a Walter Mittyesque desire to live vicariously through their portfolios. And every bon mot that Bill (take your pick, there are a multitude of them) or Steve or Michael or Bob drops in a print or televised interview is latched on to as a reaffirmation the genius and insight to invest early on with one of The Anointed. The disease exists in a related form at the Berkshire Hathaway Annual Circus in Omaha. Sooner or later, in an elevator or restaurant, you will hear a discussion of when that person started investing with Warren and how much money they have made. The reality is usually less that we would like to know or admit, as my friend Charles has pointed out in his recent piece about the long-term performance of his investments.

Rather than continuing to curse the darkness, let me light a few candles.

- When are index funds appropriate for an investment program? For most of middle America, I am hard pressed to think of when they are not. They are particularly important for those individuals who are not immortal. You may have constructed a wonderful portfolio of actively-managed funds. Unfortunately, if you pass away suddenly, your spouse or family may find that they have neither the time nor the interest to devote to those investments that you did. And that assumes a static environment (no personnel changes) in the funds you are invested in, and that the advisors you have selected, if any, will follow your lead. But surprise – if you are dead, often not at the time of your choice, you cannot control things from the hereafter. Sit in trust investment committee meetings as I did for many years, and what you will most likely hear is – “I don’t care what old George wanted – that fund is not on our approved list and to protect ourselves, we should sell it, regardless of its performance or the tax consequences.”

- How many mutual funds should one own? The interplay here is diversification and taxes. I suspect this year will prove a watershed event as investors find that their actively-managed fund has generated a huge tax bill for them while not beating its respective benchmark, or perhaps even losing money. The goal should probably be to own fewer than ten in a family unit, including individual and retirement investments. The right question to ask is why you invested in a particular fund to begin with. If you can’t remember, or the reason no longer applies, move on. In particular, retirement and 401(k) assets should be consolidated down to a smaller number of funds as you get older. Ideally they should be low cost, low expense funds. This can be done relatively easily by use of trustee to trustee transfers. And forget target date funds – they are a marketing gimmick, predicated on life expectancies not changing.

- Don’t actively managed funds make sense in some circumstances? Yes, but you really have to do a lot of due diligence, probably more than most investment firms will let you do. Just reading the Morningstar write-ups will not cut it. I think there will be a time when actively-managed value funds will be the place to be, but we need a massive flush-out of the industry to occur first, followed by fear overcoming greed in the investing public. At that point we will probably get more regulation (oh for the days of Franklin Roosevelt putting Joe Kennedy in charge of the SEC, figuring that sometimes it makes sense to have the fox guarding the hen house).

- Passive funds are attractive because of low expenses, and the fact that you don’t need to worry about managers departing or becoming ill. What should one look for in actively-managed funds? The simple answer is redundancy. Dodge and Cox is an ideal example, with all of their funds managed by reasonably-sized committees of very experienced investment personnel. And while smaller shops can argue that they have back-up and succession planning, often that is marketing hype and illusion rather than reality. I still remember a fund manager more than ten years ago telling me of a situation where a co-manager had been named to a fund in his organization. The CIO told him that it was to make the Trustees happy, giving the appearance of succession planning. But the CIO went on to say that if something ever happened to lead manager X, co-manager Y would be off the fund by sundown since Y had no portfolio management experience. Since learning such things is difficult from the outside, stick to the organizations where process and redundancy are obvious. Tweedy, Browne strikes me as another organization that fits the bill. Those are not meant as recommendations but rather are intended to give you some idea of what to look for in kicking tires and asking questions.

A few final thoughts – a lot of hedge funds folded in 2014, mainly for reasons of performance. I expect that trend to spread to mutual funds in 2015, especially those that are at best marginally profitable. Some of this is a function of having the usual acquiring firms (or stooges, as one investment banker friend calls them) – the Europeans – absent from the merger and acquisition trail. Given the present relationship of the dollar and the Euro, I don’t expect that trend to change soon. But I also expect funds to close just because the difficulty of outperforming in a world where events, to paraphrase Senator Warren, are increasingly rigged, is almost impossible. In a world of instant gratification, that successful active management is as much an art as a science should be self-evident. There is something in the process of human interaction which I used to refer to as complementary organizational dysfunction that produces extraordinary results, not easily replicable. And it involves more than just investment selection on the basis of reversion to the mean.

One example of genius would be Thomas Jefferson, dining alone, or Warren Buffet, sitting in his office, reading annual reports. A different example would be the 1927 Yankees or the Fidelity organization of the 1980’s. In retrospect what made them great is easy to see. My advice to people looking for great active management today – look for organizations without self-promotion, where individuals do not seek out to be the new “It Girl” and where the organizations focus on attracting curious people with inquiring but disciplined minds, so that there ends up being a creative, dynamic tension. Avoid organizations that emphasize collegiality and consensus. In closing, let me remind you of that wonderful scene where Orson Welles, playing Harry Lime in The Third Man says,

… in Italy for 30 years under the Borgias they had warfare, terror, murder, and bloodshed, but they produced Michelangelo, Leonardo da Vinci, and the Renaissance. In Switzerland they had brotherly love – they had 500 years of democracy and peace, and what did they produce? The cuckoo clock.

Newest ETFs from Cambria Funds and AlphaArchitect

Originally published in January 1, 2015 Commentary

Cambria Funds recently launched two ETFs, as promised by its CIO Mebane Faber, who wants to “disrupt the traditional high fee mutual fund and hedge fund business, mostly through launching ETFs.” The line-up is now five funds with assets under management totaling more than $350M:

- Cambria Shareholder Yield ETF (SYLD)

- Cambria Foreign Shareholder Yield ETF (FYLD)

- Cambria Global Value ETF (GVAL)

- Cambria Global Momentum ETF (GMOM)

- Cambria Global Asset Allocation ETF (GAA)

We wrote about the first three in “The Existential Pleasures of Engineering Beta” this past May. SYLD is now the largest actively managed ETF among the nine categories in Morningstar’s equity fund style box (small value to large growth). It’s up 12% this year and 32% since its inception May 2013.

GMOM and GAA are the two newest ETFs. Both are fund of funds.

GMOM is based on Mebane’s definitive paper “A Quantitative Approach To Tactical Asset Allocation” and popular book “The Ivy Portfolio: How to Invest Like the Top Endowments and Avoid Bear Markets.” It appears to be an in-house version of AdvisorShares Cambria Global Tactical ETF (GTAA), which Cambria stopped sub-advising this past June. Scott, a frequent and often profound contributor to our discussion board, describes GTAA in one word: “underwhelming.” (You can find follow some of the debate here.) The new version GMOM sports a much lower expense ratio, which can only help. Here is link to fact sheet.

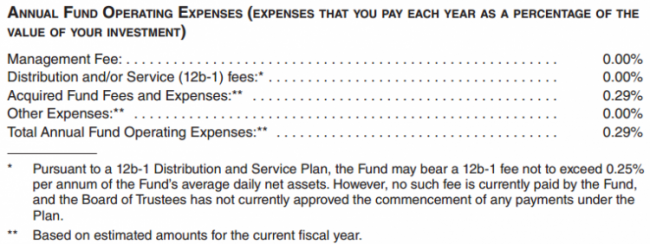

GAA is something pretty cool. It is an all-weather strategic asset allocation fund constructed for global exposure across diverse asset classes, but with lower volatility than your typical long term target allocation fund. It is a “one fund for a lifetime” offering. (See DailyAlts “Meb Faber on the Genesis of Cambria’s Global Tactical ETF.”) It is the first ETF to have a permanent 0% management fee. Its annual expense ratio is 0.29%. From its prospectus:

Here’s is link to fact sheet, and below is snapshot of current holdings:

In keeping with the theme that no good deed goes unpunished. Chuck Jaffe referenced GAA in his annual “Lump of Coal Awards” series. Mr. Jaffe warned “investors should pay attention to the total expense ratio, because that’s what they actually pay to own a fund or ETF.” Apparently, he was irked that the media focused on the zero management fee. We agree that it was pretty silly of reporters, members of Mr. Jaffe’s brotherhood, to focus so narrowly on a single feature of the fund and at the same time celebrate the fact that Mr. Faber’s move lowers the expenses that investors would otherwise bear.

![]()

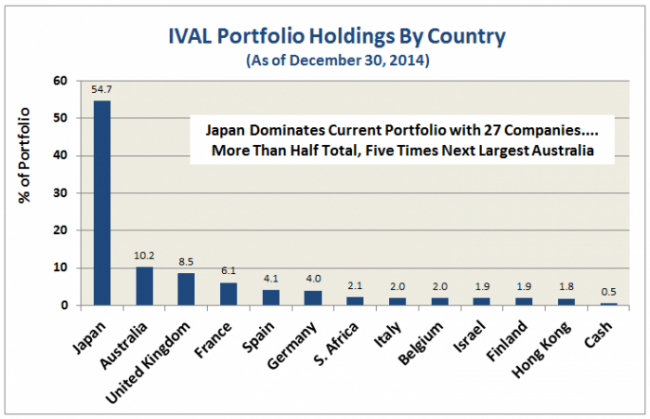

Wesley Gray announced the launch of ValueShares International Quantitative Value ETF (IVAL) on 19 December, his firm’s second active ETF. IVAL is the international sister to ValueShares Quantitative Value ETF (QVAL), which MFO profiled in December. Like QVAL, IVAL seeks the cheapest, highest quality value stocks … within the International domain. These stocks are selected in quant fashion based on value and quality criteria grounded in investing principles first outlined by Ben Graham and validated empirically through academic research.

The concentrated portfolio currently invests in 50 companies across 14 countries. Here’s breakout:

As with QVAL, there is no sector diversification constraint or, in this case, country constraint. Japan dominates current portfolio. Once candidate stocks pass the capitalization, liquidity, and quality screens, value is king.

Notice too no Russia or Brazil.

Wesley explains: “We only trade in liquid tradeable names where front-running issues are minimized. We also look at the custodian costs. Russia and Brazil are insane on both the custodial costs and the frontrunning risks so we don’t trade ’em. In the end, we’re trading in developed/developing markets. Frontier/emerging don’t meet our criteria.”

Here is link to IVAL overview. Dr. Gray informs us that the new fund’s expense ratio has just been reduced by 20bps to 0.79%.

Where In The World Is Your Fund Adviser?

Originally published in January 1, 2015 Commentary

When our esteemed colleague Ed Studzinski shares his views on an adviser or fund house, he invariably mentions location.

I’ve started to take notice.

Any place but Wall Street

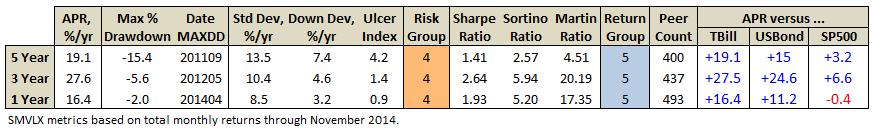

Some fund advisers seem to identify themselves with their location. Smead Capital Management, Inc., which manages Smead Value Fund (SMVLX), states: ”Our compass bearings are slightly Northwest of Wall Street…” The firm is headquartered in Seattle.

SMVLX is a 5-year Great Owl sporting top quintile performance over the past 5-, 3-, and even 1-year periods (ref. Ratings Definitions):

Bill Smead believes the separation from Wall Street gives his firm an edge.

Legendary value investor Bruce Berkowitz, founder of Fairholme Capital Management, LLC seems to agree. Fortune reported that he moved the firm from New Jersey to Florida in 2006 in order to … ”put some space between himself and Wall Street … no matter where he went in town, he was in danger of running into know-it-all investors who might pollute his thinking. ’I had to get away,’ he says.”

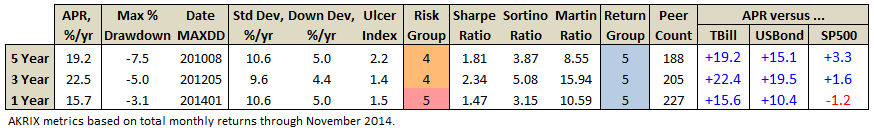

In 2002, Charles Akre of Akre Capital Management, LLC, located his firm in Middleburg, Virginia. At that time, he was sub-advising Friedman, Billings, Ramsey & Co.’s FBR Focus Fund, an enormously successful fund. The picturesque town is in horse country. Since 2009, the firm’s Akre Focus Fund (AKREX/AKRIX) is a top-quintile performer and another 5-year Great Owl:

Perhaps location does matter?

Tales of intrigue and woe

Unfortunately, determining an adviser’s actual work location is not always so apparent. Sometimes it appears downright labyrinthine, if not Byzantine.

Take Advisors Preferred, LLC. Below is a snapshot of the firm’s contact page. There is no physical address. No discernable area code. Yet, it is the named adviser for several funds with assets under management (AUM) totaling half a billion dollars, including Hundredfold Select Alternative (SFHYX) and OnTrack Core Fund (OTRFX).

Advisors Preferred turns out to be a legal entity that provides services for sub-advisers who actually manage client money without having to hassle with administrative stuff … an “adviser” if you will by name only … an “Adviser for Hire.” To find addresses of the sub-advisers to these funds you must look to the SEC required fund documents, the prospectus or the statement of additional information (SAI).

Hunderdfold Funds is sub-advised by Hunderdfold Funds, LLC, which gives its sub-advisory fees to the Simply Distribute Charitable Foundation. Actually, the charity appears to own the sub-adviser. Who controls the charity? The people that control Spectrum Financial Inc., which is located, alas, in Virginia.

The SAI also reveals that the fund’s statutory trust is not administered by the adviser, Advisors Preferred, but by Gemini Funds Services, LLC. The trust itself is a so-called shared or “series trust” comprised of independent funds. Its name is Northern Lights Fund Trust II. (Ref. SEC summary.) The trust is incorporated in Delaware, like many statutory trusts, while Gemini is headquartered in New York.

Why use a series trust? According to Gemini, it’s cheaper. “Rising business costs along with the increased level of regulatory compliance … have magnified the benefits of joining a shared trust in contrast to the expenses associated with registering a standalone trust.”

How does Hundredfold pass this cost savings on to investors? SFHYX’s latest fact sheet shows a 3.80% expense ratio. This fee is not a one-time load or performance based; it is an annual expense.

OnTrack Funds is sub-advised by Price Capital Management, Inc, which is located in Florida. Per the SEC Filing, it actually is run out of a residence. Its latest fact sheet has the expense ratio for OTRFX at 2.95%, annually. With $130M AUM, this expense translates to $3.85M per year paid by investors the people at Price Capital (sub adviser), Gemini Funds (administrator), Advisors Preferred (adviser), Ceros Financial (distributer), and others.

What about the adviser itself, Advisors Preferred? It’s actually controlled by Ceros Financial Services, LLC, which is headquartered in Maryland. Ceros is wholly-owned by Ceros Holding AG, which is 95% owned by Copiaholding AG, which is wholly-owned by Franz Winklbauer. Mr. Winklbauer is deemed to indirectly control the adviser. In 2012, Franz Winklbauer resigned as vice president of the administrative board from Ceros Holding AG. Copiaholding AG was formed in Switzerland.

Which is to say … who are all these people?

Where do they really work?

And, what do they really do?

Maybe these are related questions.

If it’s hard to figure out where advisers work, it’s probably hard to figure out what they actually do for the investors that pay them.

Guilty by affiliation

Further obfuscating adviser physical location is industry trend toward affiliation, if not outright consolidation. Take Affiliated Managers Group, or more specifically AMG Funds LLC, whose main office location is Connecticut, as registered with the SEC. It currently is the named adviser to more than 40 mutual funds with assets under management (AUM) totaling $42B, including:

- Managers Intermediate Duration Govt (MGIDX), sub advised by Amundi Smith Breeden LLC, located in North Carolina,

- Yacktman Service (YACKX), sub advised by Yacktman Asset Management, L.P. of Texas, and

- Brandywine Blue (BLUEX), sub advised by Friess Associates of Delaware, LLC, located in Delaware (fortunately) and Friess Associates LLC, located in Wyoming.

All of these funds are in process of being rebranded with the AMG name. No good deed goes unpunished?

AMG, Inc., the corporation that controls AMG Funds and is headquartered in Massachusetts, has minority or majority ownership in many other asset managers, both in the US and aboard. Below is a snapshot of US firms now “affiliated” with AMG. Note that some are themselves named advisers with multiple sub-advisers, like Aston.

AMG describes its operation as follows: “While providing our Affiliates with continued operational autonomy, we also help them to leverage the benefits of AMG’s scale in U.S. retail and global product distribution, operations and technology to enhance their growth and capabilities.”

Collectively, AMG boasts more than $600B in AUM. Time will tell whether its affiliates become controlled outright and re-branded, and more importantly, whether such affiliation ultimately benefits investors. It currently showcases full contact information of its affiliates, and affiliates like Aston showcase contact information of its sub-advisers.

Bottom line

Is Bill Smead correct when he claims separation from Wall Street gives his firm an edge? Does location matter to performance? Whether location influences fund performance remains an interesting question, but as part of your due diligence, there should be no confusion about knowing where your fund adviser (and sub-adviser) works.