I have expressed my intention to retire in the next few months with the specter of stagflation looming. I have studied the 1960s to 1970s stagflation period since I lived through these times and know that they are secular. Federal Reserve Chairman Jerome Powell recently described the potential for inflation to last for an extended period of time:

…the risk is rising that an extended period of high inflation could push longer-term expectations uncomfortably higher, which underscores the need for the Committee to move expeditiously as I have described. (Powell Says ‘Inflation Is Much Too High’ And The Fed Will Take ‘Necessary Steps’ To Address,” CNBC, 3/21/2022)

This article describes how conservative investors may prepare for this evolution in the investment environment. I’ll walk through five sets of ideas.

-

- Evaluating Similar Time-Periods (for what worked then)

- Financial Physics (low and volatile returns ahead)

- Hard or Soft Landing? (can the Fed perform magic?)

- Categories and Funds Favored to Outperform (real assets, steady demand, cash)

- Conclusion

I would like to give a hat tip to Charles Boccadoro for developing the new graphical analytical tools which I used in this article. Thank you.

1. Evaluating Similar Time Periods

Key Point: During similar time periods of inflation, rising rates, and/or quantitative tightening, commodities, global natural resources, precious metals, real return, inflation-protected bonds, global infrastructure, utilities, consumer staples, and value have performed relatively well.

The Fed’s current policy trajectory is likely to lead to stagflation, with average unemployment and inflation both averaging over 5 percent over the next few years — and ultimately to a major recession. (Larry Summers’ new warning: Fed heading for ‘stagflation and recession’,” MSN, 3/16/2022)

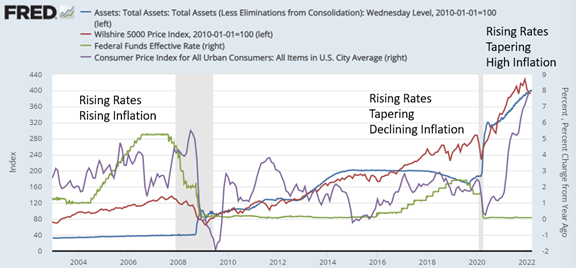

Figure #1 shows the Consumer Price Index (purple), Federal Funds rate (green line), Federal Reserve Assets rising with quantitative easing (blue), and the behavior of the S&P 500 (red line) for the past twenty years. We begin a new period with the Federal Reserve raising rates, and tapering its balance sheet to slow the economy in response to inflation. Expect higher volatility.

Figure #1: Inflation vs Fed Funds Rate and Federal Reserve Assets (QE)

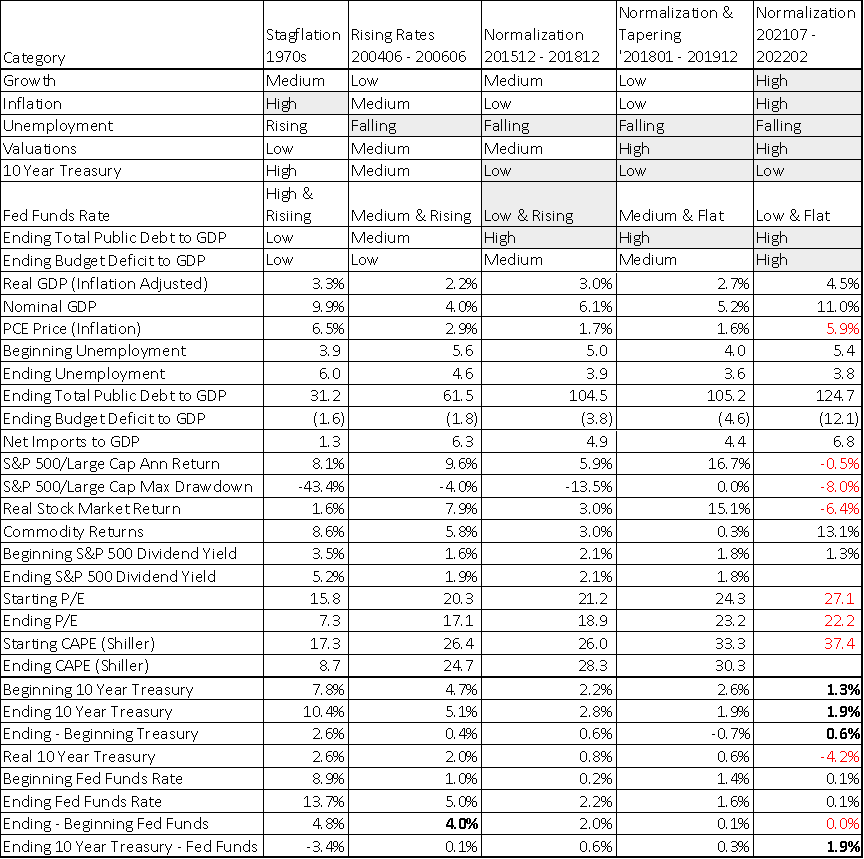

Table #1 shows the similarities and dissimilarities between the current environment and five other periods. The grey areas show similarities to the current economy and market. The red font indicates areas of concern. Yes, this time is different! There are several points to highlight:

-

- Valuations are high relative to inflationary periods.

- Short term rates are being increased from a low base.

- Total Public Debt to GDP has quadrupled since the 1970s to 125 percent of GDP.

- The Budget Deficit has increased from less than 2% of GDP to 12%.

- Stocks only outperformed inflation by less than 2% during the 1970s.

- Dividends were a larger share of the returns than the paltry dividend yield today.

- Net imports are a much larger percent of GDP than during the 1970s.

- Commodities slightly outperformed large cap stocks during the 1970’s, and are doing well this year.

Table #1: Metrics During Selected Time Periods

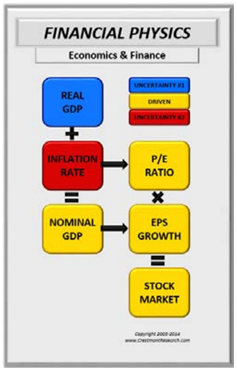

Table #2 contains the average performance of Lipper Categories during the selected time periods with the exception of the two most recent periods which are based on the two hundred funds that I track. They are color-coded by the highest (blue) and lowest (red) performers. The Category is shaded by the ones that I expect to hold up well over the remainder of the late stage.

Table #2: Category Performance During Selected Time Periods

2. Financial Physics

Key Point: Conditions favor higher inflation, and valuations are probably going to compress. Returns from stocks are likely to be low and volatile over the next decade.

The economic and financial impact of the Russian invasion of Ukraine represents a stagflationary shock for the global economy… Stagflation, an economic environment of stagnant growth and rising inflation, was once a long-tail risk, but now appears to be a real possibility…

Failing to see an easy off-ramp for the crisis [in Ukraine], the disruptions to energy markets may prove longer than initially anticipated, raising the uncertainty in the fight to rein in inflation and likely extending its duration.” (Jeffrey Rosenberg and Tom Parker, “A Stagflationary Shock,” BlackRock, Systematic Fixed Income Market Outlook, Spring 2022)

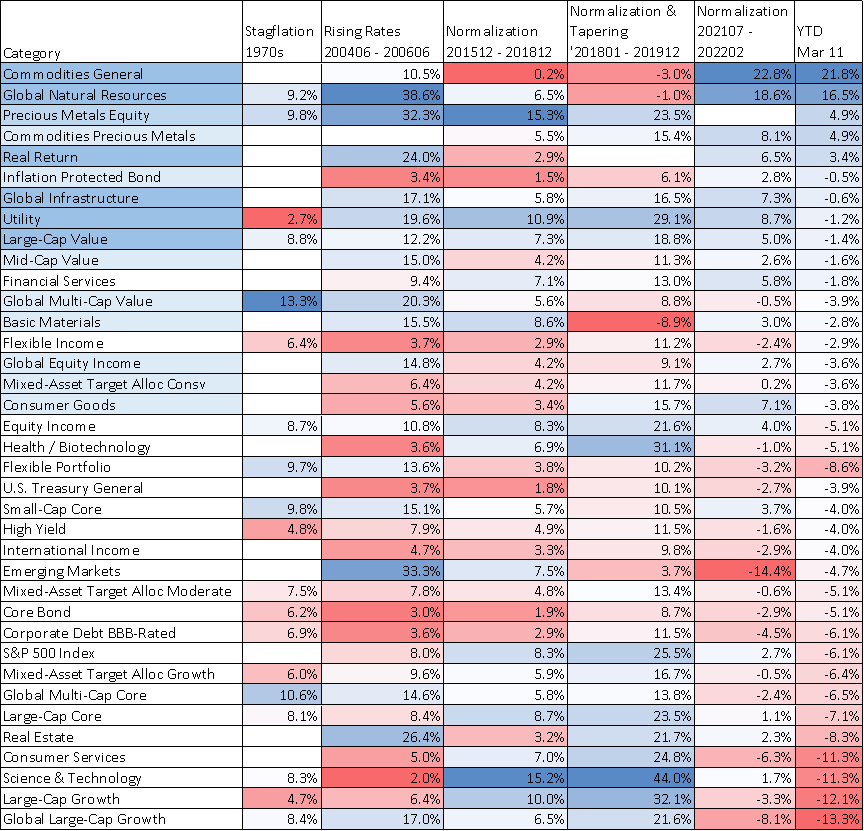

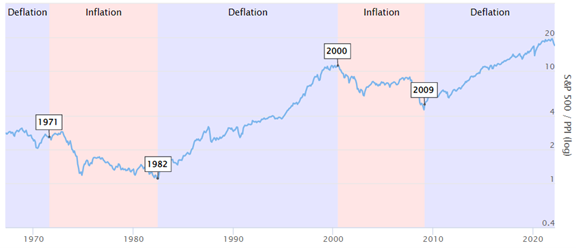

Ed Easterling, the founder of Crestmont Research, distinguishes between markets and the economy in what he calls Financial Physics. Mr. Easterling wrote Probable Outcomes and Unexpected Returns: Understanding Secular Stock Market Cycles, both great books that describe secular bull and bear markets and the role of inflation. Figure #2 shows the Financial Physics concept which he explains as:

Since Real GDP has been relatively constant over extended periods of time and all other factors are driven by inflation, a primary driver of the stock market is inflation — as it trends toward or away from price stability. Given the current state of low inflation and the likelihood of it either rising (inflation) or declining (deflation), P/E ratios are expected to decline, in general, for a number of years. As P/E ratios decline and EPS grows, the result will be another relatively nondirectional secular bear market. (Financial Physics, 2022 update)

Figure #2: Financial Physics

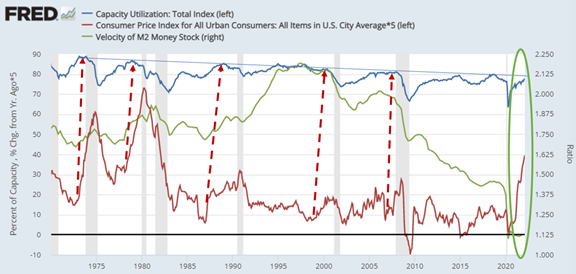

Commodity prices tend to rise as production approaches capacity as shown in Figure #3. The velocity of money is also shown and is basically the rate at which money changes hands. In spite of massive stimulus, the velocity of money has continued to slow until after the 2020 recession and since then has flattened as the money starts to circulate more which coincides with inflation rising.

Figure #3: Inflation vs Capacity and Money Velocity

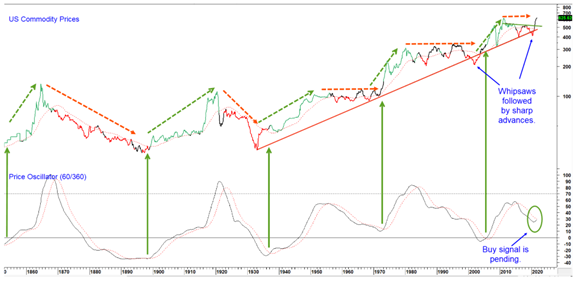

Martin Pring, chief investment strategist at Pring Turner Capital Group, a California advisory with $183M in AUM, and author of Investing in the Second Lost Decade: A Survival Guide for Keeping Your Profits Up When the Market Is Down (2012) wrote Impending Super Cycle Commodity Signal Argues Against Transitory Inflation in October 2021 where he laid the potential for a secular bull market in commodities as shown in Figure #4.

Commodity prices look poised to signal a new secular bull market, which would likely broaden out to result in the highest more generalized inflation rates since the 1970’s… If that proves to be the case, the implications for stock investors would be tremendous. One obvious effect would be an improvement in relative performance by earnings driven sectors, especially commodity sensitive ones. More importantly, history shows, that as secular commodity bull markets mature, their consequential economic distortions trigger secular bear markets for stocks in general.

Figure #4: Commodity Secular Markets

Figure #5 from Stocks to Commodities Ratio shows an interesting comparison of the S&P 500 and the Producer Price Index by Commodity: All Commodities (PPIACO). Commodities tend to perform well relative to stocks during periods of higher inflation.

Figure #5: Stocks to Commodity Ratio

Source: Stocks to Commodities Ratio

COVID has wreaked havoc on the production of commodities for the past two years, and the effects are still detrimental. Most commodity production is capital intensive and requires long lead times. After a decade of low inflation and relatively low commodity prices, it will take time for new production to ramp up. Rhiannon Hoyle, who writes about mining and commodities from The Wall Street Journal’s Australia-New Zealand bureau, observed:

Underscoring the constraints facing miners in responding to shortages, the International Energy Agency estimates that it takes more than 16 years on average from the discovery of a potential mine site through to first production. (“Ukraine War Threatens Commodities Supply and Miners Can’t React,” WSJ, 3/23/22).

Russia is a major exporter of the following commodities. While this production may not be entirely removed from the markets there will be a major shift in global supply chains as new sources are developed.

-

- Mineral fuels including oil: US$211.5 billion (43% of total exports)

- Gems, precious metals: $31.6 billion (6.4%)

- Iron, steel: $28.9 billion (5.9%)

- Fertilizers: $12.5 billion (2.5%)

- Wood: $11.7 billion (2.4%)

- Machinery including computers: $10.7 billion (2.2%)

- Cereals: $9.1 billion (1.9%)

- Aluminum: $8.8 billion (1.8%)

- Ores, slag, ash: $7.4 billion (1.5%)

- Plastics, plastic articles: $6.2 billion (1.3%)

3. Hard or Soft Landing?

Key Point: The yield curve has been flattening showing an increased risk of a recession over the next few years.

Looking beyond the March meeting, we expect higher inflation and concerns about inflation expectations to continue to weigh more heavily on Fed officials than downside risks to growth in the coming months. As a result, our baseline forecast remains that there will be rate hikes at consecutive Fed meetings and a meaningful further tightening of policy throughout the year. This faster pace of tightening raises the risk of a hard landing further down the road and suggests a higher risk of a recession over the next 2 years. (PIMCO, Tug Of War: The Fed Begins A Rate‑Hiking Cycle As Inflation Trumps Uncertainty, 3/17/22, SA registration required)

Dr. Nouriel Roubini gave advance warning of the financial crisis and has been warning of stagflation for some time. He was a professor of economics at New York University’s Stern School of Business. He has worked for the International Monetary Fund, the US Federal Reserve, and the World Bank. He is the author of Crisis Economics: A Crash Course in the Future of Finance (2010). He combines the effects of 1970s stagflation with the 2007 financial conditions to warn of a “Minsky Moment”:

We are thus left with the worst of both the stagflationary 1970s and the 2007-10 period. Debt ratios are much higher than in the 1970s, and a mix of loose economic policies and negative supply shocks threatens to fuel inflation rather than deflation, setting the stage for the mother of stagflationary debt crises over the next few years…

As matters stand, this slow-motion train wreck looks unavoidable. The Fed’s recent pivot from an ultra-dovish to a mostly dovish stance changes nothing. The Fed has been in a debt trap at least since December 2018, when a stock- and credit-market crash forced it to reverse its policy tightening a full year before Covid-19 struck. With inflation rising and stagflationary shocks looming, it is now even more ensnared. (Nouriel Roubini, “Conditions Are Ripe For Repeat Of 1970s Stagflation And 2008 Debt Crisis,” The Guardian, 7/2/21)

Wells Fargo economists argue that the probability of recession is low for this year but increases by the end of next year:

Today’s environment leads us to believe recession risks are unusually elevated; we put the odds of the U.S. economy contracting at some point between now and the end of 2023 at 30%. Our base case remains that the Fed tightens policy further over the next year or two without generating a recession… We see a significant likelihood that a technical recession is avoided, but growth slips below trend and the labor market treads water. That, however, may require living with above-target inflation somewhat longer if the FOMC re-weights its priorities as economic growth and the labor market look shakier. (Sarah House, et al., The Great Escape – Will the Fed Be Able to Wring Out Inflation Without a Recession?, 3/25/22)

4. Categories and Funds Favored to Do Well

Key Point: I favor commodities, commodity producers, real return funds, global infrastructure, value, utilities, and consumer staples in the current environment. Cash is not trash.

Historical analysis shows that value exposures have tended to outperform in a rising yield environment as it coincides with rising inflation… In a rising rate environment, traditional bonds can lose value, but investors should not write off fixed income exposure altogether… Exposure to broad commodities can provide diversification in a multi-asset portfolio and can potentially hedge against interest rate risk. (BlackRock, Maneuvering Through the Fed’s Hiking Cycle, 3/17/22, SA registration required)

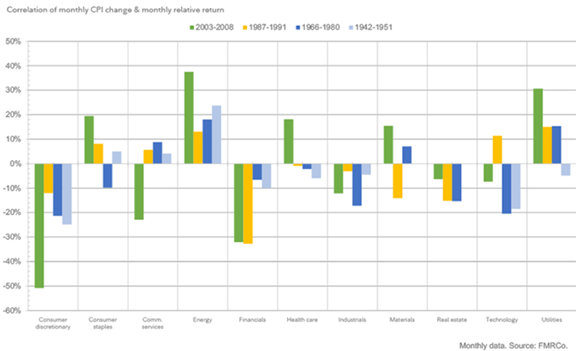

The fantastic chart from Fidelity below shows how well sectors have performed in four different inflationary regimes. Energy and utilities are the most consistent winners followed by consumer staples. Health care and materials are inconsistent winners. The most consistent losers are consumer discretionary, financials, industrials, real estate, and technology.

Figure #6: Sector Performance During Inflation Regimes

Source: Top Sectors Amid Inflation, Fidelity

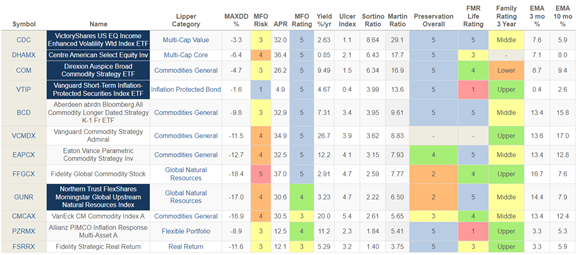

Commodities can be volatile and I look for a diversified approach to protecting against inflation. Table #3 contains funds that have done well over the past two years which may help protect against inflation.

Table #3: MFO Metrics of Top Inflation Protection Funds – Two Years (Since March 2020)

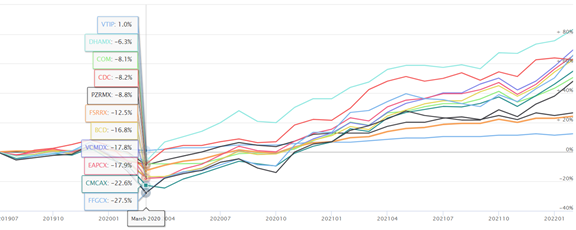

Figure #7: Fund Performance of Top Performing Inflation Protection Funds

The following are strategies from funds shown as representative examples of differences in Lipper Categories. Commodity funds invest in commodity price futures while Global Natural Resources invest in companies that produce commodities. Real Return Funds are more diversified and often less volatile. I favor Flexible Portfolios where the fund manager has the discretion to improve risk adjusted returns by investing across diverse asset classes.

Flexible Portfolio: PIMCO Inflation Response Multi-Asset Fund (PZRMX)

The fund invests in a combination of Fixed Income Instruments of varying maturities, equity securities, affiliated and unaffiliated investment companies…, forwards and derivatives, such as options, futures contracts or swap agreements, of various asset classes in seeking to mitigate the negative effects of inflation. It may invest up to 25% of its total assets in equity-related investments.

Real Return: Fidelity Strategic Real Return Fund (FSRRX)

Allocating the fund’s assets among four general investment categories, using a neutral mix of approximately 25% inflation-protected debt securities, 25% floating-rate loans, 30% commodity-linked derivative instruments and related investments, and 20% REITs and other real estate related investments…

Commodities General: Parametric Commodity Strategy Fund (EAPCX)

The fund invests primarily in commodity-linked derivative instruments backed by a portfolio of fixed-income securities. The fund’s portfolio of fixed-income securities is generally comprised of U.S. Treasury securities and money market instruments…

Global Natural Resources: Fidelity Global Commodity Stock Fund (FFGCX)

Normally investing at least 80% of assets in stocks of companies principally engaged in the energy, metals, and agriculture group of industries.

VictoryShares US Equity Income Enhanced Volatility-Weighted Index ETF (CDC)

I include CDC because it is up 1.4% year to date as of March 17th. It is currently invested (approximately 65%) in utilities, financials, and consumer staples.

The Fund seeks to achieve its investment objective by investing, under normal market conditions, at least 80% of its assets directly or indirectly in the securities included in the Nasdaq Victory US Large Cap 100 High Dividend Long/Cash Volatility Weighted Index…

The Index combines fundamental criteria with individual security risk control achieved through volatility weighting of individual securities. In accordance with a rules-based mathematical formula, the Index tactically reduces its exposure to the equity markets during periods of significant market decline and reallocates to stocks when market prices have further declined or rebounded. The term “Enhanced” in the Fund’s name refers to a feature of the Index that is designed to enhance risk-adjusted returns while attempting to minimize downside market risk through defensive positioning, as described below.

The Index follows a rules-based methodology to construct its constituent securities:

-

- The Index universe begins with the stocks included in the Nasdaq Victory US Large Cap 500 Volatility Weighted Index, a volatility weighted index comprised of the 500 largest U.S. companies by market capitalization with positive earnings over the last twelve months.

- The Index identifies the 100 highest dividend-yielding stocks in the Nasdaq Victory US Large Cap 500 Volatility Weighted Index.

- The 100 stocks are weighted based on their daily standard deviation (volatility) of daily price changes over the last 180 trading days. Stocks with lower volatility receive a higher weighting and stocks with higher volatility receive a lower weighting.

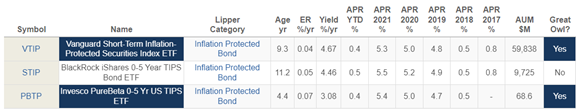

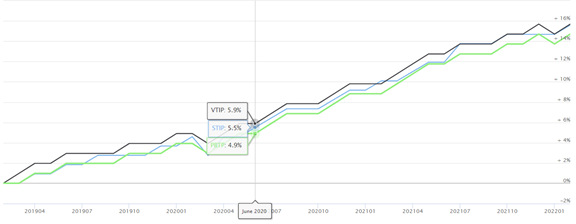

Short-Term Inflation-Protected Bonds (VTIP, STIP, PBTP). These funds are up over 0.75% year to date as of March 17th.

Table #4: Annual Inflation-Protected Bond Performance

Figure #8: Short-Term Inflation Protected Bond Performance

Closing

“Unfortunately, history isn’t on his [Fed Chairman Powell] side. Inflation is much further from the Fed’s objective, and the labor market, by many measures, is tighter than in previous soft landings. Yet the Fed starts real interest rates – nominal rates adjusted for inflation – much lower, in fact deeply negative. In other words, not only is the economy traveling above the speed limit, the Fed has the gas pedal pressed to the floor. The odds are that getting inflation back to the Fed’s 2% target will require much higher interest rates and greater risk of recession that the Fed or markets now anticipate. (“Odds Don’t Favor the Fed’s Soft Landing,” WSJ, Grep Ip, March 24, 2022)

My storyline remains that we are entering the late stage of the business cycle with valuations and inflation unusually high. Inflation will remain elevated for the next year or two at a minimum and the Federal Reserve will raise rates in response. A hard landing with a recession is more likely than a “soft landing”. I will casually reduce risky assets as indicators suggest doing so is prudent.

Investors should maintain diversified portfolios because the future is uncertain. I put 75% of portfolios in stable long-term funds, with 25% in a tactical sleeve, and limit categories to 5%. Commodities, equity of commodity producers, real return funds, utilities, and consumer staples are part of the tactical sleeve but will be scrutinized as a recession approaches.

Investing in commodities, real return funds, and utilities greatly reduced the volatility in my portfolio this year as the inflationary shock pushed prices up. This year, I have continued to rotate into inflation beneficiaries as I believe the trend will continue for some time. I have also reduced funds that are not responding well to rising rates as this trend will continue while there is high inflation. I have raised cash above normal levels to reduce risk and uncertainty as well as to take advantage of future opportunities.