Updates

As part of Heartland Advisors’ succession plan, founder William (“Bill”) J. Nasgovitz intends to transfer a controlling interest in Heartland Advisors to Will Nasgovitz, the Chief Executive Officer of Heartland Advisors, in 2022. The elder Mr. Nasgovitz launched the firm, and the Heartland Value Fund, in 1984. The younger Mr. Nasgovitz joined the firm in 2006 and co-manages the Heartland Value and Mid Cap Value funds.

On the continuing theme of “rules are for the little people,” the Wall Street Journal reports

Sens. Pat Toomey (R., Pa.) and Cynthia Lummis (R., Wyo.) sit on the powerful Senate Banking Committee and have been advocates for a light government touch toward the growing—and largely unchecked—cryptocurrency market.

They also own cryptocurrency assets. Ms. Lummis’s roughly $250,000 of bitcoin makes her the most heavily invested U.S. lawmaker in the digital asset. Mr. Toomey has smaller holdings in crypto-related investment vehicles. Together they are the only two senators with such investments… (“Only Two Senators Own Crypto Assets. Both Are Shaping the Industry’s Rules,” 12/20/21).

To be clear, such investments do not violate any laws or the Senate’s own rules, as long as the senators disclose them. At yet, as with our earlier reports on dozens of members of Congress failing to disclose their stock trading and members of the Federal Reserve’s Board of Governors playing the bond market, it’s hard to imagine that having a vested financial interest in the outcome of your deliberations makes it easier to be clear-eyed and impartial.

Cohanzick has shuffled the deck. David Sherman, president of Cohanzick Asset Management and manager of two exceptional RiverPark funds, has entered an agreement whereby his CrossingBridge division will merge with Enterprise Diversified, Inc. The two will form a new, publicly-traded company named ENDI. ENDI owns Willow Oak, and Willow Oak provides back-office support to a handful of small, value-oriented hedge funds.

Cohanzick will become the controlling shareholder of the new company, with the prospect of inheriting some useful tax losses to carry forward and gaining from the appreciation of the new company’s stock. They will, in turn, be able to leverage their logistical abilities to strengthen Willow Oak. From an outside investor’s perspective, it’s pretty much a non-event.

Briefly Noted . . .

Thanks, as ever, to The Shadow for a rich collection of leads!

Thanks, as ever, to The Shadow for a rich collection of leads!

FPA launched its first ETF, FPA Global Equity ETF, on December 17, 2021. Stephen Romick and his team lead the fund, and it uses the Contrarian Value Equity strategy that’s also embodied in FPA Crescent. The ETF charges 0.49% and, unlike Crescent, is committed to being more-or-less fully invested all the time.

JP Morgan joins the conversion parade. Sometime “in the first half of 2022,” JP Morgan anticipates converting four mutual funds to ETFs.

| Predecessor Fund | Fund |

| JPMorgan Inflation Managed Bond Fund | JPMorgan Inflation Managed Bond ETF |

| JPMorgan International Research Enhanced Equity Fund | JPMorgan International Research Enhanced Equity ETF |

| JPMorgan Market Expansion Enhanced Index Fund | JPMorgan Market Expansion Enhanced Equity ETF |

| JPMorgan Realty Income Fund | JPMorgan Realty Income ETF |

Similarly, BrandywineGLOBAL — Dynamic US Large Cap Value Fund and the Martin Currie International Sustainable Equity Fund are converting into the BrandywineGLOBAL Dynamic US Large Cap Value ETF and the Martin Currie International Sustainable Equity ETF, respectively. Both funds are parts of Franklin Templeton, which has $1.5 trillion in AUM and around 55 other ETFs. Between them, the two funds carry $250 million in assets.

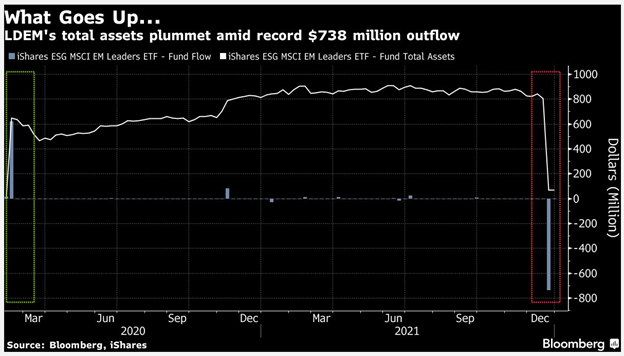

BlackRock has an owie. Assets in BlackRock’s iShares ESG MSCI EM Leaders ETF (LDEM) lost 91% of its investments in the days just before Christmas (Sydney Maki, A 91% asset plunge hits a BlackRock fund of sustainable EM stocks, 12/29/2021). In case you’re wondering what that might look like on your Bloomberg terminal:

The fund invests in mid- to large-cap, ESG-screened EM stocks. It’s dirt cheap (16 bps) and has posted index-like performance since inception. It hasn’t been making money (6% total over two years, -1.8% in 2021), but neither has its asset class. Morningstar warns that it carries more stock-specific risk (28% of the portfolio is in its top 10 names) and more risk related to substantial investments in state-owned enterprises than most. The best explanation for the collapse is the withdrawal of a huge pension fund in Finland, which provided much of the seed capital for the fund at launch.

![]() Speaking of owies. Despite a multitude of warnings, here at MFO, at Morningstar, and elsewhere, investors absolutely poured money into the ARKK Innovation ETF in December 2020 and January 2021. The warnings were pretty straightforward: (1) you can’t buy last year’s returns, so don’t let those sway your decisions, (2) ARK was wildly understaffed and inundated (net $20 billion in 2020) with dumb money, and (3) manager Cathy Woods has a consistent long-term boom-and-crash track record, with the boom having just occurred.

Speaking of owies. Despite a multitude of warnings, here at MFO, at Morningstar, and elsewhere, investors absolutely poured money into the ARKK Innovation ETF in December 2020 and January 2021. The warnings were pretty straightforward: (1) you can’t buy last year’s returns, so don’t let those sway your decisions, (2) ARK was wildly understaffed and inundated (net $20 billion in 2020) with dumb money, and (3) manager Cathy Woods has a consistent long-term boom-and-crash track record, with the boom having just occurred.

Good news for investors committing their money on December 1st: you’re only down 13% since then. Less good news for folks who made ARKK one of their New Years 2020 resolutions: you’re down 24%. Folks who gave shares as a Valentine’s Day present? They’re underwater by 39%. On the bright side, at least they didn’t spend the money on a near-suicidal gesture, like:

SMALL WINS FOR INVESTORS

Conestoga Capital Advisors has converted a relatively young hedge fund into a micro-cap mutual fund, Conestoga Micro Cap Fund. The LP averaged 38.42% per year in 2019-2020, substantially all of which was generated by 2020’s 75% return. The fund will be managed by David Neiderer and Joseph F. Monahan. Mr. Monahan co-manages their four-star Conestoga Small Cap (CCASX) and SMid Cap (CCSMX) funds. Mr. Neiderer is an equity analyst on both funds. The expense ratio for Investor shares is 1.50%, and the minimum initial investment is $2,500.

CLOSINGS (and related inconveniences)

The only ones we’ve spotted seem to be precursors to liquidation rather than celebrations of success and unmanageable affluence.

OLD WINE, NEW BOTTLES

As of February 28, 2022, the Aberdeen Global Equity Fund’s name will be abrdn Emerging Markets ex-China Fund. That’s because unpronounceable gimmicks are always helpful in conveying a fund’s identity and establishing market presence. The sequence of corporate names: Julius Baer begat Artio, Artio begat Aberdeen, Aberdeen begat abrdn.

Effective December 16, 2021, Capital Link NextGen Protocol ETF became Capital Link Global Fintech Leaders ETF. At the same time Capital Link NextGen Vehicles & Technology ETF became Capital Link Global Green Energy Transport and Technology Leaders ETF, but there’s no particular gain – in clarity or otherwise – from the change. In each case, it’s a passive ETF tracking an obscure index, but at least now you can tell what on earth the NextGen Protocol thing is up to.

Following M&A activity on the part of the parent companies of the Chartwell and Carillion Funds, the names of all of the Chartwell funds will soon be one word longer.

| Target Funds | Acquiring Funds |

| Chartwell Income | Carillon Chartwell Income |

| Chartwell Mid Cap Value | Carillon Chartwell Mid Cap Value |

| Chartwell Small Cap Growth | Carillon Chartwell Small Cap Growth |

| Chartwell Small Cap Value | Carillon Chartwell Small Cap Value |

| Chartwell Short Duration Bond | Carillon Chartwell Short Duration Bond |

| Chartwell Short Duration High Yield | Carillon Chartwell Short Duration High Yield |

Clarion Global Real Estate Portfolio has become the CBRE Global Real Estate Portfolio.

As of February 23, 2022, First Trust CEF Income Opportunity ETF drops the “CEF” bit and becomes First Trust Income Opportunities ETF. Currently, the fund invests in closed-end funds but plans to add ETFs as a second option, hence the broader name. It’s been a bit streaky, but it’s not clear that adding more options is the answer.

On February 14, 2022, the iClima Distributed Renewable Energy Transition Leaders ETF will change its name to the iClima Distributed Smart Energy ETF. Simultaneously, the iClima Global Decarbonization Transition Leaders ETF becomes the iClima Climate Change Solutions ETF.

On the theme of codifying stupid, immemorable fund names, the Litman Gregory Masters Funds, which became the uninspired PartnerSelect Funds, have now become the unpronounceable and inexplicable iMGP Funds.

| Current Name | New Name (effective 12/16/2021) |

| PartnerSelect Equity | iMGP Equity |

| PartnerSelect International | iMGP International |

| PartnerSelect Alternative Strategies | iMGP Alternative Strategies |

| PartnerSelect High Income Alternatives | iMGP High Income Alternatives |

| PartnerSelect SBH Focused Small Value | iMGP SBH Focused Small Value |

| PartnerSelect Oldfield International Value | iMGP Oldfield International Value |

| iM Dolan McEniry Corporate Bond | iMGP Dolan McEniry Corporate Bond |

| iM DBi Managed Futures Strategy ETF | iMGP DBi Managed Futures Strategy ETF |

| iM DBi Hedge Strategy ETF | iMGP DBi Hedge Strategy ETF |

On March 1, 2022, iShares Global Green Bond ETF becomes iShares USD Green Bond ETF. My best understanding is that the fund moves from a dollar-hedged global bond portfolio to a dollar-denominated one. Subsequently, the expense ratio drops by 5 bps.

Effective on February 25, 2022, Laudus International MarketMasters Fund becomes the Schwab International Opportunities Fund. On the same day, Laudus U.S. Large Cap Growth Fund becomes Schwab Select Large Cap Growth Fund.

Effective February 1, 2022, Northern Short-Intermediate Tax‑Exempt Fund becomes the Limited Term Tax‑Exempt Fund, and Northern Short-Intermediate U.S. Government Fund will be renamed Limited Term U.S. Government Fund. The changes are, so far as we can tell, purely cosmetic.

Prudential Financial took a half-step back from their embrace of unexplained acronyms, replacing QMA with Quant Solutions in the names of a dozen funds and ETFs. So, for example, PGIM QMA International Equity Fund becomes PGIM Quant Solutions International Equity Fund. Now, if they’d do a quick gut check and dump PGIM in favor of Prudential, it would be a win all the way around.

Effective December 13, 2021, William Blair Short-Term Bond Fund became William Blair Short Duration Bond Fund, and William Blair Ultra-Short Bond Fund was re‑named William Blair Ultra-Short Duration Bond Fund.

OFF TO THE DUSTBIN OF HISTORY

The Board of Directors has approved a plan of liquidation for the AC Alternatives Market Neutral Value Fund. Under the plan, the liquidation date of the fund will be March 11, 2022. Over ten years, the fund has returned 0.7% annually, making it slightly less profitable than a lemonade stand, though slightly more profitable than the average market-neutral fund. While money poured in in late 2015 and 2016, the fund has been leaking assets for years and stands at just over $35 million.

Callin’ off the wedding: “At a meeting held on December 16, 2021, the Board of Trustees of Allspring Funds Trust unanimously approved the termination of the Amended and Restated Agreement and Plan of Reorganization with respect to the merger of each Allspring Target Date Fund into a corresponding Allspring Dynamic Target Date Fund and the abandonment of the Reorganizations.”

On December 17, 2021, the minuscule, two-star AXS Aspect Core Diversified Strategy Fund was swallowed by its tiny, three-star sibling AXS Chesapeake Strategy Fund. The funds’ five managers have, collectively, zero invested in either fund. You might take that as their recommendation.

On December 10, 2021, the BMO – originally, Bank of Montreal – funds were either merged into comparable Columbia funds or were simply rebranded as Columbia’s.

| BMO Fund | Corresponding Acquiring Fund |

| BMO Pyrford International Stock | Columbia Pyrford International Stock |

| BMO LGM Emerging Markets Equity | Columbia Emerging Markets |

| BMO Short-Tax Free | Columbia Short Term Municipal Bond |

| BMO Short-Term Income | Columbia Short Term Bond |

| BMO Intermediate Tax-Free | Columbia Intermediate Municipal Bond |

| BMO Strategic Income | Columbia Strategic Income |

| BMO Core Plus Bond | Columbia Total Return Bond |

BNY Mellon Ultra Short Income Fund was liquidated on December 21, 2021. If you have a BNY Mellon adviser, they should have already told you that your balance was shifted to the Dreyfus Government Cash Management Fund.

On December 15, 2021, the Boston Partners Global Equity Advantage Fund was liquidated after 2.5 years (it was launched on my birthday in 2019, woohoo!), presumably for mediocre performance and mediocre asset gathering.

Carillon Scout International Fund becomes Carillon ClariVest International Stock Fund on or about July 16, 2022. That entails both a new team, which comes on board in March 2022, and a new strategy … which is to say, Scout International vanishes, and a new fund inherits its record.

On February 22, 2021, Cavanal Hill Active Core Fund will be liquidated.

“During the first quarter of 2022,” Change Finance U.S. Large Cap Fossil Fuel Free ETF will merge into the AXS Change Finance ESG ETF.

Fidelity Select Air Transportation Portfolio was eaten by Fidelity Select Transportation right around Thanksgiving, 2021.

Effective December 7, 2021, FS Long/Short Equity Fund was hard-closed. While a liquidation was not announced, a $4.5 million dollar fund with an atrocious record (and no inside ownership) is not likely to be closing in order to stanch the tidal wave of new money.

On or about February 11, 2022, Goldman Sachs Alternative Premia Fund takes a dirt nap. The decision occurred “after careful consideration of a number of factors,” none of which are explained in the death notice. I’m guessing that the tendency to generate long-term returns under 1% per year and the subsequent reluctance of investors to negative real returns were factors.

iShares iBonds 2021 Term High Yield and Income ETF was liquidated effective December 20, 2021.

Here’s one for fans of Nicholas Cage movies and dark conspiracies in general. The tiny, five-star John Hancock Retirement Income 2040 Fund is slated to be liquidated in spring. Here’s the official explanation:

continuation of the fund is not in the best interests of the fund or its shareholders as a result of factors or events adversely affecting the fund’s ability to conduct its business and operations in an economically viable manner. As of the close of business on or about April 22, 2022, there are not expected to be any shareholders in the fund, and the fund will be liquidated on such date.

“There are not expected to be any shareholders.” If I owned shares now, I think I’d be worried about what Hancock knows that I don’t.

In a more benign development, on December 10, 2021, John Hancock Short Duration Credit Opportunities Fund merged into their five-star Opportunistic Fixed Income Fund.

Effective December 27, 2021, Muzinich High Income Floating Rate Fund closed to new purchases, whether from existing or new investors. The fund has faithfully tracked the Credit Suisse Leveraged Loan Index since inception but has drawn just $33 million in assets. The inference is that the closure precedes a death notice, though that’s not confirmed.

SGI Conservative Fund was liquidated on December 30, 2021.

VanEck NDR Managed Allocation Fund will be disallocated and dissolved on or about January 19, 2022.