The industry appears to be in full summer-beach mode, or its doing so splendidly that there’s no need to even think about changing anything. In any case, July saw the smallest number of announced changes in about five years.

Updates

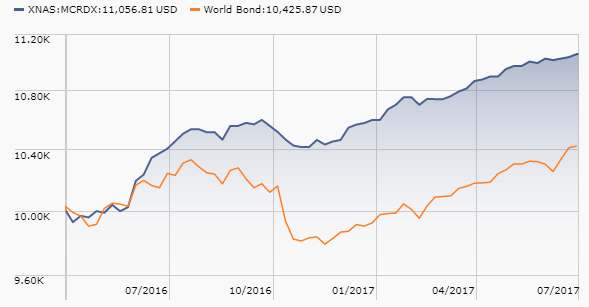

Our July 2017 profile of Matthews Asia Credit Opportunities (MCRDX/MICPX) described it as investing in high-yield bonds. That’s correct but incomplete. Manager Satya Patel reminded us that the fund’s core investments can include “convertibles, hybrids and derivatives with fixed income characteristics.” Indeed, since inception convertible bonds have represented 20-25% of the portfolio. We’ve corrected the profile to reflect that. The fund has built a substantial performance advantage over its peers since inception, similar to the consistent success of its older sibling, Mathews Asia Strategic Income (MAINX).

Briefly Noted . . .

SMALL WINS FOR INVESTORS

Effective October 9, 2017, a bunch of American Century funds (including International Discovery, Adaptive Equity, Global Gold Fund, International Core Equity Fund, International Value Fund, International Opportunities Fund, Small Cap Growth Fund, Emerging Markets Fund, Global Growth Fund and International Growth Fund) are eliminating their redemption fees.

Effective August 1, 2017, Fidelity will reduce total expenses across 14 of its 20 stock and bond index mutual funds. The average e.r. will be reduced from 11 bps to 9.9 bps.

Effective September 1, 2017, the minimum initial investment amount for individual investors in Class I shares of the Marketfield Fund (MFLDX) is being lowered from $1,000,000 to $25,000. This has long felt like the Icarus Fund, which was too proud, soared too high, got too close to the sun and plummeted. Assets are down about 97% from their peak, but the firm is independent again and their 2017 performance has been quite solid.

PIMCO is liquidating the “C” class shares for many of their funds. That strikes me as an entirely positive move.

Touchstone Small Cap Fund (TSFAX) has reopened to new and existing investors.

Effective August 1, 2017, the Teton Westwood Mighty Mites Fund (WEMMX) initial minimum investment for Class AAA, Class A, Class C, and Class T shares is $1,000. It had been $10,000.

CLOSINGS (and related inconveniences)

Anchor Tactical Credit Strategies Fund (ATCSX) has permanently closed its Investor share class. Current Investor investors have been moved to Institutional shares.

Effective the close of business on August 4, 2017, Fidelity Global Balanced (FGBLX) will close to new investors. I’m not sure why. The fund is economically viable (roughly $500 million) but nowhere near reaching a capacity constraint. Its performance has been mostly mediocre, but never embarrassing. It’s a curious decision.

One week later, the four-star Fidelity Global Strategies Fund (FDYSX) closes as well.

Effective September 29, 2017, the T. Rowe Price Global Technology Fund (PRGTX) will be closed to new investors

Vanguard Wellington (VWELX) has closed to new investors, except for folks with a Vanguard brokerage account. That’s attendant to their impending launch of global versions of Wellesley Income and Wellington. (See this month’s “Funds in Registration” for details.)

OLD WINE, NEW BOTTLES

I’m tempted to title this entry “Baillie Gifford gives up Big Sex,” but I won’t. Baillie Gifford Emerging Markets Fund, Institutional Class, has changed its ticker symbol from BGSEX to BGEGX.

Effective October 2, 2017, Deutsche Enhanced Global Bond Fund (SZGAX) will be renamed Deutsche High Conviction Global Bond Fund, Deutsche Enhanced Emerging Markets Fixed Income Fund becomes Deutsche Emerging Markets Fixed Income Fund and Deutsche Enhanced Emerging Markets Fixed Income Fund (SZEAX) will be renamed Deutsche Emerging Markets Fixed Income Fund.

Finally, Deutsche Enhanced Emerging Markets Fixed Income Fund (SCEMX) will be renamed Deutsche Emerging Markets Fixed Income Fund.

On August 29, 2017, GMO Emerging Countries Series Fund is going to redeem its investment in GMO Emerging Countries Fund (“ECF”), after which it will be renamed GMO Emerging Markets Series Fund

OFF TO THE DUSTBIN OF HISTORY

AMG TimesSquare All Cap Growth Fund, AMG Trilogy International Small Cap Fund and AMG Trilogy Global Equity Fund will liquidate on August 31, 2017.

Deutsche Core Fixed Income Fund (SFXAX) will merge into Deutsche Core Plus Income Fund (SZIAX), on or about October 30, 2017. It’s scary when even the surviving fund, in this case one that’s trailed 98% of its peers over the past decade, looks like a candidate for closure.

Dreyfus Mid-Cap Growth Fund (FRSDX) will, pending shareholder approval, merge into Dreyfus/The Boston Company Small/Mid Cap Growth Fund (DBMAX) on January 19, 2018.

Dreyfus Strategic Beta Global Equity Fund (DBGAX) will liquidate on September 8, 2017.

Geneva Advisors Small Cap Opportunities Fund (GNORX) and Geneva Advisors International Growth Fund (GNFRX) will each wrap up their affairs on August 28, 2017.

Gingko Multi-Strategy Fund (GNKIX) goes extinct on August 21, 2017. The gingko tree, for which it’s named, has survived 270,000,000 years. The fund, whose “dynamic” static engendered a turnover ratio of 1800%, lasted six.

Guidestone Global Natural Resources Equity Fund (GNRZX) has closed and will liquidate on September 22, 2017.

Pioneer Emerging Markets Fund (PEMFX) will merge into Pioneer Global Equity Fund (GLOSX) “in the fourth quarter of 2017.” Approximately 3% of Global Equity’s portfolio is invested in the emerging markets, making it a pretty poor fit for investors who had been seeking direct EM exposure. Indeed, GLOSX has more money invested in Apple than in all the EMs combined. On the other hand, PEMFX is really bad at what it does while GLOSX is mostly mediocre.

Transamerica Global Long/Short Equity (TAEAX) vanished on July 24, 2017, after just over one week’s notice.