“If you sit by the river long enough, you will get to see the bodies of your enemies float by.”

Variously attributed to Confucius, Sun Tzu, Samurai training and “Arabs.”

First, some housekeeping. As David Snowball mentioned some time ago and has confirmed recently, MFO as you know it will be going on a publishing hiatus during the New Year. My monthly contributions will also be going on that same hiatus.

As David and I have discussed his reasons for making this change, I found myself in agreement with many of them. Having been involved over the last ten years in writing monthly thought pieces for MFO, I have also reached a point where I fear that I am repeating myself. There does come a point of intellectual burnout in discussing the mutual fund industry.

Partly this is a function of demographic change in the make-up of the mutual fund investing audience. The under-40’s haven’t seen high inflation before, so don’t appreciate the effect it can have on their savings and way of life in preserving both capital and purchasing power. That same demographic is less interested in active management versus utilizing low-cost exchange-traded or passive investment funds.

In response, the industry is undergoing drastic change. As with an iceberg, much of that change is going on below the surface and not visible to current and potential investors. The industry and individual firms are doing as much as they can to ensure that only the minimal disclosure requirements are met.

I have spoken many times about the generational shift going on in mutual fund firms. Much of that is tied to firm structures as well as the deferred compensation and bonus plans for the investment professionals. On the West Coast, there are firms in the San Francisco Bay Area which face a problem of unaffordable housing costs for junior professional staff. If they have families, they must often commute long distances to get good housing, good schools, and a low crime environment. For the upper crust of those firms, they can afford to live anywhere. But with the deferred compensation or partnership payouts tied to a current book value, in a bad performance and market year, there can be a roadblock preventing people from moving out of the firm. The key question becomes one of the long-term sustainability of the investment management business while it is in that location. The solution is a general improvement in the local business climate. Or it is a relocation of the business to a more business-friendly environment to a place like Nevada or Utah.

In Boston, there is a different extreme. In another large global investment partnership, the amount of book value paid to buy into the partnership is the same amount that will be paid out from the partnership upon retiring. Other payouts for ten years are tied to a different savings/deferred compensation plan. In another large privately held investment firm in Boston, payouts upon retirement are tied to the values of the privately held shares in the firm you have accumulated over the years. In both instances, the age for “retirement” is generally age 55 plus or minus.

In Chicago, there is a variation on what journalist John Kass would call “The Chicago Way.” That is reflected in approaches to deferred compensation for key employees tied to non-compete agreements (illegal in California and generally viewed as age discrimination in New York and thus unenforceable). And, as seen in one instance in this past year, where the mutual fund’s assets under management are controlled by the firm’s parent, a firm can be forced out of business in a very short time period if the parent adopts a different corporate strategy. And at the same time, the appropriateness of Chicago as a location for investment firms as opposed to say, Florida, continues to be a subject for discussion.

Contrary to perception, people are not fungible but can and do make a difference in active management and the supporting research efforts. That is often borne out by a subsequent decline in performance as well as a departure of assets under management. And that will not change unless you are dealing with a pure, quantitative approach or a true passive approach, benchmarked tightly to an index.

That is why it is humorous to watch the pension and investment consultants try and keep their databases updated on performance and personnel in their search universe. They are always behind the eight ball as they cannot see what is going on in real-time and what had been done by whom.

The Way Forward

Most of those in the above forty categories that I talk to, look at equity valuations and are convinced that given the increasing rate of inflation which is not transitory and an inconsistent but increasingly heavy hand of government interference, things will end badly. The signs are there. We have initial public offerings of stock now selling below the offering levels. There is increasing volatility in some special purpose acquisition vehicles that have come to market. And the number of insider sales of corporate stock seems to be increasing.

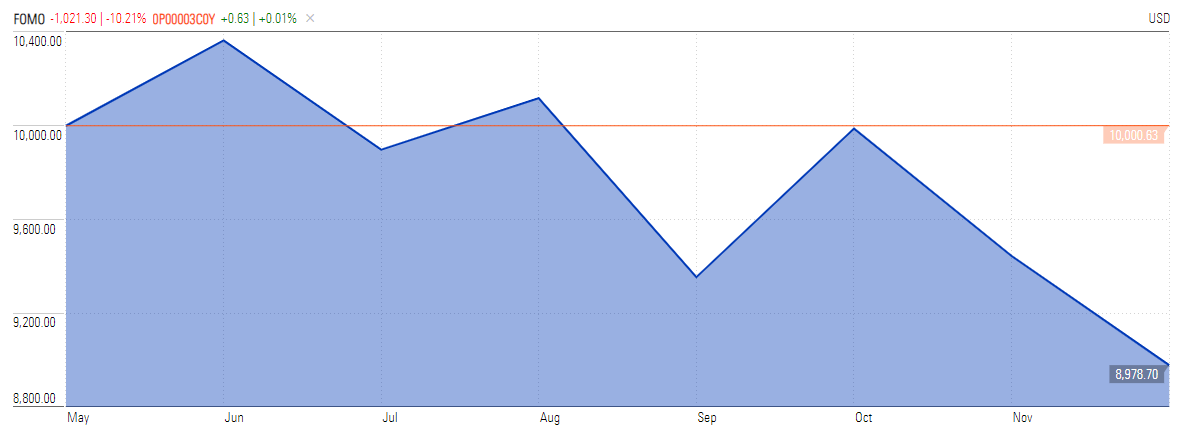

I would urge caution then. One should be less concerned about the fear of missing out, which seems to drive so many investment decisions now. Rather, you should be more concerned about the danger of permanent loss of capital, which cannot be replaced once gone. As you look at your fund investments, pay attention to their portfolios because, regardless of whether they style themselves growth or value, they often own the same things. Historic drawdown patterns may not apply. What looks liquid may not be in reality if everyone tries to go out the door at once. As Buffett once said, look at what you own from the perspective of whether you would be happy owning it if the market closes for a year. You want to own real businesses run by real people, not financial engineering situations betting on the come.

Finally, as we contemplate our (the United States) place in the world order, I am going to share a statistic that a friend in New York in a large investment firm sent me the other day. Of the “195” real countries on Planet Earth, 140 of them have apparently already signed on to the Belt and Road Initiative of China. That is the capital investment initiative across the world, but especially in emerging markets, attempting to implement a new “Silk Road” of access to natural resources and influence.

Happy New Year!