By David Snowball

Updates

In December’s story, “There’s no idea so dumb that it won’t attract a dozen ETFs,” I derided the notion of blockchain ETFs. That’s because they have so few meaningful investments; there just aren’t many publicly traded blockchain-focused firms to build a portfolio around. I described their investment universe as “a small, motley collection of firms that recently changed their names to blockchainify them (360 Capital Financial suddenly became 360 Blockchain), over-the-counter stocks, foreign small caps and recent IPOs.”

Shortly thereafter, Long Island Iced Tea Corporation – literally, guys who make bottled iced tea – changed their name to Long Island Blockchain. They’re still making iced tea and have no demonstrable competence in blockchain. Notwithstanding that, their stock tripled in value in a single day.

Business Insider chronicled the silliness around the IPO for a firm named “Longfin.”

There’s Longfin [LFIN]. The company went public in the US on December 13, 2017. In its SEC filing, it said it had revenues of $298,786 in the year 2017 and was sitting on $75 in cash. What sent the stock soaring 2,700%, from $5 to $142.82 in a few days, and gave it briefly a market capitalization of over $7 billion, was the December 15 announcement – an elegant and apparently very effective mix of gobbledygook, hype, and silliness that started out like this:

Longfin Corp., a leading global FinTech company, announces the acquisition of Ziddu.com, a Blockchain-empowered solutions provider that offers Microfinance Lending against Collateralized Warehouse Receipts in the form of Ziddu Coins.

Ummm … “sitting on $75 in cash”? I just checked my wallet: that’s rather more than I’m currently sitting on but I do have an extra $30 squirreled away in my desk which would put me over the top.

In any case, my loathing for the ETF industry grew with the registration filings of four bitcoin funds from First Trust, four from ProShares, two from REX and one from Direxion. (And no, I’m not giving you the links to such silliness. If you want them, you’ll need to find them on your own.) These funds, once launched, do represent a pathway through which the insanity of the bitcoin and cryptocurrency markets can infect major financial markets. A long shot, you say? Well, the cryptocurrency market just passed $500 billion value and (2) the 1998 Long Term Capital Management crisis was generated, in large part, by a misplaced bet on the Russian ruble. Wider systemic damage was avoided only through a swift and then-unprecedented bailout.

Briefly Noted . . .

I hardly know where to put the note that Tierra XP Latin America Real Estate ETF (LARE) became the ETFMG Alternative Harvest ETF. The “alternative harvest” at issue is marijuana.

SMALL WINS FOR INVESTORS

Effective December 18, 2017, 361 Capital, LLC agreed to reduce the limit on the total annual fund operating expenses by 0.15% to 1.79%, 1.54% and 1.39% for the 361 Global Long/Short Equity Fund’s Investor Class, Class I and Class Y shares, respectively.

Effective February 28, 2018, Calamos is going to eliminate the no-load “R” share class for all of its funds. Current “R” shareholders will be transitioned into “A” shares, with the proviso that they will not have to pay the normal “A” share sales load. Given that Calamos “A” shares are typically costly but the “R” shares are noticeably more costly than “A”, it’s a small win.

The Disciplined Growth Investors Fund (DGIFX) is a small, five-star fund that’s normally around 70% domestic equities and 30% bonds or cash. They’ve got low expenses and good risk management; it has pretty much clobbered its Lipper “moderate allocation” peer group since inception. DGIFX has returned 12.4% annually against 7.7% for its peers. Likewise with its Morningstar “aggressive allocation” peer group. The fund normally imposes a $10,000 minimum. That’s now been modified to reduce the minimum to “$100 if an automatic monthly investment is established with monthly contributions of at least $100 until the account balance reaches $10,000, and the shareholder agrees to e-delivery of account statements and transaction confirmations.”

Effective immediately after 4:00 pm Eastern Time on January 2, 2018, the Driehaus International Small Cap Growth Fund (DRIOX) will reopen to new investors. The Fund has been closed to most new investors since December 29, 2010. It’s had a very solid run (13.3% annually over the past five years, about 1.8% ahead of its peers) but, like all Driehaus funds, tends to be volatile and costly.

The FX Strategy Fund (FXFAX and FXFIX) has converted their “A” shares into low minimum, no-load “I” shares. That spares shareholders the 5.75% sales charge but, in an unusual arrangement, the “I” shares carry a 0.25% marketing fee while the “A” shares did not. Up until now, the adviser has chosen not to impose the 12(b)1 fee. It looks like that will change and “Class I shares [will] charge a 0.25% Rule 12b-1 Distribution and Shareholder Services fee.”

“Effective December 6, 2017, Vanguard Emerging Markets Bond Fund (VEMBX) will be available for investment.” I admit that I have no idea what that sentence means. The fund has been around since 2016 and returned 13.35% in 2017. But it has only $32 million in investments and, for most of 2017, has been tagged as “not available for purchase.” Which has now changed, it seems.

CLOSINGS (and related inconveniences)

Effective as of the close of business on December 29, 2017, Infinity Q Diversified Alpha Fund (IQDAX) imposes the hardest close on record: it “is closed to all new investment, including through dividend reinvestment, and the Infinity Q Fund’s transfer agent will not accept orders for purchases of shares of the Infinity Q Fund from either current Infinity Q Fund shareholders or new investors.” It’s a multi-alternative hedged fund, under $200 million in assets, five-star rating with a Great Owl designation. The GO signals consistently top-tier risk-adjusted performance against its Lipper Multi-Alternative Strategy peers.

OLD WINE, NEW BOTTLES

The focus of “Old Wine, New Bottles” is funds that change their names, generally without changing their nature. That is, there’s no corresponding change in mandate. As it turns out, name changes that don’t reflect fundamental management changes – called “superficial name changes” – should be a red flag for investors. Three scholars recently published a study of 6000 such changes. They conclude:

We study how investors respond to ‘superficial’ mutual-fund name changes that occur for no fundamental reasons. We find that such name changes remain widespread [and] are more widespread than previously studied ‘misleading’ changes. Superficial changes appear to be driven by managerial incentives. Investors react to superficial changes with increased fund flows but appear to gain no benefit through improved performance or lower fees. On the contrary, name-change funds underperform as a group. (Susanne Espenlaub, Imtiaz ul Haq and Arif Khurshed, “It’s all in the name: Mutual fund name changes after SEC Rule 35d-1,” Journal of Banking and Finance, July 2017)

By their estimation, 60% of all name changes are marketing gimmicks: sinking funds making desperate attempts to appear trendy, hot, cool, cutting edge or relevant. 20% of name changes occur in funds that have repeatedly renamed themselves. Many changes, City National Rochdale Emerging Markets (RIMIX) fund’s renaming pursuant to new ownership, are pretty valid. Others, for example those stapling “opportunity,” “contrarian” or “dynamic” to their names, are often admissions of failure.

By their estimation, 60% of all name changes are marketing gimmicks: sinking funds making desperate attempts to appear trendy, hot, cool, cutting edge or relevant. 20% of name changes occur in funds that have repeatedly renamed themselves. Many changes, City National Rochdale Emerging Markets (RIMIX) fund’s renaming pursuant to new ownership, are pretty valid. Others, for example those stapling “opportunity,” “contrarian” or “dynamic” to their names, are often admissions of failure.

Resist temptation! If there’s no good reason for a name change, then there’s almost certainly a bad reason for it.

As of April 1, 2018, Advisory Research Global Value Fund (ADVWX) becomes Advisory Research Global Dividend Fund.

City National Rochdale Emerging Markets Fund (RIMIX) is becoming Fiera Capital Emerging Markets Fund, with the same management team and mandate. The sale of the fund closed on December 1, 2017 with the team accepting contracts from Fiera. It’s a singularly worthwhile fund. MFO ranks it as a “Great Owl” fund for posting peer-beating risk-adjusted returns in each trailing period we measure. Since inception in 2012, the fund has outperformed its peers by 8.2% annually: 14.2% versus 6.0% with lower downsides by every measure we follow.

Effective on or about February 28, 2018 Columbia Diversified Equity Income Fund (INDZX) becomes Columbia Large Cap Value Fund, Columbia European Equity Fund (AXEAX) becomes Columbia Contrarian Europe Fund and Columbia Asia Pacific ex-Japan (CAJAX) becomes Columbia Contrarian Asia Pacific Fund. “Contrarian” certainly qualifies for the “chic name” label.

Effective February 28, 2018, the Congress All Cap Opportunity Fund (CACOX) will change its name to Congress SMid Core Opportunity Fund.

First Trust Low Beta Income ETF (FTLB) name is changed to First Trust Hedged BuyWrite Income ETF. First Trust High Income ETF (FTHI) name is changed to First Trust BuyWrite Income ETF.

Effective February 28, 2018, MacKay gets the credit. Nineteen of the MainStay funds add “MacKay” to their names. MacKay Shields is a fixed-income specialist affiliated with New York Life Investments, the firm behind Mainstay. No hint about why MacKay is getting hold of the eight equity-oriented funds in this list.

| Current Name |

New Name |

| MainStay California Tax Free Opportunities |

MainStay MacKay California Tax Free Opportunities |

| MainStay Common Stock |

MainStay MacKay Common Stock |

| MainStay Convertible |

MainStay MacKay Convertible |

| MainStay Cornerstone Growth |

MainStay MacKay Growth |

| MainStay Emerging Markets Debt |

MainStay MacKay Emerging Markets Debt |

| MainStay Emerging Markets Equity |

MainStay MacKay Emerging Markets Equity |

| MainStay Government |

MainStay MacKay Government |

| MainStay High Yield Corporate Bond |

MainStay MacKay High Yield Corporate Bond |

| MainStay High Yield Municipal Bond |

MainStay MacKay High Yield Municipal Bond |

| MainStay International Equity |

MainStay MacKay International Equity |

| MainStay International Opportunities |

MainStay MacKay International Opportunities |

| MainStay New York Tax Free Opportunities |

MainStay MacKay New York Tax Free Opportunities |

| MainStay S&P 500 Index |

MainStay MacKay S&P 500 Index |

| MainStay Short Duration High Yield |

MainStay MacKay Short Duration High Yield |

| MainStay Tax Advantaged Short Term Bond |

MainStay MacKay Tax Advantaged Short Term Bond |

| MainStay Tax Free Bond |

MainStay MacKay Tax Free Bond |

| MainStay Total Return Bond |

MainStay MacKay Total Return Bond |

| MainStay U.S. Equity Opportunities |

MainStay MacKay U.S. Equity Opportunities |

| MainStay Unconstrained Bond |

MainStay MacKay Unconstrained Bond |

Effective December 20, 2017, UBS Emerging Markets Equity Fund became UBS Emerging Markets Equity Opportunity Fund. That, UBS avers, better aligns with the fund’s strategy. You’ll have to imagine me rolling my eyes at that argument since I can’t imagine any strategy which couldn’t claim “opportunity” as an element.

OFF TO THE DUSTBIN OF HISTORY

On December 21, 2017, Alpine Woods Capital Investors, LLC agreed to sell four of their funds to Aberdeen Asset Managers, Ltd. The sale requires formal, if pro forma, approval by the boards of trustees and shareholders. Assuming that, the transfer will occur in the second quarter of 2018. The funds involved are Alpine Realty Income & Growth Fund (AIAGX), Alpine Global Infrastructure Fund (AIAFX), Alpine International Real Estate Equity Fund (EGALX) and Alpine Dynamic Dividend Fund (ADAVX). I am modestly confused about the fact that they list four open-end funds (and discuss Aberdeen’s record with OEFs) but then make the proviso that the agreement requires “the approval of a change in the advisory arrangements of the Alpine-advised closed-end funds.”

A harsher fate awaits Alpine Financial Services (ADAFX) and Alpine Small Cap Fund (ADIAX), both of which will be liquidated on February 14, 2018.

Ashmore Emerging Markets Equity Opportunities Fund (AEOAX), a one year old fund of Ashmore funds, will liquidate on or about January 4, 2018. In general, I think you should avoid firms that close funds within a year or two of launch; it seems to speak to fundamental problems with their business judgment and commitment to their investors.

The Baird LargeCap Fund (BHGSX), a tiny multi-cap fund with decent performance, was liquidated on December 28, 2017.

Carillon, which recently bought the Scout funds, is beginning a housecleaning. Carillon Eagle Smaller Company Fund is being reorganized into Carillon Scout Small Cap Fund (UMBHX); and Carillon Eagle Mid Cap Stock Fund is merging with Carillon Eagle Mid Cap Growth Fund (HAGIX), effective on or about July 13, 2018. Scout is taking over management of the Smaller Company Fund. In addition, Carillon is liquidating Carillon Eagle Investment Grade Bond Fund (EGBAX) and the Carillon Reams Low Duration Bond Fund (SCLDX) on or about February 28, 2018.

In May 2018, Eaton Vance Global Small-Cap Fund (EAVSX) will merge into Eaton Vance Tax-Managed Global Small-Cap Fund (ESVAX), except that by then it won’t be called Tax-Managed Global Small-Cap Fund, it will be called Global Small-Cap Equity Fund and “will no longer be required to employ tax-management techniques or seek after-tax returns.”

Estabrook Investment Grade Fixed Income Fund (EEFAX) will liquidate on January 31, 2018. The fund ends its life with one star and under $500,000 in assets … not one penny of which came from any of its five managers or five trustees.

The $485 million Fidelity Global Balanced Fund (FGBLX) is slated to merge with Fidelity Asset Manager 60% (FSANX) on April 20, 2018. Hmmm … FGBLX shareholders can think of themselves as moving into Fidelity Slightly Less Global Balanced Fund since FSANX devoted 20% of its portfolio to international equities where FGBLX has 30%. FSANX has lower expenses and a modestly better long-term record, boosted by the strong US market of the past three years.

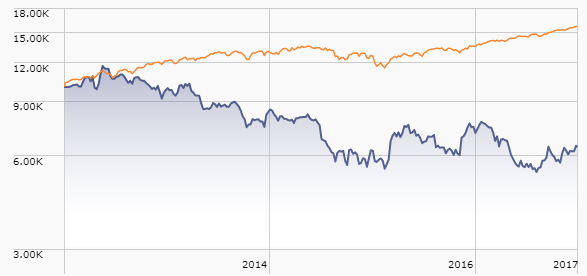

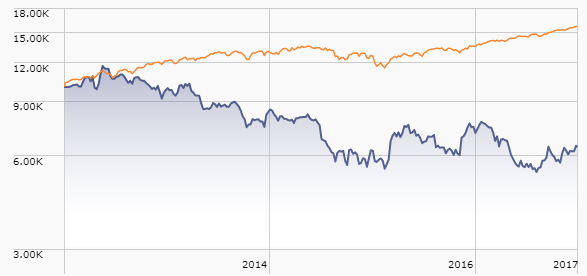

Footprints Discover Value Fund (DAVAX) liquidated on December 29, 2017. Yuh. Footprints is in blue on the chart below.

Frost Conservative Allocation, Moderate Allocation and Aggressive Allocation funds all liquidated on December 22, 2017.

The two year old, $12 million HSBC Global Equity Volatility Focused Fund (HGEAX) will be liquidated on or before January 31, 2018.

iShares Edge MSCI Min Vol Global Currency Hedged ETF (HACV) continues to hang in the balance. In mid-November they received a regulatory notice threatening them with delisting by their exchange because they had fewer than 50 shareholders. A 12/29/2017 follow-up filing claims that they are in compliance and eligible for continued listing but just in case …

Janus’s Board of Trustees approved a plan to liquidate and terminate Janus Henderson Real Return Fund (JURAX) with such liquidation (and termination!) effective on or about March 2, 2018.

As of January 20, 2017, Kellner Event Fund (KEFAX) had completed its liquidation and returned capital to its investors.

Lyrical U.S. Hedged Value Fund (LYRDX) will discontinue its operations effective January 29, 2018.

On or about the close of business on April 27, 2018, the three star Russell U.S. Large Cap Equity Fund (RLCZX) will merge into the five-star Russell Multifactor U.S. Equity Fund (RTDSX) which, by happy coincidence, is a U.S. large cap equity fund. The acquiring fund also sports a substantially lower expense ratio, so this looks like a pretty clean win for investors.

TCW High Dividend Equities Fund (TGDEX) will be liquidated on or about January 25, 2018.

Templeton Institutional Emerging Markets (TEEMX) will cease to be an institution, emerging or otherwise, on March 16, 2018.

Third Avenue International Value Fund (TAVIX) is slated to merge into Third Avenue Value Fund (TAVFX). Among the enumerated reasons for the change are (1) they’re both global funds with similar styles, (2) a single fund with a larger asset base will allow them to spread expenses over a larger number of accounts; in sum “the combined fund would have improved commercial prospects and asset growth potential.” Absent from that assessment is the fact that both funds have trailed 88% of their Morningstar peers over the past three years; the five year numbers are no better and the firm is in turmoil.

The TIAA-CREF Global Natural Resources Fund (TNRLX) will be liquidated after the close of business on April 13, 2018.

Templeton Foreign Smaller Companies Fund (FINEX) will merge into Templeton Global Smaller Companies Fund on or about June 1, 2018.

The Board of Trustees of Victory Portfolios has approved a Plan of Liquidation for the Victory Expedition Emerging Markets Small Cap Fund (VAEMX). It is anticipated that the Fund will liquidate on or about February 27, 2018.

On November 15, 2017, the Board of Trustees of Waddell & Reed Advisors (WRA, in the table below) authorizes reorganization of their funds into corresponding Ivy funds. All of the WRA funds have closed to new investors in anticipation of the move. The reorganization is expected to close on or about February 26, 2018, and does not require shareholder approval.

| Equity Funds |

|

| WRA Accumulative |

Ivy Accumulative |

| WRA New Concepts |

Ivy Mid Cap Growth |

| WRA Small Cap |

Ivy Small Cap Growth |

| WRA Vanguard |

Ivy Large Cap Growth |

| WRA Global Growth |

Ivy Global Growth |

| WRA Continental Income |

Ivy Balanced |

| WRA Science and Technology |

Ivy Science and Technology |

| WRA Wilshire Global Allocation |

Ivy Wilshire Global Allocation |

| Fixed Income Funds |

|

| WRA High Income |

Ivy High Income |

| WRA Municipal High Income |

Ivy Municipal High Income |

| Money Market |

|

| WRA Cash Management |

Ivy Cash Management |

The adviser to the WBI funds has (correctly) concluded that based on their current asset level, the funds are no longer sustainable. WBI Tactical BP Fund (WBPNX), WBI Tactical DG Fund (WBIDX) and WBI Tactical BA Fund (WBADX) will be euthanized on January 26, 2018. The obscure letter designations appear to be Wealth Builders Inc., Dividend Growth and Balanced. No clue on the meaning of BP.

Xtrackers MSCI Emerging Markets High Dividend Yield Hedged Equity ETF (HDEE) and Xtrackers MSCI Eurozone High Dividend Yield Hedged Equity ETF (HDEZ) closed on December 18 and liquidated on December 29.

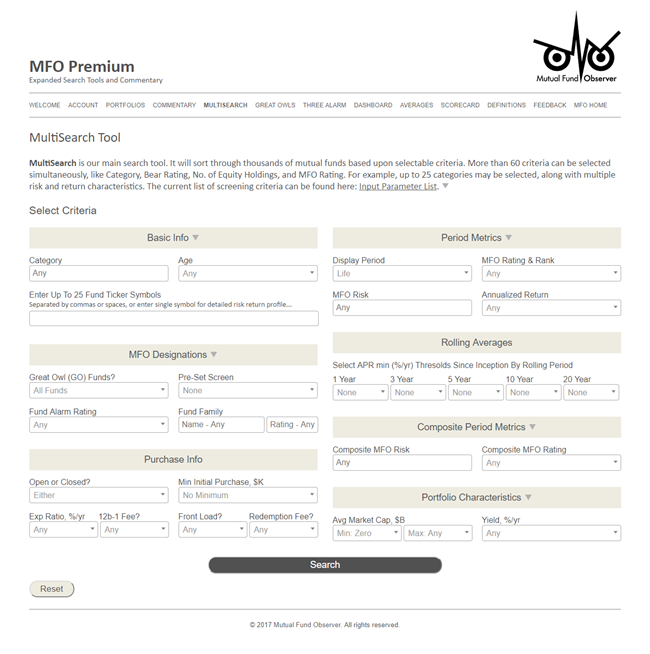

It has two features that most screeners lack, and both of them are Charles! Charles has been thinking about what’s really important for investors to know in order to make the best decisions for themselves and their families. As a result, (1) he’s built in tools – from uncommon risk measures to correlation matrices and rolling return screens – that give you information that’s meaningful. And (2) he revises the site almost monthly to accommodate your needs and interests. Literally: if you write with a concern, you get a prompt answer that actually comes from one or both of us. Quite frequently, you also get new or clarified options added to MFO Premium as a result.

It has two features that most screeners lack, and both of them are Charles! Charles has been thinking about what’s really important for investors to know in order to make the best decisions for themselves and their families. As a result, (1) he’s built in tools – from uncommon risk measures to correlation matrices and rolling return screens – that give you information that’s meaningful. And (2) he revises the site almost monthly to accommodate your needs and interests. Literally: if you write with a concern, you get a prompt answer that actually comes from one or both of us. Quite frequently, you also get new or clarified options added to MFO Premium as a result.

Landon Thomas’s long article in the

Landon Thomas’s long article in the  By their estimation, 60% of all name changes are marketing gimmicks: sinking funds making desperate attempts to appear trendy, hot, cool, cutting edge or relevant. 20% of name changes occur in funds that have repeatedly renamed themselves. Many changes, City National Rochdale Emerging Markets (RIMIX) fund’s renaming pursuant to new ownership, are pretty valid. Others, for example those stapling “opportunity,” “contrarian” or “dynamic” to their names, are often admissions of failure.

By their estimation, 60% of all name changes are marketing gimmicks: sinking funds making desperate attempts to appear trendy, hot, cool, cutting edge or relevant. 20% of name changes occur in funds that have repeatedly renamed themselves. Many changes, City National Rochdale Emerging Markets (RIMIX) fund’s renaming pursuant to new ownership, are pretty valid. Others, for example those stapling “opportunity,” “contrarian” or “dynamic” to their names, are often admissions of failure.