A handful of young funds, by luck or design, have managed the rare feat of peer beating returns since inception with risk-rated, risk-adjusted returns (MFO rating, Ulcer rating) and risk metrics (downside deviation, bear market deviation, down market deviation).

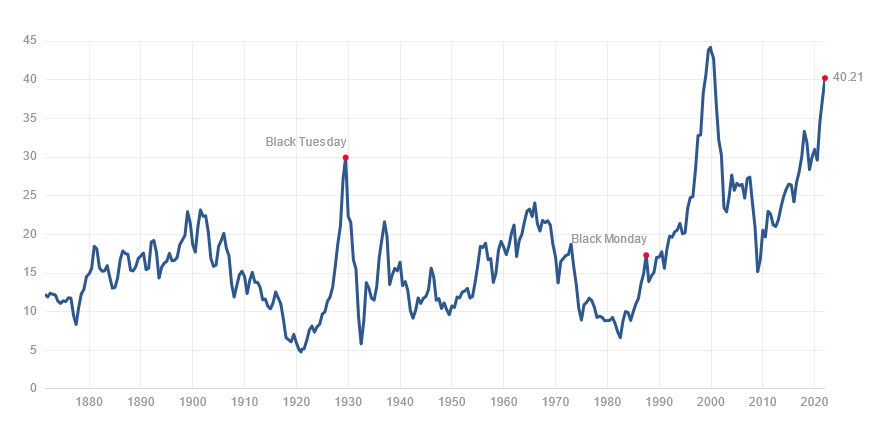

The US stock market is approaching the most extreme valuation levels of the past 150 years, at least as measured by the Schiller 10 year PE ratio.

Investors leery of the state of the market might cast an eye in their direction.

Cells marked in blue represent the top 20% performance, while green is the next highest 20%.

| APR vs peers | MFO | DSD | Bear | Down market | Ulcer rating | |||

| BlackRock China A Opportunities | CHILX | China Region | +12.9 | 5 | 1 | 1 | 2 | 1 |

| Castle Tandem | TANDX | Multi-Cap Core | -4.6 | 5 | 1 | 1 | 1 | 1 |

| Palm Valley Capital | PVCMX | Small-Cap Growth | -10.2 | 5 | 1 | 1 | 1 | 1 |

| Alger Mid Cap Focus | AFOZX | Mid-Cap Growth | +13.9 | 5 | 1 | 1 | 1 | 1 |

| Franklin Templeton Clarion Partners Real Estate Income Inc | CPREX | Real Estate | +5.4 | 5 | 1 | 1 | 1 | 1 |

| Innovator Growth-100 Power Buffer ETF – October | NOCT | Options Arbitrage / Strategies | +3.8 | 5 | 1 | 1 | 1 | 1 |

| Reynders McVeigh Core Equity | ESGEX | Multi-Cap Growth | +2.9 | 5 | 1 | 2 | 2 | 1 |

| Lazard International Quality Growth Portfolio | ICMPX | International Multi-Cap Growth | +3.8 | 5 | 1 | 2 | 2 | 1 |

| Fidelity Founders | FIFNX | Multi-Cap Growth | +3.1 | 5 | 1 | 2 | 2 | 1 |

| Federated Hermes International Developed Equity | HIEIX | International Multi-Cap Core | +3.7 | 5 | 1 | 2 | 2 | 1 |

| Wasatch International Select | WGISX | International Multi-Cap Growth | +4.4 | 5 | 1 | 2 | 2 | 1 |

A note about the two laggards: Palm Valley Capital Fund (PVCMX) is sitting at 80% cash right now, while Castle Tandem (TANDX) is at 30%. Both are run by teams of absolute value investors: folks who believe in owning great stocks, but only when they’re rationally priced. Having concluded that they’re not, both teams are waiting with piles of cash for the inevitable panic.

Full disclosure: Snowball purchased shares of Palm Valley in his personal portfolio at the fund’s launch and has been slowly adding to the position.