On July 28, 2021, T. Rowe Price launched its fourth set of target-date funds, the Retirement Blend Series. The Retirement Blend strategy has been in operation since 2018 but has been available only through collective investment trusts. The new fund series complements the existing Retirement and Target Series (as well as the Retirement Hybrid series that’s available only through a collective investment trust). All four series invest, primarily, in other T. Rowe Price funds. Retirement and Target invest, primarily but not exclusively, in actively managed funds. According to Morningstar, T. Rowe Price is the largest manager of active target-date products in the U.S., with over $300 billion in active target-date strategy assets under management, as of March 31, 2021.

The new Series will be managed by Wyatt Lee (with whom we spoke in June), Kimberly DeDominicis, and Andrew Jacobs Van Merlen whose share responsibility for the other series as well.

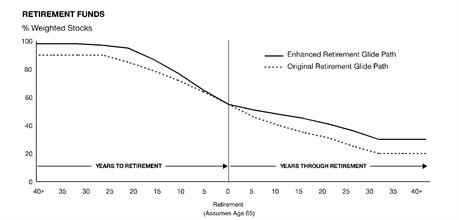

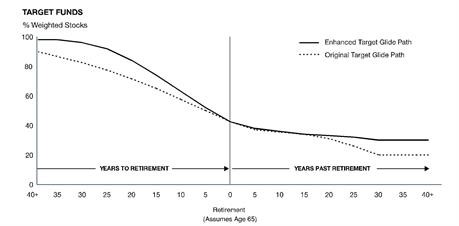

Retirement and Target series differ in their glide paths, that is, their long-term asset allocation plan. The Retirement and new Retirement Blend funds have a more aggressive allocation and the Target funds a slightly less aggressive one.

Retirement / Retirement Blend

Target

The glidepath stipulates only the very broadest allocation decisions: stocks versus bonds. One Investment Committee has the responsibility for strategic allocations (domestic vs. international, small versus large, value versus growth) within those broad bands and for choosing the funds (e.g., New Horizon, Small Cap Index or Small Cap Value) which offers the most attractive risk-return profile for implementing the team’s judgments. Another, the Asset Allocation Committee, makes the shorter-term tactical decisions about overweighting asset classes or sectors.

At their target date, the Retirement and Blend funds have a neutral weighting of 55% equity which Target will sit at 42.5%. That neutral weight is subject to change, either because T. Rowe Price’s research convinces them that a different long-term allocation should be applied across the entire Series, as happened in 2020 when equity exposure was broadly raised to account for the effects of greater longevity, or a different short-term tactical allocation is implemented to account for some market disruption or another. The tactical shifts can increase or reduce exposure to an asset class by up to 5%.

The distinctiveness of the Retirement Blend Series is its greater reliance on passive funds and corresponding lower expense ratio.

Manager Wyatt Lee explained during a June interview that he has “four levers to add value

- The broad, long-term allocations within the glidepath

- Diversification with glidepath

- Some tactical changes in the normal allocation

- Selecting of the underlying investments.”

Retirement and Retirement Blend will be identical on levers 1 – 3. On level 4, Retirement Blend will rely on passive products to gain their Core Equity, Investment Grade Bond, and Treasury exposures. That will allow for somewhat lower expense ratios while preserving the ability of active managers to add value in diversifying areas where they have a record of outperforming their passive benchmarks. Within the fixed income sleeve, diversifying areas include high yield and emerging market debt.

Mr. Wyatt believes that, over time, the more active approach of the Retirement series will lead to higher returns than the more passive approach of the Retirement Blend series but there’s no guarantee of that and the leadership of one approach over the other will likely vary with time. Since the inception of the Retirement Blend strategy as a collective trust, for example, the more active funds have outperformed by about 60 bps but over the past twelve months, it’s been a draw.

Here’s the snapshot of the three series, through the lens of a single target-date fund.

| Equity exposure | Expense ratio | |

| T. Rowe Price Target 2025 | 50% | 0.58% on $490 million |

| T. Rowe Price Retirement 2025 | 65% | 0.61% on $17 billion |

| T. Rowe Price Retirement Blend 2025 | 65% | 0.38% at launch |

Price is really good at this game

In a July 2021 discussion of T. Rowe Price’s target-date funds, Morningstar’s Jason Kephart made this observation:

T. Rowe Price Retirement is their flagship target-date fund series. It’s overseen by what we consider one of the top teams for asset-allocation research and execution in the industry … we’re pretty confident in that team overseeing it, and it’s also including a collection of T. Rowe Price’s really well-regarded active equity funds, active bond funds. So, really, what’s going to drive this series is that stock selection and bond selection, and they’re among one of the best stock-selecting firms in the industry.

Morningstar’s faith in the strength of the T. Rowe Price teams led them to upgrade the target-date series to an analyst rating of Gold, a judgment likely strengthened by subsequent fee reductions.

The topnotch management team on the T. Rowe Price Retirement target-date series has capably begun the transition to its new equity glide path, the result of an exhaustive research effort that demonstrated the firm’s vast capabilities. Confidence in the team’s execution drives a Morningstar Analyst Rating upgrade to Gold for the series’ two cheapest share classes, while the two more expensive are rated Bronze. (An Upgrade for the T. Rowe Price Retirement Target-Date Series, 3/10/2021)

Price has the only Gold-rated target-date funds investing primarily in active underlying funds, including their own and the MassMutual funds they subadvise. As of July 2021, 30 of Price’s 40 target-date funds have earned four- or five-star ratings from Morningstar; the remainder are three-star or too young to be rated. Twelve of them have earned MFO’s Great Owl designation for consistently top-decile risk-adjusted returns.

Bottom line

T. Rowe Price has also been an innovator with research-driven solutions driving their asset allocation funds. Some of that research centered on asset class performance, some on investor needs and preferences.

The Retirement Series offered the prospect of additional gains driven by the skill of its active investment management team. The Retirement Blend series offers the guarantee of lower expenses for returns that might modestly lag those of its Retirement siblings. Both offer fundamentally attractive packages, with the choice between them driven by simple investor preference.

Website: T. Rowe Price Retirement Funds, which gives you access to the series.