Dear friends,

I’m sorry we were late to the party, but glad that you’re here. We had a rough start to February. Our estimable technical director Chip had a bad fall at work which took her out for three days. Just as we were preparing for launch, our site was vandalized by what appears to be an Indonesian hacking collaborative. Then as we thought we’d undone the damage and settled back to work, they slipped in again. (To be clear: you’re safe. We collect neither personal nor tracking information. Any financial stuff goes through Amazon and PayPal, groups that can pay for security obsessiveness. Mostly they seemed interested in vandalism for the sake of “bragging rights.”)

And then, to top it off, Mr. Trump was president. Yikes.

Investing in the time of Trump

“If they had learned anything together, it was that wisdom comes to us when it can no longer do any good” (I. 26). Gabriel García Márquez, Love in the Time of Cholera

If you think it’s time to be bold, you presumably know something that the rest of us don’t. If you are indeed part of “the smart money crowd,” congratulations and thanks for stopping by! Also, you can go now.

The Dow Jones Industrials average famously breached 20,000 on January 25, rising 1,800 points since the election. Vanguard Total Stock Market Index (VTSMX) is up 16% in 10 weeks. That advance is without basis in reality; that is, economic conditions are not 16% better than 10 weeks ago nor are the prospects ahead.

So why the rally? Mostly, I suspect, because people have become unhinged by the circus in D.C. Peggy Noonan, Reagan’s best speech-writer and doyen of the country-club Republicans, frets “we are living through big history and no one here knows where it’s going or how this period ends… Mr. Trump has overloaded all circuits. Everything is too charged, nothing feels stable. ‘Nothing is stable,’ [a prominent friend] replied” (“In Trump’s Washington, Nothing Feels Stable,” WSJ, 2/4-5/17). In such moments of great uncertainty, crowds surge. (I think about the news reports of people crushed to death against the doors of a burning theater as the crowd behind them rushes without thought or perception.)

In reality, nothing good has happened. The estimable Dan Wiener, he of the Independent Adviser for Vanguard Investors, writes:

You’ve heard me say it before and I’ll say it again: This has been a “Rumor Rally” not a “Trump Rally.” Investors have been buying on the rumor and, as of yet, we don’t really know what the news is. But a sell-off is in the cards just about any time, ratcheted higher by the rising levels of uncertainty now facing the country. “The Rumor Rally” (2/1/17)

People are buying because people are buying. Last summer’s “pessimism has been replaced by optimism,” a change that John Rekenthaler describes as “stark” (“Is the Contrarian Bell Clanging for Stocks?”1/27/17). That’s not generally a reason for you to buy. “[T]he confidence of professional and individuals investors,” Jason Zweig writes, “has a perverse quality … most of the time what the market does next has nothing to do with how optimistic investors are about it; the results are disconcertingly random. So you could visualize the stock market as a poltergeist or hobgoblin who takes a twisted delight in playing pranks on the expectations of the investing public” (“Don’t Let Other Investors Make Up your Mind,” 1/20/17).

Will investors continue finding reasons to bid stocks unrelentingly higher? How great is the supply of “greater fools”? Ummm … “maybe” and “substantial.” Cullen Roche of Pragmatic Capitalist asks the right questions:

And here’s the interesting part about Trump’s Presidency – how much room is left in this balloon? … how much higher can consumer confidence go? … how much more employment can you pull out of an economy plumbing very low levels of unemployment? This looks like a balloon that is much closer to its max capacity than vice versa. “Are Expectations Too High For Trump?” (1/23/17)

Mr. Rekenthaler echoes those questions:

Last year carried the danger that recession would occur … [but] the bad news did not come true, stocks [rallied] on relief. What relief will come now? The market has already celebrated twice … Something unexpected will be required for a third celebration. Unexpected positives do happen–but that’s not generally the way to bet. All this comes as rumination, not advice … [I have] a sense of foreboding … it is a bit worrisome. I feel as if I have been here before.

Mr. Zweig agrees:

This bull market for stocks is 94 months old, making it the second-longest in modern history … Now more than ever, you should take extra risk only because your own rigorous analysis leads you to conclude that it’s a good idea, not because other folks think it is.

Panicked crowds turn quickly, driven by their most panicked members and don’t much notice who is crushed underfoot. On whole we’d prefer that you neither join them nor getting trampled by them.

So what am I doing with my portfolio? Same as always: nothing. Mr. Rekenthaler likewise. That reflects the fact that my portfolio allocation is aligned with my goals and my need to enjoy the day and sleep through the night.

What might you do? Step one is to figure out if you even have a plan. For many of us, our investments are like barnacles on a ship’s hull, accumulating bit by bit without plan or a sense of how they affect our overall well-being. If you don’t have a plan, I’d make one that answered two questions: how would I handle a short-term financial crisis? And then, what pattern of investment allows me to balance my longer-term goals with my desire to have a fulfilling life, now and then? If you do have a plan, double-check your comfort with the following prospect: you might lose 30% this year and not see that money again until well into the 2020s. That’s the reality of a stock heavy portfolio riding a very old bull market.

My preference runs toward experienced, risk-conscious managers who have both the mandate and the flexibility to save you from yourself and from the market. For me, that translates to funds willing to hold cash when the market is giddy and to aggressively invest cash when the market feels suicidal, to managers who are able to move between asset classes but who typically don’t, and those who I trust endure “the slings and arrows of outrageous fortune” with calm determination.

Except in a very long-term retirement fund that I look at only once every year, it doesn’t mean hitching my fortunes to funds (active or passive) that blindly follow the crowd.

I would normally review my own portfolio choices in our February issue, but given the extraordinary challenges of getting this month’s issue to you, I’ll save that treat for March.

Citizenship in the time of Trump

After its nearly century and a half run, Ringling Bros. and Barnum & Bailey Circus plans to shut down “The Greatest Show On Earth.” (NPR.org)

Three quick thoughts. (1) Donald Trump is our president, for the next four years he qualifies as “a fact on the ground.” (2) Mr. Trump is a “a prancing, prattling mountebank” (my phrase from last November) and he’s not going to change. (3) You can’t afford to be.

Our message isn’t going to change: you need to skip the circus and focus on the policies. That means Get Off Facebook, except for cat videos and gloating about your kids’ or grandkids’ excellence. 60% of Americans get some or much of their news, especially political news and especially but not exclusively folks under 50, from social media. There are three problems with that strategy:

- Facebook is not designed to provide reliable intelligence.

- Facebook is designed to tell you what you want to hear; Facebook simply gives you more and more of whatever it is you and your friends like. That might be the National Knitting Night results or updates on the Steelers prospects for 2017. When you rely on it for political news, it’s toxic since conservatives hear the liberals love Satan and hate America while liberals hear that conservatives are Satan and hate everyone. Neither is true but both are seductive. It’s called “the echo chamber effect” and it leads conservatives to rage and liberals to weep. As Ms. Noonan reports, “at parties, dinners and gatherings the decibel level hits the ceiling right away and stays there. No one can hear anything.”

- The delusion that reliable journalism is free is starving reliable journalism. At base, you refuse to pay for a newspaper subscription or NPR membership because you don’t think you need to; just look on the web and it’s all there, free!

Get Off Facebook then choose whatever social media outlet you most love and get off it, too. The ones we love are the ones that tell us it’s all so simple and we’re all so right. Geoffrey Fowler of The Wall Street Journal wrote two well-done pieces which might help you: “Take your brain back from social media” and “Am I really addicted to Facebook?” (You can and you are, by the way.) If you don’t subscribe to the Journal, try Googling the titles. The New York Times has run comparable articles, which would help you understand the challenge.

Having done so, steel yourself to act like a grown-up. It’s hard, but we need to rise to the challenge.

- Support policies that are good for us; oppose policies that are bad for us. In my case, that translates to setting up a monthly contribution to the ACLU and hopes that they might help slow the mad rush. I’ve managed to avoid them for 60 years but now even the anguished conservative inside me recognizes that its time. In your case, it might as easily be supporting the American Conservative Union or the Environmental Defense Fund. Regardless, focus on policy.

-

Pay for real journalism. We need people who are professionally obliged to start with facts rather than those who start with conclusions. Both sorts of articles appear to offer facts; the difference is that the latter filter for “convenient facts” and “alt-facts” to prove what they knew all along. In my case, that translates to adding a subscription to the New York Times (.com!) as a way of helping to pay for the essential work of reporting reality rather than preference.

That complements my paper subscriptions to The Wall Street Journal, The Economist and the Quad City Times.

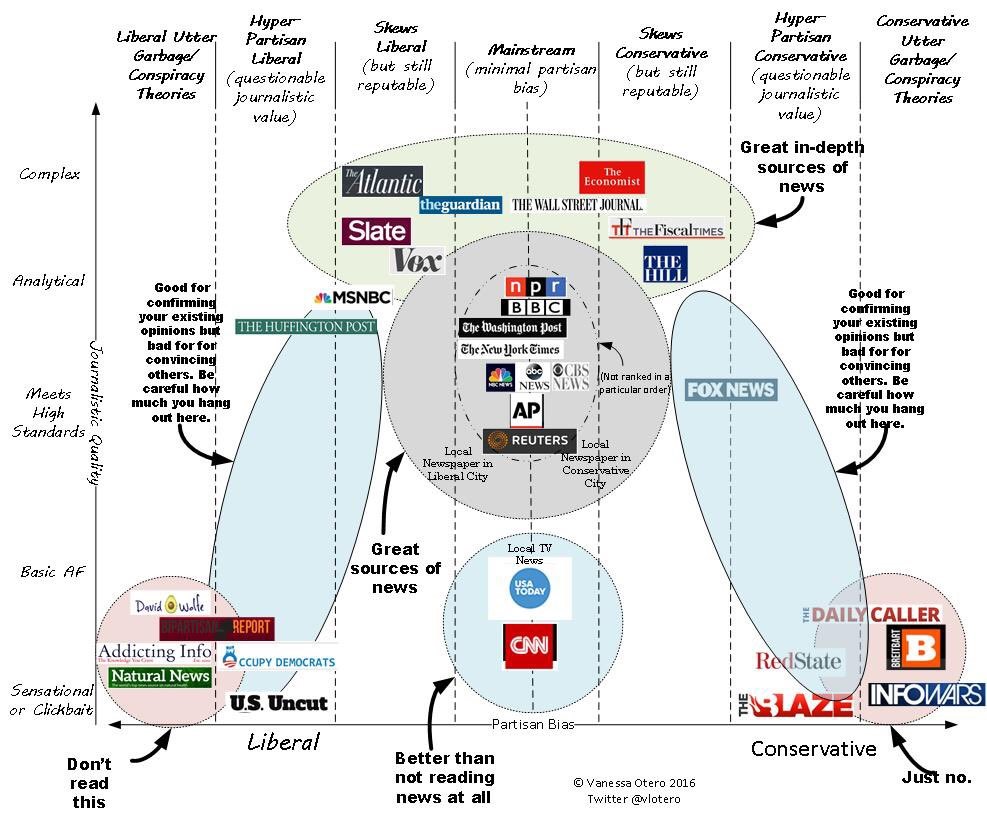

Patent attorney Vanessa Otero created a widely-discussed infographic that attempts to answer the question, “who should you turn to?”

While I’m much more skeptical of The Washington Post than she is (their daily news summary is a pained and painful liberal howl), I think she’s more right than wrong.

- Have dinner with someone you disagree with. At a table. With food you enjoy and a drink you savor. Without anything electronic. Give thanks for food and good health, for family and friends and for the wit to appreciate them. And if you must talk about the wider world, begin your conversation with these words: “Help me understand.”

- Remind your representatives that you did not hire them to join a mob, either pro- or anti -. In my case, that meant writing to senators Ernst and Grassley with a reminder that the sobriquet “the greatest deliberative body on earth” was not lightly bestowed and that it

must be earned, and earned again, by acting as the grown-ups at the picnic. I included a reminder of the words of senate Margaret Chase Smith, whose 1950 “Declaration of Conscience” wasn’t the country’s bravest statement against its worst elected official:

must be earned, and earned again, by acting as the grown-ups at the picnic. I included a reminder of the words of senate Margaret Chase Smith, whose 1950 “Declaration of Conscience” wasn’t the country’s bravest statement against its worst elected official:

I would like to speak briefly and simply about a serious national condition. It is a national feeling of fear and frustration that could result in national suicide and the end of everything that we Americans hold dear. It is a condition that comes from the lack of effective leadership in either the Legislative Branch or the Executive Branch of our Government.

I speak as briefly as possible because too much harm has already been done with irresponsible words of bitterness and selfish political opportunism. I speak as briefly as possible because the issue is too great to be obscured by eloquence. I speak simply and briefly in the hope that my words will be taken to heart.

I speak as a Republican. I speak as a woman. I speak as a United States Senator. I speak as an American.

Her statement concludes with the formal declaration of conscience:

It is with these thoughts that I have drafted what I call a “Declaration of Conscience.” I am gratified that [other senators] have concurred in that declaration and have authorized me to announce their concurrence.

The declaration reads as follows:

1. We are Republicans. But we are Americans first. It is as Americans that we express our concern with the growing confusion that threatens the security and stability of our country. Democrats and Republicans alike have contributed to that confusion.

2. The Democratic administration has initially created the confusion by its lack of effective leadership, by its contradictory grave warnings and optimistic assurances, by its complacency to the threat of communism here at home, by its oversensitiveness to rightful criticism, by its petty bitterness against its critics.

3. Certain elements of the Republican Party have materially added to this confusion in the hopes of riding the Republican party to victory through the selfish political exploitation of fear, bigotry, ignorance, and intolerance. There are enough mistakes of the Democrats for Republicans to criticize constructively without resorting to political smears.

4. To this extent, Democrats and Republicans alike have unwittingly, but undeniably, played directly into [our enemy’s] design of “confuse, divide and conquer.”

5. It is high time that we stopped thinking politically as Republicans and Democrats about elections and started thinking patriotically as Americans about national security based on individual freedom. It is high time that we all stopped being tools and victims of totalitarian techniques — techniques that, if continued here unchecked, will surely end what we have come to cherish as the American way of life.

If you think that your vision is clearer than senator Smith’s, please do share it. If you hear your conscience in her voice, perhaps it’s time to share that fact, too.

Thanks!

To the good folks at Gardey Financial, for their years of support. We’re grateful, too, to those that have renewed or initiated a subscription to MFO Premium. And, we can’t forget to thank our stalwart supporters who’ve chosen to set up monthly PayPal contributions: Deb, Greg, Jonathan and Brian. Thanks so much!

Apologies especially to Leah W and mhkappgoda; we tried to extend thanks to you both but somehow ended up with incorrect surface and email addresses that led to a returned letter and rejected email messages. Neither of which diminishes the following: Thanks!

A different sort of thanks!

In our January issue, we asked if you might take a moment to help a child. A Florida reader’s autistic child was heartbroken that his Munder Funds LED wand had died after years of use and our reader, Doug, was looking for help in finding one. We asked if you would help, and you did.

Of course you did. You’re good!

Four readers (Charles, Jason, Leah, and Toby) tracked down very similar wands that are still on the market. Two (Mark and Marvin) offered suggestions for how to get the wand working or for other toys that might make a difference. And one (Graham!) actually tracked down the former Munder marketing executive for us.

Thanks to you all. You really do make a difference.

In closing …

The members of Albuquerque’s chapter of the AAII have been kind enough to invite me to drop by on March 15th. I propose to talk about how to survive despite bad journalism and bad impulses, though I seem forever to be wandering just a bit off-topic. If you happen to be around the city that day, I’m sure you’d be welcome.

We’ll be back on-schedule and in full voice just three short weeks from now with our March 1st issue. We hope to see you there!

As ever,