Dear friends,

For those of us who teach, August is a bittersweet month. Each year we approach summer like a gaggle of penitent drunks. This time, we promise, it’ll be different. We’ll do better. Trust us: we will revise all of our courses for fall. We will catch up on that mountain of books heaped beside the chair. We will finish that book manuscript (Miscommunication in the Workplace, 2d ed., in my case.). On top of which, we’ll see our children without the use of small electronic devices, we’ll be out there running at 6:00 each morning, we’ll get our roughage and drop 10 pounds.

For those of us who teach, August is a bittersweet month. Each year we approach summer like a gaggle of penitent drunks. This time, we promise, it’ll be different. We’ll do better. Trust us: we will revise all of our courses for fall. We will catch up on that mountain of books heaped beside the chair. We will finish that book manuscript (Miscommunication in the Workplace, 2d ed., in my case.). On top of which, we’ll see our children without the use of small electronic devices, we’ll be out there running at 6:00 each morning, we’ll get our roughage and drop 10 pounds.

Then it’s August, the resumption of school is just a couple weeks off and unfulfilled promises litter the floor.

And, it’s stinkin’ hot out. My best gesture toward weight loss this summer was a recent day in the garden, rooting out rose bushes that had gone feral then tilling up the soil. By the end of that adventure, I’d lost nearly three pounds and I was struggling to recall whether such 90/90 days (that is, 90 degrees and 90% relative humidity) were around when I was young.

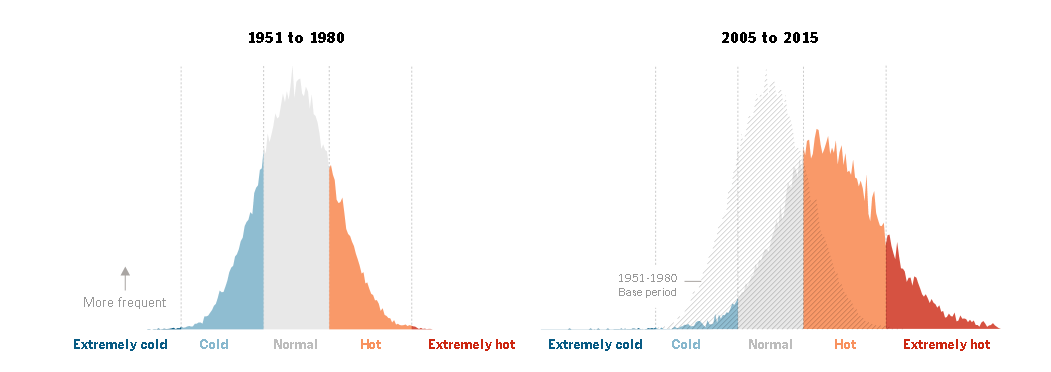

The answer, as it turns out, is “no.” Summers are getting more oppressive, with a discouraging speed, as the planet heats. Nadja Popovich and Adam Pearce, reporters for the New York Times, wrote a sober piece entitled It’s Not Your Imagination. Summers Are Getting Hotter (07/27/2017). It contains a fascinating graphic showing the changing distribution of summer temperatures from the years of my childhood to now. While “extremely hot” days were once a rarity and “hot” ones were a minority, “hot” is now our normal state and “extremely hot” is uncomfortably common.

I’ve taken a couple steps in response, small though they are. The first was to join the Environmental Defense Fund, whose mission includes addressing climate change. Why EDF? Two reasons. It was well-rated by Charity Navigator, which assesses larger charities on the degree to which they use their resources efficiently and effectively. The fact that some rich donor was offering a 2:1 match for contributions through the end of August, helped. And EDF is reasonably compatible with my political philosophy. I’m a reasonably conservative guy who’d much rather encourage progress through conversation and cooperation with governments and corporations than engaging in histrionics and lawsuits. EDF works hard to create (but not get financial gain from) corporate partnerships, to tie their initiatives to good science and to engage groups with different political perspectives. So I’ve set up a monthly contribution for them in hopes that my son’s summers will be just a bit better for it.

The second was to make a carbon offset payment to the Carbon Fund, whose motto is “reduce what you can, offset the rest.” They’re small, but seem responsible, sensible and well-respected. My contribution, admittedly a form of wergild, will help support reforestation and methane capture projects, which at least helps offset some of the pollution that my small household produces.

And, as always, the Observer is hosted on energy-efficient servers which are (mostly) powered by renewable sources.

This is part of the same strategy that we’ve advocated all along: do not obsess about the theatrics in Washington and don’t hide in a comfortable bubble of like-minded conservatives or liberals. Take responsibility, actively support what you approve of, actively oppose what you disapprove of and respect other folks who are trying to do the same.

Everything you ever wanted to know about MFO Premium *

(*But were afraid to ask)

You’re curious.

You know you are.

And now you can find out. Live. On camera.

Mutual Fund Observer exists to help independent investors make better, more thoughtful and better informed decisions about their finances. While we believe that many of the finest opportunities lie in the realm of small, independent funds, we have no financial relationship with them and accept neither underwriting nor advertising.

MFO Premium is where all of our data and screeners lie. Originally it was just used internally as we vetted funds and screened for interesting outliers. It’s distinguished from most such operations in two important ways:

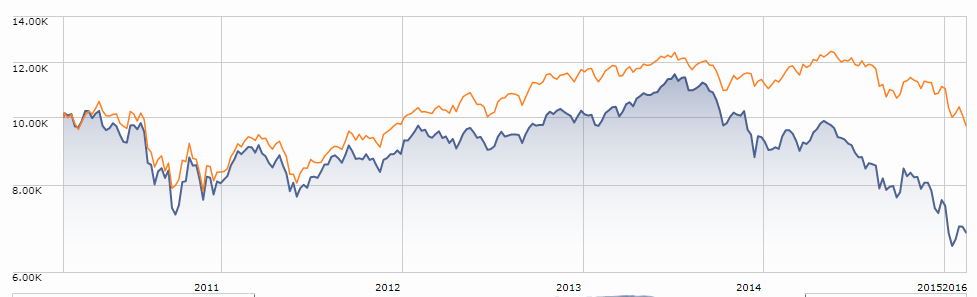

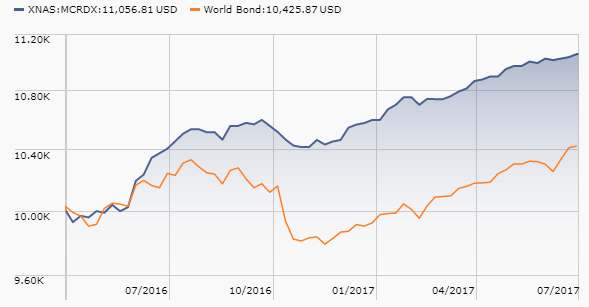

- It allows users to be highly risk-aware. While many sites use standard deviation, a measure of day-to-day volatility, to tell you all you need to know about risk. MFO Premium instead gives you four different risk-return metrics (Sharpe, Sortino, Martin and Ulcer) for both funds and benchmarks, calculated for up to 20 distinct time periods. It also provides measures of “normal” riskiness (the downside deviation) and measures for periods of extreme stress (maximum drawdowns, recovery periods, bear market month deviations). That’s complemented by custom correlation matrixes, which allow you to find out whether any particular fund is pulling its weight by adding diversification to offset the risks it carries.

- It’s highly responsive to individual needs. Charles Boccadoro, our colleague and major domo of MFO Premium, is in almost constant conversation with the site’s users. Those interactions lead us to almost monthly refinements in response to what folks most need.

MFO Premium has two missions. One is to help investors and advisors make much better informed decisions. The other is to provide an additional incentive for readers to provide (tax deductible!) financial support for Mutual Fund Observer. For a contribution of $100 or more, we’re happy to share a year’s access to MFO Premium with folks.

Webinars: August 16 and August 30

We will provide a live, interactive walk through over the MFO Premium screeners and analytics.

Our webinar will address:

- Origin and motivation behind MFO’s premium site search tools

- Underlying database and top-level implementation methodology

- Overview of various tools, including Dashboard of Profiled Funds, Fund Family Scorecard, Three Alarm Funds, Great Owls

- On-line demos of Multi Search … the site’s main tool, including pre-set screens, multi-parameter searches, evaluation period selection

- Quick review of definitions reference, limitations, and on-going improvements

Throughout our intention will be to highlight unique insights those tools provide individual investors and financial advisers … and the attendant benefits to themselves and their clients.

The webinars are free, though space is limited. At Chip’s recommendation, we’ll be using Zoom software which will allow us to be seen and to share our screen, as well as to see you (or not, at your discretion) and record the interaction. You will be provided instructions for accessing the webinar, which requires installation of a small plug-in.

Webinar #1 is Wednesday, August 16, at 3:00 p.m. Eastern Daylight Time (2:00 CDT, 1:00 MDT, noon PDT). Webinar #2 is Wednesday, August 30, at 11 a.m. Eastern Daylight Time (10:00 CDT, 9:00 MDT, 8:00 PDT).

If you would like to participate, contact us with your preferred date and we’ll arrange access.

Meet in person: September 6-8

Charles will be covering the Morningstar ETF Conference in Chicago for us. He’s hopeful of having coffee and conversation, about MFO and MFO Premium, with readers at a mutually agreeable time. If you can’t make the webinar (or just aren’t that into tech) but will be at Morningstar, please contact us with word of your interest and your plans.

The “Are You Smarter than a 5th Grader?” challenge

I am perfectly sanguine about admitting that our marketing skills are roughly equivalent to a 5th grader’s. (Okay, not those freakish 5th graders on YouTube. They’re scary. We mean the normal ones.)

If you’ve got a background in marketing and think you have a strategy or scheme, plan or ploy, trick or tactic, insight or initiative which might help the Observer reach more folks so that we can better fulfill our mission, we’d be delighted to hear from you, work with you and acknowledge you for it. We’re particularly hopeful of reaching the sorts of investors who are generally outsiders: younger folks, those with very limited resources, and others.

If you’re indeed smarter than a 5th grade marketer, contact David and we’ll talk!

Thanks.

Speaking of thanks …

As always, we’re thankful for your continued support and goodwill. Greg, Brian, Jonathan and Deb, we’re grateful for your ongoing subscriptions. And, many thanks this month to Sunil and Joseph for your generous contributions.

With wishes for a warm and relaxing end of summer,